In the fast-evolving world of digital design, the platform Figma has become a pivotal tool for teams crafting web and mobile interfaces. From a small startup to a public company, Figma’s expansion touches everything from corporate product development to educational design studios. For example, a major automotive manufacturer now uses Figma for end-to-end vehicle UI mock-ups, while a university design department has adopted it to teach real-time collaborative prototyping. Read on to explore a comprehensive set of statistics underpinning Figma’s performance.

Editor’s Choice

Here are 7 key statistics to note:

- $274.2 million in Q3 2025 revenue for Figma, representing 38% year-over-year growth.

- Figma crossed an annual revenue run-rate of over $1 billion as of Q3 2025.

- 129% net dollar retention (NDR) for customers with ARR > $10 000 as of June 30 2025.

- 13+ million monthly active users across free and paid tiers as of March 2025.

- The company’s valuation was around $12.5 billion in mid-2024 via a secondary tender offer.

- Over 80% of customers used two or more Figma products by mid-2025.

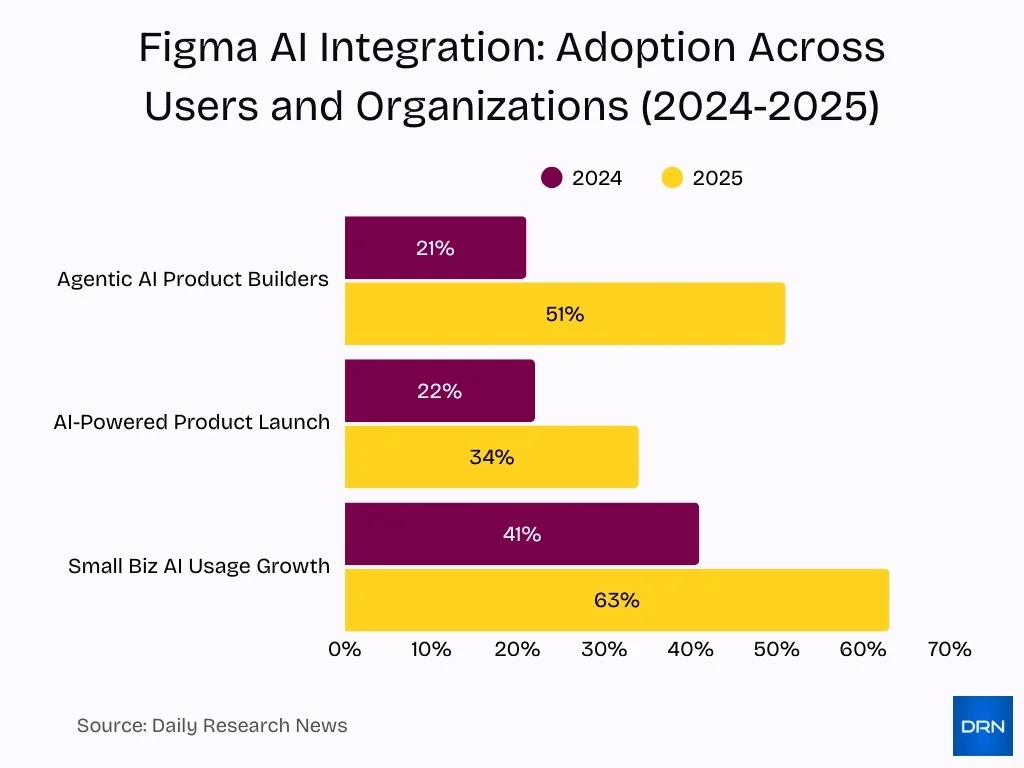

- 51% of Figma users building AI products in 2025 say they are creating “agentic” tools, up from 21% the prior year.

Recent Developments

- In Q2 2025, Figma reported revenue of $249.6 million, up 41% year-over-year.

- Operating cash flow margin in Q2 2025 was 25%, with an adjusted free cash flow margin of 24%.

- In Q3 2025, Figma’s net dollar retention (for customers with ARR > $10k) reached 131%, up 2 percentage points from the prior quarter.

- The company raised its full-year 2025 revenue guidance to between $1.044 billion and $1.046 billion, implying 37% year-over-year growth.

- Figma launched four new products in 2025: Figma Make, Figma Draw, Figma Sites, and Figma Buzz.

- By September 2025, approximately 30% of paid customers spending $100k+ ARR were using Figma Make weekly.

- Figma’s cash, cash equivalents and marketable securities stood at $1.6 billion as of June 30 2025.

- Q3 2025 GAAP operating loss was $(1.1 billion) owing to one-time stock‐based compensation; non-GAAP operating income was $34 million (12% margin).

Figma Overview

- Figma has 13 million monthly active users as of March 2025.

- Over 95% of Fortune 500 companies use Figma in their workflows.

- Figma’s user base more than doubled from 4 million (2022) to over 10 million in 2025.

- The platform saw a 159% annual user base growth rate, highlighting rapid adoption.

- Figma supports nearly 7 million monthly visits as of early 2025 with a 25.3% bounce rate.

- The company had around 1,646 employees worldwide as of March 2025, growing 62% YoY.

- About 6,972 companies with 0-9 employees actively use Figma, while large enterprises (1000+ employees) make up 13% of users.

- Around 65% of customers use 2 or fewer products on the Figma platform, showing expansion potential.

- Figma’s last twelve months’ revenue reached approximately $821 million in 2025 with a 49% growth rate.

- Nearly two-thirds of Figma users are not professional designers, indicating broad cross-industry adoption. 500.

Revenue Growth

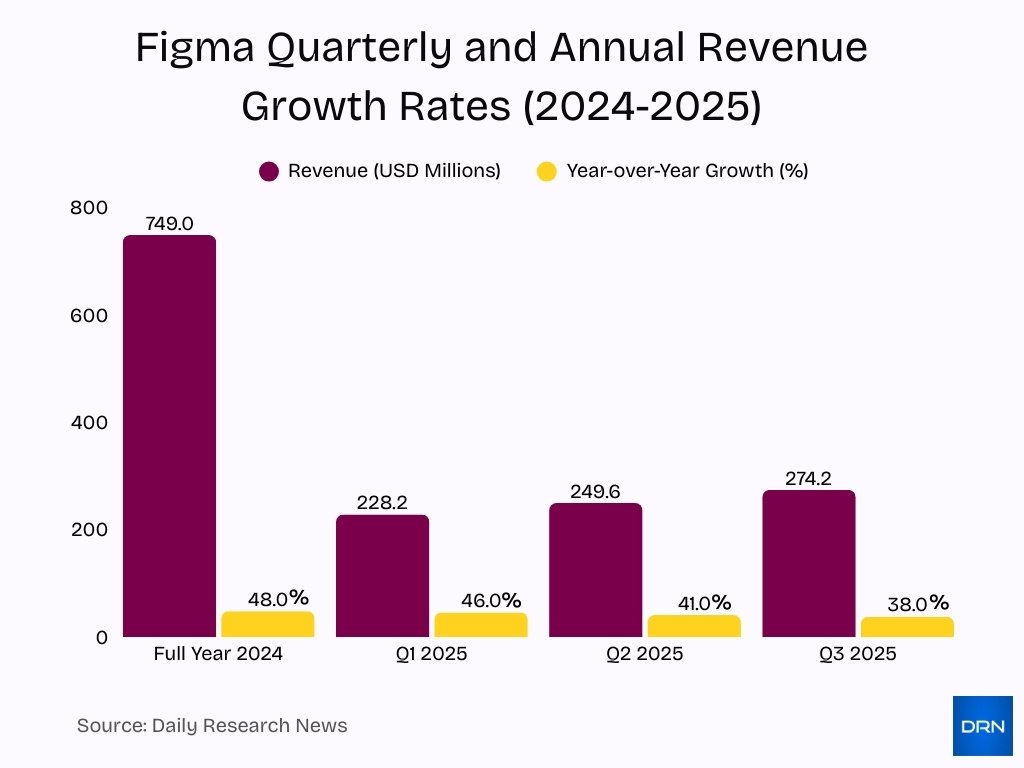

- Full‐year 2024 revenue was $749 million, an increase of 48% vs 2023.

- Q1 2025 revenue was $228.2 million, which represented 46% year-over-year growth.

- Q2 2025 revenue rose 41% to $249.6 million.

- Q3 2025 revenue was $274.2 million, up 38% year-over-year.

- Annualised revenue run-rate exceeded $1 billion as of Q3 2025.

- Growth rate shows deceleration, from 46% in Q1 to 41% in Q2 to 38% in Q3.

- Non-GAAP free cash flow in Q2 2025 $60.6 million with a margin of 24%.

- Revenue per paid customer cohort (ARR > $10k) remains strong, with increasing multi-product adoption.

Who Uses Figma?

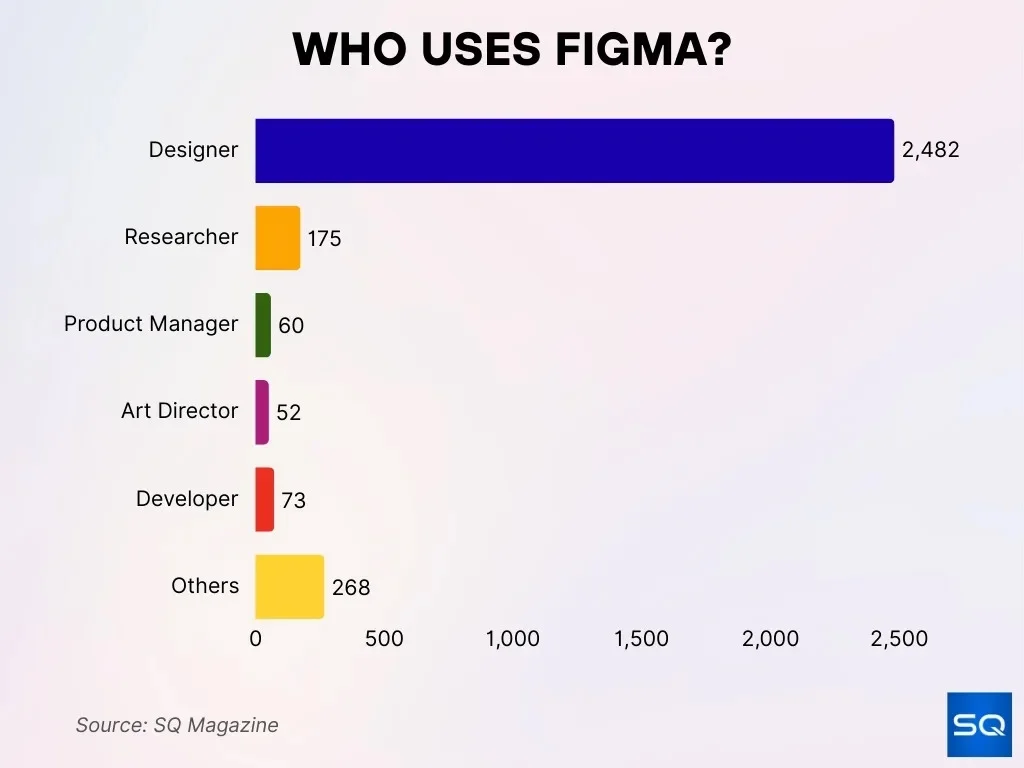

- Designers lead the platform with 2,482 users, clearly representing the overwhelming majority of Figma’s audience.

- Researchers make up 175 users, indicating a smaller yet highly valuable segment within the Figma user base.

- Product Managers contribute 60 users, demonstrating meaningful cross-functional adoption of the tool.

- Art Directors account for 52 users, emphasising strong leadership-level involvement in design workflows.

- Developers total 73 users, reinforcing that collaboration extends well beyond traditional design teams.

- Other roles collectively include 268 users, bringing additional diversity to the overall Figma ecosystem.

Company Valuation

- In a secondary tender offer in mid-2024, Figma’s valuation was reported at $12.5 billion.

- Earlier valuations $10 billion in 2021 at Series E.

- The previously proposed acquisition by Adobe valued Figma at $20 billion; that deal was later abandoned.

- Public market listing (IPO) in 2025 opened with a large valuation uplift in early trading.

- The forward valuation multiple (based on $1 billion run-rate revenue) implies a revenue multiple in the 10-15x range, suggesting market expectations for growth beyond current levels.

- The company’s cash reserves and strong retention support valuation defensibility.

- Valuations remain sensitive to growth deceleration risk.

Funding and Investments

- Total funding raised across eight rounds is approximately $749 million.

- Seed funding, $3.8–4 million in June 2013.

- Series A, $14 million in December 2015.

- Series B, $25 million in February 2018.

- Series C, $40 million in February 2019.

- Series D, $50 million in April 2020.

- Series E, $200 million in June 2021 at a $10 billion valuation.

- Series F / Secondary tender, $415 million in 2024, valuing the company at $12.5 billion.

- Investors include Index Ventures, Greylock, Kleiner Perkins, Sequoia Capital, Andreessen Horowitz, and Durable Capital.

- Funds supported the expansion of the product set, geography, and IPO readiness.

Geographic Distribution of Users

- The United States accounts for around 17% of global desktop traffic to Figma in late 2025.

- India is the company’s second-largest user market, with presence in 85% of India’s 28 official states.

- Over 40% of the top BSE100 companies in India use Figma.

- Historical ranges show US users at 38%–46% and India at 7-11% in past periods.

- India contributed 9.93% of desktop traffic vs the US at 17.14% in October 2025.

- Non-US users make up 85% of weekly active users.

- Brazil and the U.K. appear as secondary markets in earlier datasets.

- The strong international footprint indicates monetisation potential outside the US.

Company Size Distribution

- 44% of companies using Figma have fewer than 50 employees.

- 42% are medium-sized, and 13% have more than 1000 employees.

- By revenue, 69% of Figma customers generate < $50 million, 16% over $1000 million.

- Multi-product adoption is strongest among large accounts spending $100k+ ARR.

- Distribution shows broad appeal across startups and enterprises.

- This reduces the risk of over-dependence on enterprise accounts.

- Enterprise adoption remains key for high-value ARR.

Market Share Statistics

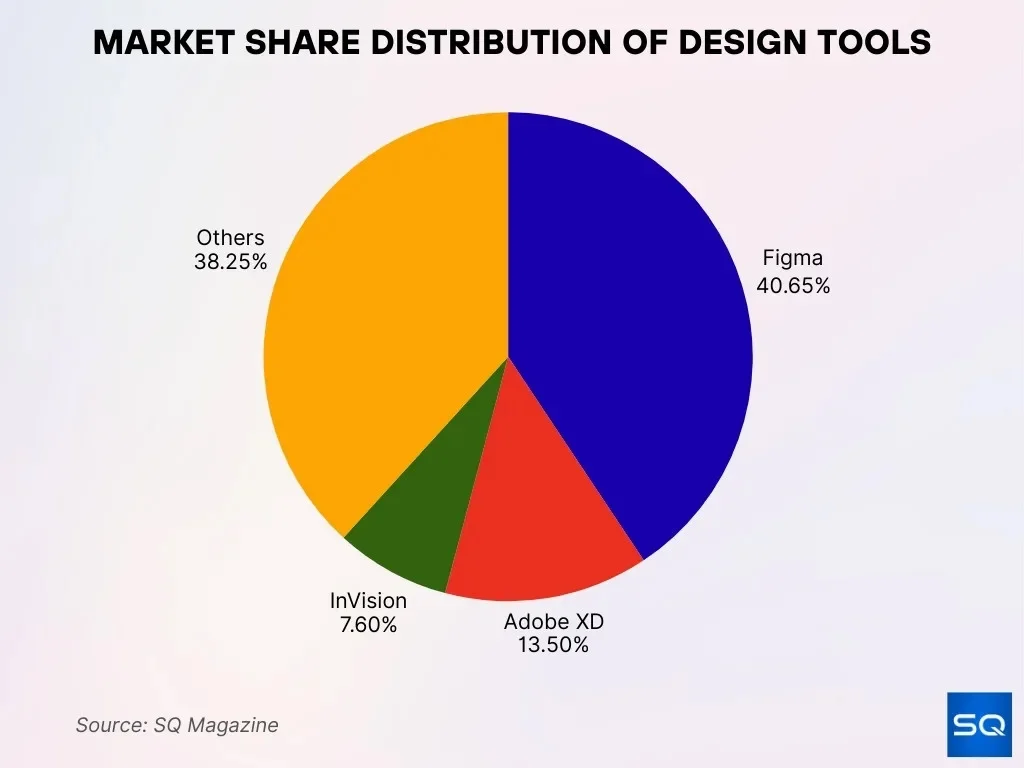

- Figma maintains a commanding 40.65% market share in the design tool category, showcasing its strong industry presence.

- Among key competitor statistics, Adobe XD holds roughly 13.5%, while InVision captures around 7.6%.

- It clearly leads over alternatives such as Adobe XD and InVision, solidifying its market advantage.

- Figma’s dominance continues due to its cloud-based collaboration model, which outpaces traditional legacy desktop tools.

- Current market trends favour browser-native platforms offering real-time collaboration, a segment where Figma excels.

- Figma keeps eroding market share from the Adobe Creative Suite, despite Adobe’s long-standing and entrenched industry presence.

- Its strong accessibility and collaborative features further reinforce its leading position in overall market share.

Notable Customers and Industry Adoption

- 95% of the Fortune 500 use Figma.

- Over 40% of the top BSE100 companies in India use Figma.

- Companies like Truecaller use Figma to scale design for hundreds of millions of users.

- The tech and IT sector leads with over 12,800 companies using Figma.

- Small business adoption is strong, with 44% being small companies.

- Enterprises increasingly adopt advanced features like Dev Mode and design-systems tooling.

- Education and free tiers drive bottom-up enterprise usage.

- Adoption spans product, engineering, education and marketing teams.

Employee and Workforce Statistics

- As of March 31, 2025, Figma had 1,646 employees, up 62% year-over-year.

- Mid-2025 measurements list 1,916 employees, reflecting strong hiring.

- Engineering comprises 39% of the workforce (755 employees).

- Sales and Support roles represent roughly 20% (373 employees).

- Revenue per employee is estimated at $588,674.

- Workforce growth aligns with expanded product portfolio and global operations.

- Some sources estimate 2,119 employees in 2025, showing rapid scaling.

- Growth reflects Figma’s transition to a broader collaborative and AI platform.

Collaboration Metrics

- 84% of designers using Figma collaborate with developers weekly.

- Q3 2025 NDR for ARR > $10k customers reached 131%.

- As of September 30 2025, Figma had 12,910 paid customers with ARR > $10k.

- 30% of high-spending customers use Figma to make weekly plans.

- 52% of teams building AI products say design is more important than for non-AI projects.

- 61% of small-company users consider AI critical for competitiveness.

- Roughly two-thirds of monthly active users are not professional designers.

- Figma’s tools (Dev Mode, FigJam, Sites) support deep cross-team workflows.

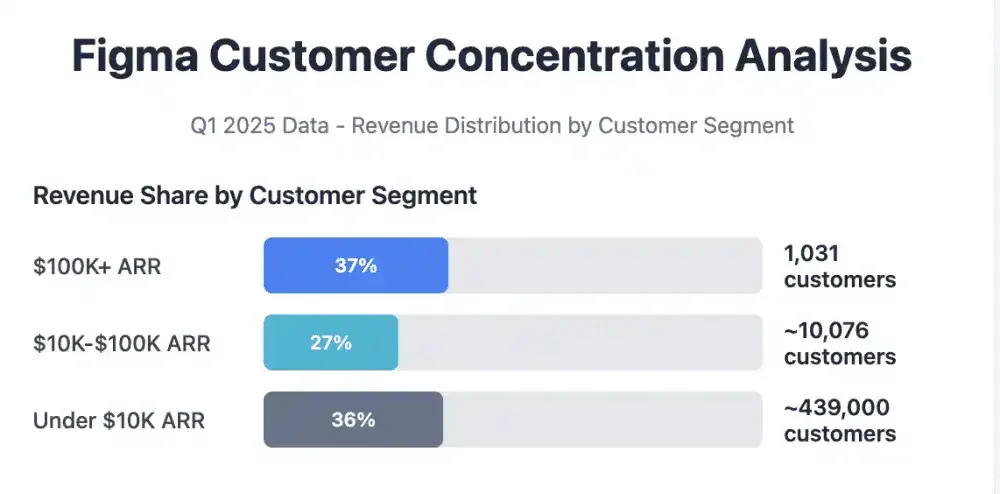

Figma Customer Concentration Analysis

- 37% of revenue comes from just 1,031 customers paying $100K+ ARR, reflecting a high-value enterprise contribution.

- 27% of revenue is contributed by around 10,076 customers in the $10K–$100K ARR segment, underscoring a solid mid-market share.

- 36% of revenue is generated from Figma’s broad base of approximately 439,000 customers paying under $10K ARR, highlighting its extensive SMB and long-tail user footprint.

Community Engagement Statistics

- Figma recorded 130.08 million visits in October 2025.

- Average session duration was 14 minutes 48 seconds.

- Gender distribution was 55.46% male and 44.54% female.

- The largest visitor age group, 25-34 years old.

- The US contributed 17.14% of traffic, India 9.93%.

- Figma community chapters number in the dozens globally.

- 51% of users building AI products focus on agentic AI, up from 21%.

- Global search interest reached 4.19 million searches monthly in 2024.

Figma for Education

- Figma offers free Education plans for over 1 million students and educators worldwide.

- More than 70% of K-12 schools using Figma report improved student collaboration and engagement.

- Over 1,100 higher-education institutions incorporate Figma for portfolio development and design projects.

- Figma’s eligibility verification process unlocks advanced design tools for verified students and educators.

- IDC forecasts the design workforce to grow from 107 million in 2025 to 144 million by 2029.

- Figma prepares students with tools aligned to modern product-design workflows demanded by employers.

- AI-driven features in Figma increase productivity by up to 30% in collaborative design tasks.

- Figma’s education programs contribute to feeding the enterprise pipeline with over 50,000 new design users annually.

- Real-time collaboration in Figma enhances classroom teamwork with 90% positive feedback from educators.

- Figma supports both K-12 and higher education with dedicated resources and interactive tools for design learning.

AI Feature Adoption

- 51% of AI-building users create agentic AI products, up from 21% previously.

- 34% of Figma users launched AI-powered products in 2025, up from 22% last year.

- 61% of small-company users view AI as vital to maintaining or growing market share.

- 30% of high-annual recurring revenue (ARR) customers use Figma Make on a weekly basis.

- AI integrations reduce real-time collaboration latency by approximately 50%.

- AI powers workflows ranging from design and content generation to site-building and coding.

- Workforce growth shows a positive correlation with the expansion of generative AI adoption.

- Figma’s user base doubled from 4 million in 2022 to over 10 million in 2025 as it shifted to a product creation platform.

- 78% of organisations now use AI in at least one business function, reflecting rapid adoption.

- Small businesses saw a 41% jump in AI usage from 2024 to 2025, with 63% using AI daily.

Traffic and Audience Insights

- Figma recorded 130.08 million visits in October 2025.

- Average session duration, 14 minutes 48 seconds, pages per visit 13.63.

- 79.87% of traffic is direct, 7.24% from Google.

- The US shows 17.96 million visits, India 12.5 million.

- Gender distribution: 55.46% male, 44.54% female.

- Largest audience age group: 25-34.

- Bounce rate sits at 37.1%.

- Sustained traffic shows strong brand momentum and funnel growth.

Cancelled Adobe Acquisition

- Adobe and Figma cancelled their $20 billion acquisition deal in December 2023 due to regulatory hurdles.

- Adobe paid Figma a $1 billion reverse termination fee as part of the deal cancellation.

- Figma’s IPO valuation projections for 2025 are estimated between $14.6 billion and $16.4 billion.

- Figma’s revenue reached $749 million in 2024, a 48% increase from 2023.

- Figma’s revenue is forecasted to surpass $1.023 billion in 2025, projecting a 37% growth rate from 2024.

- The platform grew from 4 million users in 2022 to over 10 million in 2025, more than doubling its user base.

- Figma serves 13 million monthly active users as of early 2025, with two-thirds being non-designers.

- Figma commands a 40.65% market share in the design tools category in 2025.

- The company posted a year-over-year revenue growth rate of over 39% in Q2 2025.

- Figma’s net dollar retention rate stood at 132% in early 2025, indicating strong expansion within existing accounts.

Frequently Asked Questions (FAQs)

Approximately 13 million monthly active users.

Around 40.65% of the design-tool market.

About $274.2 million, representing 38% year-over-year growth.

51% of those users.

Conclusion

Figma has transcended its origin as a browser-based design tool to become a platform of collaboration, powering designers, developers, product teams and students worldwide. We’ve seen robust growth in workforce size, collaboration metrics, community engagement, integration into education, and AI-driven workflows. The platform’s traffic and audience data reflect strong brand momentum, while the cancelled Adobe acquisition marks a pivotal moment in Figma’s independent growth story.

For organisations and individuals tracking the evolution of design, product and teamwork tools, these statistics illustrate how Figma is shaping the future of digital creation. Explore the full article to understand the detailed numbers, trends and implications.