The global console gaming market has evolved into a major force in entertainment, shaping how people across the world play, connect, and consume digital content. From next-gen consoles to recurring subscription services, growth in hardware and software sales continues to push the industry forward. In retail stores and living rooms alike, console gaming already influences sectors such as game development, streaming, and marketing.

Editor’s Choice

- The overall global games market is projected to hit $188.8 billion in 2025.

- Console gaming remains the fastest-growing gaming platform in 2025.

- The global gaming console market size in 2024 is estimated between $26.32 billion and $55.8 billion, depending on the source.

- Conservative forecasts expect the console market size to reach $28.8 billion by 2030.

- Aggressive long-term projections estimate a rise to $47.6 billion by 2033.

- In 2024, console games contributed around 28% of total global gaming revenues.

- The shift to digital distribution, subscription services, and add,ons continues to drive console market growth.

Recent Developments

- According to a leading industry report, the global games market will generate $188.8 billion in 2025, up from $187.7 billion in 2024.

- Analysts note that console platforms lead growth in 2025, outpacing mobile and PC in many regions.

- The growing install base of consoles and ongoing hardware upgrades drive demand for immersive, high-performance gaming experiences.

- The rising popularity of online multiplayer, cross-platform gaming, and digital game distribution fuels console growth globally.

- Subscription services and downloadable content (DLC) are increasingly propelling revenue, even as physical-hardware growth moderates.

- Some market-size estimates differ sharply; one source pegs the 2025 console market at $31.37 billion, with projected growth to $65.9 billion by 2034.

- Others suggest a more modest market, around $24.8 billion in 2025, rising to approximately $28.9 billion by 2030.

- This divergence underlines the challenge of comparing global estimates, as data sources differ in scope (hardware only vs hardware+software+services) and methodology.

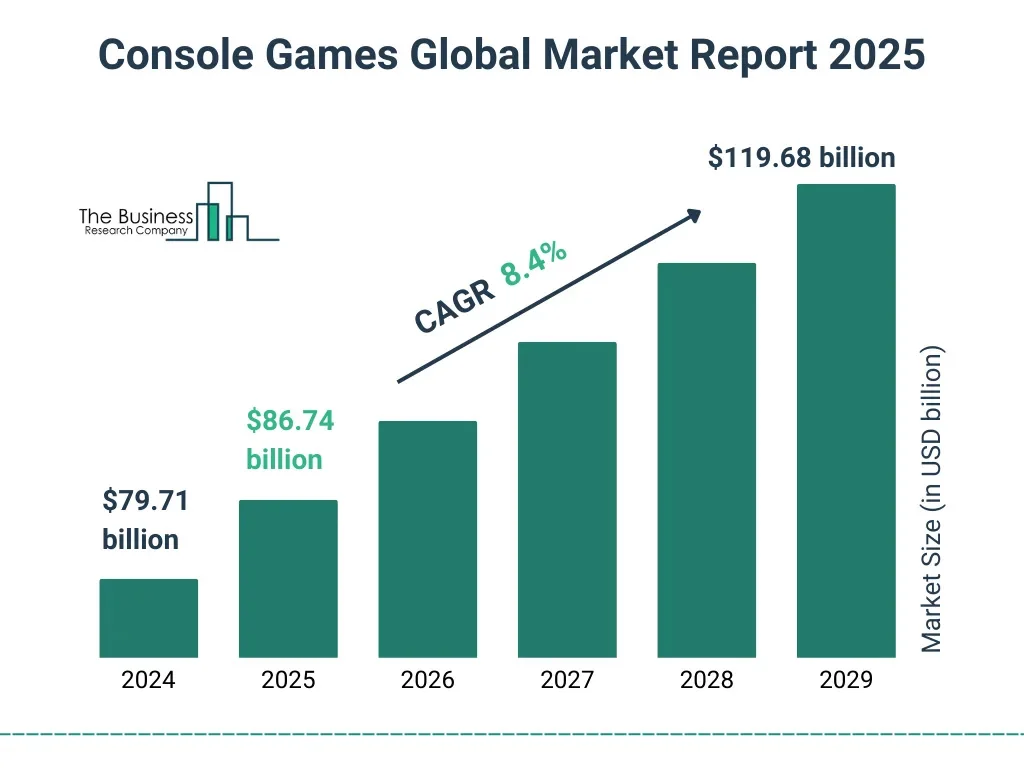

Console Games Global Market Growth

- The global console games market is anticipated to reach $86.74 billion in 2025, rising from $79.71 billion in 2024.

- The market is predicted to grow at a CAGR of 8.4% throughout 2024–2029.

- By 2029, the market size is expected to climb to $119.68 billion.

- This continued growth underscores the increasing demand for console gaming and the expanding monetization opportunities anticipated over the next five years.

Global Console Market Overview

- The console gaming segment remains a significant slice of the overall games market, contributing roughly 28% of global gaming revenues in 2024.

- Estimates for total console market value in 2024 vary widely, from ≈ $26.3 billion to $55.8 billion, depending on the components considered.

- Market size forecasts show long-term growth, up to $47.6 billion by 2033 under some scenarios.

- Demand drivers include increased consumer appetite for immersive gameplay, hardware upgrades, and broader access to digital gaming.

- The shift towards subscription-based services, downloadable content, and digital distribution underpins sustained growth.

- Console manufacturers continue to invest in next-gen hardware, which sustains engagement among existing and new users.

- Even amid market fragmentation and competition from mobile and PC gaming, consoles hold a stable and influential position.

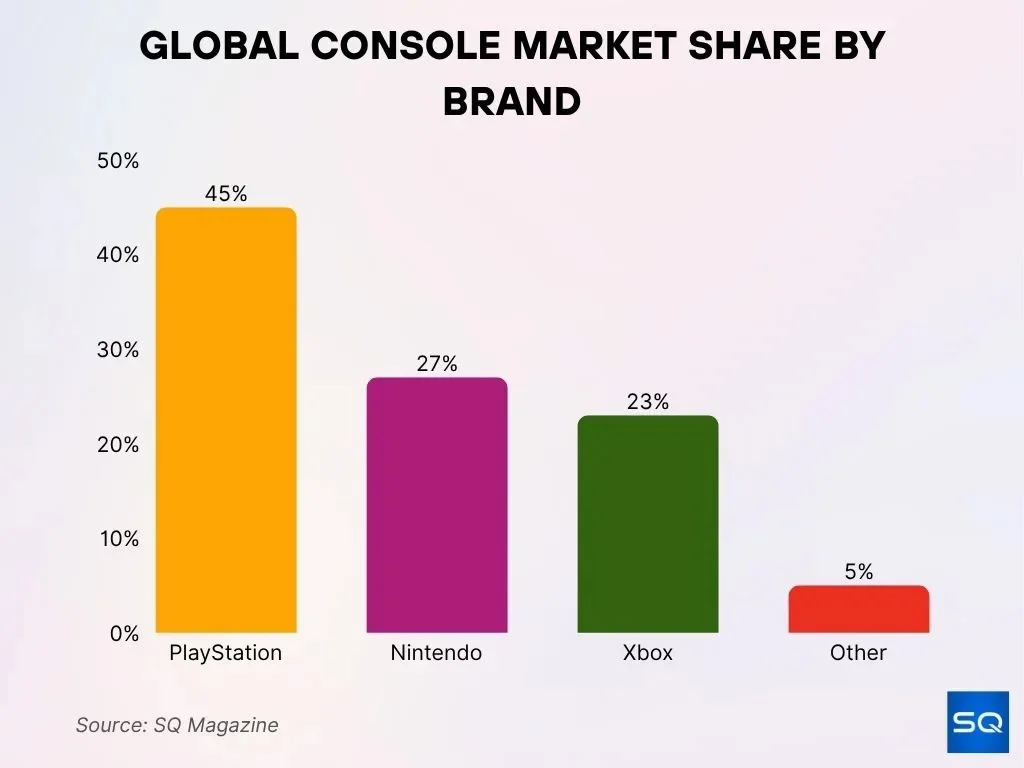

Global Console Market Distribution by Leading Brands

- PlayStation leads the worldwide console landscape with a powerful 45% market share.

- Nintendo secures the second position with a strong 27% share, fueled by impressive sales of its hybrid consoles.

- Xbox attains 23%, sustaining a firmly competitive role within the industry.

- Other brands together make up only 5%, underscoring the overwhelming dominance of the top three companies.

Market Revenue Trends

- Global console market revenue reaches $31.37 billion in 2025, growing to $65.92 billion by 2034 at 8.6% CAGR.

- Alternative forecast values the gaming console market at $24.8 billion in 2025, expanding to $28.9 billion by 2030.

- Gaming console market valued at $35.95 billion in 2025, projected to hit $70.96 billion by 2032 with a 10.2% CAGR.

- Projections show the console market rising from $29.69 billion in 2023 to $57.56 billion by 2030 at a 9.92% CAGR.

- Digital full-game sales hold steady at $8 billion annually from 2023 to 2025 in the console segment.

- Add-on content revenue surges from $15 billion in 2023 to $19 billion in 2025 for consoles.

- Subscription services generate $11 billion in 2025, up from $10 billion in 2023.

- Online sales capture 52.7% of console market share in 2025, surpassing offline at 47.3%.

- Console subscriptions account for 55% of 2024 revenue, reaching $6.6 billion in 2025 at 8.1% CAGR.

Compound Annual Growth Rate (CAGR)

- According to one projection, the gaming console market will grow at a 6.7% CAGR from 2025 to 2033, reaching about $47.6 billion by 2033.

- Another source suggests a more conservative CAGR of roughly 3.0%–3.5%, bringing the market size to ~$28.9 billion by 2030.

- A longer-term projection estimates 8.6% CAGR through 2034, heading toward $65.9 billion.

- The variation in forecasts results partly from differences in what segments are included; some include hardware only, others hardware plus software and services.

- Growth drivers cited across reports include rising demand for next-gen consoles, growth in online multiplayer and digital game distribution, and expansion of subscription services.

- Market growth appears sustained despite global economic pressures, reflecting strong consumer interest in gaming as entertainment.

- Digital transformation, streaming, downloads, and subscription models underpin the optimistic high-CAGR scenarios.

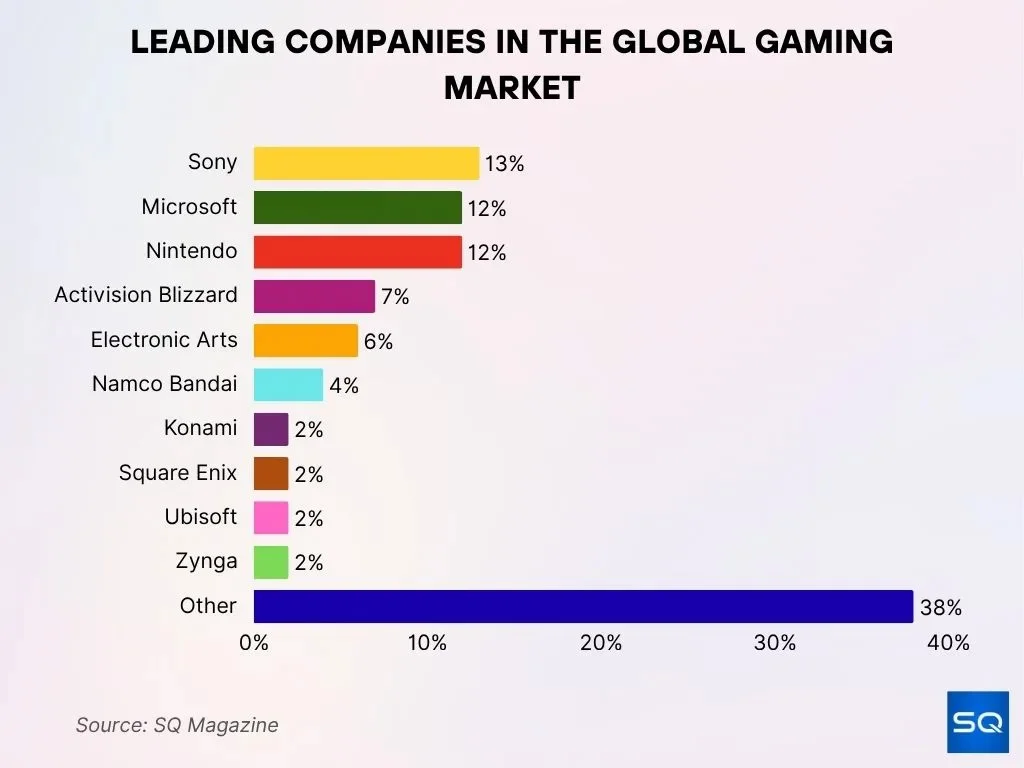

Top Leading Companies in the Global Gaming Market

- Sony stands at the forefront of the global gaming sector with a commanding 13% market share.

- Microsoft and Nintendo trail closely behind, each securing an impressive 12% portion of the market.

- Activision Blizzard achieves a solid 7% share, underscoring its robust lineup of blockbuster gaming franchises.

- Electronic Arts (EA) maintains a notable 6% market share, supported by its steady output of sports and action-focused titles.

- Namco Bandai contributes 4% to the worldwide gaming industry, reinforcing its long-standing presence.

- Konami, Square Enix, Ubisoft, and Zynga each control a modest 2% share, reflecting their niche yet stable market roles.

- A broad collection of other gaming companies collectively commands a substantial 38%, emphasizing the industry’s highly fragmented and fiercely competitive nature.

PlayStation Market Share

- PS5 sold 80.25 million units worldwide through September 2025.

- PS5 commands 70% market share in active next-gen consoles vs 30% for Xbox.

- PS5 outsells Xbox at a 2.7:1 sales ratio as of mid-2025.

- In the US, PS5 reached 25.81 million units through April 2025.

- Japan PS5 sales hit 6.86 million units through May 2025.

- PS4 lifetime sales total 117.2 million units.

- PlayStation holds 45% global console brand share in 2025.

- PS5 shipped 3.9 million units in Q2 fiscal 2025.

- PlayStation Network active users reached 119 million in early 2025.

Nintendo Market Share

- By Q1 2025, the Nintendo Switch series reached ~141.32 million lifetime units, with Switch 2 adding more during 2025.

- This unit volume sustains Nintendo’s 24–27% share of the console market.

- Nintendo’s hybrid design appeals to younger players, casual audiences, and portable-device fans.

- Forecasts highlight hybrid-segment growth at around 10.1% CAGR, supporting Nintendo’s momentum.

- Hybrid consoles remain one of the fastest-growing console categories.

- Strong title exclusivity and affordability reinforce Nintendo’s fan loyalty.

- Nintendo’s share remains stable despite intensified competition.

Xbox Market Share

- Xbox Series X|S holds about 27% of the overall console market in 2024.

- In the next-gen race, Xbox’s share is ~30%, behind PS5’s ~70%.

- Xbox unit sales remain lower than PlayStation and Nintendo, limiting its long-term share potential.

- By mid-2024, Xbox Series X|S reportedly reached ~28.3 million lifetime units.

- Subscription services and backward compatibility help sustain Xbox’s ecosystem appeal.

- Market-share figures for Xbox remain steady year over year.

- Microsoft remains a strong but clearly secondary player in the console landscape.

Model and Generation Share

- PS5 commands 69.7% market share vs 30.3% for Xbox Series X|S through March 2025.

- Nintendo Switch family reaches 153.1 million units shipped by mid-2025.

- Switch 2 sells 10.36 million units worldwide as of September 2025.

- PlayStation holds 45% overall console brand market share in 2025.

- Hybrid consoles grow at a 5.9% CAGR through 2030, the fastest segment.

- The handheld market is valued at $4.6 billion in 2024, reaching $11.3 billion by 2035.

- Home consoles claim 46% of the game console revenue share in 2025.

- PS5 outsells Xbox Series X|S by 42.51 million units lifetime.

- Nintendo maintains a 27% console brand share via hybrid strength.

Lifetime Sales Statistics

- PS5 lifetime sales reach approximately 80.3 million units worldwide by September 2025.

- Nintendo Switch lifetime sales stand at ~141.32 million units by Q1 2025.

- Combined Switch+Switch2 sales exceed 145 million by mid-2025.

- Older generations like PS4, PS2, and Nintendo DS contribute massive installed bases.

- These legacy totals strengthen brand ecosystems and software demand.

- Xbox Series X|S lifetime sales sit around 28.3 million units through mid-2024.

- Long-term sales disparities influence current brand power and future market share.

Annual Sales Figures

- PS5 leads 2025 year-to-date hardware performance globally.

- PS5 sells 8.21 million units worldwide YTD in 2025.

- Xbox Series X|S sells 1.69 million units in the same period.

- Nintendo Switch and Switch 2 remain steady contributors to annual sales momentum.

- Regional sales vary, but PlayStation often leads across the Americas, Europe, and Asia.

- Annual 2025 sales reinforce the long-standing brand hierarchy.

- Demand reflects both new buyers and repeat purchasers upgrading or adding consoles.

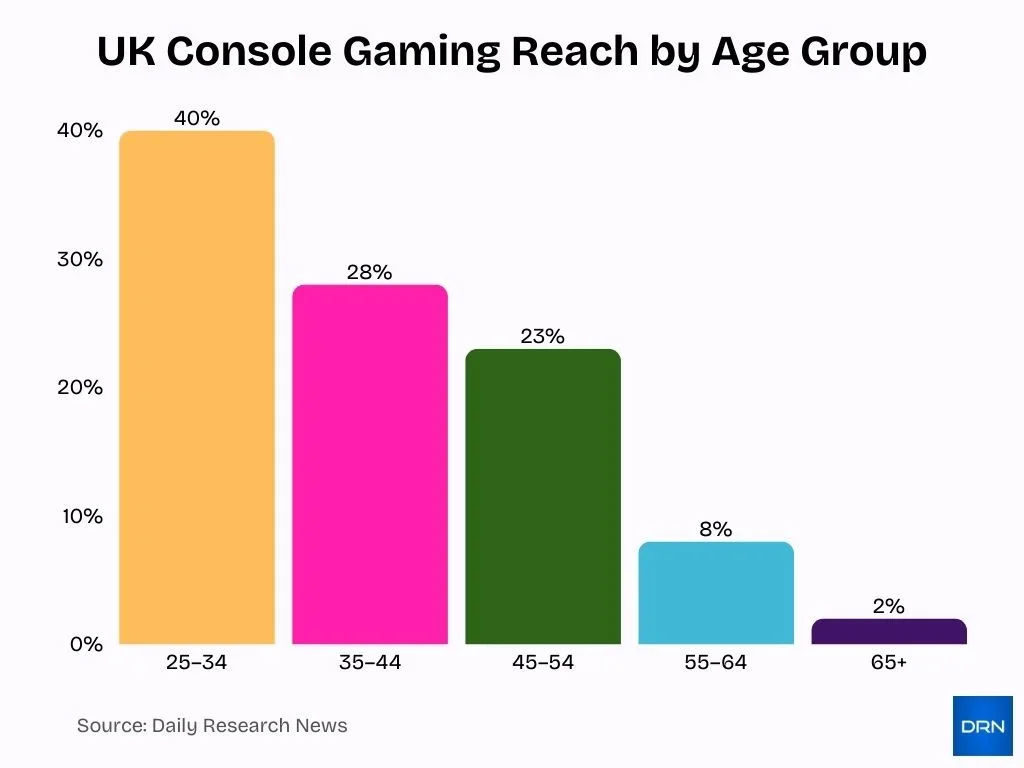

UK Console Gaming Reach by Age Group

- The 25–34 age group shows the highest console gaming reach at 40%, making it the most engaged demographic.

- Gamers aged 35–44 follow with a 28% reach, indicating strong but declining participation compared to younger adults.

- The 45–54 group maintains a moderate engagement level at 23%, showing that console gaming remains relevant into mid-adulthood.

- There is a sharp drop in reach among older adults: only 8% of individuals aged 55–64 actively engage in console gaming.

- The 65+ demographic shows minimal participation, with just 2% console gaming reach.

- Overall, the data highlights that console gaming is dominated by adults under 45, with engagement decreasing significantly with age.

- The steep decline in older groups suggests opportunities for industry expansion toward older demographics or for tailoring experiences for younger, core players.

Regional Market Share

Asia Pacific Dominance

- Asia-Pacific commanded a 47% share of the global gaming console market in 2024.

- The Asia Pacific gaming console market reached USD 14.74 billion in 2025, projected to hit USD 31.31 billion by 2034.

- The region anticipates a robust 8.71% CAGR for console gaming from 2025–2034.

- The APAC console market generated USD 12,348.1 million in revenue in 2024.

- China dominated the APAC console market, eyeing USD 11,365.2 million by 2031.

- India’s console gaming market is set for an 18.4% CAGR through 2031.

- Portable gaming consoles in the Asia-Pacific region were valued at USD 12.5 billion in 2024.

- APAC boasts around 1.5 billion gamers, fueling console demand.

- Asia Pacific console sector poised for 9.3% CAGR from 2025–2034.

North America Trends

- North America holds a 44.4% share of the global gaming console market.

- North America dominates the connected game console segment with a 35% market share.

- The North American gaming console market generated USD 6,327.4 million in revenue in 2024.The

- The North America console market is projected to reach USD 11,942.9 million by 2033 at a 7.2% CAGR.

- Subscription-based gaming in North America reached USD 2,483.8 million in 2024.

- Nintendo captured 24.64% revenue share in the North American console market in 2024.

- The North American gaming market size stood at USD 74.40 billion in 2025.

- The US contributed 84.7% of North America’s gaming spend in 2024.

- Console volume in North America surged to 17,637.0 thousand units by 2023.

Europe Market Insights

- Europe’s console market was valued at $8.08 billion in 2024.

- It is projected to grow to $8.42 billion in 2025 and $11.69 billion by 2033.

- Europe generated 18.1% of global games revenue in 2024.

- Growth comes from demand for next-gen devices and immersive technologies.

- Mobile and PC competition exists, but consoles maintain strong regional relevance.

- Gaming culture and e-sports support hardware and software demand.

- Europe shows stable, consistent growth through the next decade.

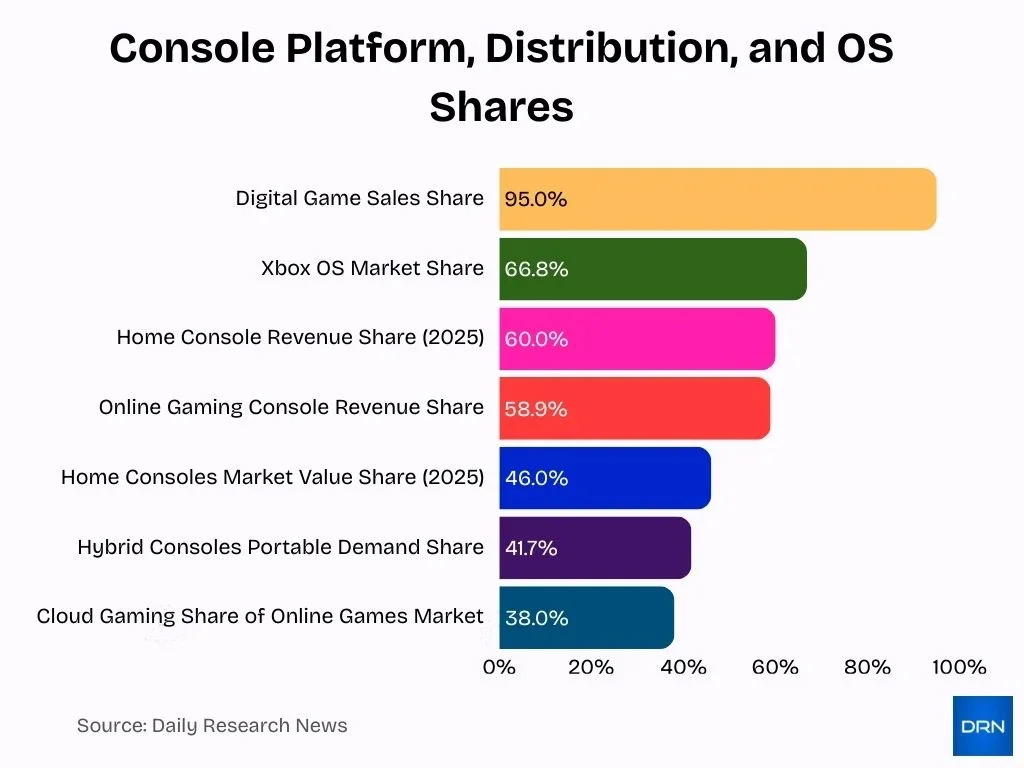

Platform Type Breakdown

- Home consoles hold 46% of the global console market value in 2025.

- Hybrid consoles claim 41.7% of portable gaming demand worldwide.

- Online gaming drives 58.9% of console-market revenues globally.

- Console market reaches $58.6 billion in 2025, growing to $95.4 billion by 2035.

- Digital game sales comprise 95% of console software distribution.

- Xbox OS dominates with a 66.8% console operating system share.

- Cloud gaming captures 38% of the online video games market.

- The home console segment is projected at 60% of gaming revenue in 2025.

Best-Selling Consoles

- Nintendo Switch family shipped 153.10 million units worldwide as of June 2025.

- Nintendo Switch 2 sold 10.36 million units by September 2025, surpassing early expectations.

- PS5 reached 84.2 million units shipped globally by Q2 fiscal 2025.

- PlayStation 2 holds the record with over 160 million units sold lifetime.

- Nintendo DS sold 154.02 million units, second-best ever.

- PlayStation 4 lifetime sales hit 117.2 million units worldwide.

- Switch 2 achieved 3.5 million units in the first four days post-launch.

- Hybrid Switch variants drive 152+ million combined sales, nearing PS2 record.

Frequently Asked Questions (FAQs)

The global console games market is projected to reach $86.74 billion in 2025.

PlayStation holds approximately 45% of the console market share in 2024.

PlayStation 5 sold about 8.21 million units year-to-date worldwide by 2025.

The Asia-Pacific region accounted for about 47% of the global console market share in 2024.

Conclusion

The global console market reflects a balanced interplay of regions, platforms, and consumer preferences. Asia-Pacific leads, fueled by rising connectivity and growing gaming populations, while North America and Europe continue to provide stable revenue through mature adoption and strong gaming ecosystems. On the platform side, home consoles remain dominant, but hybrid and portable models add flexibility and help capture diverse audiences.

Among devices, heavyweights like PS5, Switch, and Switch 2 stand out as top sellers, while legacy consoles maintain a lasting footprint thanks to extensive installed bases.