Mobile devices now form the backbone of global digital access. More than 5.78 billion people, about 70.1% of the world’s population, use a mobile phone. As mobile connectivity spreads, consumers and businesses alike are shifting behavior; users spend increasing time online via phones, and marketers are adapting accordingly. In sectors from e-commerce to social media advertising, mobile-first strategies are no longer optional; they are essential. The data below underscores why mobile must sit at the center of any marketing plan.

Editor’s Choice

- 5.78 billion unique mobile phone users globally in 2025, about 70.1 of % global population penetration.

- Mobile devices accounted for approximately 62–64% of global internet traffic in 2025.

- As of October 2025, mobile holds 51.56% of global platform share (desktop 47.02%, tablet 1.42%).

- Global web traffic via mobile rose from under 35% in 2015 to nearly 60%+ by 2025.

- Worldwide, there are now 4.32 billion active mobile internet users.

- Over 96% of internet users access the internet using a mobile phone.

- Mobile adoption continues; the number of mobile device connections tied to smartphones now accounts for roughly 87% of all mobile phones in use globally.

Recent Developments

- The 2025 Digital Overview reports a net gain of 112 million new mobile subscribers over the previous 12 months, a 2.0% year-on-year growth.

- Global internet users reached 5.56 billion in early 2025, a penetration rate of 67.9%, up by 136 million (+2.5%) from 2024.

- Smartphone handset share among all mobile handsets is 87%, reflecting an ongoing shift from feature phones.

- The global pool of social media user identities stands at 5.24 billion, roughly 63.9% of the world’s population, indicating expanded mobile-powered engagement.

- Mobile video consumption surged in 2025, increasing advertiser investment in video formats.

- Mobile accounts for the majority of ecommerce traffic and conversions in many regions.

- Mobile-first markets continue to grow, particularly in emerging economies, driving adjustments in how companies build digital products.

- More users now access the internet primarily through their phones, reshaping browsing patterns and marketing priorities.

Global Mobile Usage Statistics

- 9.2 billion mobile-cellular subscriptions exist worldwide in 2025, equating to 112 per 100 inhabitants.

- Mobile broadband subscriptions reached 99 per 100 inhabitants globally in 2025.

- 5G subscriptions hit 2.9 billion by the end of 2025, one-third of all mobile subscriptions.

- 5G networks will carry 43% of global mobile data traffic by the end of 2025.

- Global monthly mobile data traffic reached 188 EB in Q3 2025.

- Smartphone users worldwide total 4.69 billion in 2025, up 440 million YoY.

- Mobile devices account for 62.45% of global internet traffic in 2025.

- Average smartphone data usage hits 21.6 GB per month globally by Q3 2024.

- Video traffic comprises 76% of all mobile data traffic by the end of 2025.

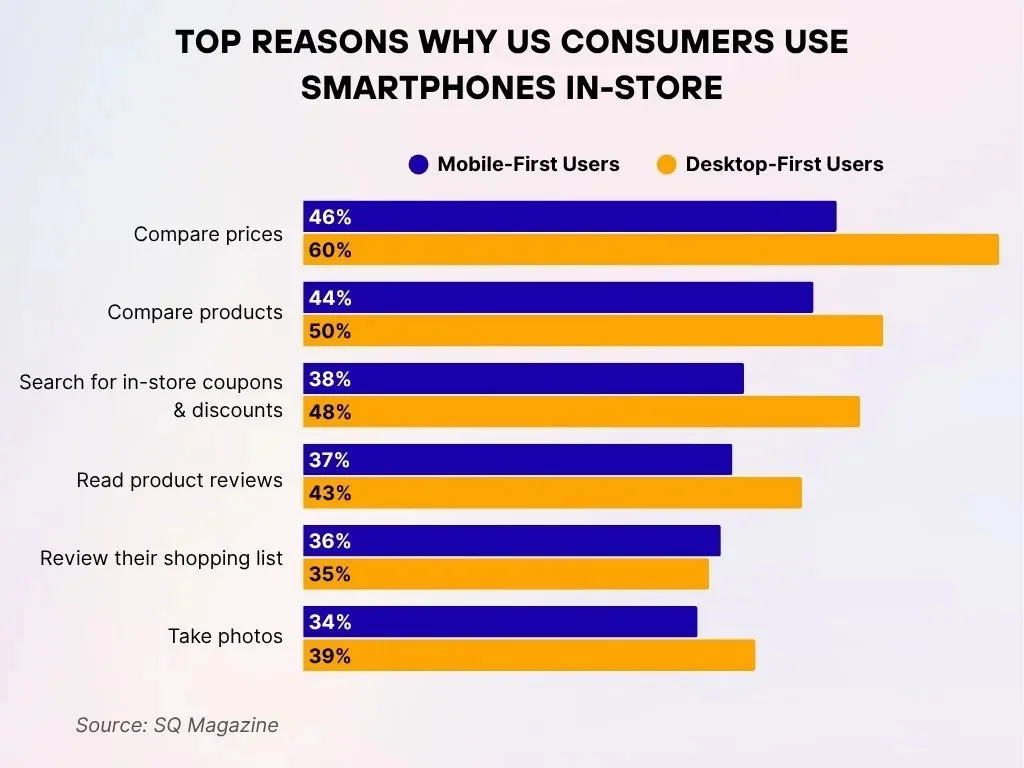

Top Key Reasons Why US Consumers Utilize Smartphones Inside Stores

- Comparing prices remains the top reason, with 60% of Desktop-First Users and 46% of Mobile-First Users doing so while shopping.

- 50% of Desktop-First Users and 44% of Mobile-First Users use their phones to compare products while in-store.

- Searching for in-store coupons & discounts is carried out by 48% of Desktop-First Users compared to 38% of Mobile-First Users.

- Reading product reviews is a habit practiced by 43% of Desktop-First Users and 37% of Mobile-First Users.

- 36% of Mobile-First Users and 35% of Desktop-First Users check or review their shopping list on their phone during in-store visits.

- Taking photos while shopping is done by 39% of Desktop-First Users versus 34% of Mobile-First Users.

Mobile Internet Traffic Share

- Mobile devices drive 62.45% to 64.35% of global internet traffic in 2025.

- Some sources estimate total mobile traffic at 64% globally in mid-2025.

- Other metrics show 60.5% of global web traffic coming from mobile as of mid-2025.

- In April 2025, 59.7% of global visits came from mobile devices.

- Tablets contribute only 1.8%–2% of global traffic.

- Mobile traffic share has grown dramatically from under 35% in 2015 to above 60%.

- The shift highlights the importance of mobile-optimized design and performance.

- Analysts expect mobile dominance to remain strong or increase in the coming years.

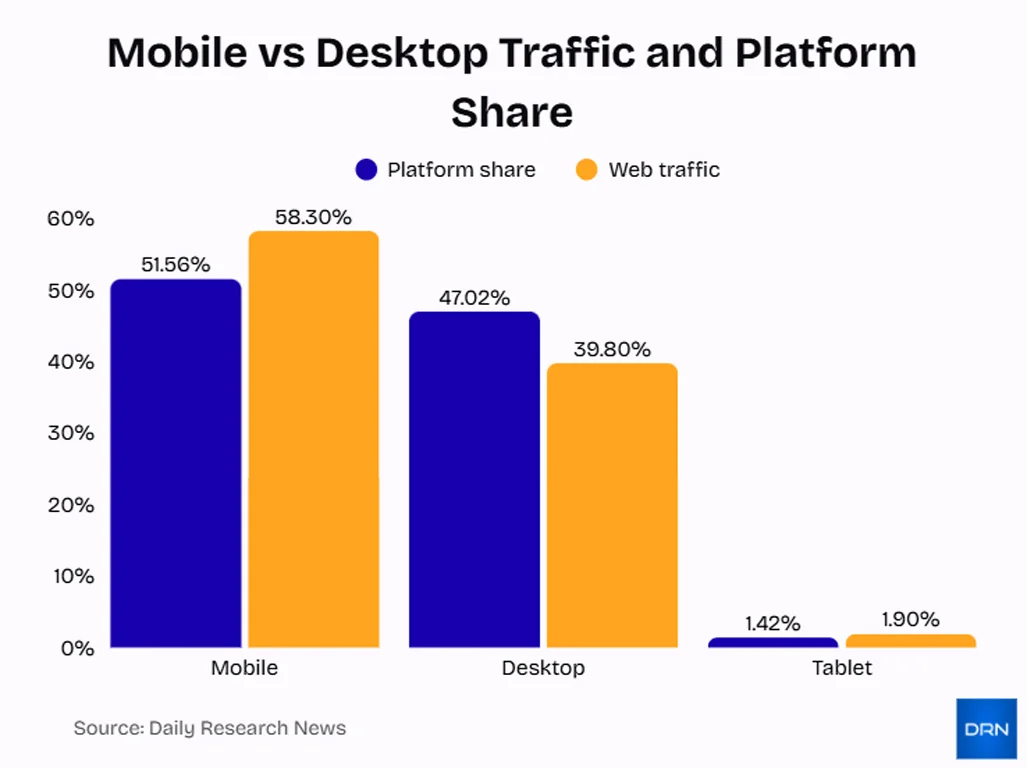

Mobile vs Desktop Usage Statistics

- As of October 2025, the global platform share is Mobile 51.56%, Desktop 47.02%, Tablet 1.42%.

- Mobile traffic ranges between 59% and 64% globally, while desktop makes up the remainder.

- Some reports place web traffic at 58.3% mobile, 39.8% desktop, and 1.9% tablet from 2024–2025.

- Compared with 2015, mobile has gained over 25 percentage points in traffic share.

- The rise reflects expanded smartphone ownership and better internet infrastructure.

- Mobile-first design has become mandatory for content and ecommerce platforms.

- Desktop remains relevant for complex workflows but trails in everyday browsing.

- Responsive design and fast mobile load times are now baseline digital requirements.

Smartphone Adoption and Penetration

- By mid-2025, there will be about 5.76 billion unique mobile users globally, representing roughly 70% of the world’s population.

- Smartphones now account for 87% of all mobile handsets in use globally.

- In the United States, 91% of adults own a smartphone, up sharply from 35% in 2011.

- The average smartphone replacement cycle is now 2.4 years, driven by rapid technological advancement.

- Android holds 71.8% of the global smartphone OS market in 2025.

- Lower device prices continue to expand smartphone access across emerging markets.

- Global smartphone users are estimated to fall between 5.3 and 5.8 billion, depending on methodology.

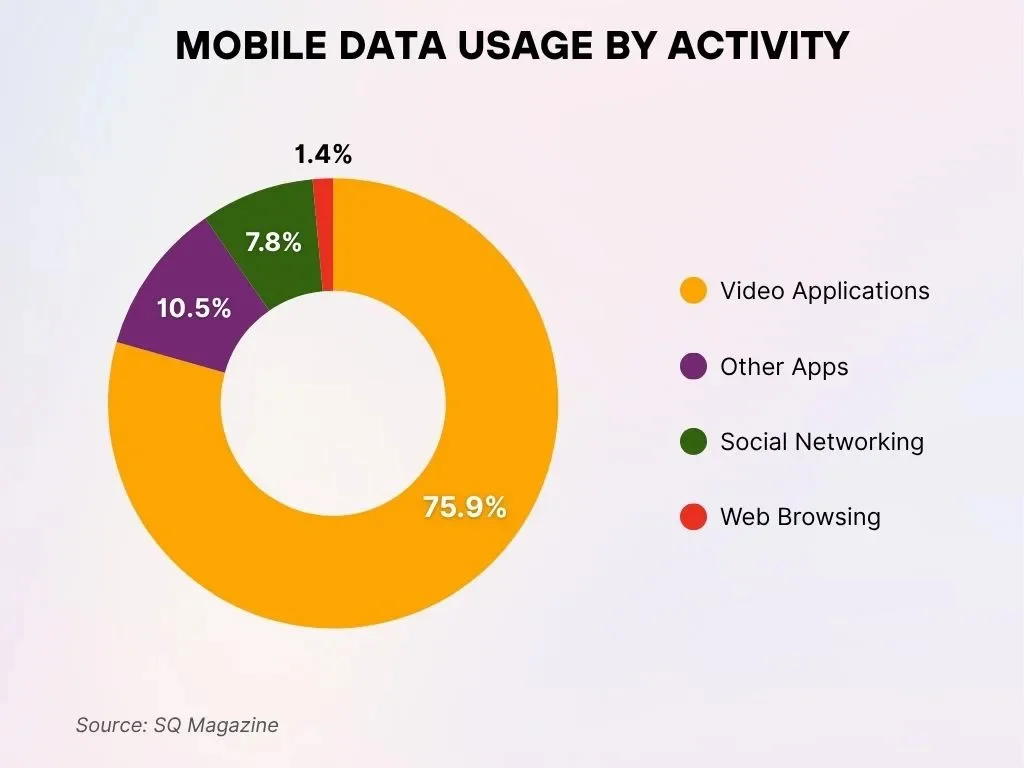

Mobile Data Consumption by Activity

- Video applications overwhelmingly dominate mobile traffic, making up a substantial 75.9% of total data usage, emphasizing their massive influence on user consumption patterns.

- Other apps collectively consume 10.5% of mobile data, representing a broad range of non-video and non-social functionalities that still contribute significantly.

- Social networking apps account for 7.8% of total mobile data usage, underscoring their persistent relevance in everyday digital engagement.

- Web browsing constitutes only 1.4% of mobile data usage, reflecting a notable shift away from traditional internet use toward more media-rich activities.

Time Spent on Mobile Devices

- The global average is 3 hours and 43 minutes per day on smartphones in 2025.

- Other sources report 4 hours and 37 minutes daily on smartphones in 2025.

- Many users spend the equivalent of 70 days per year on mobile screens.

- Users spend roughly 3 hours and 10 minutes daily in mobile apps, around 90% of total smartphone usage.

- Some analyses show app usage at 4.9 hours per day in 2025.

- 65.6% of users engage with 3 to 10 apps per day.

- App-based digital life continues to grow, making mobile UX essential for businesses.

Mobile App Usage and Downloads

- Global consumer app spending reached $40 billion in Q1 2025, up 11% year-on-year.

- Streaming and social apps each bring in around $12 billion in in-app purchases annually.

- Users spend 3–5 hours daily in mobile apps across key markets.

- The mobile app economy is projected to hit $673 billion by the end of 2025.

- Downloads continue expanding, especially across India, Indonesia, and Brazil.

- Many desktop tasks have shifted to apps for convenience and speed.

- Rising in-app engagement drives investment in retention and user experience.

Mobile User Demographics

- In the U.S., 98% of adults own a mobile phone, and 91% own a smartphone.

- Younger adults, particularly under 35, exceed global averages in daily screen time.

- Emerging markets show rapid adoption among younger age groups.

- Social media users total 5.41 billion in 2025, representing 68.5% global penetration.

- Users engage with 6.83 different social platforms per month on average.

- Social media penetration among internet users aged 16+ is 95% globally.

- Mobile-native demographics shape trends toward social, always-on mobile experiences.

Mobile Marketing Essential Statistics & Spending Insights

- 57% of users’ daily online time is allocated to mobile devices, emphasizing how dominant mobile usage has become.

- 2 out of 3 online shopping orders are completed through a mobile device, fueling the ongoing e-commerce boom.

- More than 75% of U.S. retail site visits originate from smartphones, underscoring their pivotal role in retail browsing.

- 98% of users access content on mobile phones, while 97.8% also use computers, revealing a strong pattern of cross-device engagement.

- In 2023, global mobile ad spending climbed to $362 billion, reflecting its rapidly expanding impact.

- In 2024, worldwide mobile ad spend increased by 11%, reaching $402 billion and illustrating sustained year-over-year growth.

- By 2030, global mobile ad spending is forecasted to soar to $1.3 trillion, marking a massive long-term expansion.

- For 2025 in the U.S., mobile ad spend is divided into $188B for in-app ads and $40B for mobile web ads, showcasing the strong dominance of in-app advertising formats.

Mobile Advertising Formats and Channels

- The global mobile advertising market is projected to reach $447 billion in 2025.

- In-app advertising dominates with around $390 billion in ad spend.

- Mobile ads represent 56% of total digital ad spend globally.

- Social and in-app placements make up 60% of mobile ad spending.

- Mobile ad spend rose from $402 billion in 2024 to approximately $447 billion in 2025, an 11.1% increase.

- Short-form video and vertical formats lead mobile ad innovation.

- Programmatic and native placements outperform legacy banner formats.

- In some regions, mobile ad budgets surpass 70% of total digital ad spending.

Mobile Search Advertising Statistics

- Mobile search ad spend reached $81.5 billion in 2024.

- 52% of PPC clicks come from mobile users.

- 78% of mobile searches result in retail conversions.

- Mobile search traffic continues outpacing desktop search.

- Advertisers increasingly prioritize mobile search over desktop.

- Improved targeting and smaller-screen search optimization drive higher performance.

Mobile Social Media Marketing Statistics

- 83% of global social media ad revenue in 2025 comes from mobile.

- Over 60% of mobile ad budgets go toward social media placements.

- Mobile social ads generate 1.3% CTR, higher than desktop.

- Mobile video ads drive 2x higher engagement than image-based ads.

- Social media ad spending reaches $276.7 billion in 2025.

- Asia-Pacific leads with $231 billion in mobile ad spend for 2025.

- U.S. mobile ad spending projected at $228.11 billion in 2025.

- In-app advertising yields 3x more engagement than mobile web ads.

Mobile Video Advertising Statistics

- Mobile video ads increase conversions by up to 86%.

- U.S. video ad spending grew 18% year-over-year, reaching $64 billion.

- About 90% of consumers say mobile video helps them make purchase decisions.

- 40% of global shoppers purchase items discovered via mobile video.

- Mobile video ranks among the fastest-growing mobile ad formats.

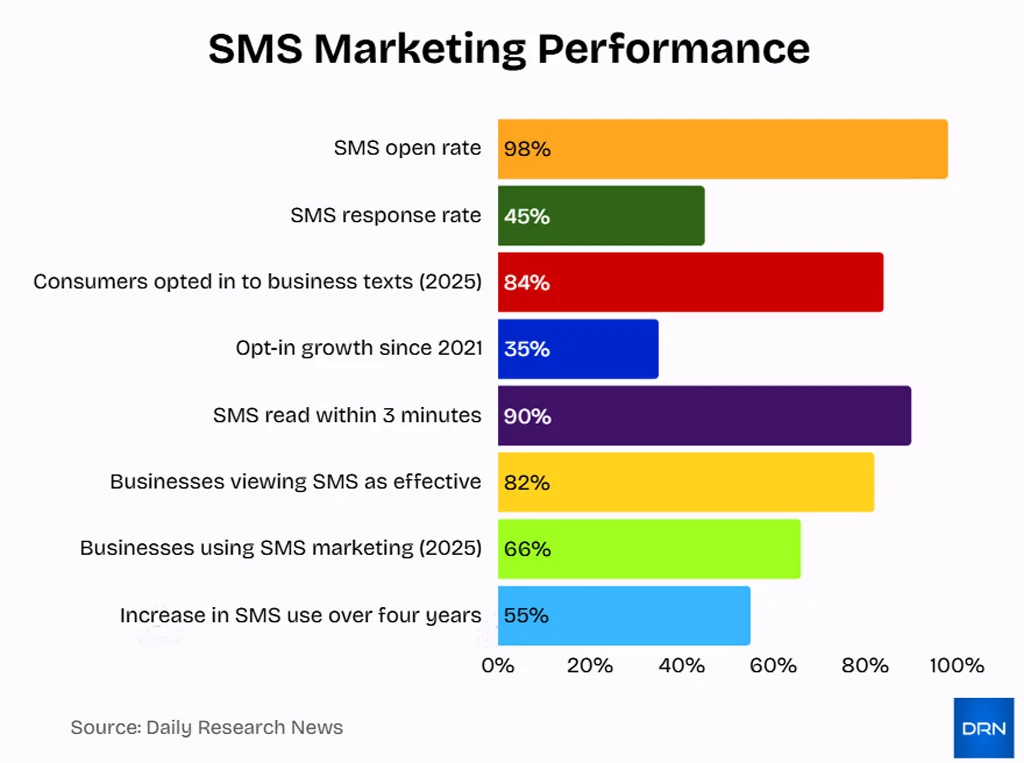

SMS and Text Message Marketing Statistics

SMS marketing reports 98% open rates and 45% response rates.

84% of consumers opted in to receive business texts in 2025, up 35% since 2021.

90% of SMS messages are read within 3 minutes, with an average response in 90 seconds.

Average SMS click-through rate hits 21–35%, far above email‘s 3.25%.

21–30% conversion rate for SMS campaigns, versus email’s 12.04%.

82% of businesses view SMS as effective for driving revenue.

66% of businesses use SMS marketing in 2025, up 55% from four years ago.

71% of consumers want two-way texting with businesses.

SMS yields $71 revenue per $1 spent on average.

Unsubscribe rates under 3.5% for SMS, lower than email’s 1.35%.

Push Notification Marketing Statistics

- Push notifications achieve an average open rate of 20%, surpassing email benchmarks across industries.

- App engagement surges up to 88% with enabled push notifications.

- Users receiving one or more push notifications in the first 90 days show nearly 3x higher retention rates.

- Personalized push notifications deliver 4x higher reaction rates than generic ones.

- Average push notification CTR stands at 28%, far exceeding email performance.

- Daily push notifications boost retention by 820% compared to zero notifications.

- Opt-in rate for mobile app push notifications averages 67.5%, with Android at 91.1%.

- 77% of users engaged with a push notification in the last month, and 48% made purchases.

- Emojis in notifications increase reaction rates by 20%, while rich media boosts clicks by 25%.

- Retail apps see 2-5x higher retention from weekly pushes and 3-6x from daily ones.

Mobile Commerce (M-Commerce) Statistics

- Global m-commerce sales reached $2.07 trillion in 2024, 57% of all ecommerce sales.

- M-commerce is expected to reach 59% of all retail ecommerce in 2025, about $4.01 trillion.

- About 1.65 billion people will shop via smartphone in 2025.

- In the U.S., 76% of adults make purchases using smartphones.

- Shopping apps account for billions of usage hours globally.

- Retailers must optimize mobile checkout and UX to capture conversions.

Mobile App Marketing and User Acquisition

- Global spending on app install ads is forecast to hit $94.9B by 2025, up 20% from 2023, underscoring aggressive mobile app marketing investment.

- The average global cost per install (CPI) across platforms is about $2.24, with iOS at $0.86 and Android at $0.44 overall.

- Mobile app CPI reaches $5.28 in North America but drops to $0.34 in Latin America, showing more than a 15x regional cost gap for user acquisition.

- Between 2022 and 2024, casual gaming app CPI jumped from $0.98 to $2.17, more than 2x, increasing paid user acquisition costs for game developers.

- A 2022 survey found that around 70% of app developers increased their user acquisition budget, while 58% expanded to new locations and demographics.

- Influencer-driven app campaigns generate about $6.50 in revenue for every $1 spent, making them a high-ROI user acquisition channel.

- Customer acquisition costs for apps have risen about 60% over the last five years, driven largely by privacy changes like iOS 14.5 and stricter tracking rules.

- The global in-app advertising market was valued at around $192.5 billion in 2024 and is projected to reach $561.24 billion by 2032 at a 14.31% CAGR, powering app growth in multiple categories.

- By platform, Android captured about 69.1% of the in-app advertising market in 2024, with other platforms projected to grow at roughly 14.6% CAGR.

Frequently Asked Questions (FAQs)

Roughly 64.35% of global web traffic comes from mobile devices as of July 2025.

Approximately 4.69 billion people globally owned a smartphone in 2025.

Global mobile advertising spend is projected to reach $402 billion in 2025.

Around 57% of global ecommerce transactions in 2024 were via mobile devices.

Conclusion

Mobile marketing stands as a core pillar for brands seeking reach, engagement, and conversions. With global mobile ad spend projected at $447 billion, more than half of all digital ad budgets now flow toward mobile audiences. Formats such as in-app ads, mobile search, and video dominate, offering higher engagement and conversion potential than traditional channels.

Meanwhile, the continued rise of m-commerce and mobile-driven acquisition further underscores mobile’s essential role in today’s marketing landscape. Businesses that neglect a mobile-first strategy risk falling behind, making now the time to act on the data and insights presented throughout this report.