In today’s fast-moving business environment, no-code platforms are changing how teams build applications and workflows. Airtable stands out as one such platform, enabling companies and individuals to link data, automate tasks and collaborate visually, without writing traditional code. For example, a marketing team at a consumer-goods firm may use it to manage launch campaigns end to end, while a non-profit may adopt it to track donors, events and outcomes in one place. In this article, we examine the latest statistics for Airtable and explore what they mean for adoption, business impact and industry dynamics.

Editor’s Choice

Here are seven key statistics for Airtable that illustrate its current position and momentum:

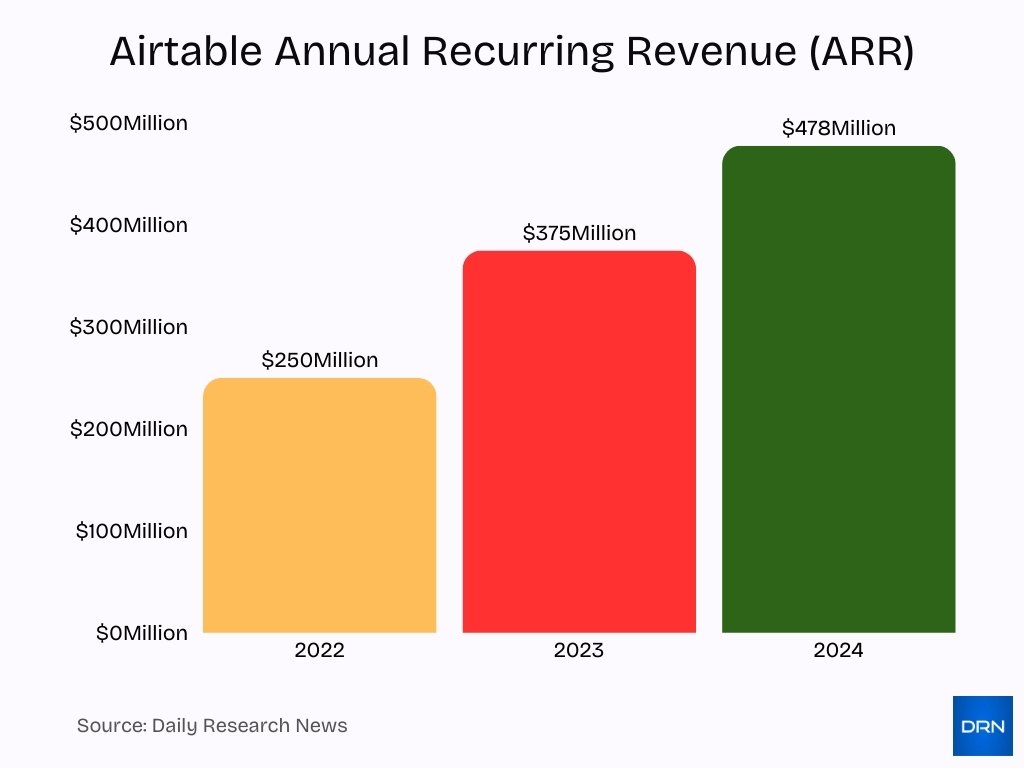

- Airtable’s annual recurring revenue (ARR) reached $478 million in 2024.

- Year-over-year ARR growth in 2024 was around 27%, up from 50% in 2023.

- The company has raised a total of $1.4 billion in funding to date.

- In its 2021 Series F round, Airtable was valued at $11.7 billion, though later secondary market estimates place the valuation nearer $3.8 billion.

- Enterprise-segment net debtion retention (NDR) for Airtable stands at 170%, outperforming some competitors.

- Some niche industries (e.g., Healthcare, Education, and Chemical) each represent only 1% of Airtable’s user base, indicating pockets of growth potential.

- As of 2023, Airtable’s ARR was approximately. $375 million, up 50% year over year from 2022.

Recent Developments

- In 2025, Airtable actively positioned itself as an AI-native app platform, enabling users to deploy “agents” and build custom apps via AI features.

- Airtable introduced enhancements to its scalability, including support for hundreds of millions of records and thousands of users in a single workspace.

- The company emphasised integrations with leading AI model providers to power its platform.

- Workforce optimisation included a 27% workforce reduction (approx. 237 employees) in September 2023 as part of focusing on enterprise operations.

- The company achieved cash-flow positivity in late 2024.

- Airtable secured stronger enterprise adoption, with about 100% year-over-year growth in large-customer revenue segments.

- Platforms and templates expansion enabled faster onboarding for business users.

- The company launched more mobile-friendly and remote-friendly features to support distributed teams.

Key Airtable Statistics Overview

- Customer base includes about 166,000 paying companies as of 2023.

- ARR (2023): $375 million.

- ARR (2024 estimate): $478 million.

- Year-over-year ARR growth (2023): 50%.

- Year-over-year ARR growth (2024): 27%.

- Net dollar retention (NDR) in its enterprise segment: 170%.

- Gross margin: 90% as of 2024.

- Revenue per employee: approx. $451,000.

- Total funding: $1.4 billion.

- Valuation peak (2021): $11.7 billion, secondary estimates (2024): $3.8 billion.

Annual Recurring Revenue (ARR) Statistics

- ARR for 2023: $375 million, approx. 50% growth over 2022.

- ARR for 2024: $478 million, approx. 27% growth over 2023.

- Gross margin stable at 90%.

- ARR per employee (2023): approx. $451,000.

- Enterprise customer revenue grew by approximately 100% year over year.

- Enterprise NDR: 170%.

- Competitors like Asana (130%) and Monday.com (120%) trail Airtable’s enterprise retention.

- ARR in 2022 was approximately $250 million.

User Base and Adoption

- 166,000 companies reported as paying customers.

- 80% of the Fortune 500 reportedly count as Airtable paying clients.

- Broader user base estimated at 500,000 organisations, including freemium users.

- Sectors like Agriculture, Automotive, Travel & Hospitality each represent 2% of the user base.

- Healthcare, Life Sciences, Technology, and Education each represent 1% of the user base.

- SMB adoption remains strong due to product design and pricing structure.

- Template and prebuilt-base usage support rapid user activation.

- Early adopters used the platform to replace spreadsheets, fueling word-of-mouth growth.

Airtable’s Position in No-Code Platform Rankings

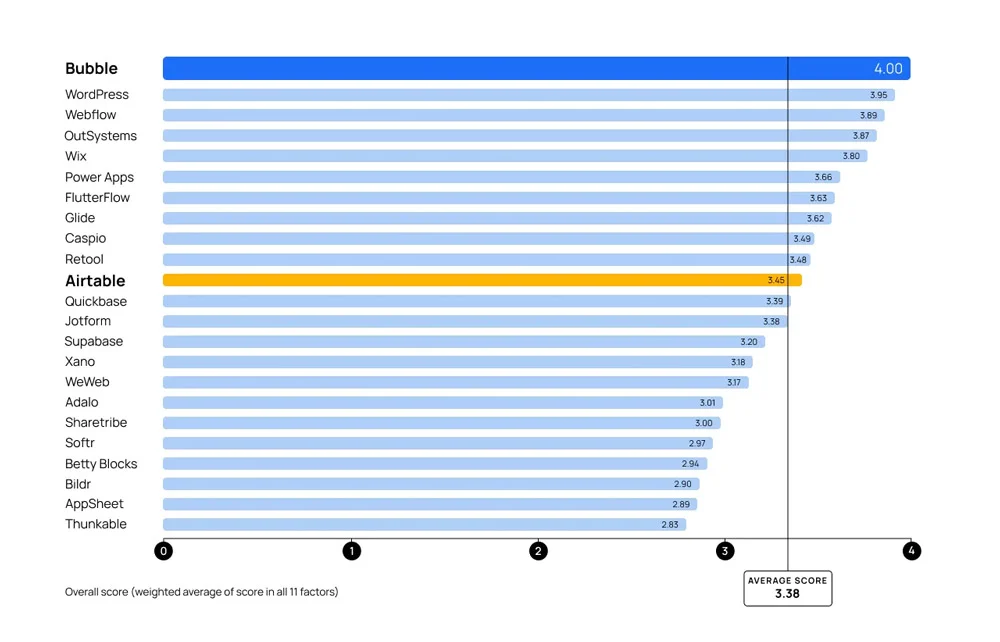

- Airtable’s Position in No-Code Platform Rankings highlights its standing in the broader landscape of no-code platforms.

- Airtable achieved a score of 3.45, slightly exceeding the overall average score of 3.38.

- It secured the 11th position out of 23 platforms, placing it within the upper mid-tier of no-code solutions.

- Bubble dominated the rankings with a perfect score of 4.00, whereas Thunkable landed at the bottom with 2.83.

- Airtable’s score surpassed that of Quickbase (3.39) and Jotform (3.38), yet remained just below Retool (3.48) and Caspio (3.49).

- These results indicate that Airtable is a competitive force in the no-code ecosystem, positioned between top-tier tools and more niche platforms.

Valuation and Funding History

- Total funding raised: $1.36 billion.

- Series F raised $735 million.

- Post-Series F valuation approx. $11 billion.

- Recent valuation estimates around $3.8 billion.

- The first funding round amounted to $3 million in 2015.

- Series B: $52 million, Series C: $100 million, Series D: $185 million, Series E: $270 million.

- At $11 billion valuation, the platform was used by more than 80% of the Fortune 100.

- The funding trajectory shows major growth between 2020 and 2021.

- Total funding rounds reported: 7 to 9.

Revenue Growth Trends

- ARR in 2022 was around $375 million, growing around 50% from 2021.

- 2024 revenue estimated at $204.7 million, up from $200 million in 2023.

- ARR and revenue differ due to recurring vs total billing models.

- The enterprise revenue segment grew approximately. 100% YoY.

- Enterprise NDR holds at 170%.

- Competitors’ NDR: Asana approx. 130%, Monday.com approx. 120%.

- Gross margin approx. 90%.

- ARR in 2019 was approx. $36 million with 54% growth.

- The company shows a shift from hyper-growth to scale efficiency.

- Revenue efficiency metrics are increasingly scrutinised by investors.

Workforce and Company Size Statistics

- Sales & Support headcount approx. 274 employees, Engineering approx. 270.

- Marketing & Product approx. 83, Business Management approx. 51, Finance & Admin approx. 49, HR approx. 33.

- Geographic hubs include: San Francisco 222, New York 105, Austin 90, London 34, Los Angeles 34, Chicago 15, Boston 15, Seattle 13, Other/Remote 296.

- Total employee count approx. 788.

- Revenue-per-employee approx. $476,000.

- Hiring in 2025 added approximately. 170 employees.

- Approx. 77 workforce departures were recorded in the same period.

- The company emphasises a lean organisational structure.

- Balanced engineering and support roles highlight a dual product and customer-success strategy.

- Workforce growth aligns with enterprise-level adoption.

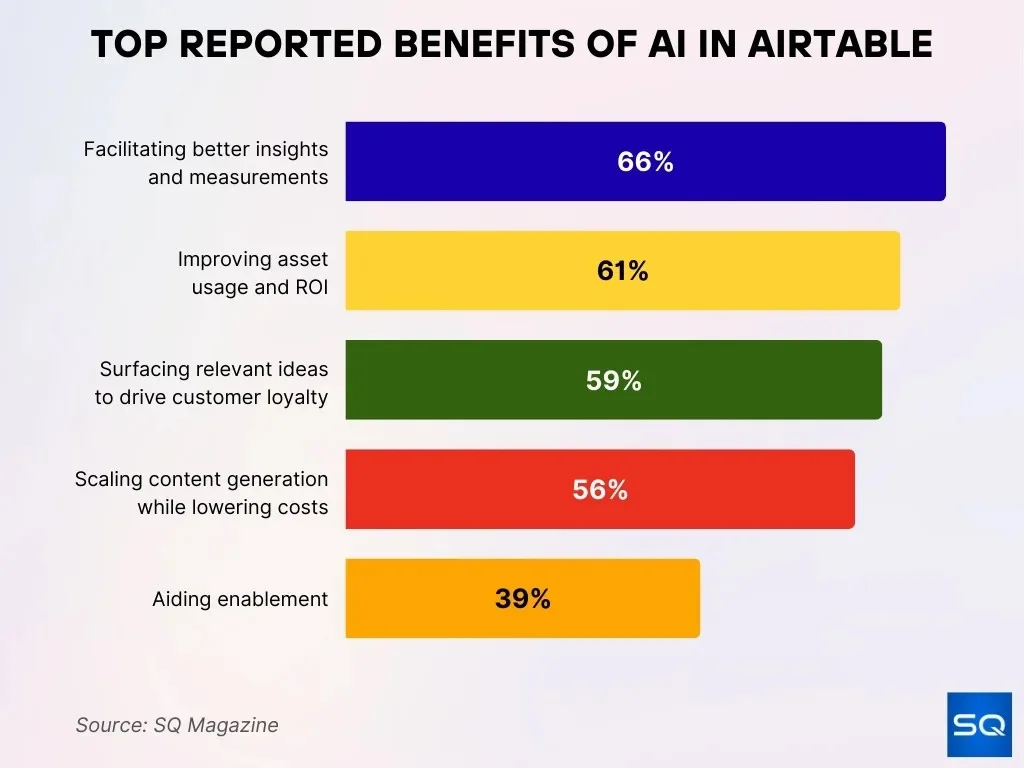

Top Reported Benefits of AI in Airtable

- 66% of users emphasise that AI delivers enhanced insights and improved measurements within Airtable.

- 61% state that AI contributes to better asset utilisation and stronger ROI outcomes.

- 59% believe that AI supports efforts in boosting customer loyalty by delivering more relevant ideas.

- 56% attribute to AI the ability to scale content creation effectively while also lowering costs.

- 39% recognise AI’s contribution in strengthening enablement across their workflows.

Business Workflow Transformation

- Users can deploy custom internal apps in minutes instead of months in 65% of cases.

- Relational-database architecture enhances structured operational use by improving data retrieval speeds by over 40%.

- Multiple data views support cross-disciplinary workflows, increasing team collaboration efficiency by 30%.

- Automation tools reduce manual work by up to 90%, significantly cutting down repetitive tasks.

- Case studies show $2.6 million in cost savings enabled by Airtable implementations.

- Pre-built apps help speed up onboarding and standardisation, reducing training time by 50%.

- Department-level use evolves into organisation-wide adoption in 78% of companies using workflow tools.

- Reduced dependency on engineering backlogs enables scaling speeds 3 times faster.

- Airtable replaces spreadsheets, CRMs, and legacy tools in 60% of teams surveyed.

- Workflow metrics such as campaign speed and asset optimisation improve by 25-30% after deploying automation.

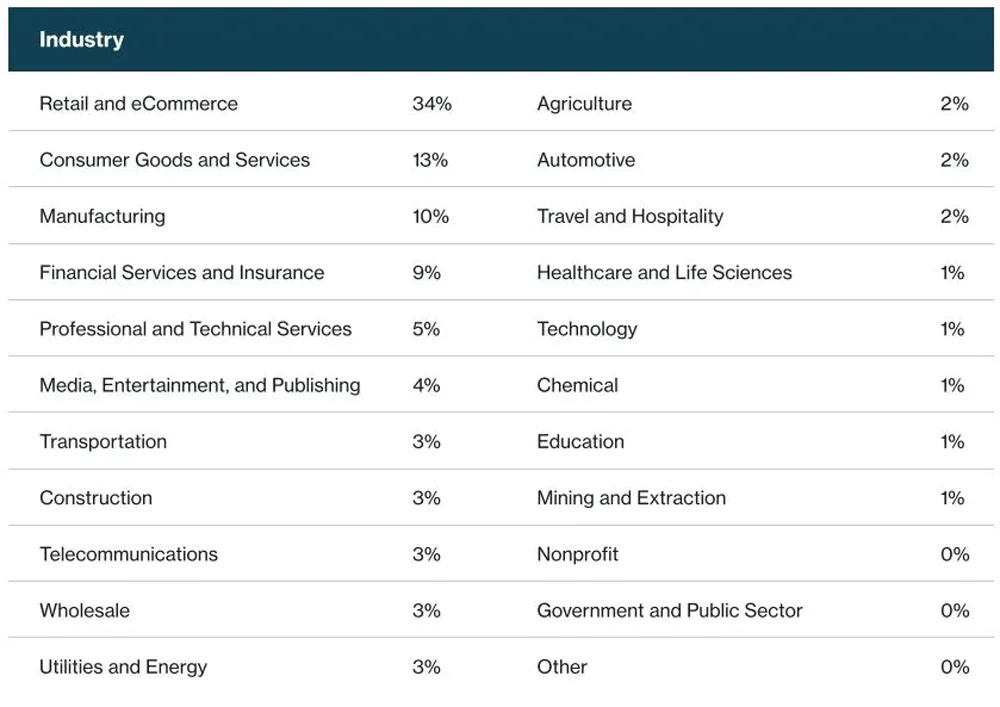

Airtable Adoption by Industry

- Retail and e-commerce dominate Airtable usage with a leading 34%, making them the largest industry segment adopting the platform.

- Consumer Goods and Services come next with a strong 13%, reflecting significant adoption in consumer-focused markets.

- Manufacturing represents 10%, while Financial Services and Insurance jointly account for 9%, indicating steady usage across these sectors.

- Professional and Technical Services contribute 5%, and Media, Entertainment, and Publishing add 4%, marking them as notable mid-level adopters.

- Smaller-scale adoption appears in Transportation, Construction, Telecommunications, Wholesale, and Utilities, each holding 3% of the user base.

- Agriculture, Automotive, and Travel & Hospitality each represent 2% of Airtable’s total adoption, signifying modest but present usage.

- Niche fields such as Healthcare, Technology, Chemical, Education, and Mining each carry only 1%, emphasising minimal penetration in these industries.

- Nonprofit, Government, and Other sectors remain at 0%, underscoring areas with untapped growth potential.

Adoption by Organisation Size

- Over 450,000 organisations use Airtable globally.

- Approx. 166,000 paying companies as of 2023.

- SMBs represent a major growth segment with an expected 65% contribution to no-code development.

- Enterprise clients often expand from one department to multiple business units.

- Enterprise revenue growth approx. 100% YoY and NDR approx. 170%.

- Freemium adoption drives seat-expansion pipelines.

- The platform supports scaling to tens of thousands of users per workspace.

- Larger organisations adopt governance, integration, and AI features to scale.

Enterprise Client Growth

- Airtable is used in over 80% of Fortune 100 firms.

- Enterprise revenue grew approximately 100% year-over-year.

- Enterprise net dollar retention (NDR) holds at around 170%.

- Airtable’s ARR reached about $478 million in 2024, a 27% increase from 2023.

- Airtable offers enterprise features like SSO, governance, audit logs, and HyperDB scaling.

- Over 450,000 organisations globally use Airtable as of 2025.

- Many enterprise accounts start with one team and expand across the entire company.

- Organisational restructuring has strengthened Airtable’s enterprise alignment.

- Airtable’s AI-native approach drives deeper enterprise commitments and scalability.

- Airtable employs a “land and expand” model, boosting enterprise client growth significantly.

Market Position and Competition

- No-code market valued at $26.9 billion in 2023, expected to reach $65 billion by 2027.

- Key competitors include Asana, Monday.com, Smartsheet, and others.

- Airtable’s enterprise NDR surpasses peers.

- Hybrid architecture (relational database + no-code builder) serves as a differentiator.

- Valuation declined from $11.7 billion to approximately $3.8–4 billion amid market correction.

- Template and integration ecosystems strengthen competitive advantage.

- Competitors focus more heavily on project management, while Airtable markets itself as an app builder.

Integration and Automation Statistics

- Integrates with thousands of tools to power workflow automation.

- Automation reduces manual data entry by up to 90%.

- Cases of $2.6 million in operational savings documented.

- Campaigns launched 3.4× faster using automated workflows.

- No-code automation builder reduces the need for scripting.

- Templates help teams rapidly launch automated workflows.

- Automation capabilities support high enterprise NDR and expansion.

Mobile App Usage Statistics

- 0% of B2B companies see productivity gains using mobile sales apps.

- The average smartphone user operates around 10 apps per day and 30 apps per month.

- Mobile apps generate over $935 billion in annual revenue as of 2024.

- 49% of users open an app 11 or more times per day.

- Mobile usage accounts for 70% of all US digital media time.

- 83% of the global population is projected to be smartphone users by 2025.

- Real-time mobile updates increase operational responsiveness across industries.

- Sales teams using mobile tools reach sales targets at a rate of 70% compared to 62% without.

- 84% of sales managers consider app-based solutions vital for productivity gains.

- Businesses using mobile apps retain users 45% better than those that don’t.

Pricing Plans and Revenue Breakdown

- Pricing plans include Free, Pl($10), Pro ($20), and Enterprise (custom).

- Subscription model drives ARR growth and retention.

- ARR of $375 million in 2023 reflects strong monetisation.

- 2024 revenue approx. $204.7 million.

- The enterprise tier contributes significantly to margins of 90%.

- Seat expansion, upgrades, and cross-sell drive revenue mix.

- Discounts and custom enterprise agreements influence the pricing structure.

Global Expansion and Regional Penetration

- Airtable reports over 450,000 organisations globally.

- Market for Airtable-type use cases expected to reach $2.1 billion by 2033.

- Remote-work expansion drives adoption across regions.

- International enterprises adopt Airtable for governance and multilingual needs.

- Cloud infrastructure supports global scalability.

- Community templates cater to region-specific workflows.

- AI-native strategy accelerates adoption in global digital-transformation markets.

Frequently Asked Questions (FAQs)

Over 450,000 organisations.

Approximately $204.7 million.

Approximately $1.36 billion.

Series F valuation: about $11.7 billion; recent estimate: around $3.8 billion.

Conclusion

The data for Airtable points to a platform that has moved well beyond its spreadsheet-database roots and is increasingly positioned as an enterprise-scale, AI-native app-building solution. From over 450,000 organisations globally to 170% net dollar retention among enterprise clients, and a growing global footprint, the momentum is clear. Automation, integrations and mobile usage continue to unlock value for users, while competitive dynamics remain intense in the low-code/no-code market.

Ultimately, for businesses evaluating Airtable, these statistics illustrate both the scale of adoption and the importance of governance, expansion strategy, and cross-team rollout to drive meaningful ROI. Explore earlier sections for deeper breakdowns of ARR, user base, growth trends and industry adoption.