Google remains the central gateway to the internet for billions worldwide. From casual fact‑checks to complex research, people continue to rely on Google Search for nearly every query imaginable. In business, marketers optimise content based on its reach, in journalism, editors shape headlines around what users actually search for, underscoring Google’s deep influence across industries. Read on to explore the full data driving Google’s dominance this year.

Editor’s Choice

- Google handles an estimated 13.6 billion searches per day in 2025.

- That tally translates to roughly 5 trillion searches annually.

- As of late 2025, Google’s global search engine market share sits around 90%.

- In mobile search globally, Google’s share reaches over 94%.

- On desktop search, Google still leads, though with a slightly lower share.

- Daily search volume demonstrates continued growth year‑over‑year, reflecting persistent user demand.

- The scale of global searches underscores the immense opportunity for content creators and advertisers to reach broad audiences.

Recent Developments

- In 2024, Google’s global search market share dipped below 90% for the first time in nearly a decade, ending the year at approximately 89.73%.

- Some reports in 2025 indicate Google processes as many as 16.4 billion searches per day, suggesting an acceleration in usage.

- The shift signals growing global internet penetration and more frequent search-driven usage.

- Mobile-first browsing continues to dominate search behaviour, pushing Google’s prioritisation of mobile optimisation.

- Some data sources, particularly newer SEO‑focused reports, show daily search numbers at 8.5 billion, highlighting discrepancies depending on methodology.

- Google’s persistence above 89% to 91% global share demonstrates resilience despite rising competition from alternative search engines.

- The continuing dominance encourages online businesses and advertisers to lean heavily on Google as a distribution and discovery channel.

Google Market Share Worldwide

- As of late 2025, Google holds about 90.04% of the global search engine market.

- Several reports place its global share between 89.5% and 91.7%, depending on the time frame and data source.

- Its closest rival, Bing, typically holds only about 3–4% share globally.

- Smaller search engines (e.g., DuckDuckGo, Yahoo!) together account for only a few per cent.

- This dominant share underscores Google’s near‑monopoly position in global search.

- For marketers and advertisers, this dominance simplifies strategy; optimising for Google covers the vast majority of search traffic.

- The wide margin ahead of competitors means even small gains in SEO or ad placement on Google can yield large impacts globally.

Daily and Annual Search Numbers

- As of 2025, one estimate suggests Google processes roughly 13.6–14 billion searches per day.

- That figure implies annual search volume exceeding 5 trillion queries worldwide.

- Other estimates are more conservative, putting daily searches at 8.5–8.9 billion, translating to 2–3 trillion annually, depending on the source.

- This broad range reflects differences in tracking methods, for example, sample‑based analytics vs. aggregated global telemetry.

- Regardless of exact numbers, all sources agree that Google handles billions of queries every single day.

- That volume gives businesses and publishers a large, continuous stream of traffic potential if they optimise content correctly.

- Daily fluctuations may occur, and peak traffic during major global events, but the baseline remains consistently high.

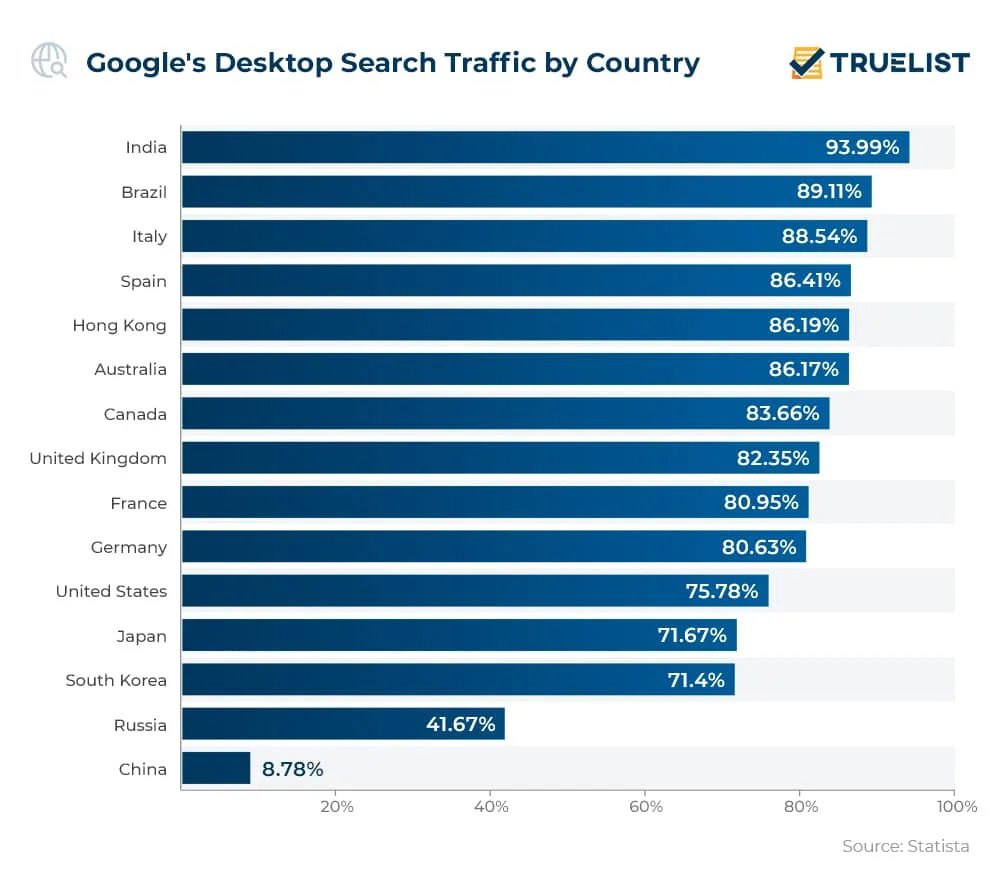

Global Snapshot of Google’s Desktop Search Traffic

- China: Google represents only 8.78% of desktop searches, as strict regulations and dominant homegrown platforms like Baidu continue to shape user behaviour.

- India: Google commands 93.99% of desktop search traffic, showcasing the strongest dominance among all countries examined.

- Brazil: Google captures 89.11% of desktop searches, remaining the primary search engine for the majority of users nationwide.

- Italy: With a substantial 88.54% share, Italy relies heavily on Google for search queries, reflecting deep user trust in the platform.

- Spain: Google oversees 86.41% of the desktop search market, maintaining a consistent presence across Southern Europe.

- Hong Kong: At 86.19%, Google dominates desktop searches as local users prefer its ecosystem over regional alternatives.

- Australia: Google holds 86.17% of desktop search traffic, reinforcing its strong market leadership throughout Oceania.

- Canada: Google secures 83.66% of desktop search usage, highlighting its widespread popularity among North American users beyond the U.S.

- United Kingdom: With 82.35% of the market, Google remains the preferred search engine, demonstrating consistent user loyalty.

- France: Google commands 80.95% of desktop search activity, remaining the dominant choice despite local alternatives.

- Germany: At 80.63% usage, Google upholds a firm stronghold, closely aligning the German market with broader EU trends.

- United States: Google holds 75.78% of the desktop search share, staying dominant while encountering greater competition than in many other countries.

- Japan: Google attains 71.67% of search traffic, preserving strong popularity despite powerful local alternatives.

- South Korea: At 71.4%, Google experiences solid adoption, though platforms like Naver remain significant competitors.

- Russia: Google’s share declines to 41.67%, as Yandex continues to be a major contender in the local search landscape.

Voice Search Usage Trends

- 20.5% of global internet users actively employ voice search in 2025.

- U.S. voice assistant users reach 153.5 million in 2025, rising from 149.8 million in 2024.

- 8.4 billion voice-enabled devices operate worldwide as of 2024.

- 71% of internet users favour voice search over typing when available.

- 32% of consumers conduct voice searches daily for routine queries.

- Smartphones drive 58% of all voice search activity globally.

- 70% of voice searches utilise natural conversational language.

- Over 50% of consumers leverage voice for local business discovery.

- Voice search queries grow at 9% year-over-year worldwide.

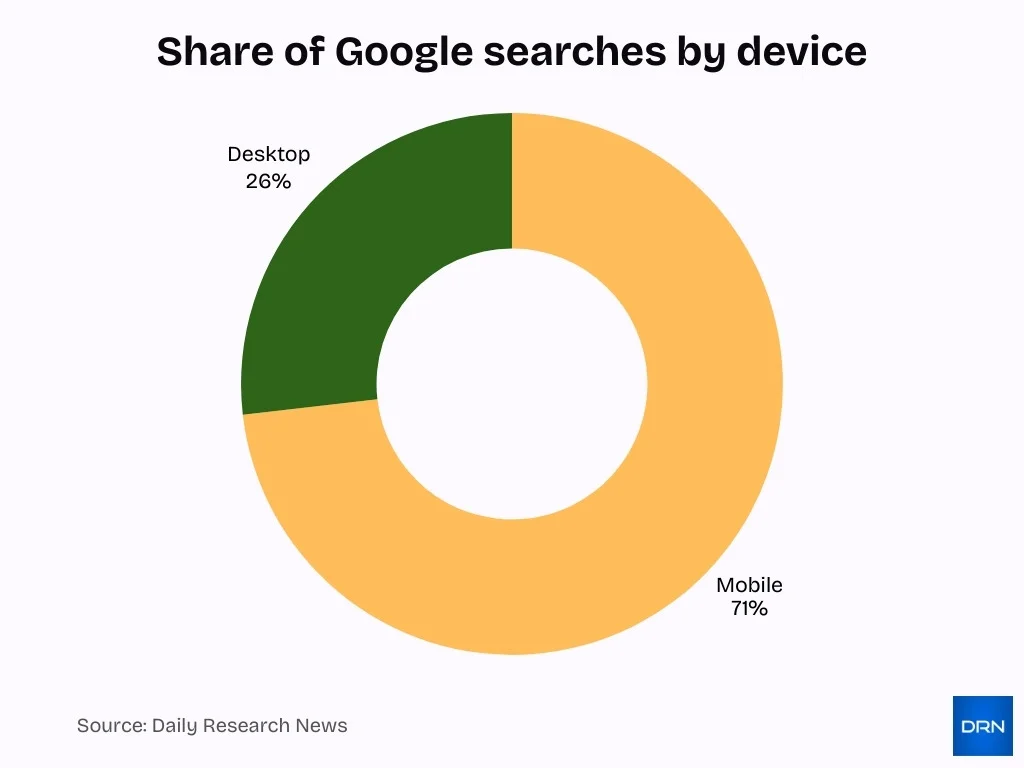

Desktop vs Mobile Search Stats

- As of mid‑2025, about 64% of global web traffic comes from mobile devices, with the remaining 36% coming from desktops.

- One 2025 estimate puts mobile’s share of all Google searches at 71%, up from 68% in 2024.

- Correspondingly, desktop accounts for around 26% of total Google search traffic in that dataset.

- Another global data source shows mobile holds 95.4% of the mobile‑search market, while Google’s desktop share is around 79–82%.

- In broader web traffic (not only Google), but global mobile web traffic share also hit 64.35% in July 2025.

- In the U.S., mobile accounts for over 60% of searches.

- Usage patterns differ; mobile users typically engage in shorter sessions, while desktop users tend to open more pages per session, indicating deeper browsing on desktop.

- The trend continues to shift towards mobile-first searching across most geographies, reflecting widespread smartphone adoption and mobile-optimised behaviour.

Google Lens and Visual Searches

- Google Lens processes 12–20 billion visual searches monthly in 2025.

- Global visual searches surged 70% year-over-year in 2025.

- Google Lens achieved 65% YoY growth with 100 billion searches by mid-2025.

- 12 billion monthly searches use Google Lens as of 2025.

- The visual search market is valued at $41.72 billion in 2024, projected to reach $151.60 billion by 2032.

- Search interest in Google Lens rose 20% YoY to 4.6 million monthly searches.

- 1.5 billion users access Google Lens for visual searches in 2025.

- Visual search users show 20-30% higher conversion rates in e-commerce.

- Asia-Pacific visual search market grows at 25.1% CAGR in 2025.

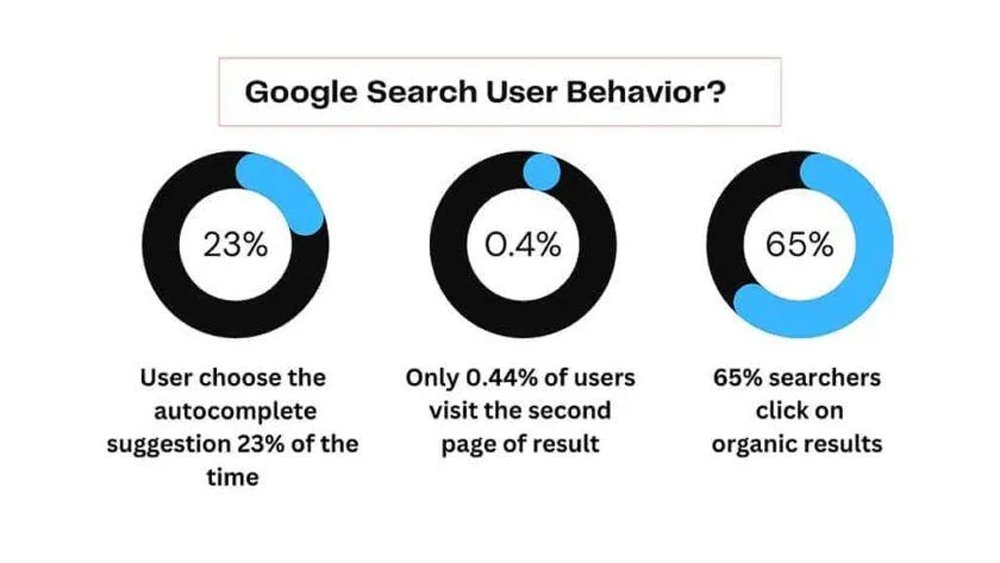

Google Search User Behaviour

- About 65% of searchers click on organic results, emphasising how crucial strong SEO strategies are for attracting user engagement.

- Roughly 23% of users rely on autocomplete suggestions, showing a significant dependence on predictive search for faster query completion.

- Only 0.4% of users proceed to the second page of search results, underscoring the critical importance of securing a page-one ranking.

Zero‑Click Search Rates

- 58.5% of U.S. Google searches result in zero clicks in 2025.

- Global zero-click searches reached 65% of all Google queries in 2024.

- 75% of mobile searches now end without a click, higher than on desktop.

- 77% zero-click rate on mobile versus 47% on desktop searches.

- AI Overviews appear in 13.14% of searches, boosting zero-clicks to 80%.

- News queries saw zero-click rates rise from 56% to 69% year-over-year.

- 60% of global searches end without external clicks per the SEO Bazooka 2025 report.

- 80% of users rely on zero-click features for 40% of their searches.

- Organic traffic drops 15–25% due to rising zero-click searches.

Organic vs Paid Click Stats

- In 2025, about 94% of clicks on Google Search go to organic results, while only 6% go to paid results.

- For standard SERPs (no images, videos, shopping), the #1 organic result has an average click-through rate (CTR) of 39.8%.

- The top paid ad slot (Ad Position 1) delivers a CTR of only about 2.1%, making organic results approximately 19× more likely to be clicked.

- The top 3 organic results together capture roughly 68–69% of all clicks on a results page.

- Across industries, organic search still provides more website traffic than paid search; many businesses report organic search contributing between 33% – 53% of total site traffic in 2025.

- Because of shifts in user behaviour, the impact of organic traffic is under pressure, meaning even high‑ranking content may yield fewer external visits.

- For advertisers using Google Ads, the platform still dominates the pay‑per‑click (PPC) market; in 2025, Google Ads holds approximately 39.4% the PPC market share.

- Some businesses report a modest conversion rate from Google Ads search campaigns (about 4.4%), indicating paid search remains a meaningful, if relatively small, traffic and revenue channel.

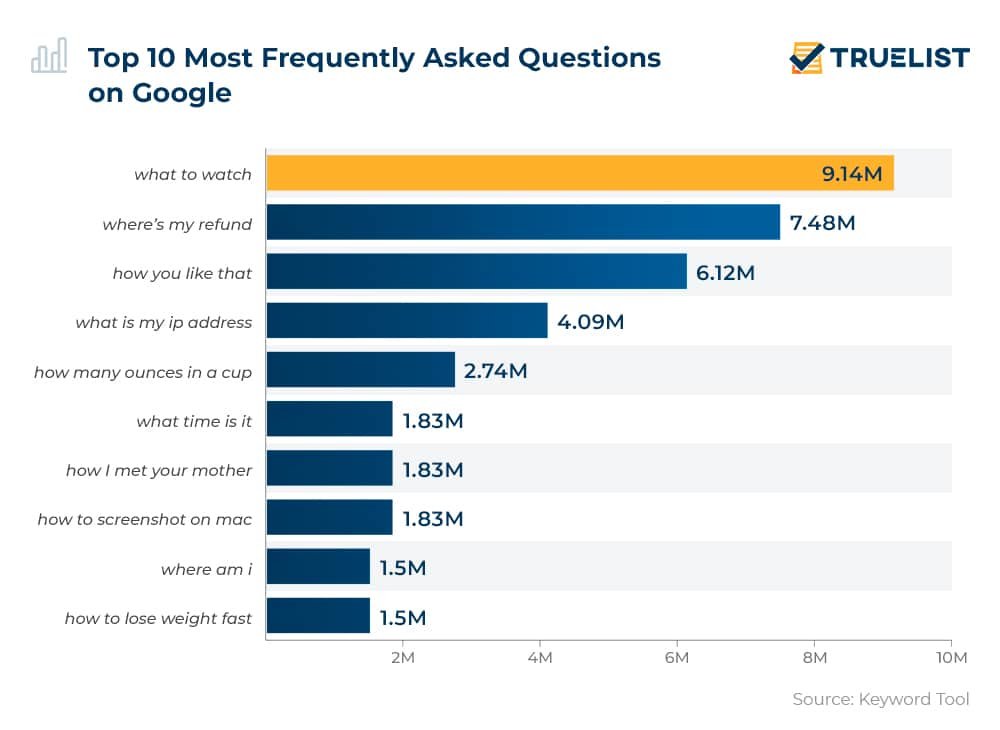

Top 10 Most Frequently Asked Questions on Google

- The #1 most-asked question on Google is “what to watch” with 9.14M searches, showing a major global interest in entertainment recommendations.

- “Where’s my refund” ranks second with 7.48M searches, highlighting widespread concern about tax or payment returns.

- “How you like that” receives 6.12M searches, likely driven by pop-culture trends and media influence.

- Technical inquiries are prominent, with “what is my IP address” generating 4.09M searches.

- A common household measurement question, “how many ounces in a cup,” draws 2.74M searches, indicating a frequent need for quick cooking references.

- Every day, practical questions such as “what time is it” (1.83M) show continued reliance on Google for instant information.

- Entertainment continues to shape queries, with “How I Met Your Mother” also reaching 1.83M searches.

- Basic tech help remains popular: “how to screenshot on Mac” brings in 1.83M searches.

- Questions related to location and personal orientation, such as “where am I,” receive 1.5M searches.

- Health and lifestyle queries appear in the top 10 as well, with “how to lose weight fast” drawing 1.5M searches.

Local Search Intent Data

- 46% of all Google searches have local intent in 2025.

- Over 1.5 billion “near me” searches occur monthly worldwide.

- 76% of people searching for nearby businesses visit within 24 hours.

- 88% of those using smartphones for local searches visit a store within a week.

- 42% of local searchers click on Google Local Pack results.

- 23.6% of clicks go to the top Local Pack position.

- 80% of local searches convert to in-person visits or purchases.

- Nearly 70% of local searches happen on mobile devices.

- 52% of small business traffic comes from organic local search.

User Demographics Overview

- 50% of Google search users fall in the 18-34 age group, dominating mobile searches.

- Users aged 16-24 conduct 25% of searches, with 1 in 4 using voice search on mobile.

- 57.96% of Google users are male, while 42.04% are female across global demographics.

- In Europe, organic search drives 51.93% of traffic, the highest among the analysed regions.

- US organic traffic averages 44.89% in 2025, down 4.5% year-over-year.

- College graduates represent 66% of frequent search engine users by education level.

- Higher-income households ($75,000+) show 62% search usage rates.

- 89% of marketers deem SEO successful for reaching digital audiences.

- Smartphone adoption among 18-34-year-olds in emerging markets rose from 25% in 2013 to higher shares by 2025.

Google Revenue from Search

- Google Search & other generated $48.51 billion in Q2 2024, powering ad revenue growth.

- Advertising accounted for 76.3% of Alphabet’s $84.74 billion total revenue in Q2 2024.

- Google Search & other revenue rose to $54.19 billion in Q2 2025, up from the prior year.

- Alphabet’s Q3 2025 Search & other hit $56.57 billion, up 14.5% year-over-year.

- Google’s total ad revenue reached $264.59 billion in 2023, mostly from search.

- Businesses earn $2 ROI for every $1 spent on Google Ads, per official data.

- Google Ads can yield up to $8 return per $1 invested in some cases.

- Alphabet Q3 2025 total revenue soared 16% to $102.3 billion, led by search ads.

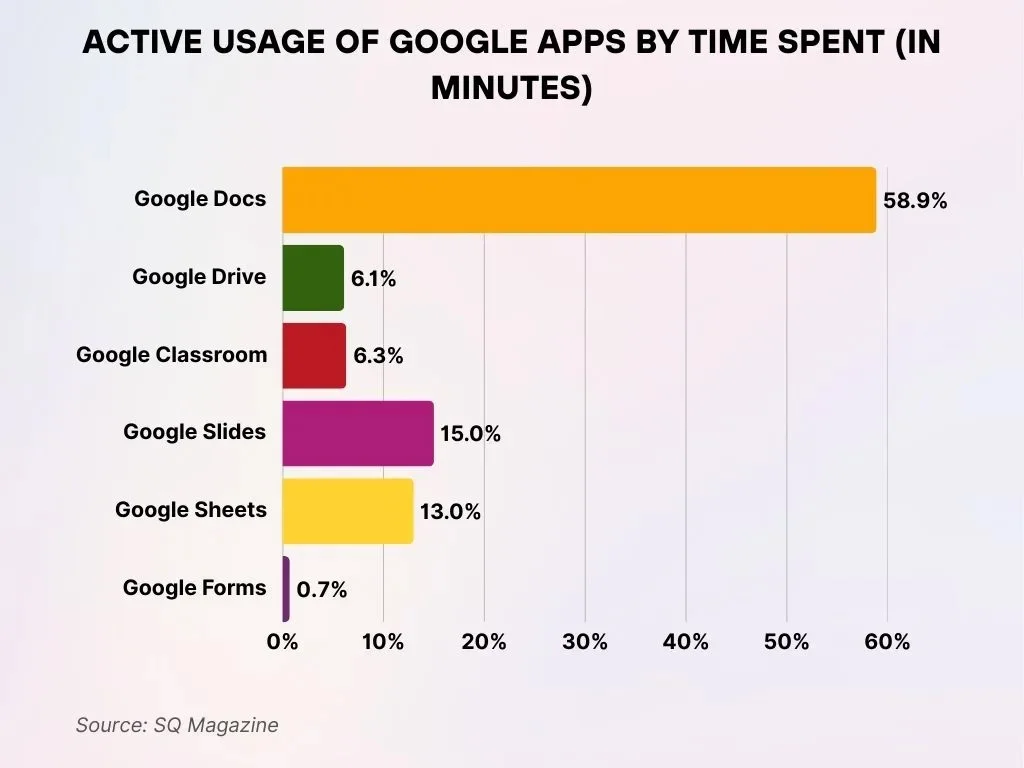

Active Time Spent Using Google Apps (in Minutes)

- Google Forms is shown in the chart, though its exact usage share is not specified, likely representing the remaining 0.7–1%.

- Google Docs stands out as the top tool with 58.9% of total active usage time, emphasising its strong leadership in document collaboration.

- Google Slides represents 15% of usage, indicating significant engagement for presentation creation in academic or professional contexts.

- Google Sheets captures 13%, underscoring its widespread adoption for data management and analysis.

- Google Classroom accounts for 6.3%, reinforcing its importance as a centralised learning management platform.

- Google Drive holds 6.1% of the total usage, reflecting its essential role in file storage and cross-device access.

Competitor Comparison Stats

- Google commands a commanding 89.62% global search market share as of March 2025.

- Bing captures 4.04% of worldwide searches in January 2025.

- Yahoo holds 1.34% of the global search engine market in early 2025.

- DuckDuckGo accounts for just 0.68% globally but reaches 1.96% in the US.

- On desktop, Google has 78.83% while Bing surges to 12.23% worldwide.

- Mobile searches see Google at 93.82% dominance in January 2025.

- In North America, Google dips to 88.58% with Bing at 7.07%.

- Europe gives Google 91.91%, Bing 3.87%, and DuckDuckGo 0.58%.

- China flips the script: Baidu leads at 56.23% all-platforms, Bing 19.23%.

Top Google Domains Traffic

- Google.com commands 18.73% of global web traffic, dwarfing all other domains.

- YouTube.com, a Google property, captures 6.44% of worldwide visits.

- Combined, Google Search, Images, and Maps drive 92.96% of global online traffic.

- 58% of Google searches in 2025 end in zero clicks within Google properties.

- Google.com records 83 billion monthly visits from 3.17 billion unique users.

- Zero-click searches rose to 69% by May 2025, keeping traffic inside Google.

- Top 100 domains claim one-third of all global web traffic.

- Google’s organic traffic share stands at 93.05% of searches in 2025.

- AI Overviews appear in 13.14% of queries, slashing external clicks by 4.8%.

Featured Snippets Impact

- Featured snippets and AI overviews dramatically shift click behaviour, often resulting in zero‑click outcomes as users get answers directly.

- For informational queries with AI Overviews, organic click-through rates dropped by as much as 61%, from 1.76% to 0.61%.

- Paid CTRs dropped by 68% when AI summaries appeared on the same queries.

- Even for queries without AI Overviews, organic CTRs fell by 41%, indicating a broad behavioural shift.

- Brands mentioned directly in AI Overviews still see elevated clicks, gaining 35% more organic and 91% more paid clicks.

- Simply ranking high on search results is no longer sufficient; placement in snippets or summaries is now critical.

- Content optimisation must prioritise structured data, concise formatting, and authoritative positioning to win snippet space.

- Google is transforming from a “click‑through portal” into a “destination in itself,” changing how users interact with the search engine.

Frequently Asked Questions (FAQs)

Google controls about 89.99% of the global search engine market worldwide.

Google processes roughly 16.4 billion searches per day worldwide.

Over 93% of global Google searches come via mobile devices in 2025.

As many as nearly 60% of Google searches result in zero clicks in 2025.

Conclusion

The data paints a detailed picture of how Google continues to shape the global search landscape, and how that landscape is evolving fast. Organic search remains the dominant source of clicks, yet rising zero‑click rates, AI‑driven features, and concentrated domain traffic challenge traditional SEO and referral‑based models. Paid search retains value, especially for commercial intent, but no longer guarantees high visibility.

For businesses, marketers, and content creators, success requires adaptation, optimising not just for rankings but for featured snippets, mobile and local search, and content designed for quick answers. As user behaviour changes, those who adjust their strategies stand to benefit most, and those who don’t risk being left behind.