LinkedIn stands as one of the world’s most influential professional networks. Beyond connecting professionals, it’s a major employer within the tech and business services space, shaping careers and driving corporate growth. The platform’s workforce reflects its strategic priorities, from AI and product engineering to sales and global operations. In industries like talent acquisition and enterprise software, knowing LinkedIn’s workforce trends offers insight into broader labor market dynamics. Let’s explore how many people work at LinkedIn and what that says about the company’s direction.

Editor’s Choice

- LinkedIn employs over 21,500 people globally as of August 2025, reflecting steady workforce expansion.

- The company reported 18,500+ full-time employees in early 2025.

- Engineering roles make up roughly 30% of LinkedIn’s workforce.

- LinkedIn’s workforce grew by about 7.2% year-over-year through 2025.

- LinkedIn operates in 38+ offices worldwide.

- Parent company Microsoft’s layoffs impacted LinkedIn’s roles in 2025.

- US hiring trends on LinkedIn show moderating growth in 2025.

Recent Developments

- LinkedIn continues workforce adjustments amid tech industry turbulence in 2025.

- In 2025, Microsoft cut thousands of jobs, including roles at LinkedIn.

- LinkedIn phased out its Associate Product Manager program in late 2025, impacting recruiting strategies.

- Several Bay Area LinkedIn offices saw 270 jobs eliminated in mid-2025.

- Industry layoffs exceeded 62,000 jobs across tech companies in early 2025.

- LinkedIn is investing in verification and trust initiatives while scaling teams.

- LinkedIn hiring slows in U.S. markets, reflecting broader economic patterns.

Overview of LinkedIn’s Workforce

- LinkedIn’s global staff includes over 21,000 employees by mid-2025.

- The company reported 18,500+ full-time workers in early 2025.

- LinkedIn is headquartered in Sunnyvale, California, with global offices.

- LinkedIn’s workforce is multidisciplinary, spanning engineering to marketing.

- LinkedIn supports a global user base exceeding 830 million members.

- Workforce numbers vary by source due to timing and reporting methods.

- LinkedIn’s employee count is smaller than giants like Microsoft, but still significant in tech.

- LinkedIn’s staffing reflects investments in AI, data, and enterprise products.

Historical Growth in LinkedIn Employee Count

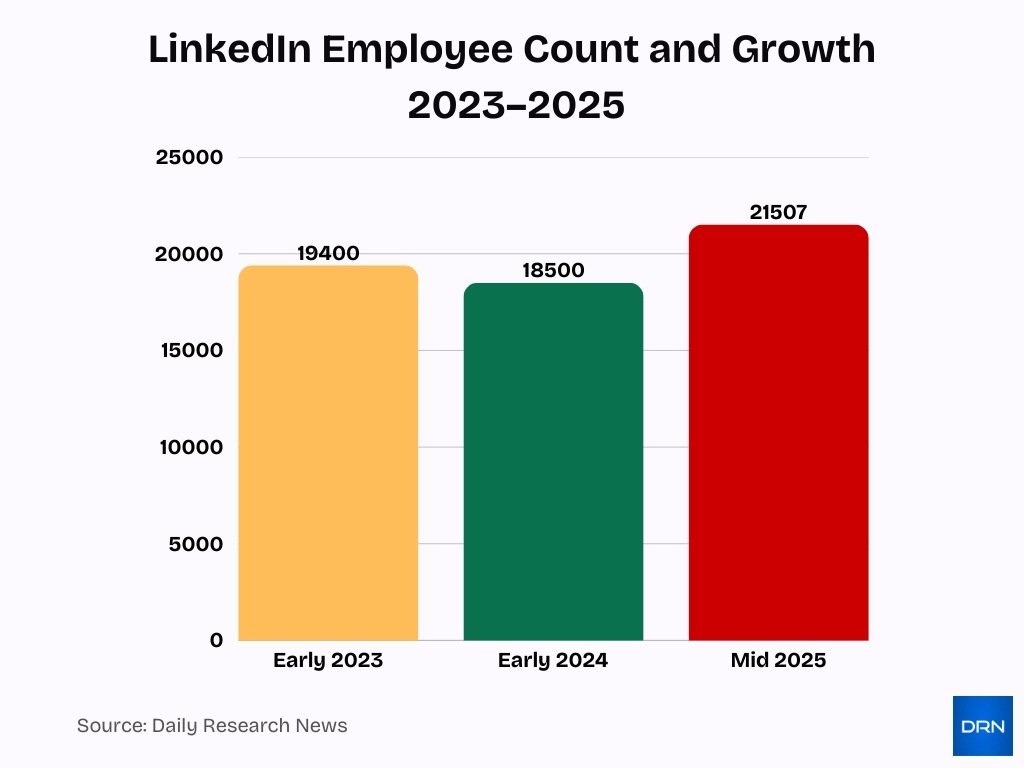

- LinkedIn’s staff grew from around 18,500 in early 2024.

- By mid-2025, headcount climbed to about 21,507, a ~7.2% increase.

- Previous layoffs in 2023 reduced headcount by ~3%.

- Older estimates place LinkedIn’s 2023 staff near 19,400.

- Growth reflects strategic hiring in product and tech roles.

- Workforce expansion aligns with broader business segment growth.

- LinkedIn employment figures vary depending on reporting and timing.

- Continued hiring suggests LinkedIn is prioritizing core offerings.

LinkedIn Employees by Region and Country

- LinkedIn employs 18,500+ full-time staff across 38+ global office locations as of 2025.

- Around 18% of LinkedIn employees are based in the San Francisco Bay Area, with about 9% in New York alone.

- Dublin is a key EMEA hub, hosting roughly 6% of LinkedIn’s global headcount in Ireland.

- The U.S. hosts 12 LinkedIn offices, including Atlanta, New York, San Francisco, Sunnyvale, and Washington, DC.

- LinkedIn lists 35–38+ offices spread across five continents, covering North America, EMEA, APAC, and Latin America.

- Major APAC sites such as Bangalore, Singapore, Shanghai, Beijing, and Sydney support local product and sales teams across the region.

- Key EMEA locations, including Dublin, London, Berlin, Madrid, Milan, Stockholm, Amsterdam, Munich, Paris, and Dubai, anchor a substantial share of regional staff.

- Latin America operations are centered in São Paulo and Mexico City, strengthening regional business growth and customer coverage.

- Toronto and multiple U.S. hubs mean North America contains a significant concentration of LinkedIn’s total workforce.

LinkedIn Offices and Headcount by Location

- LinkedIn maintains 38+ offices across more than 38 cities worldwide.

- Sunnyvale headquarters anchors operations in Silicon Valley with key engineering teams.

- The San Francisco Bay Area hosts ~18% of the total 21,507 global workforce.

- The New York office employs 5,012 employees, representing 9% of headcount.

- Dublin, Ireland, supports 1,281 staff, or 6% of total employees, as the EMEA hub.

- 12+ U.S. offices include hubs in Chicago (875), Omaha (577), and Seattle (241).

- Singapore APAC hub previously grew staff 10-fold to 90+ by 2013.

- Global workforce totals 21,507 employees, up 7.2% year-over-year.

- Engineering leads with 6,529 staff (30%) across major locations.

Employees by Department and Job Function

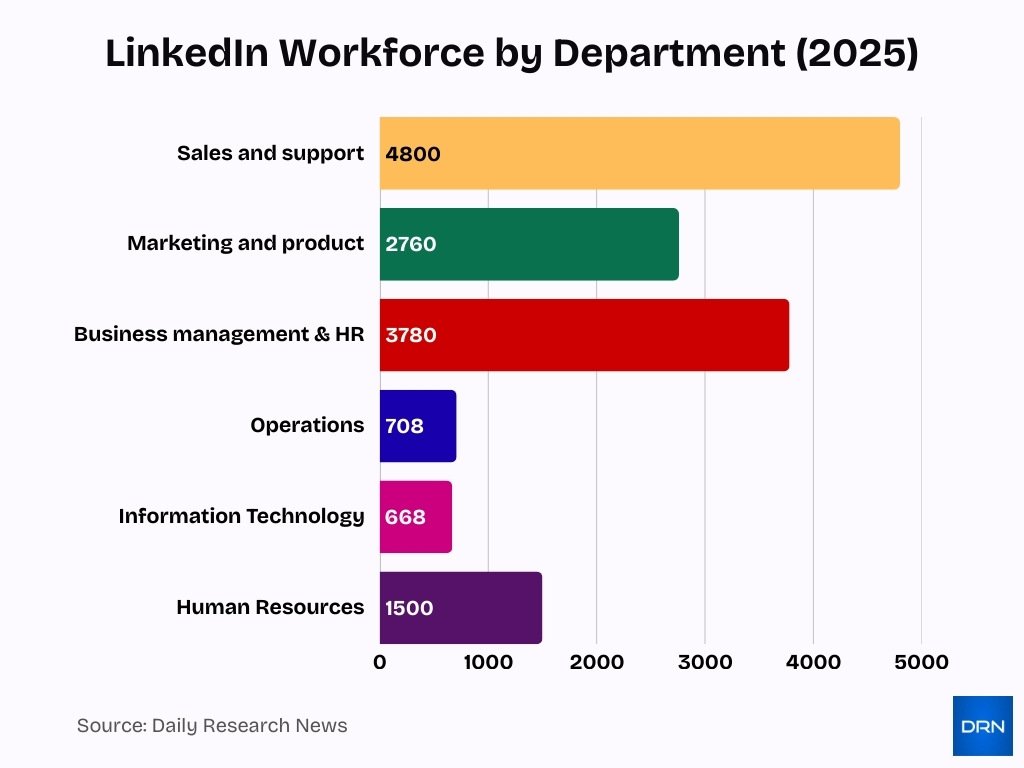

- As of August 2025, LinkedIn employs about 21,500 people, with roughly 30% (6,500+ employees) working in Engineering teams that form the largest department by headcount.

- Sales and Support roles account for around 22% (~4,800 employees), underscoring the focus on revenue-generating hiring and advertising products.

- Combined Marketing and Product functions represent nearly 13% (~2,760 employees), reflecting investment in brand expansion and customer demand generation.

- Business Management and Human Resources together make up about 18% (~3,780 employees), providing core corporate governance and people operations support.

- Smaller but critical groups such as Finance & Administration, Operations, and IT collectively represent under 20% of headcount, enabling scalable back‑office and infrastructure functions.

- The Engineering discipline alone numbers about 6,529 employees, reinforcing a technology‑centric workforce and supporting “full‑stack builder” product team models.

- Around 4,777 staff sit in Sales and Support, including customer success roles that drive enterprise adoption and account growth.

- Dedicated Human Resources teams total about 1,500 employees, partnering with legal and finance to sustain global compliance and governance standards.

- Operations (708 employees) and Information Technology (668 employees) jointly support platform reliability, security, and cross‑functional execution across regions.

Full-Time vs Contract and Contingent Workers

- LinkedIn employs over 18,500 full-time employees worldwide as of 2025.

- The total LinkedIn workforce reached 21,507 employees by August 2025, up 7.2% year-over-year.

- Contingent workers comprise 30-40% of the U.S. labor market in 2025.

- 41% of companies plan to increase contingent worker usage in 2025.

- U.S. staffing firms employed nearly 2 million temporary and contract workers weekly in Q1 2025.

- 38% of the U.S. workforce is contingent, projected to hit 50% in 10 years.

- Contract job listings on LinkedIn surged 26% from 2021 to 2022 levels.

- Global contingent workforce participation grows 25% in 2025.

- 60% of contingent workers voluntarily select flexible arrangements.

- Tech giants like Google hired more contractors than full-time staff by 2018.

Leadership Demographics

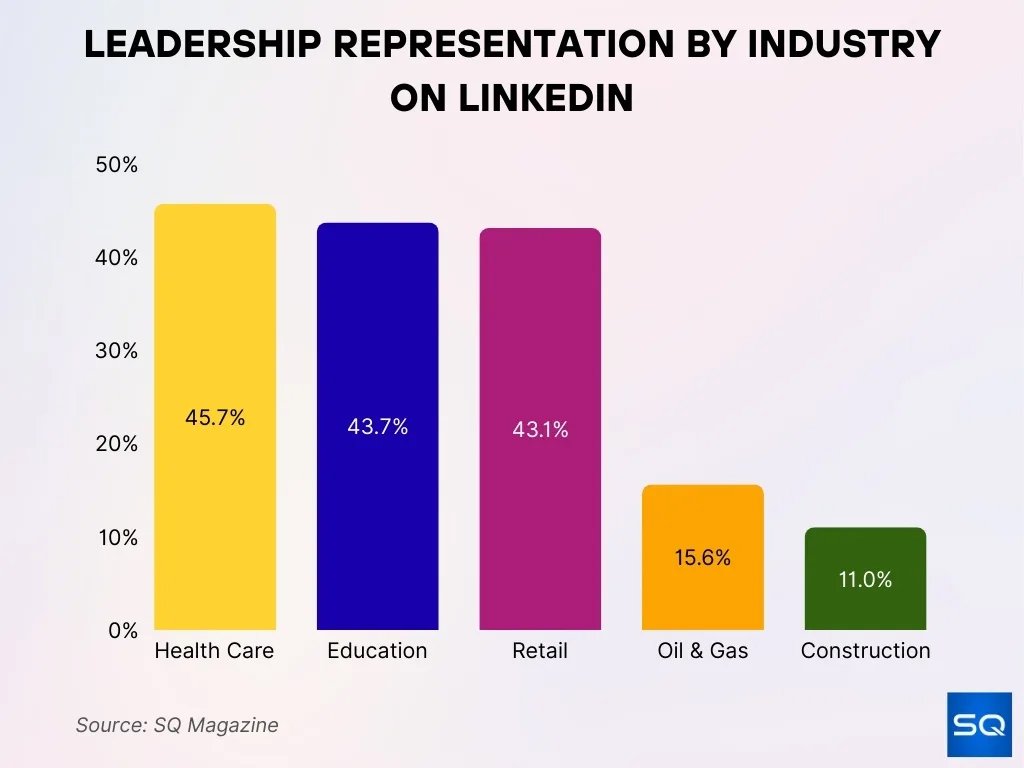

- Women held ~46% of leadership roles at LinkedIn in 2023, reflecting a strong presence in upper-level positions.

- Globally, based on member data from 74 countries, women accounted for just 30.6% of leadership positions compared to 43.4% of all roles, highlighting a significant disparity.

- In the U.S., female leadership reached 34.7%, marking a level higher than the global median.

- Representation gains have plateaued, with yearly progress slowing from ~0.4 percentage points per year (2015–2022) to only 0.2 points combined across 2022–2024.

- Female attrition is more evident at advanced career levels, particularly among older generations.

- Industry-level insights reveal wide variation, with sectors like Health Care (45.7%), Education (43.7%), and Retail (43.1%) showing strong representation, while industries such as Construction (11.0%) and Oil & Gas (15.6%) significantly lag.

Leadership and Management Headcount

- LinkedIn has about 18,500–19,400 employees, with an estimated 1–2% (roughly 180–370 roles) in top leadership positions globally.

- Across 38+ global offices, LinkedIn typically deploys about 1–3 senior managers per hub to oversee local operations and strategy.

- The core C-suite and executive team includes around 8–12 top executives, supported by dozens of VPs and SVPs across major business units.

- If roughly 8–10% of staff are in management, LinkedIn may have 1,400–1,900 managers overseeing engineering, product, and sales teams.

- Assuming 25–30% of managers focus on technology, approximately 350–570 leaders likely support engineering, AI, and data-related functions.

- With users in 200+ countries and 1.1–1.2 billion members, each major region can require dozens of directors and VPs for go-to-market leadership.

- Serving over 1 billion members and 50 million companies, each director/VP can be responsible for portfolios covering tens of millions of users or hundreds of thousands of customers.

- With around 7+ hires per minute on the platform, multiple leadership tiers are needed to manage workforce analytics and labor-market insight teams.

- Operating from roughly 36–38 offices, LinkedIn’s people and DEI leadership typically includes at least one senior HR leader per major hub plus a central global team.

- As membership grew from about 930 million to 1+ billion users, overall leadership headcount scales upward with this 7–8%+ user growth while remaining undisclosed officially.

Most Common Roles and Job Categories at LinkedIn

- At LinkedIn, software engineering and technical roles are estimated to account for around 30–35% of headcount, with about 650 engineers reported across core engineering teams as of 2025.

- Sales and business development roles make up roughly 20–25% of LinkedIn’s workforce, reflecting its reliance on Talent Solutions and enterprise B2B offerings for the majority of revenue.

- Product management and UX/design together are estimated to represent about 10–15% of staff, supporting continuous iteration of the LinkedIn platform experience across web and mobile.

- Marketing and communications roles represent roughly 8–12% of employees, backing global campaigns that help LinkedIn reach more than 1 billion members worldwide.

- Data science, analytics, and AI-related roles are estimated at around 5–10% of LinkedIn headcount, underpinning personalized feeds, recommendations, and economic graph insights.

- Customer success and account management roles together constitute about 10–15% of staff, supporting thousands of enterprise Talent and Sales Solutions clients globally.

- HR, recruiting, and people operations functions make up roughly 5–8% of employees, managing hiring and development for more than 18,500–21,500 staff worldwide.

- Legal, risk, and compliance teams are a smaller but critical segment at an estimated 2–4% of headcount, overseeing operations across 200+ countries and territories where members are active.

Hiring Volume and New Employee Additions

- LinkedIn posted net workforce growth in 2025.

- More than 1,500 new hires were added versus about 1,300 departures.

- Hiring spans engineering, product, sales, and corporate roles.

- Job listings commonly exceed 200 openings.

- AI and data roles lead to new recruitment needs.

- Hiring trends mirror overall tech labor conditions in 2025.

- U.S. metro hiring patterns show moderated but steady activity.

- Open roles range from leadership to early career positions.

What Matters Most to Today’s Job Seekers

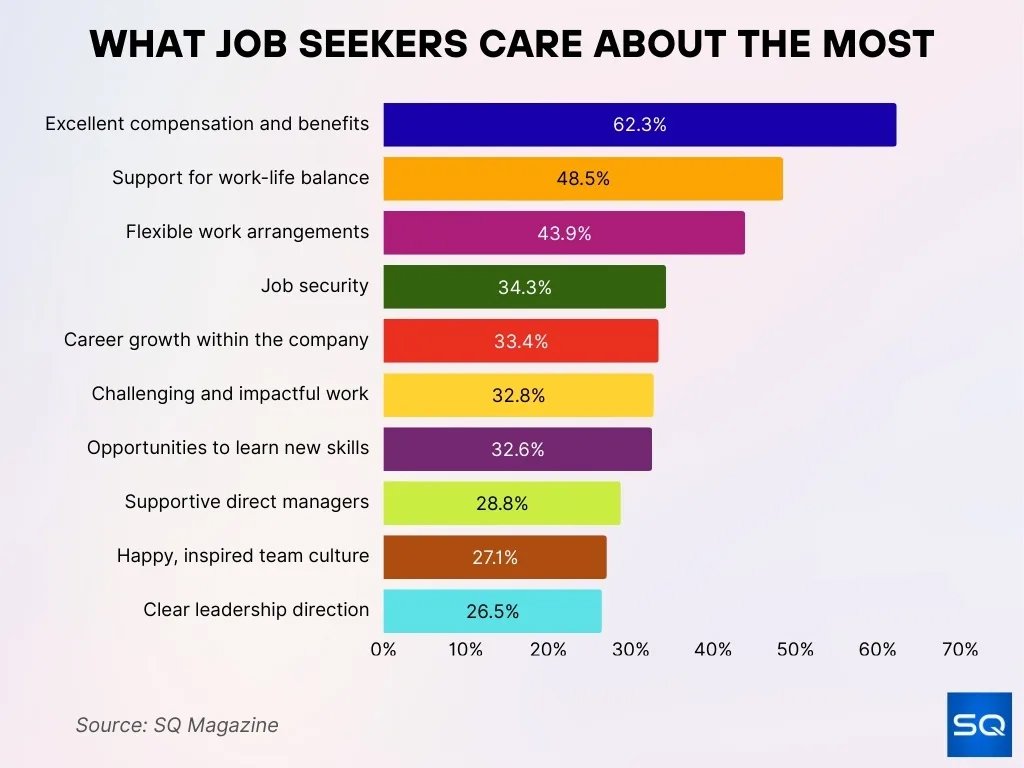

- 26.5% of individuals stress the value of clear leadership direction in the workplace.

- 62.3% of candidates place excellent compensation and benefits as the primary factor influencing their job choices.

- 48.5% of job seekers highly value strong work-life balance support, stressing the importance of flexibility and personal time.

- 43.9% of individuals regard flexible work arrangements as an essential element in their job search.

- 34.3% of applicants identify job security as a critical priority when evaluating opportunities.

- 33.4% of professionals pursue roles offering career growth opportunities within the organization.

- 32.8% of candidates seek challenging and impactful work that delivers a sense of purpose.

- 32.6% of job seekers want roles that provide opportunities to learn new skills for ongoing development.

- 28.8% report that supportive direct managers significantly influence their employment decisions.

- 27.1% are attracted to a happy and inspired team culture when considering new roles.

Employee Turnover, Attrition, and Tenure

- Employees with two years or less tenure are 38% more likely to quit.

- Longer-tenured employees exhibit 75% higher retention rates.

- Tech sector attrition stands at 18.9% in 2025.

- AI growth areas drive 47% of internal mobility shifts.

- Overall, US voluntary turnover averages 13.0% in 2025.

- Retention strategies via upskilling reduce turnover by 25%.

- Early career turnover peaks at 61% within 12 months.

- Skills development programs boost retention by 29%.

- Hospitality turnover reached 58.3% annually in 2025.

Layoffs and Workforce Restructuring at LinkedIn

- In May 2025, LinkedIn cut 270 jobs in Bay Area offices.

- Cuts aligned with Microsoft’s 6,000 role global reduction.

- Over 62,000 tech layoffs occurred industry-wide in early 2025.

- U.S. layoffs exceeded 1.1 million planned cuts in 2025.

- Cuts affected product, engineering, and support functions.

- Industry restructuring emphasizes AI efficiency.

- Companies redirected investment toward cloud and AI capabilities.

- LinkedIn prioritized roles tied to future strategic growth.

Remote, Hybrid, and In-Office Employees

- 48% of the global workforce works at least part of the time.

- 22% of U.S. workers are fully remote.

- 83% of employees prefer hybrid work models.

- Flexible roles attract 15% more women and 33% more underrepresented groups.

- Hybrid work remains a competitive advantage for tech employers.

- Remote work improves satisfaction and retention for many groups.

- Companies introduce new performance strategies to manage hybrid teams.

- Some employers continue pushing for more office presence.

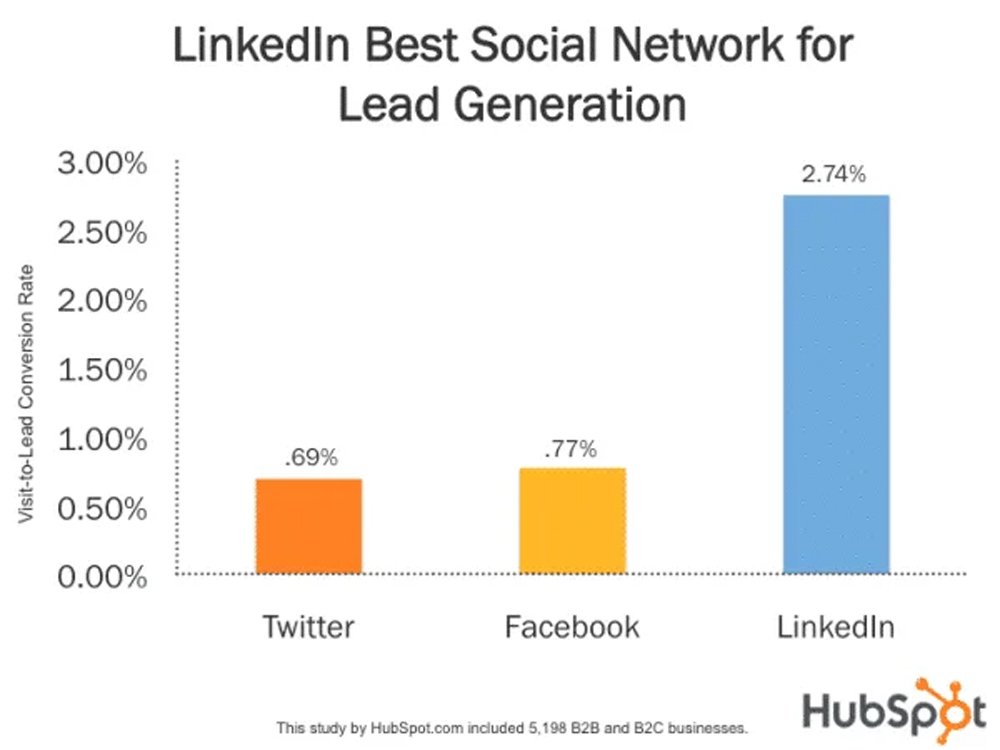

LinkedIn’s Strong Lead in Social Media Lead Generation

- LinkedIn dominates other platforms with a 2.74% visit-to-lead conversion rate, maintaining the highest performance in the study.

- Facebook ranks next with a 0.77% conversion rate, which remains significantly lower than LinkedIn’s.

- Twitter trails the group with merely a 0.69% conversion rate, underscoring its weaker lead-generation capability.

- LinkedIn’s conversion strength is 3.5x higher than Twitter and 3.6x higher than Facebook, emphasizing its superior effectiveness.

- The insights stem from a HubSpot study of 5,198 B2B and B2C businesses, showcasing real-world performance data.

- These results further solidify LinkedIn as the top platform for B2B lead generation in 2025.

Workforce Diversity, Equity, and Inclusion at LinkedIn

- LinkedIn’s global workforce is approximately 47% women, with women in technical roles increasing to 27.8% after an 11% relative gain in recent years.

- Women now hold 49% of LinkedIn’s global leadership roles, up from 42% in FY 2020, showing a strong DEI-focused talent strategy over four years.

- Black employee representation at LinkedIn’s U.S. workforce senior levels grew by 50%+ in one year, reaching 7.2% overall as part of its inclusive hiring commitments.

- Latino representation in LinkedIn’s U.S. workforce increased by 17% year over year to 7.4%, supported by targeted hiring and developmental DEI programs.

- LinkedIn surpassed its goal to double the number of U.S. Black senior ICs, managers, and leaders, reaching 124% of its FY 2025 commitment by FY 2024.

- The company reached 82% of its goal to double senior-level Latino employees by FY 2024, and more than doubled Latino leaders above Director level in four years.

- Globally, employers that post about diversity on LinkedIn see 26% more applications from women, supporting LinkedIn’s emphasis on inclusive employer branding.

- Companies with a dedicated DEI team on LinkedIn attract significantly more interest, with data showing they receive more diverse candidates than those without such teams.

- LinkedIn data shows women are 28% less likely than men to have a strong network, but women are 32% more likely to take networking courses on LinkedIn Learning to close this gap.

- Leadership hiring often comes from internal mobility and referrals, two of the least diverse channels, so LinkedIn tracks leadership pipeline diversity and succession slates to improve representation.

Future Outlook for LinkedIn’s Workforce Size

- LinkedIn currently employs over 18,500 full-time workers worldwide as of April 2025.

- U.S. hiring rates dropped 3.5% in September 2025 from the prior month, signaling slower demand.

- The Technology sector hiring was down 2.8% year-over-year in September 2025.

- AI Engineer tops LinkedIn’s 2025 fastest-growing jobs list with 62.8% remote/hybrid options.

- Head of AI roles tripled over the past five years, growing 28% in 2023.

- 68% of skills are expected to change by 2030 due to generative AI.

- LinkedIn posts mentioning AI saw 17% higher application growth over two years.

- Flexible work policies make employers 16% more likely to attract LinkedIn candidates.

- Hiring is projected to remain steady at 2025 levels into 2026, focusing on high-value AI roles.

- Data science jobs are forecast to grow 36% from 2023–2033.

Frequently Asked Questions (FAQs)

LinkedIn had more than 18,500 full-time employees globally in 2025.

LinkedIn’s estimated total workforce reached approximately 21,507 employees in 2025, showing ongoing growth.

LinkedIn’s workforce grew by about 7.2% year-over-year as of August 2025.

LinkedIn’s Irish unit has 2,000+ employees, making it its largest office outside the United States.

Conclusion

LinkedIn’s workforce reflects both expansion and adaptation to broader tech industry trends. While layoffs and restructuring touched portions of its staff, the company’s core employee count remains healthy and continues to grow at a measured pace. Hybrid and remote work patterns reshaped how LinkedIn attracts and retains talent, promoting inclusive pathways that support diversity and global representation.

Compared to larger tech giants, LinkedIn’s headcount is smaller but strategically aligned with its platform-centric business model. As hiring evolves in the face of economic headwinds and competitive talent markets, LinkedIn’s workforce strategies will likely balance innovation with stability.