The Media and Entertainment (M&E) industry continues to reshape how audiences consume content worldwide. In 2024, global revenues neared $3 trillion, with forecasts pointing toward $3.5 trillion by 2029, driven by digital advertising and streaming growth. From branded entertainment integrations and OTT platforms to immersive gaming experiences, the ecosystem is rapidly evolving. In advertising, digital formats accounted for roughly 72% of total ad revenue in 2024, emphasizing shifts in monetization.

Real-world impact shows how streaming services restructure TV viewership habits and gaming revenues rival traditional entertainment segments. Explore how these major forces are shaping the industry landscape below.

Editor’s Choice

- Global entertainment and media (M&E) revenues were just under $3 trillion in 2024, in line with estimates that the industry edged towards US$3 trillion that year.

- Industry revenue is projected to hit $3.5 trillion by 2029.

- The U.S. advertising market reached $258.6 billion in 2024.

- Digital ad formats made up 72% of total ad revenue in 2024.

- North America accounted for about 32% of the global M&E market.

- Video streaming revenues topped $233 billion in 2024.

- Music streaming in the U.S. passed 100 million subscribers in 2024.

Recent Developments

- Global industry revenues trended upward in 2024, supported by digital ad growth.

- AI-powered advertising is driving new revenue streams, expected to boost digital ad share by 2029.

- Major TV networks reported strong non-election year viewership momentum in 2025.

- Leading streaming platforms are launching genre-based subscription tiers to expand audience reach.

- Major sports and entertainment companies posted double-digit revenue growth tied to media rights deals.

- Content diversity challenges remain visible across popular streaming titles.

- Physical media formats like DVDs and CDs have seen renewed interest among younger audiences.

- Global streaming platforms continued to add tens of millions of new subscribers.

Global Media and Entertainment Overview

- Global entertainment and media (M&E) revenues were just under $3 trillion in 2024, in line with estimates that the industry edged towards $3 trillion that year.

- Forecasts project $3.5 trillion by 2029, at nearly 4% CAGR.

- North America remains the largest regional market with roughly one-third of global revenue.

- Asia-Pacific stands out as the fastest-growing regional market.

- Digital-led segments now dominate over traditional formats.

- Connected TV and mobile advertising are primary growth drivers.

- Gaming and OTT services significantly support overall industry expansion.

- Content production investment remains high as platforms diversify offerings.

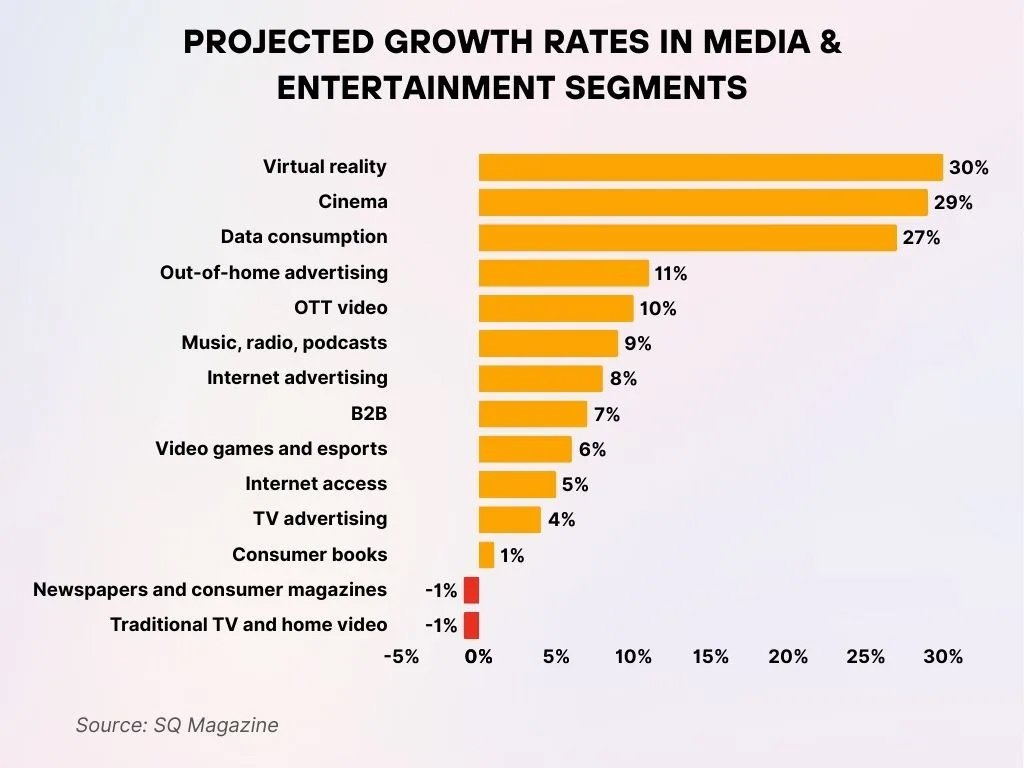

Projected Growth Rates in Media & Entertainment Segments

- Virtual reality dominates all segments with a 30% CAGR, propelled by immersive experiences and increasing adoption across gaming, events, and training.

- Cinema is positioned for a robust rebound with a 29% CAGR, supported by post-pandemic recovery and global content expansion.

- Data consumption is expected to rise at a 27% CAGR, indicating sustained growth in video streaming, gaming, and mobile internet usage.

- Out-of-home advertising demonstrates a solid recovery at an 11% CAGR, driven by the reopening of physical venues and public spaces.

- OTT (Over-the-top) video content continues to strengthen with a 10% CAGR, backed by both subscription-based and ad-supported platforms.

- Music, radio, and podcasts are projected to expand at a 9% CAGR, underscoring demand for on-the-go, personalized audio content.

- Internet advertising sustains strong performance with an 8% CAGR, as digital ad spend continues to outpace traditional media.

- B2B media is anticipated to grow at a 7% CAGR, fueled by rising demand for industry-specific content and virtual events.

- Video games and esports are set to advance at a 6% CAGR, maintaining momentum from pandemic-era popularity and competitive gaming growth.

- Internet access usage is forecast to increase at a 5% CAGR, linked to digital infrastructure expansion and mobile penetration.

- TV advertising is expected to see modest growth at a 4% CAGR, as traditional media adapts to hybrid viewing habits.

- Consumer books are likely to grow gradually at a 1% CAGR, reflecting stable demand across print and digital formats.

- Newspapers and consumer magazines are predicted to decline at a -1% CAGR, highlighting ongoing shifts toward digital media consumption.

- Traditional TV and home video are also expected to contract at a -1% CAGR, as audiences increasingly migrate to streaming platforms.

Media and Entertainment Revenue by Segment

- Digital advertising hit $258.6 billion in the U.S., up 15% year-over-year in 2024.

- Connected TV ad spend reached $35.2 billion globally, growing nearly 20% in 2024.

- U.S. digital ad revenue surged 14.9% to $258.6 billion in 2024.

- Streaming subscriptions overtook linear TV in revenue share for the first time in 2024.

- Physical media sales fell below $1 billion in video, while music hit $4.8 billion globally in 2024.

- Global gaming revenue generated $187.7 billion across all platforms in 2024.

- Global box office grossed $33 billion in 2024, down 7% from 2023.

- Licensed merchandise sales reached $307.9 billion worldwide, with Disney at $63 billion in 2024.

Digital Media and Online Entertainment Statistics

- The global digital media market was valued at about $833 billion in 2023 and is projected to reach around $925 billion in 2024 and nearly $1.9 trillion by 2030, growing at a roughly 12–13% CAGR.

- Market value is projected to approach $2 trillion by 2030.

- Streaming app revenue reached over $230 billion in 2024.

- Global video streaming revenue is estimated at around $100–130 billion in 2024 and is projected to grow to roughly $320–420 billion by 2030

- Long-term projections place video streaming above $2 trillion by the early 2030s.

- Mobile consumption accounts for the majority of digital media usage.

- Online advertising remains among the fastest-growing digital spend categories.

- OTT platforms continue expanding access to global audiences.

Streaming Video and OTT Services Statistics

- The global OTT streaming market grew from about $198 billion in 2024 toward higher levels in 2025.

- Global streaming users surpassed one billion, reflecting widespread adoption.

- OTT platforms collectively reach several billion users worldwide.

- Global OTT industry revenue is forecast to exceed $190–200 billion in 2025.

- The U.S. streaming market alone generates nearly $100 billion annually.

- American households spend hundreds of dollars per year on streaming subscriptions.

- Nearly all U.S. consumers subscribe to at least one streaming service.

- Average weekly streaming time exceeds 15 hours per user.

- Mobile devices account for more than 60% of global streaming consumption.

- Emerging markets continue to add large volumes of new OTT users.

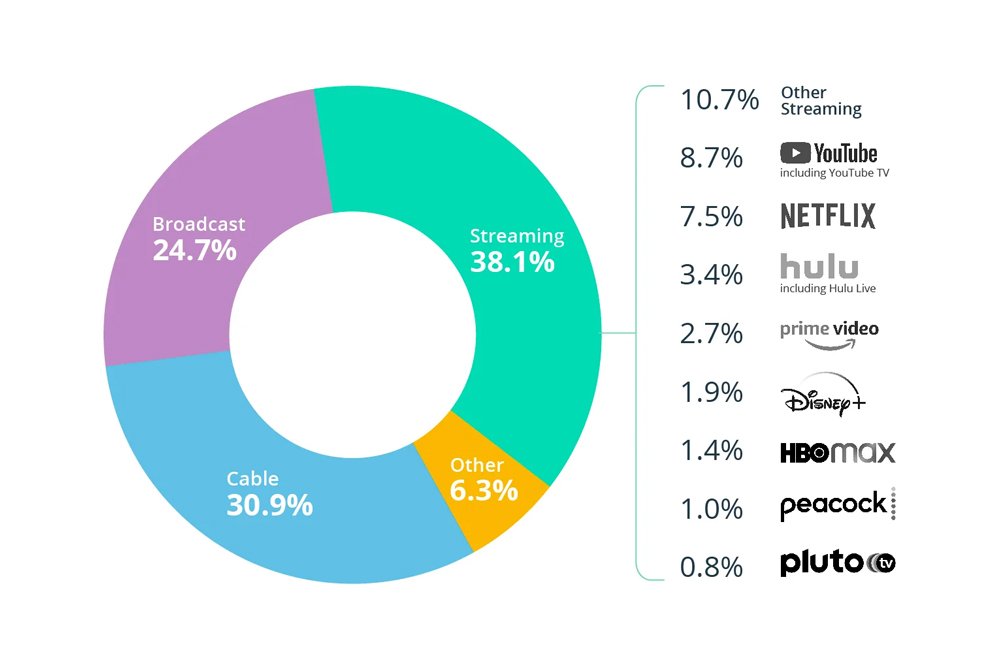

Television Viewing Share Across Platform Categories

- Streaming leads overall TV consumption with a 38.1% share, clearly outperforming both cable at 30.9% and broadcast television at 24.7%.

- Other streaming platforms, when combined, represent 10.7% of total TV viewing, indicating a meaningful contribution beyond major services.

- YouTube, including YouTube TV, commands an 8.7% share, positioning it as the largest individual streaming platform by viewing share.

- Netflix ranks next among streaming services, accounting for 7.5% of overall viewing share.

- Hulu, including Hulu Live, secures 3.4% of viewing, while Prime Video follows with a 2.7% share of total consumption.

- Disney+ records a 1.9% share, HBO Max reaches 1.4%, Peacock stands at 1.0%, and Pluto TV completes the list with 0.8% of viewing.

- The “Other” non-streaming category continues to hold 6.3%, demonstrating ongoing diversity in content sources beyond dominant platform types.

Music Industry and Audio Streaming Statistics

- Global music streaming revenue reached $36.96 billion in 2025.

- Total global streams hit over 5 trillion annually in 2025.

- U.S. on-demand audio streams surpassed 696.6 billion in the first half of 2025.

- Music streaming generated $20.4 billion in global revenues.

- Digital formats accounted for 85% of recorded music revenue.

- Paid subscriptions expanded to 752 million global users.

- Podcasts grew to 584.1 million listeners worldwide in 2025.

- Audiobooks surged with a 25.8% CAGR through 2035.

- R&B/Hip-Hop topped U.S. streaming genres in 2025.

Gaming and Esports Industry Statistics

- The global video games market generated roughly $220–230 billion in revenue in 2024 and is projected to climb toward around $300 billion by 2029–2030

- More than three billion gamers play worldwide.

- Mobile gaming represents nearly half of total gaming revenue.

- Esports audiences approach over one billion viewers globally.

- Competitive gaming events attract millions of concurrent viewers.

- Gaming revenue is projected to approach $700 billion by the end of the decade.

- Digital distribution and in-app purchases dominate revenue streams.

- Cloud and VR gaming remain smaller but fast-growing segments.

Social Media and User-Generated Content Statistics

- In the US, user-generated video and creator content on platforms like YouTube now make up roughly 20% of total TV viewing time, reflecting TV’s shift toward social video.

- As of 2025, more than 5.4 billion people worldwide use social media, and over 60%+ say social platforms are their primary channel for discovering new content.

- Around 61% of Gen Z and 53% of Millennials prefer social media and creator-led videos over traditional TV or streaming service originals for entertainment.

- Leading platforms each host massive audiences, with Facebook, WhatsApp, YouTube, and Instagram all exceeding around 2–3 billion monthly active users globally.

- On TikTok, 75% of users say the platform helps them discover new music, and viral sounds frequently push tracks into global streaming and chart hits.

- Nano-influencers on Instagram (1K–10K followers) achieve average engagement rates of about 3–4%, significantly higher than macro accounts under 1%.

- Global social media ad spend is projected to reach roughly USD 220–250 billion in 2025, capturing about 50%+ of total digital advertising budgets.

- Roughly 80% of consumers say user-generated content (UGC) highly influences their purchase decisions, and UGC campaigns can drive up to 29% higher cross-platform engagement than branded posts alone.

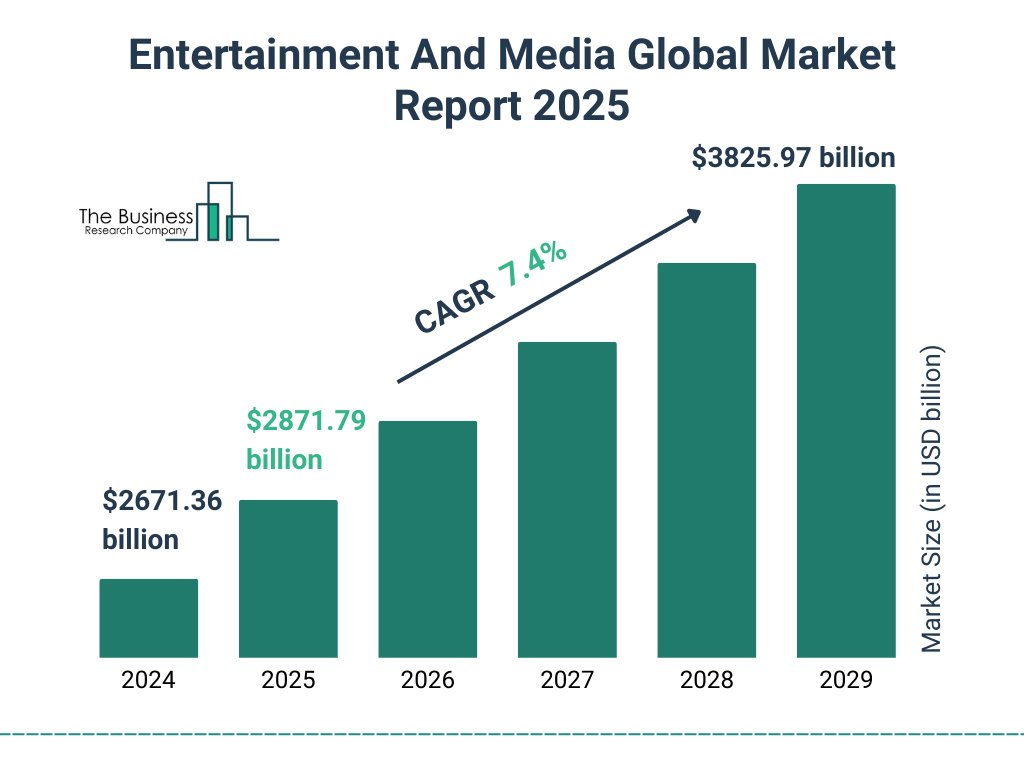

Entertainment and Media Global Market Outlook (2024–2029)

- The global entertainment and media market was valued at $2,671.36 billion in 2024, reflecting a strong baseline for sustained industry growth.

- In 2025, the market is projected to reach USD 2,871.79 billion, indicating continued expansion across digital and traditional media segments.

- The market is expected to grow at a compound annual growth rate (CAGR) of 7.4% during the forecast period 2024–2029.

- Consistent year-over-year growth is projected through 2026, 2027, and 2028, driven by rising demand for digital content, streaming services, gaming, and advertising.

- By 2029, the global entertainment and media market is forecast to reach $3,825.97 billion, highlighting the industry’s long-term scalability and investment potential.

Advertising and Marketing in Media and Entertainment

- Global ad spending is projected to exceed $1.1 trillion in 2025.

- U.S. digital advertising surpassed $250 billion annually.

- Digital channels are expected to capture around 80% of ad revenue by the end of the decade.

- Creator-driven advertising revenue continues rising rapidly.

- Digital advertising represents nearly half of ad spend in major emerging markets.

- Retail media is emerging as a major advertising growth channel.

- Programmatic advertising dominates connected TV placements.

- Short-form video ads attract growing brand investment.

- AI personalization is reshaping campaign targeting and measurement.

Subscription vs Ad-Supported Media Revenue Statistics

- Global digital subscriptions reached an estimated 923 million in Q1 2025, up from 917 million the prior year.

- Ad-supported SVOD now holds 28% of total digital subscriptions, rising from 21% last year, while ad-free fell to 36%.

- Connected TV ad revenue worldwide hit $38.3 billion in 2024, up from $31.92 billion in 2023.

- Netflix’s ad tier grew to 94 million monthly active users in 2025, a 20 million increase in six months.

- 46% of US premium SVOD subscriptions are now ad-supported, driving 71% of net growth over nine quarters.

- Netflix ad-supported plans comprise 42% of subscribers in Q2 2025, tripling from 14% in 2023.

- 75% of premium SVOD users subscribed to an ad-supported plan by March 2025, up from 66% a year earlier.

- CTV ad revenue for pure-play platforms is projected to grow 26% to $7.8 billion in 2025.

- 54% of SVOD subscribers use at least one ad-supported service, up 8 points from 2024.

Consumer Media Consumption Habits and Screen Time

- U.S. consumers spend an average of six hours daily on media and entertainment.

- Gen Z viewers dedicate 50 minutes more daily to social video than average, and 44 minutes less to TV/movies.

- 42% of subscribers report subscription fatigue from too many streaming services.

- 63% of global online users watch short-form social video daily, surpassing streaming TV at 46%.

- AI recommendations boost session durations by analyzing watch time and user patterns for personalized content.

- 29% of U.S. youth media time involves multitasking across multiple streams.

- Streaming services face rising churn from cost sensitivity and password sharing, up 10% quarterly.

- Short-form videos under 60 seconds gain 150% more shares than long-form videos on social media.

- 72% of global consumers prefer local-language content on websites and platforms.

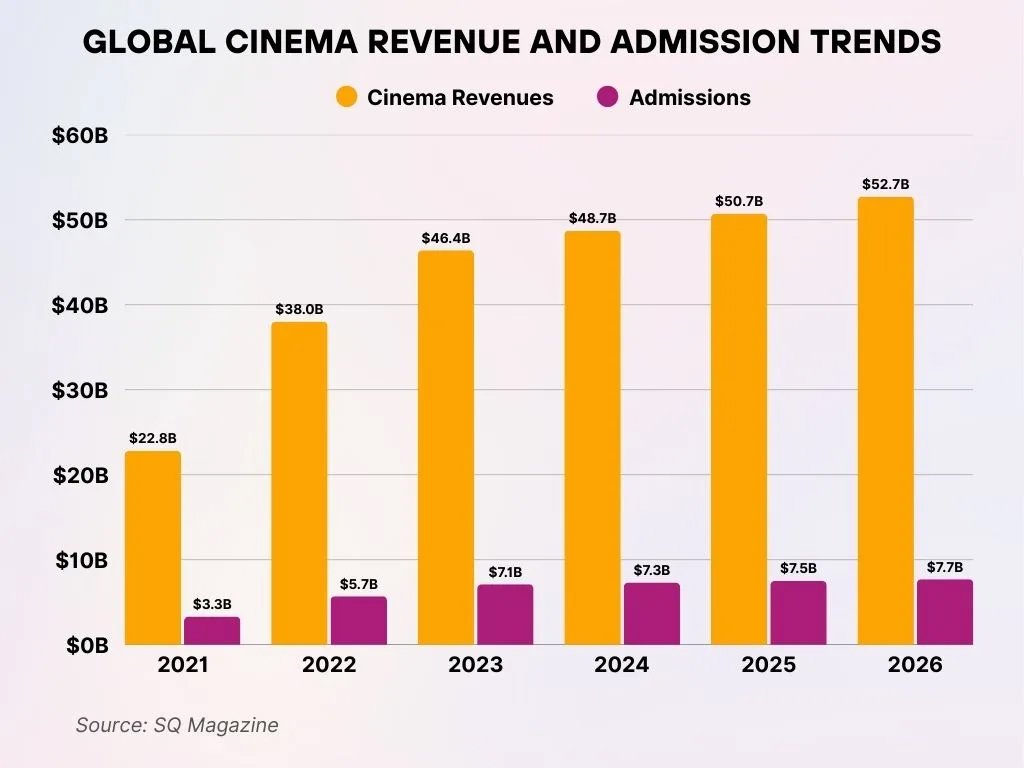

Worldwide Cinema Revenue and Attendance Growth Trends

- Global cinema revenues are forecasted to more than double, increasing from $22.8 billion in 2021 to $52.7 billion by 2026.

- In 2022, the industry experienced a strong rebound, with revenues rising to $38 billion, compared with $22.8 billion in the previous year.

- Cinema admissions showed consistent growth, climbing from 3.3 billion in 2021 to a projected 7.7 billion by 2026.

- The year 2023 represented a key milestone, generating $46.4 billion in revenue alongside 7.1 billion ticket admissions.

- Market expansion continued in 2025, with revenues reaching $50.7 billion and total admissions amounting to 7.5 billion.

- By 2026, the global cinema industry is expected to reach a new peak, achieving $52.7 billion in revenue and 7.7 billion in total admissions.

Mobile Media and App-Based Entertainment Statistics

- Global mobile advertising revenue hits $389 billion in 2025, claiming 73% of total digital ad spend.

- Mobile devices power 57-75% of worldwide video consumption.

- Entertainment apps drive $166.6 billion in global in-app purchase revenue in 2024.

- YouTube Shorts garners 200 billion daily views in early 2025.

- Apps with personalization boost user retention by up to 30%.

- India eyes 600-650 million short-form video users by 2025.

- 74% of Gen Z watch over 30 minutes of mobile video daily.

- Mobile ad spend surges to $228.12 billion in the US for 2025.

- Global in-app revenue from short drama apps reaches $700 million in Q1 2025.

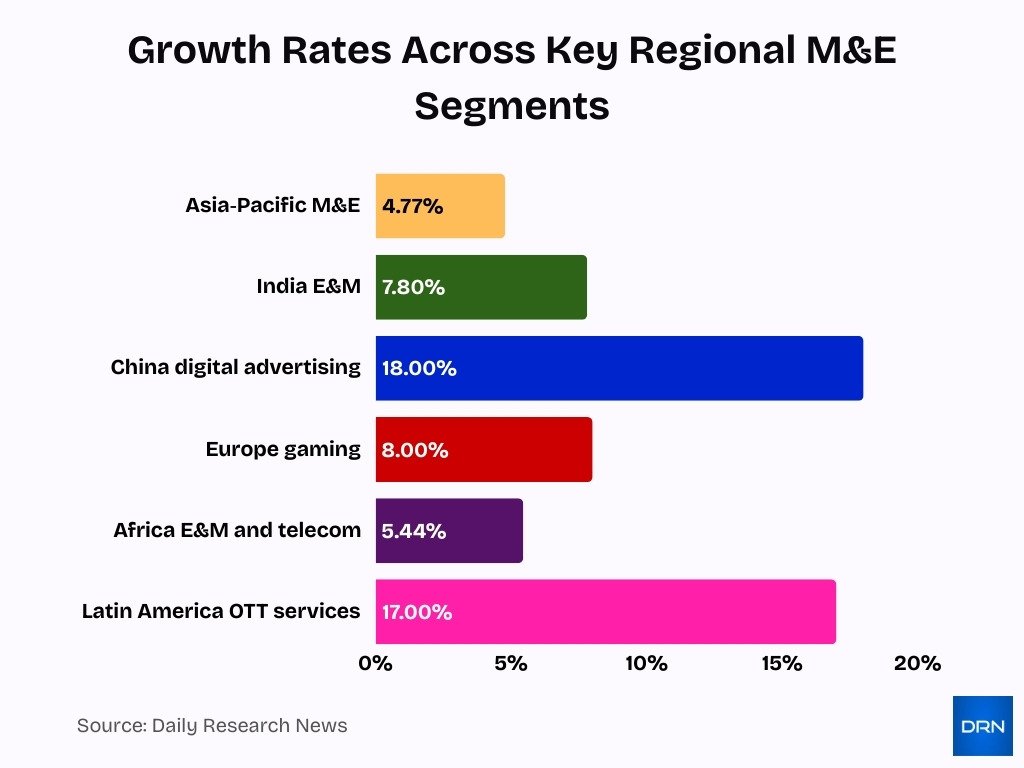

Regional Media and Entertainment Market Breakdown

- North America commands the largest share of the global M&E market at over 40% in 2025.

- Asia-Pacific M&E market reaches $1.34 trillion in 2025, growing at 4.77% CAGR.

- India’s E&M sector is valued at $32.2 billion in 2024, hitting $47.2 billion by 2029 with a 7.8% CAGR.

- China’s digital advertising surges to $53.4 billion in 2024, expanding at 18% CAGR through 2030.The

- The European gaming market stands at $84.8 billion in 2024, reaching $176.2 billion by 2033 at 8% CAGR.

- Africa’s E&M and telecom market exceeds $63 billion in 2025, with a 5.44% CAGR to 2033.

- Latin America OTT services hit $11.7 billion in 2025, growing at a 17% CAGR to $56.1 billion by 2035.

- China M&E market projected at $243 billion in 2025, fueled by a 5.95% CAGR of digital growth.

India Media and Entertainment Industry Statistics

- India’s M&E industry is growing at nearly 8% CAGR.

- Market value is projected to approach $50 billion before 2030.

- Regional language content accounts for over half of paid OTT subscriptions.

- DTH television revenues are declining at a slower pace.

- Connected smart TVs are expanding rapidly across households.

- Short-form video attracts hundreds of millions of daily users.

- Internet advertising is a major growth driver.

- Mobile and video apps are expanding beyond metro areas.

- Localization strategies significantly boost engagement.

Emerging Technologies in Media and Entertainment (AI, AR, VR)

- AI personalization contributes 27.4% to the media and entertainment market revenue in 2025.

- Generative AI in the media and entertainment market grows from $1.97 billion in 2024 to $2.53 billion in 2025.

- The global AR & VR market reaches $46.6 billion in 2025.

- AI boosts media revenue by 10% and cuts costs by 15%.

- Blockchain in the digital rights management market hits $0.25 billion in 2025.

- 5G-supported global media market reaches $750 billion by 2025.

- The virtual production market is projected to reach $3.9 billion in 2025.

- AI in the media and entertainment market is expected to grow to $21.99 billion in 2025.

Future Outlook and Forecast for the Media and Entertainment Industry

- Global M&E industry revenues to grow from $3T in 2024 to $3.5T by 2029 at 3.7% CAGR.

- Advertising is expected to expand at a 6.1% CAGR, outpacing consumer spending by three times.

- Subscription economy market projected to reach $1.94T by 2035, with hybrid models gaining traction.

- Social video advertising to surge from $31.3B in 2025 to $444.5 billion by 2035 at 30.4% CAGR.

- Mobile internet consumption to hit 31% of global media time by 2021, rising further.

- AI in the media market is expected to grow from $8.21B in 2024 to $51.08 billion by 2030 at a 35.6% CAGR.

- India’s E&M sector to reach $47.2B by 2029 at 7.8% CAGR, double the global average.

- CTV ad revenues to hit $51B by 2029, equaling 45% of traditional TV spend.

Frequently Asked Questions (FAQs)

About $3.04 trillion in 2025, reflecting continued expansion across digital, advertising, and subscription segments.

The global media and entertainment industry is projected to grow at a ~3.79% CAGR between 2025 and 2030.

The global digital media market is projected to reach about $1.9 trillion by 2030 at a CAGR of ~12.8% from 2024.

The global video streaming market is projected to escalate to approximately $2.66 trillion by 2032, growing at an 18.5% CAGR.

Conclusion

The Media and Entertainment industry reflects rapid transformation and sustained growth. Digital advertising leads revenue expansion, while subscription models evolve toward flexible, hybrid structures. Consumer behavior continues shifting toward mobile, social, and on-demand formats, opening new opportunities for platforms and creators alike. Emerging regions and technologies, particularly AI-driven personalization and immersive media, will shape the industry’s next phase.

Together, these trends point to a dynamic ecosystem that will keep redefining how audiences engage with entertainment worldwide.

Hover or focus to see the definition of the term.