Mobile ecommerce continues to reshape how people shop, driven by increasing smartphone access, faster mobile networks, and easier payment tech. Mobile devices accounted for more than half of all ecommerce revenue worldwide, with ongoing growth expected through. This shift influences everything from social commerce to app design and retail strategy. In the retail sector and digital marketing industry, brands now prioritize mobile-first experiences, while logistics and payment providers adapt to fast checkout expectations. Explore the key statistics below for a clear snapshot of the mobile ecommerce evolution.

Editor’s Choice

- 57% of global ecommerce sales were made via mobile devices in 2024, with an estimated increase to 59% in 2025.

- Worldwide mobile commerce revenue reached approximately $2.07 trillion in 2024.

- Mobile traffic drives over 70% of ecommerce site visits globally.

- More than 1.65 billion people are expected to shop via smartphones in 2026.

- Mobile commerce cart abandonment on phones can exceed 75%.

- U.S. mobile ecommerce generated roughly $564 billion in sales in 2024.

- Mobile apps can generate up to 7× more revenue per user compared with mobile web alone.

Recent Developments

- Global m‑commerce trends show rapid traffic growth as more consumers prefer mobile experiences over desktops.

- Mobile remains the leading ecommerce channel with 78% of ecommerce traffic globally in recent studies.

- Social platforms like TikTok are expanding mobile commerce activity, generating billions in transactions.

- Advanced checkout options like digital wallets improve seamless purchases on mobile.

- App‑based shopping continues to gain share, pushing brands to invest in mobile‑first tech.

- In‑store shoppers increasingly use mobile devices for product search before purchase.

- Enhanced mobile UX designs correlate with stronger engagement and retention.

- Cross‑border mobile buying is rising as payment options become more localized.

Mobile Ecommerce Market Overview

- The global mobile commerce market size was valued at around $2.24 trillion in 2025.

- Forecasts suggest it will expand to over $2.4 trillion in 2026.

- Analysts expect the mobile commerce sector to continue growing at a 9.5% CAGR through 2034.

- In the U.S., mobile commerce constituted around 44% of ecommerce sales in 2024.

- Mobile now represents the primary channel for global retail ecommerce growth.

- By value, mobile ecommerce is outpacing desktop growth year over year.

- Spending via mobile devices generally increases faster than desktop usage.

- Businesses worldwide view mobile as central to long‑term ecommerce strategy.

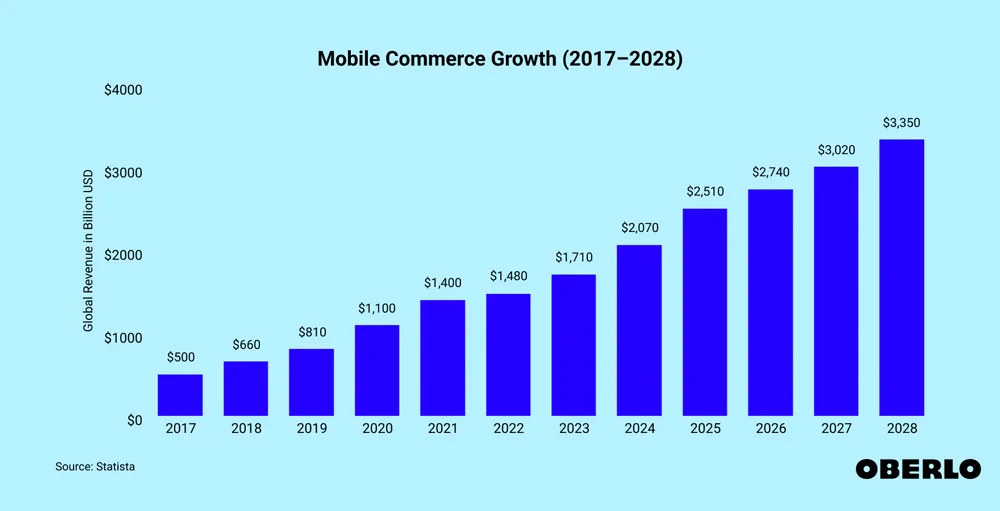

Mobile Commerce Revenue Growth

- Global mobile commerce revenue grew from $500 billion in 2017 to $1.1 trillion in 2020, reflecting rapid smartphone-driven adoption.

- Mobile commerce crossed the $1 trillion milestone in 2021, reaching $1.4 trillion in global sales.

- Growth remained steady in 2022, with mobile commerce revenue climbing to $1.48 trillion worldwide.

- In 2023, global mobile commerce sales expanded to $1.71 trillion, driven by higher mobile shopping frequency.

- Revenue surpassed $2 trillion in 2024, reaching $2.07 trillion, signaling mainstream mobile-first buying behavior.

- Mobile commerce is projected to hit $2.51 trillion in 2025, showing strong year-over-year momentum.

- By 2026, global mobile commerce revenue is expected to reach $2.74 trillion, fueled by app-based purchasing.

- Continued expansion is forecast for 2027, with mobile commerce sales estimated at $3.02 trillion.

- By 2028, global mobile commerce revenue is projected to reach $3.35 trillion, marking a nearly 7× increase since 2017.

Mobile Share of Ecommerce

- Approximately 57% of ecommerce sales happened on mobile devices in 2024.

- Estimated increase to 59% mobile share in 2025.

- Mainstream forecasts indicate mobile will account for around 59–60% of global ecommerce sales in 2025, rising from about 57% in 2024.

- Smartphone orders make up a major share of retail website transactions globally.

- Mobile now drives more traffic than desktop on retail sites.

- In North America, mobile shopping continues to rise faster than desktop.

- The increase in mobile share aligns with social commerce and app adoption.

- Mobile growth is especially notable during peak shopping events, such as Cyber Week.

Effective Ways to Enhance the Online Shopping Experience

- 65% of shoppers state that free delivery would improve their overall online shopping experience the most.

- 43% of consumers indicate that faster delivery options are a key factor in enhancing their shopping satisfaction.

- 40% of shoppers value free returns, making product exchanges easier and more convenient.

- 40% of buyers highlight better product quality as an important element in improving their online experience.

- 34% of users prefer secure payment systems to feel more confident while shopping online.

- 34% of shoppers express a desire for higher-quality products overall to improve purchase satisfaction.

- 30% believe that better customer service would significantly enhance their online shopping journey.

- 27% emphasize the importance of strong site security when choosing where to shop online.

- 27% want simpler browsing options to enable easier navigation across online shopping platforms.

US Mobile Commerce Statistics

- In 2025, U.S. mobile commerce sales were projected at about $558.29 billion, representing roughly 44.6% of total U.S. retail e‑commerce sales.

- Around 187.5 million Americans will have made at least one mobile purchase in 2025, roughly 66% of the U.S. population.

- Mobile commerce accounted for approximately 38% of overall digital commerce spending in the U.S. in recent reports.

- In 2025, about 76% of U.S. adults reported using a smartphone to make an online purchase.

- Mobile purchases during peak shopping events like Cyber Week account for over half of all online sales in the U.S.

- U.S. consumers reported 74% using mobile devices for in‑store product research before purchase.

- Digital and mobile wallet methods accounted for about 49% of U.S. online transactions, reflecting mobile preference.

- Social commerce and mobile integration continue rising, with an expanding number of transactions initiated on apps like TikTok and Instagram.

Core Factors Shoppers Value Most in Online Purchases

- Fast and reliable shipping or delivery ranks as the top priority for 58% of online shoppers when making purchase decisions.

- Secure payment methods, along with multiple payment options,s are important to 48% of consumers shopping online.

- Competitive pricing and the availability of discounts are key considerations for 46.8% of shoppers.

- Detailed and accurate product descriptions combined with high-quality product images matter to 36.4% of buyers.

- Easy and transparent returns or refunds are prioritized by 24.8% of online consumers.

- Customer reviews and user feedback influence purchasing decisions for 22% of shoppers.

- User-friendly website navigation is preferred by 20.4% of consumers during online shopping.

- Responsive and reliable customer service is expected by 18% of shoppers.

- A mobile-friendly shopping experience or app availability is valued by 14.8% of consumers.

- Personalized recommendations and tailored offers are appreciated by 10.4% of online buyers.

- Only 0.4% of respondents cited other factors beyond these key elements.

Mobile Traffic and Usage Stats

- Mobile devices generate over 70% of all ecommerce site visits globally.

- Nearly 79% of smartphone users globally have made at least one purchase on their phone in recent years.

- In the U.S., more than 180 million people have made at least one mobile purchase.

- On many retail sites, mobile traffic exceeds desktop traffic by a large margin, often around 60–70%.

- Yearly, consumers spend over 100 billion hours using ecommerce apps.

- About 30% of global digital users shop via mobile phones as of 2025.

- The surge in mobile traffic coincides with rapid social commerce adoption.

- Mobile devices are often used for price comparison, reviews, and research before final purchases.

Mobile Conversion Rates

- The average mobile ecommerce conversion rate was approximately 1.8% in 2025.

- On average, mobile conversion typically trails desktop, where desktop can reach above 3.5% in some benchmarks.

- Broader ecommerce conversion rates averaged between 2% and 4% across industries.

- In sectors like fashion and electronics, mobile conversion rates vary but often remain under 3% without optimization.

- Conversion rates can increase when mobile sites are fully optimized for UX and speed, with some studies showing gains above 3.3%.

- Conversion figures spike during major sale events such as Black Friday.

- Mobile app transactions often convert at higher rates than mobile web due to streamlined checkout flows.

- Payment friction and slow page load speeds remain key friction points impacting mobile conversion.

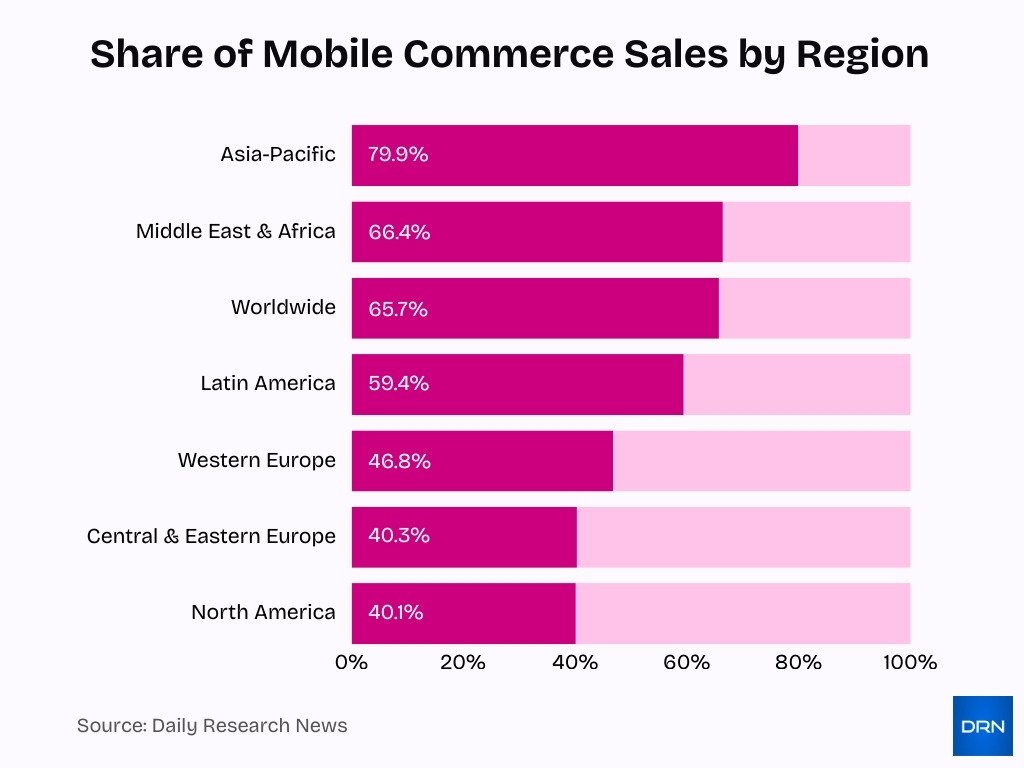

Regional Share of Mobile Commerce in Total E-Commerce Sales

- Asia-Pacific leads globally, with 79.9% of total e-commerce sales coming from mobile commerce, highlighting a strong mobile-first shopping culture.

- Middle East & Africa follow closely, where 66.4% of online sales are generated via mobile devices, reflecting rapid smartphone adoption.

- Worldwide, mobile commerce accounts for 65.7% of total e-commerce sales, confirming that mobile is now the dominant purchasing channel globally.

- Latin America records a 59.4% mobile share, driven by app-based shopping and mobile-centric internet access.

- Western Europe shows a more balanced split, with 46.8% of e-commerce sales occurring on mobile, indicating continued desktop usage.

- Central & Eastern Europe report 40.3% mobile penetration, suggesting a slower transition toward mobile-first commerce.

- North America has the lowest mobile commerce share at 40.1%, signaling a strong reliance on desktop and laptop shopping experiences.

Average Order Values by Device

- Desktop orders average $146 vs mobile at $98, a 50% higher AOV.

- Mobile apps boost AOV by 10-30% over mobile web.

- One-click upsells raise AOV by 20-30%.

- Mobile wallet users see 34% higher AOV.

- App-exclusive promotions lift AOV by 20%.

- Holiday sales increase AOV 7.7% YoY on desktop and mobile.

- Electronics AOV reaches $348 regardless of device.

- Luxury goods average $436 AOV across devices.

- Desktop conversions are worth 93% more than mobile.

Mobile App Performance Metrics

- Ecommerce mobile apps can generate up to 7× more revenue per user than mobile web.

- Apps contribute 40–50% of online sales for many ecommerce brands.

- App performance KPIs include retention, add‑to‑cart, and conversion rates.

- Efficient app design and push notifications boost user engagement and repeat purchases.

- Faster in‑app checkout flows lead to higher conversion rates compared with mobile web.

- App abandonment and low retention remain challenges if UX isn’t prioritized.

- High retention correlates with personalized offers and seamless user flows.

- Metrics like session length and frequency help gauge mobile app success.

Top Mobile Shopping Apps

- Temu was the most‑downloaded mobile shopping app globally in 2024, with nearly 484 million downloads, reflecting massive user interest.

- Mobile shopping apps often achieve conversion rates ~130% higher than mobile websites, underlining the value of app‑optimized experiences.

- Customers spend 6.4× more time in‑app (around 9.15 minutes) compared with mobile web engagement.

- In 2025, over 40 billion hours were spent worldwide using shopping apps.

- Major retail apps like Amazon, Walmart, and Shein consistently rank among the top apps for ecommerce engagement and revenue worldwide.

- Social shopping integrations (e.g., in TikTok and Instagram) increasingly function as mobile shopping platforms.

- Mobile wallets integrated within apps, such as Apple Pay and Google Pay, simplify checkout.

- Retailers reported that 50%+ of app users come back after their first purchase, indicating strong retention potential.

- Some niche market apps show rapid growth in downloads and engagement even outside traditional retail giants.

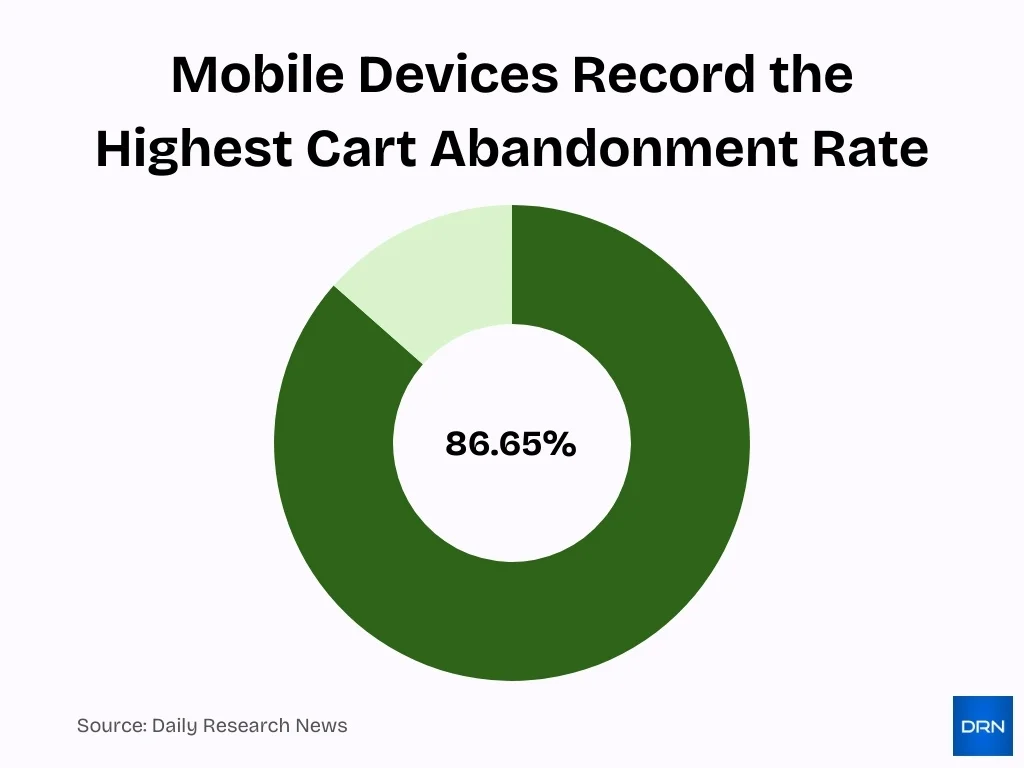

Cart Abandonment on Mobile

- Global cart abandonment averages 70.22%, but mobile devices hit 85.65%.

- North America reports mobile abandonment near 85%.

- Mobile shoppers abandon 78.74% of carts, higher than desktop (66.74%) and tablet (70.26%).

- Extra costs (shipping, taxes) drive 48-49% of mobile abandonments.

- The fashion sector sees 84.61% mobile abandonment.

- Luxury goods face 82.84% cart abandonment on mobile.

- Social media traffic exceeds 90% abandonment on mobile.

- US retailers lose $18 billion yearly from mobile cart abandonment.

- Optimized mobile checkout cuts abandonment by 10-15% with SMS recovery.

Mobile Commerce Projections 2026

- Analysts project mobile commerce spending to reach between $2.5 trillion and $4 trillion globally in 2026.

- Mobile’s share of retail ecommerce revenue is expected to remain around 59–60% in 2026.

- By 2028, some forecasts estimate mobile’s share of ecommerce could reach 63%, up from around 57% in 2024.

- Forecasts project sustained year‑over‑year mobile commerce revenue growth from 2025 into 2026.

- Growth will be propelled by mobile app innovations, checkout experience improvements, and social commerce integrations.

- Expansion of digital wallets and regional payment solutions is expected to further reduce friction.

- Emerging technologies such as AR and AI recommendations will help personalize mobile shopping.

- Continued investments in logistics and mobile fulfillment will shorten delivery times.

- Retailers increasingly prioritize mobile optimization and performance KPIs, anticipating stronger mobile commerce returns.

Smartphone Penetration Rates

- Over 5.3 billion people worldwide were using smartphones by 2025.

- Smartphone penetration is high in developed economies, often exceeding 70–80% of the population.

- In many emerging markets, smartphone ownership is increasing rapidly year‑over‑year.

- High smartphone penetration correlates strongly with mobile ecommerce adoption.

- Mobile web access continues to expand.

- Increased penetration supports higher use of mobile wallets and in‑app payments.

- Younger demographic groups generally show the highest smartphone penetration.

- Smartphone penetration directly influences mobile optimization priority.

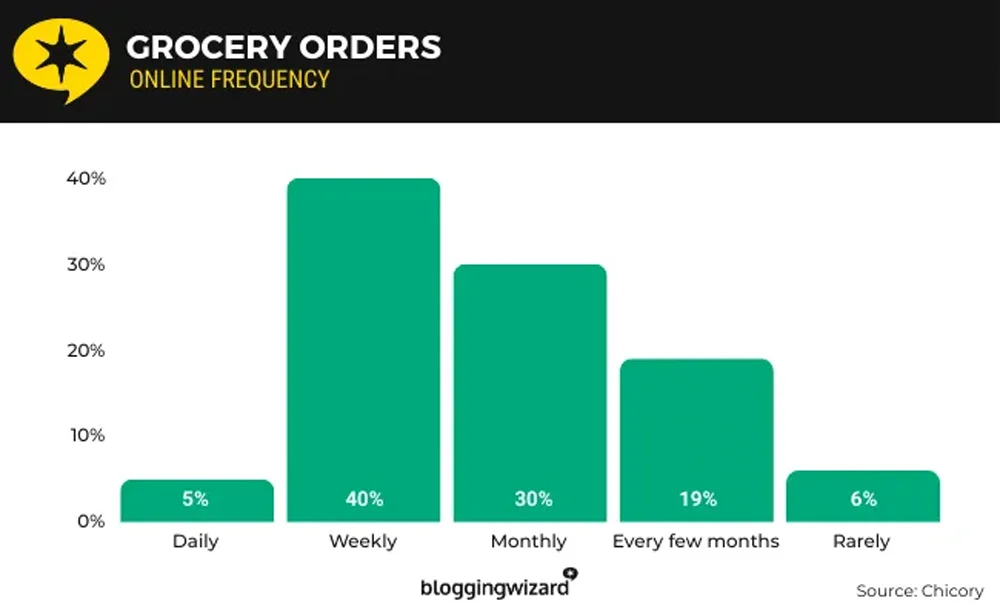

Online Grocery Ordering Frequency Patterns

- Only 5% of consumers order groceries daily through online platforms.

- Around 40% place weekly online grocery orders, making this the most common ordering frequency.

- Nearly 30% of consumers prefer ordering groceries monthly via online channels.

- Approximately 19% shop online for groceries every few months, indicating occasional usage.

- Just 6% of consumers rarely order groceries online, reflecting minimal adoption.

Demographics of Mobile Shoppers

- 92% of US mobile shoppers are adults under 50.

- 76% of US adults purchase using a smartphone.

- Gen Z and Millennials (18-34) drive 67% of online spending growth, with 72% on mobile.

- 96% of Gen Z shop online monthly via mobile.

- 72% of women shop online monthly vs 68% of men.

- Mobile buying frequency is highest among 18-24-year-olds at 46.9% of e-commerce shoppers.

- Urban areas like Ghaziabad show 90% online adoption vs 61% rural.

- Average order values are 10-15% higher on mobile apps.

- Millennials account for 33% of social commerce spending.

- Gen Z represents nearly 40% of e-retail shoppers in India.

Mobile Payment Adoption Stats

- Mobile wallets like Apple Pay and Google Pay process $10 trillion in global transactions by the end of 2025, accounting for 53% of online shopping.

- Digital wallets drive over 50% of global e-commerce transaction value in 2025.

- In India, UPI via mobile payments comprises 99.8% of total transaction volume in H1 2025.

- Contactless payments market grows at 20.5% CAGR, reaching USD 69.7 billion in 2025.

- Asia Pacific holds 34% share of the global mobile wallet market in 2024.

- Apple Pay commands 24% global mobile wallet market share in 2025.

- Retailers integrating mobile wallets see 20-30% higher conversion rates.

- In the U.S., 70% of online adults used digital payments in recent months.

- Gen Z adoption of mobile wallets leads at 78.9% in 2024.

- Mobile wallet users spend 51.1% more than cash users on average.

Mobile Optimization Challenges

- Poor mobile site performance remains a key obstacle; roughly 50%+ of users will abandon an experience that feels slow or clunky.

- Insufficient mobile UX and navigation can reduce conversion compared with desktop.

- Checkout friction drives cart abandonment.

- Addressing diversity in mobile devices and screen sizes remains a technical hurdle.

- Security and data privacy concerns can reduce user trust.

- Localized content and payment support are essential but challenging.

- Ensuring accessibility and performance on low‑end devices is crucial in emerging markets.

- Balancing rich content with fast load times demands thoughtful mobile design and testing.

Frequently Asked Questions (FAQs)

About 57% of global ecommerce sales were made on mobile devices in 2024.

Global mobile commerce revenue reached approximately $2.07 trillion in 2024.

Around 1.65 billion people are expected to shop via smartphone in 2026.

Mobile devices now drive about 78% of global ecommerce traffic.

Conclusion

Mobile ecommerce now dominates online shopping behavior, accounting for the majority of site traffic and projected to command nearly 60% or more of retail ecommerce revenue. Across regions and demographics, mobile devices, especially smartphones, remain the leading gateway to purchases. Mobile apps drive engagement and higher conversion, while mobile payments and optimization will be key strategic areas for brands moving forward. Challenges like UX performance and checkout friction persist, but addressing these head‑on will unlock further growth in the years ahead.