Linux continues to underpin vast portions of the digital ecosystem, from enterprise servers to embedded devices and cloud infrastructures. In the U.S., businesses rely on Linux for mission‑critical deployments while mobile and IoT sectors lean on its open‑source flexibility. For example, a telecom provider might deploy Linux in edge devices across their network, and a cloud provider might standardize on Linux containers to streamline operations and reduce licensing costs. Read on to explore detailed statistics that shape Linux’s current footprint and future trajectory.

Editor’s Choice

- Over 49.2% of all global cloud workloads run on Linux platforms as of Q2 2025.

- The Linux operating system market is valued at $11.4 billion in 2025, with a projected CAGR of ~16.9% to 2034.

- Approximately 62.7% of IoT developers report building firmware or services atop Linux‑based embedded platforms.

- Around 89% of organizations operate in multicloud environments, and 73% combine public and private cloud (hybrid).

- 33% of organizations spent over $12 million annually on public cloud services in 2025.

Recent Developments

- Major distributions are aligning updates to support modern architectures like ARM64 and RISC‑V, expanding Linux’s hardware reach.

- Linux kernel version 6.17 was released in September 2025.

- The kernel had ~75,314 commits in 2024, down from ~87,993 the previous year.

- The Linux OS market figure of $11.4 billion in 2025 underlines growth in enterprise services around Linux.

- Hybrid cloud adoption continues to rise, with enterprises increasingly deploying Linux for multi‑cloud workloads.

- Embedded Linux adoption is increasing, with 62.7% of IoT developers building on Linux in the first half of 2025.

- The U.S. desktop Linux share milestone crossing 5% signals growing consumer and desktop traction.

- Search interest for “Linux distribution” rose to a normalized value of 10 by August 2025, compared to ~5–6 in 2024.

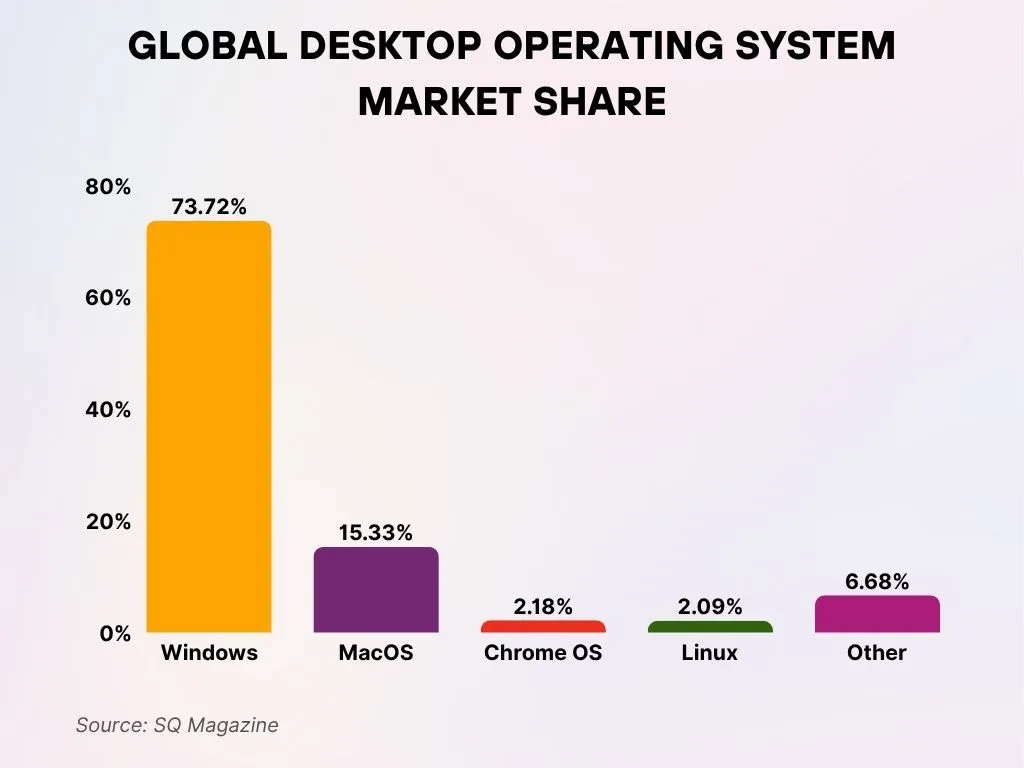

Global Desktop OS Market Share

- Windows leads with 73.72% global desktop OS share, dominating as the default choice for most users.

- macOS holds 15.33%, widely preferred by creatives and professionals.

- Chrome OS captures 2.18%, driven by adoption in schools and budget laptops.

- Linux claims 2.09%, mainly used by developers and open-source communities.

- Other OSs combine for 6.68%, reflecting a small but diverse alternative user base.

Linux Usage Statistics

- Android, which uses the Linux kernel, holds ~72% share on mobile devices, underlining the Linux kernel’s vast footprint via mobile.

- Among all device types excluding embedded, Linux kernel derivatives (such as Android or ChromeOS) have ~44.51% share as of 2025.

- The “Linux server” query interest remained large (68‑86 normalized scale) from August 2024 to August 2025.

- In embedded systems, 62.7% of IoT developers reported building firmware or services on Linux‑based platforms in the first half of 2025.

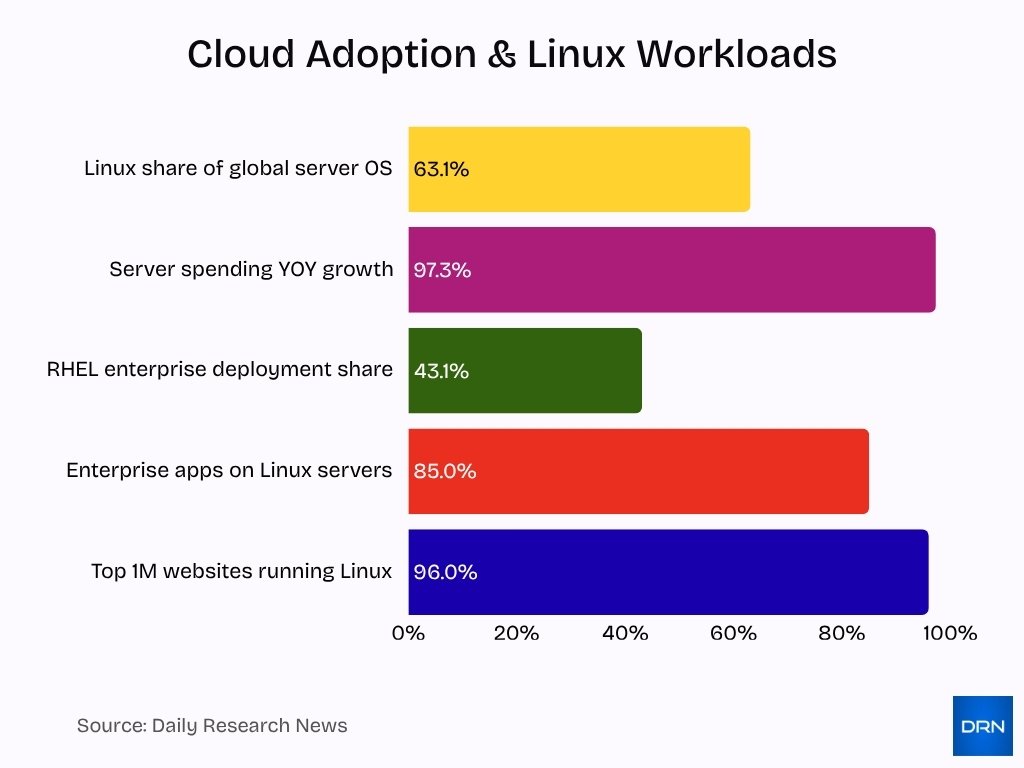

Linux in Server Infrastructure

- Linux commands an estimated ~63.1% share of the global server OS market.

- Spending on servers in Q2 2025 grew by ~97.3% year‑on‑year, driven by GPU server deployments, with unit growth of ~15.9%.

- Red Hat Enterprise Linux (RHEL) led with ~43.1% share in enterprise deployments in 2025.

- In the web server space, ~96% of the top 1 million websites run Linux.

- Approximately 85% of enterprise applications on servers use Linux.

- The server operating system market is projected to grow from ~26,389 thousand units in 2024 to ~29,539 thousand in 2025, with a CAGR of ~12.4%.

- The Linux OS market valuation at $11.4 billion in 2025 reflects its server and enterprise strength.

- Server refresh cycles backed by AI workloads amplify demand for Linux‑based infrastructure.

- Linux in servers contrasts sharply with its modest desktop presence.

Cloud Computing

- The global cloud computing market reached approximately $912.8 billion in 2025.

- Public cloud spending is forecast to exceed $723.4 billion in 2025.

- Approximately 94% of enterprises now use cloud services, and 98% of financial services organizations use some form of cloud.

- 49.2% of global cloud workloads run on Linux‑based platforms in Q2 2025.

- The U.S. accounts for about $183.6 billion of North America’s ~$248.1 billion cloud revenue in 2024.

- Hybrid and edge‑cloud integration are among the top trends in 2025, with Linux back‑ends playing a major role.

- SMBs are projected to devote more than 50% of their tech budgets to cloud services in 2025.

Mobile Devices

- Android holds 72.55% of the global mobile OS market as of October 2025.

- Linux underlies roughly 80% of the global smartphone market through Android.

- Smartphones account for 94.2% of internet access among users aged 16+ as of June 2025.

- Mobile enhances Linux’s global reach via kernel derivatives.

- U.S. desktop and laptop Linux share is modest (~4–6%) while mobile platforms multiply that reach.

- Emerging Linux‑based mobile OS alternatives exist but remain niche.

- Linux kernel updates and patches affect a vast mobile ecosystem indirectly through Android.

- Mobile traffic accounts for 62.45% of global internet activity in 2025.

- Open‑source licensing and kernel control explain Android’s dominance in emerging markets.

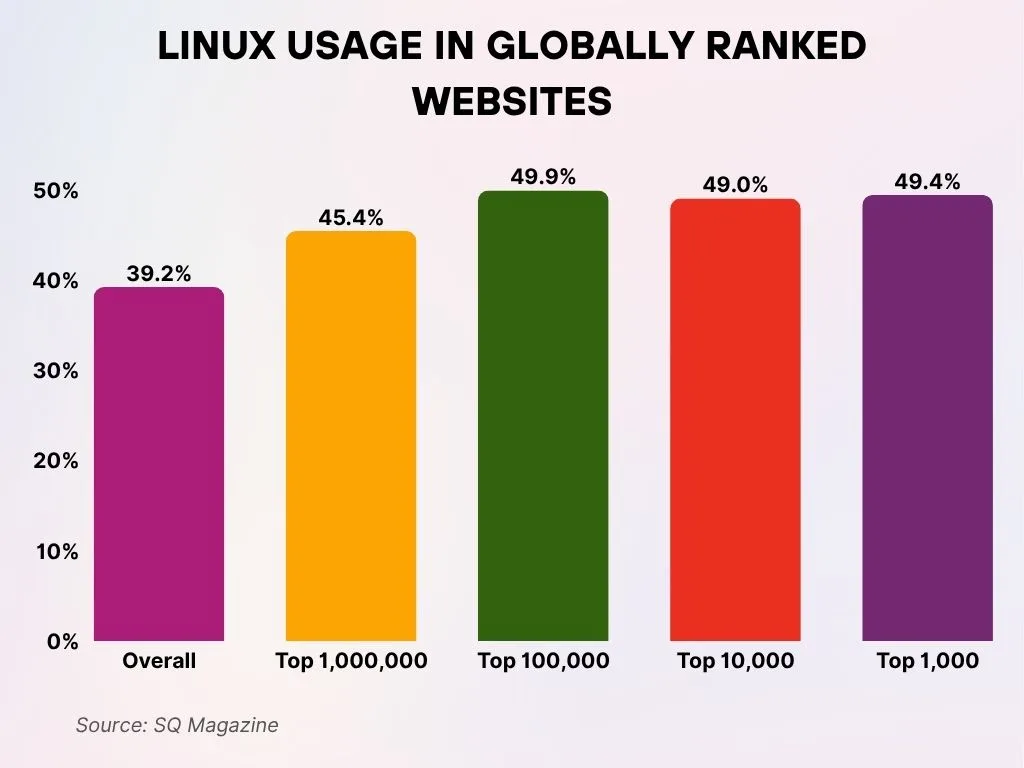

Linux Usage in Top Global Websites

- 39.2% of all websites globally run on Linux, highlighting its foundational role in web infrastructure.

- 45.4% of the top 1 million websites use Linux, showing increased adoption among more popular sites.

- 49.9% of the top 100,000 sites run on Linux, nearing a majority share in high-traffic tiers.

- 49% of the top 10,000 websites rely on Linux, underlining its high-performance capabilities.

- 49.4% of the top 1,000 sites are powered by Linux, reinforcing trust at the most elite web levels.

Linux in Supercomputers

- 100% of the TOP500 supercomputers run Linux as of June 2025.

- The US’s “El Capitan” supercomputer achieved a performance of 1.742 exaflops running Linux (TOSS).

- Linux has maintained 100% dominance in the TOP500 supercomputers since 2017.

- The global supercomputing market is projected to grow by $39.79 billion between 2025-2029, driven by Linux-based systems.

- Over 60% of global supercomputing power is concentrated in the US (35%) and China (30%), both extensively using Linux.

- 73.2% of HPC institutions cite Linux community support as a key reason for its use in supercomputing.

- Linux powers 78.3% of web-facing servers as of 2025, reflecting its scalability and hardware support that benefit supercomputers.

- Linux kernel customization in government-funded HPC labs increased by 15.6% in 2025, helping tune for performance and energy efficiency.

- Scientific simulations, such as climate modeling and genomics, rely on Linux for 96.7% of workloads in supercomputing environments.

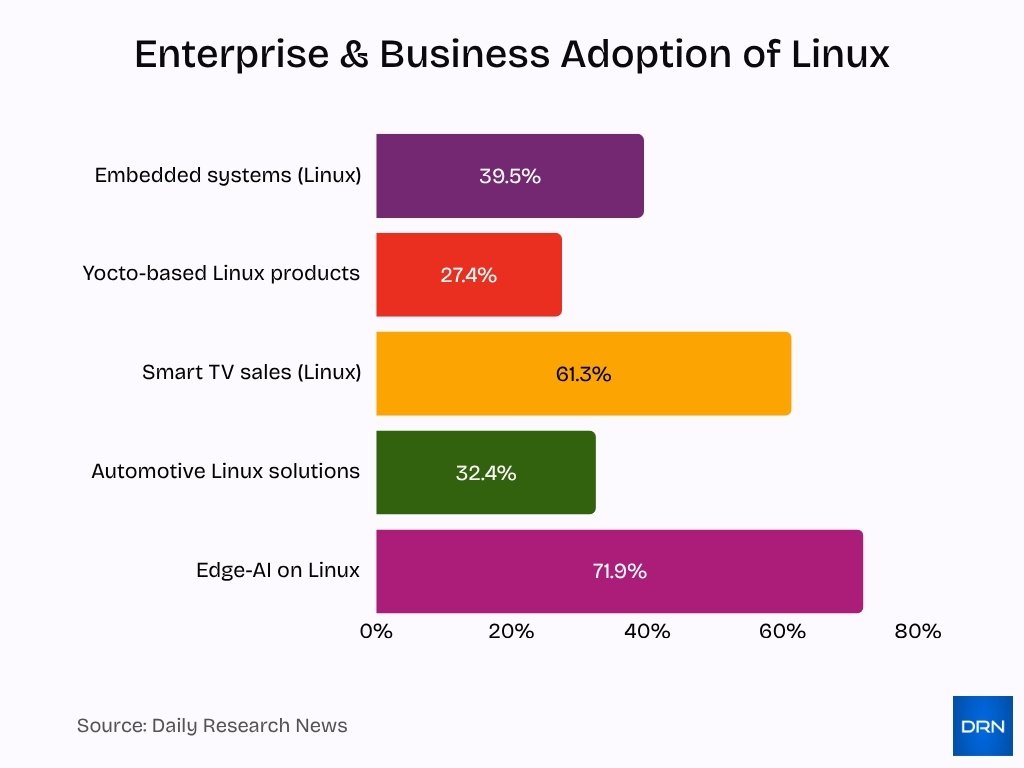

Embedded Systems and IoT

- Linux runs about 39.5% of embedded systems across various sectors in 2025.

- About 27.4% of embedded products use Yocto‑based Linux builds.

- Smart TVs using Linux (e.g., Tizen, webOS) account for 61.3% of global sales.

- Automotive Linux solutions appear in 32.4% of new vehicles globally.

- Around 71.9% of edge‑AI inference workloads run on Linux.

Linux in Enterprise and Business

- 61.4% of large enterprises run at least one mission‑critical application on Linux.

- Approximately 85% of enterprise server applications use Linux.

- The Linux software ecosystem is forecast to grow to $14.5 billion by 2032.

- RHEL leads enterprise Linux deployments with a 43.1% market share.

- Linux deployments in banking and finance grew 21.5% year‑on‑year in 2025.

- Around 68.2% of DevOps teams use Linux as their primary platform.

- Growth in AI, ML, and containerisation drives Linux as the default business OS.

- Enterprise budgets increasingly favor Linux‑based infrastructure.

Kernel Development Statistics

- The Linux kernel surpassed 40 million lines of code in early 2025.

- Over 400,000 new lines were added every two months during recent release cycles.

- More than 11,000 contributors participated in the latest kernel development cycle.

- Thousands of maintainers and subsystem leads support ongoing kernel development.

- 1,339 verified companies use the Linux kernel across industries.

- Most code additions relate to drivers and new hardware support.

- Enterprises track and influence kernel subsystems for their custom needs.

- Recent releases include tens of thousands of changes per merge window.

- Linux remains one of the world’s most actively developed open‑source projects.

- New hardware platforms like RISC‑V and expanded ARM64 are shaping kernel growth.

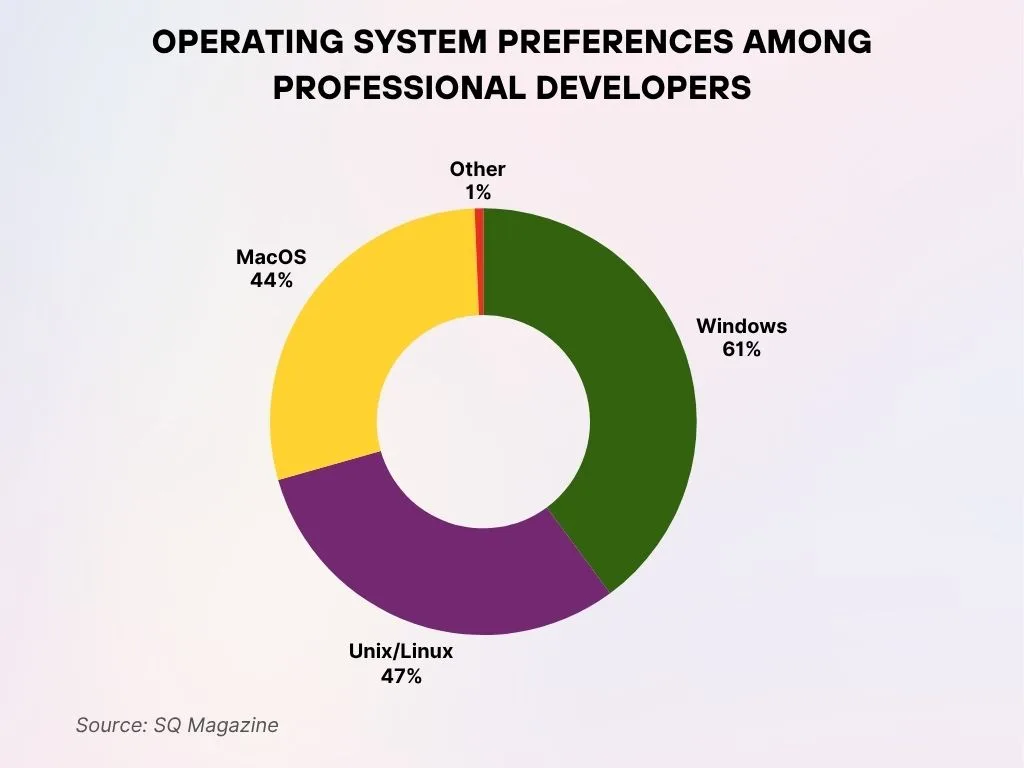

OS Preferences Among Professional Developers

- 61% of developers use Windows as their primary development OS, making it the top choice.

- 47% prefer Unix/Linux, popular for backend, system-level, and open-source development.

- 44% use macOS, especially common among mobile, design, and cross-platform developers.

- Only 1% rely on other OSs, showing minimal usage outside the top three platforms.

Linux in Gaming

- Linux holds a 3.05% market share on the Steam gaming platform as of October 2025.

- Nearly 90% of Windows games run on Linux through Proton and Wine compatibility layers.

- Anti-cheat support limits compatibility for 15-20% of competitive Linux gaming titles.

- Steam Deck users account for roughly 33% of Linux-based Steam activity.

- Indie and single-player games make up more than 65% of Linux gamers’ favored genres.

- GPU driver improvements have increased Linux gaming performance by 5-15% over Windows in many titles.

- Linux desktop gaming share is modest but expected to grow at about 0.5-1% annually.

- Over 70% of major game streaming platforms use Linux-based backend infrastructure.

- Linux gaming’s growth rate has been steady, with a 0.41% user share increase on Steam in the last year.

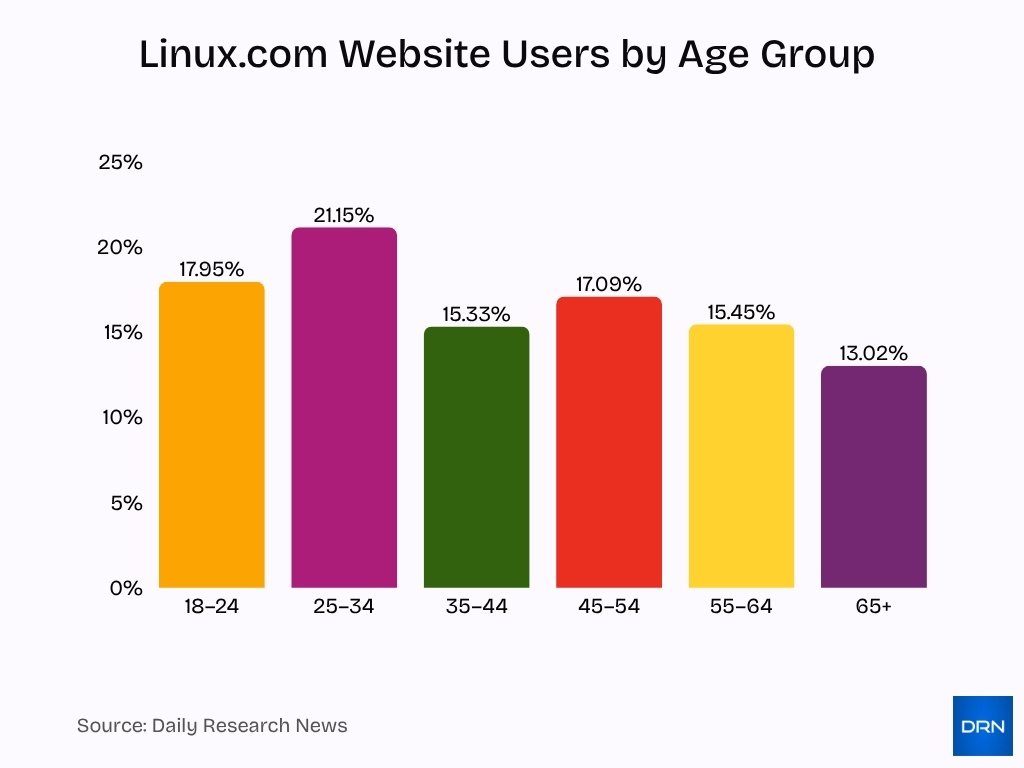

Linux.com Website Users by Age Group

- 21.15% of users are aged 25–34, making it the largest age group on Linux.com.

- 17.95% are aged 18–24, showing strong engagement among younger adults.

- 17.09% fall in the 45–54 range, indicating solid interest among mid-career professionals.

- 15.45% are in the 55–64 age group, reflecting continued usage among older tech users.

- 15.33% of users are aged 35–44, showing steady engagement in this demographic.

- 13.02% are aged 65+, suggesting a smaller but notable senior user base.

Security Statistics

- 1,732 confirmed data compromises occurred in H1 2025, an 11% year‑over‑year increase.

- Linux systems remain a key target in the rising number of published exploits.

- The OSSRA report shows growing vulnerabilities in Linux‑based components.

- Cybercrime costs are estimated to reach $10.5 trillion globally in 2025.

- Many open‑source projects are not yet compliant with security regulations.

- 72% of business leaders cite hybrid infrastructure risks tied to Linux servers.

- Only 0.56% of GitHub projects contain full SBOMs, exposing supply chain blind spots.

- Critical Linux kernel flaws like CVE‑2024‑1086 are actively exploited.

- Enterprises must focus on patching, hardening, and supply chain visibility.

- While secure by design, Linux’s scale makes vigilance essential.

Frequently Asked Questions (FAQs)

43.1%.

47%

3.05%.

Conclusion

Linux continues to play a central role across server infrastructure, cloud computing, mobile devices, embedded systems, enterprise business, kernel development, gaming, and security. From the kernel’s expansion lines of code to Linux powering nearly half of cloud workloads and gaming users on Steam, the ecosystem remains dynamic and growing.

At the same time, security and regulatory challenges underscore that scale brings responsibility. Whether you’re an enterprise architect, developer, gamer, or infrastructure lead, these statistics offer insight into where Linux stands today and where it’s headed.