Since its launch, DeepSeek has rapidly emerged as a serious player in the global AI chatbot scene. Its low-cost, open source strategy and broad accessibility enabled it to reach millions of users within months, transforming how people access AI-powered assistance for writing, research, coding, and more. In business settings, companies test DeepSeek for content generation and customer support automation, while in education and research, it helps students with drafting summaries, solving problems, and structuring ideas.

Editor’s Choice

- DeepSeek reached ~96.9 million monthly active users (MAU) by April 2025.

- The platform drew ~22.15 million daily active users (DAU) in January 2025.

- On the U.S. App Store, DeepSeek ranked #1 free app within weeks of release.

- Since its launch, DeepSeek has logged 57.2 million downloads by April 2025.

- DeepSeek’s first major model reportedly cost under $6 million to develop.

- More than 50% of DeepSeek’s users come from China, India, and Indonesia.

- The global AI chatbot market is valued at $15.6 billion in 2025.

Recent Developments

- DeepSeek app garnered 2.6 million downloads across App Store and Google Play by late January 2025.

- It surged to the #1 free app spot on the U.S. App Store on January 26, 2025.

- DeepSeek achieved 33.7 million monthly active users and 22.15 million daily active users in January 2025.

- Website traffic exploded with a 2,800% increase to 89.3 million unique visitors the week of January 20-26, 2025.

- App downloads reached 14.2 million in January 2025 alone, totaling 57.2 million by May.

- Open-source model weights downloaded 11.2 million times in the first five months of 2025.

- V3.2 Exp API prices slashed by 50%+ in September 2025, dropping input to under $0.28 per 1M tokens.

- Regulatory bans hit 7 countries, including Italy, Australia, and Canada, over data privacy concerns by early 2025.

Key DeepSeek AI Statistics Overview

- Monthly Active Users, MAU, hit 96.88 million globally by April 2025.

- Daily Active Users, DAU, reached 22.15 million in January 2025.

- DeepSeek’s total downloads surpassed 57.2million by April 2025.

- In its launch month, the U.S. saw DeepSeek become the #1 free app on iOS, a rare feat for a non-Western AI tool.

- More than half, 51.24%, of global monthly active users are from China, India, and Indonesia.

- Download growth followed a strong pattern, about 20 million in January 2025, 28.5 million in February, then 15.3 million in March, and 13 million in April 2025.

- DeepSeek’s global entry contributed to the broader AI chatbot market, estimated at $15.6 billion in 2025.

- Compared to 2021, when the chatbot market was roughly $2.5 billion, 2025 reflects more than a 6× increase in market value in four years.

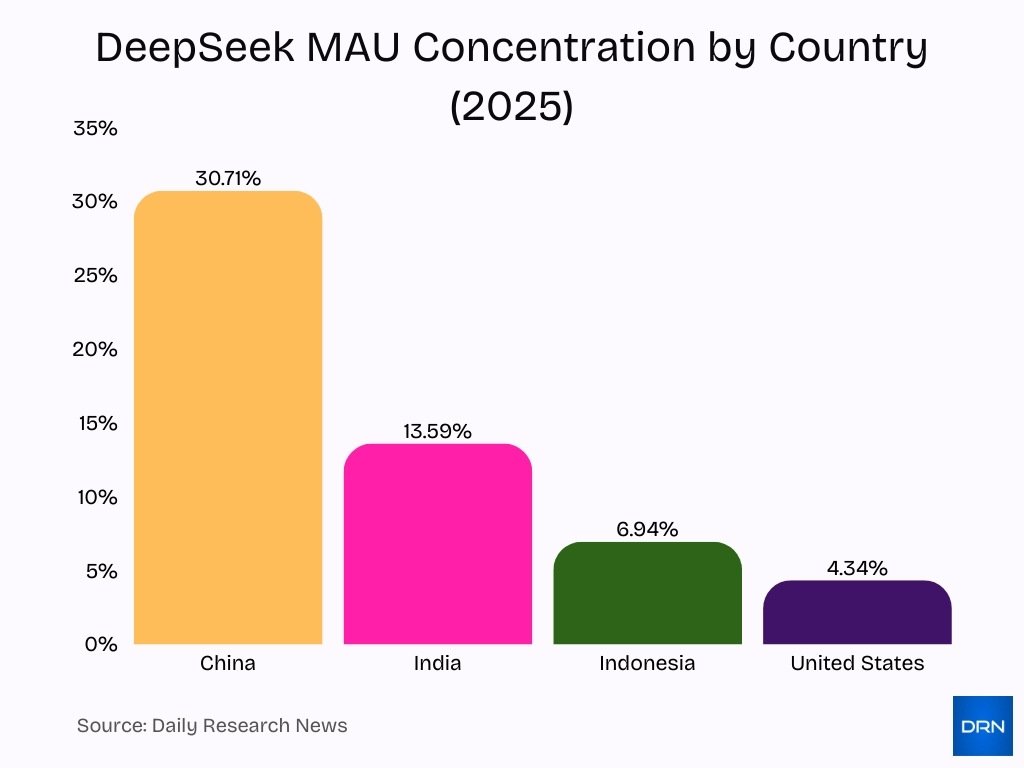

DeepSeek MAU by Country

- DeepSeek achieved 33.7 million global MAU in January 2025.

- Global MAU surged to 96.88 million by April 2025, a 25.81% monthly increase.

- China holds 30.71% of DeepSeek MAU, equating to over 29.7 million users.

- India accounts for 13.59% of MAU, around 13.2 million active users by April 2025.

- Indonesia represented 6.94% of the total MAU in early 2025.

- The United States represents 4.34% of DeepSeek’s MAU base.

- The top three markets (China, India, Indonesia) comprise 51.24% of global MAU.

- DeepSeek ranked among the top 5 AI apps by MAU globally in mid-2025.

- MAU grew nearly 3x from 33.7 million in January to 96.88 million in April 2025.

Web Traffic and Visit Statistics

- ChatGPT garnered 4.61 billion monthly visits, leading all AI chatbots in October 2025.

- Gemini.google.com averaged 7:08 minutes of visit duration, second in AI traffic rankings.

- Top 10 AI chatbots like ChatGPT and DeepSeek showed 31-37% bounce rates on average.

- Character.ai recorded the highest 17:53 minutes average time spent among the top platforms.

- ChatGPT received 37.5 million daily searches in 2024 versus Google’s 14 billion.

- DeepSeek attracted 792.6 million total visits with 136.5 million unique users monthly.

- AI referral traffic from ChatGPT achieved a 16% conversion rate, far exceeding Google’s 1.8%.

- ChatGPT.com commanded 81.38% direct traffic share in recent analytics.

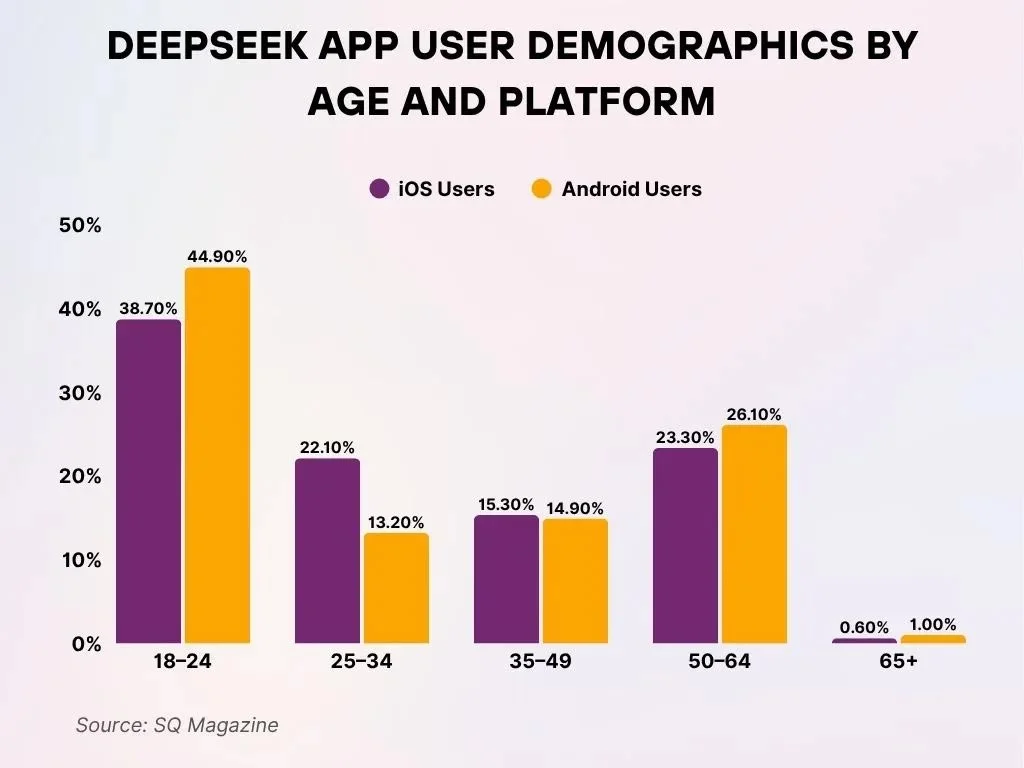

DeepSeek App User Distribution by Age and Platform

- Individuals aged 65+ form the smallest segment, making up just 0.6% of iOS users and 1.0% of Android users.

- The largest user segment is the 18–24 age group, representing 44.9% of Android users and 38.7% of iOS users.

- Among iOS users, the second-largest group is the 50–64 age range, which constitutes 23.3% of the total.

- For Android users, the 50–64 age group is also a major segment, accounting for 26.1% of all users.

- The 25–34 demographic represents 22.1% of iOS users while comprising only 13.2% of Android users.

- The 35–49 age bracket shows a nearly equal presence, with 15.3% of iOS users and 14.9% of Android users falling within this group.

User Engagement and Retention Metrics

- 80% of users report positive experiences with chatbots, driving high engagement.

- 27% of users interact with chatbots daily, boosting retention metrics.

- 62% of customers prefer chatbots over waiting for agents, enhancing user stickiness.

- Banking chatbots achieve 65% user retention through personalized guidance.

- 74% prefer chatbots for routine queries, reducing workloads and improving retention.

- 73% of users expect chatbot features on websites, indicating strong engagement.

- Chatbot journeys average 80% CSAT scores, reinforcing enterprise retention.

- 46% organizational adoption in SaaS shows growing retention commitment.

Market Share in the AI Sector

- The global AI market in 2025 is estimated at $294.16 billion.

- The generative AI chatbot market is projected to $9.90 billion in 2025.

- The market could reach $65.94 billion by 2032, reflecting strong future demand.

- Traditional and generative chatbot markets are expanding rapidly.

- 31% of B2B marketers use chatbots in their marketing efforts.

- Around 12% of marketing budgets in some industries now go to chatbot technology.

- The growing commercialization of AI positions chatbots as a key component of the broader AI economy.

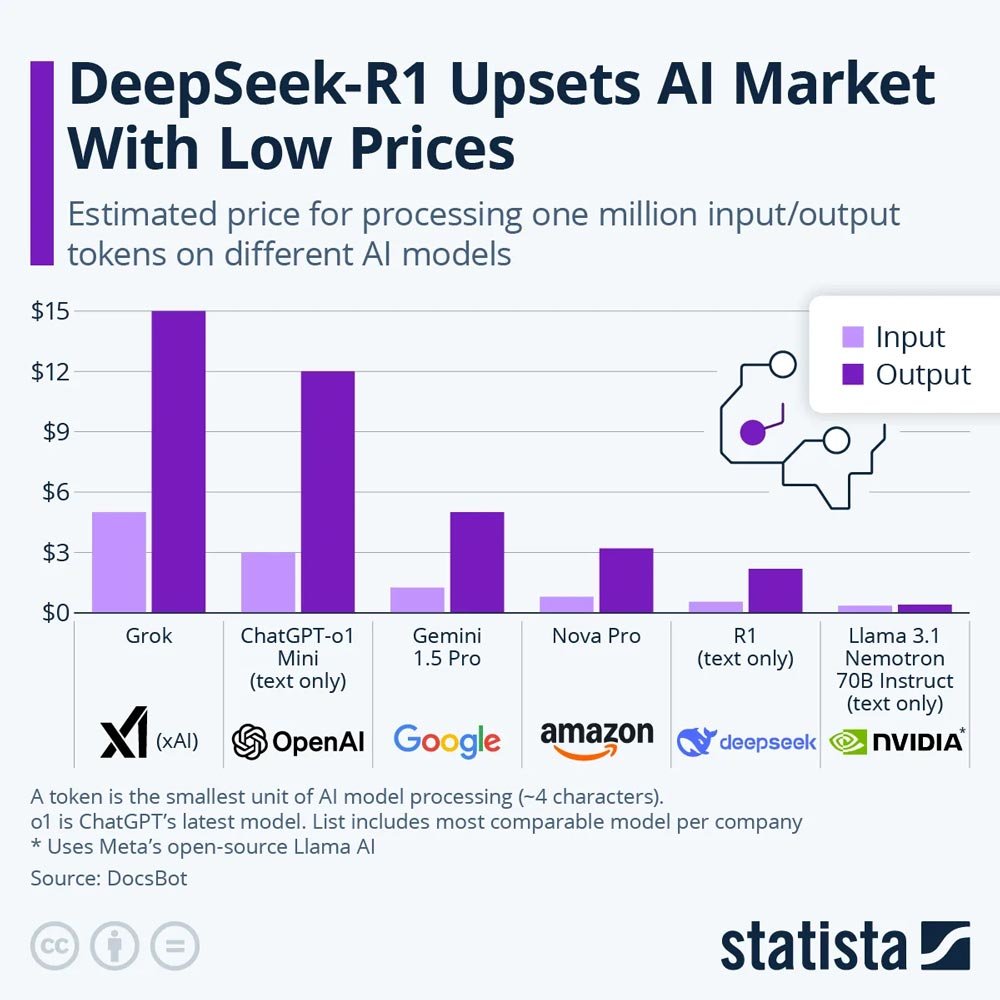

DeepSeek-R1 Disrupts AI Token Pricing Market

- DeepSeek-R1 significantly disrupts the AI token pricing market by offering the lowest price among major AI models for processing 1 million tokens, maintaining costs of around $0.10 for input and $0.20 for output.

- Grok (xAI) imposes the highest charges, requiring about $6 for input and a notably steep $14 for output.

- ChatGPT-o1 Mini (OpenAI) remains on the higher-priced end, costing approximately $3 for input and $12 for output.

- Gemini 1.5 Pro (Google) positions itself in the mid-range, with rates of around $1 for input and $6 for output.

- Nova Pro (Amazon) stands out as a more affordable option compared to top-tier models, charging about $0.50 for input and $3.50 for output.

- LLaMA 3.1 Nemotron 70B (NVIDIA) is similarly budget-friendly, offering an estimated cost of just $0.20 for input and $0.30 for output.

Position vs Other AI Chatbots

- ChatGPT leads with about 82.7% of generative AI chatbot website visits.

- DeepSeek holds a smaller share, around 1.5% globally.

- Competitors include Perplexity, Microsoft Copilot, Google Gemini, and Claude.

- A 2025 ranking lists DeepSeek among the fastest-growing generative AI chatbots, despite holding about 0.2% of the U.S. market share.

- The competitive landscape remains crowded and highly uneven.

- DeepSeek’s early-stage adoption means a small share but significant room for growth.

- Growth will depend on awareness, differentiation, and performance improvements.

Benchmark Performance Metrics

- DeepSeek-V3 scores 88.5% on the MMLU benchmark, outperforming open-source rivals.

- Achieves 75.9% on MMLU-Pro and 59.1% on GPQA-Diamond.

- Delivers 90.2% accuracy on MATH-500 and 39.2% on AIME 2024.

- Records 51.6% percentile on Codeforces and 42.0% resolved on SWE-bench.

- Trained using only 2.788M H800 GPU hours, versus 60M estimated for GPT-4.

- Pre-training on 14.8T tokens costs $5.576M, far below competitors’ billions.

- Exhibits a hallucination rate below 14.3%, better than reasoning variants.

- Uses 2,000 GPUs in training versus 16,000 for some rivals like Llama 3.

- 671B total parameters with 37B activated per token for efficiency.

Accuracy and Reliability Statistics

- A 2025 NewsGuard audit found DeepSeek achieved only 17% accuracy in news and information tasks.

- The audit reported a 30% rate of repeating false claims and a 53% rate of vague or unhelpful responses.

- DeepSeek recorded an 83% fail rate, significantly higher than the peer average.

- Many generative AI models still struggle with hallucination, error propagation, and factual recall.

- Tools like HalluDetect demonstrate improvements in detecting hallucinations, though detection remains imperfect.

- Industry surveys show 77% of businesses worry about AI hallucinations.

- Deploying DeepSeek for critical tasks requires careful oversight and verification.

Reasoning and Problem-Solving Performance

- Major AI models average below 50% accuracy on recent financial task benchmarks.

- Healthcare AI systems achieve 81.8% diagnostic accuracy on validated clinical vignettes.

- Multimodal manufacturing safety chatbots reach 86.66% accuracy with optimal retrieval.

- DeepSeek chatbot scores only 17% accuracy in NewsGuard news audits.

- o1-preview model attains 81.52% average accuracy on reasoning evaluations.

- Radiology AI detects lung nodules at 94% accuracy, surpassing human 65%.

- GPT-5 hits 94.6% closed-book accuracy on AIME 2025 math benchmark.

- Industrial safety chatbots predict accidents with 73.81% test accuracy.

- Hybrid financial AI approaches boost accuracy to 63-66% over baseline 60%.

Model Architecture and Parameter Scale

- Training compute for notable AI models doubles every 5 months, per the 2025 Stanford AI Index Report.

- Datasets for training LLMs grow every 8 months, while power use increases annually.

- The global AI chip market reached $166.9 billion in 2025, up from $123.16 billion in 2024.

- AI chip spending is projected at $92 billion worldwide by the end of 2025.

- DeepSeek V3 uses a Mixture-of-Experts architecture with 671 billion total parameters, activating only 37 billion per query.

- 52% of 2025 AI models have fewer than 1 billion parameters, with 70% under 3 billion.

- Performance gap between top and 10th-ranked models shrank from 11.9% to 5.4% in one year.

- The top two AI models were separated by just 0.7% on benchmarks in 2025.

- Over 30 AI models trained at 10^25 FLOP scale by mid-2025, matching GPT-4 level.

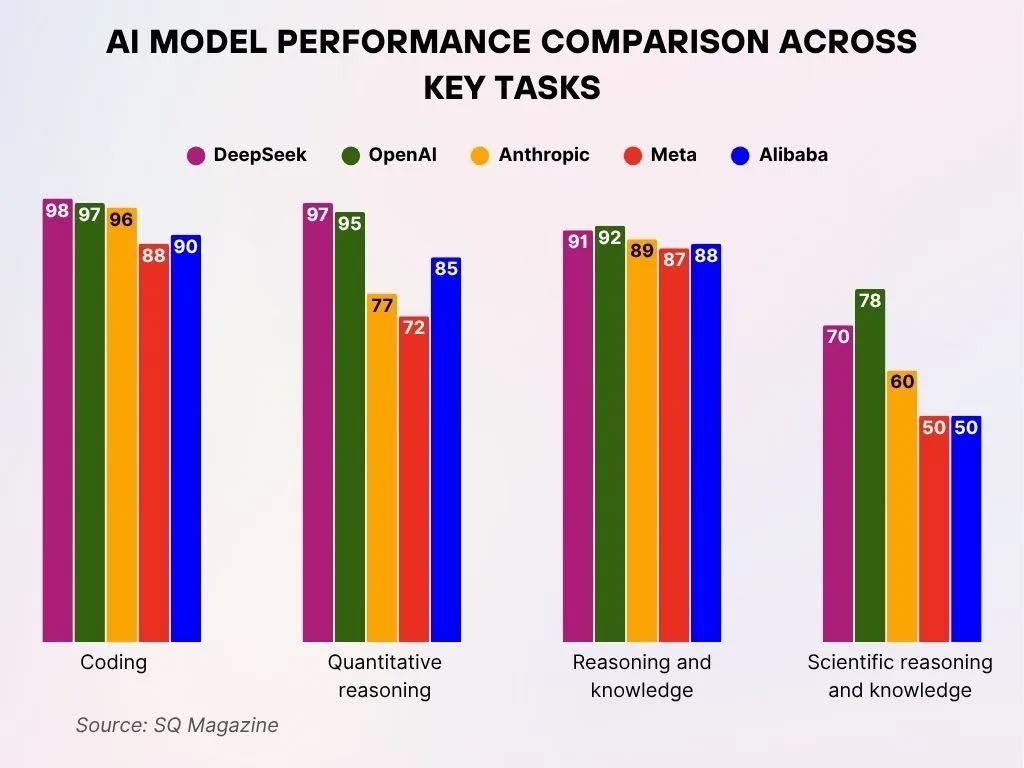

AI Model Performance Evaluation Across Major Tasks

- In Coding, DeepSeek secures a near-perfect score of _98_, narrowly surpassing OpenAI (97) and Anthropic (96**), while maintaining the same high-level competitive edge.

- For Quantitative Reasoning, DeepSeek once more takes the lead with 97, outperforming OpenAI (95) and placing itself far ahead of Anthropic (77) and Meta (72).

- In terms of Reasoning and Knowledge, OpenAI achieves a score of 92, just slightly surpassing DeepSeek at 91, with Anthropic, Alibaba, and Meta following closely behind in performance.

- For Scientific Reasoning and Knowledge, OpenAI stays ahead with a score of 78, trailed by DeepSeek at 70, whereas Anthropic (60), Meta, and Alibaba (each at 50) remain considerably lower in comparison.

API Usage and Request Volume

- Global private investment in generative AI reached $33.9 billion in 2025.

- 78% of companies report using AI in at least one business function.

- API driven deployment is the preferred method for enterprise AI integration.

- The global generative AI market is projected to grow from $16.9 billion in 2024 to $109.4 billion by 2030.

- Chatbots and virtual assistant technologies may reach $14.6 billion by 2030.

- API based AI systems offer scalability and reduced infrastructure overhead.

- DeepSeek’s reliability issues may limit enterprise API adoption until improvements occur.

Revenue and Monetization Metrics

- The generative AI chatbot market is projected to reach $9.90 billion in 2025.

- The broader chatbot market is valued at $15.6 billion in 2025.

- Projections indicate the market could reach $65.9 billion by 2032.

- AI hardware spending reached $44.3 billion in 2025.

- Businesses report an average return of $3.70 per $1 invested in AI.

- Between 70% and 85% of AI projects reportedly fail to scale successfully.

- DeepSeek’s monetization depends on improving reliability and maintaining user trust.

Future Growth Projections and Trends

- The generative AI chatbot market is expected to reach USD 65.94 billion by 2032 at a 31.1% CAGR.

- Global generative AI market projected at USD 109.37 billion by 2030 with 37.6% CAGR.

- The AI chip market is expected to hit USD 500 billion by 2028, growing over 60% annually.

- AI chip demand to peak in 2028, potentially doubling Korean chip sales.

- 72% of organizations now integrate AI into business functions, up from 55% prior year.

- 92% of Fortune 500 companies use OpenAI technology.

- Hallucination detection tools market to grow from USD 1.12 billion in 2024 to USD 12.65 billion by 2033 at 31.4% CAGR.

- DeepSeek AI achieves 71.0% accuracy on AIME 2024 math benchmark, nearing top models.

- The generative AI market is poised to become $1.3 trillion by 2032 at a 42% CAGR.

Frequently Asked Questions (FAQs)

As of April 2025, DeepSeek had 96.88 million monthly active users globally.

In January 2025, DeepSeek’s DAU stood at 22.15 million users globally.

In early 2025, the combined share from China, India, and Indonesia was 51.24% of DeepSeek’s monthly active users.

As of November 2025, DeepSeek held about 0.2% market share in the U.S. generative-AI chatbot market, according to a recent ranking.

Conclusion

The data suggests that while the generative AI chatbot sector is on a steep upward trajectory, with market size, funding, and enterprise adoption all increasing, actual performance and reliability vary significantly across tools. For DeepSeek, the low 17% accuracy in a major audit highlights the importance of scrutiny and transparency, particularly for information retrieval or decision-making tasks.

As AI infrastructure and benchmarks evolve, the gap between hype and utility may narrow, but only tools that combine scale, robust architecture, and rigorous evaluation will sustain growth and trust in the long run. Readers interested in how these trends shape business strategies or AI adoption should explore the full article for deeper insight.