Antivirus software remains a critical component of digital security for both consumers and businesses. Across industries, from finance to healthcare, organizations deploy antivirus tools to prevent data breaches and protect endpoints, while households rely on them to block malware and ransomware. For example, a retail chain may use enterprise antivirus to secure point-of-sale systems, and a home user might install a consumer antivirus suite on their laptop to protect banking credentials. Below, we explore a wealth of current statistics on antivirus usage, market size, and threat trends, inviting you to dig into the full article for deeper insight.

Editor’s Choice

- 66% of U.S. adults reported using antivirus software in 2025.

- 34% of U.S. adults currently operate without any antivirus protection in 2025.

- 75% of surveyed users believe antivirus protection is effective at keeping them safe.

- The global antivirus software market was valued at $4.72 billion in 2025.

- Forecast growth to $5.52 billion by 2029, CAGR 6.9%.

- 42% of incident response cases in 2024 involved the deployment of malware.

- 35% of all attack events were ransomware, increasing 84% over the previous year.

Recent Developments

- 72% of organizations report increased cyber risk in the past year.

- Ransomware remains a top concern for organizations globally.

- The prevalence of phishing attacks rose by 1,265% in recent years, driven by generative AI techniques.

- Cloud intrusions increased by 75% in 2023, creating higher demand for endpoint and antivirus technologies.

- 25% of U.S. antivirus users apply protection to both business and personal devices.

- Coverage on business-only devices remains at 0.4% in the U.S., illustrating gaps in enterprise personal device overlap.

- The gap between 85% of U.S. adults who believe antivirus software is necessary and the 66% who actually use it remains nearly 20 percentage points.

- Cyber threat actors are increasingly targeting non-traditional endpoints, including IoT and mobile, which influences antivirus evolution.

Global Antivirus Software Market

- The global antivirus software market demonstrates steady annual growth from 2023 to 2033 without interruption.

- The market is anticipated to expand at a CAGR of 4.0%, reflecting consistent upward momentum.

- By 2033, the total market value is projected to reach $6.2 billion USD, marking a notable rise.

- In 2023, the market size stands at $4.2B, showing the baseline for the growth trajectory.

- The year 2024 records a market value of $4.4B, continuing the forward trend.

- The market expands to $4.5B in 2025, maintaining predictable progression.

- In 2026, the market size increases to $4.7B, strengthening overall growth.

- By 2027, the value will reach $4.9B, demonstrating ongoing expansion.

- The year 2028 shows an increase to $5.1B, reinforcing the upward pattern.

- In 2029, the market reaches $5.3B, highlighting steady development.

- By 2030, the value advances to $5.5B, supporting long-term growth.

- The size grows further to $5.7B in 2031, continuing its consistent climb.

- In 2032, the market hits $6.0B, approaching the forecast peak.

- By 2033, the market will achieve $6.2B, aligning with projected trends.

Antivirus Usage Statistics

- In the U.S., 66% of adults reported actively using antivirus software in 2025.

- 41% use antivirus exclusively on personal devices.

- 25% apply antivirus protection on both personal and business devices.

- 34% of U.S. adults do not use antivirus software.

- 75% of consumers believe antivirus protection is effective.

- Awareness, 85%, exceeds usage, 66%, showing a persistent gap.

- Most consumer antivirus installations remain on desktop rather than mobile.

- Younger adults aged 18 to 25 are less likely to use third-party antivirus products.

Growth Trends in Antivirus Adoption

- Antivirus software is expected to grow at around a 5.7% CAGR from 2024 to 2032.

- Other estimates predict a 6.9% CAGR from 2025 to 2029.

- India’s regional market expects a 9.6% CAGR between 2025 and 2029.

- Mature markets reflect slower growth due to high saturation.

- Enterprise adoption continues to increase as organizations transition from signature-based to behavior-based solutions.

- Growth in mobile and IoT endpoints fuels the adoption of next-generation antivirus solutions.

- Awareness campaigns help adoption, though user inertia slows progress.

- AI and cloud capabilities support growing adoption among SMBs seeking simpler protection.

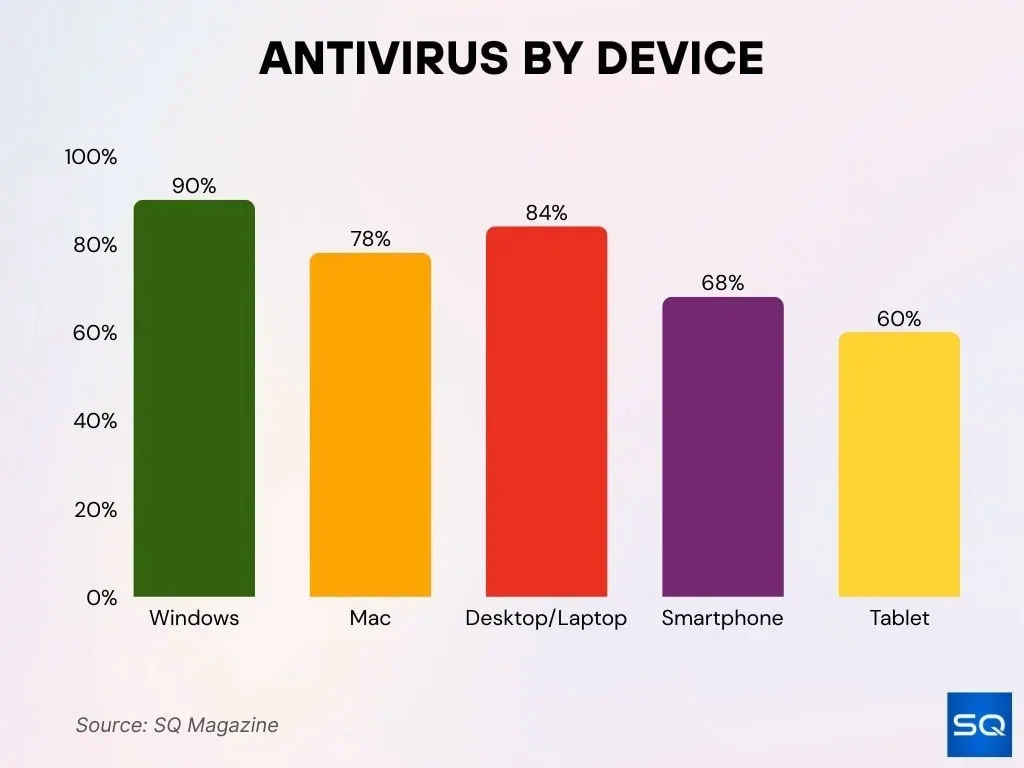

Antivirus Protection by Device Type

- Antivirus protection adoption shows that 90% of Windows users have antivirus software installed, while roughly 78% of Mac users do as well.

- Around 84% of desktop or laptop users report having some form of antivirus protection in place.

- Approximately 68% of smartphone users indicate that they use some type of antivirus on their devices.

- Nearly 60% of tablet owners say they rely on antivirus software for their device security.

Malware and Ransomware Trends

- In 2024, 42% of incident response cases involved malware.

- 28% of these malware cases involved ransomware.

- 35% of all attacks in 2024 were ransomware, an 84% year-over-year increase.

- Cloud intrusions rose by 75% in 2023.

- Phishing attacks increased by 1,265% over recent years.

- Manufacturing reported the highest number of ransomware attacks in 2023.

- 65% of financial organizations reported a ransomware attack in 2024.

- AI-powered malware and zero-day attacks are driving antivirus providers toward more advanced detection techniques.

Antivirus Effectiveness and Detection Rates

- Several home user security products achieved 99.99% online protection in September 2025 testing.

- Bitdefender recorded 98.8% offline detection and 99.99% online detection.

- Microsoft Defender recorded 88.4% offline detection and 97.9% online detection.

- 75% of antivirus users say their protection is effective, though only 25% consider it very effective.

- 45% of Windows device owners install third-party antivirus software rather than relying on built-in tools.

- Multiple products in 2025 Windows 11 tests achieved 100% ratings in protection, usability, and performance.

- Some high-detection products produce higher false positives, creating trade-offs.

- 34% of U.S. adults operate without antivirus software, limiting real-world protection impact.

Free vs Paid Antivirus Usage Statistics

- 61% of U.S. antivirus users rely on free tools, while 36% use paid software.

- Globally, 27% of third-party antivirus users choose free tools, 73% choose paid.

- 78% of Mac users have antivirus software, compared with 90% of Windows users.

- 45% of non-users cite high cost as a barrier.

- 57% of non-users worry that antivirus vendors could misuse their personal data.

- Free antivirus software is more popular among cost-sensitive users and casual consumers.

- 56% of advanced users choose paid antivirus, citing stronger protection.

- Among smartphone users, 64% rely on built-in tools, with third-party use evenly split between free and paid.

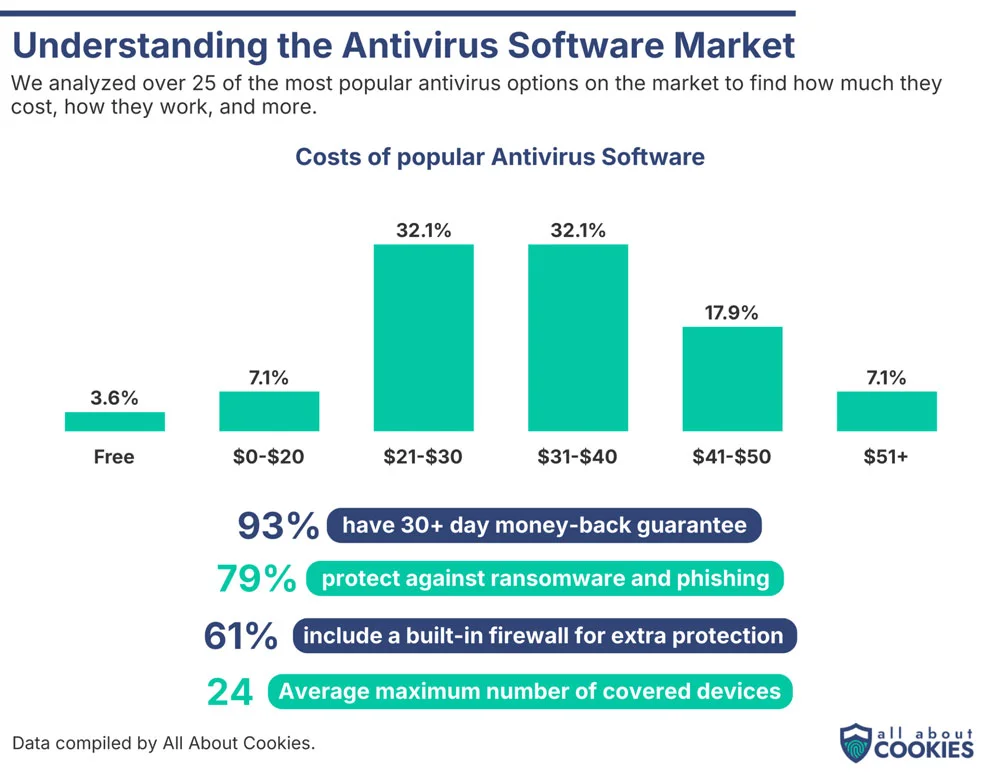

Trends in Antivirus Software Costs and Coverage

- 32.1% of antivirus plans cost between $21–$30, making it the most common price range.

- Another 32.1% fall in the $31–$40 range, showing mid-tier pricing dominance.

- Only 3.6% of antivirus options are free, highlighting the shift toward paid protection.

- 17.9% of antivirus software is priced at $41–$50, while 7.1% go above $51.

- 93% of antivirus products offer a 30+ day money-back guarantee.

- 79% include defenses against ransomware and phishing attacks.

- 61% come with a built-in firewall for additional protection.

- The average maximum coverage per antivirus subscription is 24 devices.

Operating System Vulnerability Statistics

- Only 78% of Mac users have antivirus software, compared to 90% of Windows users.

- Only 32% of Mac users rely on third-party antivirus software.

- Older Windows versions continue to run on many devices, increasing vulnerability risk.

- Android devices, with a 75% OS share, face rising mobile malware but show low third-party antivirus adoption.

- Mobile attacks surged 52% in 2023, particularly targeting Android.

- Built-in protections sometimes lack behavioral and zero-day detection depth.

- Desktop OS protection remains the strongest antivirus investment area, compared with mobile and IoT.

Antivirus Usage Demographics

- Younger adults aged 18 to 25 use fewer third-party antivirus tools compared with older groups.

- 66% of U.S. adults use antivirus software on at least one device.

- 41% use antivirus exclusively on personal devices and 25% on personal and business devices.

- Awareness outpaces usage, with 85% saying antivirus software is necessary.

- Mobile users often skip third-party antivirus software, believing built-in tools are adequate.

- Higher-income households are more likely to buy paid antivirus suites.

- Urban users show higher antivirus adoption rates than rural users.

Enterprise Antivirus Adoption

- Large enterprises hold over 57% of the endpoint and antimalware market.

- North America represents approximately 39.5% of the enterprise endpoint security market share.

- Cloud-native antivirus solutions are preferred by over 45% of enterprises for centralized updates and management.

- Microsoft Defender adoption delivers a 242% return on investment over three years for enterprises.

- In 2025, North America accounts for around 48.3% of the global antivirus market share.

- Behavior-based detection represents the modern standard, replacing traditional signature-based antivirus in the majority of cases.

- Endpoint Detection and Response (EDR) features increasingly integrate with traditional antivirus, forming a multi-layer security approach.

- Small and medium businesses (SMBs) rely on free or built-in antivirus tools in over 60% of cases.

- Remote work has driven a 30% increase in securing multiple endpoints, including desktops, laptops, mobile devices, and IoT devices.

- The enterprise antivirus market revenue is projected to grow from $5 billion in 2024 to nearly $9 billion by 2033.

Regional Antivirus Market Statistics

- India’s antivirus software market will grow by $124.1 million between 2025 and 2029 at a 9.6% CAGR.

- The global antivirus market is valued at $4.72 billion in 2025.

- North America will hold more than 48.3% of antivirus revenue by 2035.

- North America was the largest region in 2024, and Europe the fastest growing.

- The broader antivirus tools market is forecast to reach $12.36 billion by 2032.

- Asia Pacific growth is accelerating as digital infrastructure expands.

- Emerging markets show higher growth rates than saturated regions.

- The U.S., Canada, and Western Europe lead penetration, while APAC, LATAM, and MEA show rapid expansion.

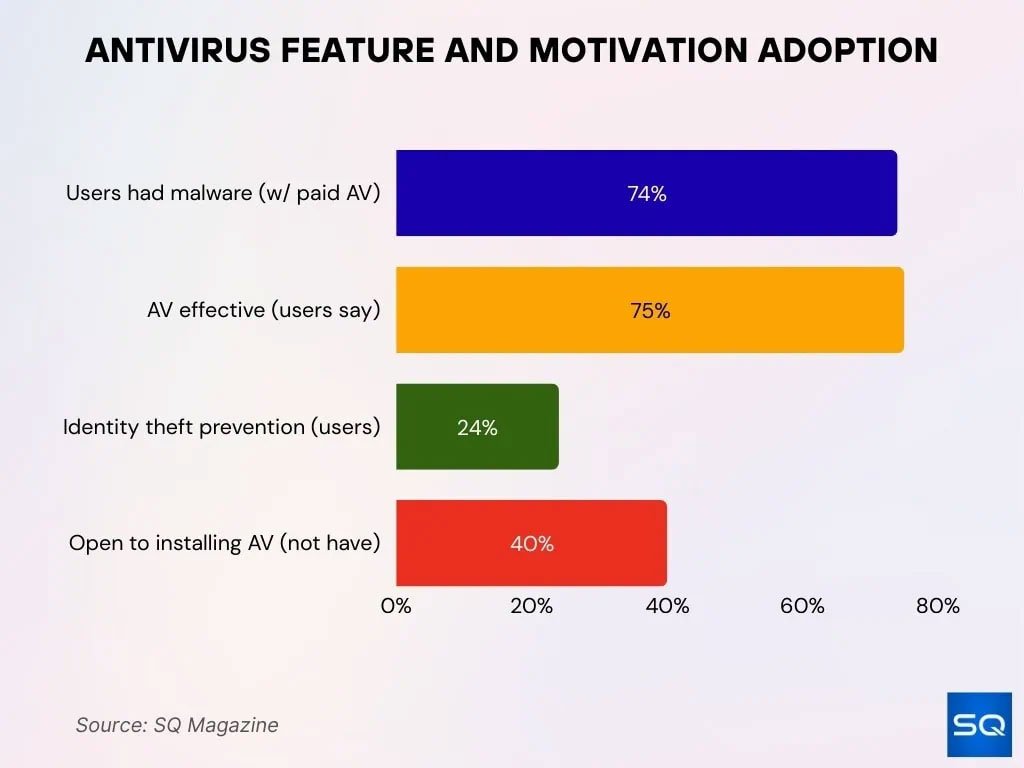

Antivirus Feature Adoption

- Among users of commercial antivirus software, 74% indicated that they had encountered malware or a virus during the past year, restating their ongoing exposure to digital threats.

- 75% of users state that their antivirus is effective in safeguarding them, emphasizing their confidence in the tool’s protective capabilities.

- Identity theft prevention is highlighted by approximately 24% of users as a primary reason for relying on antivirus solutions, underscoring its role as a major motivator.

- Close to 40% of individuals who currently lack antivirus software mention that they are open to installing it, suggesting a notable willingness to adopt protection tools.

Barriers to Antivirus Adoption

- 34% of U.S. adults do not use antivirus software.

- 45% cite cost as the main barrier.

- 57% worry antivirus vendors may misuse personal data.

- Some users perceive antivirus software as complex to install or configure.

- Built-in OS protection is viewed as “good enough” by certain user groups.

- Mobile users often do not install dedicated antivirus tools.

- Emerging market users cite a lack of awareness and affordability barriers.

- Some organizations prioritize other security projects over antivirus.

Role of Artificial Intelligence in Antivirus

- 61% of organizations rely on AI to detect anomalies and predict threats in endpoint and cloud environments.

- AI behavior-based detection reduces zero-day exploits by 70% compared to traditional methods.

- 79% of cloud security teams use AI for real-time threat intelligence and monitoring.

- 82% of antivirus vendors promote “AI-powered” modules as a key product feature.

- Google reported discovering five AI-enhanced malware families that adapt dynamically to evade defenses.

- AI antivirus solutions offer multi-device protection across PC, mobile, and IoT with detection rates above 99%.

- AI antivirus reduces false positives and false negatives, improving accuracy by up to 30% over traditional methods.

- Early adopter enterprises report a 65% faster detection and response speed thanks to AI integration.

- AI-powered antivirus solutions save organizations an average of 65.2% in breach-related costs.

- Multi-device antivirus solutions with AI protect up to 10 devices across multiple platforms seamlessly.

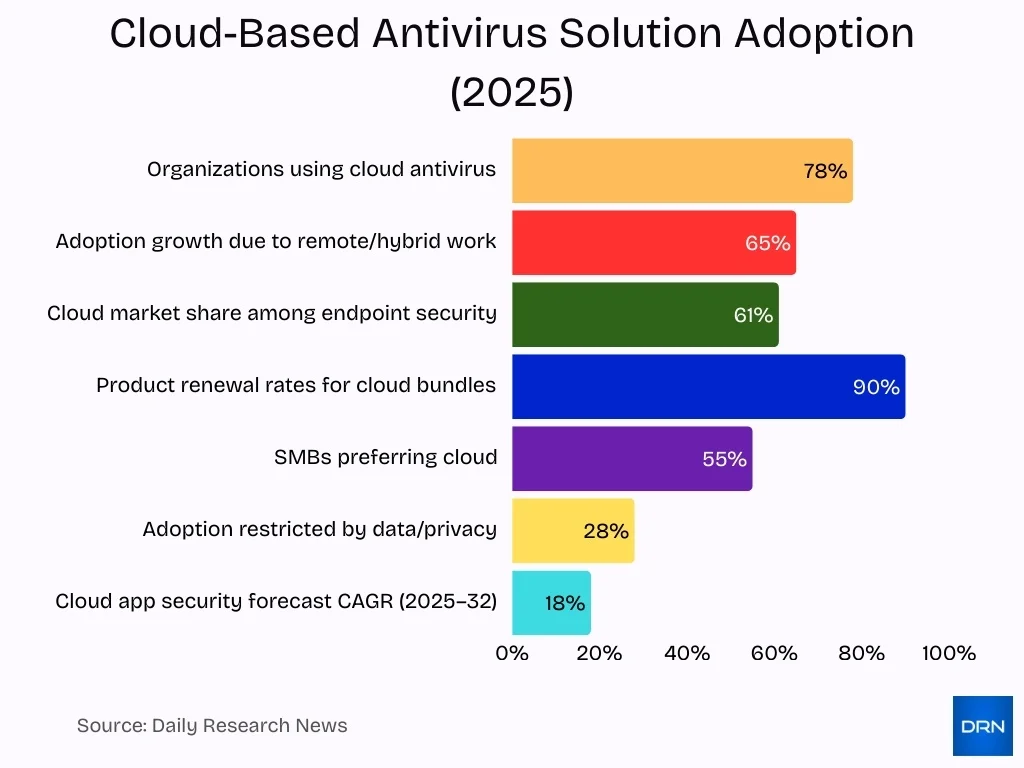

Cloud-Based Antivirus Solutions Statistics

- 78% of organizations adopted cloud-based antivirus solutions due to scalability and remote protection benefits in 2025.

- Remote and hybrid work led to a 65% increase in cloud antivirus adoption since 2023.

- Cloud antivirus market share is forecasted to grow at a 6.9% CAGR through 2029.

- Centralized management via cloud antivirus solutions enhances security analytics for over 70% of enterprises.

- Vendors report 90% renewal rates for customers with cloud-based antivirus bundles.

- Cloud scanning engines reduce device performance impact by 30-40% compared to traditional antivirus software.

- About 55% of SMBs prefer cloud antivirus due to reduced infrastructure and maintenance costs.

- Privacy and data residency concerns restrict adoption by around 28% of organizations in regulated sectors.

- The global antivirus software market was valued at $4.72 billion in 2025, with cloud solutions driving growth.

- Cloud application security is projected to grow at an 18% CAGR from 2025 to 2032, fueled by remote work trends.

Antivirus Industry Forecast and Future Trends

- The antivirus market will reach $5.52 billion by 2029.

- A separate forecast anticipates $8.45 billion by 2035.

- The broad antivirus tools market may hit $12.36 billion by 2032.

- Future trends include AI integration, cloud native protection, IoT expansion, and regulatory growth.

- Antivirus vendors will expand into EDR and XDR as threats evolve.

- Consumer markets may plateau in mature regions while emerging regions drive growth.

- Bundling with VPN and identity services will increase.

- Trust, transparency, and accurate detection will become essential competitive factors.

Frequently Asked Questions (FAQs)

Approximately 66 % of U.S. adults used antivirus software in 2025.

The global antivirus software market is estimated at $4.72 billion in 2025.

The market is forecast to grow at around 6 % CAGR between 2026 and 2035.

The top three brands together held about 54% of the U.S. antivirus market in 2025.

Conclusion

The antivirus market remains vital yet shows signs of maturation. Adoption is strong in developed regions, but awareness and usage gaps persist, especially in mobile and emerging markets. Regional growth opportunities remain, with regions such as India and the Asia Pacific growing at higher rates. The role of AI and cloud-based solutions is accelerating, reshaping the traditional antivirus model. As threats become more sophisticated, the industry’s future will favor comprehensive, multi-layered approaches rather than standalone tools.

For consumers and enterprises alike, staying ahead means choosing antivirus solutions integrated with broader security frameworks and adaptable to new device types. Explore the full article to understand detailed statistics on usage, brand market share, device type protection, and more.