The iPhone remains one of the most influential consumer electronics products worldwide; its performance reflects both consumer preferences and broader trends in mobile technology. The continued strength of iPhone shipments and its revenue share underscores how the brand still drives the global smartphone market. For instance, companies building apps for iOS rely on a large installed base to justify their investment, and carriers structure upgrade and subsidy strategies around predictable iPhone sales cycles. Read on for detailed data and analysis.

Editor’s Choice

- Apple shipped 225.7 million iPhones in 2024, showing a slight decline from 2023.

- The iPhone contributed 51% of Apple’s total revenue in 2024.

- Global smartphone shipments in 2025 are projected to rise 3.3% year-over-year, driven largely by Apple’s expected growth.

- In 2025, Apple is forecast to ship enough iPhones to potentially reclaim the global top smartphone-seller spot after more than a decade.

- Q1 2025 iPhone shipments reached 54.7 million units, an increase compared with Q1 2024.

- Despite economic headwinds, Apple forecasts double-digit iPhone revenue growth for the 2025 holiday quarter, indicating strong demand.

- The new iPhone 17 series, launched in 2025, contributed significantly to renewed global demand.

Recent Developments

- As of late 2025, global smartphone shipments are forecast to grow 3.3%, reflecting renewed demand after pandemic-era volatility.

- Apple’s iPhone shipments are expected to grow 10% in 2025, boosted by strong reception for the iPhone 17 series.

- The 2025 holiday quarter, fiscal Q1 2026, is projected to see iPhone revenue rise 10–12% year-over-year.

- In Q3 2025, global iPhone shipments rose 3% annually, with iPhone 16 still dominating, but the iPhone 17 was influencing momentum.

- The launch of iPhone 17 has triggered a wave of upgrades. In markets like India, it helped drive record quarterly shipments.

- Some previously released variants, such as iPhone Air, underperformed, showing consumer preference still leans toward core numbered models.

- Regional manufacturing and supply-chain adjustments boosted shipments in emerging markets, helping Apple offset weaker demand in certain mature markets.

- Despite economic headwinds and rising interest rates globally, Apple remains confident that its product strategy and brand loyalty will sustain demand through late 2025.

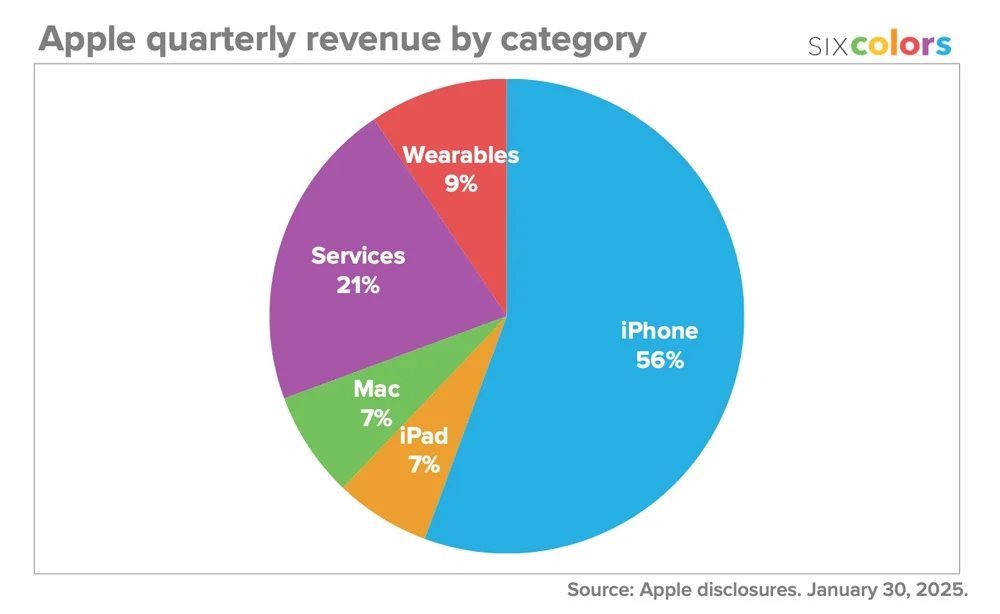

Apple’s Quarterly Revenue Distribution by Product Category

- iPhone remains the primary revenue driver, delivering 56% of Apple’s total quarterly earnings.

- Services hold the second-largest share, making up 21% of the overall revenue.

- Wearables account for 9% of quarterly revenue, emphasising their growing role in Apple’s portfolio.

- Both Mac and iPad contribute equally, with each generating 7% of the total revenue.

- These statistics underscore Apple’s heavy dependence on iPhone sales, while its Services and Wearables divisions continue to gain significance in broadening the company’s revenue streams.

iPhone Total Sales Worldwide

- Apple shipped 225.7 million iPhones worldwide in 2024, down slightly from 231.8 million in 2023.

- Peak annual shipments hit a record 233.9 million units in 2021.

- Over 3 billion iPhones have been shipped globally since the launch in 2007.

- From 2010 to 2023, cumulative shipments exceeded 1.8 billion units worldwide.

- In 2025, Apple projects 243 million iPhone shipments, surpassing Samsung’s 235 million.

- 358 million second-hand iPhones sold from 2023 to Q2 2025.

- Apple captured 49% of the global refurbished smartphone market in 2022.

- iPhones represented 62% of organised second-hand smartphone shipments in Q2 2024.

- In Q3 2025, Apple held 17% global smartphone market share with strong iPhone 17 series sales.

Annual iPhone Shipments

- In 2024, Apple shipped 225.7 million units.

- In 2023, shipments were 231.8 million units.

- The 2021 high of 233.9 million units remains the record.

- The downward drift from the 2021 peak to 2024 reflects typical market saturation cycles and longer upgrade intervals.

- 2025 is projected to mark a rebound, with analysts forecasting a 10% increase in shipments globally.

- The rebound is fueled in part by demand for the iPhone 17 lineup and upgrade demand from users who postponed replacements earlier.

- Emerging markets, particularly Asia, contribute significantly to incremental growth in 2025 shipments.

- Expanding local production and supply-chain diversification helps Apple meet demand without supply constraints.

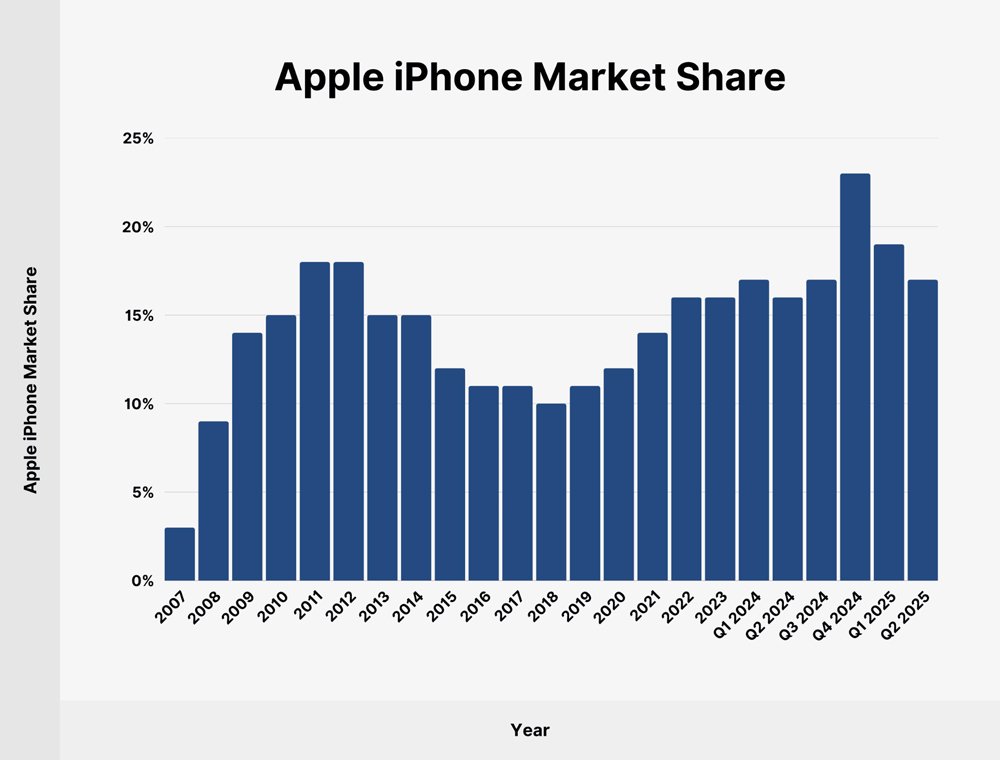

iPhone Market Share Global

- iPhone market share rose from ~3% in 2007 to ~18% by 2011–2012, showing steady early growth after the first iPhone launch.

- This period reflects Apple’s strongest early expansion following the original device debut.

- Market share remained around 15% from 2013 to 2015, marking a phase of plateau and stability.

- A gradual decline followed, with levels dipping to ~11% by 2017.

- After hitting a low near 10% in 2018, market share began a recovery phase.

- By 2021, the share increased to ~14%, signalling renewed momentum.

- From 2022–2024, iPhone maintained 16%–17% market share, indicating consistent and resilient growth.

- A dramatic spike occurred in Q1 2025, with market share jumping to ~23%, the highest in the entire timeline.

- By Q2 2025, market share eased to ~17%, remaining within Apple’s upper historical range.

US iPhone market share

- iOS holds a 58.91% mobile OS market share in the US as of November 2025.

- In Q1 2024, iOS commanded a 61.45% share of the US mobile OS market, up 3.35% from 2023.

- iPhone shipments accounted for 54% of all smartphones in the US during Q2 2025.

- From Oct 2024–Oct 2025, iOS averaged 58.05% market share among US mobile operating systems.

- Apple led US mobile vendors with a 58.05% share from Oct 2024 to Oct 2025.

- iOS reached a peak US yearly share of 61.45% in 2024, surpassing Android‘s 38.13%.

- In Q4 2023, iOS had 58.66% of the US market, growing steadily into 2025.

- Q3 2023 saw iOS at 56.83% in the US, reflecting consistent dominance.

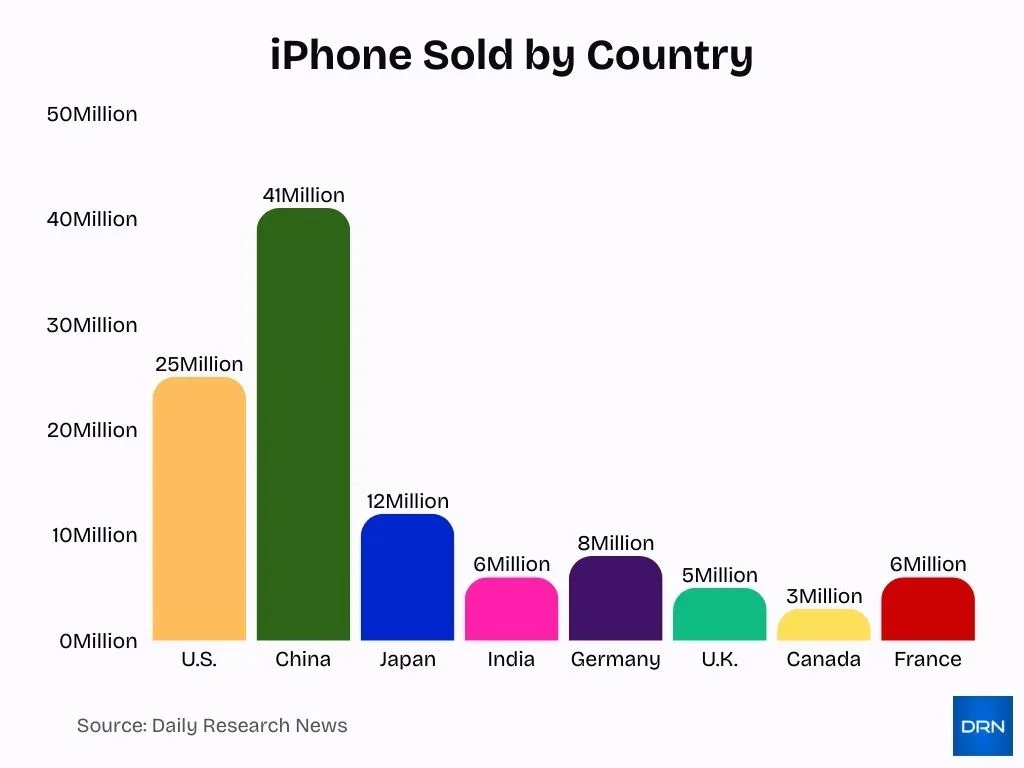

Country-wise iPhone sales

- The United States led with 25 million iPhone units sold in Q2 2023, holding 54% smartphone market share in Q2 2025.

- China topped sales at 41 million iPhone units in Q2 2023, with 15.5% market share in 2024.

- Japan recorded a 70% iPhone user share among smartphones, with 12 million units estimated annually.

- India saw 5.9 million iPhone shipments in H1 2025, up 21.5% YoY.

- Germany achieved 8 million iPhone sales annually, leading European markets.

- The United Kingdom held 50.65 of % iPhone market share with 5 million units sold yearly.

- Canada reached 56% iPhone user penetration and 3 million annual sales.

- France posted a 35.38% market share alongside 5.5 million units annually.

- Australia captured a 58.46% share with strong premium demand.

China’s iPhone market share

- In October 2025, iPhones captured 25% of China’s smartphone sales, up 37% YoY, fueled by iPhone 17 demand.

- Full-year 2024 saw Apple’s market share at 15.5% with 42.9 million iPhone shipments amid fierce local rivalry.

- During Q3 2025, Apple shipped 10.8 million units, grabbing 15.8% share and securing second place in rankings.

- Singles’ Day 2025 sales hit 26% for iPhones, driving overall market growth of 3% YoY despite rivals’ struggles.

- China’s smartphone shipments totalled 285 million units in 2024, up 4% YoY, with Apple trailing Vivo (17%) and Huawei (16%).

- Statcounter data shows Apple at 23.82% mobile vendor market share in China for October 2025.

- Q4 2024 iPhone shipments plunged 25% YoY to 13.1 million units, holding 17% share as Huawei surged 24%.

- New iPhone 17 models comprised over 80% of Apple’s sales in China during October 2025.

- Q3 2025 China shipments reached 68.4 million units, down just 0.6% YoY, boosted by Apple’s sole top-vendor growth.

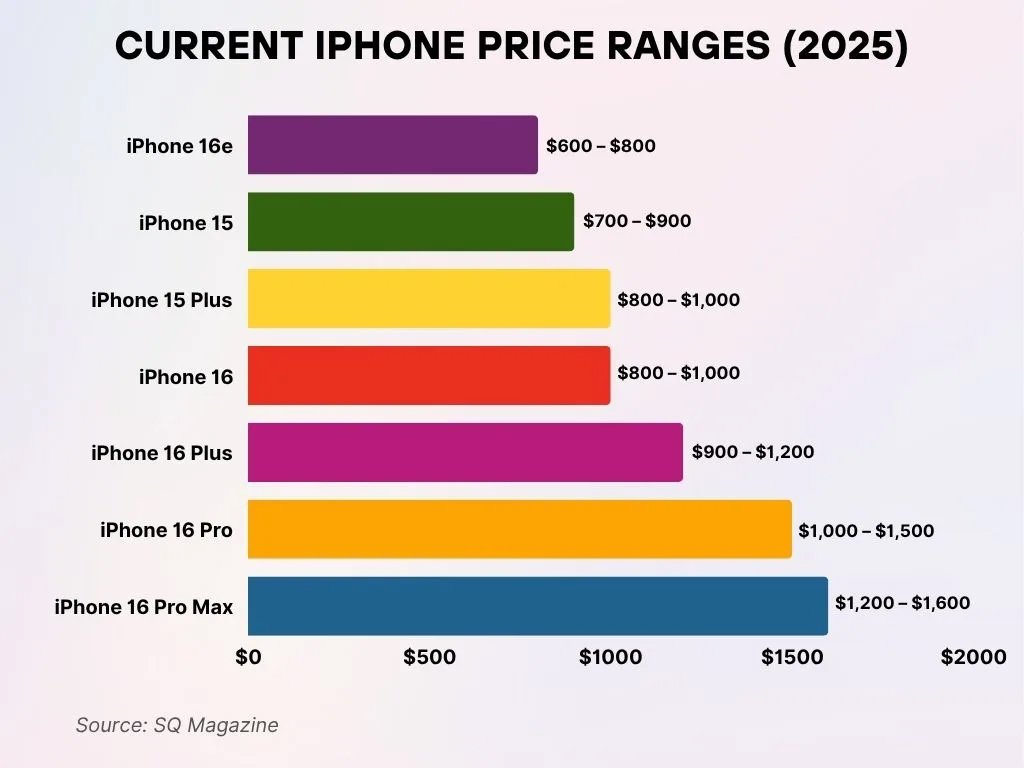

Current iPhone Price Ranges

- iPhone 16e stands as the most affordable model, with pricing that spans between $600 – $800.

- iPhone 15 is positioned slightly higher, offering a price range of $700 – $900.

- Both the iPhone 15 Plus and iPhone 16 fall into a similar pricing bracket, ranging from $800 – $1,000.

- The iPhone 16 Plus occupies the mid-premium tier, carrying a cost between $900 – $1,200.

- iPhone 16 Pro targets high-end consumers, coming in at a price range of $1,000 – $1,500.

- The iPhone 16 Pro Max is the most expensive option, priced at $1,200 – $1,600.

- These pricing categories illustrate Apple’s broad product strategy, offering devices that span from entry-level to premium segments.

Global iPhone users

- 1.561 billion active iPhone users worldwide in 2025, up 3.6% from the prior year.

- Global iOS market share stands at 26.92% of smartphones in 2025.

- 150.7 million iPhone users in the US, with 54–58% smartphone market dominance.

- Apple to ship 243 million iPhones globally in 2025, surpassing Samsung’s 235 million.

- Japan leads with 70% iPhone user penetration among smartphone owners.

- iPhone shipments grew 10% year-over-year in 2025, driven by iPhone 17 series demand.

- North America boasts a 57.55% iOS share, the highest regional penetration worldwide.

- Over 2.6 billion total iPhones sold globally since the 2007 launch.

- US iPhone users reached 150.7 million in 2025, up 5.16% annually.

U.S. iPhone users

- 150.7 million iPhone users in the US as of 2025.

- Apple holds 58% smartphone market share in the US through 2025.

- iPhones represent 54% of all US smartphone sales in 2025.

- 155 million Americans use iPhones, up 1.3% from 2024.

- 92% of US iPhone owners retain loyalty when staying with the same carrier.

- 89% overall iPhone retention rate among US smartphone users in 2025.

- 88% of US teenagers own iPhones in 2025.

- Apple’s Big 3 carrier sell-out share reached 72% in Q1 2025.

- 84% of iPhone owners plan to buy another Apple device next.

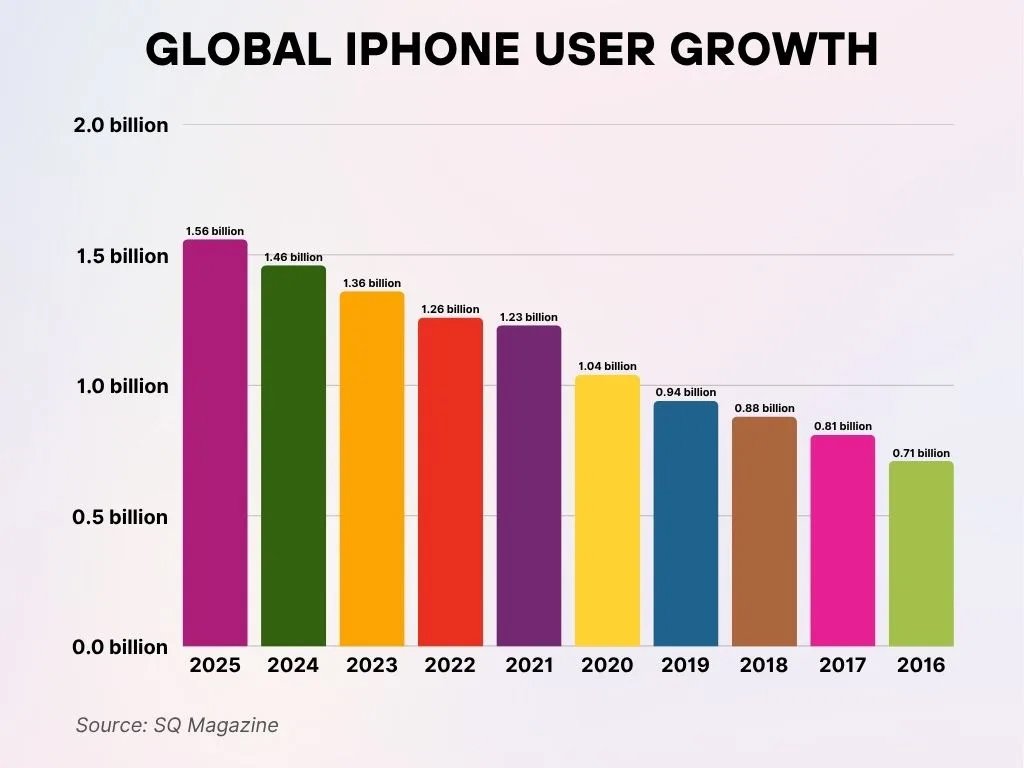

Global iPhone User Growth

- In 2025, the worldwide count of iPhone users is expected to climb to 1.56 billion, showcasing continued growth.

- By 2024, the global community of iPhone users had reached roughly 1.46 billion, reflecting a significant increase.

- In 2023, the total number of iPhone users worldwide rose to 1.36 billion, marking another year of steady adoption.

- The year 2022 witnessed iPhone users rising to 1.26 billion, indicating persistent upward momentum.

- In 2021, the global iPhone user population was around 1.23 billion, continuing its consistent expansion.

- During 2020, the user base reached 1.04 billion, notably surpassing the 1-billion threshold for the first time.

- The year 2019 recorded an estimated 0.94 billion iPhone users worldwide, highlighting ongoing growth.

- In 2018, the number of global iPhone users climbed to 0.88 billion, reflecting sustained adoption.

- The year 2017 saw 0.81 billion iPhone users globally, continuing the upward trend.

- Back in 2016, the worldwide iPhone user count stood at 0.71 billion, marking the early phase of this long-term rise.

- These statistics collectively demonstrate a steady year-over-year surge in global iPhone adoption, representing more than 2× growth between 2016 and 2025.

iOS Market Share

- Global iOS market share stands at 27–29.2% in 2025, trailing Android’s 71–73%.

- In the US, iOS commands 58–60% smartphone market share in 2025.

- Japan sees iOS at 68.75%, one of its highest regional penetrations.

- Europe records iOS at 37.77%, with Android at 61.71%.

- North America iOS share reaches 57.55–60% amid strong brand loyalty.

- iOS captures 67% of global app revenue despite a lower unit share.

- In the UK, iOS holds 49.92% versus Android’s slim edge.

- Apple’s App Store is projected to generate $138 billion in revenue in 2025.

iPhone Contribution to Apple Revenue

- iPhone generated $201.18 billion in FY2024, comprising 51.45% of Apple’s total revenue.

- In FY2023, iPhone revenue reached $200.58 billion, accounting for 52.33% of total sales.

- FY2022 saw iPhone contribute $205.49 billion, or 52.11% of Apple’s revenue.

- Q3 FY2024 iPhone sales hit $39.29 billion, representing 45.8% of quarterly revenue.

- Q1 FY2025 iPhone made up 55.6% of Apple’s total revenue.

- Q2 FY2024 iPhone accounted for 50.46% of overall company revenue.

- Apple’s total FY2024 revenue was $391.04 billion, with iPhone as the top segment.

- iPhone revenue dipped 2.10% YoY to $201.18 billion in FY2024 from the prior year.

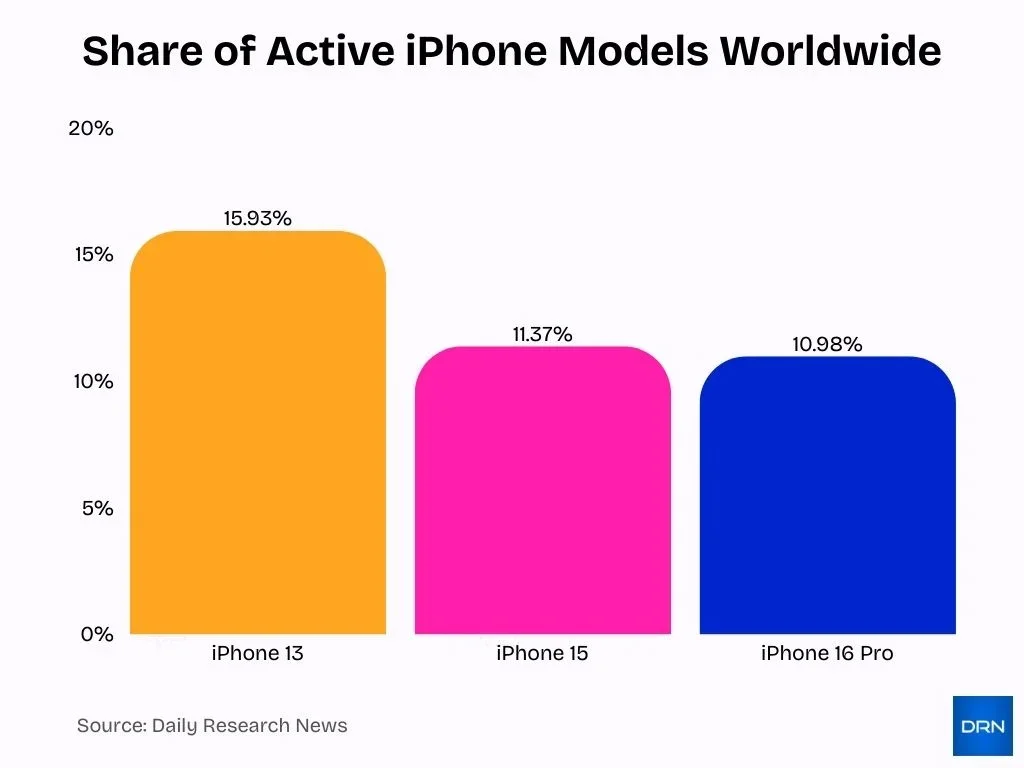

Top Selling iPhone Models

- iPhone 13 holds a 15.93% share of active iPhones globally as of late October 2025.

- iPhone 15 commands 11.37% of active devices worldwide in October 2025.

- iPhone 16 Pro secures 10.98% market share among active iPhones at the end of October 2025.

- iPhone 16 topped global smartphone sales as the **#1 bestselling in Q1 2025.

- iPhone 16 Pro led iPhone shipments with strong YoY growth in Q2 2025.

- Apple projects 243 million total iPhone shipments globally for the full-year 2025.

- iPhone 16 became India’s top-shipped smartphone, contributing 5% of the total market in Q3 2025.

- iPhone 16 series drove Apple’s 25.6% YoY shipment growth in India during Q3 2025.

iPhone Replacement, Upgrade Cycles & Second-hand Market Trends

- Apple captured 56% of global refurbished smartphone sales in 2024, up from 51% in 2023.

- The global refurbished smartphone market grew 5% YoY in 2024, driven by strong iPhone demand.

- In India, refurbished iPhone sales surged 19% YoY in H12025.

- iPhones accounted for over 60% of refurbished smartphone sales in India during H12025.

- iPhones retain 45-60% of value after 24 months, far exceeding Android devices.

- After 4 years, iPhones hold 52.5% resale value vs. 21.1% for flagship Androids.

- 36% of new iPhone buyers in late 2024 upgraded after owning a prior device for 2 years or less.

- India‘s refurbished smartphone market grew 5% YoY in H12025, second-fastest globally.

- 17 million iPhones shipped in the organised second-hand market in Q22024, 62% of total volume.

Global Trends & Forecast for iPhone Shipments

Apple forecasts 243 million iPhone shipments globally in 2025, surpassing Samsung’s 235 million units for the first time since 2011.

iPhone shipments projected to grow 10% YoY in 2025, driven by strong iPhone 17 series demand.

Apple is expected to capture 19.4% global smartphone market share in 2025, ahead of Samsung’s 18.7%.

2024 iPhone shipments totalled 225.7–225.9 million units, down slightly from 231.8–229.1 million in 2023.

iPhone 17 series sales rose 12% in the US and 18% in China versus iPhone 16 in the first four weeks post-launch.

Q4 2024 iPhone shipments hit 77.1 million units, up from the prior quarter but down 1 million from Q4 2023.

Global smartphone market to expand 3.3% in 2025, supporting Apple’s rebound amid upgrade cycles.

358 million second-hand iPhones traded from 2023 to mid-2025, fueling pent-up demand for new models.

Samsung shipments grow at just 4.6% YoY in 2025, trailing Apple’s pace due to Chinese competition.

Frequently Asked Questions (FAQs)

There are around 1.56 billion active iPhone users worldwide in 2025.

iOS holds roughly 27.6% of the global smartphone OS market as of late 2025.

Apple is projected to capture 19.4% of global smartphone shipments in 2025.

In Q2 2025, Apple shipped 46.4 million iPhones, representing 15.7% of global smartphone shipments.

Conclusion

iPhone remains a powerful force in the global smartphone landscape. A user base exceeding 1.5 billion, stable iOS market share near 27% globally, and strong demand in both mature markets, like the US, and emerging markets all highlight its enduring relevance. The dominance of models such as iPhone 13, iPhone 15, and iPhone 16, combined with active second-hand sales, suggests Apple benefits from both new upgrades and sustained device longevity.

With forecasts projecting up to 243 million shipments this year, Apple could reclaim the top spot among global smartphone makers. For businesses, developers, and consumers alike, these trends reinforce iPhone’s central role in shaping the future of mobile technology.