Mobile banking has evolved from a niche convenience to a core financial channel worldwide. More than 2.17 billion people across the globe use banking services on their phones, a 35% increase since 2020, driven by smartphone access and fintech expansion. This shift is transforming how consumers manage money, from checking balances to paying bills and transferring funds instantly. In the United States, 72% of adults now use mobile banking apps, up from 65% in 2022, showing mainstream adoption across age groups.

Real-world impact is clear: banks are closing branches as more customers migrate to digital channels, and underserved regions are gaining financial access through mobile accounts. This article digs into the latest mobile banking statistics to reveal key trends shaping the industry today.

Editor’s Choice

- 2.17 billion people globally used mobile banking by the end of 2025.

- 72% of U.S. adults reported using mobile banking apps in 2025.

- 89% of banks worldwide have launched mobile banking apps.

- 61% mobile banking penetration in North America in 2025.

- 76% of consumers in the U.S. use mobile banking or online banking.

- 34% of consumers log into mobile banking apps daily.

- The mobile banking software/platform market is projected to reach $1.58 billion in 2025, while global mobile-banking‑related revenue across banks is estimated at around $1.9 trillion.

Recent Developments

- By mid-2025, 76% of U.S. customers use mobile banking apps, exceeding prior years’ adoption metrics.

- Daily mobile app engagement has risen sharply, with 34% of users logging in every day.

- Traditional bank branch closures continue as digital shifts accelerate, with major institutions reducing physical footprints.

- Banks cutting branch networks report that mobile apps now lead how customers access accounts.

- Personalized experiences and security enhancements are top consumer demands in 2025 mobile banking.

- AI and automation are increasingly embedded in banking apps to streamline services and reduce operational costs.

- Non-bank digital platforms like fintech apps are rising alongside traditional banks, diversifying service options.

- Consumer expectations for digital banking convenience have prompted legacy banks to accelerate mobile app updates.

Global Mobile Banking Overview

- 2.17 billion individuals will use mobile banking services globally by 2025.

- Approximately 66% of the world’s population has access to mobile banking.

- 89% of banks worldwide offer mobile banking apps, signaling universal institutional adoption.

- In Europe, 76% mobile banking usage reflects deep market maturity.

- North America reached 61% mobile banking penetration in 2025.

- Asia-Pacific markets saw dramatic user and transaction growth due to mobile-first ecosystems.

- Emerging markets show rapid adoption tied to affordable smartphones and fintech platforms.

- Daily mobile money flows reached $4.6 billion in mobile accounts, reflecting increased usage intensity.

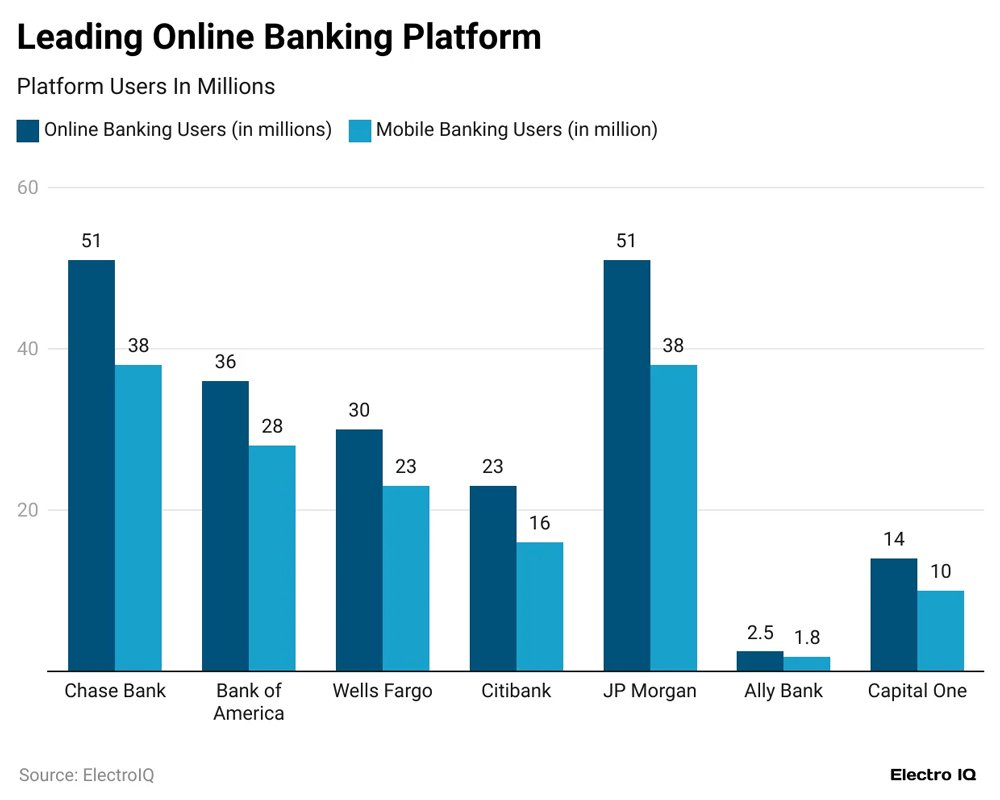

Leading Online Banking Platforms

- Chase Bank remains the market leader, attracting 51 million online users and 38 million mobile users across its digital platforms.

- JP Morgan closely parallels Chase, reporting 51 million online users while also supporting 38 million mobile users nationwide.

- Bank of America demonstrates a strong digital presence, with 36 million online users and 28 million actively using its mobile banking services.

- Wells Fargo maintains a solid customer base, serving 30 million online users alongside 23 million mobile users.

- Citibank continues to expand its digital reach, accounting for 23 million online users and 16 million mobile users.

- Capital One shows steady digital adoption, registering 14 million online users and 10 million mobile users.

- Ally Bank, while comparatively smaller, still holds a notable digital footprint with 2.5 million online users and 1.8 million mobile users.

Key Mobile Banking Adoption Milestones

- SMS banking was launched by European banks in 1999 via WAP-enabled phones.

- Royal Bank of Scotland released the world’s first full banking app in May 2011, gaining 1 million users in six months.

- Wachovia Bank pioneered U.S. mobile banking in 2006, followed by Bank of America in 2007, with 500,000 users quickly.

- 89% of global banks will offer mobile apps by 2025.

- Mobile banking users surged 35% globally from 2020 to 2025, reaching 2.17 billion.

- 72% of U.S. adults used mobile banking apps in 2025.

- 80% of financial institutions partnered with fintechs by the early 2020s.

- Mobile banking touchpoints rose 72% from 2020 to 2023, hitting 150 per customer annually.

- 48% of consumers accessed mobile banking apps daily by 2025.

Global Mobile Banking Usage Statistics

- 72% of U.S. adults use mobile banking apps in 2025, rising from 65% in 2022.

- 2.17 billion users globally will be engaged in mobile banking by 2025.

- 61% mobile banking penetration in North America reflects broad acceptance.

- Europe’s usage rate reached 76%.

- Global launch rates of banking apps reached 89%+.

- Daily engagement shows 34% log in every day.

- Mobile wallets are used by ~60% of consumers, showing overlap with banking app use.

- Consumer preference for mobile access continues to climb against traditional channels.

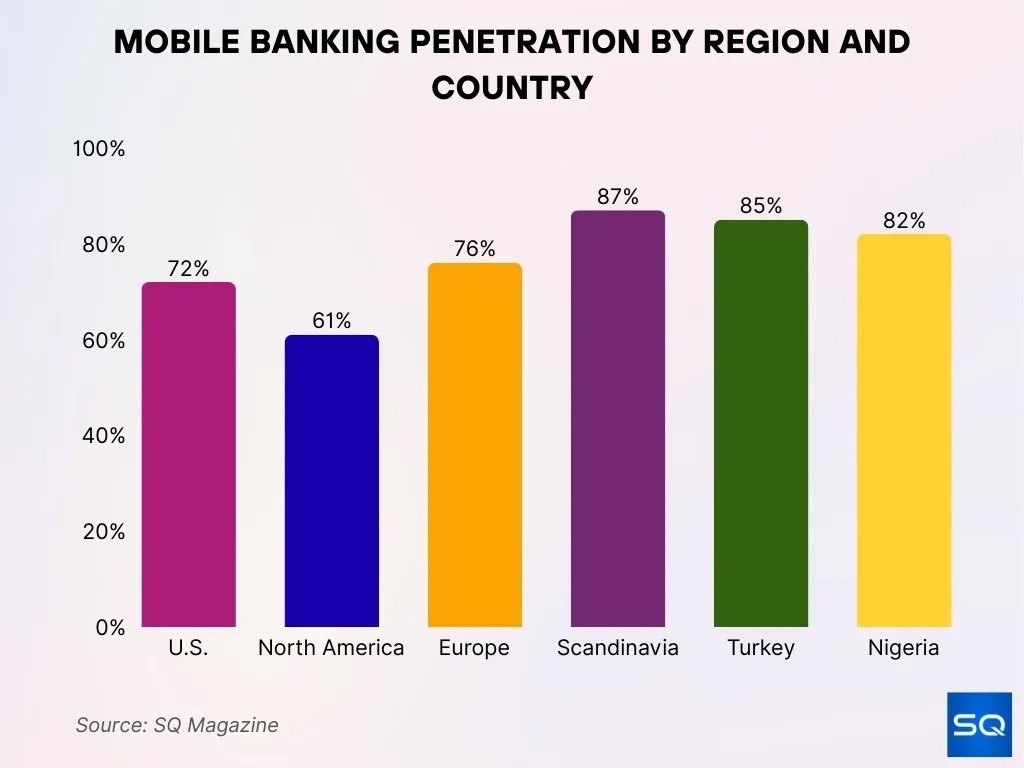

Adoption Rates by Region

- As of 2025, 72% of U.S. adults actively use mobile banking apps, highlighting a strong nationwide adoption rate.

- In 2025, North America records a mobile banking penetration of 61%, reflecting steady regional usage.

- Europe leads globally with 76% mobile banking usage, with Scandinavia standing out as a top performer at over 87% adoption.

- Turkey (85%) and Nigeria (82%) rank among the highest mobile banking penetration rates worldwide, signaling rapid digital finance growth.

- China accounts for over 860 million mobile banking users, making it by far the largest national user base globally.

- On a global scale, 66% of the world’s population now has access to mobile banking, with the strongest growth seen in India, Nigeria, and Bangladesh.

- India’s UPI processes 20 billion transactions per month, handling nearly $293 billion, demonstrating deep integration with mobile financial systems.

- UPI in India has surpassed Visa, managing over 640 million transactions per day compared to Visa’s 639 million, underscoring its massive transaction volume.

Mobile Banking Usage in the United States

- 72% of U.S. adults reported using mobile banking apps in 2025, up from 65% in 2022.

- Digital banking users in the U.S. are expected to reach 216.8 million in 2025, up from 203 million in 2022.

- 34% of U.S. consumers use a mobile banking app daily.

- Mobile banking has become the primary method for banking for many Americans.

- Over 40% of Americans bank with a fintech provider alongside traditional banks.

- Traditional bank visits declined sharply while mobile transactions surged.

- The U.S. mobile banking sector processed over $620 billion in transactions in 2025.

- Peer-to-peer networks now connect over 2,300 financial institutions in the U.S.

Growth of Mobile Banking in the Asia-Pacific Region

- Asia-Pacific leads with $740 billion in mobile banking revenue in 2025.

- China boasts 860 million mobile banking users in 2025.

- Asia-Pacific mobile banking transaction volume surged 34% in 2025.

- UPI transactions in India reached 59.33 billion in Q3 2025 alone.

- India’s mobile banking market hit $109.79 million in 2025.

- Southeast Asia saw 49% mobile fintech penetration in 2024, rising toward 60%.

- Smartphone penetration exceeds 70% in key Asia-Pacific markets, fueling growth.

- Asia-Pacific mobile banking is projected to grow at 16.8% CAGR through 2035.

- China’s mobile payment users topped 1,022 million as of June 2025.

Mobile Banking in Emerging and Developing Economies

- Latin America mobile banking users grew by over 40% between 2021 and 2025.

- Middle East and Africa saw ~74% year over year adoption growth from 2023 to 2025.

- Africa’s mobile banking revenue growth reflects a 43% adoption increase.

- Smartphone affordability continues to drive adoption in emerging markets.

- Urban populations adopt mobile banking faster than rural communities.

- 42% of adults in low and middle-income countries now make digital payments.

- Financial inclusion programs continue expanding mobile banking awareness.

- Mobile banking adoption in emerging regions outpaces traditional banking growth.

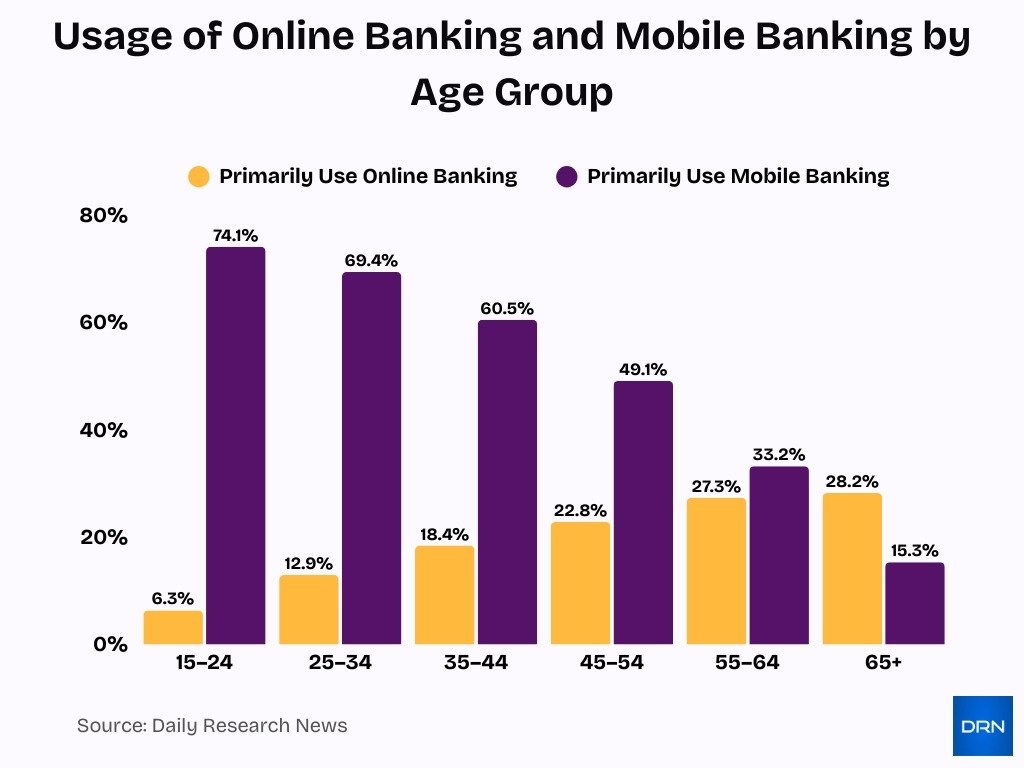

Online vs. Mobile Banking Usage by Age Group

- Digital banking adoption is highest among younger adults, peaking at 82.3% in the 25–34 age group.

- Mobile banking dominates among younger users, with 74.1% of 15–24-year-olds and 69.4% of 25–34-year-olds primarily using mobile apps.

- Preference shifts with age, as reliance on online (desktop) banking steadily increases from 6.3% (ages 15–24) to 28.2% among those 65+.

- Mobile banking usage declines sharply with age, dropping from 74.1% in the youngest group to just 15.3% among users 65 and older.

- Overall, digital banking usage decreases after midlife, falling from 78.9% (ages 35–44) to 43.5% in the 65+ group.

- A crossover trend is evident around ages 55–64, where online banking (27.3%) nearly matches mobile banking (33.2%).

- Older adults show greater comfort with traditional online platforms, while younger generations are mobile-first, reflecting broader technology and lifestyle differences.

Mobile Banking Behavior by Generation

- Gen Z averages 48% daily mobile banking tasks, with 89% viewing accounts via apps.

- Millennials perform 58% daily finance tasks on apps, 85% at least weekly.

- 72% of Gen Z actively use mobile banking apps, preferring digital-first experiences.

- 80% of Millennials prioritize functional features like account management in apps.

- 57% of Gen Z primarily rely on mobile apps for banking needs.

- Boomers show 38-41% mobile app preference, often mixing with branch visits.

- User experience ranks top for Gen Z, with 23% choosing banks for mobile apps.

- 67% of Millennials seek advanced budgeting tools in mobile platforms.

- 64% of Gen Z/Millennials use apps most often, vs 13% Boomers favoring branches.

Mobile Banking App Usage Frequency

- 34% of consumers use mobile banking apps daily.

- Gen Z shows 89% mobile banking app usage, compared to 39% for Baby Boomers.

- 45% of consumers perform finance tasks on mobile apps daily.

- 72% of U.S. consumers prefer managing finances via mobile apps or online.

- 91% of users check account balances via mobile banking apps.

- 62% of consumers transfer money using mobile banking apps.

- Consumer banking apps hit 2 billion downloads in the year to June 2025, up 5.1% YoY.

- 67% of consumers use P2P payments, with 55% via mobile devices.

- 48% of consumers have 3+ finance apps downloaded on their phones.

- 76% of American customers actively use mobile banking apps.

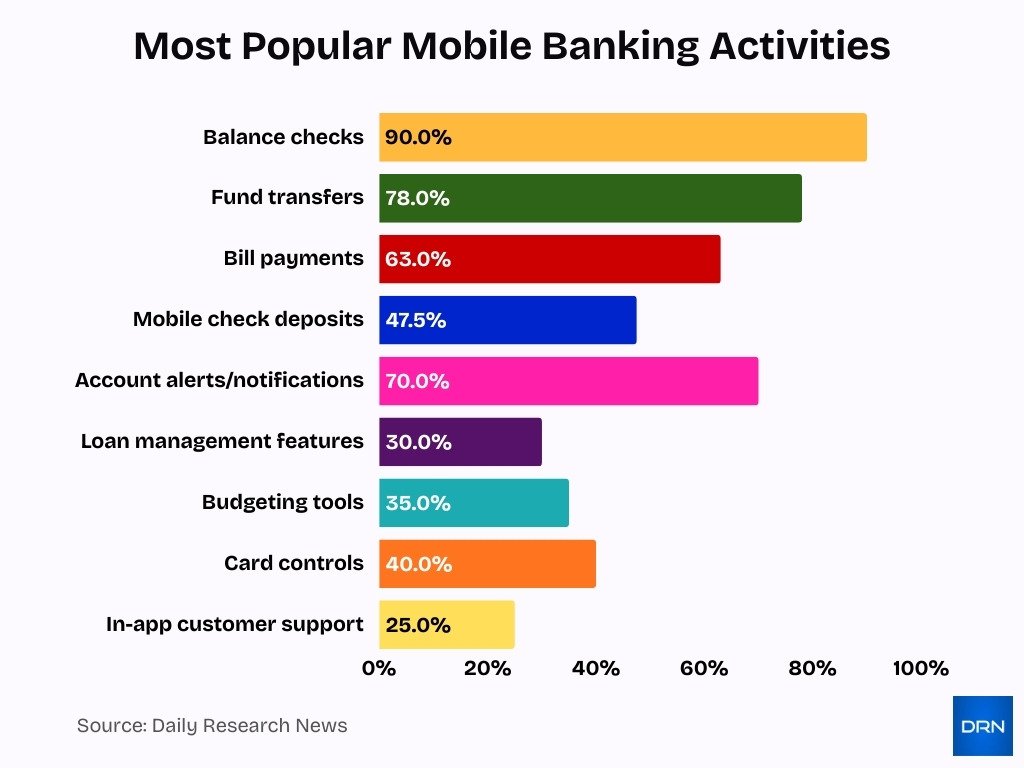

Most Common Mobile Banking Activities

- Balance checks remain the most common activity, used by over 90% of users.

- Fund transfers are performed by approximately 78% of users.

- Bill payments are completed by 63% of customers via mobile apps.

- Mobile check deposits are used by 45 to 50% of U.S. users.

- Account alerts and notifications engage over 70% of users weekly.

- Loan management features are used by about 30% of users.

- Budgeting tools are used by approximately 35% of customers.

- Card controls are accessed monthly by around 40% of users.

- In-app customer support is used by roughly 25% of users.

Mobile Banking Transaction Volume and Value

- UPI processed ~166.7 billion transactions in 2025.

- UPI transaction value exceeded ₹245 trillion, approximately $2.9 trillion.

- Global mobile banking revenue reached $1.92 trillion in 2025.

- Asia-Pacific generated $740 billion in mobile banking revenue.

- Europe recorded approximately $445 billion in revenue.

- Latin America generated $172 billion.

- Africa contributed $58 billion, reflecting strong adoption growth.

- U.S. mobile banking transactions surpassed $620 billion in value.

Digital Wallets and Mobile Banking Integration Stats

- 44.9% of U.S. smartphone owners used proximity mobile payments.

- Digital wallets accounted for ~50% of global e-commerce value.

- 56% of consumers globally use digital wallets.

- Asia-Pacific digital wallet penetration reached 76%.

- ~70% of users under 40 rely on wallets alongside mobile banking.

- 82% of account holders in lower-income regions made digital payments.

- 42% of consumers worldwide made digital merchant payments.

- Cross-border wallet remittances reached $822 billion annually.

Digital, Mobile, and Traditional Banking Usage Trends

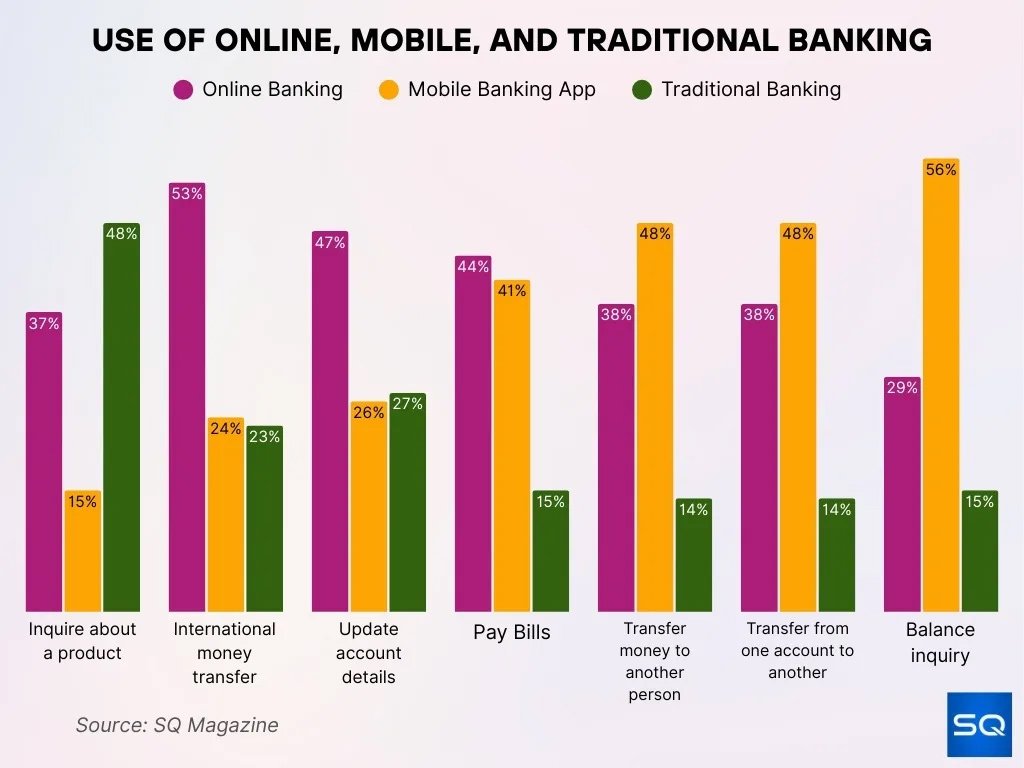

- 37% of customers inquire about banking products online, whereas 48% continue to depend on traditional banking channels for the same purpose.

- 53% of users utilize online platforms for international money transfers, compared to 24% who complete these transactions through mobile apps.

- 47% of customers update their account details online, while 27% still prefer visiting traditional bank branches.

- 44% of individuals pay bills online, but 41% now rely on mobile apps to handle bill payments.

- 48% of users transfer money to another person via mobile apps, compared to 38% who perform these transfers online.

- 48% also use mobile apps to transfer money between accounts, with only 14% continuing to rely on traditional banking methods.

- 56% of customers conduct balance inquiries using mobile apps, compared to 29% who do so online and 15% who still visit bank branches.

Neobanks and Digital-Only Banking Statistics

- Neobanks generated $39.5 billion in revenue in 2024.

- NuBank generated $11.5 billion in revenue.

- North America recorded 39 million neobank users.

- The global neobank market reached approximately $210 billion.

- Digital-only banks continue expanding customer bases through 2028.

- Neobanks show higher mobile engagement than traditional banks.

- Integrated financial tools improve customer retention.

- AI-driven personalization supports mobile-first banking experiences.

Revenue and Market Size of Mobile Banking

- Global mobile banking revenue totaled $1.92 trillion in 2025.

- Asia-Pacific accounted for $740 billion.

- Europe contributed $445 billion.

- Latin America generated $172 billion.

- Africa reached $58 billion in revenue.

- Digital banks generated $1.61 trillion in net interest income.

- App-based platforms remain a fast-growing market segment.

- Mobile banking reduced bank operating costs by 20–40%.

Security, Fraud, and Scam Statistics in Mobile Banking

- Mobile banking fraud cases increased by ~28% in 2025.

- 53% of U.S. consumers cite security concerns.

- Biometric authentication reduced fraud by ~31%.

- 85% of mobile banking apps now use multi-factor authentication.

- Mobile phishing attacks increased by ~21%.

- AI-driven fraud detection blocked ~78% of suspicious transactions.

- Bank cybersecurity investments increased by 24% in 2025.

- Payment fraud in Europe reached €4.2 billion in 2024.

Frequently Asked Questions (FAQs)

72% of U.S. adults reported using mobile banking apps as of 2025.

An estimated 2.17 billion people globally used mobile banking services in 2025.

At least $4.6 billion flows through mobile money accounts every day worldwide as of 2025

In 2025, 86% of adults globally owned a mobile phone, and 68% had a smartphone.

Conclusion

Mobile banking continues to reshape how consumers and businesses manage money. Usage rates, transaction values, and digital wallet integration have reached unprecedented levels, confirming mobile channels as essential financial infrastructure. Mobile platforms now process trillions in transaction value, while digital-only banks expand rapidly. At the same time, security remains a critical challenge as fraud evolves alongside adoption.

Together, these trends show mobile banking is no longer optional; it is now central to everyday financial life and the future of global banking systems.