Spotify continues to be one of the world’s largest audio streaming platforms, shaping how millions listen to music and podcasts globally. The company’s workforce has seen considerable changes in recent years as it balances expansion with cost efficiency. Spotify’s staffing trends not only reflect internal strategic shifts but also broader tech-sector dynamics like remote work and talent optimization. These trends influence everything from product innovation teams in Stockholm and New York to regional support hubs serving millions of subscribers worldwide. Read on for detailed, data-driven insights into Spotify’s workforce.

Editor’s Choice

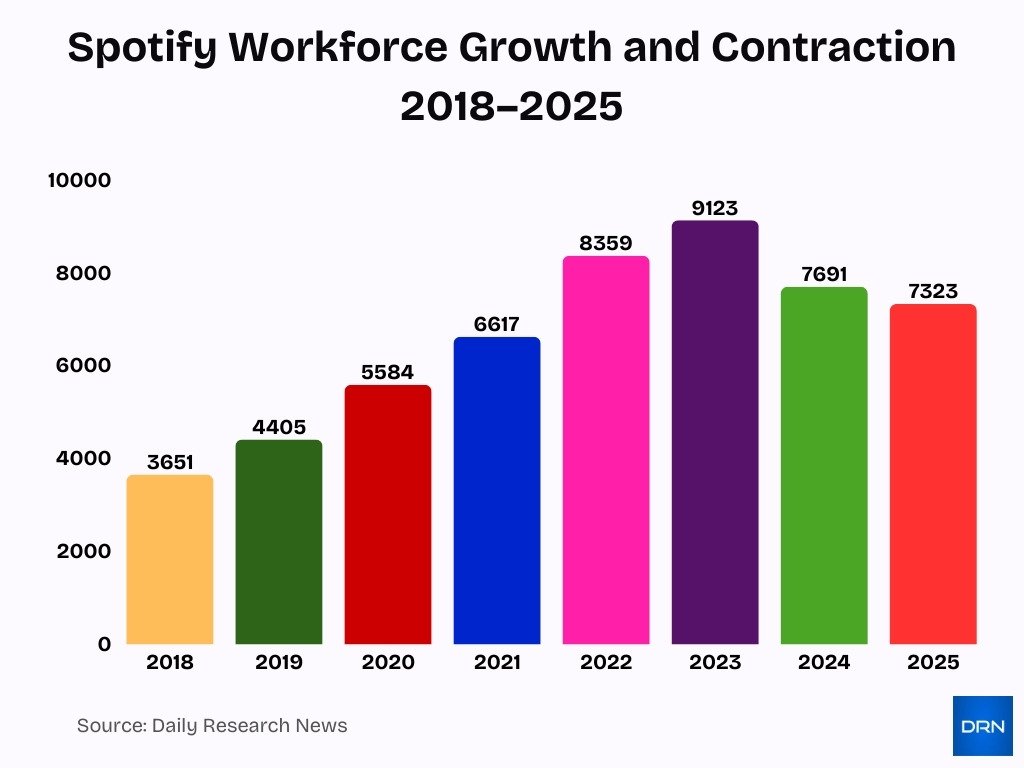

- As of September 2025, Spotify employed approximately 7,323 people globally.

- In 2024, the total Spotify workforce stood at 7,691 employees, down from 9,123 in 2023.

- Spotify’s workforce contracted by around 15.7% between 2023 and 2024.

- By Q2 2025, Spotify’s staff count was about 7,309 worldwide.

- Spotify reported its first full-year profit in 2024, a significant milestone tied to workforce restructuring.

- The company operates in more than 180 markets globally.

- Spotify’s user base reached 713 million active accounts in 2025.

Recent Developments

- In December 2023, Spotify announced a major organizational change, reducing its total workforce by about 17% to improve long-term sustainability.

- The headcount decline was part of a strategy to align operations with economic realities and profitability goals.

- By mid-2025, staff levels had further declined, reflecting a continued focus on operational efficiency.

- Spotify posted its first full-year profit in 2024, signaling a shift in corporate priorities.

- The company reaffirmed a Work From Anywhere policy, aiming to boost flexibility and retention.

- Leadership emphasized optimizing talent deployment rather than returning to traditional office mandates.

- Spotify’s staffing adjustments came amid slower global economic growth and tech sector hiring recalibrations.

- Despite workforce cuts, Spotify maintained focus on expanding user engagement and content offerings.

Spotify Employee Count Overview

- 2025: 7,323 employees (September estimate).

- Q2 2025: 7,309 employees globally.

- 2024 annual: 7,691 full-time employees.

- 2023 annual: 9,123 employees, marking an earlier peak staffing.

- 2022: 8,359 employees.

- 2021: 6,617 employees, showing a rapid growth period.

- 2020: 5,584 employees.

- Spotify’s workforce more than doubled from 2018 to 2023 before recent reductions.

Workforce Over Time

- Spotify’s workforce grew consistently from 3,651 employees in 2018 to 5,584 in 2020, reflecting steady global expansion and platform development.

- Hiring accelerated between 2021 and 2022, with headcount rising from 6,617 to 8,359 employees as the company invested heavily in content, technology, and new markets.

- The workforce peaked in 2023 at 9,123 employees, marking the height of Spotify’s growth-driven hiring phase.

- In 2024, employee numbers declined to 7,691, signaling the start of a strategic pullback.

- The contraction continued into 2025, with staff levels falling further to around 7,309–7,323 employees.

- Overall, this shift highlights Spotify’s transition from aggressive expansion to a stronger focus on cost control, efficiency, and long-term sustainability in a maturing streaming market.

Spotify Employees by Region

- As of Q2 2025, Spotify employed 7,309 full-time staff across 184+ markets, reflecting a leaner but still global workforce footprint.

- Spotify averaged 7,691 employees worldwide in 2024, down from 9,123 in 2023 as restructuring shifted headcount across key regions.

- The U.S. and Europe together account for roughly 53% of Spotify users and about 67% of revenue, indicating a heavy concentration of regional employees in these hubs.

- Spotify maintains around 15–16 offices globally, with major employee clusters in Stockholm, New York, London, and San Francisco supporting regional operations.

- In addition to core regions, an average of about 1,294 employees and contractors in 2022 were spread across countries, including India, Brazil, Canada, Japan, and the UAE, underscoring broader regional staffing.

- Spotify operates in 180+ markets worldwide, requiring distributed teams for local support, content, and engineering functions.

- As of 2024, thousands of Spotify employees were based in the United States, with Sweden and the United Kingdom also hosting sizable regional workforces.

- A distributed-first, work-from-anywhere model helped cut attrition by about 15%, allowing regional teams outside the U.S. and Europe to grow more flexibly.

- Over 60% of employees participated in Spotify Gives Back programs in 2023, indicating strong global engagement across its regional offices and remote workforce.

Spotify Employees by Department

- In 2024, Spotify’s average headcount by department showed Research and Development as the largest group with 3,944 employees.

- Sales and Marketing comprised 2,177 employees in 2024.

- Content Production and Customer Service accounted for 502 staff in 2024.

- General and Administrative functions included 1,068 employees in 2024.

- Between 2022 and 2024, research roles grew by 13%.

- Sales and Marketing roles saw a 9% contraction in 2024.

- Content and customer operations saw a 24% decline year over year.

- Administrative roles dropped 20% in 2024.

- Spotify’s department breakdown reflects a shift toward core engineering and product functions.

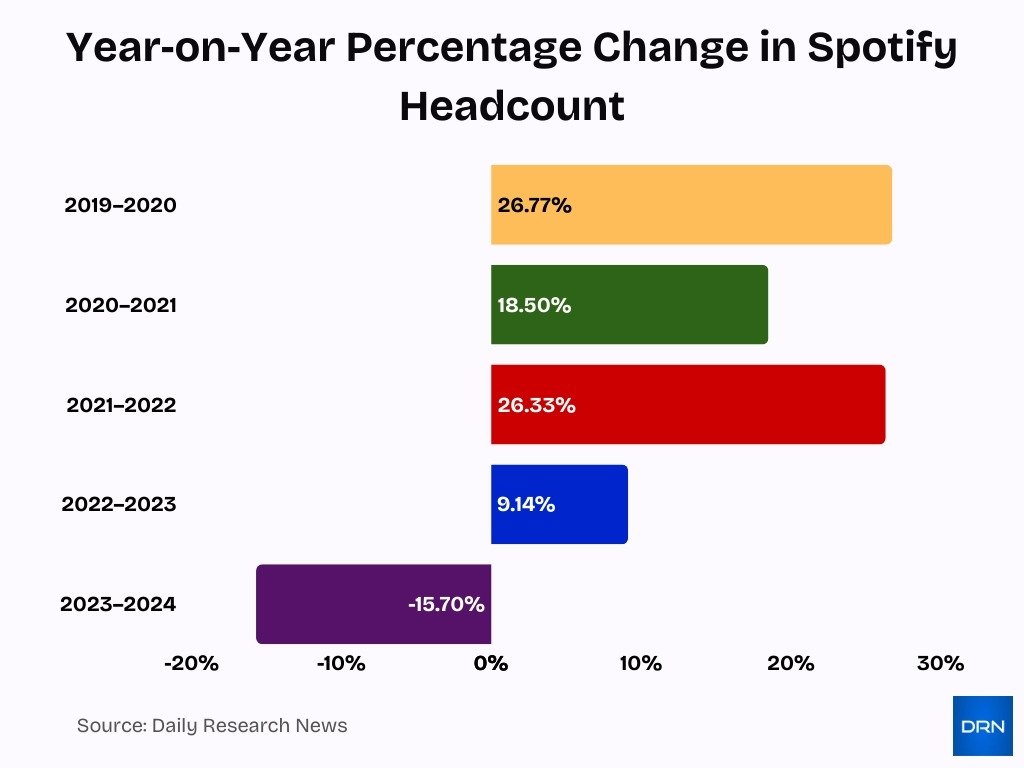

Year-on-Year Change in Spotify Staff

- 2023 vs 2022: +9.14% increase in staff.

- 2024 vs 2023: −15.7% decrease in employees.

- From 2022 to 2023, Spotify added 764 roles.

- From 2023 to 2024, Spotify reduced 1,432 roles.

- 2019 to 2020: +26.77% growth.

- 2020 to 2021: +18.5% growth.

- 2021 to 2022: +26.33% growth.

- Spotify’s longer-term pattern shows rapid expansion through 2023, then strategic contraction.

Engineering and Product Headcount at Spotify

- Engineering and product teams made up the largest proportion of Spotify’s workforce in 2024, with 3,944 staff.

- This group represented roughly 51% of total employees in 2024.

- Investment in product and tech roles underpins personalization, AI features, and platform development.

- Engineering headcount grew 13% from 2022 to 2023.

- Contraction in 2024 was proportionally lower in tech than in non-tech areas.

- Engineering hubs span Stockholm, New York, and London.

- Product teams collaborate globally across 180+ markets.

- Continued focus on AI and personalization shapes priorities in 2025.

Content, Creator, and Partnerships Teams at Spotify

- Content, creator, and partnerships headcount fell 24% in 2024 to 502 employees, down from about 660 a year earlier.

- This reduction was part of a broader 15.7% company-wide headcount cut from 9,123 staff in 2023 to 7,691 in 2024.

- Spotify’s global workforce had previously grown 3× in five years, from 3,651 employees in 2018 to 9,123 in 2023, before these cuts hit content-facing teams.

- Audiobook listeners on Spotify in key markets (U.S., U.K., Australia) grew 30% year over year, boosting demand for specialist content and creator roles before the 2024 restructuring.

- Audiobook listening hours on Spotify increased by 35%+ year over year in the U.S., U.K., and Australia, intensifying workloads for content and partnerships managers.

- Spotify’s English-language audiobook catalog nearly tripled to 400,000+ titles within about a year, expanding relationships with publishers and rights holders.

- Spotify now operates in 180+ markets worldwide, requiring content, creator, and partnerships teams to coordinate campaigns across North America, Europe, and other regions.

- The platform serves 713 million total users, including 281 million subscribers, making creator and partnership functions central to managing high-impact artist and label relationships.

- Spotify’s workforce cuts of around 17% in one 2023–2024 round translated to roughly 1,500 roles, heavily affecting podcast and content operations hubs like New York and Los Angeles.

- Despite reductions, Spotify generated its first full-year profit in 2024, signaling that streamlined content and partnership teams helped optimize overall content spend efficiency.

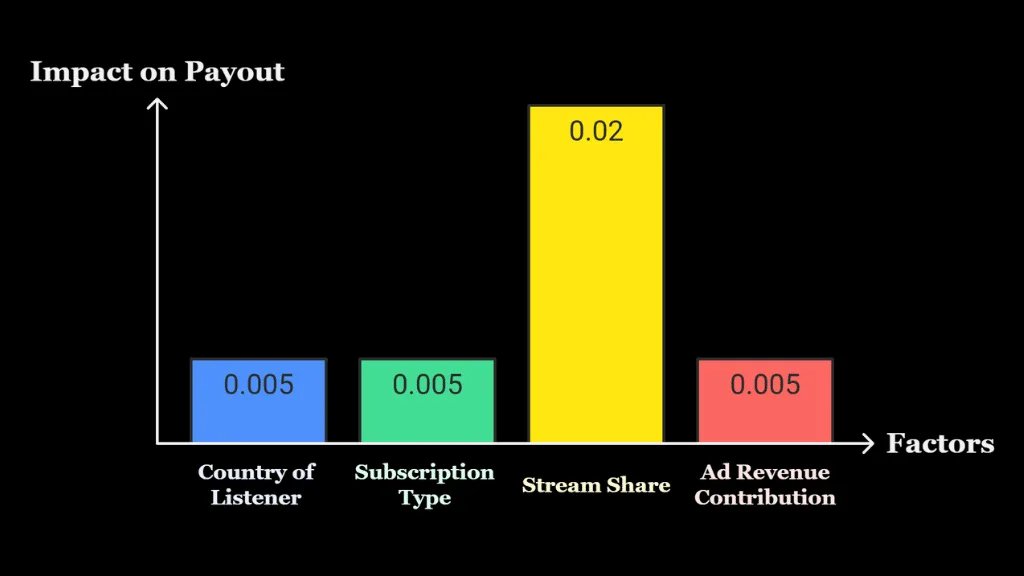

Primary Determinants Influencing Spotify Artist Revenue Distribution

- The listener’s country plays a meaningful role in determining payouts, influencing revenue calculations with a weight of 0.005.

- The subscription type, whether free or premium, exerts an equal level of influence on payouts, carrying a weight of 0.005.

- Stream share represents the most significant factor, assigned a weight of 0.02, which establishes it as the primary driver of artist payouts.

- Ad revenue contribution further affects overall payouts by adding an extra impact valued at 0.005.

Business, Sales, and Marketing Staff at Spotify

- Spotify’s sales and marketing headcount stood at 2,177 employees in 2024.

- Sales staff reductions cut 17% of the total workforce, impacting 1,500 jobs in 2024.

- Total employees dropped to 7,691 in 2024, down 15.7% from 9,123 in 2023.

- Advertising revenue reached €1.85 billion in 2024, up 10% year-over-year.

- Sales and marketing costs fell to €1.49 billion in 2024, a 9% reduction from 2023.

- Premium subscribers grew to 281 million by Q3 2025, fueling subscriber growth teams.

- Global ad revenue forecast hit $2.1 billion in 2024, rising 13% annually.

- Marketing spend decreased 7% to €1.5 billion in 2023, continuing into 2024 with efficiencies.

- Podcast ad growth outpaced music ads, boosting sales roles demand in 2024.

Corporate, HR, and Support Employees at Spotify

- General and Administrative functions accounted for 1,068 employees at Spotify in 2024.

- G&A expenses reached €448 million in Spotify’s 2024 annual report.

- Spotify’s corporate functions shrank by 20% in 2024 amid restructuring efforts.

- Total workforce dropped to 7,691 employees globally by the end of 2024, down 15.7% YoY.

- HR teams support the Work From Anywhere policy, reducing attrition by 15% through flexible operations.

- Spotify executed 17% headcount reduction in late 2023, impacting 1,500 roles, including support functions.

- Legal and finance teams managed €112 million in G&A costs during Q3 2024.

- Support roles in customer service adapted to 263 million Premium subscribers by Q4 2024.

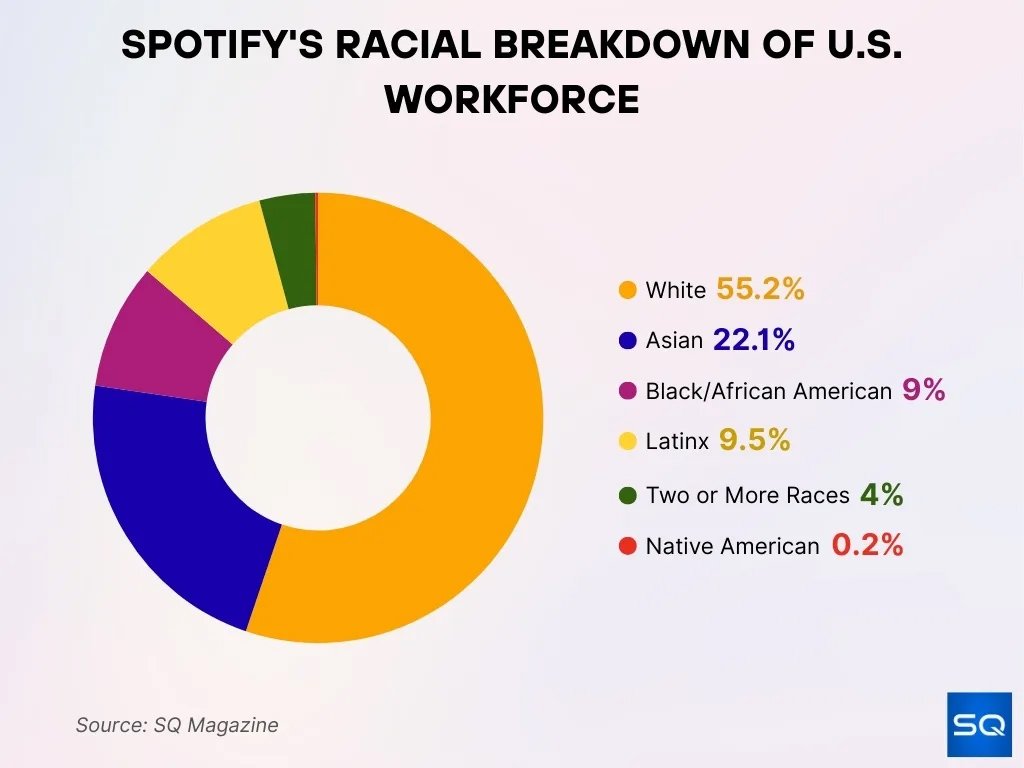

Spotify Employee Demographics and Diversity

- U.S.-specific racial composition reflects 55.2% White, 22.1% Asian, 9% Black/African American, 9.5% Latinx, 4% two or more races, and 0.2% Native American, highlighting the diversity distribution across the U.S. workforce.

- Spotify’s U.S. workforce racial profile outlines a structured view of employee representation across multiple racial and ethnic groups within the organization.

- In 2022, the overall workforce consisted of 53.9% male, 45.7% female, and 0.4% non-binary, demonstrating gender representation across employees.

- Leadership roles at the director level and above were composed of 57.9% male, 41.9% female, and 0.2% non-binary, indicating gender balance trends in senior positions.

- Within R&D, female representation increased from 27.4% in 2019 to 32% in more recent reporting, signaling measurable progress over time.

- Spotify supports 16 belonging communities, designed to empower underrepresented identities and strengthen inclusive engagement.

- The 2024 Equity & Impact report reaffirms that inclusion remains a core pillar of Spotify’s organizational culture.

- Spotify’s membership in the Valuable 500 highlights its ongoing commitment to disability inclusion and accessible workplaces.

Revenue per Employee at Spotify

- Revenue per employee reached $2.04 million in 2024 with €15.67 billion in revenue and 7,691 employees.

- Headcount dropped 15.7% from 9,123 in 2023 to 7,691 in 2024, boosting the ratio.

- Q3 2025 revenue hit €4.3 billion, up 12% year-over-year on constant currency.

- Employee count stabilized at 7,309 full-time staff by Q2 2025.

- LTM revenue per employee averaged $2.0 million as of late 2025.

- This exceeds many media peers, signaling superior capital efficiency.

- 281 million subscribers drove 12% premium growth in Q3 2025.

- 713 million MAUs reflect high engagement, supporting productivity.

- Operating income soared to €582 million in Q3, up significantly.

Profit per Employee at Spotify

- Spotify achieved a €148,000 profit per employee in 2024 with €1.138 billion net income and 7,691 average employees.

- Workforce dropped 15.7% from 9,123 in 2023 to 7,691 by end-2024, boosting per-employee profit.

- 2023 profit per employee lagged at roughly negative €55,000 amid €532 million net loss and higher headcount.

- Q4 2024 operating income hit €477 million, equating to €65,600 per employee.

- Q3 2025 delivered €582 million operating income, signaling €80,000 annualized profit per employee.

- Gross margin soared 555 bps to 32.2% in Q4 2024, directly aiding per-employee profitability gains.

- Headcount stabilized at 7,300 in 2025 while earnings grew, lifting profit per employee further.

- Subscriptions reached 263 million in 2024, underpinning profit growth at €148,000 per employee.

- 17% workforce cut in 2023 (1,500 jobs) set the stage for 2024‘s leaner, profitable structure.

Spotify Workforce Compared to User Base

- In September 2025, Spotify had 713 million total users and 281 million subscribers.

- With 7,323 employees, Spotify supports about 97,000 users per employee.

- Users grew around 11% year over year by Q3 2025.

- Subscribers increased by about 12% year over year.

- User growth continues to outpace headcount growth.

- Platform automation enables scale with fewer staff.

- Support demands rise while staffing stays lean.

- The ratio underscores operational efficiency.

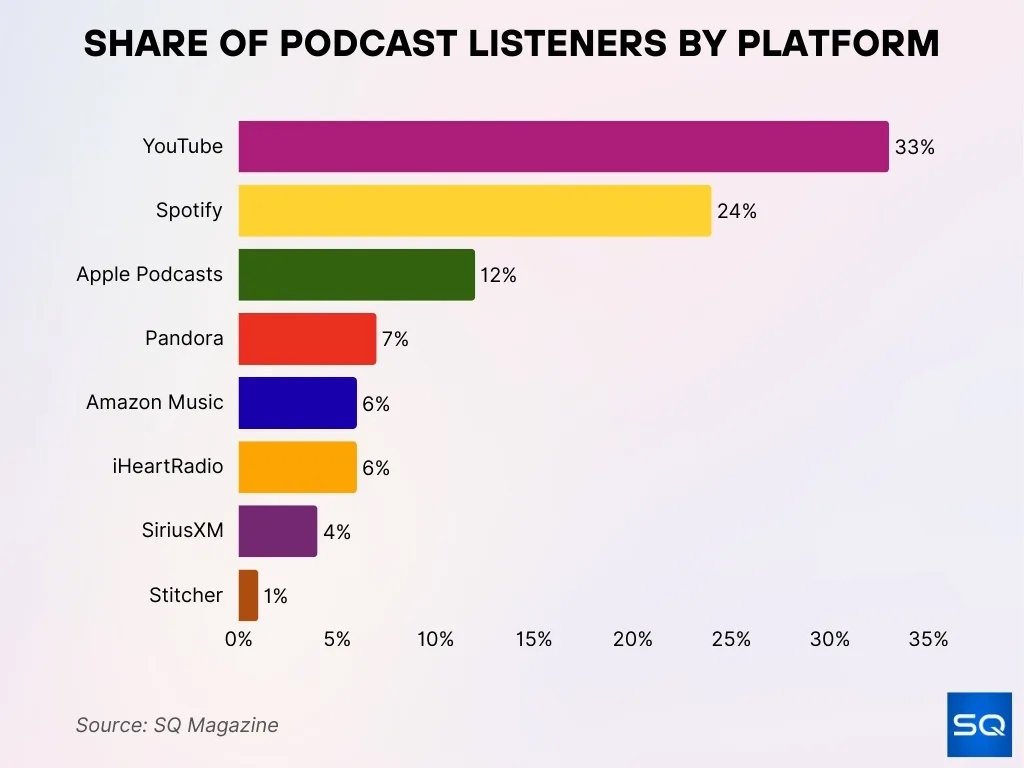

Distribution of Podcast Audience Across Listening Platforms

- YouTube dominates the landscape by attracting 33% of monthly podcast listeners, positioning it as the leading platform for podcast consumption.

- Spotify secures 24% of the audience, firmly establishing itself as the second most widely used platform for podcasts.

- Apple Podcasts accounts for 12% of total listeners, maintaining a notable share of the podcast market.

- Pandora holds 7%, while Amazon Music and iHeartRadio each capture 6% of the overall podcast audience.

- SiriusXM represents 4% of listeners, whereas Stitcher registers a minimal share of just 1%.

Percentage of Workforce Cut in Major Layoffs

- The December 2023 layoff equaled about 17% of the workforce.

- January 2023 cuts represented 6%.

- Mid-2023 reductions added 2 to 3%.

- Combined 2023 layoffs totaled nearly 25%.

- Cuts varied by department.

- Reductions exceeded typical attrition rates.

- Layoffs prioritized financial health.

- Workforce size reset toward sustainable levels.

Spotify Workforce Restructuring Timeline

- Spotify cut 600 jobs in January 2023, representing 6% of its workforce.

- Spotify eliminated 200 positions in June 2023, about 2% of staff, mainly from podcasts.

- December 2023 layoffs slashed 17% of the workforce, affecting 1,500 employees.

- The total 2023 reductions exceeded 2,300 employees, dropping headcount from the peak.

- Workforce fell from 9,123 at end-2023 to 7,691 by end-2024, a 15.7% decline.

- 2024 saw 1,432 fewer employees amid continued optimization efforts.

- Headcount reached 7,309 by Q2 2025, stabilizing post-reductions.

- Restructuring enabled the first full-year profit in 2024 with €1.14B net income.

- Work-from-anywhere policy cut attrition by 15% during downsizing.

Remote and Hybrid Workers at Spotify

- Spotify’s Work From Anywhere program, launched in 2021, gives over 6,500 employees flexibility to work fully remote, office‑based, or hybrid across global locations.

- After adopting Work From Anywhere, Spotify recorded a 15% drop in attrition in Q2 2022 compared with 2019, signaling stronger retention among remote and hybrid staff.

- Roughly 50% of new hires in 2021 were based outside main hubs such as Stockholm, New York, and London, showing how remote roles broadened talent reach.

- Since Work From Anywhere began, Spotify’s time‑to‑hire decreased from 48 to 42 days, aided by remote recruiting across more markets.

- Remote and hybrid work contributed to hiring in 42 U.S. states and multiple countries, including Germany, Spain, and the Netherlands, deepening workforce diversity.

- Spotify maintains around 15–16 offices worldwide, with major hubs in Stockholm, New York, and London, while remote staff operate beyond these locations.

- By 2022, Work From Anywhere supported operations in 184 markets, enabling distributed teams in tech, marketing, and operations to serve local audiences.

- Following the remote shift, about 6% of employees relocated to new cities or countries, still retaining full roles under the flexible policy.

- Remote‑friendly hiring helped grow headcount from 6,617 employees in 2021 to 8,359 in 2022, reflecting expansion powered by flexible work.

- Leadership’s backing of Work From Anywhere is tied to measurable outcomes like a 15% attrition decline and six‑day faster hiring, reinforcing flexibility as a core retention lever.

Frequently Asked Questions (FAQs)

Spotify has about 7,309 full‑time employees as of Q2 2025.

At the end of 2024, Spotify’s employee count was 7,691, down from previous years.

Spotify’s headcount declined by approximately 15.7% between 2023 and 2024.

Spotify’s workforce peaked at 9,123 employees in 2023 before reductions.

Conclusion

Spotify’s workforce reflects a deliberate shift from aggressive expansion to strategic optimization. Workforce reductions, particularly the 17% cut in late 2023, reshaped staffing as the company pursued profitability. At the same time, subscriber growth and engagement continued to rise, improving efficiency metrics such as users per employee. Spotify’s Work From Anywhere policy and diversity initiatives signal evolving workplace priorities in a global organization.

As Spotify balances scale, talent strategy, and financial performance, workforce trends will remain a key signal for investors, employees, and industry observers alike.