Dropbox continues to be one of the most recognized cloud storage and file-sharing platforms in the world. The company balances stagnating user growth with a strategic pivot toward AI tools and enterprise penetration to sustain relevance in a competitive cloud market. Organizations use Dropbox to streamline collaboration across distributed teams, while individuals rely on it to safeguard and access files across devices. These real-world applications highlight why current data on users, revenue, and engagement matter for anyone evaluating cloud service trends. Scroll down to explore the definitive Dropbox Statistics with up-to-date figures.

Editor’s Choice

- Dropbox serves over 700 million registered users worldwide.

- Paid or paying users reached approximately 18.16 to 18.22 million in early 2025.

- In 2024, Dropbox generated about $2.55 billion in revenue.

- ARPU (Average Revenue Per User) remained around $139 to $140.

- GAAP gross margin surpassed 80% consistently.

- Q3 2025 EPS of $0.74 beat forecasts by about 15%.

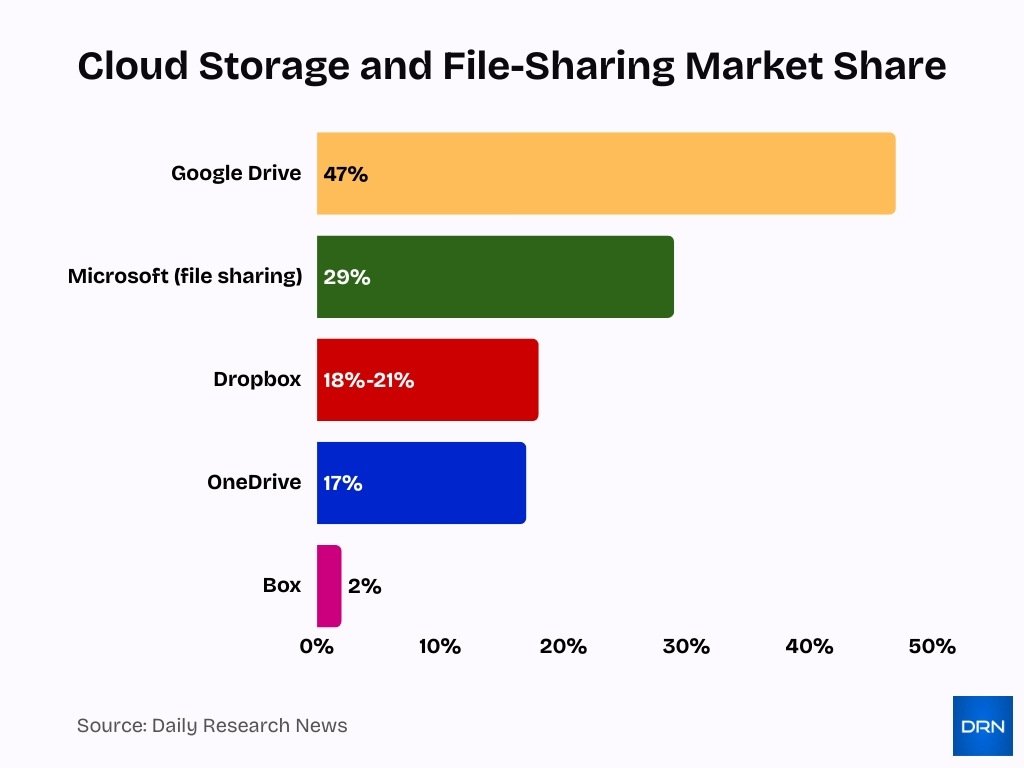

- Dropbox holds an estimated 18–21% market share in file sync and share services.

Recent Developments

- In December 2025, Dropbox announced a CFO transition, with Ross Tennenbaum set to replace Timothy Regan.

- Dropbox raised its annual revenue guidance midpoint to approximately $2.51 billion.

- Share price reacted with about a 5% drop following the CFO news.

- The company continues to invest in AI-powered tools, notably Dropbox Dash.

- Dropbox amended its credit agreements, adding up to $700 million in secured loans in 2025.

- Dropbox launched an additional $1.5 billion stock repurchase program.

- Q2 2025 revenue was $625.7 million, down slightly year over year.

- In Q3 2025, non-GAAP operating margin improved to about 41.1%.

- Dropbox faces activist investor pressure over governance and growth strategy.

- The company shows continued focus on enterprise and AI innovation.

Dropbox User Statistics

- Dropbox has more than 700 million registered users as of 2025.

- The service’s user base remained stable after reaching 700 million around 2021.

- Registered users span 180 plus countries worldwide.

- User growth has slowed significantly in recent years.

- Mobile and desktop app adoption remains high globally.

- The majority of registered users are on freemium plans rather than paid tiers.

- User engagement includes file shares, syncs, and collaboration across teams.

- The registered base underpins Dropbox’s network effects in cloud ecosystems.

- Cloud storage consumption continues to rise overall, though Dropbox’s share growth is flat.

- Customer stickiness is supported by integrations with major productivity tools.

Revenue Statistics

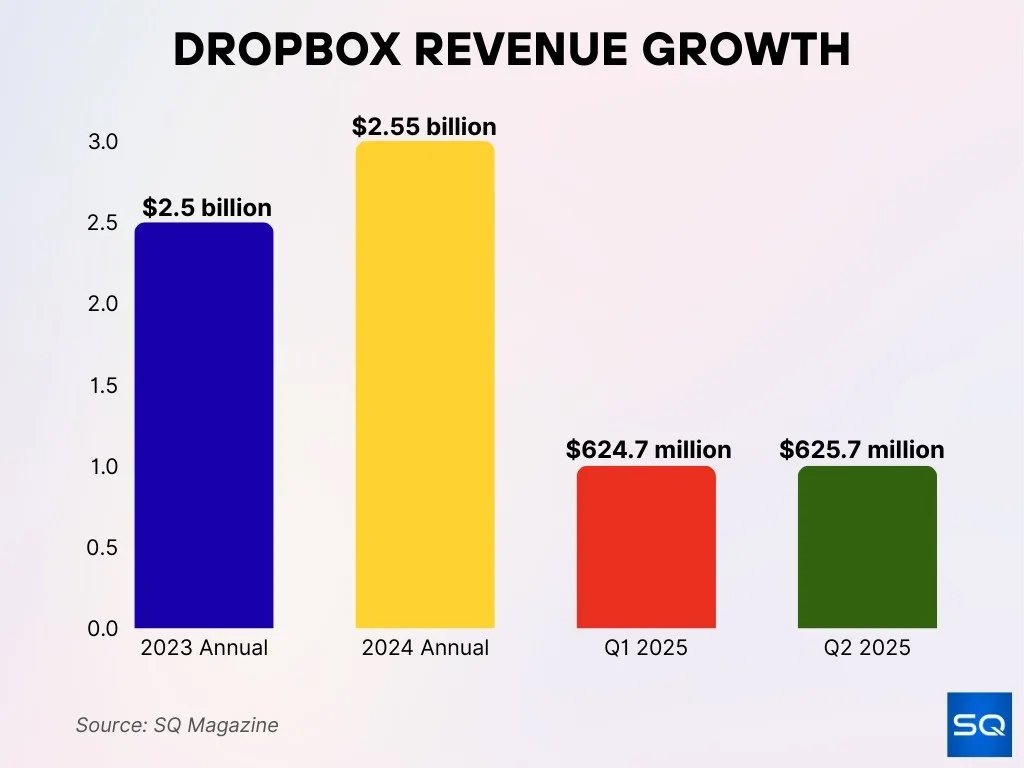

- Annual revenue for 2023 reached $2.50 billion, reflecting a 7.6% increase compared to 2022, indicating solid year-over-year growth momentum.

- Annual revenue in 2024 totaled $2.55 billion, representing an increase of 1.86%, showing continued but moderate expansion.

- Trailing-12-month (TTM) revenue as of mid-2025 stood at $2.53 billion, marking a slight decline of 0.04%, signaling near-term stability with minor softness.

- Q2 2025 revenue amounted to $625.7 million, registering a decline of approximately 1.4% year-over-year, highlighting short-term pressure.

- Q1 2025 revenue was reported at $624.7 million, showing a 1% decrease from the prior year, continuing the downward quarterly trend.

- Revenue softness was primarily attributed to the scaling back of FormSwift’s contribution, which impacted overall top-line performance.

Profitability and Margin Statistics

- Q1 2025 GAAP gross margin was 81.3%.

- Non-GAAP gross margin in Q1 2025 was 82.9%.

- GAAP operating margin reached 29.4% in Q1 2025.

- Non-GAAP operating margin expanded to 41.7% in Q1 2025.

- Q3 2025 non-GAAP operating margin was about 41.1%.

- Free cash flow of $153.7 million in Q1 2025 reflected strong cash conversion.

- Cost controls improved operating efficiency.

- Margins held steady despite revenue pressure.

- AI investment remained a strategic priority.

- Profitability metrics continue to guide investor sentiment.

Dropbox Usage and Engagement Statistics

- Dropbox supports over 700 million registered users globally.

- About 18.1–18.2 million users pay for subscriptions.

- Users span 180 plus countries.

- Core engagement centers on file sharing, sync, and collaboration.

- Mobile and desktop app usage remains central to engagement.

- Businesses rely on Dropbox for team collaboration workflows.

- Enterprise engagement remains more stable than consumer usage.

- Integrations enhance daily active use.

- AI features aim to increase active engagement.

Average Revenue Per User (ARPU) Statistics

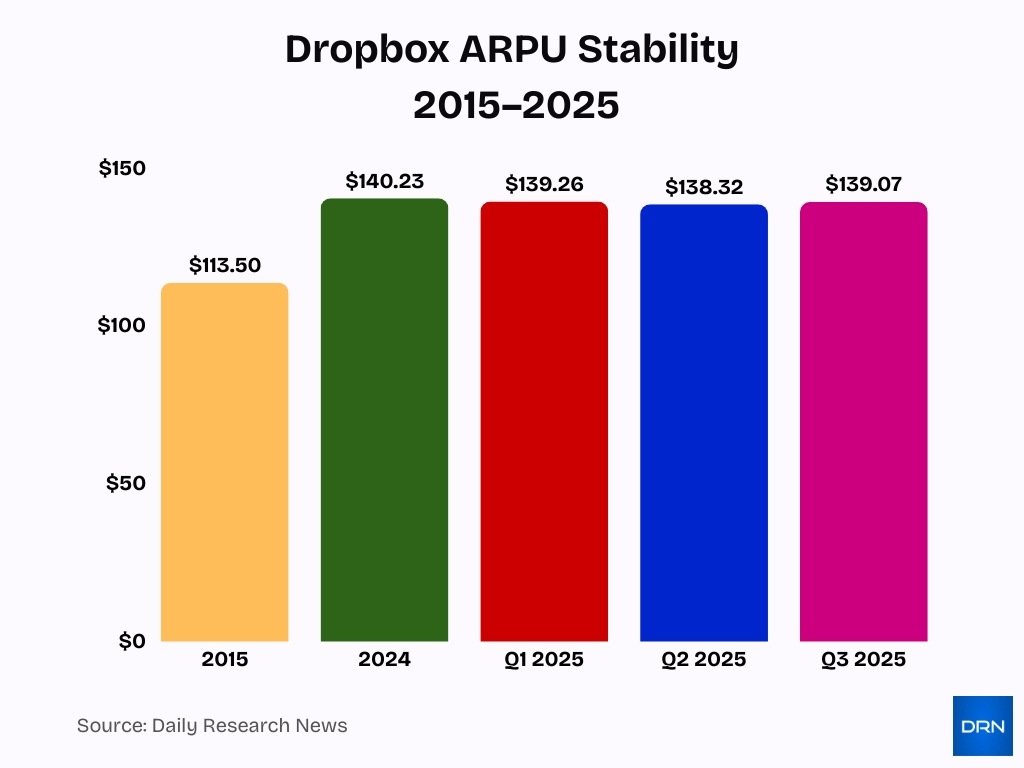

- In Q1 2025, Dropbox reported an ARPU of $139.26.

- Q2 2025 ARPU declined slightly to $138.32.

- Q3 2025 ARPU held near $139.07.

- Full year 2024 ARPU averaged about $140.23.

- Long-term ARPU stability reflects consistent monetization.

- Freemium conversion limits rapid ARPU expansion.

- ARPU stability offsets fluctuations in paid user totals.

- Product mix changes influence minor ARPU shifts.

Enterprise and Team Accounts Statistics

- Dropbox reports 575,000 paying business teams as of 2025.

- 97% of Fortune 500 companies use Dropbox services.

- Business & Team plans contribute 8–10% to total revenue.

- Dropbox generated $2.55 billion in revenue in 2024.

- Premium retention rate stands at approximately 90%.

- 18.1–18.2 million total paying customers, with business growth steady.

- Admin console offers centralized user management for teams.

- Certified for SOC 2, ISO 27001, HIPAA, and GDPR compliance.

Leading Industries Actively Using Dropbox

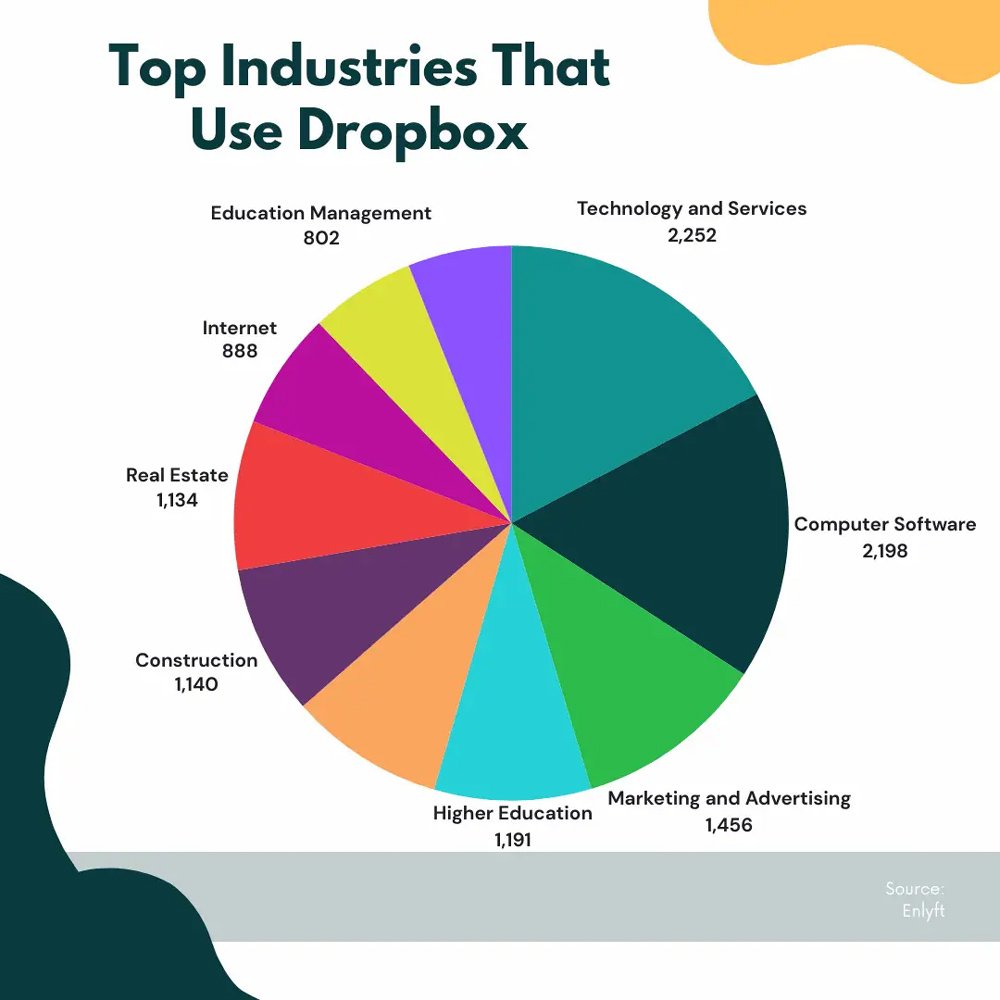

- Technology and Services emerge as the top sector, with 2,252 companies actively using Dropbox for their operations.

- Computer Software ranks just behind, as 2,198 companies have adopted Dropbox as a core platform.

- Marketing and Advertising show strong adoption, with 1,456 companies leveraging Dropbox for collaboration and storage.

- Higher Education relies heavily on the platform, with 1,191 institutions depending on Dropbox for academic and administrative needs.

- Construction demonstrates notable usage, represented by 1,140 companies utilizing Dropbox services.

- Real Estate closely follows, contributing 1,134 companies as active Dropbox users.

- The Internet industry includes 888 companies that make consistent use of Dropbox solutions.

- Education Management completes the list, with 802 organizations incorporating Dropbox into their workflows.

Demographics and Geography

- Dropbox serves over 700 million registered users across more than 180 countries.

- 68% of corporate Dropbox users are based in the United States.

- In 2023, US revenue totaled $1.42 billion, accounting for 56.7% of total revenue.

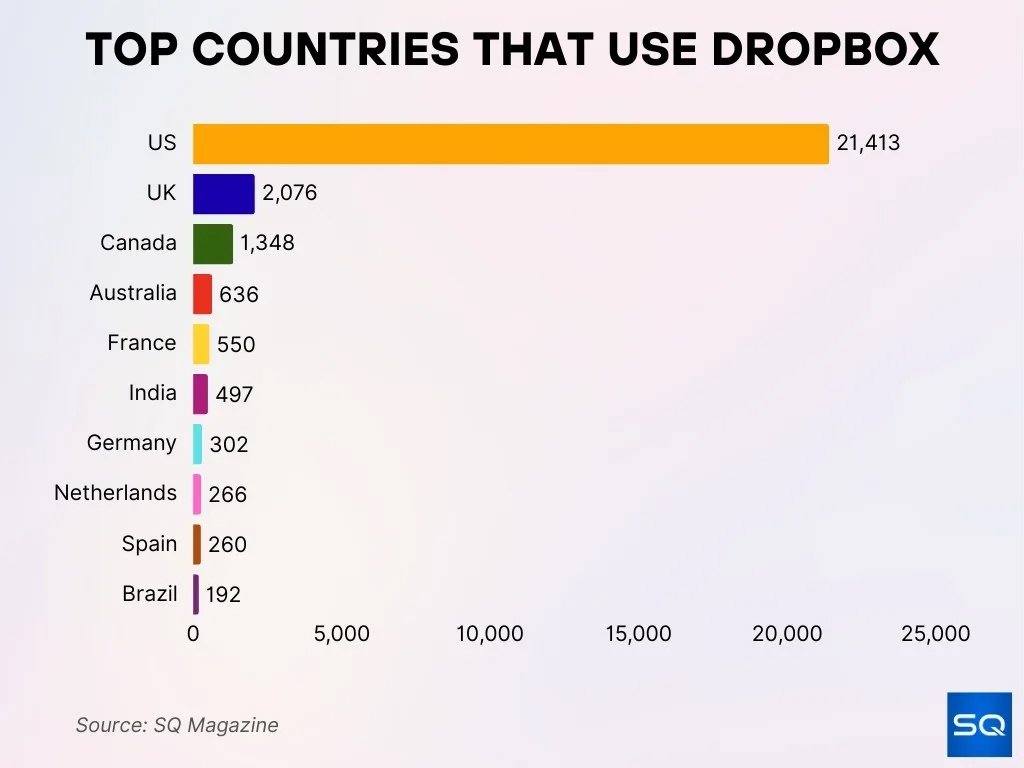

- The United States leads with 21,413 companies using Dropbox.

- 575,000 paying business teams utilize Dropbox Business as of 2025.

- 97% of Fortune 500 companies include Dropbox among their tools.

- The technology and services sector has 2,252 companies using Dropbox.

- Marketing and advertising accounts for 1,456 companies leveraging Dropbox.

- Higher education relies on Dropbox with 1,191 institutions.

- 18% of U.S. consumers use Dropbox for personal cloud storage.

Pricing and Plan Adoption Statistics

- The Basic free plan offers 2 GB of storage.

- The Plus plan costs $9.99 per month for 2 TB.

- Professional plans average $16.58 per month for 3 TB.

- Business plans start at $15 per user per month.

- Advanced plans cost around $24 per user per month.

- Enterprise plans are custom-priced.

- Paid plan adoption slowed in 2025.

- Annual billing discounts influence upgrades.

- Freemium conversion grew less than 1% year over year.

- Enterprise plan adoption shows stronger momentum.

Product and Feature Usage Statistics

- In a 2025 internal survey, 78% of Dropbox employees said AI tools like Dropbox Dash make them more productive, up 20 percentage points from the prior year.

- A 2024 IT survey for Dropbox found AI adoption in operations cut manual incident‑resolution work by roughly 25–30% for many teams using automated workflows.

- Dropbox has over 700M registered users in more than 180 countries, with daily activity still dominated by core file sync and sharing use cases.

- Users sync around 1.2B files every day on Dropbox, reflecting that the primary workload remains file synchronization and sharing across devices.

- Dropbox counts over 575K paying teams, underscoring heavy usage of collaboration tools for multi‑user projects and team workflows.

- Among business users analyzed in an earlier study, roughly one in three joined Dropbox because they were invited by someone else, highlighting collaboration‑driven adoption.

- Dropbox supports native editing integrations with suites like Google Workspace and Microsoft 365, which together cover well over 3B productivity‑suite users globally who can connect document editing to Dropbox storage.

- Dropbox Sign claims up to 80% faster turnaround time on signed PDFs versus traditional methods, illustrating higher efficiency for paid eSignature workflows.

- Dropbox users create and manage over 2.1B sharing connections, enabling sync management, link control, and access settings for large volumes of content.

- Over 575K business teams rely on Dropbox’s secure infrastructure, indicating that enterprise‑grade security and compliance features are central to business usage.

- Dropbox’s COO noted that AI‑enabled products and automation are expected to deliver a modest ARPU lift on 2024 guidance of $2.535–2.55B in revenue, reflecting growing automation adoption among paying users.

- Dropbox’s ARPU increased from about US$113.5 in 2015 to nearly US$139.9 in 2024, suggesting that customers engaging more deeply with advanced features show higher retention and monetization.

Leading Countries by Dropbox Adoption

- The United States dominates usage with 21,413 companies, accounting for the largest share of Dropbox users worldwide.

- The United Kingdom ranks next, with 2,076 companies actively using Dropbox for their operations.

- Canada records 1,348 companies that have adopted the platform across various industries.

- Australia represents 636 companies functioning as active Dropbox users in the region.

- France adds 550 companies to Dropbox’s global user base.

- India includes 497 companies that are utilizing Dropbox for business needs.

- Germany is home to 302 companies currently using the service.

- The Netherlands shows 266 companies that rely on Dropbox for data management.

- Spain reports 260 companies counted among Dropbox users nationwide.

- Brazil completes the ranking with 192 companies actively using Dropbox.

Dropbox Mobile and Desktop Usage Statistics

- Dropbox’s mobile app installations surged by about 60% on desktops and mobile during the pandemic, reflecting strong cross‑device usage.

- Over 700 million registered users across more than 180 countries access Dropbox via a mix of mobile and desktop clients.

- Dropbox serves more than 18 million paying users, many of whom rely on desktop sync clients for daily workflows.

- Dropbox processes around 60 billion API calls per month, driven heavily by mobile and app integrations like scanning and capture tools.

- About 97% of Fortune 500 companies use Dropbox, where desktop deployments dominate corporate sync and collaboration.

- Dropbox for Business supports unlimited devices on paid plans, encouraging frequent switching between mobile and desktop for the same account.

- Dropbox Basic users are limited to 3 linked devices, which shapes how often they connect both phones and computers to one account.

- Worldwide, roughly 9 million businesses rely on Dropbox, with many using desktop clients to handle large shared file workflows.

- Dropbox’s cross‑device platform spans iOS, Android, Windows, and macOS, enabling consistent offline and sync performance across devices.

Security, Compliance, and Privacy Statistics

- Files are protected with 256-bit AES encryption at rest.

- Data in transit uses SSL/TLS protocols with 128-bit or higher AES encryption.

- Dropbox holds ISO 27001, SOC 2, and CSA STAR Level 2 security certifications.

- The platform supports GDPR and HIPAA compliance via BAAs and controls.

- Over 575,000 paying teams rely on Dropbox security controls.

- Two-factor authentication (2FA) is enforced with password resets for account protection.

- A bug bounty program pays ethical hackers to identify vulnerabilities.

- End-to-end encryption is seamlessly integrated for business teams, not default user-managed.

- Audit logs track file activity for compliance reporting in regulated industries.

Dropbox Competition and Alternatives Statistics

- Dropbox commands 18–21% global file-sharing market share, trailing leaders like Microsoft at 29.4%.

- Google Drive dominates with 47.4% cloud storage share and 2.4 billion monthly visits, dwarfing Dropbox‘s 137.2 million.

- OneDrive captures 17.35 of % file hosting market share, used by 26,581 companies mainly in IT services.

- Box secures a 1.8% file hosting share, favored by enterprises with 2,699 companies, and focuses on governance.

- Bundled ecosystems like Google Workspace (over 3 billion users) and Microsoft 365 drive dominance over standalone Dropbox.

- Free tiers vary: Google Drive offers 15 GB, MEGA leads at 20 GB, influencing 54.62% multi-service users to switch.

- Migration tools like Cloudsfer support 20+ providers, aiding shifts amid 89% multi-cloud adoption rates.

- Pricing perceptions erode trust, with 49% of cloud bills as fees rather than storage, spurring dissatisfaction.

Financial Performance and Valuation Statistics

- 2024 revenue reached about $2.55 billion.

- Annual recurring revenue remained near $2.54 billion.

- Free cash flow exceeded $870 million in 2024.

- Gross margins consistently surpassed 80%.

- Operating margins expanded through cost discipline.

- Leadership changes aim to improve valuation.

- Stock repurchases support shareholder returns.

- The company trades under the DBX ticker.

- Valuation reflects competitive cloud market dynamics.

Frequently Asked Questions (FAQs)

Dropbox had over 700 million registered users globally in 2025.

Dropbox generated $2.55 billion in revenue in 2024, growing about 1.9% compared with 2023.

In Q3 2025, Dropbox reported 18.07 million paying users and an ARPU of $139.07.

Dropbox’s annual recurring revenue (ARR) at Q3 2025 was $2.536 billion.

Conclusion

Dropbox remains a major cloud storage and collaboration platform with a broad global footprint. While user growth has plateaued, enterprise adoption, AI features, and strong margins continue to support the business. Pricing and plan data show steady but cautious subscription trends, while integrations and mobile usage reinforce daily relevance. Security and compliance capabilities meet most enterprise needs, even as competition intensifies.

Financially, Dropbox delivers stable revenue, strong cash flow, and disciplined profitability. Together, these statistics present a clear, data-driven picture of Dropbox’s position and prospects.