The mobile gaming industry has become one of the most influential segments in global entertainment. Mobile games are expected to generate well over $100 billion in revenue, accounting for more than half of the entire video games market. This rapid growth affects everything from smartphone design to how advertisers and brands engage consumers worldwide. In everyday life, mobile games influence social trends, from fitness apps that gamify movement to educational games that aid learning, and shape how millions spend their leisure time. Dive deeper to understand the key trends and numbers driving mobile gaming today.

Editor’s Choice

- $103 billion projected revenue from mobile games in 2025, making it the largest gaming segment globally.

- Mobile games are expected to make up ~55% of total gaming industry revenue in 2025.

- Global gaming market revenue is estimated at $188.8 billion in 2025.

- Mobile gaming downloads reached about 49.6 billion in 2024.

- In-app purchase revenue in mobile grew 4% in 2024 over 2023.

- Sessions increased by ~12% and time spent grew by ~8% in 2024.

- The Asia Pacific region continues to lead mobile gaming revenue share.

Recent Developments

- Major acquisitions continue shaping the mobile game landscape, such as Scopely’s $3.5 billion purchase of significant mobile gaming titles, including Pokémon GO.

- Developers increasingly emphasize live operations and engagement over pure new installs.

- Hybrid monetization strategies, ads, and IAP are gaining popularity across regions.

- High-profile studio consolidations reflect a maturing market and diversification of revenue streams.

- Casual games continue to see significant growth in sessions and in-app revenue.

- Declines in new installs with stable or rising revenue suggest that quality over quantity is becoming more important.

- Mobile titles are increasingly integrating social and community features to boost retention.

- Marketing focus is shifting to user engagement metrics rather than just download volume.

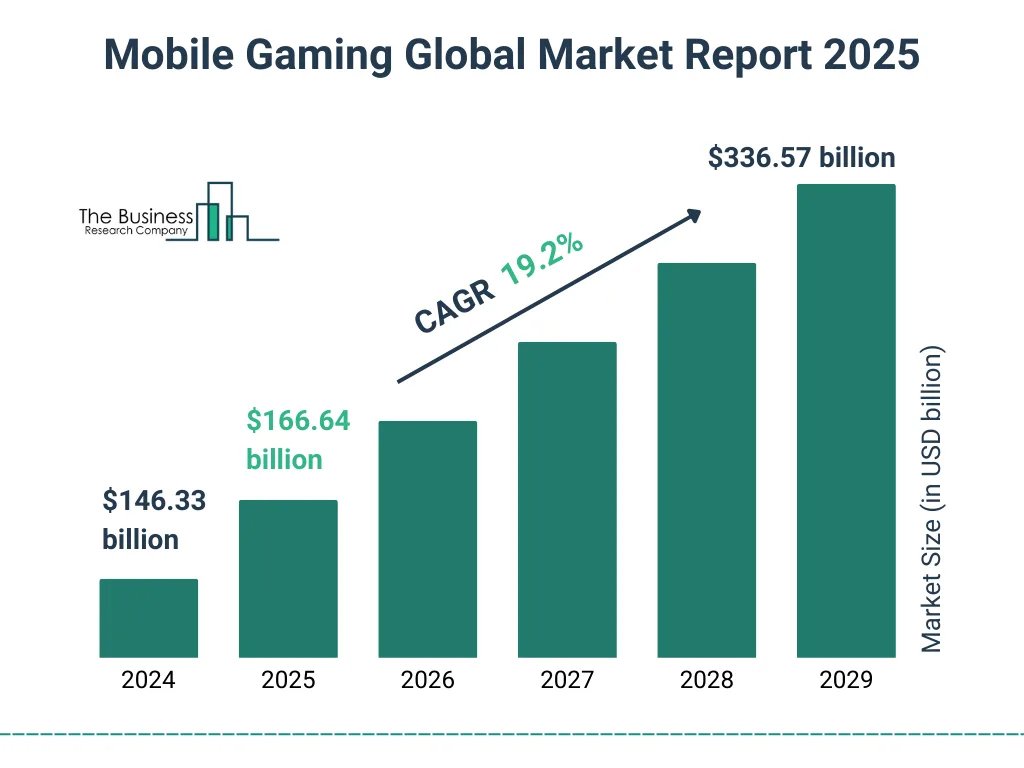

Global Mobile Games Market Size

- The global mobile gaming market was valued at $146.33 billion in 2024, highlighting its significant industry presence.

- It is projected to expand to $166.64 billion in 2025, indicating continued strong momentum.

- By 2029, the market size is expected to reach a massive $336.57 billion, showcasing substantial future potential.

- This surge reflects a Compound Annual Growth Rate (CAGR) of 19.2%, emphasizing the rapid upward trajectory of the sector.

Mobile Games Revenue Growth Trends

- Year over year, mobile revenue grew from $92 billion in 2024 to an estimated $103 billion in 2025.

- Revenue share for mobile climbed relative to PC and console segments.

- In-app purchases grew by 4% in 2024 compared to 2023.

- Engagement metrics increased even as downloads decreased.

- Advertiser spending in mobile gaming is projected to increase in 2025.

- ARPU trends show steady growth across multiple regions.

- Latin America saw mobile game revenue climb +13% in 2024 despite fewer installs.

- Casual and hybrid casual titles are key revenue drivers.

Mobile Games Share of Total Gaming Revenue

- Mobile games are expected to capture about 55% of total gaming revenue in 2025.

- This share surpasses both PC and console combined in many regions.

- In 2024, mobile made up roughly 49.6% of global gaming revenue.

- Mobile’s share has grown steadily over the past decade.

- In digital-first markets like Asia, mobile accounts for a larger proportion of total gaming revenue.

- Strong mobile share influences investment flows toward mobile-first titles.

- Brands increasingly see mobile games as primary advertising channels.

- The overall gaming ecosystem continues shifting toward mobile monetization models.

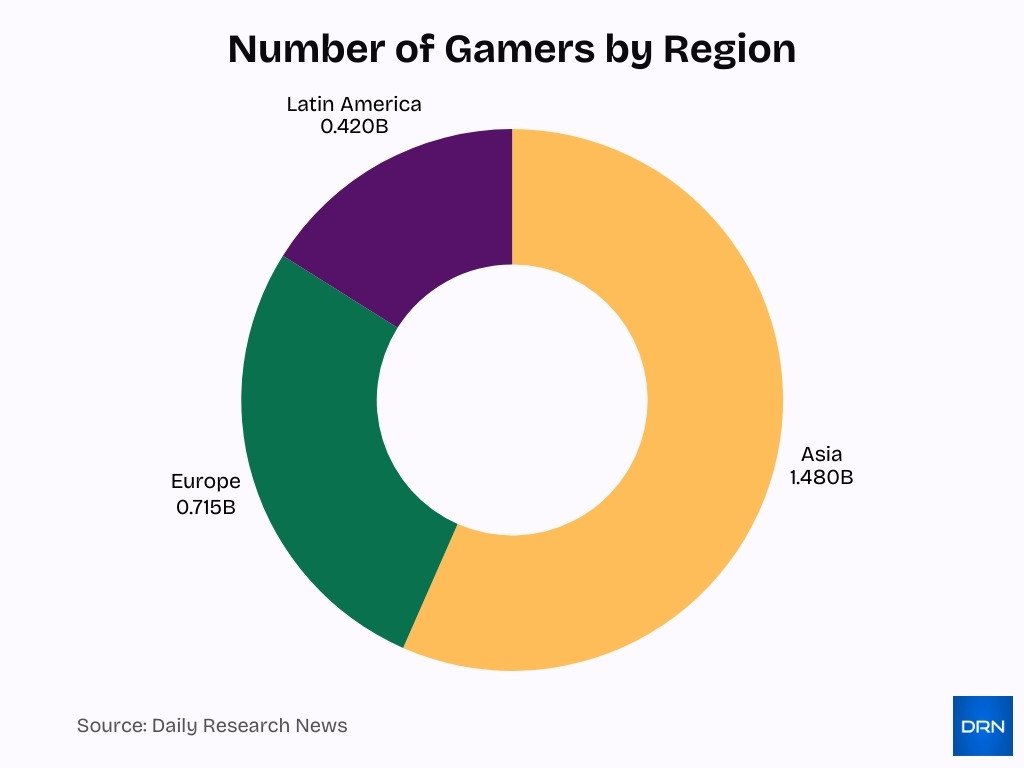

Number of Mobile Gamers Worldwide

- There are approximately 3.32 billion gamers globally in 2025.

- Asia accounts for the largest share of gamers, around 1.48 billion.

- Europe follows with approximately 715 million gamers.

- Latin America hosts about 420 million gamers.

- Mobile gaming makes up a significant portion of the total gamer base.

- Some estimates project the mobile gamer count rising toward 3.5 billion by the end of 2025.

- Nearly 84% of internet users play video games worldwide.

- Growth in mobile gaming users remains strongest in emerging markets.

Mobile Game Downloads and Install Trends

- In 2024, global mobile game downloads reached approximately 49.6 billion, though this marked a 6% year-over-year decline.

- This decline reflects a broader market stabilization and rising user acquisition costs.

- India led global installs with 8.45 billion downloads in FY 2024,25.

- In January 2025, worldwide downloads exceeded 4.41 billion, a 5.4% increase month over month.

- October 2025 saw 3.78 billion installs, with India contributing 18%.

- Southeast Asia recorded 1.93 billion installs in Q1 2025, making it the second-largest region.

- Brazil, the US, and Indonesia remain high-ranking markets for monthly installs.

- Developers increasingly focus on live operations and retention strategies over new user acquisition.

Mobile Game User Engagement and Retention

- Global mobile game sessions grew 12% YoY in 2024, reaching roughly 3.5 trillion play sessions worldwide.

- Players spent an estimated 3.5 trillion hours in mobile games in 2024, with total time played up around 8% YoY.

- New mobile game downloads slipped to about 49.6 billion in 2024, a decline of roughly 6% year over year as studios shifted focus toward retention.

- Mobile gamers now average about 3–4 sessions per day, with median session length around 4–6 minutes, driving higher daily engagement.

- Games using hybrid monetization and deeper engagement loops saw about 37% higher IAP revenue growth YoY than titles relying on a single revenue stream.

- In-app purchase revenue from mobile games reached roughly 82 billion dollars in 2024, rising about 4% YoY alongside stronger engagement.

- Global mobile gaming downloads fell about 7% YoY, yet total sessions rose 12%, underscoring how engagement and retention now outpace install growth.

- Engagement-focused strategies helped lift mobile gaming’s share of the wider 187.7 billion dollar global games market, which grew about 2.1% in 2024.

Time Spent Playing Mobile Games

- In 2024, total time spent in mobile games rose 8% year over year, even as overall app usage growth slowed.

- Users now dedicate about 11% of their daily mobile device time to gaming, equal to roughly 23 minutes per day on average.

- Between February 2023 and 2024, mobile gamers aged 50+ spent 20.76 minutes daily, while younger cohorts reached well over 25 minutes on gaming apps.

- In several emerging markets like Indonesia, Brazil, Saudi Arabia, Singapore, and South Korea, top players exceed 5 hours per day on mobile games.

- Typical mobile gaming sessions last only 4–5 minutes, but players fit in 4–6 sessions per day, driving high cumulative time spent.

- Casual mobile titles log a median of 15 minutes of playtime per user per day, while the top quartile surpasses 28 minutes.

- Classic mobile games see the top 25% of titles achieve about 6 sessions per user per day, indicating strong daily engagement.

- Across the top 10 global markets, total time spent on mobile surpassed 5 hours per day in 2023, with gaming capturing a growing share of those hours.

Most Popular Mobile Game Genres

- Simulation and Puzzle genres each captured about 20% of total downloads in 2024.

- Arcade games saw a 12.5% drop in downloads but still held nearly one-fifth of the total.

- Strategy game downloads grew around 14.5% in 2024.

- Hyper casual titles softened relative to hybrid casual models.

- Puzzle games remain strong revenue generators through IAP.

- Shooter and Casino genres lead in revenue share in some regions.

- Sports and Simulation titles maintain strong seasonal performance.

- RPG and Tabletop genres attract highly loyal niche audiences.

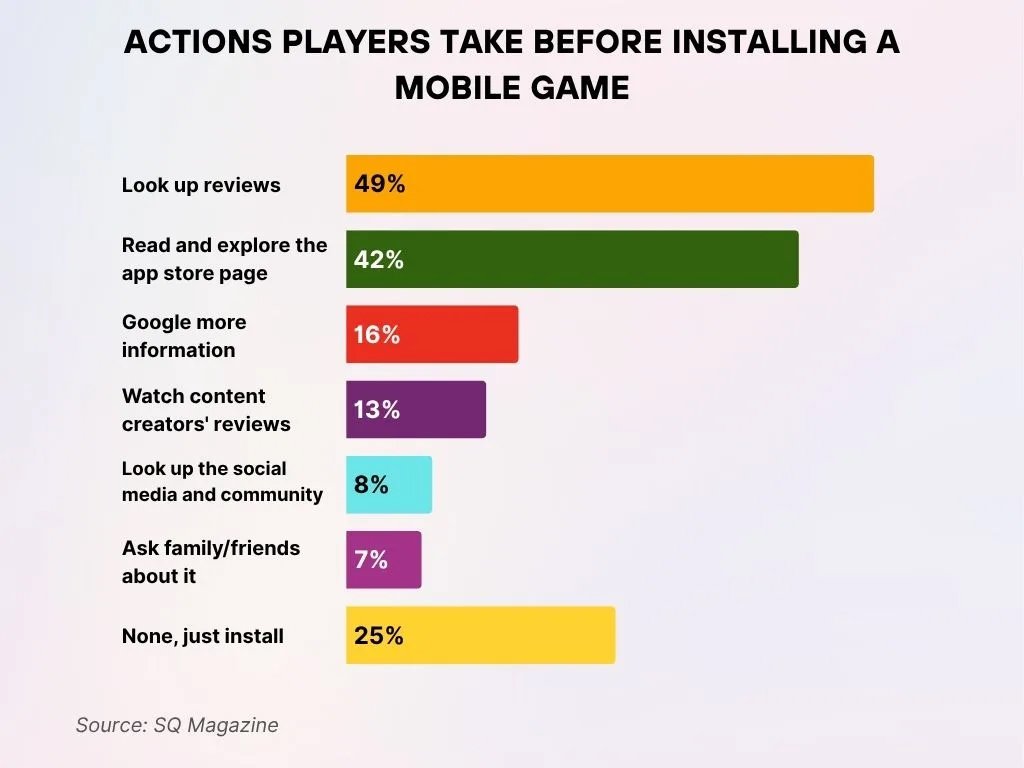

Key Actions Players Take Before Installing a Mobile Game

- 49% of players check reviews before downloading a mobile game, making this the most common step taken before installation.

- 42% prefer to read and explore the app store page to understand its features, ratings, and gameplay before installing.

- 16% of users Google additional information to make a more informed decision beyond what the app store provides.

- 13% watch content creators’ reviews, emphasizing the growing influence of gaming influencers.

- 8% review the game’s social media and community presence to gauge its popularity and overall user sentiment.

- 7% rely on family or friends’ opinions before choosing to install the game.

- Interestingly, 25% of players take no prior action and simply install the game immediately.

Top Mobile Games by Revenue

- Honor of Kings generated $2.6 billion worldwide in 2024, topping mobile game revenues.

- Honor of Kings earned $143 million in June 2025 alone in China.

- Genshin Impact projects $0.8 billion global revenue for 2025.

- Candy Crush Saga hit $1.24 billion in 2024 with $20 billion lifetime by 2025.

- Candy Crush Saga grossed $288 million in Q2 2025.

- Roblox reported $1.08 billion in total revenue in Q2 2025.

- Monopoly Go! Surpassed $5 billion gross bookings by April 2025.

- PUBG Mobile achieved $129 million in revenue in August 2025.

- PUBG Mobile maintains a $90-140 million monthly average in 2025.

Regional Mobile Gaming Statistics

- India led with 8.45 billion mobile game installs in FY 2024-25, outpacing Indonesia’s 3.34 billion.

- Southeast Asia recorded 1.93 billion new mobile game installs in Q1 2025, second globally.

- Brazil, the US, and Indonesia ranked among the top markets, with India at 682 million global downloads in January 2025.

- Latin America’s mobile gaming market hit $2.94 billion in 2024, with 45% engagement growth in Mexico.

- North America generated $28 billion in IAP revenue in 2024, up 9% year-over-year.

- Europe’s mobile gaming revenue reached $22.1 billion in 2024, growing at a 7.8% CAGR to 2030.

- Oceania mobile games market projected at $1.95 billion in 2025, with 5.52% annual growth.

- Emerging markets like LATAM saw 8% install growth and 5-7% session rise in 2024.

- India ARPU lags at $3.03, versus $215 in the US, fueling growth potential.

Mobile Gaming Preferences by Platform (Android vs iOS)

- Android holds ~79% global OS share in 2025, while iOS maintains about 17%.

- Android leads in total game downloads due to its presence in emerging markets.

- iOS users spend far more per capita, about $120 annually, vs $38 on Android.

- The App Store is projected to generate $138 billion in 2025, with games contributing heavily.

- Android is more dominant in casual and hyper casual segments.

- iOS gamers are more likely to participate in high-value purchases.

- Platform preference varies regionally, with iOS stronger in North America and Europe.

- Despite fewer installs, iOS typically leads in revenue share.

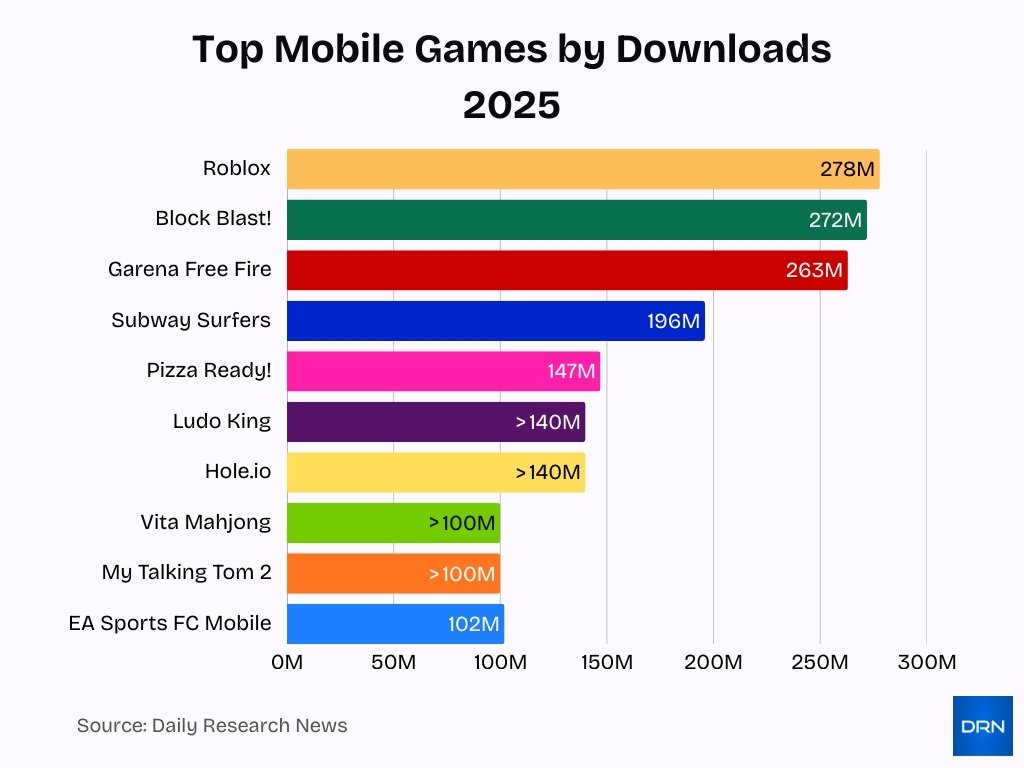

Top Mobile Games by Downloads

- Roblox led global mobile downloads in 2025 with 278 million installs.

- Block Blast! Followed by 272 million downloads.

- Garena Free Fire achieved 263 million installs.

- Subway Surfers attracted 196 million downloads.

- Pizza Ready! Reached 147 million installs.

- Ludo King and Hole.io surpassed 140 million installs.

- Vita Mahjong and My Talking Tom 2 exceeded 100 million downloads.

- EA Sports FC Mobile recorded 102 million installs.

In-App Purchase Revenue in Mobile Games

- IAP revenue grew ~4% in 2024, showing stability.

- Players spent $82 billion on IAP in 2024.

- Hybrid casual games saw 37% year-over-year IAP growth.

- North America saw +9%, and Europe +14% IAP increases.

- Latin America recorded ~13% IAP growth, and the Middle East 18%.

- Asia saw a slight dip in IAP growth, but overall spending remained strong.

- IAP remains the dominant monetization model globally.

- Event-driven and seasonal monetization are top performers.

Advertising Revenue in Mobile Games

- Global in-app advertising generated around $340 billion in 2024, accounting for roughly 65% of total mobile app revenue, with mobile games capturing a significant share of this spend.

- In the United States alone, mobile gaming ad revenue reached about $6.8 billion in 2024 and is projected to climb to roughly $7.3 billion in 2025.

- Over 97% of mobile apps are free to download, and free apps (including free-to-play games with ads and IAPs) drive about 98% of total app revenue.

- Free apps generate an estimated 98% of mobile app revenue worldwide, underscoring how ad-supported and IAP-based free-to-play games dominate monetization.

- In-game ad sales on mobile are expected to hit roughly $11.54 billion by the end of 2024, reflecting strong advertiser demand for in-game and in-app inventory.

- Global mobile games and other gaming segments produced over $187.7 billion in revenue in 2024, with mobile remaining the largest and most ad-monetized platform.

- Rewarded and interstitial ad formats can deliver high returns, with interstitial eCPMs reaching up to about $20 in top-tier markets for mobile games.

- Mobile apps achieve an average revenue per user of around $4.52, with most of this value in free apps monetized through in-app advertising and IAPs.

Paying vs Non-Paying Mobile Gamers

- 95% of mobile gamers are non-paying, with just 5% driving IAP revenue.

- The top 10% of spenders (whales) generate 70% of in-app purchase revenue.

- Whales (1-2% of players) contribute 50-70% of total IAP revenue.

- Hybrid monetization boosts ARPU by 28% over ad-only models.

- 74% of US gamers watch video ads for rewards, fueling non-payer revenue.

- Ad revenue accounts for 26% of mobile gaming’s total, from non-paying users.

- Only 5% of app users make IAPs, despite exceeding paid app revenues.

- Strategy games lead IAP at $17.5 billion, varying by genre.

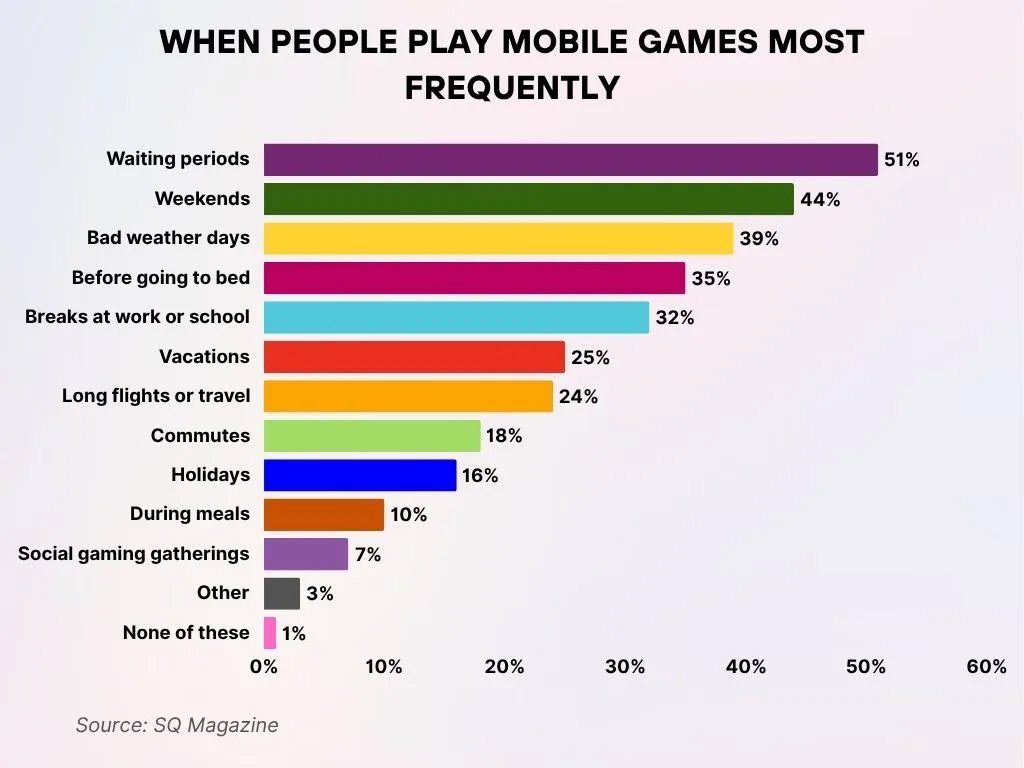

When People Most Often Engage in Mobile Gaming

- During waiting periods, 51% of players turn to mobile games, making it the most common occasion for gameplay.

- On weekends, 44% of users play more, taking advantage of their extra leisure time.

- On bad weather days, 39% of players pick up games, using them as indoor entertainment.

- Before bedtime, 35% engage in gaming, showing it has become part of their nighttime routine.

- During work or school breaks, 32% play games, using brief free moments to unwind.

- While on vacations, 25% increase gameplay, and 24% do so during long flights or travel, highlighting gaming as a travel pastime.

- During commutes, 18% play games, making use of otherwise idle travel time.

- On holidays, 16% show an increase in gaming, likely due to celebratory free time.

- During meals, 10% engage in gaming, emphasizing it as a multitasking activity.

- In social gaming gatherings, 7% participate, pointing to shared community playtime.

- Other scenarios were chosen by 3% of respondents.

- Only 1% said that none of these occasions applied to them.

Future Outlook for the Mobile Games Market

- Mobile gaming market projected to reach $256.19 billion by 2030, growing at a CAGR of 10.2% from 2025.

- Revenue expected to hit $163.98 billion by 2030 with a CAGR of 5.40% from 2025 worldwide.

- Hybrid/cross-platform gaming to grow at the fastest CAGR of 13% from 2025-2030.

- Cloud gaming platforms set for fastest growth, boosted by 5G enabling low-latency streaming.

- The AR gaming market is expected to expand from $14.12 billion in 2024 to $141.7 billion by 2033.

- Emerging markets like India show 50% smartphone gaming user growth in recent years.

- China’s mobile gaming revenue is expected to nearly double to $36.57 billion by 2034 at a 7.3% CAGR.

- AI personalization boosts engagement via dynamic difficulty and predictive retention modeling.

- Play-to-earn models are expected to witness the fastest CAGR through 2030 amid blockchain adoption.

Frequently Asked Questions (FAQs)

Mobile gaming is on track to generate approximately $103 billion in revenue in 2025, representing the largest share of the overall gaming market.

Mobile gaming is projected to account for about 55% of total gaming industry revenue in 2025.

Global mobile game downloads totaled approximately 49.6 billion in 2024, despite a decline from the previous year.

There are about 3.32 billion active video gamers globally in 2025, with mobile gaming representing the majority of that base.

Conclusion

Mobile gaming has solidified its position as a centerpiece of global entertainment, blending expansive user reach with evolving monetization. Android’s broad install base contrasts with iOS’s strong per-user spend, shaping how developers build and monetize games. In-app purchases and advertising remain the main economic engines, while retention and churn metrics highlight ongoing challenges in user engagement.

Looking forward, advancements in technology, monetization, and personalization will influence how mobile games attract, retain, and monetize players around the world.

Hover or focus to see the definition of the term.