The mobile app industry continues to surge, driven by widespread smartphone adoption, faster mobile data, and increasing consumer demand. From everyday utilities to entertainment and business tools, mobile apps now shape how people work, communicate, shop, and play. For example, retailers rely on apps to reach customers through in-app purchases and mobile commerce, and fitness platforms use apps to deliver personalized workouts and track health data. In this article, we unpack the latest numbers behind this growth, from market size and download trends to shifting category dynamics and revenue patterns.

Editor’s Choice

- The global mobile application market is estimated to reach $333.93 billion in 2025.

- In 2024, there were approximately 137.8 billion mobile app downloads worldwide.

- In 2024, consumer spending (iOS + Android) on apps reached $150.1 billion.

- In 2024, mobile ad spend on mobile apps hit $390 billion, up 7.7% from the prior year.

- On average, mobile users in 2024 opened an app 11 or more times per day in about 49% of cases.

- Some of the fastest-growing app categories in 2024 were news & magazines (16.6% growth) and travel apps (16.1% growth).

- The segment that drives the largest share of consumer spending is games, accounting for 53% of app spending in 2024.

Recent Developments

- In 2025, the global mobile application market value rose to about $333.93 billion.

- Forecasts suggest the market could grow to $745.36 billion by 2030, reflecting strong continued momentum.

- A separate forecast pegs the market at $330.61 billion in 2025, with a long-term projection of over $1,100 billion by 2034.

- Mobile app adoption continues climbing as smartphone penetration and internet access expand globally.

- Analysts note rising demand for AI-enabled features, in-app commerce, and mobile-first enterprise solutions as major recent drivers.

- Increasing competition and market saturation in mature regions push developers to innovate across user experience, monetization, and cross-platform compatibility.

- With the trend toward consolidation, many businesses are shrinking multiple tools into single multifunctional apps to reduce overhead and simplify user experience.

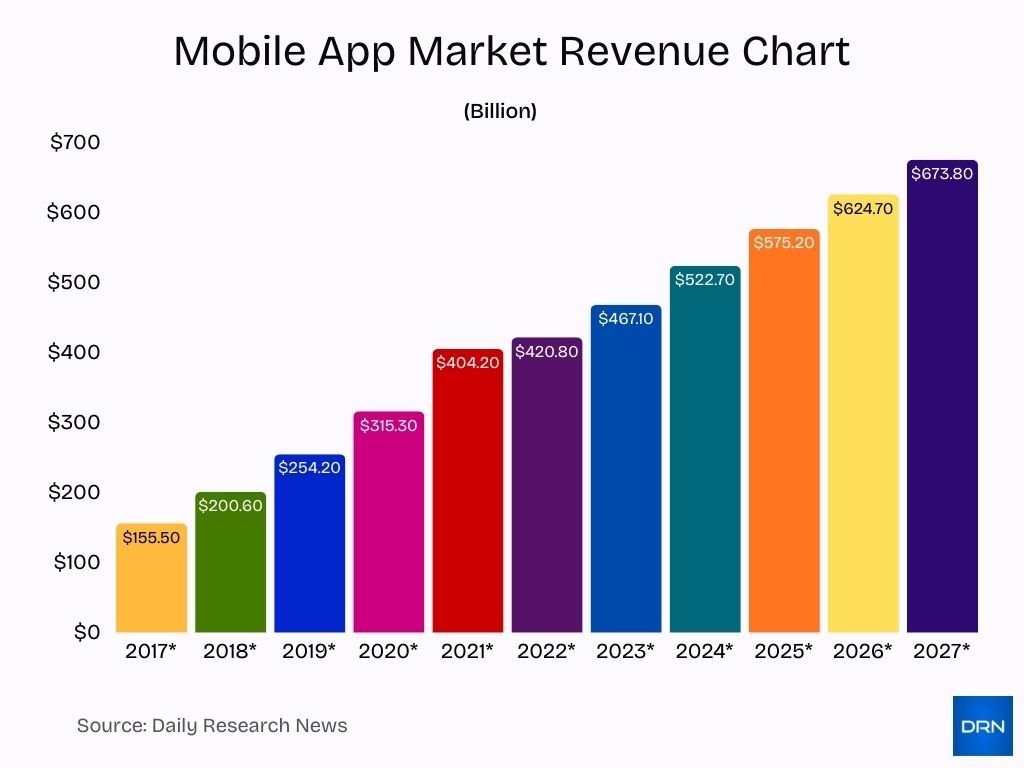

Mobile App Market Size and Revenue Growth

- The mobile app market demonstrates a steady upward trajectory in total revenue from 2017 to 2027, highlighting long-term growth.

- Revenue expands from $155.5 million in 2017 to a projected $673.8 million in 2027, showcasing strong long-term industry expansion.

- Between 2017 and 2020, total revenue nearly doubled (from $155.5 to $315.3), signaling an era of early rapid growth.

- The rise from 2020 to 2021 stands out as particularly significant, climbing from $315.3 to $404.2, an increase of ~$89B, likely driven by accelerated digital adoption.

- From 2021 onward, revenues keep increasing steadily, surpassing $400B and reaching $522.7 by 2024, reflecting continued market strength.

- The projected revenue figures for 2025–2027 illustrate ongoing momentum with 2025: $575.2, 2026: $624.7, and 2027: $673.8, signaling sustained industry growth.

- The overall increase from 2023 ($467.1) to 2027 ($673.8) exceeds $200B, reinforcing strong future market confidence.

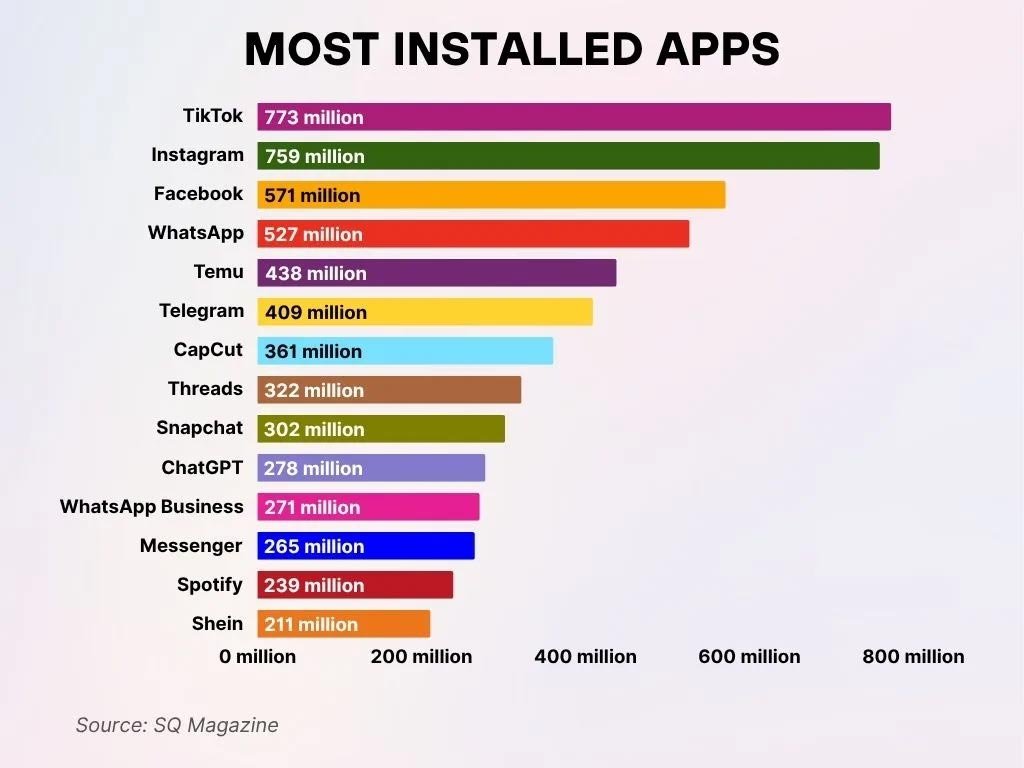

Most Downloaded Applications

- TikTok tops the list with 773 million installs, emphasizing its strong dominance in the short-form video landscape.

- Instagram secures the next position with 759 million installs, showcasing its steady popularity among users who enjoy photos and stories.

- Facebook maintains its presence with 571 million installs, underscoring its enduring relevance across multiple age groups.

- WhatsApp logged 527 million installs, reaffirming its crucial role as a leading global messaging platform.

- Temu, the fast-growing e-commerce app, accumulated 438 million installs, signaling swift worldwide expansion and user growth.

- Telegram reached 409 million installs, boosted by its privacy-centric features and rising user confidence.

- CapCut, the video-editing tool from TikTok’s parent firm, garnered 361 million installs, driven by high demand from content creators.

- Threads secured 322 million installs, reflecting Meta’s achievement in launching a strong Twitter-style alternative.

- Snapchat amassed 302 million installs, sustaining its pull among younger users through AR tools and interactive chat features.

- ChatGPT recorded 278 million installs, underscoring the rapid embrace of AI-powered consumer tools.

- WhatsApp Business achieved 271 million installs, indicating robust adoption by SMEs and various service providers.

- Messenger, Facebook’s separate chat app, hit 265 million installs, confirming its ongoing utility for communication.

- Spotify gained 239 million installs, reinforcing its strong position in music streaming across platforms.

- Shein reached 211 million installs, underscoring its significant influence in fast fashion and its vast digital retail reach.

Fastest Growing Mobile App Categories

- News and magazines apps grew by 16.6% YoY in revenue in 2024.

- Travel apps achieved 16.1% YoY growth, signaling post-pandemic recovery.

- AI chatbot apps surged with 112% YoY growth, leading all categories.

- AI apps overall saw 209% revenue growth through 2024.

- E-commerce installs increased by 17% YoY in 2024.

- Finance app installs rose 27% YoY amid digital payment trends.

- Health & fitness apps like Strava grew revenue by 15-20% in 2024.

- Gaming apps generated $287B in projected 2025 revenue.

- Software apps powered by AI hit over 50% YoY growth.

Mobile App Revenue by Category

- In 2024, global consumer spending on mobile apps reached $150.1 billion.

- Games accounted for 53% of that consumer spending in 2024.

- Subscription revenues rose to about $66.8 billion in 2024, with iOS users contributing roughly 73% of that amount.

- Non-gaming apps saw strong growth; in-app purchase growth was up ~23% year over year, compared to gaming’s ~4% growth.

- Monetization through in-app purchases and subscriptions now surpasses traditional paid app download models in most categories.

- Revenue from tools, utilities, social, streaming, and entertainment apps now represents a substantial share of total app marketplace earnings.

- The overall mobile app market’s revenue is projected to reach around $585 billion in 2025, up from roughly $530–540 billion in 2024.

Regional Mobile App Market Insights

- The global mobile application market is valued at $333.93 billion in 2025, with forecasts pointing toward $745.36 billion by 2030.

- In 2024, the mobile app market in India generated about $10,591.2 million, and it’s forecast to grow at a CAGR of 17.8% through 2030.

- By 2030, the Indian market is expected to reach about $27,675.5 million.

- Growth in emerging economies is driven by expanding smartphone penetration, lower-cost devices, and increasing mobile internet access.

- In regions with high iOS adoption, average consumer spending per user tends to be higher.

- Android heavy regions generate high download volumes but lower revenue per user.

- Developers targeting global reach often tailor monetization strategies by region, subscription-heavy models in iOS markets, and ad-based models in Android markets.

- Emerging markets present a major long-term opportunity due to rising smartphone usage and increasing willingness to pay.

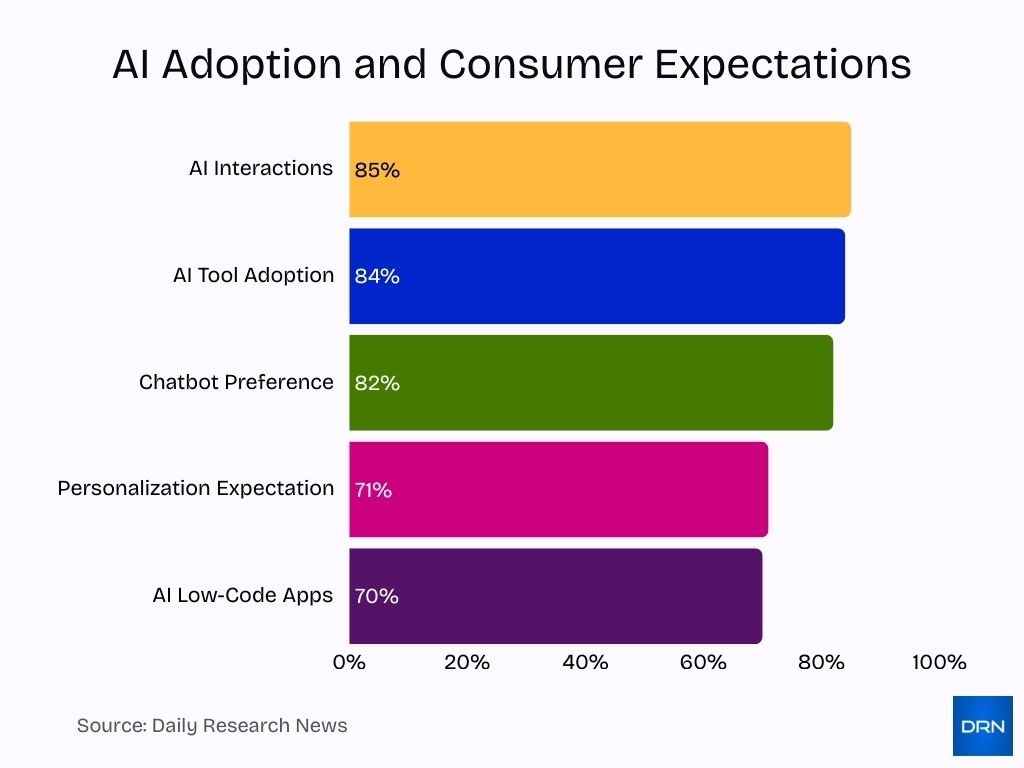

Influence of AI and IoT on Mobile Apps

- 85% of app interactions will be influenced by AI by 2025, revolutionizing mobile experiences.

- GenAI apps recorded 2 billion downloads and 16 billion hours of usage in H1 2025 alone.

- ChatGPT mobile app attracts 557 million monthly active users worldwide.

- 82% of consumers prefer chatbots over waiting for customer representatives.

- 71% of consumers expect companies to deliver personalized content via apps.

- The AIoT market is expected to grow from $18.37 billion in 2024 to $79.13 billion by 2030.

- 84% of developers use or plan to use AI tools in their processes, aiding mobile app development.

- 70% of new apps in 2025 use low-code/no-code platforms with AI integration.

- 16.6 billion IoT devices connected by the end of 2023, driving mobile app expansions.

User Engagement and Retention Rates

- Global in-app purchase revenue reached $150 billion even as downloads plateaued, indicating stronger engagement among existing users.

- Users spent 4.2 trillion hours across mobile apps in 2024, averaging roughly 3.5 hours per day per user.

- Mobile gaming sessions rose 12% year over year in 2024.

- Time spent in mobile games grew 8% year over year in 2024.

- Retention strategies like frequent updates and live ops helped offset a 7% decline in global game downloads.

- Subscription and IAP growth in non-gaming apps indicates rising loyalty and long-term engagement.

- The divergence between stable downloads and rising revenue shows that active user engagement is now more important than installs.

- As markets mature, retention and lifetime value have become more critical than acquisition volume.

Impact of 5G and New Technologies on Mobile Apps

- AI-powered apps hit 3.3 billion downloads in 2024, surging 26% YoY amid 5G rollout.

- Global mobile app downloads reach 299 billion in 2025, fueled by 5G expansion.

- The 5G enterprise market is valued at $6.73 billion in 2025, growing 31% CAGR to $26 billion by 2030.

- Real-time collaboration features in apps surged 300% in 2025 implementations via 5G low latency.

- AR/VR market hits $62 billion by 2029 with 8.9% CAGR, boosted by 5G bandwidth.

- GenAI apps logged 2 billion downloads in H1 2025, with 16 billion hours of usage.

- 5G speeds cut load times, lifting e-commerce conversions by up to 20%.

- Private 5G networks claim 38% revenue share in enterprise mobility.

- AI in the mobile apps market grows from $21 billion in 2024 to $354 billion by 2034 at a 32.5% CAGR.

Advertising Revenue within Mobile Apps

- Total advertising spend within mobile apps exceeded $390 billion in 2024, growing 7.7% year-over-year.

- Social networking apps generated $134.4 billion in mobile ad revenue in 2024.

- Mobile games accounted for $106.5 billion of ad revenue in 2024, expected to grow 54.5% over five years.

- Hybrid monetization strategies combining ads and subscriptions grew 20% in mobile gaming apps in 2024.

- iOS app monetization revenue grew 10% in 2024, capturing 55% of global in-app purchase revenue.

- User time spent in mobile apps increased ad impressions, contributing to a 9% rise in digital ad spending globally in late 2024.

- Advertisers shifted budgets significantly to mobile, with U.S. mobile ad spend reaching over $216 billion in 2024.

- Games’ top 5% paying users now generate 48% of total gaming ad revenue, showing concentrated monetization.

- In regions with lower pay willingness, ad-based monetization continues to dominate mobile app revenue models.

- Cross-category apps combine ads with subscription revenue to diversify earnings, reflecting a trend toward hybrid monetization.

Mobile App Store Market Share and Distribution

- As of 2025, Android holds 71.4% global OS market share, while iOS holds about 28.2%.

- In 2024, Google Play recorded ~102.4 billion downloads, while iOS recorded ~35.4 billion.

- Despite lower downloads, iOS generated about 68% of total consumer spending in 2024.

- Google Play hosts over 2.1 million apps, while the App Store hosts ~2.04 million apps.

- About 96.97% of Google Play apps are free, compared to 95.33% on iOS.

- Games make up roughly 10–12% of app listings in both stores.

- Google Play dominates global distribution in emerging, high-volume markets.

- iOS offers higher monetization per user, making it a priority for revenue-focused developers.

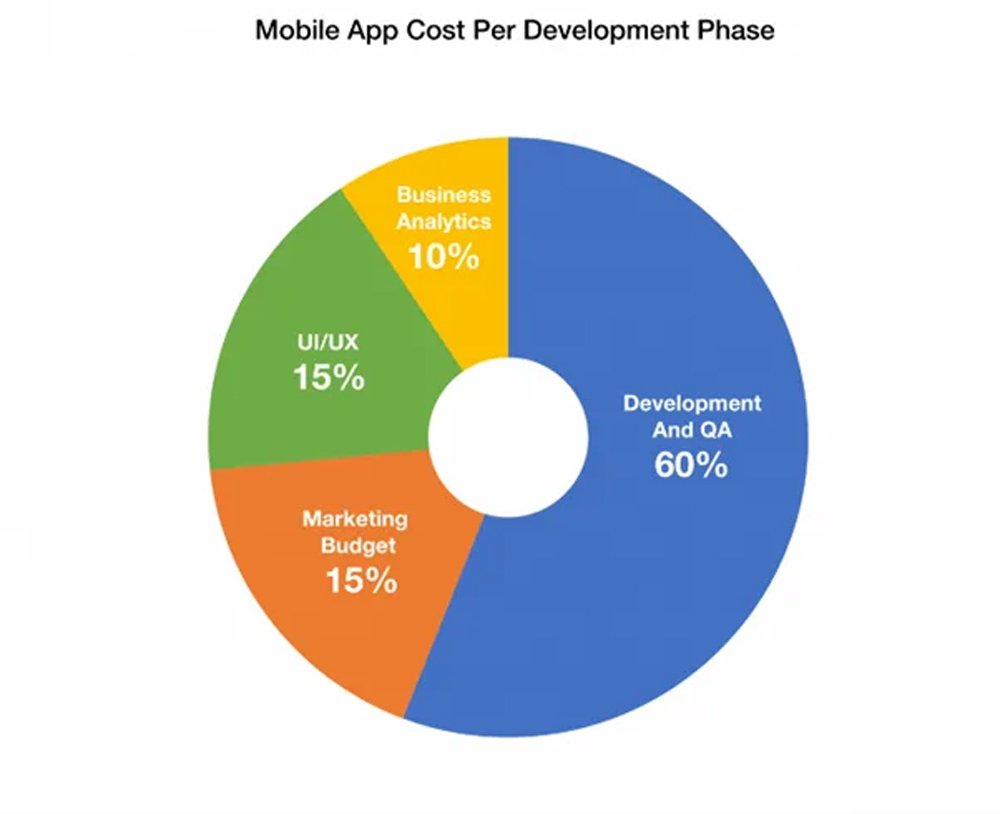

Mobile App Budget Distribution by Development Stage

- Development and QA represent the largest portion of the expenses, taking up 60% of the overall mobile app budget, emphasizing their major role in the project.

- UI/UX design contributes 15%, highlighting the significance of crafting a seamless and intuitive user experience.

- The marketing budget constitutes another 15%, demonstrating how essential strategic promotion is for an app’s overall success.

- Business analytics receives 10%, reinforcing its role in enabling data-driven decision-making and effective app strategy planning.

Mobile Gaming App Growth and Revenue

- The global games market is expected to reach $188.8 billion in 2025, with $103.0 billion coming from mobile gaming.

- Another estimate values the mobile gaming market at $135.06 billion in 2025, growing to $229.6 billion by 2030.

- Mobile game IAP revenue grew 4% year over year in 2024.

- Time spent in mobile games increased 8%, while gaming sessions grew 12% in 2024.

- Hybrid casual game IAP revenue grew 37% year over year.

- Top games like MONOPOLY GO! generated $2.21 billion in 2024.

- North America saw a 9% increase in IAP revenue, while Europe saw 14% growth.

- Developers rely more on live ops and updates to sustain engagement and revenue.

Social Media and Messaging App Statistics

- About 35% of all time spent on mobile devices is on social media apps.

- There are over 6.3 billion smartphone users globally in 2025.

- Roughly 70% of people rely on mobile devices as their primary method of internet access.

- Over 120 million new smartphone users joined the global market in the prior 12 months.

- 5G expansion supports richer social features like video, voice, and live streaming.

- Many users rely on messaging apps as their default communication method.

- Social apps continue to represent major monetization opportunities via ads and commerce.

Mobile App Adoption by Device Type and Platform

- 92% of all mobile app usage happens on smartphones.

- 75% of total app downloads are on Android devices.

- Smartphones account for nearly 90% of all app downloads worldwide.

- Android dominates with a 72.7% global mobile OS market share in 2025.

- iOS holds around 27% of the mobile OS market globally.

- Tablets contribute about 9% of mobile app usage, mainly for entertainment and e-learning.

- India saw a 190% increase in smartphone adoption since 2019.

- Over 6.3 billion smartphone users exist globally in 2025.

- Mobile internet access accounts for roughly 96% of total internet use worldwide.

- Wearables and smart TV app downloads grew by 15% year-over-year, highlighting emerging device segments.

Mobile App Consumer Spending Patterns

- Global mobile app revenue is expected to reach $585 billion in 2025, growing at 8–12% year over year.

- In-app purchases account for approximately 55% of total mobile app revenue globally.

- Subscription spending is projected to reach around $190 billion worldwide in 2025.

- Mature markets like North America and Europe generate 3x higher per-user spending than emerging markets.

- Mobile gaming remains dominant, but spending is diversifying with health, wellness, and productivity apps gaining share.

- Apps with high engagement and retention see up to 4x greater revenue than those relying on download spikes.

- More than 60% of consumer spending on mobile apps is on subscriptions and in-app purchases.

- Smartphone adoption growth is driving a long-term increase in mobile app consumer spending potential.

- iOS users spend an average of $101 per user annually, compared to $38 on Android.

- Social media, entertainment, and fitness apps contribute significantly to diversified spending beyond gaming.

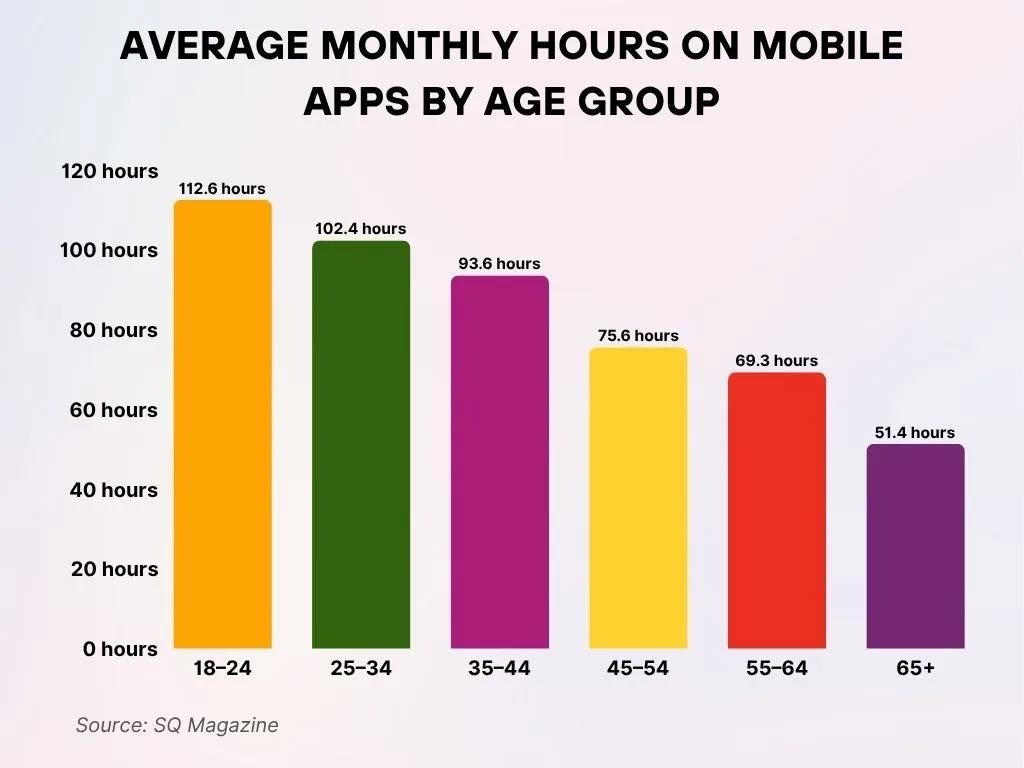

Average Monthly Time Spent on Mobile Apps by Age Group

- Young adults aged 18–24 spend the most time on mobile apps, averaging 112.6 hours per month per user while maintaining high digital engagement.

- Users aged 25–34 follow closely with 102.4 hours monthly, indicating strong mobile engagement during early career and social life stages.

- The 35–44 age group records an average of 93.6 hours, reflecting consistent mobile usage even among busy professionals and parents.

- Middle-aged users 45–54 log 75.6 hours, still showing notable mobile activity across entertainment and utility apps.

- Older adults aged 55–64 spend 69.3 hours monthly, demonstrating a gradual decline in mobile app dependence.

- Older people 65+ use mobile apps the least, with an average of 51.4 hours per month, indicating lower digital interaction within this group.

Challenges and Opportunities in the Mobile App Market

- App competition drives $10-30 average user acquisition costs per install in 2025.

- Android fragmentation affects 28.5% on Android 15 and 16.8% on Android 14 in mid-2025.

- App maintenance consumes 15-20% of the initial development budget annually.

- 300+ billion total app downloads projected globally in 2025.

- Emerging markets like India lead as a country for app downloads, surpassing the US.

- Cross-platform tools deliver 30-50% development cost savings over native apps.

- AI in the mobile apps market grows from $16.7B in 2023 to $249.8 by 2033 at 33.7% CAGR.

- Hybrid monetization enables apps with 100K MAU to earn $5K-$100K+ monthly ad revenue.

Frequently Asked Questions (FAQs)

The global mobile-app market is valued at $333.93 billion in 2025.

Consumers spent roughly $150.1 billion on mobile apps in 2024.

The global mobile-app market is forecast to grow at a CAGR of 14.3% from 2024 through 2030.

In 2024, games accounted for 53% of total consumer spending on mobile apps.

Conclusion

The global mobile app market growth is no longer just about downloads; it hinges on engaged users, diverse monetization strategies, and technological integration. Developers now balance cross-platform reach, monetization models, and feature complexity to reach both mature markets and emerging ones. As smartphone penetration deepens and AI and IoT technologies spread, mobile apps have room to evolve beyond social and gaming into productivity, health, services, and connected lifestyles.

For businesses and developers alike, understanding these shifts and adapting accordingly remains key to unlocking future growth.