The world’s leading cryptocurrency, Bitcoin (BTC), continues to garner attention across investment, institutional, and grassroots landscapes. From retail adoption to government engagement, Bitcoin’s influence extends far beyond speculative trading. For example, major U.S. regulatory moves elevated Bitcoin’s status among traditional assets, and global wallet-use expansion shows growing public access. The statistics below offer a detailed look at Bitcoin’s trajectory. Explore the full article for insights and context.

Editor’s Choice

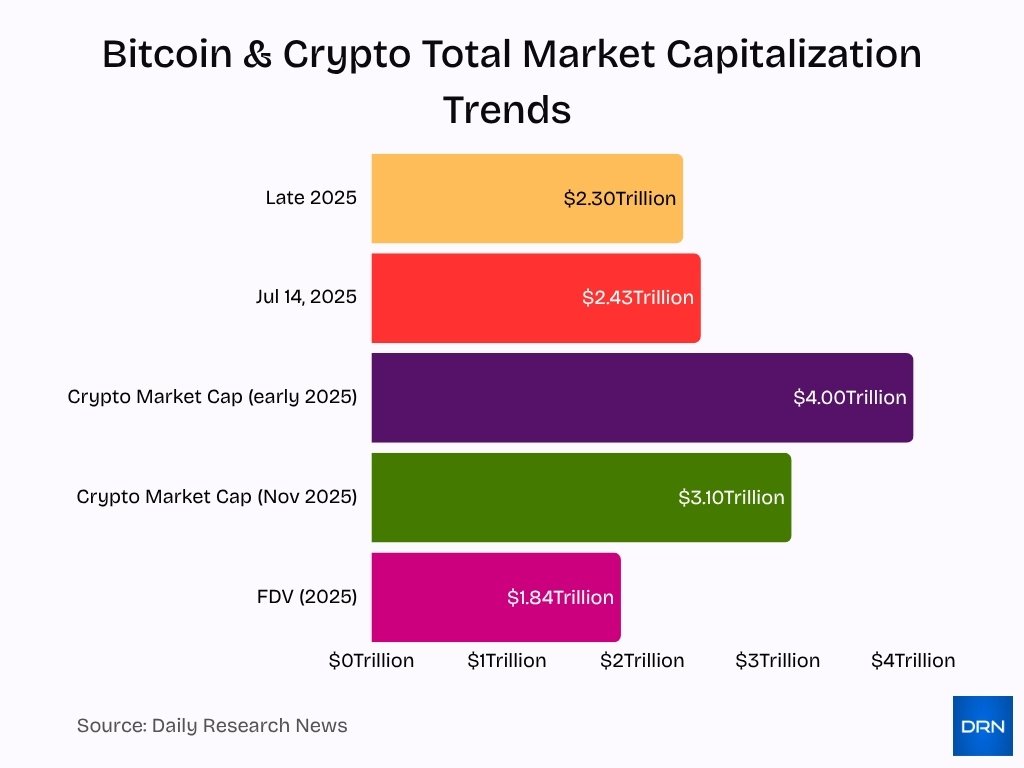

- The total crypto market cap peaked at $4 trillion in early 2025, but fell to $3.1 trillion by November

- Global cryptocurrency adoption rate estimated at 9.9% in 2025.

- Matches with October 2025 reports, which estimate 480–500 million people have some Bitcoin. Less than 1 million wallets hold at least 1 full BTC.

- Bitcoin’s market capitalization was around $2.2-2.3 trillion in late 2025.

- Consistent with blockchain supply data, over 19 million mined by 2025, max supply capped at 21 million.

- Spot trading volume on centralized exchanges hit $5.1 trillion in Q3 2025.

- In the U.S., cryptocurrency ownership rose from 20% in 2024 to 22% in 2025.

Recent Developments

- Global crypto adoption increased in 2025, with U.S. ownership rising to 22%.

- The U.S. passed the GENIUS Act in mid-2025, establishing the first federal stablecoin regulatory framework with bipartisan support of 68-30 in the Senate.

- In 2025, the U.S. government established a Strategic Bitcoin Reserve, holding over 207,000 BTC worth about $17 billion as of March.

- Global crypto ETFs saw record inflows of approximately $5.95 billion in one week in early October 2025.

- U.S. banks gained clearer regulatory pathways to engage in crypto activities with guidance changes announced in early 2025.

- The global crypto market dropped by over $1 trillion in six weeks during late 2025 amid volatility, erasing significant Bitcoin gains.

- Bitcoin reached an all-time high near $126,000 in mid-2025 before retracing lower.

- The combined AI and crypto market sector grew to an estimated $5.5 billion in 2025, a 48% year-over-year increase.

- South Asia became the fastest-growing region for crypto adoption in 2025, with U.S. crypto activity surging about 50% compared to 2024.

- North America saw a 49% annual growth rate in crypto adoption in 2025, reflecting regulatory clarity and institutional inflows.

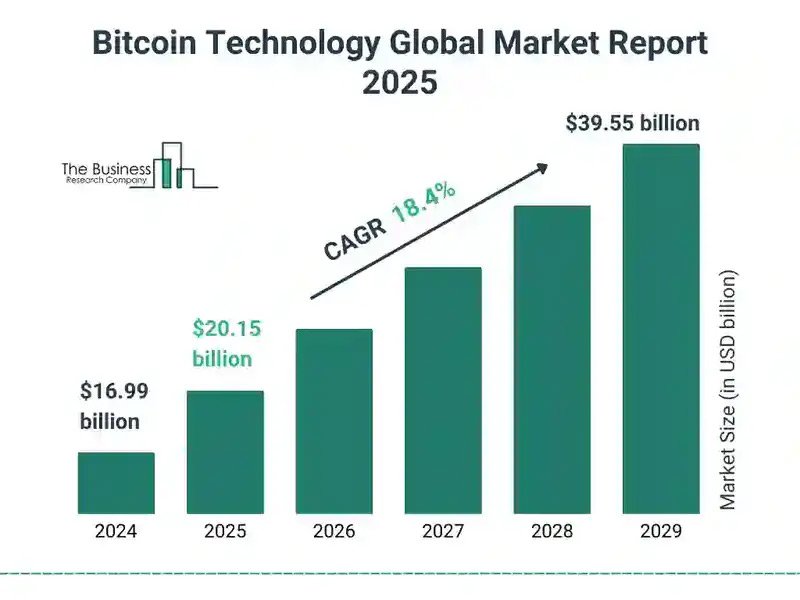

Bitcoin Tech Market Outlook

- The global market is projected to reach $20.15 billion in 2025.

- Expected to expand at a CAGR of 18.4% over the forecast period.

- Market size forecasted to climb to $39.55 by 2029.

Key Bitcoin Price Statistics

- Bitcoin’s historical price traded around $106,000–$111,000 in October 2025.

- In 2025, Bitcoin’s price hit a high of $125,000 in October and recently fell below $90,000

- In mid-2025, Bitcoin’s value surged over 30% in a month before hitting new highs.

- On July 14, 2025, Bitcoin surpassed $120,000 and had a market cap of $2.43 trillion, overtaking major corporations.

- Despite such highs, Bitcoin lost 27% of its value over six weeks in late 2025.

- Daily volatility increased; 14 of the last 30 days were positive green days (47%) in late 2025.

- The fully diluted valuation (FDV) of Bitcoin reached $1.84 trillion in 2025.

Historical Bitcoin Price Performance

- In 2025, Bitcoin’s price hit a high of $125,000 in October and recently fell below $90,000.

- The 2024 halving positively impacted Bitcoin’s price, with subsequent months seeing over 35% gains attributed to reduced supply and increased demand.

- Bitcoin’s correlation with major equity indices surged to 0.87 by 2024-25, reflecting stronger ties to traditional financial markets.

- At the end of November 2024, Bitcoin’s price was over $97,000, marking a significant growth milestone post-halving.

- Institutional flows and ETFs in 2025 pushed Bitcoin’s market dynamics into a new phase, with ETF inflows reaching nearly $7 billion annually.

- BlackRock’s Bitcoin ETF managed assets exceeded $50 billion in less than a year, leading institutional adoption.

- Bitcoin’s peak price reached a record $125,245.57 in October 2025, driven by regulatory clarity and institutional inflows.

- The late 2025 price correction brought Bitcoin below $94,000, highlighting ongoing market volatility amid mainstream pressures.

- Since launching in 2009, Bitcoin has evolved through phases of exploration, adaptation, and maturity, reflected in its growing adoption and market behavior.

- Institutional demand and ETF presence fundamentally changed Bitcoin’s price behavior as it increasingly acts as a mainstream financial asset.

Bitcoin Market Capitalization Statistics

- The Bitcoin market cap ranged around $2.2–2.3 trillion in late 2025.

- On July 14, 2025, Bitcoin’s market cap was $2.43 trillion, surpassing major companies.

- Bitcoin remains the largest cryptocurrency by market cap.

- Fully diluted valuation is about $1.84 trillion as of 2025.

- The total crypto market cap peaked at $4 trillion in early 2025, but fell to $3.1 trillion by November

- Market cap fluctuations from early 2025 highs to late-2025 corrections show high sensitivity to sentiment and regulation.

- Capital allocation is increasingly driven by institutional flows, which feed into market cap measures.

Bitcoin Trading Volume Statistics

- The 24-hour spot trading volume for Bitcoin averaged approximately $60 billion in late 2025.

- The daily derivatives trading volume for all crypto in 2025 averaged $24.6 billion, up 16% vs 2024.

- Open interest in Bitcoin futures climbed to $16.3 billion in 2025.

- About 2.6 million BTC changed hands over four months.

- Global spot Bitcoin exchange flows include over 5 million tracked data points in 2025.

- Spot trading volume across centralized exchanges reached a multi-trillion-dollar annual run-rate by Q3 2025.

- The top five exchanges account for above 70% of trading volume.

- Volume spikes followed price dips, such as when Bitcoin fell below $92,000 in November 2025.

Bitcoin Dominance in the Crypto Market

- Bitcoin dominance in the crypto market stood around 40-45% by mid-2025.

- Addresses holding more than 1 BTC represent about 1.2-2.1% of all addresses but control roughly 60% of Bitcoin’s supply.

- Institutional Bitcoin holdings have grown significantly, with public and private companies holding over 3.8 million BTC valued at around $435 billion as of late 2025.

- Bitcoin exchange-traded products and institutional acquisitions reached 944,330 BTC in 2025, surpassing previous annual totals.

- Bitcoin futures open interest consistently exceeds that of major altcoins, reflecting its central role in derivatives markets.

- Bitcoin dominance has slightly dipped from above 61% to around 58.8% during altcoin rallies, but shows resilience with regulatory clarity and inflows.

- The number of Bitcoin addresses holding at least 1 BTC has crossed 1 million, signaling concentrated ownership.

- Exchange-listed Bitcoin products remain the primary investment vehicle, further solidifying Bitcoin’s market leadership.

- Open interest in Bitcoin futures correlates with price volatility, often signaling trader sentiment and market liquidity.

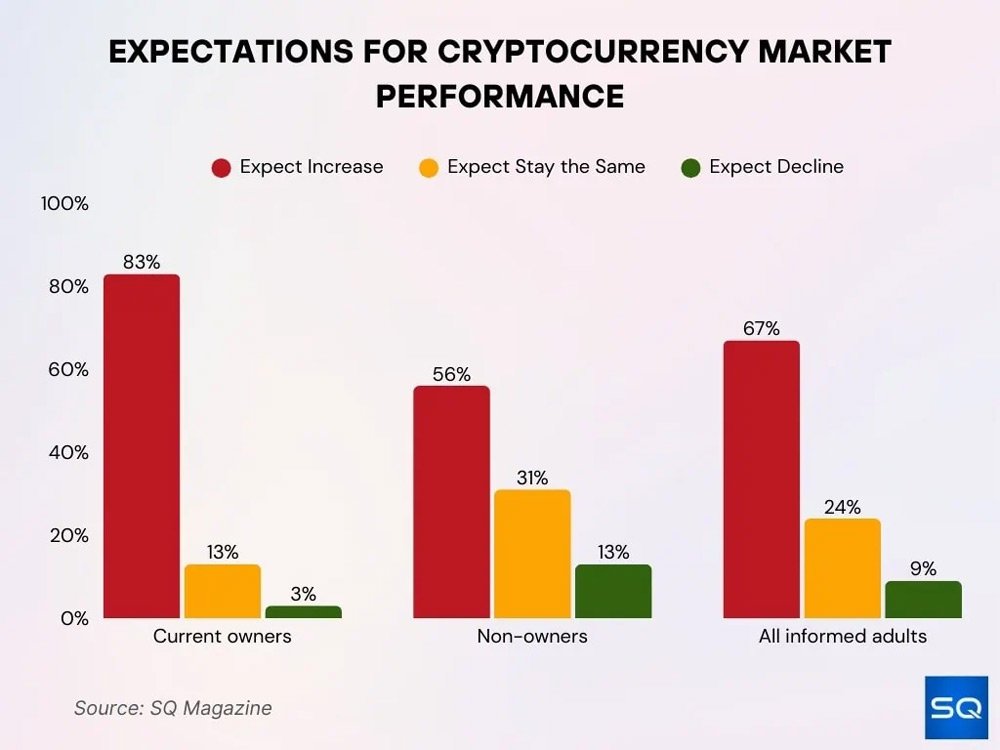

Public Expectations for Future Crypto Performance

- 83% of current owners expect growth, 13% expect stability, and 3% expect a decline.

- Among non-owners, 56% foresee growth, 31% expect stability, and 13% predict a drop.

- Across all informed adults, 67% expect growth, 24% expect no change, and 9% expect a decline.

Bitcoin Halving Event Statistics

- The April 2024 Bitcoin halving reduced the block reward from 6.25 BTC to 3.125 BTC.

- Daily Bitcoin issuance was cut in half from 900 BTC to 450 BTC after the 2024 halving.

- The next halving, expected around April 2028, will reduce the reward to 1.5625 BTC.

- Bitcoin mining revenue jumped to $3.7 billion in Q4 2024, a 42% increase from the previous quarter despite the halving.

- Mining difficulty reached a record 123T in 2025, increasing operational costs post-halving.

- Post-halving miner revenue dropped initially but stabilized near pre-halving levels by early 2025.

- About 1.32 million BTC remain unmined in 2025, representing less than 7% of the total supply.

- Halving events historically cause Bitcoin price volatility due to the 50% supply reduction meeting shifting demand.

- The market sees halving as a long-term scarcity event rather than a short-term price catalyst.

- Miner fees have become a larger share of revenue post-2024 halving, offsetting block reward cuts.

Bitcoin Mining Statistics

- The block subsidy is 3.125 BTC after the 2024 halving.

- Less efficient miners have exited the market, improving overall network efficiency.

- Miners now derive a higher share of revenue from transaction fees.

- The global mining hardware market was valued at $23.7 billion in 2024.

- The average mining cost per Bitcoin is estimated to be above $90,000 in 2025.

- Mining profitability is more sensitive to energy prices and regulation in 2025.

- Mining is shifting geographically toward regions with reliable renewable power.

Bitcoin Hashrate and Difficulty Statistics

- Bitcoin hashrate reached 1.05 ZH/s in 2025.

- All-time high hashrate peaked at 1.442 ZH/s in September 2025.

- Difficulty reached near historic highs due to elevated hashrate.

- Miners continue to invest in hardware despite decreasing subsidies.

- Hashrate concentration among major pools raises centralization concerns.

- Difficulty increases render older hardware less viable.

- Elevated hashrate boosts security but raises energy consumption concerns.

Bitcoin Energy Consumption Statistics

- Bitcoin’s energy consumption is estimated at 173 TWh in 2025.

- Renewable energy share in mining rose to 52.4% in 2025.

- Bitcoin’s carbon footprint is estimated at 39 million metric tons of CO₂.

- Some estimates place consumption at 204 TWh and footprint at 114 million tons CO₂.

- Mining accounts for 0.5–0.6% of global electricity consumption.

- Mining’s energy intensity continues to attract regulatory scrutiny.

- Renewables adoption rises as miners seek lower-cost and ESG-aligned energy sources.

Bitcoin Transaction Statistics

- In 2025, daily Bitcoin transactions fluctuated from 330,000 to 450,000, depending on network activity

- Another snapshot recorded 327,000 to 336,000 transactions in 24 hours.

- Average transaction value was 1.32 BTC ($121,744).

- Median transaction value was 0.005 BTC ($463).

- The average transaction fee was 0.000012 BTC ($1.08).

- Active unique addresses in 24 hours totaled 215,473.

- Total bitcoins sent in 24 hours included 433,071 BTC ($39.8 billion).

- Block count in 24 hours was 134, around 6 per hour.

- Block reward incl. fees totaled 3.125 BTC + 0.02685 BTC.

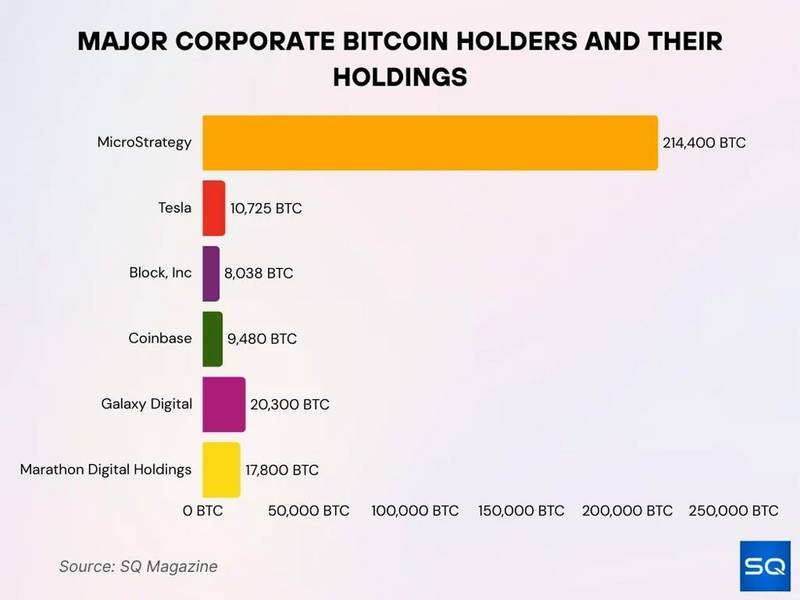

Top Corporate & Institutional Bitcoin Holders

- MicroStrategy: holds 214,400 BTC (~$14.5B, May 2025).

- Tesla: Holds 10,725 BTC (~$730M), maintaining a solid crypto position.

- Block, Inc.: Holds 8,038 BTC (~$550M), reinforcing long-term Bitcoin strategy.

- Coinbase: Holds 9,480 BTC (~$640M) as part of a diversified treasury plan.

- Galaxy Digital: Owns 20,300 BTC (~$1.35B), continuing aggressive accumulation.

- Marathon Digital Holdings: Controls 17,800 BTC (~$1.2B).

- US Bitcoin ETFs (Grayscale, BlackRock, etc.): Collectively hold 821,000 BTC (~3.9% of total supply).

Bitcoin Address and Wallet Statistics

- Roughly 950,000 wallet addresses hold 1 BTC or more, under 0.2% of all addresses.

- Over 200 million wallet addresses have ever held Bitcoin.

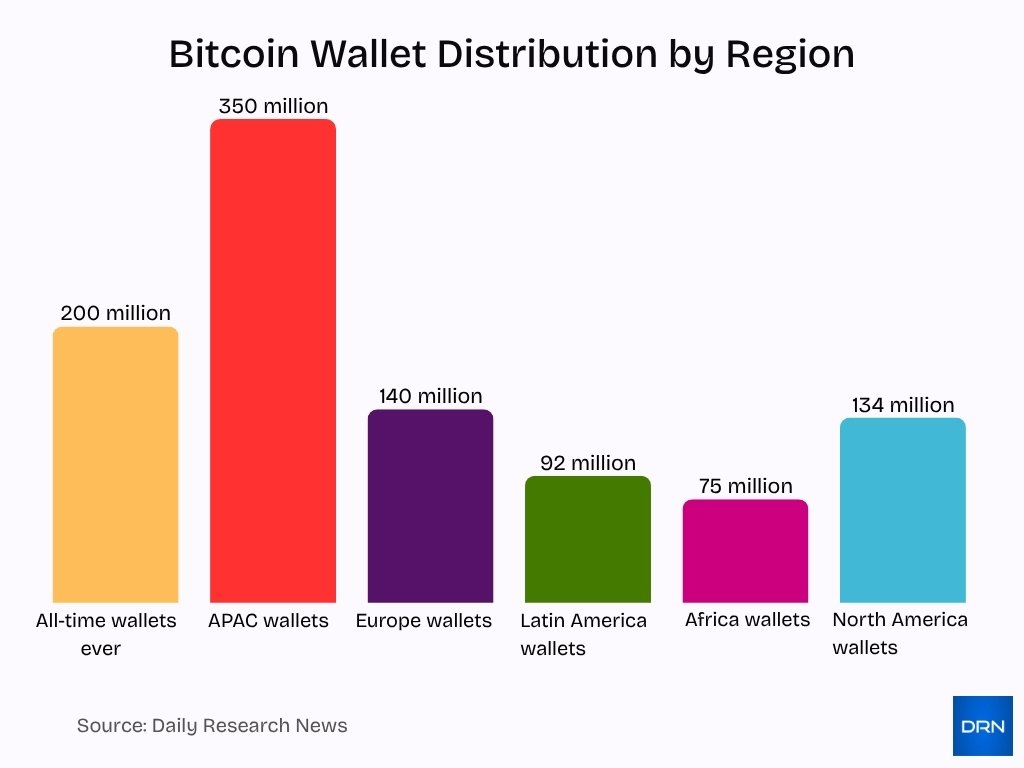

- Global wallet-user distribution: Asia-Pacific 350 million, Europe 140 million, Latin America 92 million, Africa 75 million, North America 134 million.

- The richest 83 addresses hold 11.2% of the supply, the top 4 hold 3.23%.

- Addresses with <0.00001 BTC number 7.16 million (12.55%).

- Addresses holding 0.001–0.01 BTC number 11.68 million (20.48%), holding 43,229 BTC (0.22% of supply).

- Wallets with ≥$1 million BTC surged in 2025.

- Wallet penetration in 2025 is 7.4% of Internet users.

Bitcoin Ownership and Distribution Statistics

- Individuals hold 65.9% of all Bitcoin supply.

- Funds hold 7.8%, businesses 6.2%, governments 1.5%.

- An estimated 3-4 million BTC are considered permanently lost.

- The top 100 addresses own roughly 14% of the supply.

- Regional distribution: Asia-Pacific 350 million wallets, Europe 140 million, North America 134 million.

- Owning 1 BTC places an address in the top 0.1%.

- About 12% of the supply is custodied by exchanges.

Bitcoin Institutional Investment Statistics

- As of September 2025, 338 entities held Bitcoin, including 265 public and private companies.

- Institutions hold 2.39 million BTC across ETFs and corporate treasuries.

- U.S. Bitcoin ETFs had $179.5 billion in AUM by mid-July 2025.

- Institutional share of ETF AUM was 22.9% in Q1 2025.

- Corporate treasuries hold significant multi-hundred-thousand BTC totals.

- The first five months of 2025 saw $18.4 billion in ETF inflows.

- A record weekly inflow of $5.95 billion occurred in early October 2025.

Bitcoin Volatility and Risk Statistics

- As of November 2025, Bitcoin fell over 30% from its 2025 peak.

- Bitcoin dropped $30,000+ within six weeks.

- Pricing shows thick-tailed volatility and high persistence.

- Bitcoin’s variance risk premium is significantly higher than that of the S&P 500.

- Value at Risk models under-predict extreme tail moves, with a 4.7% breakout rate.

- During consolidation ($104k-$114k), volatility remained elevated.

- Bitcoin risk includes regulatory pressure, concentration, energy scrutiny, and macro shocks.

Frequently Asked Questions (FAQs)

Around 24 % of respondents in the U.S., U.K., France, and Singapore reported owning crypto in 2025, up from ~20–21 % in 2024.

Institutions hold nearly 18 % of the total Bitcoin supply.

Public companies & governments hold about 1,684,979 BTC, representing ~8.02 % of Bitcoin’s total supply.

The global crypto adoption rate is 9.9% in 2025, with the market projected to reach $7.98 trillion by 2030.

Conclusion

Bitcoin continues its evolution from niche digital asset to mainstream financial instrument. Adoption is broadening, institutional participation is growing, and the supply fundamentals are increasingly constrained. At the same time, on-chain data show high transaction volume, concentrated ownership, and shifting wallet dynamics. Yet, the risks remain tangible, steep price swings, regulatory uncertainty, and market concentration present real challenges.

For U.S. investors and global participants alike, these statistics offer a clear view of Bitcoin’s current state and underlying structural features. As always, a grounded understanding of both opportunity and risk helps in navigating this asset. You’re invited to dive deeper into the full article for further insights and context.

Hover or focus to see the definition of the term.