Cloud computing is now part of nearly every business strategy. From enabling companies to scale their infrastructure instantly to powering global AI deployments, the cloud touches industries in tangible ways. For example, retailers leverage elastic cloud storage to handle holiday-season traffic spikes, while healthcare providers use cloud-based analytics to process patient data faster. In this article, we examine the latest statistics around cloud adoption, spending, market growth, and emerging trends.

Editor’s Choice

Here are seven standout statistics that capture the state of cloud computing in 2025:

- The global cloud-computing market size is projected at $912.77 billion for 2025.

- Worldwide end-user spending on public cloud services is forecast to total $723.4 billion in 2025, up from $595.7 billion in 2024.

- More than 90% of organisations use some form of cloud computing.

- The global cloud infrastructure services market revenue in Q3 2025 surged to $107 billion, rising by $7.6 billion in a single quarter.

- Roughly 32% of organisations report cloud-budget waste due to idle or under-utilised resources in 2025.

- In 2025, the North America region holds the largest share of the cloud computing market revenue at 41%.

- Public cloud end-user spending is expected to increase by 21.4% from 2024 to 2025.

Recent Developments

- The cloud infrastructure market saw a revenue jump to $107 billion in Q3 2025, marking a 28% year-on-year growth.

- Vendor consolidation is intensifying; the top three providers together hold around 63%+ of the global infrastructure services market share.

- Regional sovereignty is increasingly relevant, with demand for sovereign-cloud models rising.

- More than 20% of organisations say they have little to no understanding of their cloud cost structure.

- Hybrid and multicloud strategies gain traction as companies seek to avoid vendor lock-in.

- Around 48% of organisations plan to move at least half their applications to the cloud in the next year.

- AI and machine-learning workloads are driving new demand for scalable cloud services.

- Energy and sustainability concerns grow as cloud scale continues to expand.

Global Cloud Market Growth

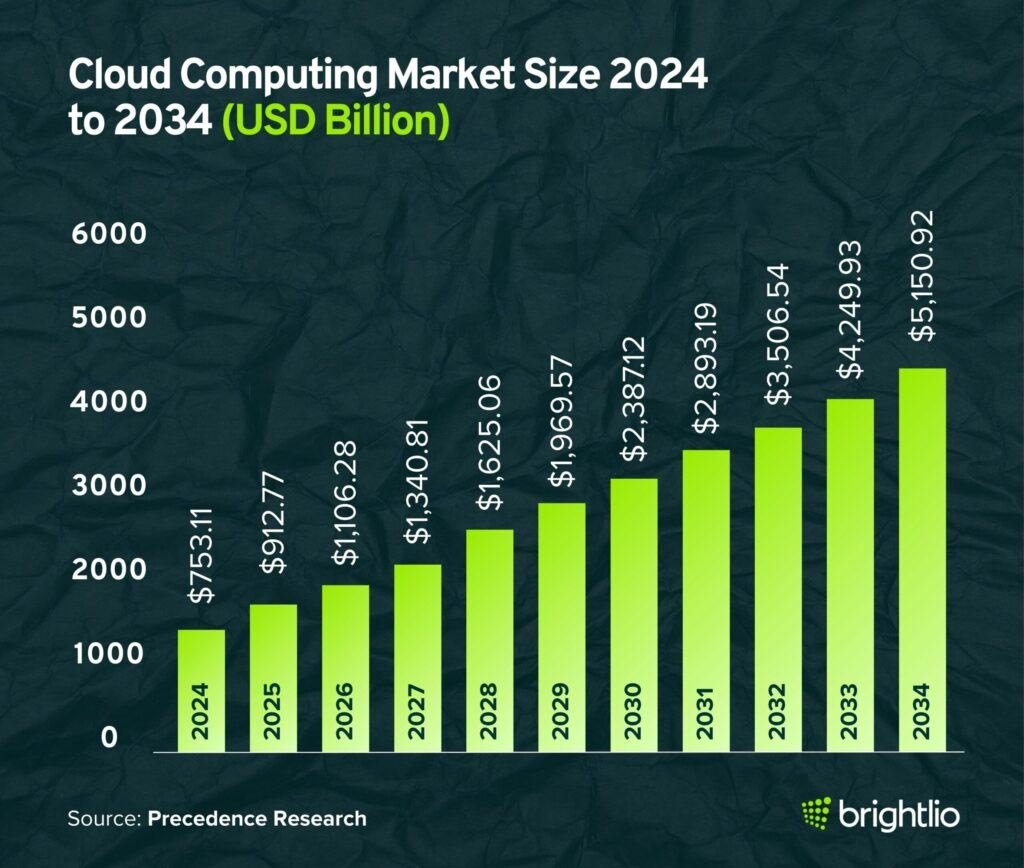

- The cloud computing market is projected to grow steadily and sharply over the next decade.

- In 2024, the market size stands at $753.11 billion, marking the starting point of a strong upward trend.

- By 2025, the market is expected to reach $912.77 billion, showing double-digit year-over-year growth.

- The industry surpasses the $1 trillion milestone in 2026, hitting $1,106.28 billion.

- Continued acceleration pushes the market to $1.34 trillion in 2027 and $1.63 trillion in 2028.

- A major leap occurs by 2029, when the market grows to $1,969.57 billion, approaching the $2 trillion threshold.

- Entering the next decade, 2030 sees further expansion to $2,387.12 billion, reflecting increasing enterprise cloud adoption.

- By 2031, the market will climb to $2,893.19 billion, strengthening its position as a core pillar of global digital infrastructure.

- The year 2032 marks another milestone, with the market hitting $3,506.54 billion, crossing the $3.5 trillion mark.

- In 2033, cloud computing reached $4,249.93 billion, showcasing exponential growth dynamics.

- By 2034, the market is projected to soar to $5,150.92 billion, representing nearly a 7× increase from 2024 levels.

Cloud Adoption Rates

- More than 90% of organisations globally use cloud computing.

- Among enterprises, adoption rises to 94%+.

- Roughly 60% of organisations run over half their workloads in the cloud.

- Around 44% of small businesses use cloud infrastructure.

- 48% of organisations plan to migrate at least half of their applications within the next year.

- Hybrid cloud adoption is expected to reach 90% by 2027.

- In developing markets, about 30% currently use cloud solutions.

- Lines of business now drive 40% of cloud initiatives.

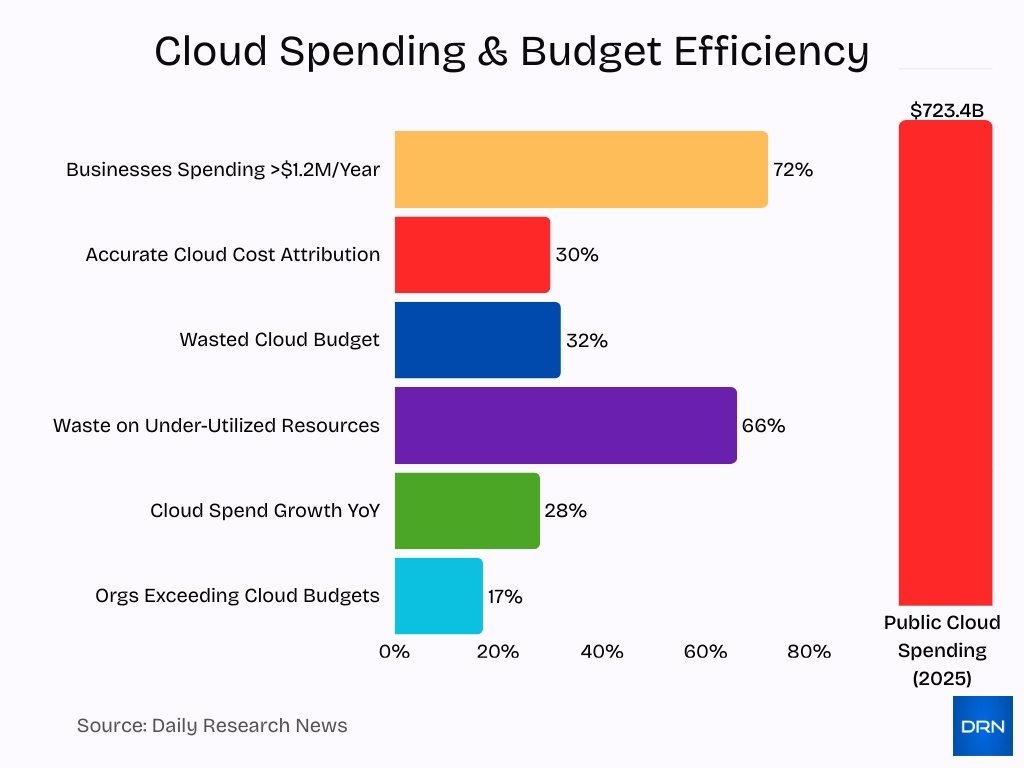

Cloud Spending and Cost

- Global end-user spending on public cloud services is forecast at $723.4 billion in 2025.

- About 33% of organisations are spending over $12 million annually on public-cloud services.

- Around 72% of businesses report annual cloud-services spending over $1.2 million.

- Only 30% can accurately attribute cloud costs internally.

- Roughly 32% of cloud budgets are wasted due to idle or over-provisioned resources.

- 66% report wasted spend due to under-utilised resources.

- Cloud-spend growth is estimated at around 28% year-on-year.

- About 17% exceeded their cloud budgets in recent studies.

Service Delivery Models (IaaS, PaaS, SaaS)

- The SaaS market is projected to $390.5 billion in 2025.

- PaaS is expected to reach $208.64 billion in 2025.

- IaaS is growing at an estimated 26.2% CAGR through 2025.

- Global cloud infrastructure services revenue reached $99 billion in Q2 2025.

- AWS holds 29%, Azure 22%, and GCP 12% as of Q1 2025.

- IaaS continues to be the fastest-growing cloud model.

- Mature organisations adopt more PaaS and SaaS.

- Pre-built AI and analytics in PaaS/SaaS reduce development time.

- Multi-model adoption (IaaS + PaaS + SaaS) is now standard practice.

Cloud Security Statistics

- 82% of breaches involve cloud-stored data.

- Around 47% of cloud-stored data is sensitive.

- Only 26% use CSPM tools extensively.

- Fewer than 10% encrypt over 80% of sensitive data.

- About 55% use encryption key-rotation.

- The zero-trust security market is projected to reach $60 billion by 2027.

- Misconfigurations and identity issues are leading causes of cloud incidents.

- About 70% expect cloud-security budgets to increase in 2025.

- Incident-readiness remains low.

- Multicloud environments increase security complexity.

Data Storage and Management

- Global data volumes are projected to reach 181 ZB by 2025.

- Roughly half the world’s data will be stored in public clouds by 2025.

- Around 71% of U.S. residents use cloud-storage services.

- 69% of organisations have hybrid-cloud storage architectures.

- Edge and decentralised storage models continue to grow.

- 74% of organisations use public cloud for data warehousing.

- Data-management complexity continues to increase.

- Most organisations archive cold data in cloud object storage.

- Fewer than half have mature data-governance policies.

- Adoption of advanced data-management architectures rises year-on-year.

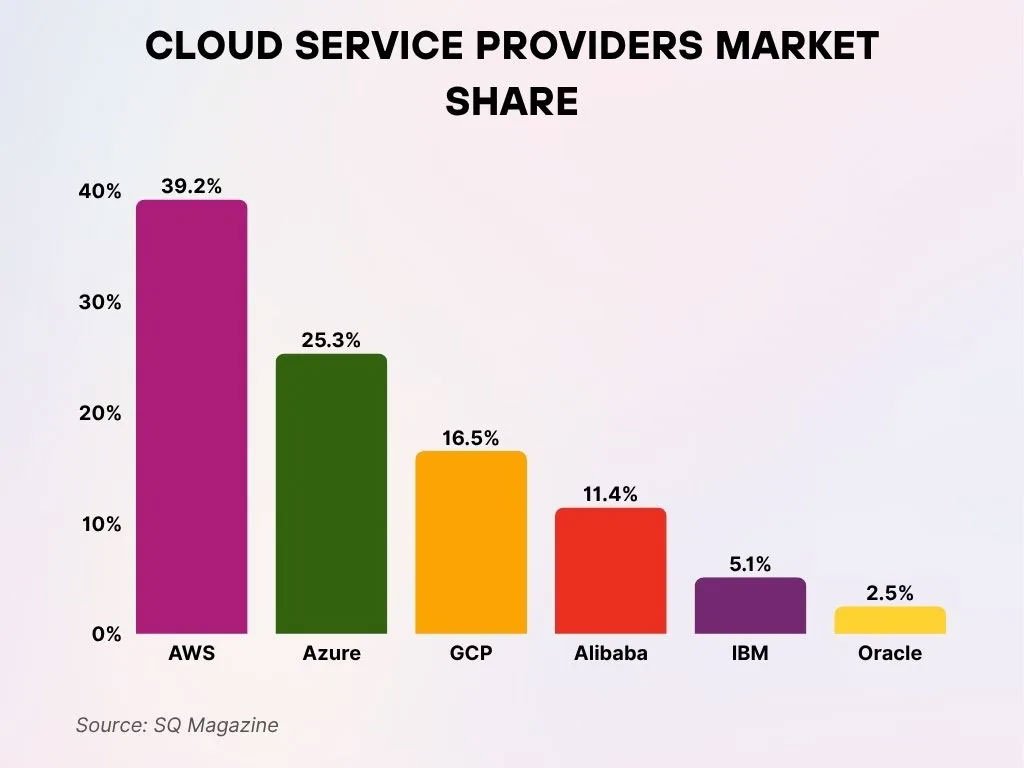

Cloud Service Providers Market Share

- AWS continues to dominate the cloud market with a commanding 39.2% share while maintaining its industry leadership.

- Microsoft Azure secures the second-largest segment with 25.3% of the market, reinforcing its strong competitive position.

- Google Cloud Platform (GCP) captures 16.5% of the global market as it steadily expands its cloud footprint.

- Alibaba Cloud sustains its market presence with a notable 11.4% share across global cloud services.

- IBM Cloud contributes a modest 5.1% to the overall market as it focuses on specialised enterprise solutions.

- Oracle Cloud represents the smallest share of the sector with a 2.5% market share while continuing to grow its cloud offerings.

Public vs Private vs Hybrid Cloud Statistics

- 73% of organisations use hybrid cloud in 2025.

- 80% of organisations use multiple public cloud providers.

- Nearly 90% expect hybrid-cloud use by 2027.

- Public-cloud workloads account for 58% of enterprise workloads.

- Hybrid deployments reduce operational costs by 23%.

- Fewer than 50% have full visibility into hybrid cloud systems.

- Regulated sectors prefer private or hybrid cloud.

- Fewer than 10% have mature digital sovereignty strategies.

- About 21% repatriated workloads from public to private cloud in 2025.

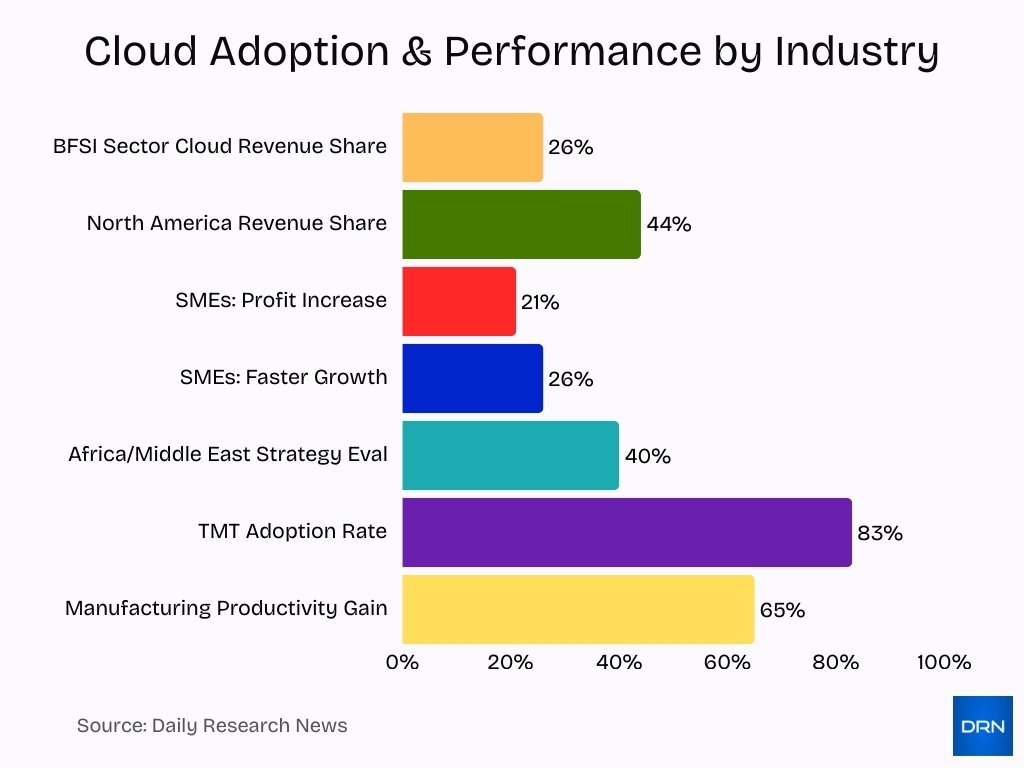

Usage by Industries

- BFSI holds 26% of cloud-computing revenue in 2025.

- India is among the fastest-growing cloud markets in APAC.

- North America accounts for 44% of cloud revenue.

- SMEs using cloud see 21% higher profits and 26% faster growth.

- 40% of organisations in Africa and the Middle East are evaluating cloud strategies.

- TMT industries have an 83% adoption rate.

- Industry-specific cloud offerings accelerate adoption.

- Manufacturing reports 65% productivity improvement via cloud solutions.

Multicloud Strategies and Usage

- 92% of enterprises use a multicloud strategy.

- Organisations use an average of 2.4 public clouds.

- Key motivations include avoiding lock-in and improving resilience.

- Over 50% plan to adopt vertical industry-specific cloud platforms.

- 56% struggle to secure data across multiple clouds.

- 70% consider edge integration a crucial multicloud factor.

- Over 50% will fail to meet multicloud expectations by 2029.

- Nearly 90% use more than one public cloud provider.

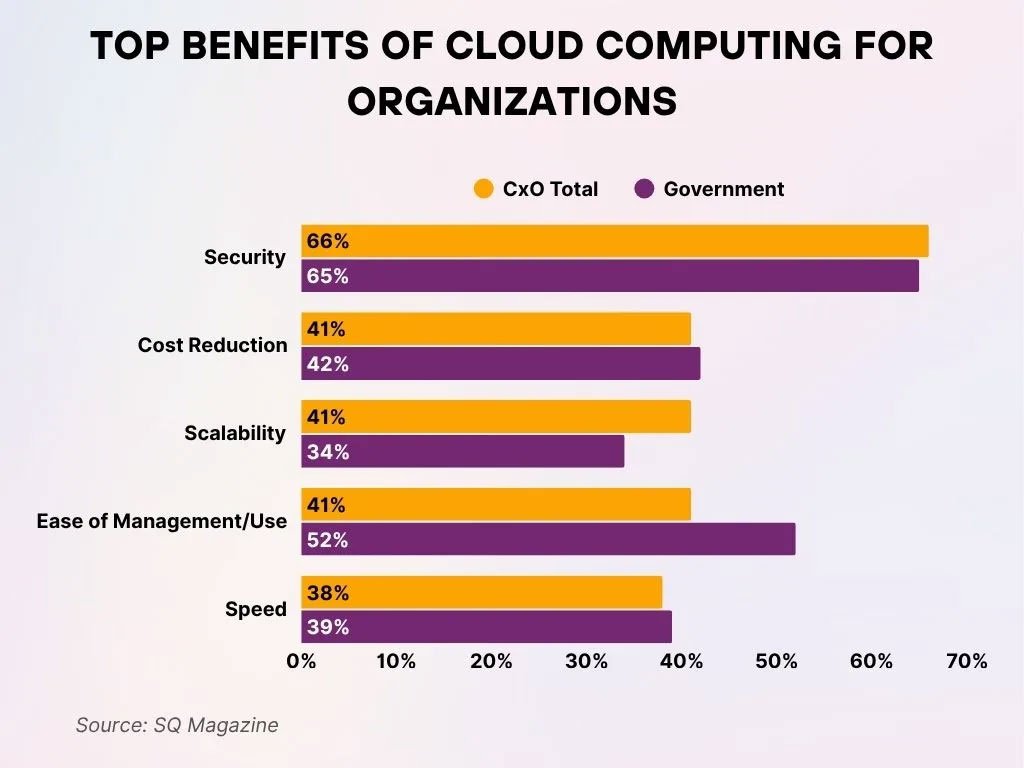

Top Benefits of Cloud Computing for Organisations

- Security emerges as the foremost advantage, noted by 66% of CxOs and 65% of government respondents.

- Cost reduction is acknowledged by 41% of CxOs and 42% of government organisations.

- Scalability is appealing to 41% of CxOs, in contrast to 34% within the government sector.

- Ease of management/use is emphasised by 52% of government users, with 41% of CxOs expressing similar views.

- Speed is regarded comparably, highlighted by 38% of CxOs and 39% of government leaders.

Cloud Cost Optimisation Challenges

- 32% of cloud budgets are wasted.

- Only 30% can attribute cloud costs accurately.

- 84% cite cost management as the top cloud challenge.

- Fewer than 20% have mature FinOps practices.

- 40% of inefficiency stems from poor workload placement.

- Only 45% use reserved instances or savings plans.

- 75% report increased cloud waste in 2025.

- 54% cite limited visibility as the cause of overspending.

Top Cloud Computing Challenges

- 77% cite security and compliance as top concerns.

- Skills shortages remain widespread.

- Over 50% cite multicloud complexity as a barrier.

- 44% cite legacy migration difficulty.

- Fewer than 10% have mature sovereignty strategies.

- 82% worry about unpredictable cloud bills.

- Environmental concerns continue to grow.

- Vendor lock-in worries affect 60% of organisations.

Monitoring and Management

- 60% use MSPs for cloud operations.

- Only 25% have full-stack observability.

- 40% use automated scaling or self-healing infrastructure.

- 45% say legacy tools lack needed visibility.

- FinOps teams rose from 51% in 2024 to 59% in 2025.

- 48% plan to add edge monitoring within 12 months.

- 30% use AI/ML anomaly detection for monitoring.

Cloud Computing and Energy Consumption

- Cloud infrastructures could account for 20% of global electricity consumption in 2025.

- Data-centre operations may reach 5.5% of global carbon emissions.

- 40% of cloud decision-makers prioritise energy reduction.

- 35% use efficient compute strategies such as serverless or containers.

- 30-40% of data-centre energy usage comes from cooling.

- 28% pursue green-cloud procurement with renewables.

- Cloud migration can reduce energy costs by up to 64%.

Cloud Computing Skills and Workforce Trends

- There are 15.6 million cloud-native developers worldwide in 2025.

- 96% of enterprises use Kubernetes or similar orchestration tools.

- Demand for cloud and AI skills grows by 25% in 2025.

- 35% cite high salary expectations as the main hiring obstacle.

- 78% of job roles reference AI or cloud skills.

- 45% of IT staff require reskilling for cloud roles.

- Cloud-certification adoption increases by 20% year-on-year.

Frequently Asked Questions (FAQs)

$912.77 billion.

21.20%.

63%.

32%.

Conclusion

The data underscores that cloud computing is not just a technology trend; it is core infrastructure for business transformation. Organisations across sectors are embracing public, private, hybrid and multicloud models, deploying large numbers of workloads, and leveraging advanced services at scale. At the same time, significant challenges remain: cost control, security, skills, and sustainability all demand strategic focus.

Businesses that actively monitor and manage their cloud strategies, invest in workforce capability, and optimise for cost and performance will be better positioned to reap the full benefits. As you explore the detailed statistics above, consider how your organisation’s cloud posture aligns with wider trends, and which next steps can deliver the most value.