The professional social network LinkedIn continues to evolve as a workplace staple. The balance between mobile and desktop use has shifted noticeably, affecting how professionals browse, engage, and consume content. Insights into device usage help marketers, content creators, and recruiters shape their strategies for maximum impact. Below, we dive into key figures and trends driving LinkedIn engagement across devices.

Editor’s Choice

- LinkedIn had roughly 1.20 billion registered members worldwide at the start of 2025.

- Mobile access accounts for about 57% of all LinkedIn use, depending on the data source.

- In February 2025, the platform saw around 1.77 billion monthly visits.

- Users on mobile spend an average of 48 hours per month on LinkedIn.

- The age group 25–34 remains the largest share globally at around 47%.

- In the U.S., 35.8% of LinkedIn users are millennials.

- Only about 1% of users post content weekly, yet those posts generate a disproportionate amount of platform-wide impressions.

Recent Developments

- LinkedIn ad revenue projected to reach $8.2 billion in 2025, up 18.3% year-over-year.

- Ad reach grew by 176 million members (17.1%) from January 2024 to 2025.

- Generative AI advertisers allocate 12% of digital ad budgets to LinkedIn, vs. 3% average.

- 89% of B2B marketers use LinkedIn for lead generation.

- LinkedIn is 277% more effective for lead generation than Facebook and X.

- 62% of marketers report LinkedIn generates leads, twice the next social channel.

- The average LinkedIn user spends 7 minutes 38 seconds per visit, with 7.98 pages viewed.

- Over 95% of LinkedIn impressions from mobile in 2025 campaigns.

- 41% of LinkedIn users adopted ChatGPT by 2025, up from 15% in 2024.

- Short-form video on LinkedIn grows 12% year-over-year with high completion rates.

LinkedIn Mobile vs Desktop Overview

- Nearly 70% of LinkedIn users access the platform via mobile devices overall.

- Mobile web traffic on LinkedIn is reported as low as 31.4%, with desktop at 68.6%.

- A combined view, including mobile app and we,b estimates mobile traffic at around 57% of total LinkedIn visits.

- Desktop usage accounts for about 74.24% of LinkedIn visits during standard working hours.

- Mobile use dominates during off-hours and commuting times, representing a majority of traffic then.

- Content consumption and quick browsing favor mobile, while job applications and long-form content favor desktop.

- Regionally, mobile-first markets like Asia and Africa show higher mobile LinkedIn usage than North America.

- Around 16.2% of US LinkedIn users open the app at least once daily, indicating strong mobile engagement.

- Desktop sessions tend to be longer per visit, especially for in-depth tasks like profile editing or ad management.

- Mobile traffic drives about 70% of LinkedIn impressions, but desktop still drives around 65% of conversions.

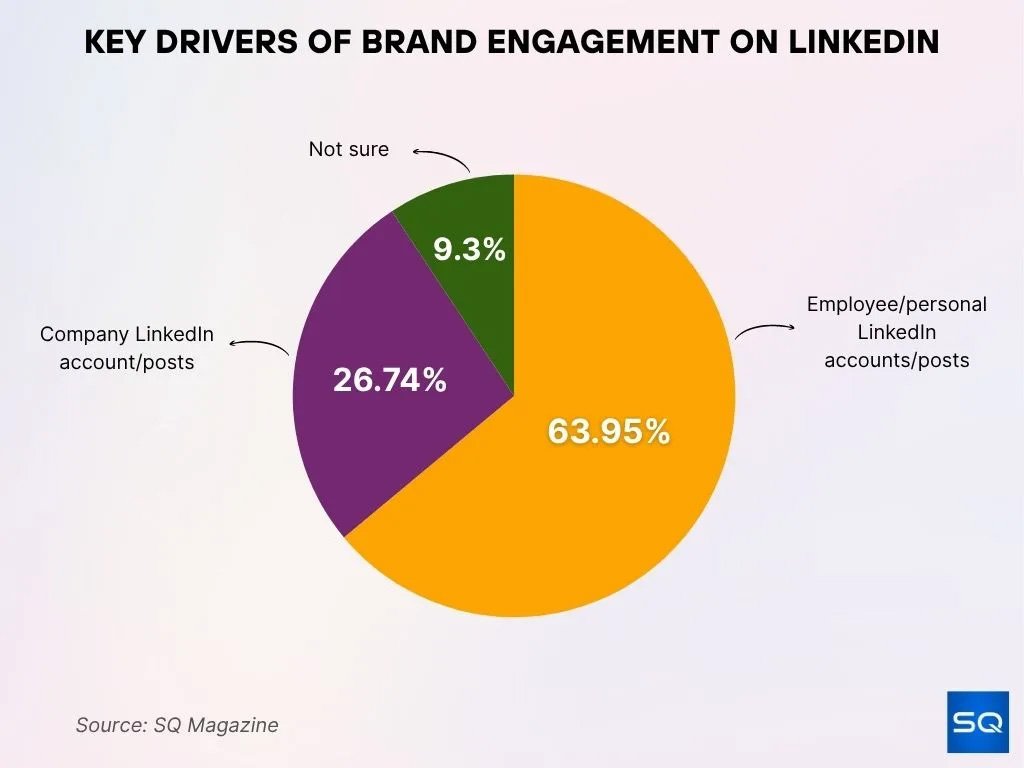

Primary Factors Influencing Brand Engagement on LinkedIn

- Employee and personal LinkedIn accounts deliver the strongest engagement, with 63.95% of respondents identifying them as the leading source of traffic, leads, and sales, making them the most influential driver.

- Company LinkedIn accounts and brand posts rank second in impact, generating engagement for 26.74% of brands and serving as a significant contributor to overall performance.

- Only 9.30% of respondents remain uncertain about which source contributes more strongly to engagement, indicating a relatively small portion lacks clarity.

Percentage of Users on Mobile

- According to one 2025 report, 57% of LinkedIn traffic comes from mobile devices.

- A different study, including mobile app and web usage, estimates closer to 70% mobile access.

- Another snapshot from late 2024 puts ≈ 31.42% on mobile web, indicating a much lower mobile share if app traffic is excluded.

- One source noted that between August 2024 and January 2025, mobile web accounted for just 25.76% of visits, implying a dominant desktop web usage in that period.

- Reports suggest nearly 70% of active members log in via mobile at least once a month, reflecting the mobility of modern professionals.

- Mobile usage tends to spike during morning commutes, lunch breaks, and evenings, when users browse casually.

- In regions with high smartphone penetration and limited desktop access, the mobile majority is more pronounced.

- For marketers, this mobile share underscores the necessity of mobile-first design in ads, posts, and user experience.

Percentage of Users on Desktop

- Desktop accounts for 35.96% of global web traffic as of November 2024.

- In the U.S., desktops hold a 43.25% share of web traffic.

- Desktop comprises 49.72% of the worldwide platform market share through October 2025.

- Laptops and desktops capture 46.51% of total web traffic.

- Desktop represents 39.5% of global web traffic as of July 2025.

- Desktop holds a 38.1% share after a 7.2% year-over-year decline.

- In Japan, desktop browsing reaches 55.77% of internet traffic.

- Desktop accounts for 51.55% of traffic in Canada.

- Globally, desktops dropped from 99.3% in 2009 to 39.85% in 2025.

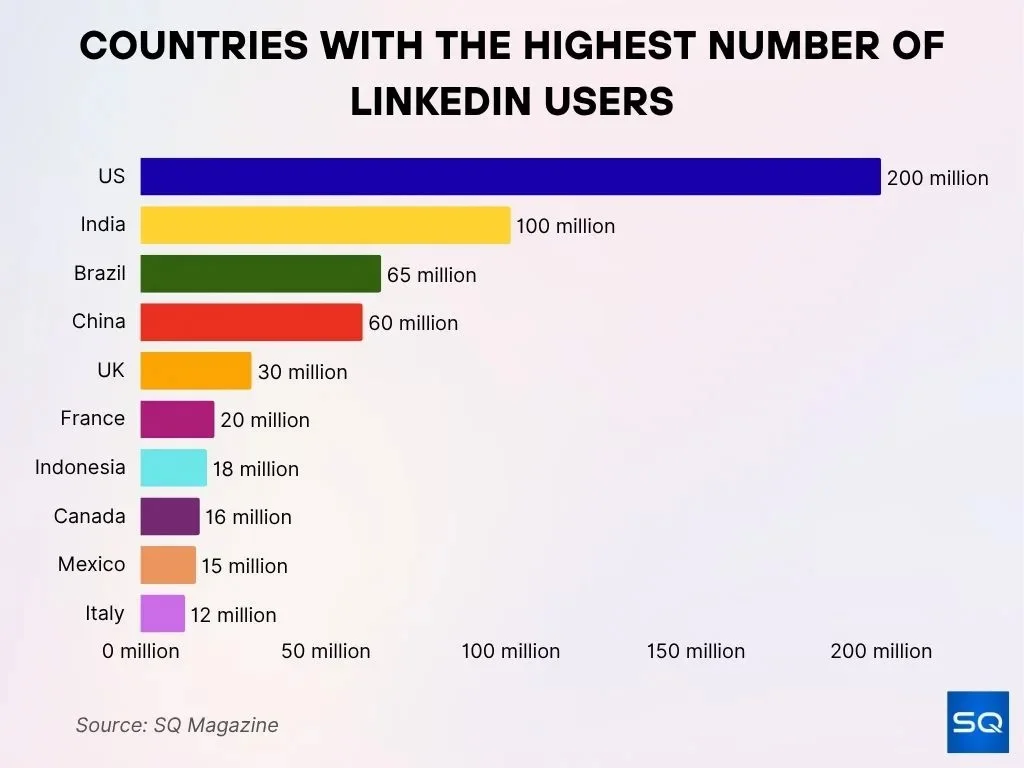

Nations With the Largest Count of LinkedIn Users

- The United States stands as the global leader with 200 million LinkedIn users.

- India secures the second position by having 100 million users.

- Brazil records 65 million users, placing it just ahead of China, which has 60 million.

- The United Kingdom reports a total of 30 million LinkedIn members.

- Other prominent countries include France with 20 million, Indonesia with 18 million, and Canada with 16 million users.

- Mexico accounts for 15 million users, while Italy completes the ranking with 12 million.

User Engagement on Mobile

- Around 80% of LinkedIn content engagement comes from mobile users.

- Mobile users on LinkedIn spend an average of 48 hours per month on the platform.

- Nearly 70% of LinkedIn users access the platform through mobile devices.

- LinkedIn mobile sessions average under five minutes, focusing on short bursts of activity.

- About 57% of total LinkedIn traffic is generated by mobile devices.

- Video posts on LinkedIn receive up to 5 times more engagement on mobile than static posts.

- Push notifications on mobile drive immediate interactions, boosting timely engagement.

- Mobile users engage mostly during commutes, lunch breaks, and evenings, reflecting short interaction peaks.

- Mobile serves as the main login mode for many users at least once a month, indicating habitual use.

- Professionals across various industries show dominant engagement via mobile, not limited to casual users.

User Engagement on Desktop

- Desktop accounts for 68.58% of LinkedIn traffic per SimilarWeb data.

- 74.24% of LinkedIn visits occurred on desktop from Aug 2024–Jan 2025.

- Desktop sessions last longer than mobile for deep tasks like job applications.

- Recruiters achieve 69% higher InMail responses using desktop tools.

- Power users prefer a desktop for complex workflows during working hours.

- Desktop drives thoughtful engagement with longer reads and profile updates.

- LinkedIn hires show a 67% retention rate from desktop-preferred sourcing.

- Desktop usage peaks for content creation and detailed networking tasks.

Time Spent on Mobile

- Users on mobile spend, on average, 48 hours per month on LinkedIn.

- The average session duration is around 7 minutes 20 seconds.

- During mobile sessions, users review roughly 6 pages per visit on average.

- Mobile sessions tend to be shorter and more frequent, aligning with typical phone usage patterns.

- Mobile browsing and engagement dominate content consumption outside regular office hours.

- Mobile access enables quick checks of notifications, messages, or brief content scrolls.

- The high mobile time usage suggests LinkedIn’s mobile-first design increasingly matches user behavior.

- Marketers should treat mobile sessions as opportunities for impactful, concise content.

Time Spent on Desktop

- Desktop accounts for roughly 68.5% to 74.2% of LinkedIn visits compared to mobile’s 25.8–31.5%.

- LinkedIn desktop usage peaks during traditional working hours, especially among office-based professionals.

- Desktop sessions on LinkedIn tend to be longer, supporting deep reads and detailed browsing.

- Around 69.9% of LinkedIn traffic comes from desktop when excluding mobile app visits.

- Desktop maintains a stronghold for job applications and editing profiles, requiring precision.

- Content creators draft posts and manage ad campaigns more comfortably on a desktop.

- Desktop engagement dominates tasks like reviewing applications and sending detailed HR communications.

- Deep content like whitepapers and long-form articles sees higher engagement rates on desktop.

- The surge in LinkedIn job applications has increased by over 45% in one year, mostly processed via desktop.

- Approximately 75% of job seekers use LinkedIn on desktop for professional networking and job search tasks.

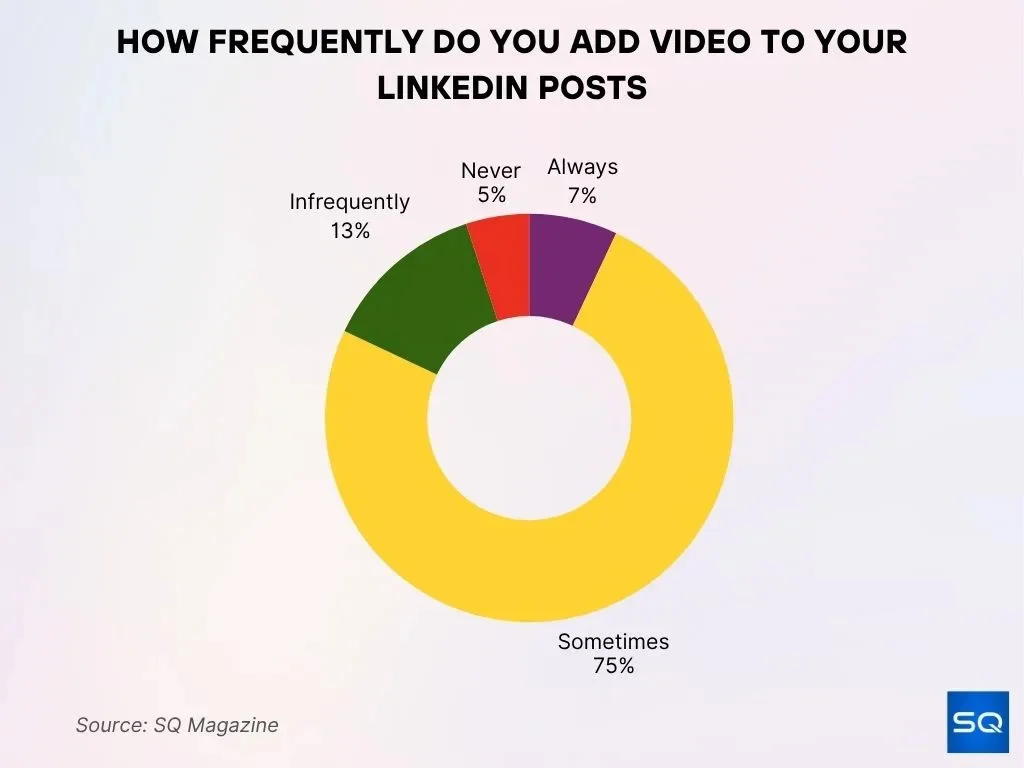

How Often Do You Include Video in Your LinkedIn Posts

- Sometimes, adding video is identified as the most common approach, selected by 75% of respondents.

- Only 7% of users always include video in their LinkedIn posts.

- Infrequently adding video represents 13% of all responses collected.

- A small 5% of users never add video to their LinkedIn content.

Device Preferences by Industry

- C Suite contacts show around 96% mobile usage.

- Legal professionals show ≈ 95% mobile access.

- Surveyors and architects report about 88% mobile usage.

- ESG and sustainability leads show mobile access near 87%.

- Industrial sector professionals report about 86% mobile usage.

- Financial services professionals have around 71% mobile usage.

- In the engineering sectors, mobile usage is about 67%.

- These industry differences imply that while mobile dominates broadly, certain fields still rely more on desktops.

Content Consumption by Device

- About 70% of LinkedIn users access the platform via mobile devices.

- Daily, users produce around 2 million posts, articles, and videos.

- Mobile users drive a large share of engagement, with some campaigns reporting over 95% of impressions on mobile feed.

- Video content viewership has grown by more than 30%, with mobile-favored formats.

- Posts with images or media perform better than plain text.

- Mobile web or native app consumption accounts for the majority of global content views.

- Long-form articles still find meaningful engagement on desktop.

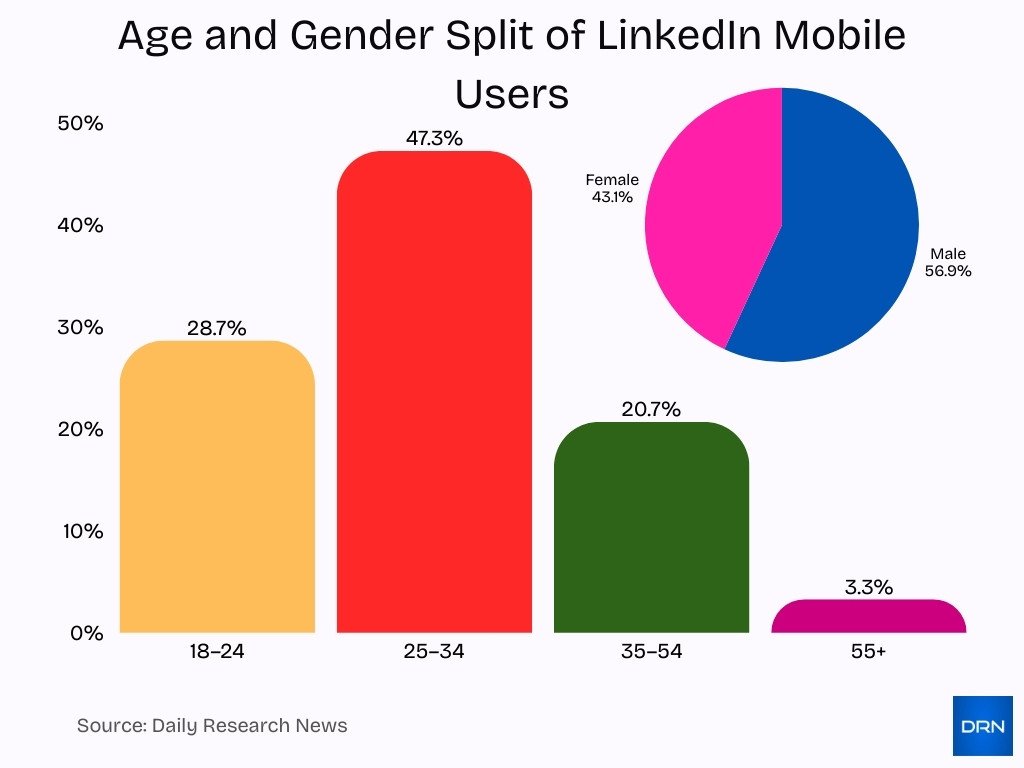

Demographics of Mobile Users

- 47.3% of LinkedIn users worldwide are aged 25–34.

- The age groups 18–24 and 35–54 represent 28.7% and 20.7% of users, respectively.

- Users aged 55+ make up approximately 3.3% of LinkedIn’s audience.

- Globally, mobile users are 56.9% male and 43.1% female.

- In the United States, the gender split among mobile users is 55% male and 45% female.

- Around 97.1% of youth aged 15–29 report using mobile phones.

- The mobile internet gender gap in India narrowed from 40% to 32% due to women’s adoption growth.

- Africa has the highest mobile traffic share at 73.57% of all internet traffic.

- Smartphone usage is highest among ages 18–29 at 94%, followed by 30–49 at 89%.

- Younger professionals aged 25–34 are key mobile decision-makers in B2B marketing.

Demographics of Desktop Users

- Desktop users aged 35–54 comprise 20.7% of professional networks like LinkedIn.

- Gen X (45–60) allocates 38% of digital time to the desktop for productivity tasks.

- Baby Boomers (61+) spend 52% of their online time on desktop devices.

- 25% of desktop users fall in the 18–34 age group, versus 35% mobile users.

- 68% of work-from-home users aged 30–50 perform tasks on desktops.

- Professionals in engineering and finance drive 7% CAGR growth in desktop workstations.

- 70% usage of productivity tools like Teams occurs on desktop platforms.

- Excluding mobile apps, desktop accounts for ~36–40% of total web traffic globally.

- North America shows a 34% desktop share amid a strong office infrastructure.

- Recruiters rely on ATS systems for 75% of hires, favoring desktop interfaces.

Ad Performance on Mobile

- Over 95% of LinkedIn ad impressions are delivered on mobile devices.

- 80% of LinkedIn users access the platform via mobile.

- Mobile devices account for 60.5% of global web traffic as of 2025.

- 64.35% of global internet traffic originates from mobile devices.

- Mobile CTR ranges from 2-5%, outperforming desktop’s 1-3%.

- Average mobile ad CTR stands at 1.3%, higher than desktop.

- Mobile devices drive 60-70% of digital ad clicks globally.

- Sponsored content on LinkedIn achieves 0.45-0.65% CTR on mobile.

- Mobile ad spending in the US is projected to hit $228 billion in 2025.

Ad Performance on Desktop

- Desktop conversion rates average 4.3%, outperforming mobile‘s 2.2% across most verticals.

- Desktop delivers 52% higher conversion rates than mobile for high-intent tasks.

- Desktop users are 25% more likely to tackle important tasks like form submissions.

- Desktop ads see 19% higher click rates and 20% more cart additions versus mobile.

- Desktop CTR averages 1.9% in B2B, beating mobile‘s 1.2%.

- Desktop users spend 40% more per order, ideal for long-form promos.

- Desktop PPC excels in conversions for long-form landing pages.

- The financial industry reports a desktop 2.1% conversion rate vs a mobile 0.59%.

Trends Over Time

- Mobile devices drive 59.7% to 63.8% of LinkedIn’s global web traffic over recent years.

- LinkedIn mobile access, including app and mobile web, approaches 70% of total user access.

- Short-form posts and vertical video content on LinkedIn have grown by 36% year-over-year.

- Desktop use remains critical for job applications and consuming long-form content.

- Mobile device usage on LinkedIn is highest in Asia (72.3%), Africa (69.8%), and Latin America (62.1%).

- Desktop still accounts for about 30-40% of LinkedIn activity, mainly in North America and Europe.

- Around 16.2% of US LinkedIn users open the app daily, reflecting steady engagement.

- Dual-channel marketing strategies combining mobile and desktop are recommended for a broader reach.

- LinkedIn’s video creation rate on mobile is growing at twice the rate of other post formats.

- In-office working hours see more desktop usage, while mobile dominates outside office times.

Implications for Content Creators & Marketers

- Mobile devices drive 62.54% of global website traffic in 2025.

- Video content generates 1200% more shares than text and images combined.

- Desktop landing pages convert 8% better than mobile despite lower traffic.

- Social media usage peaks at 88% on mobile devices worldwide.

- Audience segmentation boosts sales for 80% of companies using it.

- A/B testing yields a 15.9% mean lift in 33.5% of cases for marketers.

- Visual content gets 94% more views than text-only formats.

- Facebook Reels achieve 6x more engagement than photo posts.

- Desktop popups convert at 48.73% versus mobile’s 34.15% rate.

Frequently Asked Questions (FAQs)

57% of LinkedIn traffic comes from mobile devices.

Desktop accounted for 74.24% of LinkedIn visits in that period.

35.8% of U.S. LinkedIn users are millennials.

Over 95% of ad impressions were delivered on mobile.

Conclusion

LinkedIn’s user base reflects a clear shift toward mobile access and consumption, roughly 70% via mobile devices globally, powered by younger users, visual content, and shorter engagement sessions. Desktop remains relevant for deeper tasks, long-form content, and high-intent actions. For marketers and content creators, success increasingly depends on a dual channel strategy, delivering fast, engaging content for mobile feeds while maintaining depth and usability for desktop conversions. Understanding these device dynamics can help you reach the right audience, with the right format, at the right time.