Facebook Marketplace continues to expand its role in peer-to-peer and business-to-consumer shopping as millions of people turn to social platforms for everyday purchases. Its wide reach supports scenarios ranging from local furniture pickup to nationwide resale of electronics. This blend of social interaction and commerce gives the platform an edge in a crowded ecommerce market, inviting readers to explore how Marketplace is evolving.

Editor’s Choice

- In 2025, Facebook reported about 3.07 billion monthly active users (MAUs) globally.

- Roughly 16% of Facebook’s MAUs, or about 491 million users, log in with the intention of shopping on Facebook Marketplace.

- The platform holds approximately 51.19% of the global social commerce market share, making it the leading social commerce marketplace worldwide.

- In 2024,2025, Facebook’s overall user base grew by tens of millions, reinforcing Marketplace’s large potential audience for sellers and advertisers.

- Facebook Marketplace is available in 228 countries and territories, giving it an extensive global reach.

- Marketplace sees substantial mobile traffic, with a large majority of interactions coming from smartphone users.

- The scale of activity, in terms of users, listings, and transactions, has turned Marketplace into a major venue for both casual shoppers and small businesses.

Recent Developments

- As of 2025, Facebook MAUs increased to roughly 3.07 billion, continuing a growth trend from previous years.

- Marketplace usage expanded further, with some sources reporting up to 1.1 billion monthly visits to Marketplace.

- Marketplace’s strong adoption persists, with about 16% of overall MAUs using the service specifically for shopping.

- Marketplace’s dominance in social commerce remains above 50% market share, giving it a strategic edge.

- The seller base has grown to around 250 million global sellers listing items on Marketplace.

- Listing volume reportedly exceeded 1.3 billion by 2024.

- Consumer adoption in the United States remains strong, with a substantial share of internet users engaging with Marketplace.

- Growth aligns with broader movements in social commerce globally, as mobile usage and in-app shopping expand.

Facebook Marketplace Overview

- Facebook Marketplace boasts over 1.1 billion monthly active users worldwide.

- Available in 70+ countries, serving a global audience of buyers and sellers.

- Generates $10 billion+ in estimated annual gross merchandise value (GMV).

- Attracts 250 million+ active sellers listing items across diverse categories.

- Records 800 million+ monthly visits, with average sessions lasting 20 minutes.

- Facilitates over 3 billion buyer-seller connections monthly via integrated messaging.

- Holds ~22% share of the global online resale market.

- Supports top categories like furniture, electronics, and clothing as best-sellers.

User Base and Reach

- Facebook boasts 3.07 billion monthly active users worldwide in 2025.

- 2.11 billion daily active users access Facebook, marking a 5.5% YoY increase.

- India leads with over 375 million Facebook users, followed by the US at 194.1 million.

- Asia accounts for 1.1 billion active Facebook users, or 47.7% of the global total.

- Approximately 16% of Facebook’s 3.07 billion users, or 491 million, shop on Marketplace monthly.

- Over 1.1 billion shoppers use Facebook Marketplace across 228 countries and territories monthly.

- Facebook Marketplace attracts 1 billion+ monthly users from its massive 3.07 billion Facebook base.

- 77.7% of Facebook shoppers make purchases specifically on Marketplace.

- More than 250 million active sellers list products on Facebook Marketplace globally.

Demographics and Age Distribution

- The largest age group on Facebook in the U.S. is 25–34, accounting for about 24.97% of users.

- Users aged 35–44 represent about 18.68%.

- Users aged 45–54 make up roughly 16.31%.

- Those aged 55–64 account for around 14.31%.

- Users aged 65+ represent approximately 10.02% of Facebook’s population.

- Marketplace users globally show a slight male skew, though distribution varies by region.

- Marketplace’s broad demographic spread supports diverse product categories.

- High representation of users aged 25–44 suggests strong buying activity driven by life stage needs such as home goods or electronics.

Monthly Active Marketplace Users

- 1.1 billion monthly active users access Facebook Marketplace in 2025.

- Represents 36–40% of total Facebook MAUs at 3.07 billion.

- 491 million users log in specifically for shopping each month.

- Over 250 million sellers actively list items on the platform.

- 800 million+ monthly visits recorded in recent years.

- Facilitates 3 billion buyer-seller connections monthly.

- 16% of active Facebook users browse solely for Marketplace.

- Average session lasts about 20 minutes per visit.

- Available in 228 countries with a strong local transaction focus.

Seller Adoption and Activity

- As of 2025, about 250 million sellers use Facebook Marketplace worldwide.

- Marketplace supports both casual sellers and small businesses due to its low barrier to entry.

- Shipped orders incur a 10% seller fee, with a minimum charge of $0.80.

- Local pickup sales remain free for sellers.

- Seller payouts for shipped orders typically process within 5 days of delivery.

- Growing global adoption reflects increased participation in social commerce.

- Marketplace offers particular advantages for bulky items such as furniture through local pickup.

- The seller base helps sustain Marketplace’s large and diverse inventory.

Facebook Marketplace Market Share Insights

- Facebook Marketplace maintains a commanding presence with 51.19%, firmly establishing it as the leading platform within social commerce.

- Instagram secures 15.81%, indicating strong engagement even though it remains significantly behind Marketplace.

- Facebook Shop (one brand) holds 9.54%, showcasing its niche contribution within the broader Facebook ecosystem.

- TikTok registers 9.34%, demonstrating its rise as an emerging competitive player in the social commerce space.

- Facebook Messenger represents 5.37%, underscoring its smaller role in overall shopping activity.

Top-selling Product Categories

- Furniture, clothing & accessories, and electronics rank as the top three best-selling categories on Facebook Marketplace.

- The global furniture e-commerce market reached $256 billion in value, highlighting its dominance.

- U.S. secondhand apparel market grew 14% YoY to $74 billion in 2024.

- Consumer electronics online sales rose 6.8% in 2023, totaling over $51.3 billion for top retailers.

- Vehicles and parts account for 21% of Facebook Marketplace scam volume, indicating high demand.

- Home goods like sofas, beds, and tables drive consistent local pickup sales on Marketplace.

- Secondhand apparel market projected to hit $138.90 billion globally by 2035 at 11.1% CAGR.

- Over 80% of Facebook Marketplace property listings are houses and flats, boosting category diversity.

Listings Volume and Category Breakdown

- Facebook Marketplace surpassed 1 billion listings by 2021, reaching an estimated 4 billion+ active listings in 2025.

- Over 1.1 billion monthly users engage with Marketplace across 228 countries, representing 40% of Facebook’s total user base.

- Furniture, electronics, and clothing/accessories dominate as the top three categories for listings and sales volume.

- Vehicles and parts account for 21% of scam-reported listings, indicating high volume in automotive categories.

- Home goods like furniture represent 5% of fraudulent listings, underscoring bulky items’ popularity in local transactions.

- Apparel, including shoes and clothing, comprises 7% of scam volume, reflecting strong demand in fashion categories.

- Electronics such as phones and consoles make up 12% of high-risk listings, with sales often under 24 hours.

- 10 million+ active sellers contribute to rapid turnover, averaging 3–7 days for common household items.

- Over 80% of property listings are houses and flats, boosting Marketplace’s real estate category diversity.

Local vs Shipped Transactions

- The majority of Facebook Marketplace transactions use local pickup, especially for large items like furniture.

- Shipped orders incur a 10% platform fee (minimum $0.80) on the total sale value, including shipping.

- Local pickup sales have zero fees, allowing sellers to retain 100% of the sale price.

- Sellers report 75–80% local pickup vs 20–25% shipped in personal transaction histories.

- Local pickup is preferred for bulky items, reducing shipping costs and damage risks.

- Shipping enables national reach but adds 5–10% fees plus buyer-paid postage, $3.50–$20.

- 97.2 million US consumers favor pickup options like BOPIS, mirroring Marketplace trends.

Gross Merchandise Value (GMV) Estimates

- The global social commerce market reached $1.16 trillion in 2024.

- Market growth trends suggest Facebook Marketplace’s GMV will continue rising.

- Marketplace generated an estimated $30 billion in annual revenue by 2024, reflecting strong monetization potential.

- Fee-based revenue represents only a portion of total GMV due to the prevalence of local pickup.

- The 250 million seller base supports high transaction volume.

- Marketplace is positioned to capture a growing share of global social commerce.

- Category diversity widens the platform’s contribution to GMV.

- While the exact 2025 GMV numbers are unavailable, indicators point toward continued upward growth.

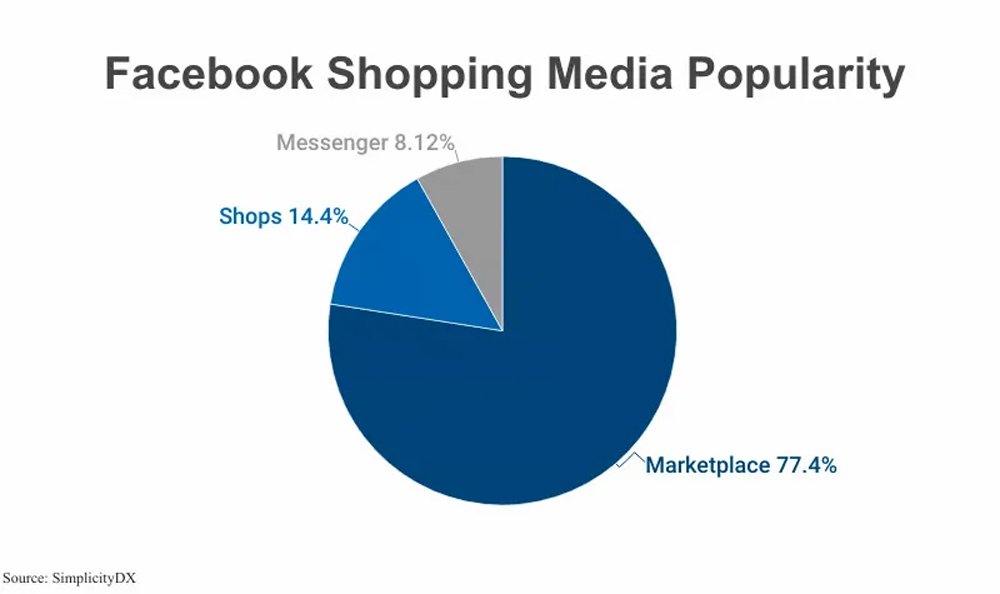

Facebook Shopping Media Popularity

- Facebook Marketplace dominates the platform’s shopping landscape with 77.4% popularity, emphasizing its role as the leading commerce channel.

- Facebook Shops secures 14.4%, indicating consistent traction among both businesses and consumers.

- Facebook Messenger accounts for 8.12%, reflecting its smaller yet noteworthy contribution to Facebook’s overall shopping ecosystem.

Mobile Usage and App Engagement

- Over 80% of Marketplace traffic comes from mobile devices.

- Around 81.8% of Facebook users access the platform exclusively via mobile.

- Nearly 30% of U.S. adults use Facebook regularly for updates, overlapping with Marketplace behavior.

- More than half of Facebook users conduct product research on the platform.

- About 30% of online shoppers are likely to make Facebook purchases on mobile.

- Mobile engagement supports fast browsing and impulse buying.

- Strong mobile usage makes ad optimization critical for sellers.

- Facebook’s 3.06+ billion MAUs ensure global mobile-first accessibility.

Messaging Volume and Negotiation Patterns

- Marketplaces process billions of in-app messages annually, driving coordination for tens of millions of transactions.

- Etsy sellers responding within 2 hours achieve the highest conversion rates from buyer inquiries.

- Responding to pre-purchase messages in under 2 days boosts conversion rates by 27% on Etsy.

- Live chat in marketplaces increases ecommerce conversion rates by 3% and revenue by 6%.

- Quick replies within 45 seconds in chat can triple the buyer’s purchase likelihood.

- eBay negotiations average 5.45 hours of seller response time, impacting deal success.

- 80% of B2B marketplace negotiations will occur digitally via messaging by 2025.

- Star Seller badges from fast messaging yield 22% higher sales and 27% more loyalty.

- In-app messaging platforms market reach $22.5 billion by 2033, fueling negotiations.

Advertising Performance in Facebook Marketplace

- The average click-through rate (CTR) for ads on Facebook Marketplace is typically around 1.5%, a figure that remains closely aligned with broader industry standards.

- Throughout Facebook’s ecosystem, the usual CTR for lead-generation ads reaches 2.53%, whereas traffic-focused ads maintain an average CTR of 1.57%.

- Within advertising sectors, retail and e-commerce campaigns achieve an impressive 10.2% conversion rate, marking the highest performance across all industries.

- The average cost per click (CPC) for traffic campaigns is nearly $0.77, while lead-generation ads typically incur a CPC of about $1.88.

- For 2025, Facebook’s global ad revenue is anticipated to hit $156.8 billion, showing a 5.8% year-over-year increase.

- Across Meta’s ad platforms, advertisers can now reach approximately 2,417 users per $10 spent, reflecting a notable 5% increase from last year.

- Facebook’s total ad revenue for 2024 reached $164.5 billion, rising from $134 billion in the previous year.

- Roughly one in four young adult daily active users (DAUs) in the U.S. and Canada engage with Facebook Marketplace, making it a prime advertising environment for brands targeting this demographic.

Safety, Scams, and Trust Indicators

- 73% of purchase fraud cases at TSB bank stem from Facebook Marketplace.

- Over 62% of Facebook Marketplace users in the US have faced scams.

- 34% of adverts on Facebook Marketplace were assessed as potential scams by TSB experts.

- Facebook Marketplace accounts for 73% of TSB’s purchase fraud volume.

- 17% of Facebook shoppers in England reported being scammed on Marketplace in 2022.

- Financial scams on Marketplace spiked 340% in Q2 2025.

- 1 in 6 users encounter scam or suspicious listings on Marketplace.

- North America represents 42% of global eCommerce fraud losses, including Marketplace.

- Over 11,500 classified scams were reported in Australia in 2023, many via Marketplace.

Forecasts and Future Outlook

- Global social commerce market projected to reach $1.48 trillion by 2030 at a 10% CAGR.

- Social commerce penetration rate expected to hit 25-31% by 2025 worldwide.

- Mobile-first social commerce to dominate with smartphone connections exceeding 80% of mobile total by 2025.

- Asia-Pacific social commerce is forecasted to capture major global market share growth through 2032.

- U.S. social commerce sales projected at $114.7 billion in 2025, up 14.4% annually.

- China’s social commerce conversion rates lead at 30%, far above global averages.

- Live commerce segment to grow at 33.6% CAGR through 2035 with 42.5% market share.

- Mobile commerce is expected to drive 59% of total e-commerce sales at $4.01 trillion in 2025.

- Category diversity in social commerce spans apparel, beauty, and food, supporting resilient multi-segment growth.

Frequently Asked Questions (FAQs)

Approximately 1.1 billion users visit Marketplace monthly, which is roughly 40 % of all Facebook users.

There are around 250 million sellers listing products on Facebook Marketplace globally.

Facebook Marketplace holds an estimated 51.19 % of the global social commerce market share.

Over 80 % of Facebook Marketplace traffic is generated via mobile devices.

Conclusion

Facebook Marketplace continues to evolve far beyond its origins as a simple classifieds board. With hundreds of millions of monthly buyers, a strong mobile-first user base, and deep integration into global social commerce, it stands today as a major venue for both casual sellers and businesses. Buyer behavior reflects both planned purchases and impulse buys, supported by efficient mobile usage, in-app messaging, and wide category selection.

Safety and trust remain important considerations, particularly in shipped transactions. As global social commerce expands and mobile adoption increases, Marketplace appears well-positioned for further growth, provided it advances user protection and maintains balanced buyer, seller dynamics.