The digital subscription landscape continues its rapid expansion as consumers and businesses shift toward access‑first models across media, software, and services. Digital platform subscriptions are not just about entertainment; they’re reshaping revenue models in enterprise SaaS, e‑commerce recurring purchases, and mobile app monetization. For example, streaming platforms maintain record subscriber counts, while SaaS tools increasingly rely on subscription revenue for stability and growth. These trends reflect a broader shift in consumer expectations and corporate strategy. Read on to unpack the latest data driving the subscription economy.

Editor’s Choice

- The global subscription economy is projected to grow from roughly $722 billion in 2025 to $1.2 trillion by 2030.

- Subscription services revenue across digital segments is forecast to expand at a double‑digit CAGR through 2029.

- U.S. consumers spend an average of $924 annually on subscription services.

- Monthly subscription models account for an estimated ~70% of all digital subscriptions.

- Over 900 million digital subscriptions worldwide are expected in core categories like video and music by 2026.

- Social media subscription revenue is forecast to exceed $30 billion in 2025, growing at ~20% CAGR.

- Subscription e‑commerce markets could more than double to $46 billion by 2034.

Recent Developments

- Multiple industries are expanding their subscription offerings beyond traditional media to include software, gaming, and digital services.

- Platforms are emphasizing bundles and tiered pricing to retain subscribers amid rising competition.

- Consumer sentiment indicates subscription fatigue as users manage numerous services simultaneously.

- Publishers are increasingly combining subscriptions with advertising to balance their revenue.

- Subscription fatigue is now a key concern influencing churn and retention strategies.

- SaaS firms are refining customer onboarding and usage analytics to reduce churn.

- Recurring revenue forecasts now incorporate lifetime value optimization as a growth lever.

- Payment innovations, including auto‑renewal tools, are becoming standard in subscription platforms.

Global Subscription Economy Overview

- The subscription economy was valued at approximately $722 billion in 2025.

- Analysts project ~67% growth by 2030, nearing $1.2 trillion.

- Subscription revenue CAGR across major markets is estimated at ~15%‑17% through 2029.

- North America remains the largest regional contributor to the subscription economy.

- Emerging markets demonstrate faster subscription adoption than developed markets.

- Social media subscription markets alone are projected to hit $30 billion+ by 2025.

- Subscription business models now extend into mobility, gaming, and wellness services.

- Strategic partnerships between content creators and platforms are increasing global monetization.

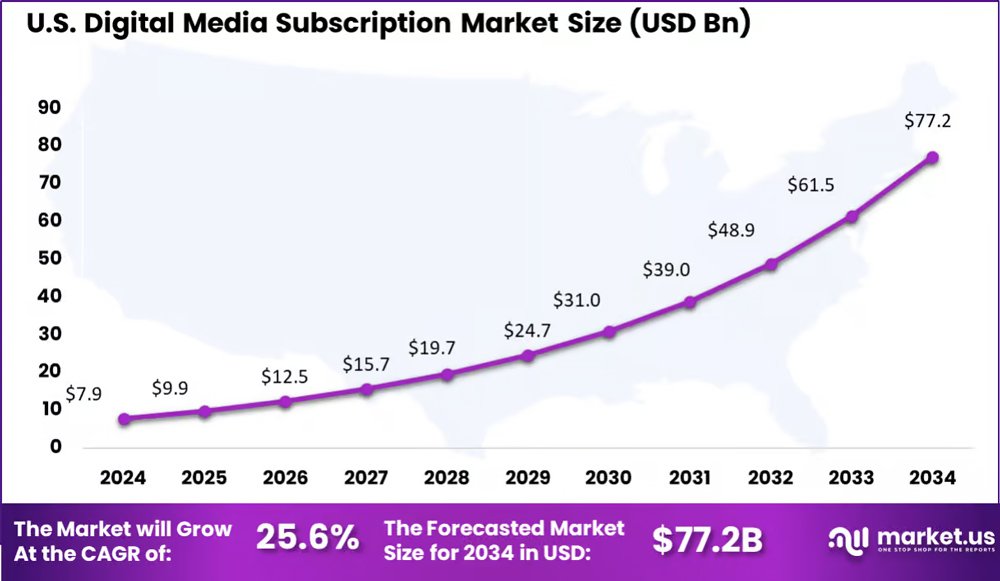

U.S. Digital Media Subscription Market Growth Insights

- The U.S. digital media subscription market is projected to grow from $7.9 billion in 2024 to $77.2 billion by 2034, highlighting massive long-term expansion.

- The market is expected to register a strong 25.6% CAGR, underscoring a rapid consumer shift toward paid digital content.

- Market value crosses the $10 billion mark in 2026, reaching $12.5 billion, signaling early-stage acceleration.

- By 2029, the industry nearly triple from 2024 levels, reaching $24.7 billion.

- The market surpasses $30 billion in 2030, climbing to $31.0 billion, driven by streaming, news, and premium content subscriptions.

- Growth intensifies post-2030, with the market jumping from $39.0 billion in 2031 to $48.9 billion in 2032 in just one year.

- By 2033, the market size will exceed $60 billion, reaching $61.5 billion, reflecting strong subscriber retention and ARPU growth.

- The 2034 forecast of $77.2 billion represents an almost 10× increase compared to 2024, indicating a highly scalable and resilient subscription economy.

Digital Platform Subscription Overview

- Digital platforms, from streaming to apps, increasingly adopt recurring revenue models.

- Monthly subscriptions dominate user preferences, representing roughly 70% of all plans.

- Consumers in the U.S. spend an average of almost $1,000 per year on digital subscriptions.

- Digital content monetization now incorporates premium tiers, ad‑supported alternatives, and micro‑subscriptions.

- Platforms implement usage‑based billing to complement traditional monthly or annual plans.

- Subscription options span annual, quarterly, and pay‑as‑you‑go formats.

- Cross‑platform bundles are growing in popularity, e.g., streaming and gaming.

- Data protection and privacy compliance are increasingly central to subscription services.

Number of Digital Subscriptions Worldwide

- By 2026, projections anticipate ~790 million video subscriptions globally.

- Music subscriptions are forecast to exceed ~810 million by 2026.

- Digital media subscriptions approached 923 million users in early 2025.

- Over 4.2 billion total global subscriptions across categories could be in force by 2026, according to some forecasts.

- Social media subscriptions are trending upward with increased monetization.

- Mobile apps continue adding recurring users as in‑app features expand.

- Subscription counts in entertainment, SaaS, and services vary widely by region.

- Platforms continue tracking active vs. inactive subscription numbers to refine growth forecasts.

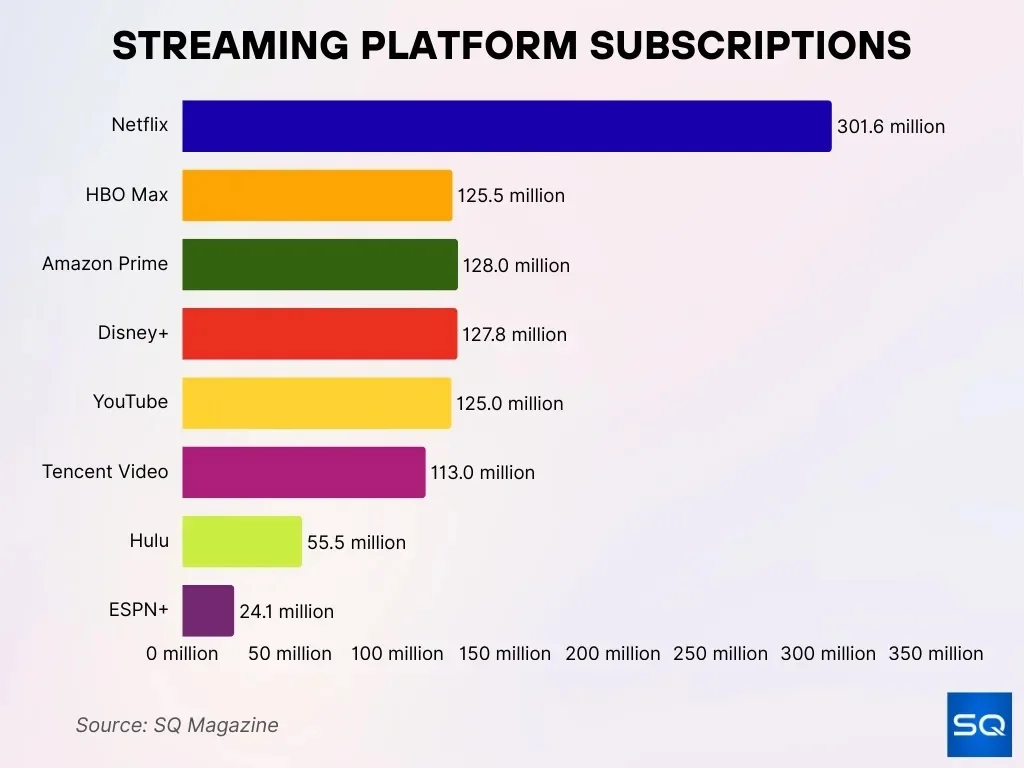

Global Video Streaming Subscription Statistics Overview

- Netflix reported 301.6M subscribers in early 2025, reinforcing its position as the largest global video streaming platform by total paid users.

- HBO Max achieved 125.5M paid memberships in 2025, reflecting strong growth driven by premium content and global expansion.

- Major streaming platforms reported sizable subscriber bases, including Tencent Video with 113M, YouTube (Premium + Music) with 125M, Disney+ with 127.8M, Hulu with 55.5M, and ESPN+ with 24.1M subscribers.

- Amazon Prime Video is projected to reach 128M subscribers by the end of 2025, with 90.5M users having video access, while only 5.48M subscribers remain ad-free.

- Global video streaming subscriptions are estimated to total 1.8 billion in 2025, highlighting the mass adoption of subscription-based entertainment worldwide.

- Streaming platforms account for 36 % of total TV usage, surpassing the combined share of cable and traditional broadcast television.

- Netflix’s ad-supported plan has reached 40M active users, with 40 % of all new signups choosing the lower-cost, ad-based tier.

- In the U.S. streaming market, Netflix holds a 27 % market share, while Amazon commands 26 %, making them the two dominant streaming services nationally.

Digital Subscription Revenue and CAGR Statistics

- Global digital subscription revenue is projected to surpass $900 billion in 2026, up from roughly $780 billion in 2025, reflecting steady year‑over‑year gains.

- The overall digital subscription market is expanding at a compound annual growth rate (CAGR) of 14%–17% through 2029.

- Media and entertainment subscriptions account for nearly 45% of total digital subscription revenue worldwide.

- SaaS subscriptions continue to post one of the highest CAGRs, averaging 18% annually between 2024 and 2026.

- U.S.-based subscription platforms generate over 40% of global digital subscription revenue, maintaining market leadership.

- Annual subscription plans contribute approximately 55% of total recurring revenue, driven by discounted pricing and lower churn.

- Ad‑supported subscription tiers now represent 15%–20% of total subscription revenue in digital media.

- Subscription price increases added an estimated $38 billion in incremental global revenue between 2024 and 2025.

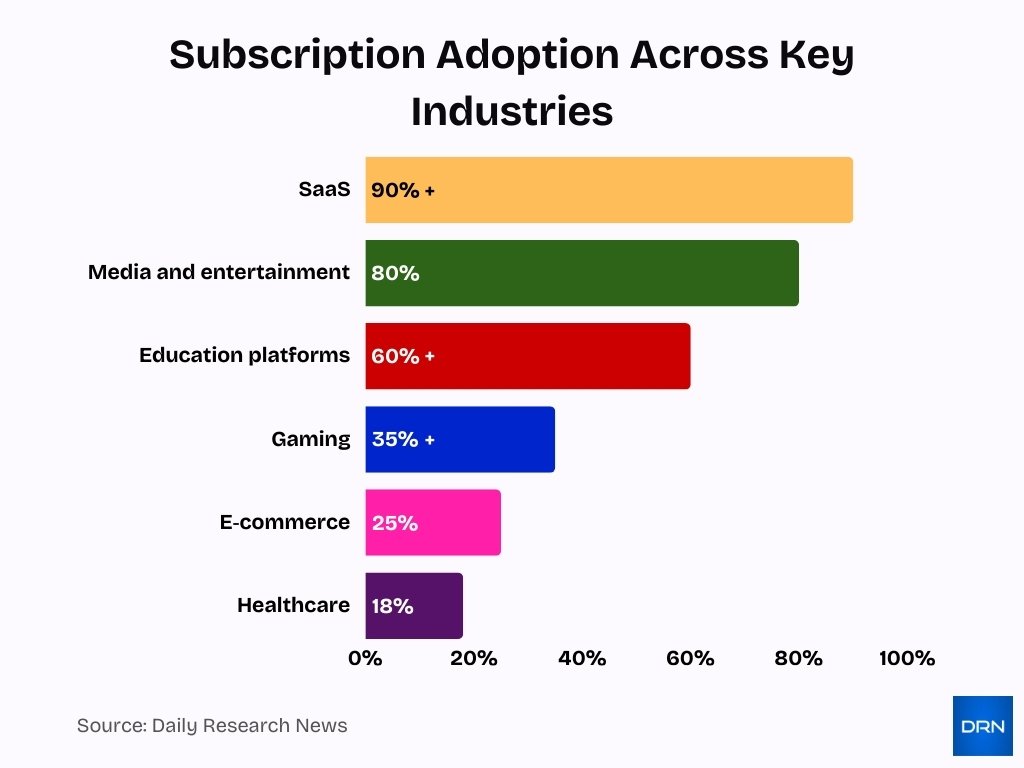

Digital Subscription Adoption by Industry (Media, SaaS, E‑commerce, etc.)

- Media and entertainment lead adoption, with over 80% of U.S. households subscribed to at least one digital media service.

- SaaS subscriptions are used by nearly 90% of mid‑size U.S. businesses, reflecting cloud‑first IT strategies.

- E‑commerce subscription adoption grew ~25% year over year in 2025, driven by auto‑replenishment models.

- Education platforms report subscription usage by more than 60% of U.S. colleges and training providers.

- Fitness and wellness apps recorded double‑digit subscription growth entering 2026.

- Gaming subscriptions are now used by over 35% of active console and PC gamers in North America.

- Professional services increasingly bundle subscriptions with consulting and support offerings.

- Healthcare digital subscriptions remain niche but grew ~18% in 2025, led by telehealth platforms.

Music and Audio Streaming Subscription Statistics

- Global paid music subscriptions surpassed 810 million users in 2025.

- Music streaming revenue reached $28.6 billion globally, up 10% year over year.

- The U.S. accounts for roughly 32% of global music streaming revenue.

- Podcast subscriptions and premium audio plans grew ~20% in 2025.

- Family and student plans represent over 40% of music subscription sign‑ups.

- Audio streaming users spend an average of 18 hours per week listening.

- Churn in music subscriptions remains lower than video, averaging ~25% annually.

- Smart speakers influence over 30% of new music subscription activations.

News and Publishing Subscription Statistics

- Digital news subscriptions reached over 310 million worldwide in 2025.

- U.S. publishers generated $14 billion+ in digital subscription revenue in 2025.

- About 21% of U.S. adults pay for at least one digital news subscription.

- Local news subscriptions grew ~8% year over year, outpacing national outlets.

- Bundled news and audio offerings improve retention by 12%–18%.

- Mobile apps drive over 65% of digital news subscription usage.

- Introductory pricing accounts for nearly half of new subscriber conversions.

- Publishers increasingly combine subscriptions with events and newsletters for ARPU growth.

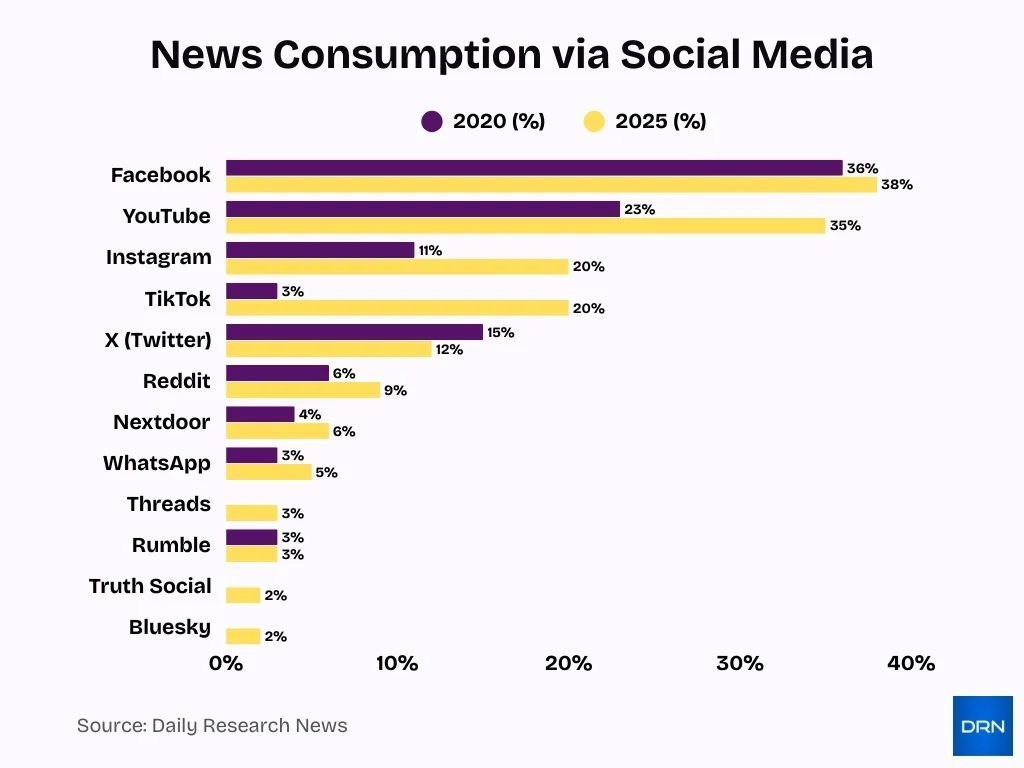

U.S. Social Media News Consumption Trends

- Facebook remains the dominant news platform, with regular news usage increasing from 36% in 2020 to 38% in 2025, reinforcing its position as the primary social news source in the U.S.

- YouTube shows the strongest mainstream growth, rising sharply from 23% to 35%, highlighting the growing preference for video-based news consumption.

- TikTok records the fastest expansion, surging from just 3% in 2020 to 20% in 2025, signaling a major shift toward short-form, algorithm-driven news discovery.

- Instagram doubles its news consumption share, climbing from 11% to 20%, driven by Reels, creator-led news formats, and visual storytelling.

- X (Twitter) experiences a decline, falling from 15% to 12%, indicating reduced reliance on real-time text-based news.

- Reddit strengthens its niche role, increasing from 6% to 9%, as users seek community-driven discussions and in-depth commentary.

- Messaging and neighborhood platforms grow modestly, with WhatsApp rising from 3% to 5% and Nextdoor increasing from 4% to 6%.

- New and alternative platforms enter the news landscape, including Threads (3%), Truth Social (2%), and Bluesky (2%) in 2025, though adoption remains limited.

- Rumble maintains stable usage, holding at 3% across both years, suggesting a consistent but niche audience.

Gaming and Cloud Gaming Subscription Statistics

- Global gaming subscription revenue exceeded $11 billion in 2025.

- Over 250 million gamers worldwide now use at least one subscription‑based gaming service.

- Cloud gaming subscriptions are growing at a CAGR above 40%, albeit from a smaller base.

- North America represents ~38% of global gaming subscription revenue.

- Console gaming subscriptions maintain higher retention than PC‑based plans.

- Subscription models drive longer average playtime compared with one‑time purchases.

- Family and multi‑user gaming plans are gaining popularity in the U.S.

- In‑game subscription perks influence over 50% of subscriber retention decisions.

Software and SaaS Subscription Statistics

- Global SaaS subscription revenue surpassed $250 billion in 2025.

- The U.S. accounts for nearly 50% of worldwide SaaS subscription spending.

- Average SaaS contract values increased by ~9% year over year entering 2026.

- Annual SaaS plans show 30% lower churn than monthly plans.

- Enterprise SaaS subscriptions grew faster than SMB plans in 2025.

- Usage‑based pricing is now offered by over 60% of SaaS providers.

- Customer lifetime value optimization is a top SaaS growth priority for 2026.

- AI‑powered SaaS tools report higher ARPU than traditional software subscriptions.

Mobile App Subscription Statistics

- Global app subscription revenue generated roughly $45.6 billion in 2024, with the United States accounting for over half of that revenue.

- Subscription‑based apps contributed about 40% of total mobile app revenue in 2025.

- 96% of total App Store and Google Play spending came from subscriptions and in‑app purchases in recent data.

- Mobile app downloads are expected to reach around 299 billion worldwide in 2025, increasing demand for subscription‑driven services.

- Nearly 49% of users open an app 11+ times a day, indicating strong engagement potential for app subscriptions.

- Subscription offerings are expanding beyond entertainment into health, lifestyle, and productivity categories.

- Mobile apps now command about 70% of all U.S. digital media time, reinforcing where subscription focus should remain.

- Apple App Store subscription content and services are projected to represent roughly 44% of total App Store revenue in 2025–26.

- Android devices continue dominating downloads, providing a broad reach for subscription services.

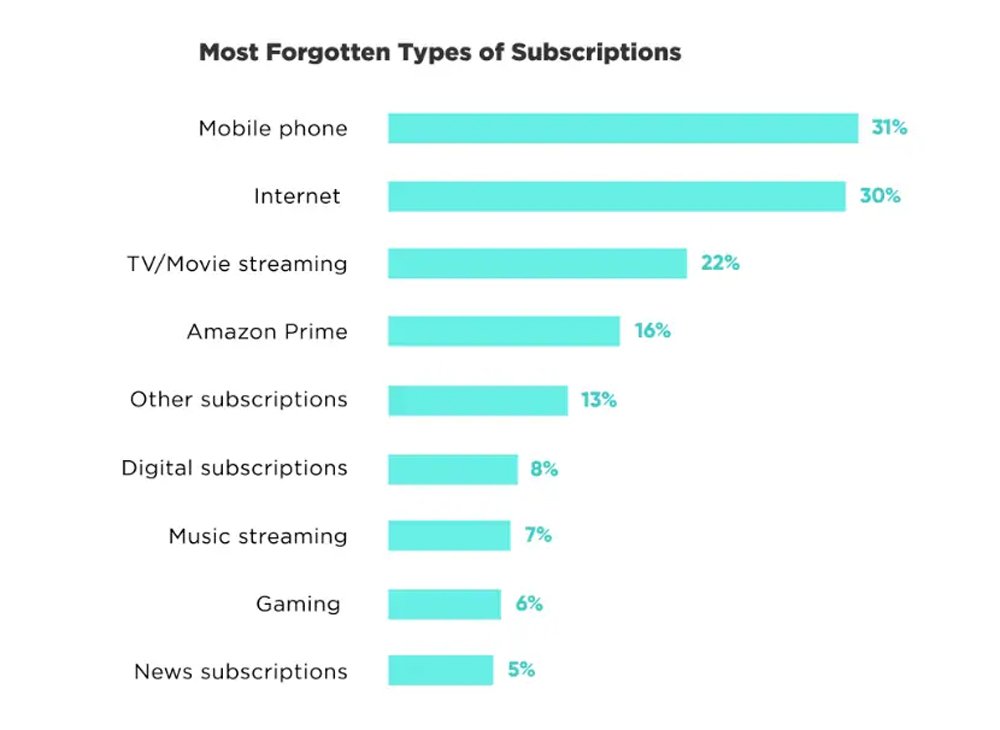

Most Commonly Overlooked Subscription Categories

- 31% of users forget mobile phone subscriptions, making them the most frequently overlooked recurring expense.

- 30% forget internet plans, underscoring how hidden household costs often go unnoticed.

- 22% lose track of TV and movie streaming services, reflecting growing subscription overload among consumers.

- 16% forget Amazon Prime memberships, even though these services have widespread and regular usage.

- 13% forget other miscellaneous subscriptions, which collectively contribute to unnoticed and accumulating spending.

- 8% overlook digital subscriptions such as software tools and mobile apps, despite their frequent background usage.

- 7% forget music streaming services, showing that popular entertainment subscriptions are still commonly ignored.

- 6% forget gaming subscriptions, which are often linked to auto-renewal billing cycles.

- 5% lose track of news subscriptions, making this the least forgotten subscription category overall.

Regional Digital Subscription Statistics

- North America captured over 45% of the global subscription economy share in 2024, generating $219.15 billion in revenue.

- Asia-Pacific subscription economy reached $111 billion in 2024, with a projected 15.7% CAGR from 2025 onward.

- U.S. consumer spending on apps is forecasted at $74 billion in 2025 across App Store and Google Play.

- Europe‘s subscription economy generated $129.1 billion in 2024, growing at 12.4% CAGR from 2025.

- Japan’s digital subscription market is valued at $33.9 billion in 2025.

- Latin America subscription market hit $36.6 billion in 2024, with 15.1% CAGR projected from 2025.

- LATAM subscribers average 3.5 subscriptions per person, rising to 3.8 in Brazil and Mexico.

- Africa’s mobile sector, fueling subscriptions, contributed $220 billion or 7.7% of GDP in 2024.

- India led downmarket app installs, with global downloads at 299 billion in 2025, up 8% YoY.

- The global subscription economy is set to reach $565.6–722 billion in 2025.

Digital Subscription User Demographics Statistics

- 70% of 18-44-year-olds utilise digital subscription services, outpacing older groups.

- 86% of adults aged 18-34 hold at least one subscription service.

- 79% of US adults aged 18-34 use iPhones, aligning with premium digital subscriptions.

- 21% of Millennials open apps 50+ times daily, driving high subscription engagement.

- 60% of Gen Z and Millennials express interest in bundled streaming subscriptions.

- 91.6% of urban households access the internet for digital subscriptions, vs 83.3% rural.

- 55% of higher-income earners prefer subscription services, vs 36% lower-income earners.

- 84% of news subscribers aged 65+ consume content multiple times daily.

- 34.7% of music streaming users access via family plans.

- Over 33% of US subscriptions are now bundled deals.

Device and Platform Usage for Subscriptions

- Smartphones dominate subscription engagement, especially for video, music, and gaming services.

- Mobile accounts for about 70% of digital media consumption time in the U.S. and similar markets.

- Android devices held over 70% market share of global mobile OS usage, enabling broad subscription access.

- In the U.S., iOS devices delivered a substantial subscription revenue share, with a high average ARPU.

- Tablets and connected TVs contribute to subscription access but trail behind smartphones.

- Wearables and secondary devices increasingly serve notification and micro‑billing engagement points.

- Bundling across devices improves cross‑platform retention and usage statistics.

- Subscription platforms optimize delivery through mobile apps, web, and smart TV integrations.

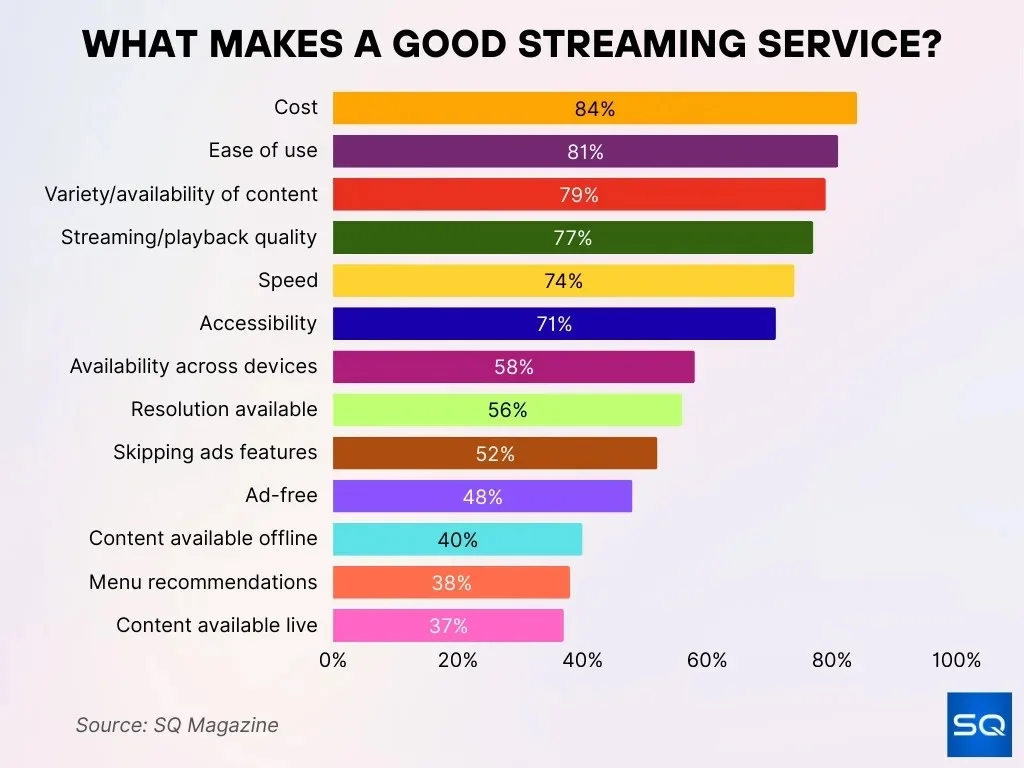

Key Factors That Define a High-Quality Streaming Service

- 84% of viewers rank cost and affordability as the most important factor, confirming that price sensitivity strongly influences streaming service selection.

- 81% of users place high importance on ease of use, indicating that intuitive design and simple navigation significantly enhance overall satisfaction.

- 79% emphasize the importance of a wide content variety, demonstrating that an extensive content library matters nearly as much as pricing.

- 77% consider streaming quality a critical factor, directly linking smooth playback and reliability to long-term user retention.

- 74% prioritize speed and performance, including fast loading times and quick menu responsiveness, to ensure a seamless viewing experience.

- 71% look for strong accessibility and search functionality, allowing them to quickly locate and enjoy their preferred content.

- 58% expect multi-device availability, highlighting the demand for uninterrupted viewing across phones, tablets, TVs, and laptops.

- 56% factor in resolution quality, with 4K and HD options significantly increasing the perceived value of a streaming platform.

- 52% want ad-skipping features, aiming to minimize disruptions and maintain continuous viewing sessions.

- 48% prefer completely ad-free streaming, reflecting growing user frustration with mandatory advertising interruptions.

- 40% value offline download options, enabling flexible and convenient viewing while traveling or without internet access.

- 38% seek smart recommendation menus, underscoring the rising demand for personalized content discovery.

- 37% appreciate live content availability, indicating a smaller yet consistent interest in real-time streaming offerings.

Subscription Pricing and Plan Type Statistics

Premium streaming services average $14–$20 per month for ad-free plans across major platforms like Netflix and Disney+.

- 66% of consumers would consider a single comprehensive subscription bundle for streaming and other services.

- Annual plans show 80–90% renewal rates in SaaS, far exceeding monthly due to lower churn.

- Ad-supported tiers reach 65% of Hulu subscribers and 40% of Disney+ users in 2025.

- Micro-subscriptions capture over 45% revenue share among individual consumers seeking affordable niche content.

- Annual subscribers prove 2.4x more profitable than monthly ones in subscription models.

- Tiered pricing dominates with basic at $9.99, standard at $15.99, and premium at $19.99 monthly tiers.

- 44% of subscription brands plan retail bundles like Amazon Prime to boost adoption in 2025.

- The average US household spends $42 monthly on streaming, fueling interest in cost-saving pricing strategies.

- India uses low regional pricing, like ₹599 annually for mobile tiers, to drive higher subscription counts.

Subscriber Retention and Churn Rate Statistics

- Average churn across subscription services is around 4.1% per month, reflecting ongoing retention challenges.

- Media and entertainment verticals typically report higher churn rates than SaaS services.

- Mobile app subscriptions often face early drop‑off in engagement without strong onboarding triggers.

- Bundled service adoption tends to reduce churn by fostering multi‑service engagement.

- Annual subscribers display lower churn than monthly subscribers due to pre‑payment incentives.

- Personalized retention campaigns using AI analytics improve subscriber longevity.

- Easy cancellation and pause options have become benchmarks to reduce voluntary churn.

- Engagement metrics such as weekly opens and in‑app interaction correlate strongly with retention.

Future Trends and Forecasts for Digital Subscriptions

- The global subscription economy is projected to reach $1.2 trillion by 2030, up 67% from $722 billion in 2025 as digital subscription models scale across sectors.

- Platforms using AI‑powered recommendation engines report around 35% higher engagement and up to 30% fewer cancellations, materially boosting subscription retention.

- By 2030, digital video subscriptions alone are expected to represent over 33% of global subscription spend within the broader $1.2 trillion subscription economy.

- Around 45% of SaaS companies already use some form of usage‑based pricing, up from 34% in 2020, and this share is forecast to keep rising toward 2030.

- The global subscription billing management market is forecast to grow from $7.15 billion in 2024 to $17.95 billion by 2030 at a 16.9% CAGR, reflecting deeper monetization sophistication.

- Mobility‑as‑a‑Service subscriptions are expected to be the fastest‑growing class, with projected growth of over 540% between 2025 and 2030 as connected, mobile‑first services expand.

- Studies show 92% of businesses now use AI‑driven personalization to drive growth, underscoring how tailored subscription experiences will become the default.

- In OTT streaming, AI recommendation engines influence about 75% of user engagement, with 80% of users watching recommended content, directly reinforcing long‑term subscription behavior.

Frequently Asked Questions (FAQs)

Nearly 1.8 billion global video streaming subscriptions were recorded by 2025.

The subscription services market was projected to reach $388.9 billion with a 17.4% CAGR from 2024 to 2029.

Netflix had surpassed roughly 301.6 million subscribers globally in early 2025.

About 65% of OTT streaming viewing time was done on mobile and TV apps rather than browsers.

Conclusion

Digital subscriptions span a dynamic ecosystem that extends well beyond traditional media streaming. Mobile apps continue emerging as a major revenue engine, with strong regional growth in North America and Asia‑Pacific. Consumer behavior shows clear preferences for mobile engagement, flexible pricing, and bundled plans. Retention and churn remain key performance metrics that subscription providers must manage through data‑driven tactics.

Looking ahead, the subscription economy is poised for sustained growth through technological innovation, broader platform access, and evolving consumer expectations, laying the groundwork for even more decentralized and personalized subscription models in the coming decade.