E-commerce platforms are the backbone of online retail. Worldwide sales from online commerce are projected to be between roughly $6.4 trillion and $6.86 trillion, a solid increase from 2024 figures, reflecting continued consumer demand for digital shopping experiences. Mobile devices now account for the majority of retail traffic and sales, and SaaS-based platforms are rapidly outpacing traditional self-hosted solutions in adoption. Industries from direct-to-consumer brands to enterprise retailers rely on these platforms to scale, personalize, and secure digital commerce.

This article dissects the key e-commerce platform statistics, offering clear insights into market size, usage trends, and platform leadership. Dive in to understand what’s shaping online commerce today.

Editor’s Choice

- $6.86 trillion, global ecommerce sales forecast for 2025, up from 2024.

- Over 13.6 million ecommerce stores are active on tracked platforms worldwide.

- 33.4% of tracked sites use WooCommerce, leading in total installations.

- 2.86 million live Shopify stores in 2025.

- 59% of total ecommerce revenue comes from mobile commerce.

- Hosted SaaS platforms 47% share of ecommerce platform market in 2025.

- Global ecommerce sales represent nearly 21% of total retail.

Recent Developments

- Global ecommerce revenues continue to grow, with estimates between $6.42 trillion and $6.86 trillion in 2025.

- Year-over-year growth is 6.8%–8.4%, driven by the expansion of mobile and cross-border shopping.

- Black Friday 2025 sales saw 25%–30% YoY growth for online platforms.

- Social commerce platforms such as TikTok Shop are rapidly scaling, with billions in quarterly sales.

- AI and mobile optimization enhancements are increasingly integrated into platform offerings.

- More brands shift to headless commerce architectures to improve performance.

- Plugins and third-party integrations expand as platforms grow their ecosystems.

- Data security and privacy concerns prompt updated compliance measures across platforms.

E-commerce Platform Statistics Overview

- Worldwide, there are over 13.6 million live ecommerce stores across more than 340 platforms.

- WooCommerce leads total installations with a plurality share in broad web crawls.

- Shopify powers 2.86 million stores in 2025.

- Over 80% of ecommerce sites run on open-source or SaaS solutions.

- SaaS solutions are strong in ease-of-use and growth adoption.

- Magento holds 8% global share among ecommerce technologies.

- Smaller builders like Wix and Squarespace remain competitive in UX-centric segments.

- Platform choice correlates with business complexity and scale.

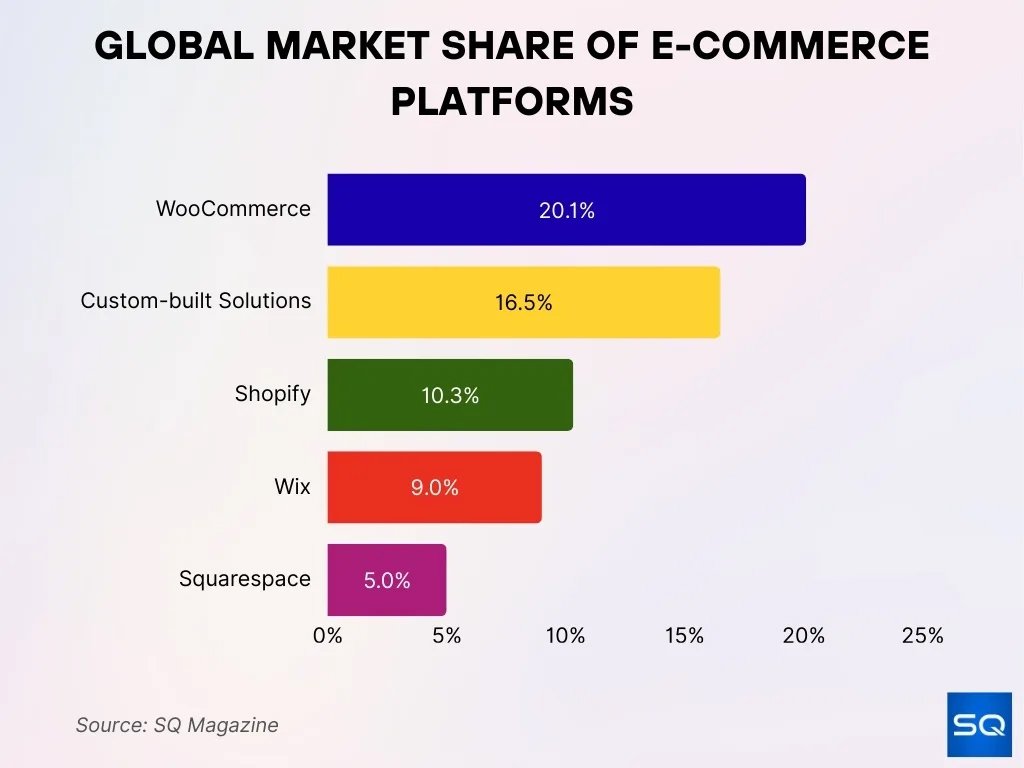

E-commerce Platform Market Share by Platform

- WooCommerce leads the global e-commerce platform market with a 20.1% share, followed by custom-built solutions at 16.5%, Shopify at 10.32%, Wix at 9%, and Squarespace at 5%.

- There are now over 28 million online stores worldwide, which translates to approximately 2,162 new stores launched daily between 2024 and 2025.

- 49.1%, representing over 13 million stores, are based in the U.S., underscoring the country’s dominance in e-commerce adoption.

- A total of 603 e-commerce platforms collectively support more than 4.9 million e-commerce businesses across the global market.

- Shopify powers between 4.6 and 4.63 million active websites globally, reflecting its strong international presence.

- In the United States, Shopify commands a 29% e-commerce platform share, significantly higher than its global market share.

- Shopify holds a 23% share among the top 1 million websites, demonstrating its popularity with high-traffic and enterprise-level merchants.

- Among the top 100,000 websites worldwide, Shopify outperforms WooCommerce with a leading 19% market share.

Global E-commerce Platform Market Size

- The global ecommerce market is projected to be between $6.42 trillion and $6.86 trillion in 2025.

- E-commerce sales represent nearly 21% of all global retail sales.

- This reflects continued expansion from 2024’s 6%–8% growth.

- The U.S. ecommerce market alone is expected to surpass $1.17 trillion in 2025.

- Analysts forecast rising global CAGR through the late 2020s.

- Emerging regions, particularly Asia and Latin America, contribute significant growth.

- Cross-border ecommerce now fuels increased platform reach worldwide.

- Mobile commerce revenue is a key driver of market expansion.

Number of Websites Using Major E-commerce Platforms

- Tracking data shows 13.6 million+ live sites using ecommerce technology.

- WooCommerce powers millions of stores globally across size tiers.

- Shopify hosts 2.86 million active ecommerce stores in 2025.

- Tech tracking tools show a strong Shopify site presence.

- Magento supports 239,000+ storefronts globally.

- Platforms such as Wix and Squarespace contribute hundreds of thousands of commerce sites.

- Many small businesses run custom or niche ecommerce stacks.

- Growth in platform usage correlates with easier onboarding tools and integrated apps.

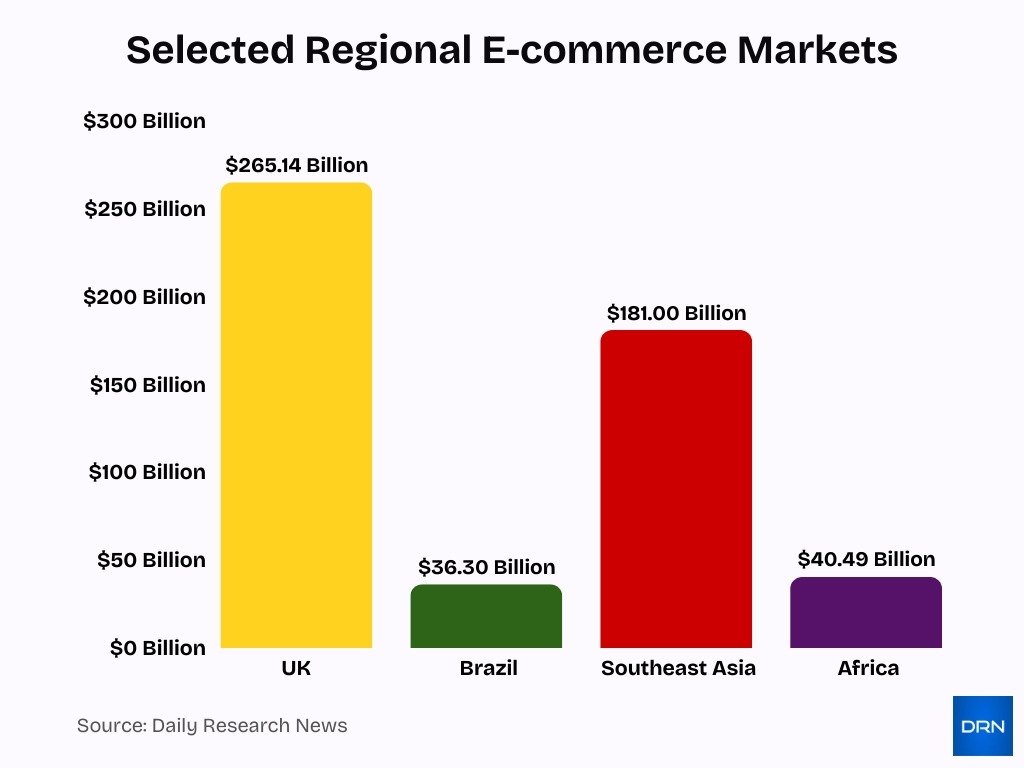

Regional Breakdown of E-commerce Platform Usage

- U.S. ecommerce sales projected to grow 5.0% in 2025 amid moderate tariffs.

- China ecommerce market is valued at $1.53 trillion in 2025, expanding at 10.42% CAGR.

- India ecommerce penetration is expected to exceed 11% of total retail sales in 2025.

- In South Korea, smartphones drive 74% of ecommerce transaction value.

- The UK ecommerce market reached $265.14 billion in 2025, with 3.6% growth forecast.

- Germany ecommerce generated $792.6 million in 2023, targeting $2.77 billion by 2030.

- Brazil ecommerce revenue is expected to hit US$36.3 billion in 2025.

- Southeast Asia ecommerce GMV to reach $181 billion in 2025, growing 16% YoY.

- Africa ecommerce market is forecasted at $40.49 billion in 2025, with 8.46% CAGR to 2029.

- Middle East ecommerce set for 21.58% CAGR from 2025-2033.

E-commerce Platform Adoption by Business Size

- Small businesses drive 78% adoption of SaaS e-commerce platforms due to low entry costs.

- SMBs account for 73% cloud-based e-commerce deployments in 2025.

- Hosted platforms command 47% global e-commerce market share, fueled by SMB growth.

- Large enterprises hold 55% revenue in enterprise-grade e-commerce solutions.

- SMEs show 20.2% CAGR in digital commerce platform adoption through 2025.

- 85% of EU small enterprises use web sales, generating key revenue.

- WooCommerce powers 33.4% of global e-commerce sites, popular with SMBs.

- 71% of MSMEs joined e-commerce platforms post-2020 for rapid scaling.

- Enterprises with 1000+ employees deploy 150+ SaaS e-commerce apps on average.

B2C vs B2B E-commerce Platform Usage

- Global B2B ecommerce markets are valued at approximately $32.11 trillion in 2025.

- B2B ecommerce is forecast to grow at a 14.5% CAGR.

- B2C ecommerce remains critical but is smaller in transaction value than B2B.

- B2B platforms emphasize custom pricing, quotes, and multi-user accounts.

- B2C usage dominates consumer purchase behavior.

- Many platforms support hybrid B2C and B2B models.

- B2B customers increasingly demand self-service purchasing.

- Digital catalogs and API integrations accelerate B2B engagement.

- Mobile access for B2B buyers is increasing, but trails B2C.

- Social commerce integration is more prevalent in B2C platforms.

Self-hosted vs SaaS E-commerce Platforms

- Shopify holds a 26.2% market share among e-commerce sites, outpacing self-hosted WooCommerce at 20.1%.

- 89% of SMBs now use SaaS solutions, up from 87% in 2022.

- Self-hosted Magento powers enterprises with 9.2% overall market share in 2025.

- Self-hosted platforms demand 15-20% annual upkeep of initial development costs.

- E-commerce SaaS market grows from $30B in 2024 to $75B by 2033 at 10.5% CAGR.

- Headless commerce market valued at $1.74B in 2025, reaching $7.16B by 2032 at 22.4% CAGR.

- Self-hosted maintenance costs $1,800-$6,000 annually for comprehensive services.

- 66% of Australian businesses use headless technologies in 2025.

Mobile Commerce on E-commerce Platforms

- Mobile commerce accounts for roughly 59% of total ecommerce sales in 2025.

- U.S. mobile retail ecommerce sales are projected at about $710 billion in 2025.

- Global mobile commerce represented 57% of ecommerce sales in 2024 and continues rising.

- Around 76% of U.S. adults shop via mobile devices.

- Approximately 1.65 billion mobile shoppers shop globally.

- Smartphone users exceed 4.8 billion worldwide.

- More than 60% of website traffic comes from mobile devices.

- South Korea records 75% mobile-centric ecommerce activity.

- Mobile wallets reduce checkout friction.

- Augmented reality and personalization enhance mobile conversion.

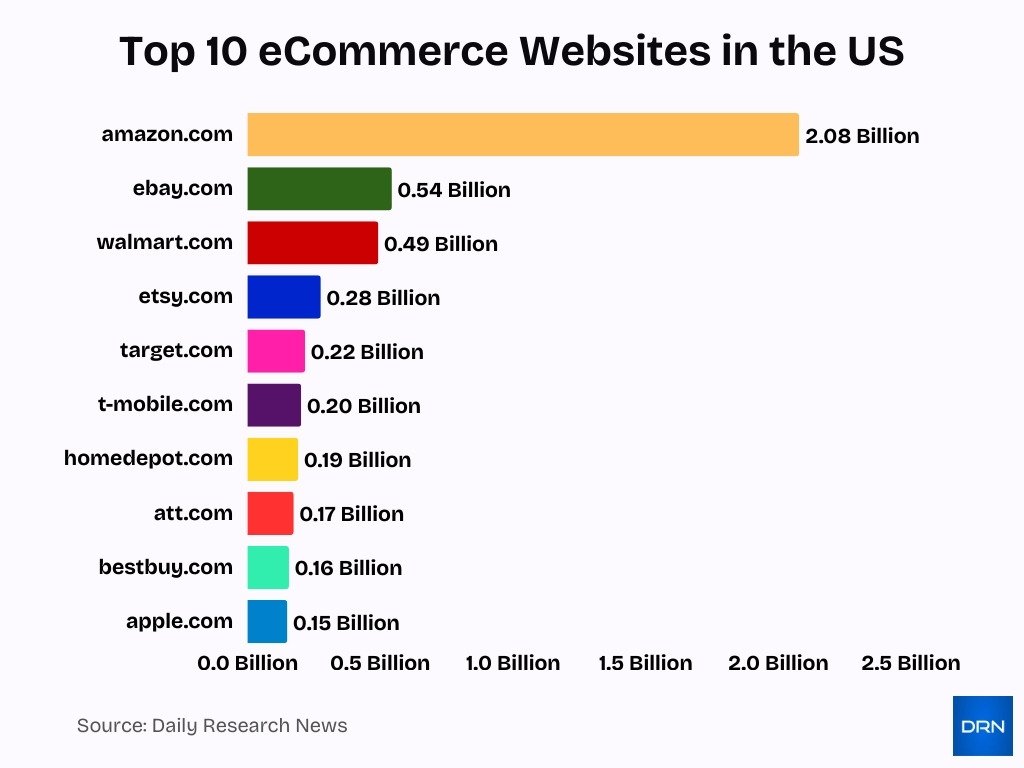

Top U.S. Retail and Commerce Websites by Monthly Visits

- Amazon.com dominates the digital commerce landscape with 2.08 billion monthly visits, far exceeding all other sites and reinforcing its position as the undisputed market leader.

- eBay.com ranks second with 543.8 million visits per month, highlighting its continued relevance as a global online marketplace despite intense competition.

- Walmart.com follows closely at 492.7 million monthly visits, reflecting the retailer’s strong omnichannel strategy and successful transition from brick-and-mortar to digital commerce.

- Etsy.com attracts 276.2 million monthly visits, underscoring the growing consumer demand for handmade, vintage, and niche products.

- Target.com records 217.4 million visits per month, demonstrating solid performance driven by brand loyalty, curated product offerings, and digital fulfillment options.

- T-Mobile.com sees 202.3 million monthly visits, indicating high consumer engagement in the telecommunications and wireless services sector.

- HomeDepot.com generates 191.0 million visits per month, reflecting strong online interest in home improvement and DIY projects.

- AT&T.com captures 173.8 million monthly visits, showing consistent traffic tied to mobile plans, internet services, and device upgrades.

- BestBuy.com reaches 155.9 million monthly visits, maintaining its role as a key destination for consumer electronics and tech purchases.

- Apple.com records 150.3 million visits per month, highlighting sustained interest in premium devices, software ecosystems, and brand-driven demand.

Conversion Rates by E-commerce Platform

- Mobile commerce averages a 1.8% conversion rate, compared to 3.9% on desktop.

- Global e-commerce platforms average 1.9% conversion, varying by category, like 3.6% for electronics.

- Shopify stores achieve an average conversion rate of 2.5-3%, with top performers exceeding 4%.

- AI personalization boosts conversion rates by 18% and order value by 22%.

- One-click checkouts like Shop Pay increase conversions by up to 50%.

- Social commerce platforms average 3% conversion for impulse buys.

- Site speed under 3 seconds lifts conversions by 32%, aided by trust signals.

- Headless commerce improves conversions by an average 42%.

- Complex checkouts cause 70% drop-off before completion.

- Retargeting lifts e-commerce conversions by 150% on average.

Average Order Value by Platform

- Global e-commerce AOV averages $144 in 2024, projected to reach $150-180 by the end of 2025.

- Luxury platforms achieve $436 AOV through premium pricing and personalization services.

- Grocery platforms like Walmart.com record $68 AOV driven by bulk purchases.

- Amazon Marketplace AOV stands at $52 per order across US shoppers.

- U.S. e-commerce AOV hits $153 as of April 2025, exceeding global averages.

- Social commerce platforms show a lower AOV at $14-15 per order compared to traditional e-commerce.

- Cross-border purchases yield 17% higher AOV than domestic orders.

- Digital wallets boost AOV by 33%, from $33 to $44 per transaction.

- Personalized upsells increase AOV by 10-45% via tailored recommendations.

- Bundling on marketplaces lifts AOV by 15-20% through complementary product offers.

Popular Product Categories by Platform

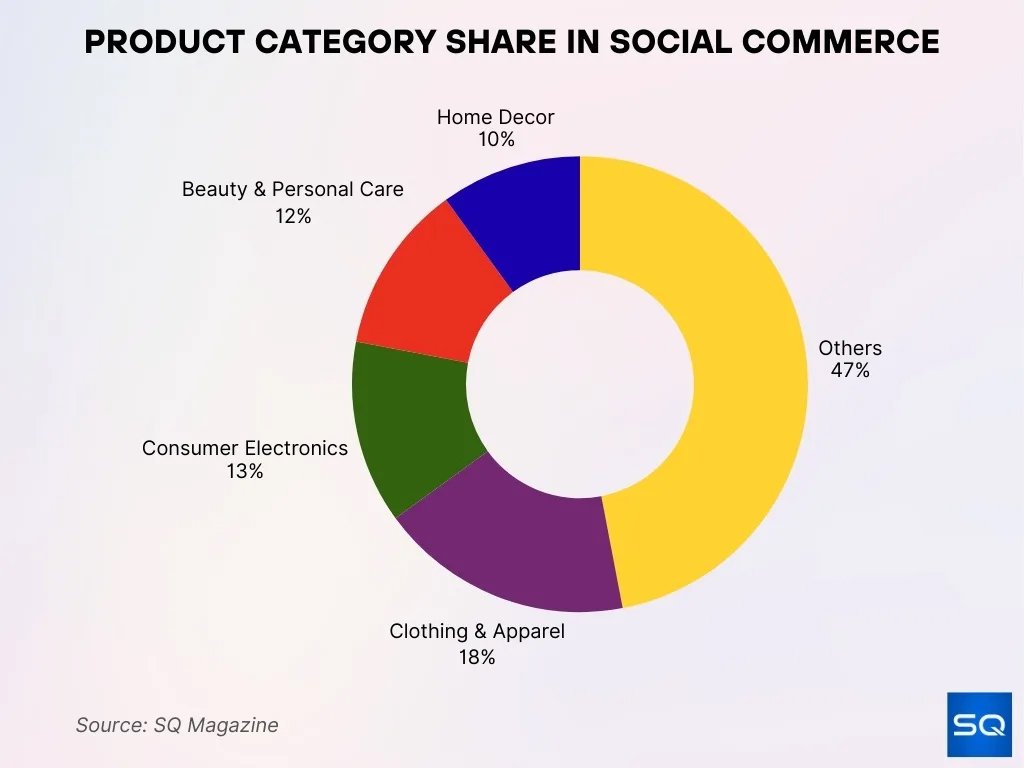

- Other Categories will generate 47% of total sales, demonstrating the broad diversity and expansive range of products available through social commerce platforms.

- Clothing & Apparel captures 18% of spending, establishing it as the largest clearly defined category within the social commerce market.

- Consumer Electronics makes up 13% of total sales, underscoring the strong consumer preference for purchasing technology products through social media channels.

- Beauty & Personal Care accounts for 12%, emphasizing consistent demand driven by lifestyle-focused and personal wellness products.

- Home Decor contributes 10% of overall spending, reflecting a significant portion of consumer interest in home-focused purchases via social commerce.

Cross-border E-commerce Platform Usage

- The cross-border ecommerce market is valued at around $1.47 trillion in 2025.

- B2C represents 79.6% of cross-border activity.

- Apparel accounts for 35.3% of cross-border sales.

- Digital wallets hold 51% share of cross-border payments.

- Asia Pacific holds 29.4% of the cross-border market share.

- North America shows rapid growth in cross-border transactions.

- Consumers buy internationally for variety and pricing.

- Brands localize storefronts for global buyers.

- Logistics improvements boost cross-border adoption.

Payment Methods Supported Across Platforms

- Digital wallets reached 4.3 billion users globally in 2024, comprising 52.9% of the world population.

- Credit and debit cards hold a dominant ecommerce market share, with 4 out of 10 GenZ preferring them as the top online payment mode.

- Local payment systems boost conversion rates up to 30% by matching regional preferences.

- Buy now, pay later sees 33.6% adoption among US Millennials, with a CAGR of 9% through 2028.

- India’s UPI dominates with 62% of real-time P2B volume and over 600 million daily transactions.

- Secure payment features like SSL reduce cart abandonment, as 92% of shoppers demand trusted options.

- Cryptocurrency payments remain niche at 2% merchant adoption despite $31 billion volume in 2024.

- Multi-currency support lifts conversions by 28%, with 92% shoppers preferring local currency displays.

- Mobile-optimized flows cut abandonment via wallets, driving $10 trillion in global digital transactions.

E-commerce Platforms and Social Commerce Integration

- Social commerce sales may reach $1.17 trillion globally in 2025.

- U.S. social commerce sales exceed $85 billion.

- Instagram reports 1.4 billion users shopping on the platform.

- 44% of Instagram users shop weekly.

- TikTok Shop drove a 26% increase in U.S. social commerce sales.

- Social commerce may account for 17% of online sales.

- Millennials and Gen Z lead social commerce adoption.

- Integrated social shopping boosts engagement.

- Influencer marketing continues driving discovery.

Global Social Commerce Expenditure by Age Group

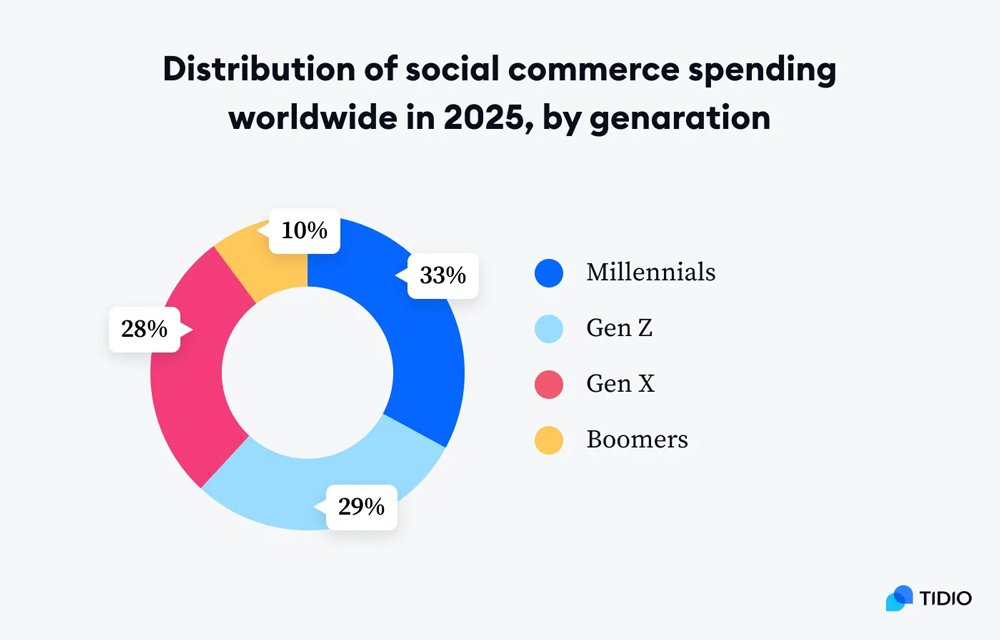

- Millennials dominate global social commerce spending, leading with 33% of the total share.

- Gen Z represents 29%, indicating strong adoption and engagement among younger consumers.

- Gen X contributes 28%, placing them nearly on par with Gen Z in terms of spending power.

- Boomers account for 10%, reflecting the smallest proportion of social commerce spending across all generational groups.

Future Outlook for E-commerce Platforms

- Global e-commerce market to hit $73.47 trillion by 2030, growing at 18.67% CAGR from $31.22 trillion in 2025.

- Online retail is projected to capture 24% of global retail sales by 2028.

- Mobile commerce market to surge from $1.84 trillion in 2024 to $14 trillion by 2033 at 25.3% CAGR.

- Social commerce expected to reach $6.23 trillion by 2030, with 30.71% CAGR from $1.63 trillion in 2025.

- Cross-border B2C e-commerce to grow at 27% CAGR, hitting $8.61 trillion by 2034 from $1.27 trillion in 2024.

- AI personalization in e-commerce is forecasted at $64.03 billion by 2034, with 24.34% CAGR from $9.01 billion in 2025.

- Sustainable e-commerce market to expand to $42.17 billion by 2030 at 15.68% CAGR from $17.74 billion in 2024.

- Headless commerce set to achieve $13.2 billion by 2035, growing at 22.5% CAGR.

- AR in e-commerce is projected to reach $38.55 billion by 2030 from $5.88 billion in 2024.

- Payment security for e-commerce is expected to grow to $88.44 billion by 2033 at 11.91% CAGR.

Frequently Asked Questions (FAQs)

Mobile commerce is projected to account for about 59% of total ecommerce retail sales in 2025, equating to roughly $4.0 trillion in volume.

The average ecommerce conversion rate worldwide in 2025 sits between 2.5% and 3%, with specific sectors such as food & beverage topping 6.11%.

The global B2B ecommerce market is valued at approximately $32.11 trillion in 2025, and is forecast to grow at a 14.5% CAGR to reach $36.16 trillion by 2026.

In 2025, ecommerce is projected to account for 20.5% of worldwide retail sales, with expectations to reach 22.5% by 2028.

Conclusion

E-commerce platforms reflect a mature yet rapidly evolving digital marketplace. Global sales reach into the trillions, with mobile, social, and cross-border commerce reshaping how consumers discover and buy products. Platforms that integrate personalization, localized payments, and seamless checkout capture stronger engagement and revenue. Looking ahead, expanding global participation and continuous innovation will define the next phase of ecommerce growth.