pc Gen Z is reshaping the gaming world through preferences that differ sharply from those of older generations. Born between the mid-1990s and early 2010s, this cohort favors digital connectivity, mobile access, and social gaming experiences. From casual players enjoying mobile games during short breaks to dedicated console and PC gamers, their habits influence game design, platform strategies, and industry trends.

In real-world terms, companies like Epic Games adjust launches to favor cross-platform play, while marketers tailor ads for mobile and streaming audiences. With Gen Z expected to fuel gaming growth and beyond, these numbers tell a compelling story worth exploring more deeply.

Editor’s Choice Statistics

- 87% of Gen Z play games regularly, making them one of the most active gamer groups globally.

- 92% of Gen Z engage with games via mobile devices, underscoring the platform’s dominance.

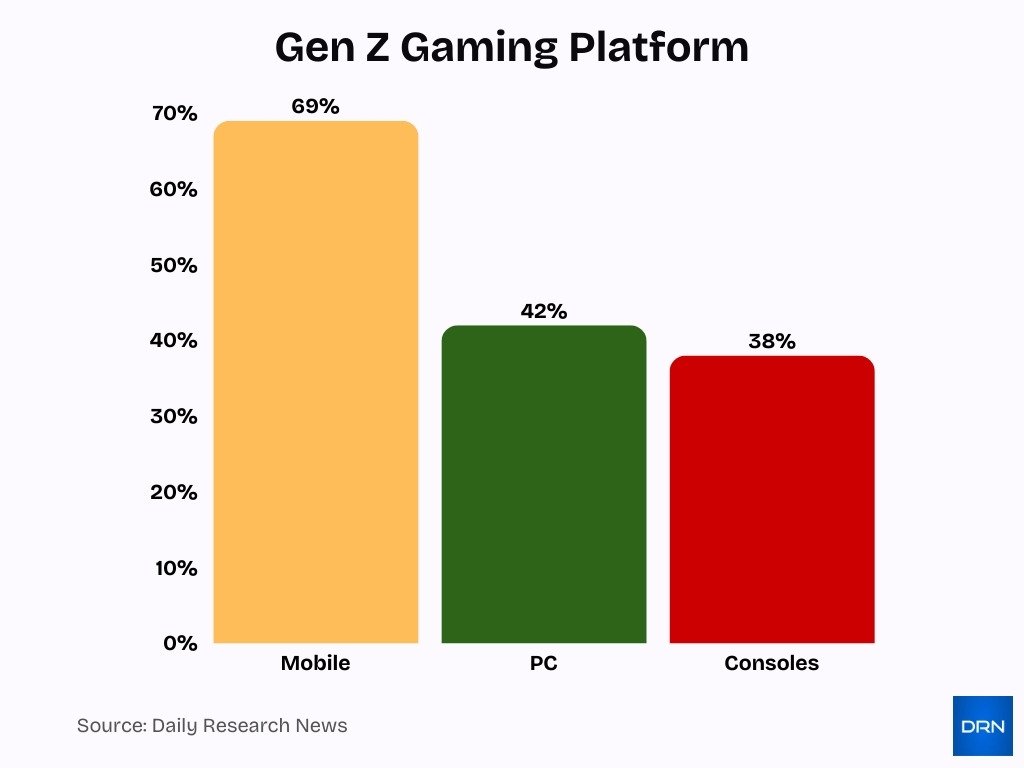

- 69% of Gen Z gamers primarily play on mobile, compared with 42% on PC and 38% on console.

- The average Gen Z gamer logs 7 hours 20 minutes per week playing games.

- 52% of Gen Z gamers make at least one in-game purchase, higher than the overall gamer average.

- Mobile esports viewership among younger players has surged 340% since 2022.

- Gen Z spends 17% of their free time gaming, more than any other generation except Gen Alpha.

Recent Developments

- Digital gaming penetration among Gen Z is expected to reach about 75% by 2027 in the U.S., highlighting steady growth.

- Mobile gaming revenue reached $92 billion in 2024, nearly half the entire market.

- Mobile player numbers top 3 billion worldwide, reinforcing the reach of handheld gaming.

- In-game purchases hit $81 billion in 2024, increasing year-over-year despite economic headwinds.

- Cross-platform play demand rises, with 70% of Gen Z regularly switching between devices during gameplay.

- Console and PC dual engagement is rising, with 58% use consoles and 54% use PCs alongside mobile gaming.

- The global gaming market is forecast to exceed $188 billion in 2025, supporting industry expansion.

- Gen Z spending on AAA games has shown fluctuation, with notable drops in some digital purchases due to economic pressures.

Overview of Gen Z Gaming Habits

- 88% of Gen Z identify as gaming enthusiasts, engaging beyond simple play to watching and discussing games.

- Average playtime for Gen Z is 7 hours 20 minutes per week, reflecting deep engagement.

- 90% of Gen Z engage with games socially, including playing with friends and joining communities.

- The majority of Gen Z discover games through video content and creator platforms, reshaping marketing strategies.

- Nearly 70% of younger players are motivated by competitive or cooperative gaming elements.

- Multiplatform play boosts retention, with Gen Z favoring titles that save progress across devices.

- Mobile remains the most accessible entry point, reinforcing daily gaming habits.

- Console and PC play remains strong among dedicated gamers who value high-performance experiences.

Gen Z Gaming Platform Market Share

- Mobile leads with 69% engagement among Gen Z gamers.

- 42% of Gen Z play on PCs regularly.

- 38% engage with console platforms.

- Among youth players broadly, mobile gaming reaches 92% participation.

- Mobile accounts for roughly 79% of total gamer participation worldwide.

- 19% of U.S. gamers play on mobile, PC, and console, showing adoption of multiple platforms.

- Console gaming revenue is projected to grow at a 7% CAGR through 2027, outpacing PC.

- PC and console maintain strong followings among players seeking high-fidelity experiences.

Mobile Gaming Adoption Among Gen Z

- 73% of Gen Z gamers play primarily on mobile devices, far outpacing other platforms.

- 92% of Gen Z access games via mobile, highlighting its dominance as the preferred platform.

- 74% of Gen Z in India spend at least 6 hours weekly on mobile gaming.

- Gen Z averages 6 hours 10 minutes daily on gaming, with mobile leading short, frequent sessions.

- Free-to-play models prevail, as Gen Z favors cost-free titles with optional in-app purchases.

- 52% of Gen Z gamers make at least one in-game purchase, exceeding overall averages.

- 17% of Gen Z complete daily gaming in-app purchases, fueling monetization.

- 58% of Gen Z view gaming as their main social space, boosted by mobile chat features.

- Mobile esports viewership among Gen Z surged 340% since 2022, signaling rising competition.

- Global mobile gaming revenue hits $126 billion in 2025, driven by Gen Z expansion.

Console Gaming Adoption Among Gen Z

- 38% of Gen Z gamers regularly use consoles, behind mobile at 69%.

- 58% of Gen Z console users engage in cross-platform multiplayer experiences.

- Global console revenue reaches $45.9 billion in 2025, up 5.5% year-over-year.

- 46% of Gen Z subscribe to gaming services like Xbox Game Pass or PlayStation Plus.

- 74% of console gamers overall subscribe to services, higher than on other platforms.

- 70% of Gen Z gamers value consoles for staying socially connected via multiplayer.

- 58% of Gen Z view gaming, especially consoles, as their primary social hub.

- 67% of multiplayer Gen Z gamers use voice chat during console sessions.

PC Gaming Adoption Among Gen Z

- 87% of Gen Z (ages 13–24) play games regularly, with 42% using PC platforms.

- PC gaming market reaches $86.12 billion in 2025, growing at 8.47% CAGR through 2032.

- 42% of Gen Z gamers play on PC, compared to 69% on mobile and 38% on consoles.

- 54% of Gen Z use PC for cross-platform gaming, alongside 58% on consoles.

- Global games market hits $197 billion in 2025, with PC capturing a significant share via multiplayer.

- 66% of PC gamers subscribe to services like Game Pass, boosting Gen Z affordability.

- Asia-Pacific holds 46.7% of PC gaming revenue, attracting Gen Z with esports communities.

- Steam peaks at 40.27 million concurrent users, drawing Gen Z for competitive titles.

Preferred Primary Gaming Platform

- 69% of Gen Z gamers prefer mobile as their primary gaming platform.

- 42% of Gen Z engage with PC gaming, favoring competitive titles.

- 38% of Gen Z play on consoles, drawn to immersive experiences.

- 58% of Gen Z use consoles for cross-platform gaming sessions.

- 54% of Gen Z leverage PCs for multi-platform cross-play.

- 79% of total gamers, including Gen Z, play primarily on mobile devices.

- 86% of Gen Z identify as “mobile gamers first” over other platforms.

- 92% of Gen Z access games via mobile devices regularly.

- Nearly 50% of Gen Z gamers play across multiple platforms weekly.

Tablet and Other Device Usage

- Tablet gaming usage among Gen Z rose from 17% in 2020 to 22% in Q2 2024.

- Global gaming tablet market valued at $115M in 2024, projected to hit $128M in 2025.

- Smartphone/tablet games market grew from $87.6B in 2024 to $104.8B in 2025 at 19.6% CAGR.

- 92% of Gen Z are mobile gamers, many extending play to tablets for casual sessions.

- Gaming phones/tablets market at $15B in 2025, set to reach $45B by 2033 with 15% CAGR.

- Tablet market share worldwide stands at 1.42% for device usage in late 2025.

- Cross-platform Gen Z gamers return 31% more often, boosting tablet versatility.

- 74.8% of Gen Z will be digital gamers by 2027, including tablets as a secondary device.

- Cloud gaming is tried by 60% of players, with 80% positive on tablets for high-fidelity play.

Cross-Platform and Multi-Device Behavior

- Cross-platform gaming boosts retention by up to 31% compared with single-platform play.

- About 58% of Gen Z use consoles for cross-platform gaming, and 54% use PCs, showing fluid multi-device use.

- Tri-platform engagement, mobile, PC, and console, among Gen Z registers roughly 13% to 15%.

- Cross-progression features increase time spent across devices by about 40% on average.

- Leading cross-platform titles help players save progress across devices, a strong preference among Gen Z.

- Gen Z is twice as likely to switch devices during a play session compared with older gamers.

- Mobile remains the anchor platform in multi-device gaming behavior.

- Cloud gaming services are accelerating cross-platform flexibility for younger players.

Time Spent Gaming by Gen Z

- Gen Z gamers average 6 hours 10 minutes gaming per day, totaling 43 hours weekly.

- Average gamer spends 8.6 hours per week gaming in 2025, up from 8.2 hours in 2024.

- 81% of Gen Z play games, averaging 7 hours 20 minutes per week, according to Newzoo.

- Teenagers aged 13-17 average 10-15 hours weekly on gaming, or 1.5-2 hours daily.

- Gen Z dedicates 25% of its leisure time to gaming, exceeding social media at 18%.

- 74% of Indian Gen Z mobile users spend 6+ hours weekly on mobile games.

- Younger teens game 10-15 hours weekly, with weekend sessions exceeding 3 hours.

- 39% of UK teens spend more than 3 hours daily gaming, surpassing TV time.

- Multi-device Gen Z gamers achieve 10.3 hours weekly, above single-device averages.

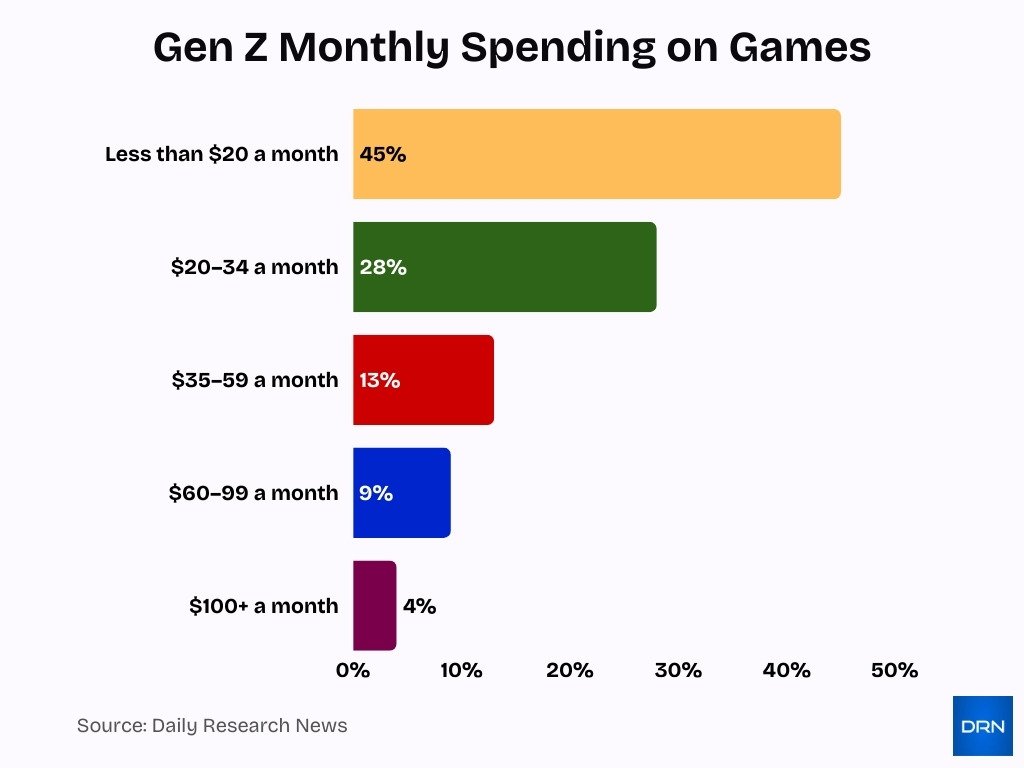

How Much Do Gen Z Spend on Games Each Month?

- Most Gen Z gamers are low spenders: Around 45% spend less than $20 per month, making this the largest segment by a wide margin.

- Nearly three in ten Gen Z gamers (about 28%) spend between $20 and $34 per month, indicating moderate but consistent spending habits.

- Mid-level spending is less common: Only ~13% spend $35–59 per month, showing a sharp drop after the $34 threshold.

- Higher monthly spending is relatively rare: Roughly 9% of Gen Z gamers spend $60–99 per month on games.

- Heavy spenders are a small minority: Just ~4% report spending $100 or more per month, highlighting that premium gaming expenditure is uncommon within this generation.

- Overall trend: Approximately three-quarters of Gen Z (≈73%) spend under $35 per month, reinforcing the dominance of budget-conscious gaming behavior.

Game Genres Preferred by Gen Z Gamers

- Gen Z gamers favor shooters at 66% preference rate.

- Action/adventure games claim 62% favoritism among Gen Z.

- Shooter games lead with 58% as the top genre for Gen Z.

- Adventure titles attract 45% of Gen Z players.

- 68% of 16-24 year olds prefer multiplayer over single-player.

- Only 30% of Gen Z opts for solo gaming experiences.

- 57% of Gen Z play casual mobile games frequently.

- Esports appeals strongly, with 65% of viewers aged 18-34.

Online Multiplayer and Social Gaming Behavior

- A Deloitte survey shows 40% of Gen Z and Millennials say they socialize more in video games than in the physical world.

- Research from Newzoo reports 25% of Gen Z’s leisure time is spent gaming, making it their top social activity over social media and streaming.

- A Statista-based study finds 87% of Gen Z gamers play specifically to stay connected with friends through games.

- Around 58% of Gen Z gamers now view gaming as their primary social space, ahead of messaging apps and other social media.

- Approximately 67% of multiplayer gamers use in‑game voice chat regularly, underlining communication as a core play behavior.

- Surveys indicate 45% of players have made at least one real-life friend through gaming communities, whom they first met online.

- Industry analyses show that adding rich social features can boost player retention by 20–40%, as longer sessions and return rates increase in multiplayer titles.

- In mobile games, socially driven features account for an estimated 30–60% of in‑app purchase revenue, especially cosmetics used for self‑expression.

- Social gamers are significantly more engaged, with Gen Z players reporting 34% play primarily to socialize, compared with 26% in older generations.

- Safety research reveals 84.4% of respondents would not let a child under 13 play online multiplayer, highlighting concerns that rise with social interaction.

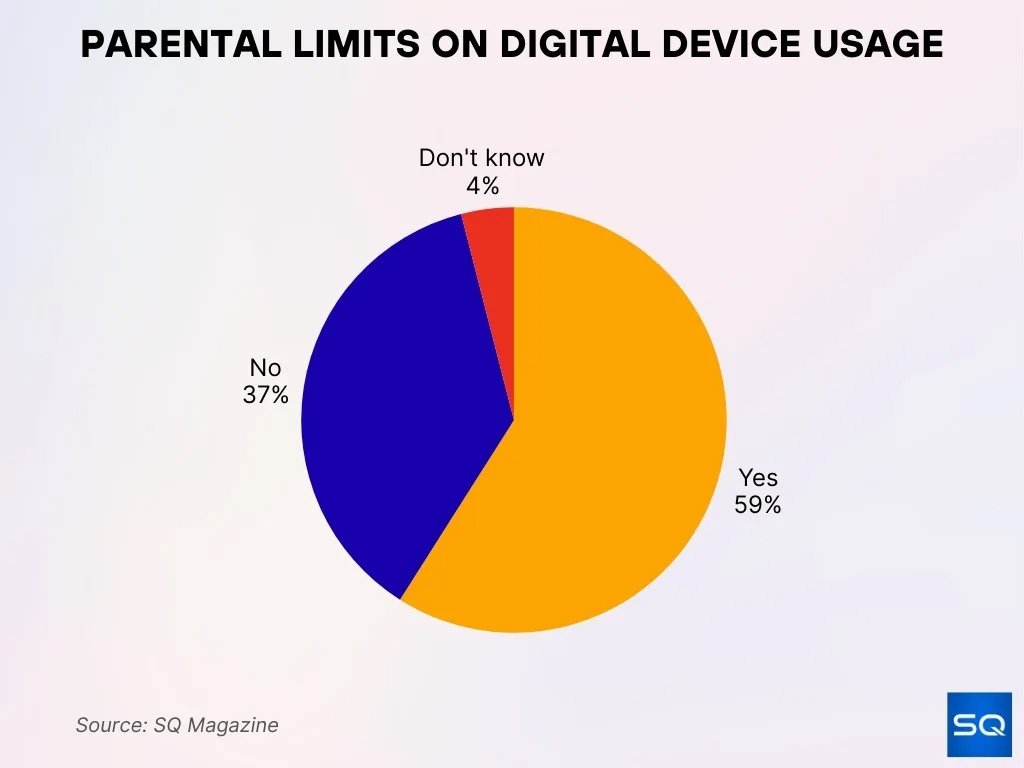

Parental Restrictions on Digital Device Usage

- 59% of respondents state that their parents or guardians impose limits on the number of hours they are allowed to use digital devices.

- 37% indicate that they have no restrictions placed on their digital device usage by their parents or guardians.

- 4% report that they are uncertain about whether any limits or controls on their device usage are currently in place.

Streaming, Esports, and Creator Engagement

- About 80% of gamers aged 16 to 24 played games online in 2024, showing the core role of connected play.

- Gen Z gamers often watch esports and gaming streams as part of their routines.

- Community platforms like Discord and Twitch are widely used for social viewing and playing together.

- Esports viewership among Gen Z has grown significantly, including mobile esports.

- Gen Z follows livestreaming creators more than playing alone, often discovering games via creators.

- 62% of Gen Z gamers discover brands through video games, emphasizing gaming’s media influence.

- In-game concerts and championships draw large Gen Z audiences.

- Gaming clips and highlights often outperform non-gaming content in short-form video engagement.

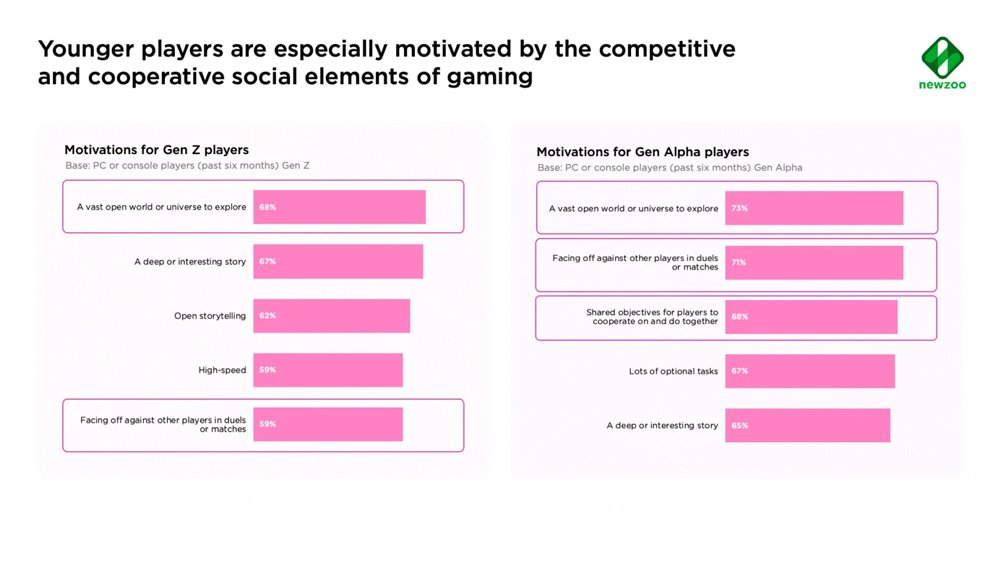

Influencing Gaming Preferences of Gen Z and Gen Alpha

- Gen Z players are primarily motivated by a vast open world or universe to explore (68%), closely followed by a deep or interesting story (67%).

- Open storytelling strongly appeals to 62% of Gen Z gamers, while high-speed gameplay attracts 59% of this group.

- Facing off against other players in duels or competitive matches is an important motivator for 59% of Gen Z gamers.

- Gen Alpha players rank a vast open world or universe to explore as their top motivation, with a high preference rate of 73%.

- Facing off against other players in duels or matches serves as a key motivation for 71% of Gen Alpha gamers.

- Shared objectives that enable players to cooperate and collaborate appeal to 68% of Gen Alpha gamers.

- Lots of optional tasks significantly engage 67% of Gen Alpha gamers.

- A deep or interesting story remains a strong motivational factor for 65% of Gen Alpha players.

Gaming Subscriptions and Cloud Gaming Usage

- PlayStation Plus leads with 51.6 million subscribers in Q1 2025.

- Xbox Game Pass reached 35-37 million subscribers by mid-2025.

- Nintendo Switch Online has about 34 million members worldwide.

- The global gaming subscription market hit $14.3 billion in 2025.

- 81% of Gen Z actively play video games weekly.

- 51% of cloud gamers use the service daily in 2025.

- Nearly 75% of gamers spend on in-app purchases monthly.

- Gen Z gamers average 7 hours 20 minutes weekly playtime.

- Cloud gaming market grows at 46.3% CAGR to 2032.

- 73% of paying users spend under $20/month on cloud gaming.

Free-to-Play vs Paid Game Preferences

- Gen Z gamers spend an average of 6 hours 10 minutes daily, with 79% playing free-to-play mobile titles.

- Free-to-play market reaches $62.32 billion in 2025, growing at 15.58% CAGR through 2032.

- 52% of Gen Z make at least one in-game purchase, exceeding the overall gamers at 42%.

- 91% of Gen Z bought in-game items like gear or currency in the past six months.

- Free-to-play models captured 52% of total gaming market revenue in 2024.

- Microtransactions generated $24.4 billion on PC alone in 2024, 58% of PC revenue.

- Gen Z spending on games dropped 25% in 2025 amid a preference for free titles.

- 93% of younger Gen Z/Alpha spent on microtransactions for social gaming features.

Influences on Gen Z Game and Platform Choice

- 58% of Gen Z see gaming as their main social space.

- 67% of multiplayer Gen Z gamers use voice chat for connection.

- 63% of Gen Z gamers discover new games via content creators and streamers.

- 34% of Gen Z play games primarily to socialize.

- Peer recommendations drive Gen Z game choices over traditional ads.

- 62% of Gen Z gamers discover brands through video games.

- 52% of U.S. Gen Z gamers subscribe to at least one gaming service.

- Gen Z favors shooting (66%) and action/adventure (62%) genres.

- 25% of Gen Z gamers cap GPU budgets at $500.

- Cross-platform boosts Gen Z player retention by 31%.

Impact of Gaming on Gen Z Lifestyle and Well-being

- 79% of Gen Z and Gen Alpha players play with friends, highlighting gaming’s social role.

- Many gamers report benefits such as stress relief and cognitive improvement.

- Gaming supports problem-solving, teamwork, and resilience.

- Around 41% of teens say gaming has negatively affected their sleep.

- Gaming has become part of the identity and daily routine for many Gen Zers.

- Many say gaming helped them meet people they would not otherwise meet.

- Gaming contributes to community building and shared interests.

- Certain spending and play patterns raise well-being concerns.

Frequently Asked Questions (FAQs)

69% of Gen Z gamers engage primarily through mobile devices, indicating mobile’s dominant role in their gaming preferences.

Approximately 42% of Gen Z regularly play on PC and 38% use console platforms, showing notable cross‑device engagement beyond mobile.

Mobile esports viewership has surged by an estimated 340% since 2022, reflecting rising competitive and streaming interest.

The average gamer now spends about 8.6 hours per week gaming in 2025, up from 8.2 hours in 2024.

Conclusion

Gen Z continues to shape the gaming ecosystem through distinct platform preferences, social play behaviors, and spending patterns. Mobile and online connectivity dominate, while cloud gaming and subscription services grow in relevance. Game choice hinges on community, creators, and cost-effective access, not just graphics or franchise legacy. At the same time, gaming’s impact on social connectivity and lifestyle is profound, offering benefits like social bonding and skill development alongside challenges in wellbeing and spending trends.

Together, these statistics present a clear, data-driven view of how the next generation is defining the future of gaming.