Mobile devices now shape how most people access the internet. Smartphones and tablets together account for a growing majority of global web traffic, while desktops continue to serve specific needs like professional work and detailed research. These shifts influence everything from search behavior to ecommerce performance and platform design decisions. In digital marketing, for example, mobile-first campaigns are essential to capture attention, while enterprise applications still rely heavily on desktops for productivity. This article breaks down the latest mobile vs desktop usage data and trends so you can understand where audiences are today.

Editor’s Choice

- ~59.6% of global web traffic came from mobile devices in mid-2025.

- Desktop devices accounted for ~38.1% of web traffic in 2025, depending on the source.

- Mobile traffic has made up the majority of total web visits since 2017.

- In the U.S., mobile and desktop traffic is more balanced than globally.

- Smartphones are now owned by over 70% of the world’s population.

- Mobile accounted for ~57% of global ecommerce transactions in 2024.

- Mobile engagement and app usage far outpace mobile web browsing in time spent.

Recent Developments

- Mobile web traffic in 2025 reached 59.6% of total global web traffic.

- Desktop share remains substantial globally, representing roughly 35–39.5% of traffic in 2025.

- Mobile devices continue to drive more than half of all digital engagement worldwide.

- The gap between mobile and desktop traffic is widening compared to previous years.

- Many publishers report mobile traffic outpacing desktop across nearly all content categories.

- Mobile responsiveness and page speed have become priorities for SEO and user experience in 2025.

- Growth of 5G, cheaper devices, and improved mobile apps continues to push mobile usage higher.

- Mobile-first indexing by search engines increases the importance of mobile performance.

- Cross-platform tools now focus on seamless device transitions as users switch between mobile and desktop.

- Ecommerce platforms increasingly optimize for mobile checkout flows and wallets like Apple Pay and Google Pay.

Global Traffic Share: Mobile vs Desktop

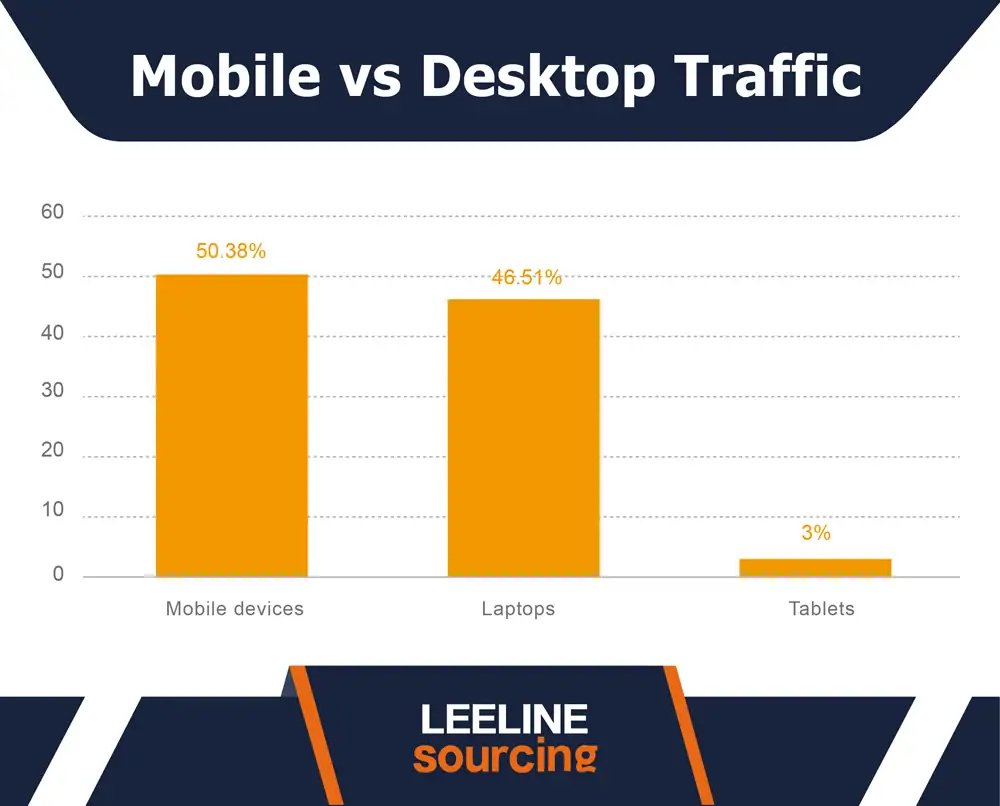

- Mobile devices dominate overall usage, accounting for 50.38% of total web traffic across websites.

- Laptops (desktops) come in a close second with 46.51%, highlighting that usage levels are nearly equal between device types.

- Tablets represent a minor portion of total activity, contributing only 3% to overall website traffic.

- The data clearly indicates that a mobile-first design strategy is critical, as over half of users now access websites primarily through smartphones.

Historical Shift from Desktop to Mobile

- In 2009, mobile traffic was under 1% while desktops dominated globally.

- By 2016, mobile devices first overtaken desktops in web traffic share.

- Between 2017 and 2020, mobile traffic grew steadily while desktop traffic declined or stagnated.

- By 2023, mobile traffic consistently stayed above 50%.

- 2024 saw mobile traffic near 60%, signaling a plateau but continued dominance.

- From 2010 to 2025, mobile share moved from ~1.6% to above 60%.

- The shift reflects broader smartphone penetration and faster mobile broadband globally.

- Desktop remains important for tasks requiring larger screens and keyboard input.

Mobile vs Desktop Share in Organic, Paid & Social Media Traffic

- Organic search remains a major driver of traffic, with mobile devices contributing approximately 62.54% of global organic search visits in late 2024.

- Search engines account for ~92.96% of global web traffic sources, underlining why organic search is critical for both mobile and desktop strategies.

- In the U.S., an estimated 63% of organic search traffic came from mobile devices as of mid-2025.

- Social media traffic accounts for about 16% of overall website visits, with a significant portion originating from mobile platforms.

- Paid social media advertising spend is projected to reach $276.7 billion in 2025, with mobile absorbing a growing share.

- Marketers report that mobile devices account for over half of annual traffic across organic, paid search, and social media.

- Mobile ads often deliver higher click-through rates than desktop ads on visual and video-first platforms.

- Desktop remains relevant for paid search and display traffic in professional and work-oriented contexts.

Regional Differences in Device Usage

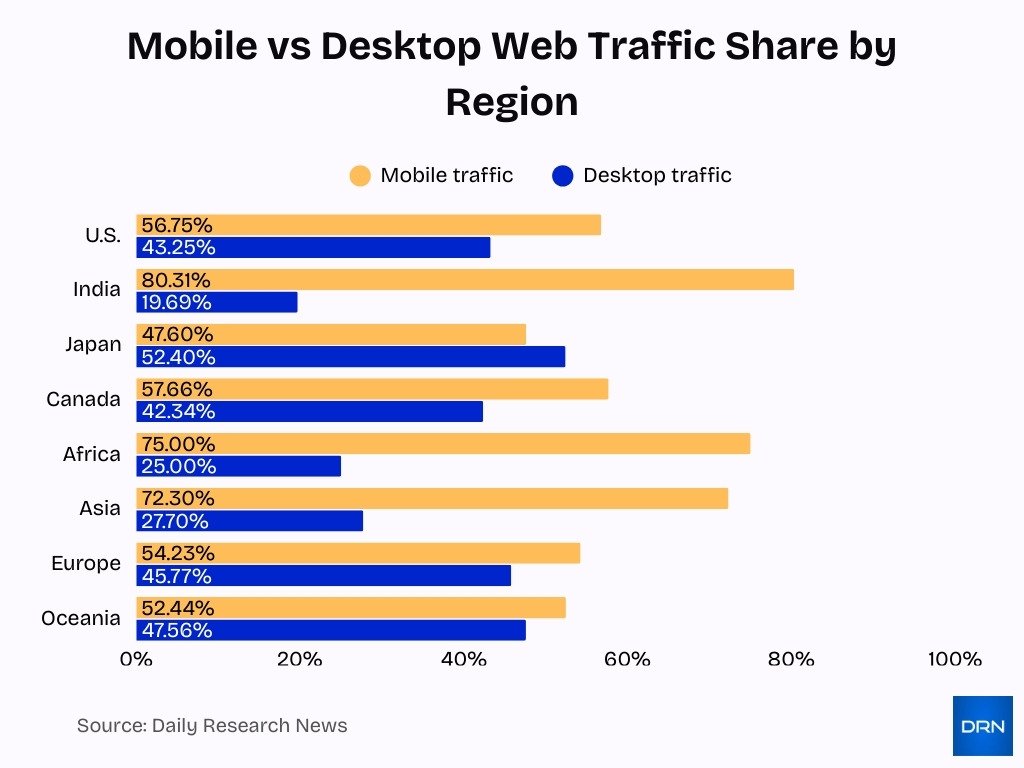

- In the U.S., mobile accounts for 56.75% of web traffic while desktop takes 43.25%.

- India leads with 80.31% of internet traffic from mobile devices.

- Japan favors desktops at 52.4% compared to 47.6% mobile share.

- Canada shows 57.66% mobile traffic againsta higher desktop preference.

- Africa reports over 75% of webpage views via mobile devices.

- Asia dominates with 72.3% of web traffic from smartphones.

- Europe has a balanced 54.23% mobile web traffic share.

- Oceania sees 52.44% mobile web traffic, catching up to desktop.

Mobile vs Desktop Share in Ecommerce, B2B, and B2C Traffic

- Mobile comprises over 70% of ecommerce traffic, significantly outpacing desktop for shopping visits.

- Over 70% of online sales in recent holiday seasons were initiated on mobile devices.

- For B2C ecommerce, mobile dominates both browsing and checkout behavior.

- B2B websites receive more desktop visits, reflecting complex and work-driven purchasing behavior.

- Content downloads, such as whitepapers, are 2.3 times more likely on desktop than mobile.

- Email opens skew mobile at ~68%, while clicks and conversions often favor desktop in B2B.

- Desktop sessions in B2B contexts show longer engagement durations.

- Nearly half of mobile visitors leave ecommerce sites due to usability or page speed issues.

Time Spent: Mobile vs Desktop Internet Usage

- Mobile sessions average 704–775 seconds, while desktop sessions reach 996–1,918 seconds.

- Desktop users spend 77.8% longer per visit than mobile users in 2021 data.

- In 2023, desktop visit duration was 37.7% longer than mobile.

- US adults average 4h 39m/day on mobile vs 2h 20m on desktop in 2025.

- Mobile screen time hits 4h 58m daily in the US vs 2h 16m on desktop.

- 70%+ mobile sessions last up to 3.5 minutes, vs 60% desktop.

- eCommerce mobile sessions average 72 seconds, desktop 150 seconds.

- Desktop averages 5.5 pages/visit, mobile 4.8 pages in retail.

Mobile vs Desktop Usage by Demographics

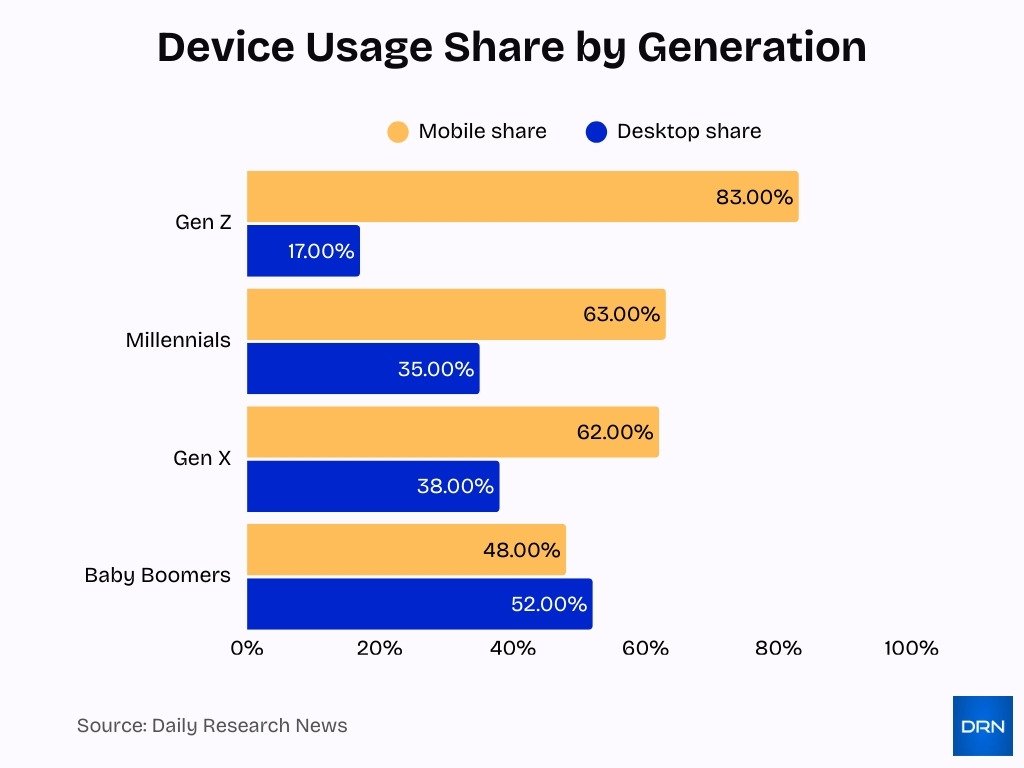

- Gen Z (10–27) uses mobile for 83% of their digital time.

- Millennials (28–44) balance 63% mobile and 35% desktop usage.

- Gen X (45–60) shows 62% mobile adoption for general browsing.

- Baby Boomers (61–78) allocate 52% of their online time to desktops.

- 45% of Gen Z and 36% of Millennials are mobile-only users.

- 27% of low-income (<$30K) Americans rely solely on smartphones for the internet.

- 79% of adults 18–34 watch videos weekly on smartphones.

- 96.3% of internet users 16+ access via mobile phones.

- Older adults (65+) use smartphones as their primary device at 51%.

- Work-from-home users 30–50 perform 68% of tasks on desktops.

Sessions, Pages per Session & Visit Duration by Device

- Mobile users typically view 3–4 pages per session.

- Desktop users often view 4–7 pages per session, reflecting deeper exploration.

- Average mobile session duration is shorter than that of desktop, driven by quick task behavior.

- Desktop users are more likely to navigate multiple content layers.

- Ecommerce sites average ~3.5 pages per session across devices.

- Desktop engagement remains higher for research-heavy workflows.

- Mobile sessions increase in frequency due to social and notification-driven visits.

- Content pacing and structure should align with device-specific behavior.

Average Internet Download and Upload Performance Across Operating Systems

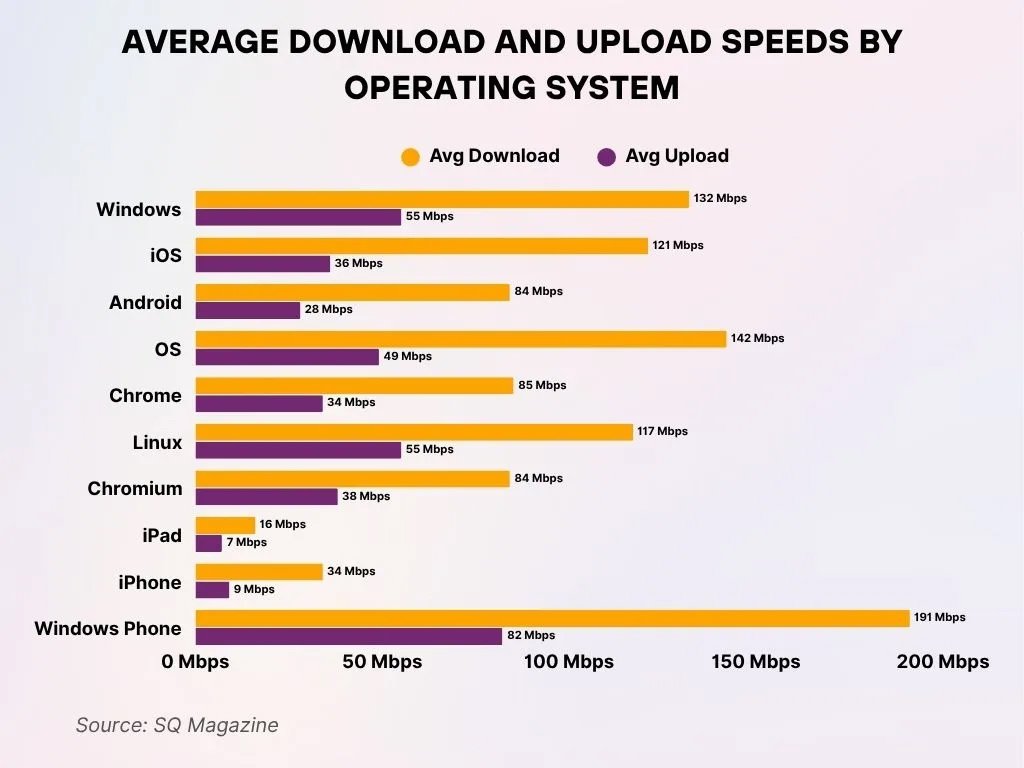

- Windows provides a strong average download speed of 132 Mbps along with a reliable upload speed of 55 Mbps, reflecting consistently high performance.

- iOS achieves an average download rate of 121 Mbps and an upload speed of 36 Mbps, indicating solid but slightly lower throughput than Windows.

- Android demonstrates comparatively weaker results, with an average download speed of 84 Mbps and an upload speed of 28 Mbps across devices.

- Generic OS outperforms most competitors by delivering a leading download speed of 142 Mbps and a robust upload speed of 49 Mbps on average.

- Chrome OS sustains dependable connectivity, recording an average download speed of 85 Mbps and an upload speed of 34 Mbps.

- Linux aligns closely with Windows on uploads at 55 Mbps, while maintaining a competitive download speed of 117 Mbps.

- Chromium OS reports an average download speed of 84 Mbps and an upload speed of 38 Mbps, placing it in the mid-range performance tier.

- iPad exhibits limited bandwidth capacity, showing a low download speed of 16 Mbps and a minimal upload speed of 7 Mbps.

- iPhone performs slightly better than iPad, with an average download speed of 34 Mbps and an upload speed of 9 Mbps.

- Windows Phone unexpectedly leads all platforms, achieving the highest download speed of 191 Mbps and the top upload speed of 82 Mbps across every category.

Revenue Contribution and Cart Abandonment Rate

- The average global cart abandonment rate in 2025 is ~70%.

- Mobile cart abandonment often reaches 75–80%, higher than desktop.

- Desktop abandonment typically ranges between 66–70%.

- Extra costs, long forms, and slow pages drive abandonment, especially on mobile.

- Mobile abandonment exceeds 78% globally in some regions.

- Cart recovery emails recapture roughly 10% of lost conversions.

- Cart abandonment represents hundreds of billions of dollars in lost revenue annually.

- Streamlined mobile checkout remains a top revenue optimization priority.

Click-through Rate, CPC, and ROI by Device

- Mobile ads account for roughly 72% of digital ad spend in 2025.

- Mobile CTR on social platforms often outperforms desktop by ~35%.

- Search CTR varies by device, with mobile sometimes edging desktop depending on format.

- Mobile CPCs can be lower due to high-volume inventory and competition.

- Mobile ROI is strongest on engagement-driven platforms like short-form video apps.

- Desktop remains effective for B2B and long-cycle conversion campaigns.

- Device-specific creative improves ROI across channels.

- Cross-device attribution improves understanding of true campaign performance.

Mobile App vs Mobile Web Usage

- Mobile apps account for 90% of smartphone usage time versus 10% for mobile web.

- Users spend 4 hours 37 minutes daily on mobile apps, dominating total mobile time.

- Apps see 2x longer session lengths at 5 minutes compared to 2.5 minutes on mobile web.

- Mobile app retention reaches 32% over 90 days versus 20% for web apps.

- Ecommerce apps convert 2–5x higher than mobile web with 3x greater average order value.

- App users make 33% more purchases more frequently than mobile web shoppers.

- Push notifications achieve 20% open rates, outperforming email’s 1-2% click rates.

- Ecommerce app users show 45% higher repeat purchase likelihood than mobile web.

- Mobile web drives 59.7% of global traffic, leading new user acquisition via search.

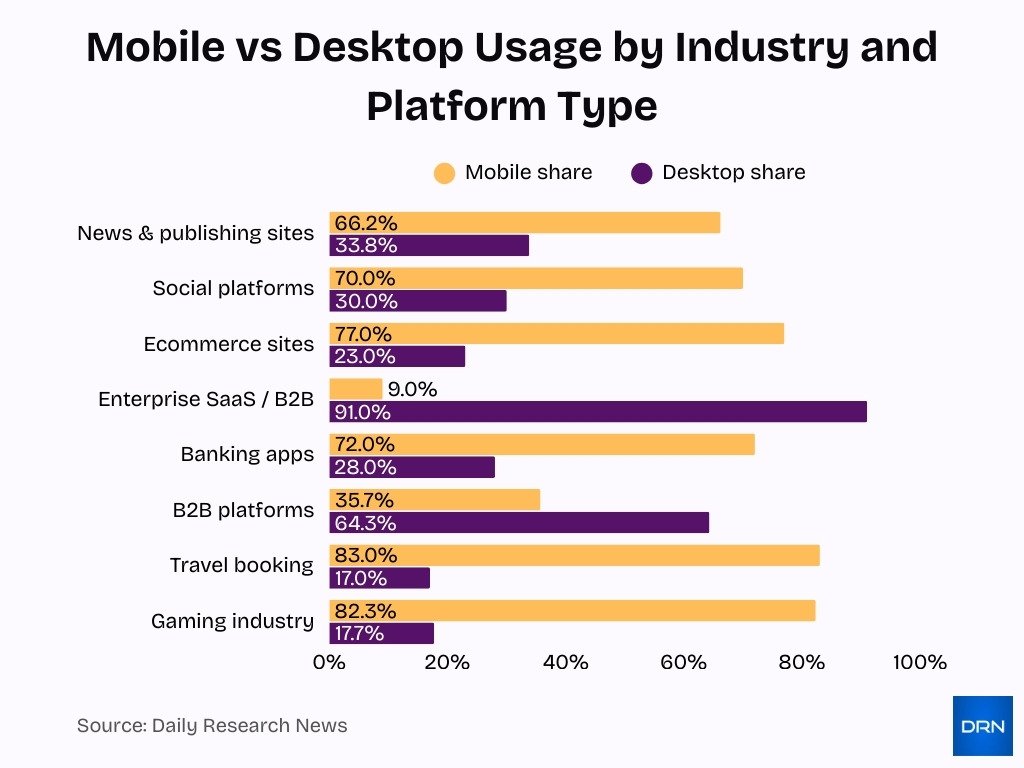

Industry-wise Device Usage Breakdown

- News and publishing sites report 66.2% of traffic from mobile devices.

- Social platforms like YouTube and Facebook see over 70% mobile traffic share.

- Ecommerce sites generated 77% of visits from mobile in recent data.

- Enterprise SaaS and B2B tools show 91% desktop traffic dominance.

- Banking apps achieved 72% adoption among U.S. adults via mobile.

- B2B platforms maintain 64.3% desktop share in site visits.

- Travel booking sites attract 83% of research on mobile devices.

- The gaming industry claims 82.3% smartphone usage for mobile gaming.

Peak Usage Times and Content Consumption Patterns

- Global mobile devices now generate 62.54% of website traffic, making them the dominant touchpoint for peak browsing sessions throughout the day.

- Mobile holds 51.71% of the overall platform market share vs 46.86% for desktop, reflecting heavier on-the-go usage across mornings, commutes, and evenings.

- Smartphone users spend an average of 5h 16m per day on their phones in 2025, concentrating most screen time into recurring daily peaks.

- Mobile accounts for 58% of all time spent on digital media, including video, social, and news, underscoring its dominance in content consumption.

- Streaming on mobile devices represents 71% of all video consumption in 2025, indicating that most video views occur away from desktop screens.

- Social media users spend about 141–143 minutes per day on platforms worldwide, with engagement clustering around key non-work windows.

- General social engagement peaks between 10 a.m. and 5 p.m. on weekdays, while entertainment-focused networks show their strongest activity in the evening.

- Optimal social posting windows commonly fall between 8–11 a.m. and 6–9 p.m., aligning with morning routines and after-work browsing.

- Mobile contributes the majority of social media screen time (36%) on devices, while desktops skew more toward productivity and longer research sessions.

- In 2025, daily mobile phone use rose to 4h 49m globally, supporting multiple short check-ins for news, social, and gaming across the day.

Mobile vs Desktop in Social Media, Video & Online Shopping

- Mobile devices command 59.6% of global web traffic in Q1 2025, surpassing desktop’s 38.1% share.

- 95% of social media users access platforms primarily via mobile phones.

- 71% of all video consumption occurs on mobile devices in 2025.

- Desktop conversion rates average 4.3%, outpacing mobile’s 2.2%.

- Mobile traffic accounts for 62.54% of global website visits in Q2 2025.

- 75% of consumers watch videos on smartphones, emphasizing mobile dominance.

- Social commerce on platforms like Instagram and TikTok drives over $1.2 trillion in mobile sales.

- Desktop conversion rates are 1.9x higher than mobile on average for ecommerce.

- 87% of mobile time is spent in apps, fueling social media and video engagement.

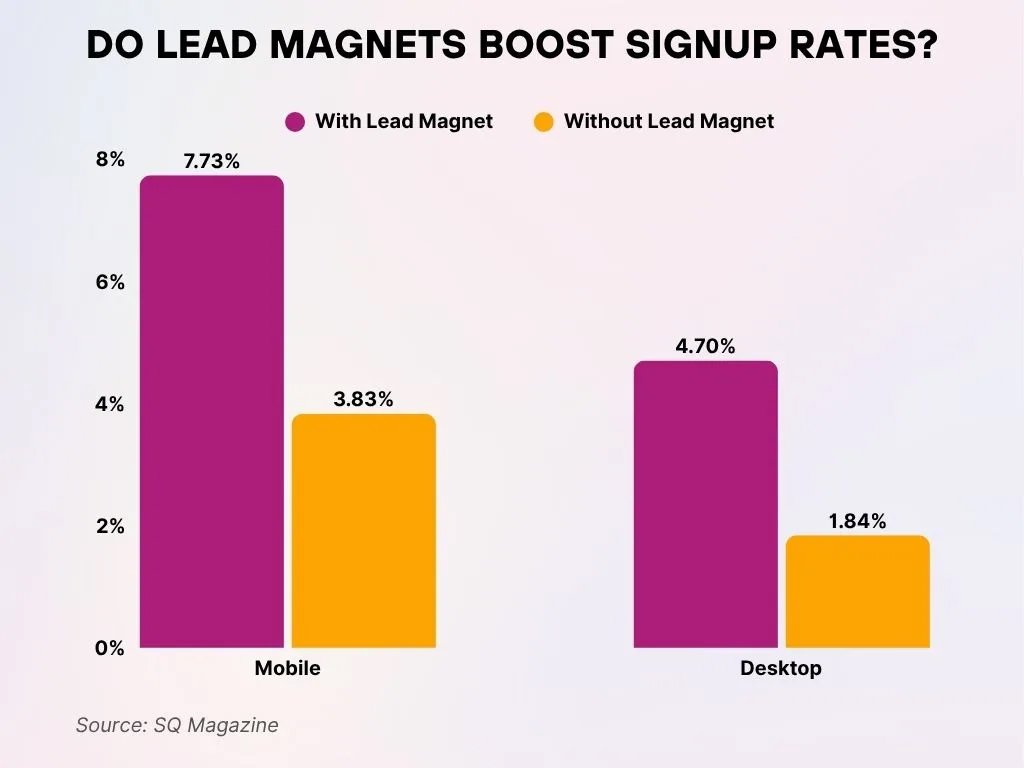

Do Lead Magnets Significantly Increase Email Signup Rates?

- On mobile devices, the use of a lead magnet raises email signup rates to 7.73%, compared with only 3.83% when no lead magnet is offered.

- On desktop, lead magnets generate a 4.7% signup rate, which is more than double the 1.84% conversion rate achieved without them.

- When evaluated across both device types, lead magnets consistently deliver significant improvements in signup performance, with mobile users showing a stronger response than desktop users.

- These results clearly demonstrate the effectiveness of lead magnets, particularly on mobile platforms, in driving higher conversion rates.

Cross-device Behavior and Customer Journey Trends

- 85% of online purchases start on one device and are completed on another.

- Over 60% of customer journeys now involve multiple devices.

- Cross-device consistency boosts conversion rates by 230%.

- 80% of Millennials use multiple devices to complete purchases.

- Desktop conversion rate stands at 4.14% vs mobile’s 1.53%.

- 30% of smartphone cart abandoners convert on different devices.

- Cross-device insights lower cost per action by 30–50%.

- Mobile cart abandonment hits 83% vs desktop’s 67%.

- 62.17% interaction rate for mobile popups in 2025 data.

Impact of Mobile-first Indexing and SEO

- Over 70% of websites now use mobile-first indexing as the default in 2025.

- Mobile devices drive 64% of global web traffic, boosting SEO rankings for optimized sites.

- Page load from 1-3 seconds increases bounce rate by 32% on mobile.

- 53% of mobile users abandon sites taking over 3 seconds to load.

- Responsive design cuts mobile bounce rates by 50% versus non-responsive sites.

- 87% of smartphone users search daily, prioritizing mobile-optimized local SEO.

- Nearly 60% of website visits come from mobile traffic in 2025.

- 80% of top-ranking sites feature full mobile optimization and content parity.

- Mobile-first indexing is the default for all sites, enhancing crawlability by 70%+.

Frequently Asked Questions (FAQs)

~59.6% of global internet traffic comes from mobile devices as of mid‑2025, compared with the remainder from desktops and tablets.

Mobile accounts for ~51.56–52.31% of the worldwide web traffic market share in late 2025, while desktop holds ~47.02–47.69% of the share.

Mobile drives about 70.92% of ecommerce site visits globally, with mobile revenue share near ~59.9%, and in some markets, mobile accounts for 78% of ecommerce traffic and 66% of all online orders.

Users spend ~90% of their mobile internet time in apps rather than mobile web browsers, with over 100 billion hours logged in apps annually.

Conclusion

The comparison between mobile and desktop usage highlights a clear reality: mobile leads in traffic volume, engagement, discovery, social interaction, and video consumption, while desktop continues to excel in deep research, professional workflows, and higher conversion efficiency. User behavior varies widely by device, industry, and intent, reinforcing the need for tailored optimization strategies.

A strong mobile-first approach, supported by seamless cross-device experiences, remains essential for businesses aiming to improve engagement, visibility, and revenue outcomes in an increasingly device-diverse digital landscape.