Cloud computing has become a foundational pillar for modern businesses, enabling everything from scalable data storage to global collaboration. As organisations rush to migrate workloads, cloud adoption continues to accelerate, reshaping how companies operate, deploy IT, and innovate. In sectors like finance and healthcare, cloud-driven agility has already translated into faster product launches and greater data resilience. Meanwhile, retailers rely on cloud elasticity to handle seasonal spikes in demand. Read on for a detailed look at the latest statistics shaping cloud adoption worldwide.

Editor’s Choice

- The global cloud computing market is projected to grow from $752.44 billion in 2024 to approximately $943.65 billion in 2025.

- Worldwide public cloud end-user spending is forecasted to hit $723.4 billion in 2025, up from roughly $595.7 billion in 2024.

- As of 2025, 94% of enterprises globally are using at least some form of cloud computing.

- Around 72% of global workloads are now hosted in cloud environments, compared with 66% the previous year.

- The worldwide Infrastructure-as-a-Service (IaaS) market grew 22.5% in 2024, reaching $171.8 billion, driven by growing demand for AI infrastructure and cloud migrations.

- Small businesses, about 44% now use cloud infrastructure or hosting services, while adoption among small tech companies and larger firms is higher.

- Hybrid and multi-cloud strategies continue to rise, with many enterprises mixing public and private cloud deployments.

Recent Developments

- Global cloud infrastructure spending reached $90.9 billion in Q1 2025, surging 21% year-over-year.

- Public cloud services spending is forecasted to hit $723.4 billion in 2025, up 21.5% from 2024.

- 49% of organisations fully embraced cloud-native architecture in 2025, rising 7% YoY.

- 86% of businesses consider or plan to shift workloads from public cloud for better control.

- The hybrid cloud market is projected at $134–173 billion in 2025, growing to $430–578 billion by 2030–2034.

- GenAI workloads account for 12% of cloud spend in 2025, expected to reach 28% by 2028.

- 94% of enterprises leverage cloud, with 89–90% adopting cloud-native technologies.

- 33% of organisations spend over $12 million annually on public cloud services in 2025.

- 47% pursue cloud-first strategies, while 37% aim for fully cloud-native operations soon.

Global Cloud Market Growth

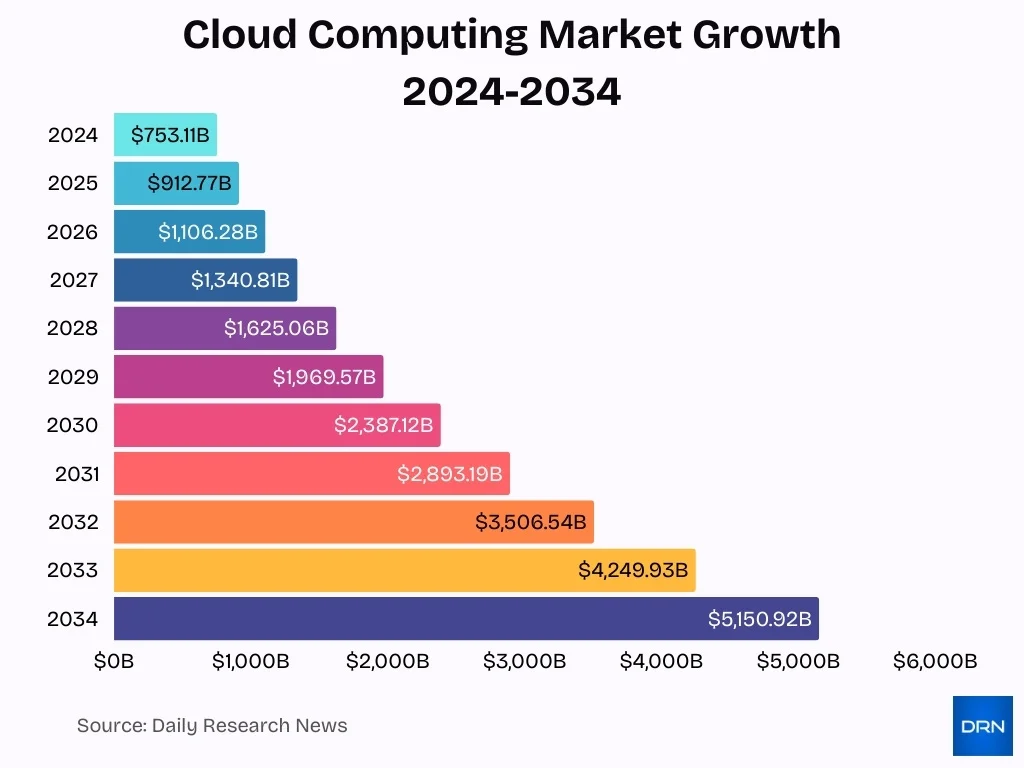

- The cloud computing market is projected to grow steadily and sharply over the next decade.

- In 2024, the market size stands at $753.11 billion, marking the starting point of a strong upward trend.

- By 2025, the market is expected to reach $912.77 billion, showing double-digit year-over-year growth.

- The industry surpasses the $1 trillion milestone in 2026, hitting $1,106.28 billion.

- Continued acceleration pushes the market to $1.34 trillion in 2027 and $1.63 trillion in 2028.

- A major leap occurs by 2029, when the market grows to $1,969.57 billion, approaching the $2 trillion threshold.

- Entering the next decade, 2030 sees further expansion to $2,387.12 billion, reflecting increasing enterprise cloud adoption.

- By 2031, the market will climb to $2,893.19 billion, strengthening its position as a core pillar of global digital infrastructure.

- The year 2032 marks another milestone, with the market hitting $3,506.54 billion, crossing the $3.5 trillion mark.

- In 2033, cloud computing reached $4,249.93 billion, showcasing exponential growth dynamics.

- By 2034, the market is projected to soar to $5,150.92 billion, representing nearly a 7× increase from 2024 levels.

Cloud Adoption Rates

- As of 2025, roughly 94% of enterprises worldwide report using cloud services in some form.

- Global workload migration is accelerating, with 72% of workloads now hosted in the cloud, up from 66% in the previous year.

- Over 50% of organisations now follow a cloud-first strategy when adopting new infrastructure or software.

- The use of cloud-native architectures rose to 49% in 2025, up 7 points compared with last year.

- In 2025, about 85% to 95% of new digital workloads are expected to deploy on cloud-native platforms.

- Nearly universal cloud adoption persists, with 94% of all companies using cloud computing services.

- These adoption rates show cloud has become a baseline infrastructure choice rather than a competitive differentiator.

Enterprise Cloud Usage

- 94% of enterprises worldwide now use cloud services in some capacity.

- For many, cloud supports digital transformation efforts, including legacy modernisation and deployment of AI workloads.

- The IaaS market grew by 22.5% in 2024 to $171.8 billion, reflecting strong enterprise demand.

- Enterprises are increasingly adopting hybrid environments, combining public and private clouds for performance and compliance.

- Multi-cloud strategies are becoming common, with organisations using more than one provider to avoid lock-in and improve resiliency.

- Growing reliance on cloud-native services marks a shift from traditional on-premises infrastructure.

- Enterprises expecting global scale and heavier compute needs are driving more cloud consumption.

- The large enterprise segment accounted for over 51.7% of cloud computing revenue in 2024.

SMB Cloud Adoption

- In 2025, around 63% of SMB workloads are hosted in the cloud, with about 62% of SMB data stored or processed in the cloud.

- The SME cloud market size reached $351.8 billion in 2024 and is projected to grow at a CAGR of 14.18% from 2025–2033.

- SMB cloud spending rose 31% year-over-year during early 2025.

- SMBs plan to double multi-cloud use and triple hybrid-cloud adoption by 2026.

- Cloud accounting and financial management systems are growing in popularity among SMEs.

- Cloud helps reduce upfront infrastructure costs, offering greater flexibility for capital-constrained small firms.

- Some SMEs still struggle with barriers such as limited expertise and security concerns.

Usage of Cloud Computing in Higher Education

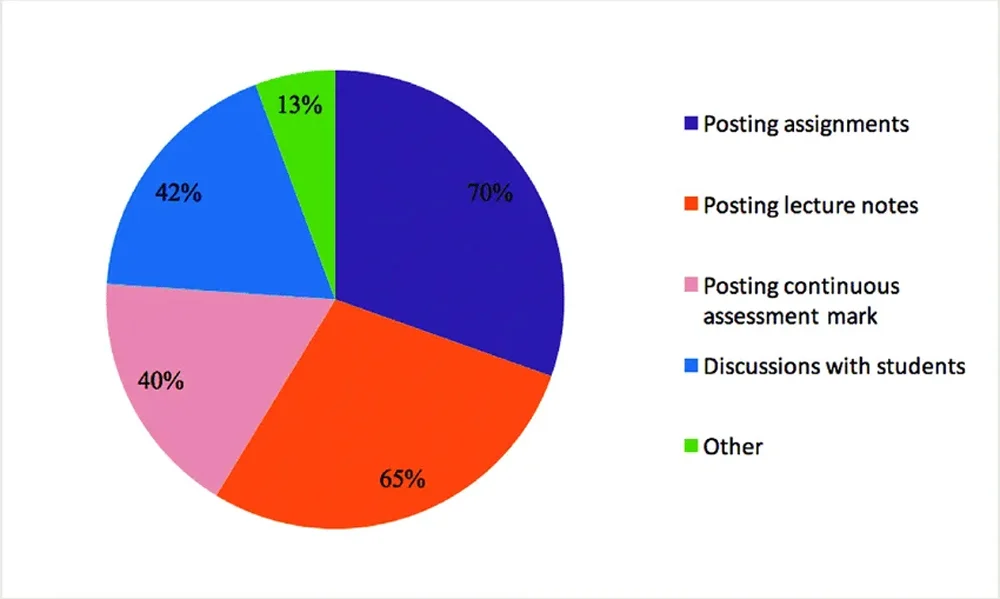

- About 70% of institutions utilise cloud platforms for uploading assignments, making it the most widely adopted academic application.

- Nearly 65% of institutions depend on cloud services to provide lecture notes, significantly improving student accessibility.

- Around 40% of institutions make use of cloud systems to share continuous assessment marks with learners.

- Approximately 42% of institutions participate in student discussions through cloud-based platforms.

- Nearly 13% of all activities are categorised as other uses, showing varied but less frequent applications.

Public Cloud Statistics

- Worldwide end-user spending on public cloud services is expected to reach $723.4 billion in 2025, up from $595.7 billion in 2024.

- Roughly 69% of businesses use public cloud infrastructure as their primary environment.

- More than 60% of corporate data is now stored in the cloud.

- 96% of firms using cloud report reliance on at least one public cloud service.

- Public cloud remains especially popular among startups, with 82% using public cloud exclusively.

- The public cloud segment accounted for 57% of the global cloud market share in 2024.

- Analysts project double-digit growth across all public cloud service types through 2025.

Private Cloud Statistics

- 84% of companies utilise private cloud alongside other cloud models.

- The global private cloud market reached $136.51 billion in 2025.

- 92% of organisations trust private cloud for security and compliance needs.

- 53% prioritise private cloud for deploying new workloads over the next three years.

- Private cloud market projected to hit $195 billion by 2030.

- The SME segment in private cloud grows at a 10% CAGR from 2024-2030.

- 32% of company workloads run in private cloud environments.

- Asia Pacific private cloud market expands at 12.1% CAGR through 2030.

- IaaS in private cloud achieves 10.1% CAGR, reaching $105 billion by 2030.

Hybrid Cloud Strategies

- 72% of enterprises implemented hybrid cloud in 2023, rising to 73% adoption in 2025.

- Global hybrid cloud market reaches $128–$173 billion in 2025 with 12–22% CAGR through 2030.

- 90% of organisations are expected to adopt hybrid cloud models by 2027.

- 48% of IT leaders view hybrid cloud as essential for operations within 12–24 months.

- 56% of companies with over $500 million in revenue use hybrid cloud approaches.

- 59% of tech leaders deploy hybrid/multicloud primarily for enhanced security.

- 80% of organisations incorporate multiple public clouds in hybrid strategies.

- U.S. hybrid cloud market valued at $48.32 billion in 2025, growing to $212 billion by 2034.

- Financial services, healthcare, and manufacturing lead hybrid cloud adoption due to regulations.

Multi-Cloud Approaches

- About 89% of companies now employ multi-cloud infrastructure.

- Surveys show 92% of organisations use multi-cloud approaches in 2025.

- SMBs expect to increase multi-cloud usage significantly by 2026.

- Multi-cloud helps optimise performance, manage risk, and control costs.

- Multi-cloud adoption reflects growing cloud maturity and workload diversification.

Market Share of Leading Cloud Providers

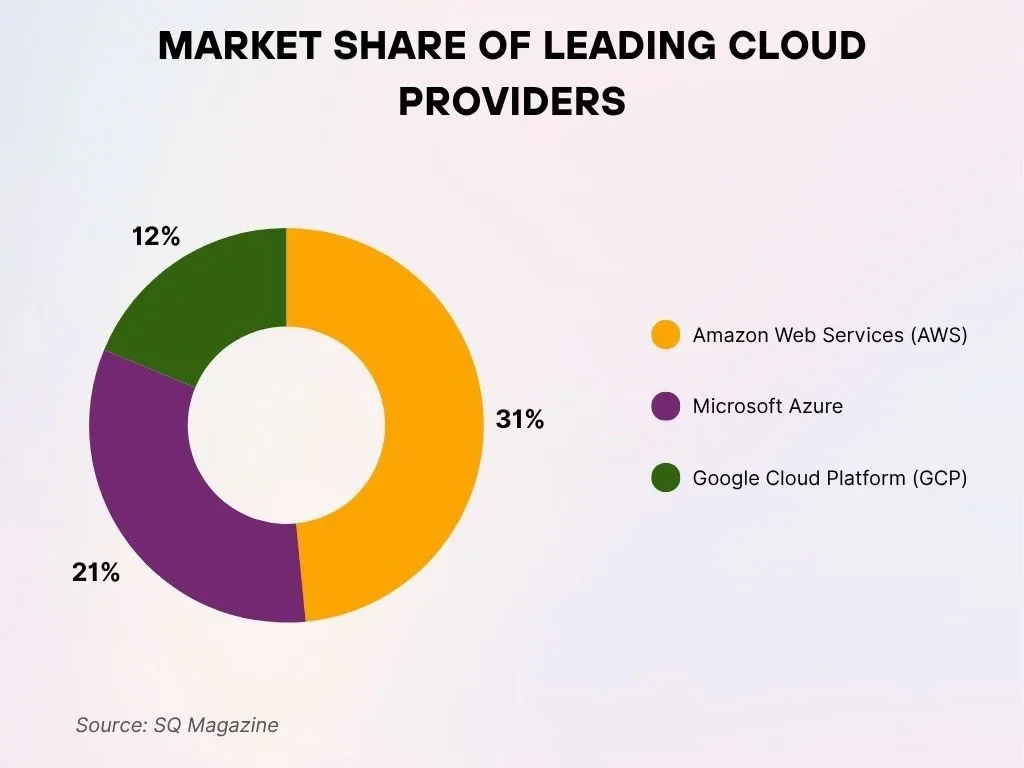

- Amazon Web Services (AWS) maintains the largest share in the cloud market with a commanding 31% portion.

- Microsoft Azure stands as the second-largest cloud platform, securing 21% of the worldwide market.

- Google Cloud Platform (GCP) occupies the third position, holding a 12% share of the market.

AWS Market Dominance

- As of Q3 2025, AWS holds about 29% of the global cloud infrastructure market.

- In Q2 2025, AWS’s market share was 30%.

- AWS’s revenue in Q3 2025 reached $33 billion, up ~20% year-over-year.

- AWS’s market share has gradually declined from 34% in 2022 to 29% in 2025.

- AWS remains a Leader in strategic cloud services evaluations.

- Its dominance reflects broad service offerings and a global footprint.

- Competition continues to intensify as other providers strengthen their offerings.

Azure Adoption Trends

- Microsoft Azure holds roughly 20% of the global cloud market as of Q2 2025.

- Azure’s share was 22% in Q1 2025.

- Azure saw a 33% year-over-year revenue increase in 2025.

- Azure integrates deeply with enterprise tools, supporting adoption.

- Azure is particularly strong in hybrid cloud and regulated enterprise markets.

- Analysts expect Azure to grow as demand rises for AI-ready infrastructure.

- Azure remains second in market share behind AWS.

Google Cloud Growth

- Google Cloud holds about 13% of the global cloud market as of Q2 2025.

- GCP maintained its 13% share in Q3 2025.

- Google Cloud revenue grew to $15.2 billion in Q3 2025.

- GCP’s momentum reflects strong analytics and AI offerings.

- Google Cloud continues to gain traction for data-intensive workloads.

- GCP competes strongly in ML and containerised application sectors.

- GCP’s growth suggests an increasingly diversified cloud market.

Cloud Spending Forecasts

- The global cloud computing market in 2025 is valued at $912.77 billion.

- The cloud market could reach $5.15 trillion by 2034, at a 21.2% CAGR.

- Public cloud spending is expected to reach $723.4 billion in 2025.

- About 71% of organisations expect to increase cloud budgets in the next year.

- Public cloud spending could exceed $1 trillion by 2026.

- Hybrid and multi-cloud deployments significantly influence spending trends.

- Q2 2025 cloud infrastructure spending hit $99 billion.

- Analysts expect strong double-digit growth across IaaS, PaaS, and SaaS.

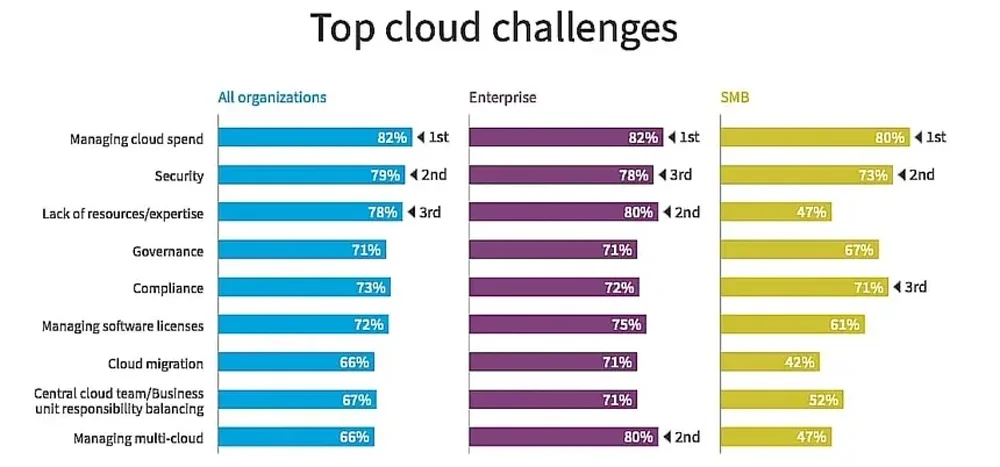

Key Cloud Challenges Encountered by Organisations

- Managing cloud spend continues to be the #1 challenge across all groups, impacting 82% of enterprises, 80% of SMBs, and 82% overall.

- Security remains a significant concern, influencing 79% of all organisations and 73% of SMBs.

- A lack of resources/expertise affects 78% overall, impacts 80% of enterprises, but touches only 47% of SMBs.

- Governance challenges are experienced by 71% of enterprises and 67% of SMBs.

- Compliance is reported by 73% overall and stands as a top 3 concern for SMBs at 71%.

- Managing software licenses influences 72% of all organisations and affects 75% of enterprises.

- Cloud migration presents a difficulty for 66% of all groups, with 71% of enterprises and only 42% of SMBs encountering it.

- Balancing responsibilities between cloud teams and business units is an issue for 67% overall.

- Managing multi-cloud environments is challenging for 66% overall, 80% of enterprises, and 47% of SMBs.

Cloud Security Concerns

- Misconfigured cloud storage causes 23% of security incidents.

- 99% of cloud security failures stem from customer misconfigurations through 2025.

- 82% of cloud breaches result from customer misconfigurations in shared responsibility models.

- 83% of organisations worry about data sovereignty due to misconfigurations.

- 60% of corporate data now resides in cloud environments.

- 54% of cloud-stored data is classified as sensitive in 2025.

- 78% of enterprises face compliance challenges with data sovereignty regulations.

- AI workloads expand threat surface, with 93% of businesses expecting daily AI attacks.

- Cloud-native microservices face SQL injection in 41% of organisations.

- 51% of companies use hybrid cloud models for sensitive data control.

Industry Cloud Adoption

- Healthcare, finance, retail, and telecom lead with 69% public cloud adoption as primary infrastructure in 2025.

- By 2025, over 70% of enterprises will use industry cloud platforms to accelerate business initiatives.

- Regulated industries favour hybrid cloud at 54% adoption for enhanced compliance and security.

- Hybrid cloud generates 2.5x greater business value than single-cloud approaches.

- 57% of manufacturers leverage cloud computing alongside IIoT for real-time operations.

- Cloud-based delivery cuts buffering by 23% in media and entertainment platforms.

- SaaS market hits $295B in 2025, with startups driving public cloud preference.

- The multi-cloud market is valued at $14.11B in 2025, growing at 32% CAGR.

- 95% of new digital workloads will deploy on cloud-native platforms by 2025.

Frequently Asked Questions (FAQs)

The global cloud computing market is estimated at $912.77 billion in 2025.

About 94% of enterprises globally report using cloud services of some kind in 2025.

Worldwide public cloud spending in 2025 is forecast to reach $723.4 billion, up from $595.7 billion in 2024.

About 72% of all global workloads are hosted in cloud environments in 2025, compared to 66% the year before.

Conclusion

The cloud landscape shows a clear picture: the market is growing fast, adoption continues to broaden, and the competition among top providers intensifies. AWS remains the market leader, but Azure and Google Cloud are steadily gaining ground, driven by enterprise demand, AI workloads, and hybrid-cloud strategies. At the same time, cost management and security remain core challenges that enterprises must address proactively.

Across industries, cloud is no longer optional; it is becoming central to digital infrastructure and business agility. As organisations plan for the next 5–10 years, these trends will shape how they choose providers, manage workloads, and balance growth, cost, and risk.