Apple Pay has become one of the most widely used mobile payment methods in the world, reshaping how consumers shop in stores, online, and within apps. As digital wallets become mainstream, Apple Pay’s user base is expanding steadily, supported by widespread merchant acceptance and growing consumer trust. In real-world terms, millions of iPhone users now tap their devices for everyday purchases at grocery stores and ride-hailing services, while many e-commerce platforms offer Apple Pay as a default checkout option. Explore the trends and data shaping Apple Pay’s trajectory and beyond.

Editor’s Choice

- Apple Pay’s global active users are estimated at over 650 million in 2025.

- Apple Pay processed around $8.7 trillion in global transactions in 2025.

- In the U.S., Apple Pay users are projected to reach approximately 63.9 million in 2025.

- 54.8% of U.S. mobile payment platform users chose Apple Pay in 2024.

- Apple Pay holds about 14.2% of online consumer payments globally.

- Apple Pay is accepted by over 90% of U.S. retailers.

- Apple Pay could account for roughly 10% of all global card transactions by 2025.

Recent Developments

- Apple Pay reached an estimated 624–640 million global users in 2025.

- 85% of U.S. retailers now accept Apple Pay, boosting merchant adoption.

- Transactions processed soared to $7.6 trillion, a 21% increase in 2025.

- Shopify integration drove a 28% increase in SMB transactions via Apple Pay in 2025.

- AI-driven fraud detection cut suspicious activity by 42% in 2025.

- A global outage on May 16, 2025, affected services like Apple Pay and Apple Wallet.

- 59% of consumers used a digital wallet in the past 90 days in 2025.

- 44% of consumers plan to use digital wallets more frequently in 2025.

General Apple Pay Overview

- Apple Pay boasts an estimated 624 million global users in 2025.

- Available in 90 countries and regions worldwide.

- Processed over $6 trillion in global payments in 2022.

- Generated $1.9 billion in revenue for Apple in 2022.

- Accounts for 14.2% of all online consumer payments as of 2024.

- Represents 5.6% of all in-store purchases in 2024.

- Holds a 54.8% share among U.S. mobile payment users in 2024.

- Prevents over $1 billion in fraud losses annually with a 60-90% reduction.

- Accepted by over 90% of U.S. retailers.

Global & U.S. Apple Pay Market

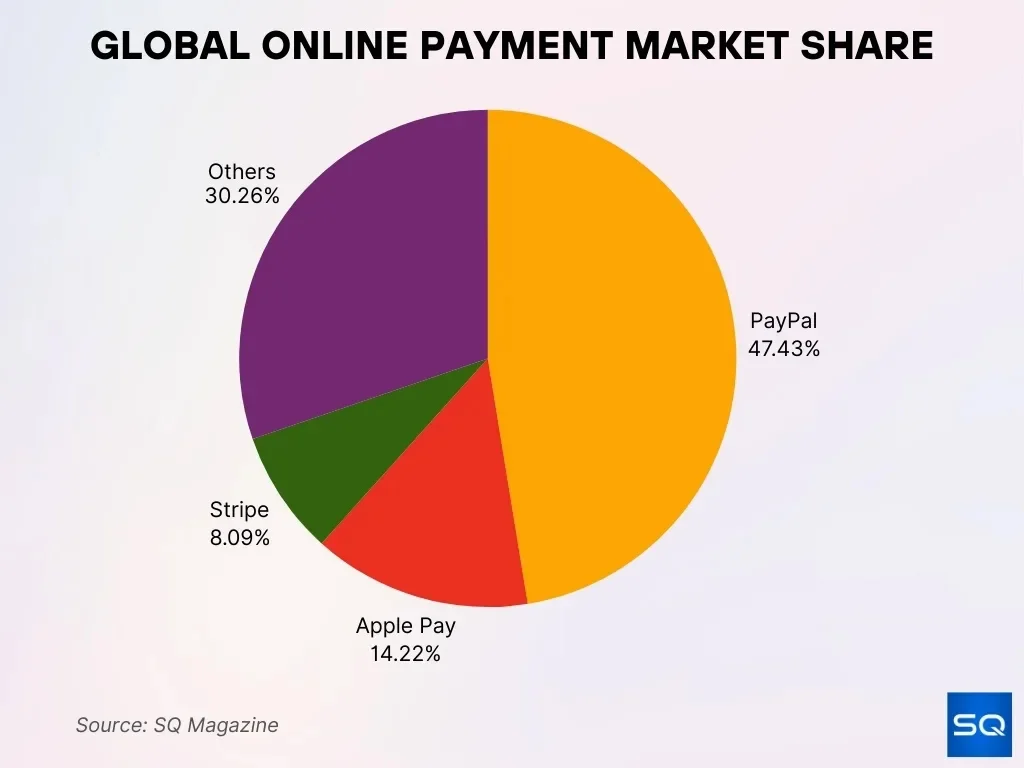

- In the global online payments market, Apple Pay captured a 14.22% market share in 2025, compared with PayPal’s 47.43% and Stripe’s 8.09%.

- In the United States in 2025, Apple Pay dominates 49% of the mobile wallet user base, highlighting its strong consumer adoption.

- Across U.S. retailers, Apple Pay is supported by approximately 85–90% of merchants, reflecting widespread merchant integration.

- In-store usage of Apple Pay is more than twice as frequent as PayPal (8%) or Google Pay (4.2%), emphasizing its checkout preference.

- On a global scale, Apple Pay represents 35% of all mobile wallet transactions, underscoring its significant transactional influence.

Global Apple Pay User Statistics

- Over 650 million people used Apple Pay globally in 2025.

- This figure reflects a strong expansion from earlier estimates of roughly 624 million users.

- Apple Pay users span around 78 markets worldwide.

- Global mobile payment adoption reached billions of users, with Apple Pay among the top providers.

- Apple Pay’s global share of all card transactions is projected to be near 10% by 2025.

- In 2024, Apple Pay processed around 14.2% of online payments worldwide.

- Contactless payments, including Apple Pay, continue increasing as consumers shift away from cash.

- Apple Pay’s infrastructure extends to millions of e-commerce sites and apps.

Apple Pay Users in the United States

- The number of U.S. Apple Pay users is projected to be roughly 63.9 million in 2025.

- This represents around 22.3% of the U.S. population.

- Apple Pay’s U.S. user base grew 6.1% year-over-year from 2024 to 2025.

- Earlier estimates showed about 60.2 million users in 2024.

- Apple Pay accounts for over 54% of in-store mobile wallet transactions in the U.S.

- U.S. retail acceptance rates for Apple Pay exceed 90%.

- Apple Pay is used by a significant portion of mobile payment platform users in America.

- Growth forecasts project U.S. Apple Pay penetration to rise further through the decade.

Regional and Country-wise Apple Pay Adoption

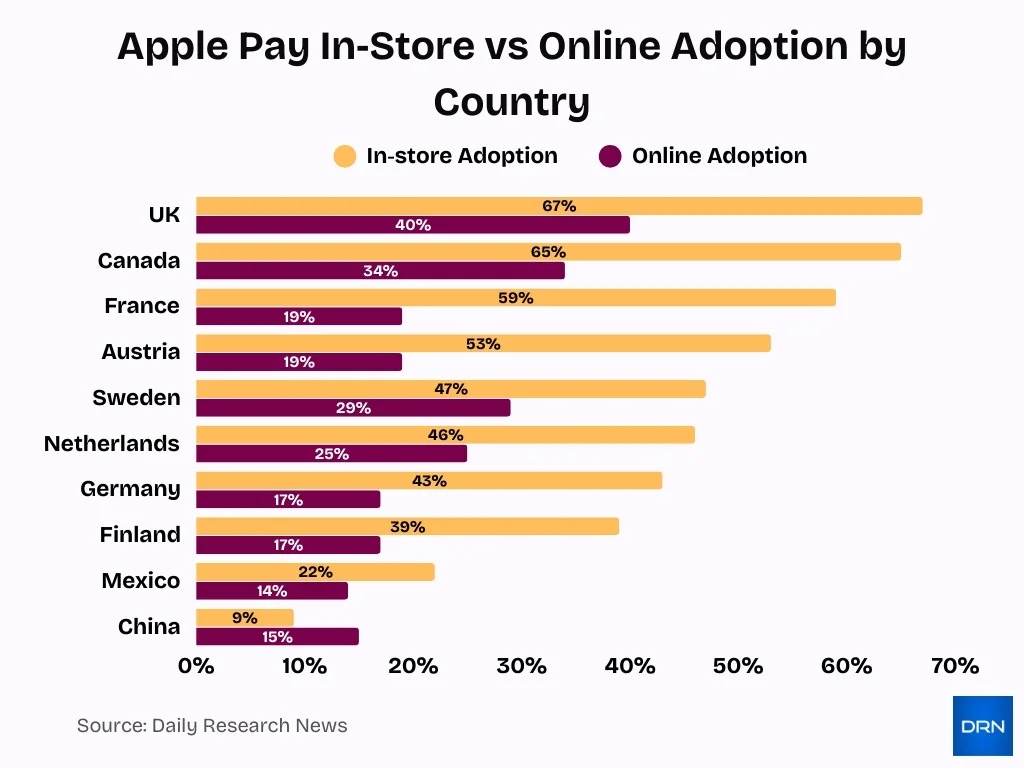

- The UK leads with 67% in-store and 40% online Apple Pay adoption.

- Canada reports 65% in-store and 34% online usage rates.

- France shows 59% in-store but only 19% online adoption.

- Austria has 53% in-store and 19% online penetration.

- Sweden achieves 47% in-store and 29% online usage.The The

- The Netherlands records 46% in-store and 25% online adoption.

- Germany demonstrates 43% in-store and 17% online rates.

- Finland sees 39% in-store and 17% online penetration.

- Mexico has 22% in-store and 14% online growing use.

- China exhibits 9% in-store but 15% online adoption.

Apple Pay Penetration Among iPhone Owners

- About 96% of active iPhones worldwide are technically Apple Pay-capable, giving the service near‑universal device coverage.

- Roughly 51% of global iPhone users have activated Apple Pay at least once, meaning about half of owners have turned it on.

- In the U.S., around 52% of iPhone users with Apple Pay enabled use it regularly at checkout, showing strong engagement among activators.

- In 2019, Apple Pay activation reached 48% of iPhone users, up 45.5% year over year from 2018, reflecting rapid early penetration.

- Apple Pay in‑store penetration reaches about 63% in the U.K., 60% in France, and 57% in Canada, versus 43% in Germany and 32% in Spain.

- Global Apple Pay users are estimated at around 624 million in 2025, a large share of whom are iPhone owners using the Wallet integration.

- In 2024, about 61.3 million U.S. iPhone owners actively used Apple Pay, representing over half of all U.S. mobile wallet users.

- Less than 20% of Apple Pay’s historical growth has come from brand‑new users, with most expansion from existing iPhone users increasing usage.

Apple Pay Usage Frequency and Behavior

- Apple Pay remains the dominant mobile wallet for in-store purchases in the U.S., used in about 54% of mobile wallet taps at checkout in 2025.

- Surveys show Apple Pay usage at physical points of sale more than doubles that of Google Pay and PayPal in the U.S.

- Roughly 15.9% of consumers reported using Apple Pay in the past year, up significantly from previous years.

- Use of stored digital cash balances for Apple Pay rose from 1.0% to 3.7% of in-store transactions between 2023 and 2025.

- Gen Z and Millennials lead mobile wallet usage, with younger users showing higher frequencies of Apple Pay transactions.

- Apple Pay users often choose it for quick checkout and contactless payment convenience versus cards.

- Usage frequency tends to spike during peak shopping seasons like holidays and sales events.

- Global mobile payment trends suggest contactless payment usage is expanding overall, benefitting Apple Pay’s frequency stats.

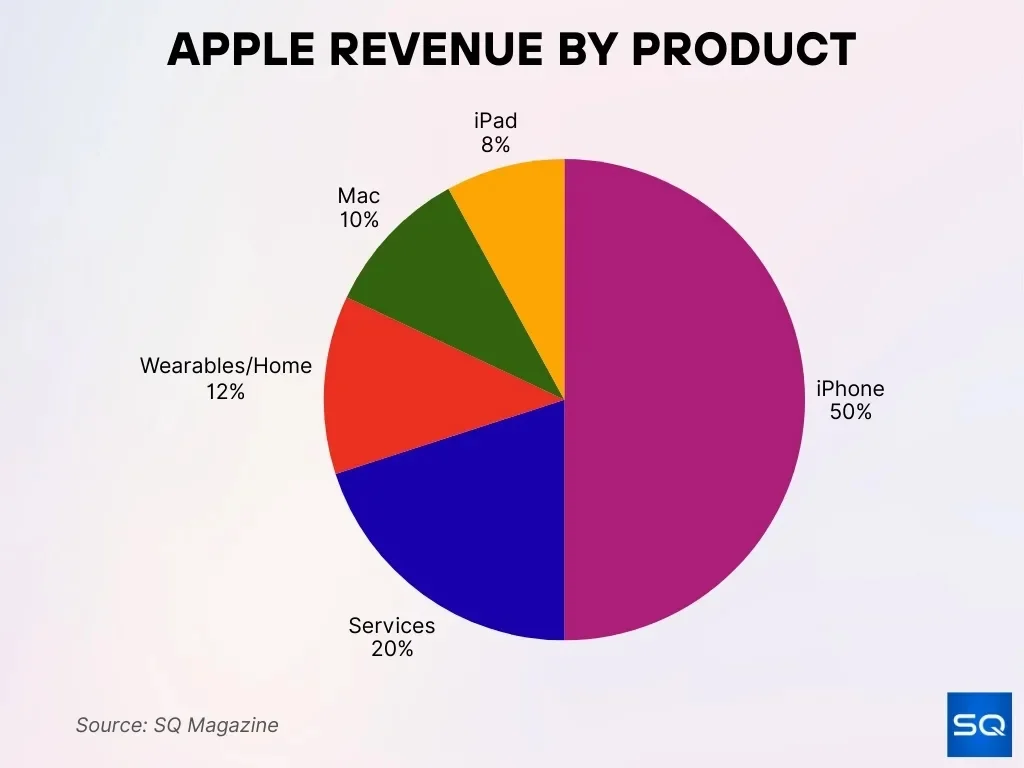

Revenue Share of Apple Products by Category

- The iPhone continues to stand as Apple’s most significant revenue generator, accounting for 50% of the company’s total revenue and reinforcing its dominant position.

- Services contribute 20% of overall revenue, clearly reflecting Apple’s increasing emphasis on subscriptions, digital services, and recurring income streams.

- Wearables and Home products represent 12% of total revenue, demonstrating consistent growth across devices such as Apple Watch, AirPods, and smart home technologies.

- The Mac product line delivers 10% of revenue, successfully maintaining a stable share within Apple’s ecosystem despite changing market dynamics.

- The iPad accounts for the smallest share at 8% of total revenue, positioning it as the least contributing product category in Apple’s portfolio.

In-Store Apple Pay Payment Statistics

- 85–90% of U.S. retail stores now accept Apple Pay for in-store payments in 2025.

- 52% of U.S. in-store mobile wallet users prefer Apple Pay, double that of PayPal or Google Pay.

- Apple Pay represented about 32% of all U.S. contactless POS transactions in 2025.

- Over 50% of mobile payment users in the U.S. use Apple Pay at physical retail checkouts.

- Contactless payment adoption in-store grew 18% year-over-year, driven largely by Apple Pay usage.

- 68% of Gen Z consumers used Apple Pay in-store at least once monthly in 2025.

- 72% of urban retailers report higher checkout speed after integrating Apple Pay.

- Apple Pay accounts for roughly 1 in 3 in-store digital wallet purchases in the U.S.

- 45% of retailers actively promote Apple Pay to enhance payment efficiency and customer convenience.

- Apple Pay usage in high-traffic retail environments grew 22% annually from 2023–2025.

Online and In-app Apple Pay Payment Statistics

- Apple Pay held a 14.22% global share of online payments in 2025, second place behind PayPal.

- Millions of e-commerce sites worldwide offer Apple Pay at checkout, ranking it among the top online payment options.

- Apple Pay’s online share grew from around 12.7% in 2023 to over 14% by 2025.

- In-app payments via Apple Pay rose by about 26% in 2025.

- Online transaction volume with Apple Pay continues growing as retailers optimize checkout experiences.

- Apple Pay’s presence in apps improves conversion rates due to fast, secure payments.

- Regions with high e-commerce adoption see notable online Apple Pay usage.

- Many subscription services now list Apple Pay as a preferred billing option.

Apple Pay Transaction Volume and Value

- Apple Pay processed an estimated $7.6 trillion to $8.7 trillion in transaction volume globally in 2025.

- Transaction value grew roughly 20% year-over-year, reflecting rising adoption and spending.

- In the U.S., Apple Pay accounts for around $2.9 trillion in payments in 2025.

- The average Apple Pay transaction value ranges between $29 and $57 per purchase.

- Mobile wallet transaction volumes overall continue to expand rapidly.

- Contactless payment usage across digital wallets rose significantly.

- Apple Pay’s contribution to global payment rails reflects broader contactless payment growth trends.

- Many regions show double-digit growth in Apple Pay transaction values year-over-year.

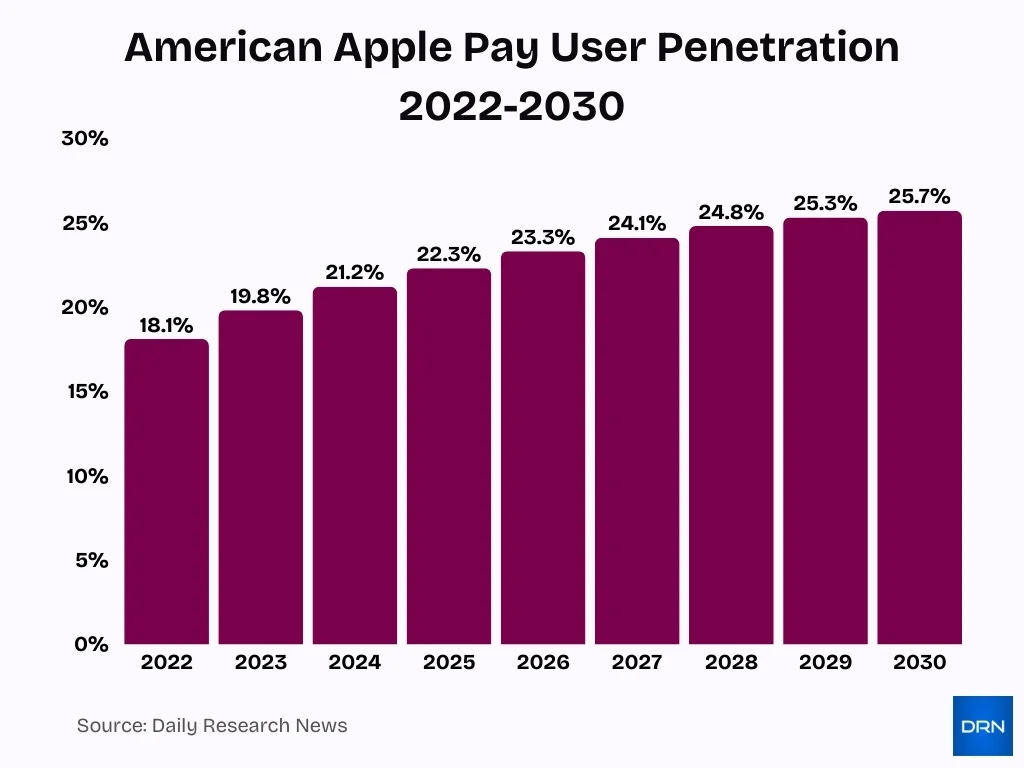

American Apple Pay User Penetration Trends (2022–2030)

- Apple Pay adoption in the U.S. shows consistent growth, rising from 18.1% in 2022 to 25.7% by 2030 among consumers aged 14+.

- Between 2022 and 2024, penetration increased by over 3 percentage points, signaling strong early momentum in mobile wallet usage.

- Adoption is projected to cross 20% in 2024, reaching 21.2%, marking a key mainstream adoption milestone.

- From 2025 onward, growth continues at a steady but gradually slowing pace, increasing from 22.3% (2025) to 25.7% (2030).

- The period 2026–2028 shows incremental gains of about 0.7–0.8 percentage points per year, indicating market maturation.

- By 2030, roughly 1 in 4 American consumers is expected to use Apple Pay, reinforcing its position as a leading digital payment method.

Revenue Generated by Apple Pay

- Apple Pay generated $9.4 billion in revenue in 2025, representing 3.4% of Apple’s total company revenue.

- Apple charges banks an approximate 0.15% fee per transaction, driving scalable income from high volumes.

- Transaction volume hit over $7.6 trillion globally in 2025, up 21% year-over-year.

- In-app purchases via Apple Pay surged 26% in 2025, boosting digital commerce revenue.

- Apple Pay captured 14.3% of global e-commerce sales in 2025.

- 580 million+ active users worldwide fueled 16% year-over-year growth in 2025.

- Apple Pay handled 54% of in-store mobile wallet transactions in 2024, with continued dominance.

- 44% of subscription services now prefer Apple Pay for recurring payments.

- Services revenue, including Apple Pay integrations, reached $28.8 billion in Q4 2025.

Apple Pay Market Share Among Digital Wallets

- In the global online payments market in 2025, Apple Pay held about 14.2% of market share.

- Apple Pay dominates U.S. mobile wallet usage with a roughly 49 to 54% share.

- Globally, Apple Pay accounts for an estimated 35% of mobile wallet transactions.

- Competitor shares include PayPal, Stripe, and Google Pay.

- Apple Pay’s U.S. market lead persists despite rapid growth from rivals.

- Market share varies depending on region and usage definitions.

- The broader digital wallet market surpassed 4.3 billion global users by mid-2025.

- Apple Pay’s share reflects a strong preference among iOS users for native wallet payment.

Merchant and Retailer Acceptance of Apple Pay

- 85–90% of U.S. retailers accept Apple Pay at point-of-sale terminals.

- 85% of U.S. retailers now support Apple Pay for in-store transactions.

- Retail businesses comprise the largest share at 14% of Apple Pay accepting companies.

- 58% of U.S. consumers use Apple Pay for in-store, restaurant, or POS purchases.

- Apple Pay accounts for 54% of in-store mobile wallet usage in the U.S.

- Nearly 574,200 companies worldwide accept Apple Pay, with 80,140 retailers.

- 92% of mobile debit card payments are processed through Apple Pay.

- Tap to Pay on iPhone is now available in 34 countries, boosting small merchant adoption.

- 41.4% of Apple Pay companies are small businesses with fewer than 10 employees.

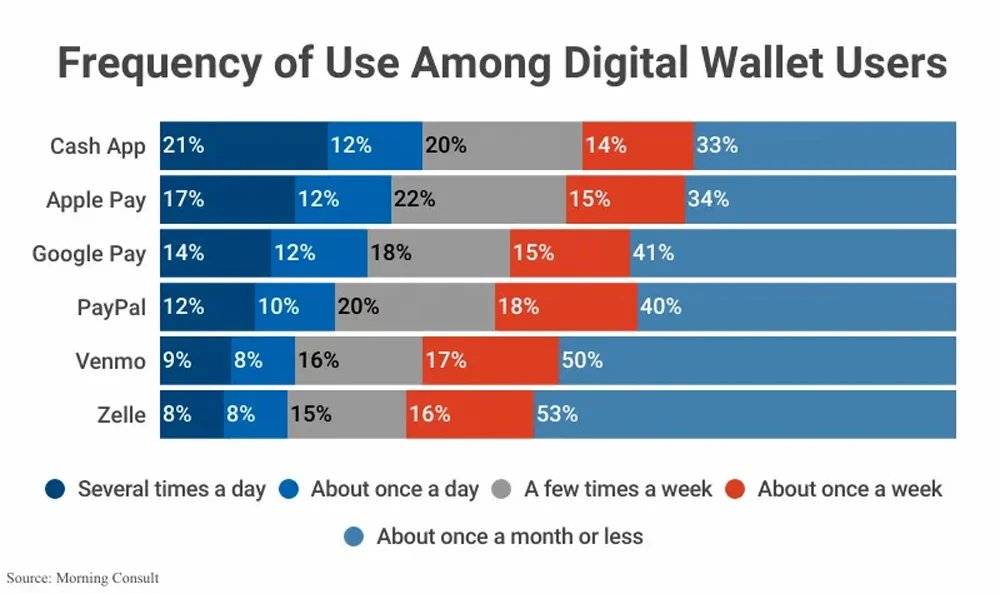

Usage Frequency Patterns Among Digital Wallet Users

- Cash App demonstrates the highest overall usage frequency, with 21% of users engaging several times a day and 12% using it about once a day, while a notable 33% still access it about once a month or less.

- Apple Pay reflects strong weekly and daily engagement, as 22% of users utilize it a few times a week and 17% use it several times a day, though 34% depend on it about once a month or less.

- Google Pay records 14% of users interacting with it several times daily, but a substantial 41% report usage limited to about once a month or less.

- PayPal continues to be widely adopted, yet used less frequently, with 12% of users accessing it daily and 40% relying on it monthly or less.

- Venmo shows lower usage frequency, with only 9% of users engaging several times daily, while a majority 50% use it about once a month or less.

- Zelle ranks lowest in frequent engagement, as just 8% of users access it several times daily, and the largest share, 53%, rely on it monthly or less.

Demographics of Apple Pay Users

- In 2025, 22.3% of U.S. consumers aged 14+ use Apple Pay.

- Millennials make up 43% of U.S. Apple Pay users, while Gen Z accounts for 31%.

- About 62% of Gen Z users use Apple Pay at least once per week.

- Baby Boomers represent only 9% of users but show steady annual growth of 4%.

- Households earning over $100,000/year generate 58% of Apple Pay transactions.

- Globally, 70% of Apple Pay users are aged 18–34, highlighting strong youth adoption.

- The gender split is roughly 55% male and 45% female among active users.

- Urban residents are 2.1× more likely to use Apple Pay than rural populations.

- 65% of users link Apple Pay to credit cards, while 35% prefer debit cards.

- Usage peaks among users in tech-forward cities like San Francisco, New York, and London.

Apple Pay in Contactless Payments

- Apple Pay captures 54% of all U.S. mobile wallet in-store taps.

- Global Apple Pay transactions reached $7.6 trillion in 2025.

- 85% of U.S. retailers accept Apple Pay for contactless payments.

- Over 70% of U.S. retailers offer contactless payment options, including Apple Pay.

- Tap to Pay on iPhone is available in 34 countries worldwide.

- 61.3 million U.S. iPhone owners actively used Apple Pay in 2024.

- Apple Pay accounted for 3.2% of in-store U.S. transactions in 2023.

- U.S. contactless merchant adoption hit 85% by 2023.

- Global cash usage dropped to 80% of 2019 levels, boosting Apple Pay.

Using Apple Pay for Peer-to-Peer Transfers

- Apple Pay’s Apple Cash enables P2P transfers up to $10,000 per message and $10,000 weekly in the U.S.

- Gen Z shows 73.1% weekly Apple Pay usage among digital wallet holders, driving P2P bill splitting.

- P2P payments via mobile wallets like Apple Cash reach 84% user reliance, up from 25% previously.

- Apple Pay commands 54% of in-store mobile wallet transactions, boosting Wallet P2P activity.

- 63% of Apple Pay users also engage Venmo for messaging-integrated P2P.

- Face ID/Touch ID secures 99% of Apple Pay P2P payments with a 0.01% fraud rate.

- Apple Cash adoption hits 60-65 million U.S. users in supported regions by 2025.

- Competing apps hold sway as 59% of Apple Pay users also use Venmo, and 63% use Cash App.

Adoption Among Banks and Card Issuers

- Over 8,000 banks worldwide support Apple Pay in 2025, with 72.5% serving U.S. customers.

- 5,000+ banking institutions partner with Apple Pay globally for wide consumer accessibility.

- 90% of U.S. retailers now accept Apple Pay, reflecting strong major bank integration.

- Apple Pay is supported by over 6,600 U.S. banks and financial institutions, including top issuers.

- France sees 60% of iPhone users actively using Apple Pay, aligning with EU open banking.

- Cross-border payments via Apple Pay support 50+ currencies for seamless global transactions.

- Fintech platforms like Shopify and BigCommerce enable default Apple Pay compatibility.

- Apple Pay transactions show 60-90% lower fraud rates than traditional cards, per issuer reports.

Apple Pay Security and Fraud Statistics

- Apple Pay fraud rates remain extremely low at around 0.01%.

- Dynamic tokenization replaces real card numbers in nearly 100% of transactions.

- Biometric authentication secures over 99% of Apple Pay transactions.

- Lost devices are remotely disabled in under 1 minute for 95% of cases.

- Two-factor authentication is required for all setups, blocking 99.9% unauthorized access.

- Machine learning detects fraud in real-time for 1.8 billion prevented transactions in 2023.

- 37.4% of fraud incidents stem from external banking vulnerabilities.

- Apple complies with PCI DSS Level 1 standards, securing over 7 billion transactions yearly.

Apple Pay Future Outlook and Forecasts

- Apple Pay is forecast to reach over 75 million U.S. users by 2030, representing more than 25% of the population.

- The mobile payments market will grow from $88.5 billion in 2024 to $587.5 billion by 2030 at a 38% CAGR.

- Apple Pay holds a 92% market share among digital wallets and 14.2% of online consumer payments as of 2024.

- Apple Pay is projected to capture 10% of all global card transactions.

- Global Apple Pay users stand at 624 million in 2025, expected to exceed 635 million by 2030.

- Over 90% of U.S. retailers accept Apple Pay, with 10 million merchants worldwide.

- Apple Pay prevented more than $1 billion in fraud last year, reducing it by over 60% versus cards.

- 85% of U.S. retailers now support Apple Pay, boosted by 5,000+ bank partnerships.

- Apple Pay transactions grow 2x faster than chip cards, enhancing in-app and transit usage.

Frequently Asked Questions (FAQs)

Apple Pay has an estimated 624–785 million active users worldwide in 2025.

Apple Pay accounts for about 54 % of all in‑store mobile wallet transactions in the U.S.

Apple Pay processed roughly $7.6 trillion in global transactions in 2025.

Apple Pay is projected to reach over 84 million U.S. users by 2030.

Conclusion

Apple Pay stands as a key pillar in the mobile payments ecosystem. It maintains a strong market share domestically and globally, underpinned by broad merchant acceptance and robust security protocols. Adoption continues across demographic segments, particularly among younger and higher-income users. As digital wallets proliferate and mobile commerce expands further, Apple Pay is poised to grow both in transaction volume and user base.

With projections pointing toward broader global adoption and deeper integration, the next decade promises continued momentum for contactless and digital wallet payments worldwide.