The way people access the internet hinges on the browser they choose. Browser usage continues to shape web design, digital marketing strategies, and even data privacy discussions. From developers optimizing web apps for Chrome to advertisers targeting Safari users on mobile, browser share influences decisions across industries. In e‑commerce, for example, retailers tailor features to the most popular browsers to improve conversion rates, while cybersecurity teams focus on the browsers that pose the highest attack surface.

Dive into this article to uncover the latest browser statistics, trends, and what they mean for businesses and users alike.

Editor’s Choice

- Google Chrome leads the global browser market with around 71% market share as of late 2025.

- Safari holds the second spot with roughly 14% worldwide.

- Mobile browsing now accounts for nearly 60% of web traffic globally.

- Desktop browsing comprises about 37–38% of total web traffic.

- In the U.S., Chrome captures more than half of all browser usage.

- Regionally, Chrome and Safari dominate in most markets with strong mobile prevalence.

- Emerging AI‑integrated browsers suggest future shifts in market competition.

Recent Developments

- AI‑powered browsers are entering the competitive landscape, with new tools from OpenAI and others aiming to reshape browsing experiences.

- Startup Perplexity is in talks with phone makers to pre‑install its AI browser on devices, signaling broader industry interest.

- UK regulators have launched probes into Safari and Chrome’s mobile dominance to assess competitive impacts.

- Microsoft Edge has seen a notable decline in desktop share in recent months.

- Chrome’s share neared 70% in parts of 2025, indicating deepening dominance.

- These shifts reflect intensifying battles over user engagement and default placements on devices.

- Browser privacy debates are increasingly tied to data‑collection practices across major vendors.

- Emerging features like AI assistants and proactive browsing aim to redefine the browser’s role beyond navigation.

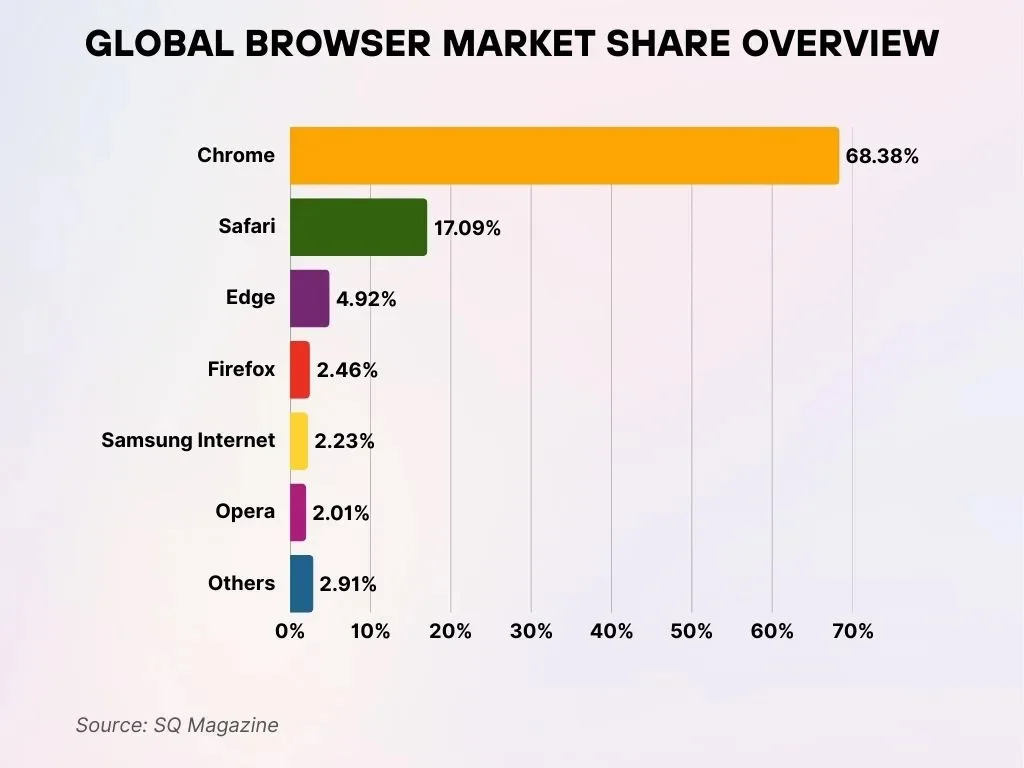

Global Browser Market Share

- Chrome overwhelmingly leads the global browser market with a dominant 68.38% share, firmly sustaining its status as the industry leader worldwide.

- Safari ranks second by capturing 17.09% of the global market, primarily fueled by strong adoption among iOS and macOS users.

- Edge secures 4.92% of the overall market, largely benefiting from its deep integration with Windows operating systems.

- Firefox holds 2.46% market share, continuing to attract users who strongly value privacy, control, and customization features.

- Samsung Internet maintains 2.23% of the browser market, with usage mainly driven by Samsung smartphone and tablet users.

- Opera accounts for 2.01% of total usage, remaining popular among users seeking lightweight performance and data-saving capabilities.

- Other browsers collectively represent 2.91% of the global market, encompassing a variety of smaller and niche browsing platforms.

Desktop Browser Market Share

- On desktops worldwide, Chrome holds over 75% share.

- Microsoft Edge ranks second with about 9.5% desktop share.

- Safari captures roughly 5.3% of desktop usage.

- Firefox’s desktop share is around 4.3%.

- Opera accounts for over 2% of desktop browsing.

- Brave and niche browsers hold small single‑digit percentages.

- Desktop share trends show Chrome’s lead strengthening year over year.

- Edge’s desktop share has been volatile, with some recent declines reported.

Mobile Browser Market Share

- Chrome leads mobile browsing with over 65% share globally.

- Safari drives about 22% of mobile browser usage worldwide.

- Samsung Internet holds around 3% share on mobile devices.

- Opera and other smaller browsers each command less than 2%.

- On mobile, Chrome’s dominance surpasses its desktop performance.

- Safari’s mobile share benefits from Apple device penetration in key markets.

- Mobile browser usage continues to grow faster than desktop traffic.

- Smaller mobile browsers like UC Browser and Android’s default browser have minimal global share.

Browser Share by Region

- In the United States, Chrome holds 53.41% of the total browser market share as of December 2025.

- Safari commands 29.41% of the U.S. browser market, driven by iOS popularity.

- In Europe, Firefox achieves 7.45% desktop share, stronger than its 6.9% in the U.S.

- Safari dominates Japan with 23.94% browser share due to high iPhone penetration.

- India sees Chrome at an overwhelming 91.77% of total browser usage.

- In Indonesia, Samsung Internet captures 1.13% amid Android-heavy markets.

- Chrome reaches 64.01% on U.S. desktops, exceeding mobile figures.

- Emerging markets like India show Chrome at over 90%, higher than the mature U.S. 53%.

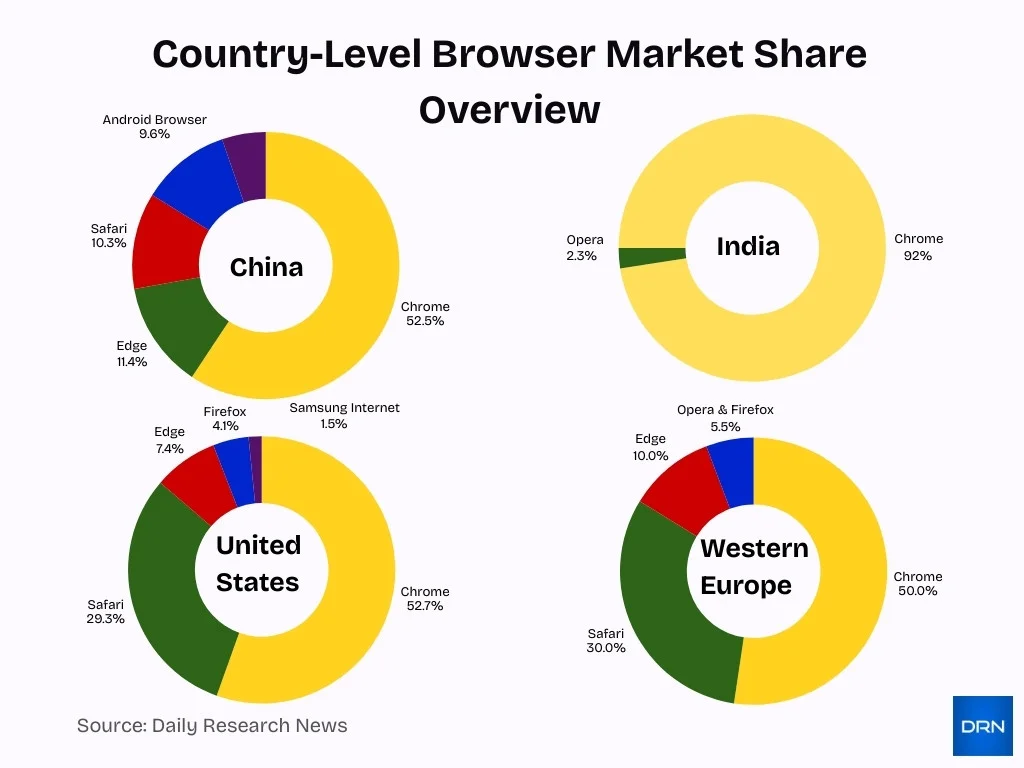

Web Browser Share by Country

- In China, Chrome leads with roughly 52.5% of users, followed by Edge at ~11.4% and Safari at ~10.3% as of late 2025.

- China’s Android and UC Browser installations hold ~9.6% and ~4.7% of usage, respectively, showing local preferences.

- In India, Chrome dominates with over 92% share across all platforms, with Opera next at ~2.3%.

- India’s mobile browser landscape reflects Chrome’s near-universal adoption, driven by Android prevalence.

- U.S. browser use shows Chrome at ~52.7%, Safari at ~29.3%, and Edge at ~7.4%.

- Firefox and Samsung Internet also appear in the U.S. with ~4.1% and ~1.5%, respectively.

- Across Western Europe, Chrome is used by around 50%, while Safari holds ~30% and Edge ~10%.

- Smaller browsers like Opera and Firefox in many countries collectively remain below 5–6%.

Top Browsers Comparison

- Google Chrome remains the clear leader with a worldwide share above 70%.

- Safari consistently ranks second globally, holding around 14–16% of the market.

- Microsoft Edge stabilizes in third place with roughly 4.5–5.2% global usage.

- Firefox lingers between 2–3%, showing a slow but steady decline compared to earlier years.

- Samsung Internet leads among smaller browsers with about 1.9–3% share.

- Opera and others collectively make up under 3% in global browser metrics.

- Chrome’s mobile dominance is stronger than on desktop, where Edge and Firefox have relatively higher positions.

- Browser engine diversity (Chromium, WebKit, Gecko) influences performance, extension ecosystems, and compatibility.

Chrome Market Share Statistics

- Chrome’s global share stands above 70% as of late 2025.

- Chrome commands above 75% of the desktop market usage worldwide.

- On mobile, Chrome’s share remains near or above 60–65% globally.

- Chrome’s share has remained above 60% consistently for several years, highlighting entrenched use.

- Chrome’s broad extension ecosystem and Google service integration drive its adoption.

- Chrome’s version variations (for Android, desktop, iOS) each capture significant yet distinct usage slices.

- Chrome’s dominance on Android devices mirrors Android’s ~70–75% global OS share.

- Security and performance updates often aim to justify Chrome’s ongoing popularity.

Safari Market Share Statistics

- Safari holds about 14–16% of all browser usage globally.

- On mobile platforms (iOS), Safari reaches ~22–25% share worldwide.

- On tablets, Safari’s share approaches 30–36% due to iPad penetration.

- Desktop Safari remains modest, typically under 7–8% of use.

- Safari’s share in the U.S. can exceed 30%, narrowing the gap with Chrome domestically.

- Safari’s integration with Apple services and privacy features strengthens its base.

- Apple’s shifting mobile privacy rules can influence Safari’s broader web metrics.

- Regional Apple device dominance supports Safari’s relative strength.

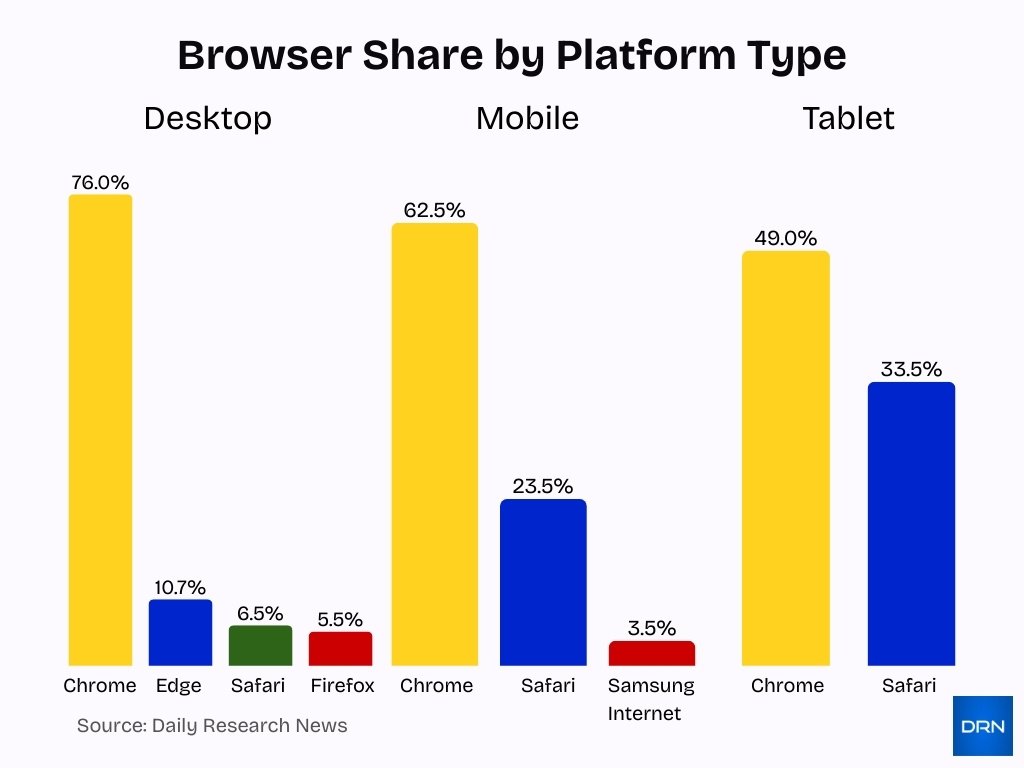

Browser Usage by Platform

- Desktop usage is dominated by Chrome, holding roughly 75–77% share globally in late 2025.

- Microsoft Edge captures nearly 9.5–11.9% of the desktop browsing space.

- Safari accounts for ~5–8% of desktop use, reflecting Apple hardware dependency.

- Firefox’s desktop footprint sits around 4–7% depending on the dataset.

- On mobile platforms, Chrome tends to surpass 60% globally, with Safari at ~22–25% thanks to iPhones.

- Samsung Internet maintains a small but notable position on Android mobile devices (~3–4%).

- Tablet browsing shows Chrome leading around 48–50%, followed by Safari on Apple tablets at ~31–36%.

- Browser usage on consoles and emerging connected devices remains niche, typically under 2% per platform.

Edge Market Share Statistics

- Microsoft Edge holds about 4–5% globally on all platforms.

- On desktop, Edge typically has ~9–12% share, higher than its global average.

- Edge’s mobile presence remains small, often under 1% globally.

- Year‑over‑year changes show modest fluctuation rather than rapid growth.

- Edge usage in Western markets like the U.K. and Europe shows slightly higher desktop shares.

- The browser’s integration with Windows OS helps maintain its installed base.

- Edge’s Chromium engine alignment enhances compatibility with modern web standards.

- Some reports suggest user dissatisfaction with aggressive Edge promotions, possibly affecting share.

Firefox Market Share Statistics

- Firefox holds roughly 2–3% of global browser share as of late 2025.

- Mozilla’s total user base is estimated at ~305 million people worldwide.

- Year‑over‑year, Firefox’s share has slowly declined from above 3% to around ~2.25%–2.57%.

- On mobile platforms, Firefox’s share is much smaller, generally below 1%.

- Firefox’s highest historical share peaked around ~31.8% back in 2009 before Chrome’s rise.

- Desktop usage of Firefox remains stronger than mobile, though still modest compared with Chrome or Edge.

- Firefox attracts users who prioritize privacy and open‑source technology.

- Despite its share decline, Firefox continues to be one of the top five browsers globally.

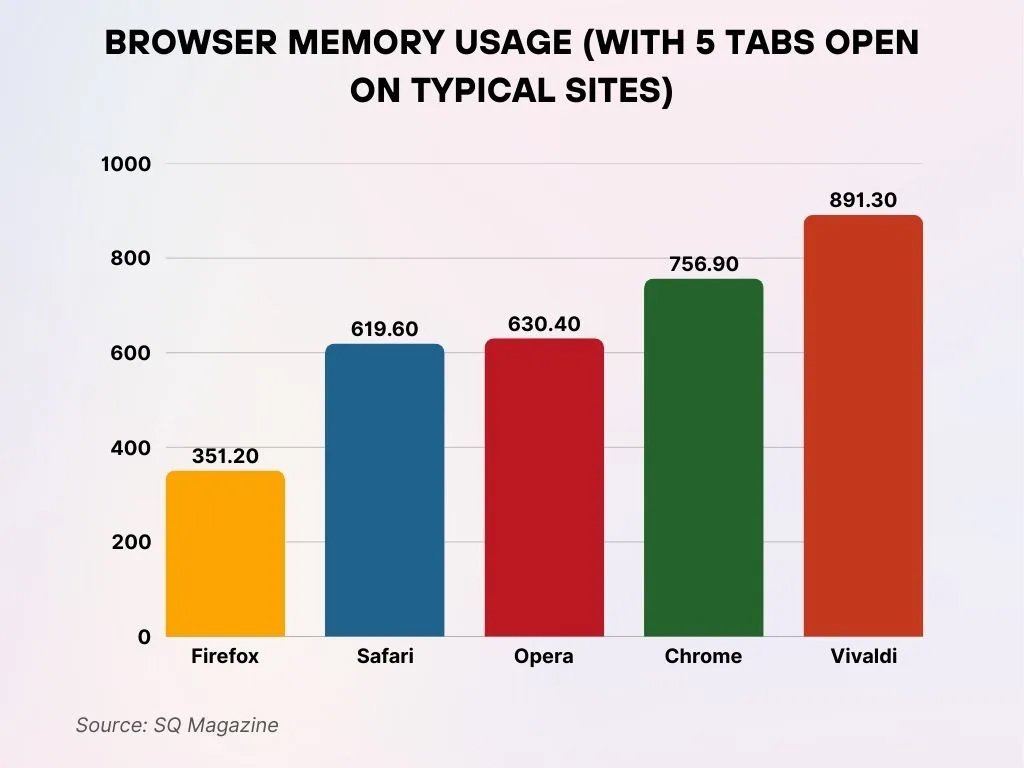

Browser RAM Consumption With Five Active Tabs

- Firefox stands out as the most memory-efficient browser, using only 351.20 MB of RAM with 5 tabs open on typical websites.

- Safari consumes 619.60 MB of memory, which is nearly double the usage recorded by Firefox under the same conditions.

- Opera marginally surpasses Safari, registering 630.40 MB of memory usage across 5 active tabs.

- Chrome requires a substantially higher 756.90 MB of memory, positioning it among the more resource-intensive browsers.

- Vivaldi ranks at the top for highest memory consumption, reaching 891.30 MB with 5 tabs open.

Opera and Others Share

- Opera generally holds ~1.5–2.4% of the global browser market share.

- In some regions like Africa and Southeast Asia, Opera’s share is slightly higher due to data‑saving features.

- Other smaller browsers (Brave, UC Browser, Yandex, DuckDuckGo, Tor) collectively make up approximately 2–4% of the global landscape.

- Brave’s user base has grown modestly, now holding around ~1% share due to its privacy focus.

- Niche browsers like Tor and DuckDuckGo prioritize privacy but maintain very small overall shares (often <1%).

- Browser usage outside the top 5 continues to diversify as privacy and niche tools gain attention.

- Some region‑specific browsers have localized adoption but little global impact.

- Legacy browsers like Internet Explorer still show small residual usage in enterprise environments.

Browser Market Share Trends

- Chrome has sustained dominance over the past decade, consistently above ~60% global share.

- Safari has fluctuated but remains the second most used browser, particularly on iOS and macOS devices.

- Edge showed modest growth in earlier years but has seen volatility and occasional declines.

- Firefox has steadily declined from double‑digit shares in the early 2010s to around ~2–3% today.

- Smaller browsers like Brave have grown slightly as privacy concerns gain prominence.

- Browser adoption varies with device trends; mobile increases correlate with Chrome and Safari gains.

- Tablet and emerging device use show new browsers entering the market.

- Diverging regional preferences continue to drive certain trends.

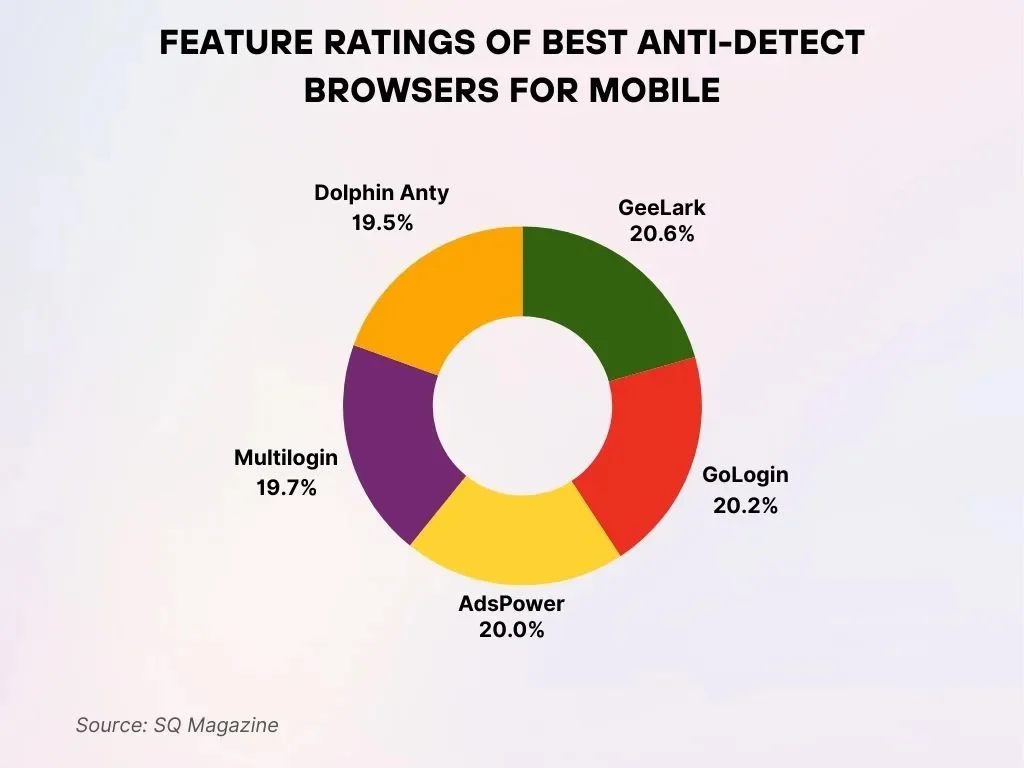

Mobile Anti-Detect Browsers Feature Rating Comparison

- GeeLark dominates the feature ratings with 20.6%, positioning it as the top-performing mobile anti-detect browser in terms of overall feature strength.

- GoLogin captures a robust 20.2% rating, reflecting its highly competitive and well-balanced mobile browser features.

- AdsPower records a 20.0% feature share, staying closely aligned with the leading browsers in mobile feature performance.

- Multilogin secures a 19.7% rating, reinforcing its strong reputation for reliable mobile anti-detect functionality.

- Dolphin Anty achieves a 19.5% rating, completing the top five mobile anti-detect browsers based on feature quality.

Historical Browser Trends

- Chrome launched in 2008 with 0.3% market share, surging to 15% by the end of 2010.

- Firefox peaked at 32.21% global share in November 2009.

- Internet Explorer held nearly 60% share in 2008 before declining sharply.

- Safari grew 44.57% annually from 2009–2010, tracking iPhone adoption.

- Mobile web traffic overtook desktop in October 2016, from 0.7% in 2009 to 60.5% by 2025.

- Opera peaked at 2.86% in 2023 but fell to 2.56% in 2024.

- Brave privacy browser users grew 21.58% YoY to 82.7 million post-2020.

- Chrome dominates at 71.23% worldwide share as of December 2025.

Regional Browser Leaders

- In North America, Chrome holds a 53.65% market share while Safari commands 29.72%.

- Europe sees Chrome at 64.02%, with Edge at 12.58% and Firefox at 7.45%.

- Asia reports Chrome dominating with 80.29% usage share.

- Latin America mirrors trends as Chrome exceeds 83.88% market share.

- Africa shows a strong Chrome lead at 84.55%, followed by Edge at 6.31%.

- Safari peaks in regions with high Apple adoption, reaching 36.86% in the Americas.

- Edge gains modest strength in Europe at 12.58%, above global averages.

- Firefox maintains 7.45% in Europe, stronger than in other continents.

Security & Privacy Statistics

- Users increasingly consider browser security a priority when choosing tools.

- Privacy‑focused browsers like Brave and Tor emphasize minimal tracking and limited data sharing.

- Mainstream browsers still collect some level of usage data for personalization or services.

- Research shows differences in how browsers handle IP and metadata exposure, impacting privacy.

- Some browsers introduce tracker blocking and enhanced HTTPS enforcement to bolster security.

- Enterprise‑oriented browsers are emerging with stronger access controls for corporate use.

- Privacy tools like VPNs, ad blockers, and specialized extensions are commonly recommended for safety.

- Users with heightened privacy needs often opt for niche browsers with strict data policies.

Frequently Asked Questions (FAQs)

Google Chrome holds around 71% of the worldwide browser market share as of late 2025.

Safari accounts for about 14–16% of the global browser market share in 2025.

Chrome dominates mobile web browsing with over 65% share globally as of June 2025.

Microsoft Edge holds approximately 4.85% of the global browser market share in 2025, with around 274 million users.

Conclusion

As progress, the browser landscape remains clearly led by Chrome’s dominant position, with Safari consistently holding second place across most markets. Alternative browsers like Firefox, Edge, and Opera maintain steady but smaller user bases, often attracting users with specific preferences such as privacy or lightweight performance. The growth of privacy‑focused browsers and the emergence of enterprise‑grade solutions underscores a shifting focus toward security in an age of rising digital threats.

Ultimately, understanding these statistics helps businesses, developers, and users make informed choices about platform optimization and personal browsing strategies. Stay tuned as browser competition and innovation continue to evolve in response to user needs and technology trends.