Android remains the world’s most widely used mobile operating system, powering a vast range of devices from phones to wearables. It reaches billions of users globally and shapes how people connect, work, and consume digital content every day. In real-world settings, Android’s ecosystem drives mobile banking adoption in emerging markets and enables global app distribution via the Google Play Store. These influences matter not only to consumers but also to businesses aiming to reach broad audiences. Explore the statistics below to understand the latest trends and shifts in Android’s global impact.

Editor’s Choice

- ~3.9 billion people are using Android worldwide in 2025, underscoring its massive user base.

- Android holds roughly 72–73% of the global mobile OS market, far ahead of competitors.

- In the U.S., Android’s share stands near 41–42%, while iOS leads domestically.

- Android powers the majority of devices in India with ~95+% share.

- Over 2 million apps are estimated to be available on the Google Play Store in 2025.

- More than 110 billion apps were downloaded in Q1 2025 on Google Play.

- Android’s market share has grown significantly since 2010, highlighting long-term adoption trends.

Recent Developments

- Android 15 commands 26.17% of devices as of November 2025, making it the most used version.

- Google slashed Play Store apps by nearly 50% since 2024, removing over 1 million low-quality entries.

- Play Store blocked 2.36 million harmful apps and banned 158,000 developer accounts in 2024.

- Kaspersky detected 29% more Android attacks in H1 2025 versus H1 2024, blocking 12 million threats.

- Foldable smartphone market hits USD 31.30 billion in 2025, with Q3 shipments up 14% YoY.

- Foldables capture 2.5% of global smartphone shipments in Q3 2025, led by Samsung.

- Google AI integrations drive 10% higher query engagement via Gemini 2.5 in early 2025 tests.

- 80% of OEM Android models feature customizations, mainly in security layers like JCE and CA stores.

- Android powers 75.65% of automotive OEM app stores in 2024, fueling customized experiences.

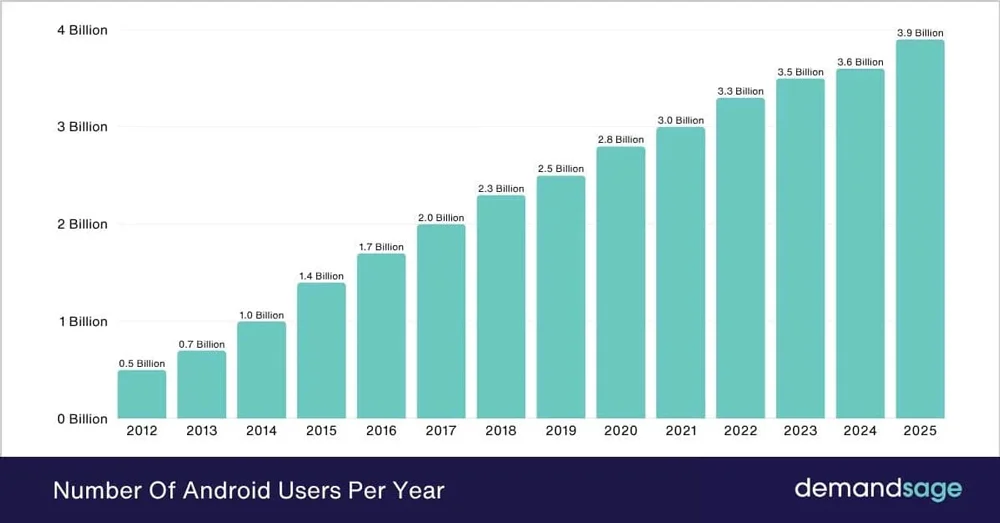

Growth of Android Users Worldwide (2012–2025)

- The number of Android users has grown steadily and dramatically over the last decade, highlighting Android’s dominance in the global mobile market.

- In 2012, Android had approximately 0.5 billion users, marking the early stage of mass adoption.

- User numbers crossed the 1 billion milestone in 2014, showing rapid early growth driven by affordable smartphones.

- Between 2015 and 2017, Android users increased from 1.4 billion to 2.0 billion, reflecting strong expansion in emerging markets.

- By 2018, the platform surpassed 2.3 billion users, reinforcing Android’s position as the world’s leading mobile operating system.

- Despite global disruptions, Android usage continued to rise, reaching 2.8 billion users in 2020.

- In 2021, the user base crossed 3.0 billion, a major milestone in mobile technology adoption.

- Growth remained consistent through 2022 and 2023, increasing from 3.3 billion to 3.5 billion users.

- By 2024, Android users reached 3.6 billion, indicating a maturing but still expanding ecosystem.

- Projections for 2025 estimate nearly 3.9 billion Android users, underscoring Android’s long-term global relevance and scale.

Global Android Market Share

- Android commands a 72.2% global mobile OS market share as of January 2025.

- Worldwide, Android’s share reached a peak of 76.18% in 2019.

- In Asia, Android dominates with an 82.03% market share in 2025.

- Android holds 47.53% in North America as of early 2025.

- South America sees Android at 86.66% market penetration in 2025.

- India boasts 95.21% Android adoption among mobile users.

- In Brazil, Android captures over 78% of the smartphone OS market.

- Android’s global share surged from 12% in 2010 to 72% by 2025.

- Globally, 3.9 billion users rely on Android devices in 2025.

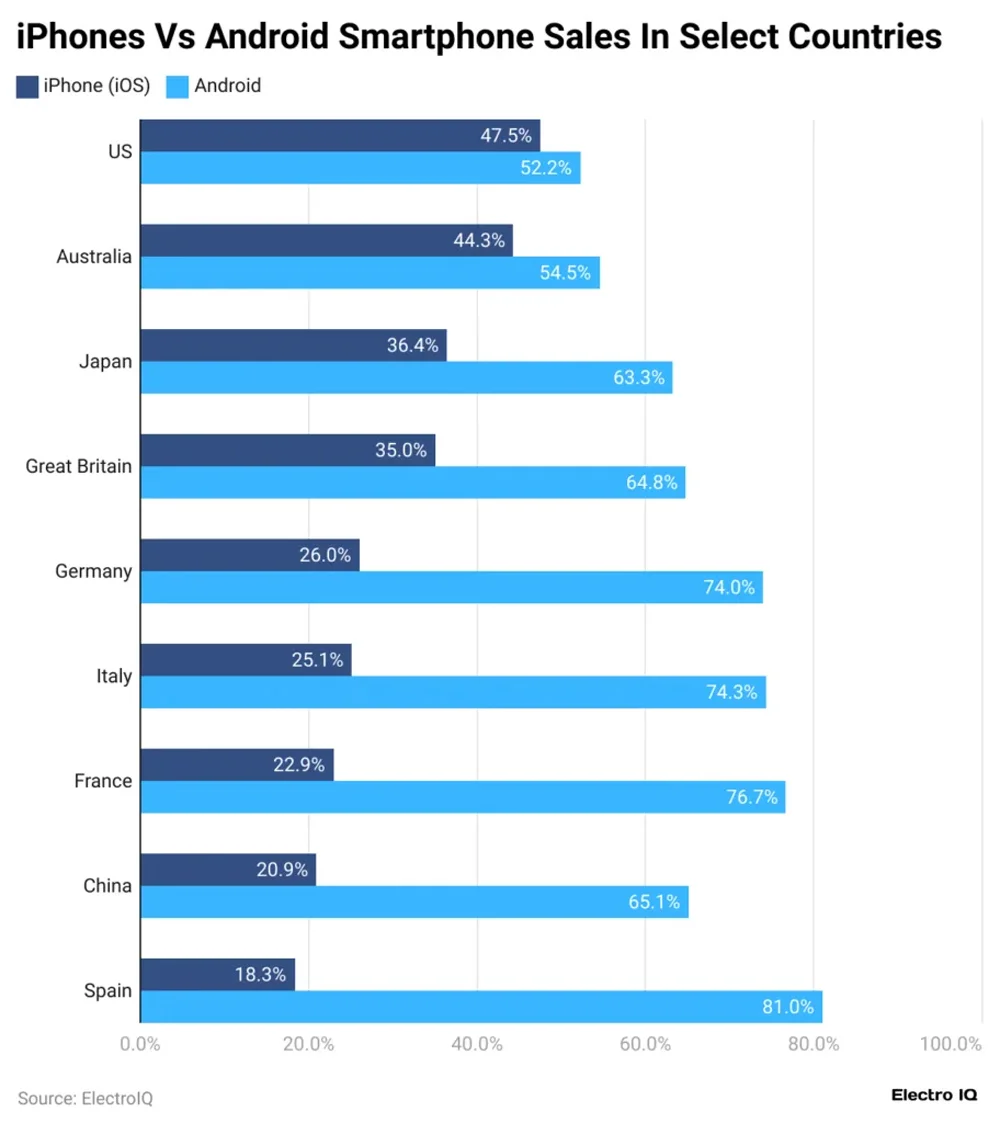

Comparative Smartphone Market Share: iPhones and Android Across Key Countries

- In the United States, Android leads the smartphone market with 52.2%, while iPhones closely follow at 47.5%, indicating a highly competitive and nearly balanced market landscape.

- In Australia, Android secures 54.5% of smartphone sales compared to 44.3% for iPhones, reflecting a consistent preference toward Android devices.

- In Japan, Android dominates with a strong 63.3% share, whereas iPhones lag at 36.4%, highlighting distinct regional brand loyalty trends.

- In Great Britain, Android captures 64.8% of total smartphone sales, significantly outperforming iPhones, which hold 35.0% of the market.

- In Germany, Android accounts for a substantial 74.0% market share, leaving iPhones with only 26.0%, emphasizing clear Android superiority.

- In Italy, Android maintains dominance at 74.3%, while iPhones register 25.1%, demonstrating strong consumer alignment with Android platforms.

- In France, Android commands 76.7% of the market, with iPhones at 22.9%, underscoring Europe’s strong inclination toward Android devices.

- In China, Android holds 65.1%, while iPhones remain at 20.9%, reflecting Android’s extensive global reach and scalability.

- In Spain, Android peaks at an impressive 81.0%, compared to 18.3% for iPhones, marking one of the widest market share gaps observed.

Android Smartphone Shipments and Sales

- In Q2 2025, global smartphone shipments reached roughly 295.2 million units.

- Samsung shipped about 58 million units, reflecting demand for flagship and mid-range Android models.

- Xiaomi maintained notable shipment volumes of around 42.5 million units.

- Vivo recorded shipments of roughly 27.1 million units, signaling strength in Asia.

- Smaller OEMs accounted for a sizeable ~32.6% of shipments, highlighting market fragmentation.

- Android OS devices represent a substantial majority of shipped smartphones.

- While Apple has occasionally topped shipment rankings, Android vendors collectively ship far larger volumes.

- Overall smartphone shipment growth continues, with Android units a major contributor.

Android Tablet Market Statistics

- Android tablets hold a 36–37% global market share in 2025.

- Samsung leads Android vendors with 18.7% global tablet share in Q2 2025, shipping 7.2 million units.

- Lenovo follows with 8.2% global share, shipping 3.1 million Android tablets in Q2 2025.

- India’s tablet market shipped 5.73 million units in 2024, growing 42.8% YoY, dominated by Android.

- Samsung captured 37.5% share in India’s Q3 2025 tablet market, leading the commercial segment at 49.7%.

- Android commands 51.7% of the global tablet market in 2025 due to diverse manufacturers.

- Android Enterprise holds 85% enterprise market share with strong adoption in business sectors.

- India’s Q1 2025 tablet market grew 15% YoY, with Samsung at 34% and Lenovo at 19% Android share.

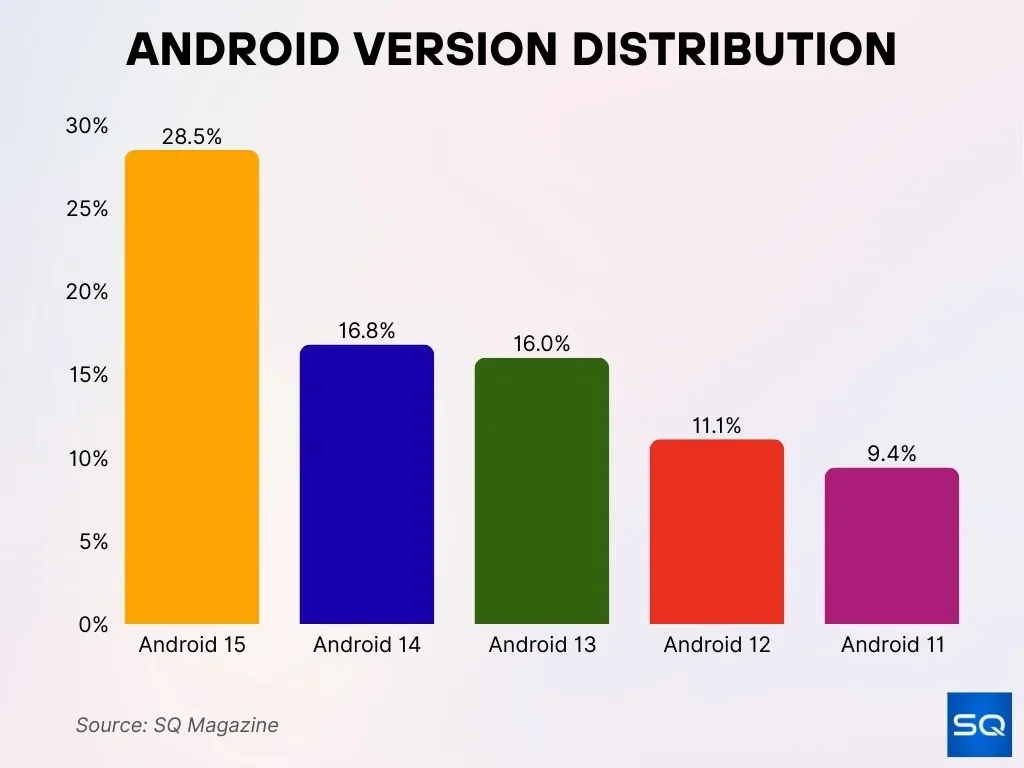

Distribution of Android Version

- As of mid-2025, Android 15 commands 28.5% of the total share, whereas Android 14 accounts for 16.8% of the overall distribution.

- Android 13 represented 16% of active devices during mid-2025, maintaining a strong presence across the ecosystem.

- Android 12 continued to stay relevant, covering 11.1% of devices within the active user base.

- Older versions, such as Android 11, comprised 9.4% of the total active device base, reflecting ongoing legacy usage.

Android App Ecosystem Statistics

- Google Play Store hosts over 2.06 million active apps in 2025, the largest globally.

- Millions of developers, around 580,000 active publishers, contribute to the ecosystem.

- Apps are available in over 190 countries and markets worldwide.

- 299 billion new app installs recorded on Google Play in 2025.

- Over 3,000 apps are launched daily, fueling constant competition.

- Gaming apps generated projected $40.1 billion in revenue in 2025.

- 97% of apps are free, with ads and in-app purchases dominating monetization.

- Supports apps in dozens of languages across 135+ countries for subscriptions.

- 2.5 billion active Android devices are accessible via the open ecosystem.

Google Play Store App Counts and Growth

- As of 2025, the Google Play Store hosts approximately 2.06 million apps.

- Daily new app releases range between 1,200–1,250 apps.

- During 2024, over 102.4 billion downloads occurred from Google Play.

- App count growth fluctuates due to quality controls and removals.

- Free apps constitute the overwhelming majority of offerings.

- App diversity spans dozens of categories.

- Publisher numbers exceed 600,000 unique developers.

- Google Play remains a central distribution hub for Android apps.

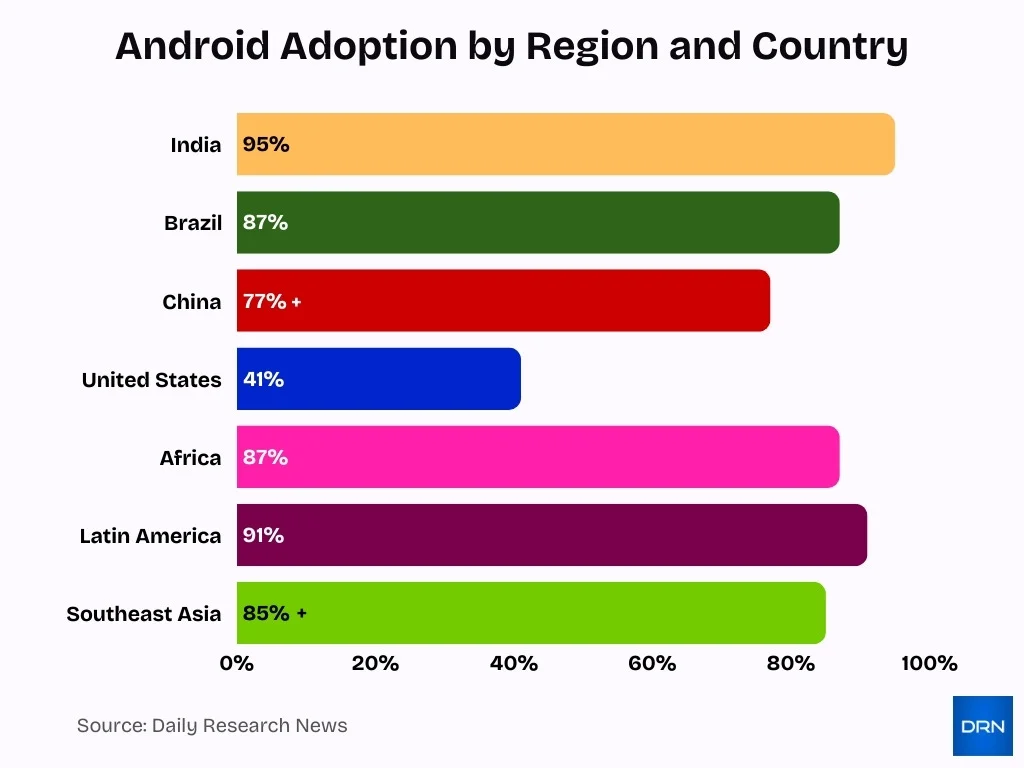

Android Adoption by Region and Country

- India boasts the highest Android adoption at 95.36% mobile OS market share in 2025.

- Brazil sees Android dominating with an 86.66% share in South America as of early 2025.

- China records Android at over 77% smartphone OS market share in March 2025.

- In the U.S., Android holds 40.74% of the mobile OS market through late 2025.

- Africa exhibits a strong Android penetration at 86.6% market share in 2025.

- Latin America favors Android with 90.9% adoption across the region.

- Southeast Asia‘s Indonesia mirrors high adoption, exceeding 85% Android share.

- Globally, Android commands 72.2 of % mobile OS market share as of January 2025.

Android App Downloads and Usage

- Google Play recorded 299 billion app downloads in 2025, up 8% from 277 billion in 2024.

- Global mobile app downloads reached 299 billion in 2025, driven by emerging markets.

- India led with 280 million+ Google Play downloads in Q1 2025 alone.

- Games accounted for 49% of total app downloads worldwide in 2024-2025.

- Users open apps 11+ times daily on average, with 49% highly engaged.

- Social media and entertainment apps comprise 40% of total usage time.

- Android users spend 4.9 hours daily on mobile apps, 89% of phone time.

- In-app purchases hit $257 billion globally in 2025, growing 26.4% CAGR.

- The tools category captured 19.73% of Google Play downloads in 2025.

- China topped regional downloads with 113 billion apps in 2023, a trend continuing.

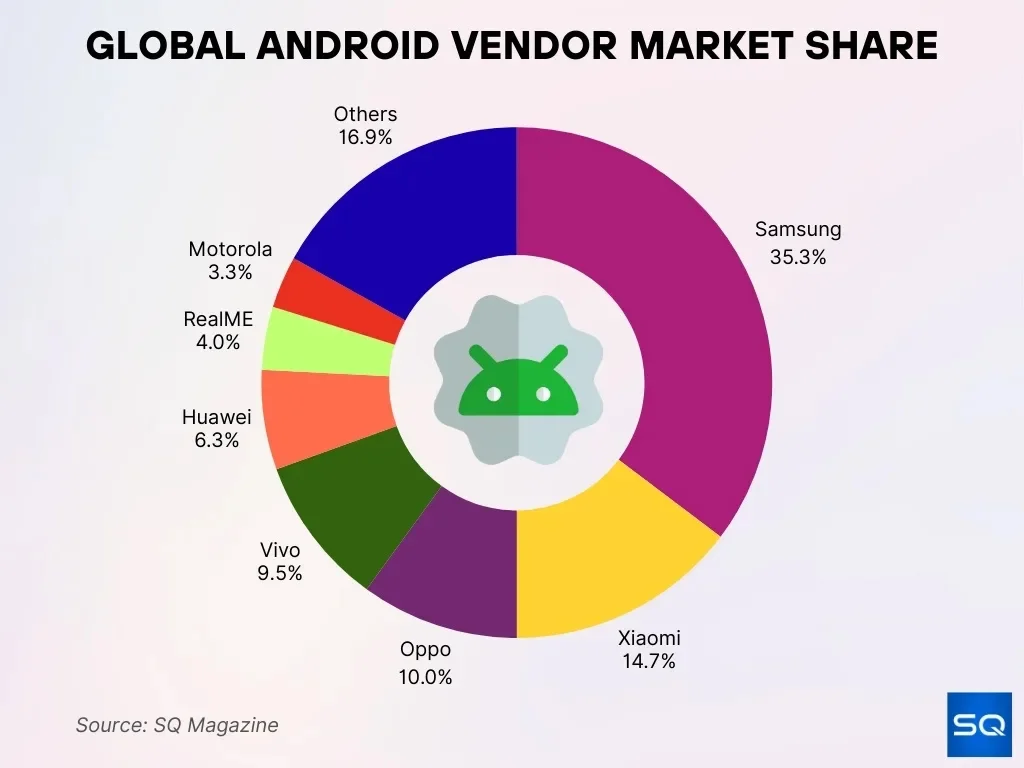

Worldwide Android Vendor Market Distribution

- Samsung dominates the global Android market with 35.3%, commanding over one-third of the total Android market share worldwide.

- Xiaomi captures 14.7%, positioning itself as the second-largest Android vendor across the global smartphone landscape.

- Oppo holds 10.0%, firmly establishing its role as a strong mid-tier competitor in the worldwide Android ecosystem.

- Vivo records 9.5%, maintaining intense competition with Oppo in terms of global smartphone sales.

- Huawei retains 6.3%, continuing its presence in the market despite regulatory restrictions and market challenges.

- RealME accounts for 4.0%, successfully sustaining its position among fast-growing and emerging Android brands.

- Motorola secures 3.3%, indicating a modest market presence when compared with the leading Android vendors.

- Other brands collectively contribute 16.9%, highlighting the highly fragmented nature of the remaining Android market.

Android Gaming Statistics

- Mobile gaming generated more than $111 billion in revenue globally in 2025.

- In-app purchase revenue grew about 4% year-over-year in 2024.

- Gaming apps account for an outsized portion of in-app spending.

- Casual and hybrid games show strong retention and monetization.

- Top mobile games have generated billions in revenue individually.

- North America and Europe posted notable growth in mobile gaming spend.

- Mobile remains the dominant gaming platform worldwide by revenue.

Security and Malware Statistics

- Android devices remain frequent targets of mobile malware.

- Malware incidents increased by about 67% year-over-year.

- Hundreds of malicious apps recorded more than 42 million downloads.

- Cybersecurity firms detected millions of mobile malware samples.

- Google banned 2.36 million harmful apps and blocked 158,000 developer accounts.

- Google Play Protect scans billions of apps daily.

- API vulnerabilities can expose apps to data leaks and fraud.

- Roughly 1 in 5 devices may encounter malware, emphasizing security risks.

Android Usage by Device Type (Phone, Tablet, TV, Wearables, Auto)

- Android commands 72% global smartphone market share in 2025.

- Smartphones represent over 95% of total Android daily active usage.

- Android tablets hold 47-52% market share versus iOS in 2025.

- Samsung leads Android tablets with 18.7% global share in Q2 2025.

- Android TV/Google TV powers 150 million monthly active devices.

- Wearables see Android capturing 40% market amid a 209.8 billion valuation in 2025.

- The Android Automotive market is valued at $3.2 billion in 2024, growing rapidly.

- Gartner forecasts 70% vehicles using Android OS by 2028 from under 1% today.

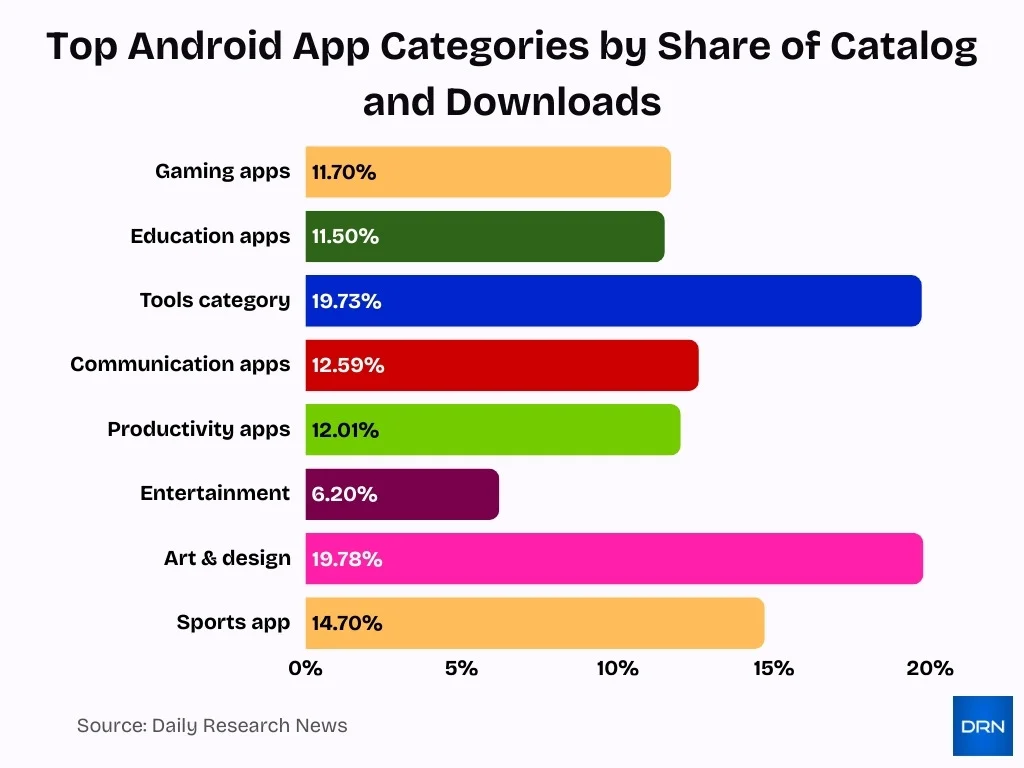

Top Android App Categories by Popularity

- Google Play features 49 distinct categories for Android apps.

- Gaming apps comprise 11.7% of all available apps in Q2 2024.

- Education apps hold the second spot at 11.5% of the catalog.

- The tools category leads with 19.73% of global downloads.

- Communication apps capture 12.59% of total downloads.

- Productivity apps account for 12.01% of downloads.

- The entertainment category represents 6.2% of global downloads.

- Art and design downloads surged by 19.78% from 12/2024 to 11/2025.

- Sports apps grew 14.7% in monthly downloads recently.

Android Revenues and Market Size

- The mobile application market is valued at approximately $333.9 billion in 2025.

- Google Play revenue projections for 2025 range between $60 billion–65 billion.

- Mobile gaming contributes significantly to Android ecosystem revenues.

- Consumer app spending continues to rise year-over-year.

- Annual mobile app downloads are projected to reach nearly 143 billion by 2026.

- Subscriptions and in-app purchases make up a large share of revenue.

- Android supports multi-billion-dollar business models for developers.

- Businesses continue investing in Android monetization opportunities.

Android Enterprise and Business Adoption

- Android Enterprise holds an 85% market share in enterprise mobility, dominating business device deployments.

- 82% of Android Enterprise Recommended users rate their devices as more enterprise-grade and secure.

- The global Android Enterprise Management market reached USD 4.8 billion in 2024, signaling robust adoption growth.

- 56% of enterprise purchase decision-makers prefer Android Enterprise Recommended devices exclusively.

- Over 80% of organizations now implement BYOD policies, heavily featuring Android devices.

- 82% of businesses actively leverage BYOD, with Android enabling secure corporate data access.

- 87% of companies depend on employees’ personal smartphones for business app access via Android.

- The Android Enterprise market is projected to grow from $3.4 billion in 2024 to $10.8 billion by 2033.

Frequently Asked Questions (FAQs)

There are approximately 3.6–3.9 billion active Android users globally in 2025.

Android accounts for about 72–74% of the global mobile operating system market share in 2025.

In 2025, there are roughly 2.14–3.95 million apps available on the Google Play Store.

The Google Play Store saw over 110 billion app downloads in the first quarter of 2025.

Conclusion

Android’s ecosystem remains vast, dynamic, and influential, spanning billions of users, millions of apps, and a multi-billion-dollar economic footprint. From dominating mobile gaming revenues to supporting enterprise applications, Android continues to shape global digital experiences. Despite ongoing security challenges, the platform shows resilience and adaptability across devices and industries.

Understanding these statistics helps businesses, developers, and decision-makers navigate Android’s evolving role in the mobile economy.