Music streaming has become the dominant force in how people access and enjoy music worldwide. Global music streaming revenue topped $29.6 billion, marking the tenth consecutive year of growth and underscoring the shift from ownership to access-based listening. In the U.S., streaming accounted for the majority of music consumption, driven by both ad-supported and subscription models. This revolution affects industries from artist revenue models to advertising strategies.

Across mobile devices and smart platforms, users spend hours daily discovering and engaging with music. Dive deeper into the latest user data, market shifts, and emerging trends in the sections below.

Editor’s Choice

- The global recorded music market reached $29.6 billion in 2024, a record high.

- Music streaming represented 69% of global recorded music revenues in 2024.

- Paid music streaming subscribers worldwide hit 752 million in 2024.

- Total music streaming revenue is projected to grow significantly through the decade.

- Global on-demand audio streams reached 5.1 trillion in 2025, up nearly 10% from the previous year.

- Spotify reported 713 million total users, including 281 million paid subscribers.

- Over 250 million tracks are available across platforms as of the end of 2025.

Recent Developments

- Spotify increased US subscription prices in early 2026, with Premium rising to $12.99/month.

- Trend toward hi‑res audio and curated content boosts growth for niche platforms like Qobuz in 2026.

- YouTube streams will no longer count toward Billboard charts starting in 2026, affecting how music popularity is measured.

- Global recorded music revenues grew 5.9% in H1 2025, though the growth pace slowed vs prior years.

- Streaming prices are expected to adjust every 12–24 months as industry revenues expand.

- Mid‑2025 data showed continued streaming growth with slower expansion rates globally and in the U.S.

- Dynamic genre shifts, like a surge in Christian/gospel and rock streams, reflect evolving listener tastes.

- Platforms increasingly integrate AI‑driven discovery and playlist personalization to keep engagement high.

Global Overview of Music Streaming

- Music streaming accounted for 69% of total global recorded music revenue in 2024.

- Paid subscription formats led revenue growth with a nearly 10% rise in 2024.

- 752 million paid subscribers were active worldwide by the end of 2024.

- Streaming continues to increase its revenue share compared with downloads and physical formats.

- Streaming made up more than 80% of recorded music revenue by some industry measures.

- Over 1.3 billion people engage with streaming platforms globally as part of broader digital consumption.

- Ad‑supported tiers still contribute important reach, especially among younger demographics.

- Emerging regions such as the Middle East, Africa, and Latin America outpaced growth rates in 2024.

Music Streaming Market Growth Overview

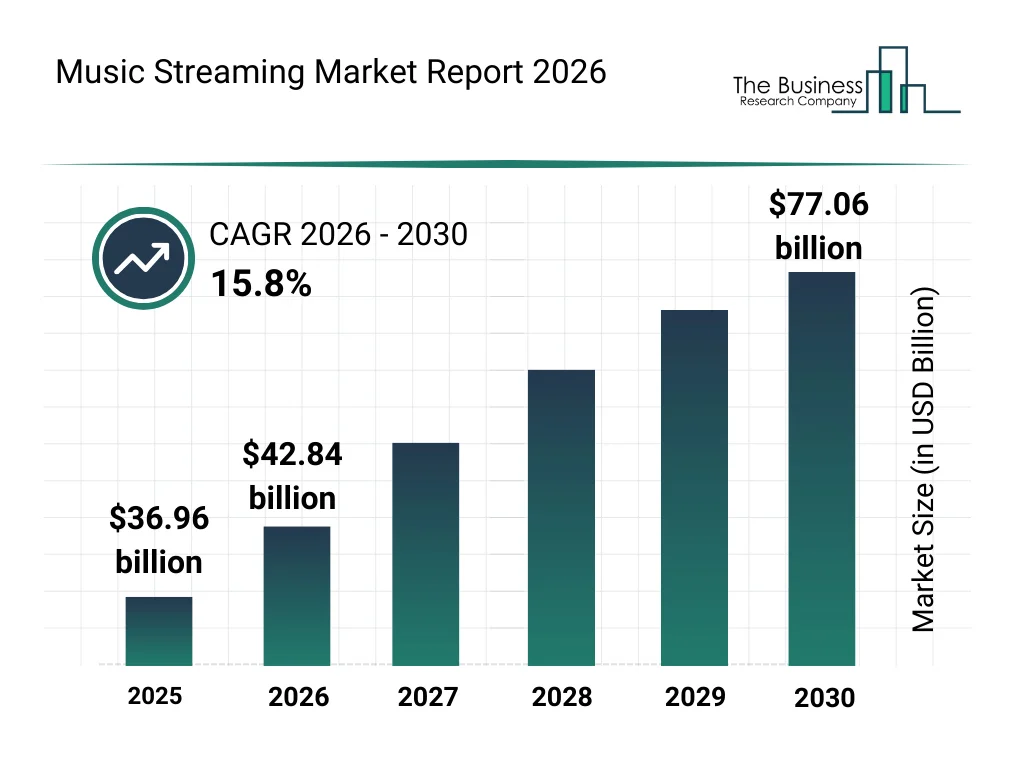

- The global music streaming market was valued at $36.96 billion in 2025, highlighting the industry’s strong monetization base.

- Market revenue increased to $42.84 billion in 2026, reflecting the accelerating adoption of streaming platforms worldwide.

- The industry is projected to grow at a CAGR of 15.8% from 2026 to 2030, indicating sustained double-digit expansion.

- Continued year-over-year growth is visible through 2027, 2028, and 2029, driven by rising paid subscriptions and mobile streaming usage.

- By 2030, the global music streaming market is expected to reach $77.06 billion, more than doubling its 2025 value.

- This growth trajectory underscores the increasing role of on-demand audio streaming in the global recorded music ecosystem.

Growth Rate and Forecast for Music Streaming

- The market is projected to grow at a ~15.5% CAGR between 2026–2035.

- Other forecasts put 19% CAGR from 2024 to 2029.

- Some analysts estimate the 2026 market at ~$49 billion, rising to over $176 billion by 2033.

- On‑demand audio content demand continues to expand with high user retention.

- Increased smartphone penetration drives long‑term growth in streaming adoption.

- Ad formats and freemium models are expected to grow moderately during 2026–2031.

- Asia‑Pacific and Latin American markets show accelerated forecasted growth.

- North America remains a stable but slower‑growing segment compared to emerging regions.

User Statistics in Music Streaming

- Spotify reported 713 million total users globally as of 2026.

- Of those, 281 million were paid subscribers.

- The number of worldwide paid music subscribers exceeded 750 million in 2024.

- On average, listeners spend a significant amount of time streaming music daily.

- US paid subscriber additions numbered 6.3 million net new users in a recent 12‑month period.

- Streaming accounts for the bulk of music listening time, especially among ages 18–34.

- Platforms now host over 250 million music tracks globally.

- Free and ad‑supported models continue to attract users, particularly younger demographics.

Global Music Streaming Platforms by Subscriber Market Share

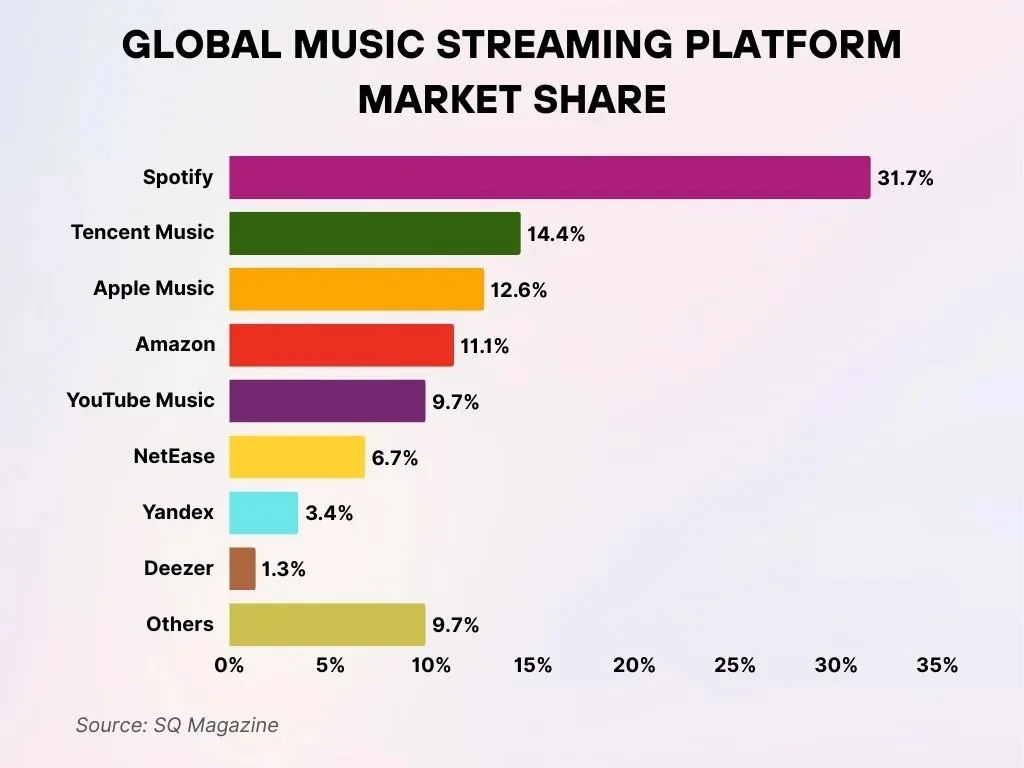

- Spotify dominates the global music streaming market by commanding a 31.7% share of total subscribers worldwide.

- Tencent Music secures the second-largest position with 14.4% of subscribers, largely fueled by its strong dominance in the Chinese market.

- Apple Music represents 12.6% of the global subscriber base, positioning it as the third-largest music streaming platform globally.

- Amazon Music closely trails competitors with an 11.1% share of global music streaming subscribers.

- YouTube Music accounts for 9.7%, highlighting its rapid adoption and growing popularity among younger audiences.

- NetEase holds a 6.7% market share, supported by its robust footprint within China’s music streaming ecosystem.

- Yandex controls 3.4% of subscribers, with usage concentrated primarily in the Russian music streaming market.

- Deezer contributes a modest 1.3%, sustained by a niche yet highly loyal global user base.

- Other music streaming platforms combined represent 9.7%, underscoring a highly fragmented long tail of smaller streaming services.

Subscriber Growth in Music Streaming

- Global paid music streaming subscriber count surpassed 752 million in 2024, growing double digits year‑over‑year.

- By mid‑2025, Spotify alone reported ~276 million paying subscribers and ~696 million monthly active users.

- Allocations show Spotify’s subscriber base rising from 252 million in Q3 2024 to 281 million by Q3 2025.

- U.S. paid music streaming services added 6.3 million net new subscribers in a recent 12‑month period.

- Regional markets in Latin America and Africa recorded some of the fastest subscriber growth rates globally in 2024–25.

- Subscription growth outpaced ad‑supported free tiers in most major markets.

- Increased bundling with telecom plans boosted subscriber additions in South Asia and Southeast Asia.

- Emerging platforms like Audiomack reported over 50 million monthly active users with ~31% YoY growth as of early 2026.

Emerging Markets Driving Music Streaming

- Sub-Saharan Africa recorded music revenues grew 22.6% in 2024, surpassing $110 million for the first time.

- Latin America led global growth with recorded music revenues up 22.5% in 2024, driven by streaming.

- India’s music streaming market is set to grow at a 17.3% CAGR from 2025 to 2030, reaching $4.87 billion.

- Asia Pacific music streaming accounted for 33.9% market share in 2025 due to low data costs.

- South east Asia music streaming market is valued at $488 million in 2024, projected to hit $1.29 billion by 2033.

- Sub-Saharan Africa streaming revenues rose 24.7% in 2023, led by Nigeria’s 44% surge.

- Indian users consume an average of 36GB of mobile data monthly in 2025, boosting streaming via cheap tariffs.

- Mdundo in Africa hit 30.8 million MAUs by end-2023, up 16% YoY, with subscriptions surging 48%.

- Bad Bunny garnered over 19.8 billion Spotify streams globally in 2025, fueling Latin adoption.

- Middle East & North Africa saw the fastest regional growth at 22.8% in 2024, nearly all from streaming.

Countries Leading in Digital Music Adoption

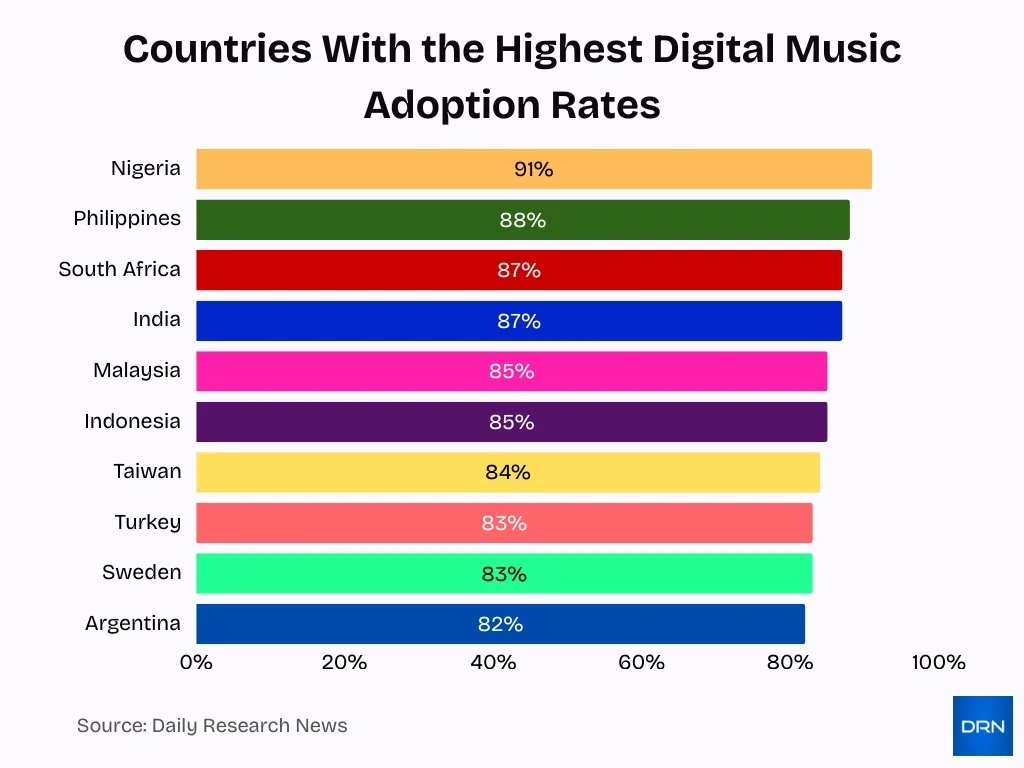

- Nigeria tops the list with a 91% digital music adoption rate, highlighting exceptionally strong consumer engagement with streaming and digital platforms.

- The Philippines follows closely at 88%, reflecting widespread mobile-first music consumption and high streaming penetration.

- South Africa and India are tied at 87%, underscoring rapid digital music adoption across both African and Asian emerging markets.

- Malaysia and Indonesia each report 85% adoption, driven by affordable smartphones and growing access to music streaming services.

- Taiwan shows a solid 84% adoption rate, indicating a mature digital infrastructure and consistent streaming usage.

- Turkey and Sweden both stand at 83%, demonstrating strong but slightly lower digital music penetration compared to leading countries.

- Argentina rounds out the list with 82% adoption, still reflecting a high level of digital music usage among consumers.

Free vs Paid Users in Music Streaming

- Paid subscriptions now generate roughly 72% of global streaming revenue, highlighting a consumer shift toward premium tiers.

- On Spotify as of 2025, approximately 39.7% of users were paying Premium subscribers, with the remainder on free tiers.

- Free and ad‑supported tiers maintain strong engagement, especially among Gen Z and younger users.

- Growth in ad‑supported users continues, but at a slower pace than premium adoption.

- Weighted chart‑counting changes for platforms like YouTube highlight industry debate around free vs paid stream value.

- Many free users convert to paid plans after exploring high‑quality personalized features.

- Services use freemium models with limited skips and video ads to funnel users toward paid tiers.

- Platforms also introduce low‑cost, country‑specific paid tiers to reduce friction for emerging market users.

ARPU and Monetization in Music Streaming

- Spotify raised the U.S. Premium price to $12.99/month effective February 2026.

- YouTube Music paid $8 billion to music rights holders in the 12 months ending June 2025.

- Spotify‘s global Premium ARPU reached €4.69 in 2024, up 7% YoY.

- Premium ARPU on Spotify is about 12X higher than ad-supported tiers (€13.07 vs €1.12 quarterly).

- Apple Music maintains an ARPU of $7-8 per user without free tier dilution.

- Super listeners (2% of streamers) drive 18% of streams and 50% of concert ticket sales.

- Paid streams generate $0.003-$0.005 on Spotify, higher than ad-supported rates.

- Global music streaming ARPU forecast to increase through 2027.

- Spotify Premium ARPU grew 4% YoY in Q1 2025 from AI features.

On‑Demand Audio Streaming Trends

- On‑demand audio is projected to capture over 50% of the music streaming market share by 2026.

- Global on‑demand music streams hit a record ≈5.1 trillion in 2025, up nearly 9.6% from 2024.

- U.S. on‑demand streams alone reached ~1.4 trillion in the same period.

- Playlists and curated experiences drive much of on‑demand listening time across demographics.

- Personalized AI playlists and user‑driven discovery features are increasingly central to engagement.

- Trends show listeners increasingly revisiting older catalog tracks rather than only new releases.

- Podcasts and spoken‑word content continue to grow alongside music, broadening on‑demand audio use.

- Dynamic recommendations based on mood, activity, and time of day shape listening patterns.

Most Streamed Songs and Artists in Music Streaming

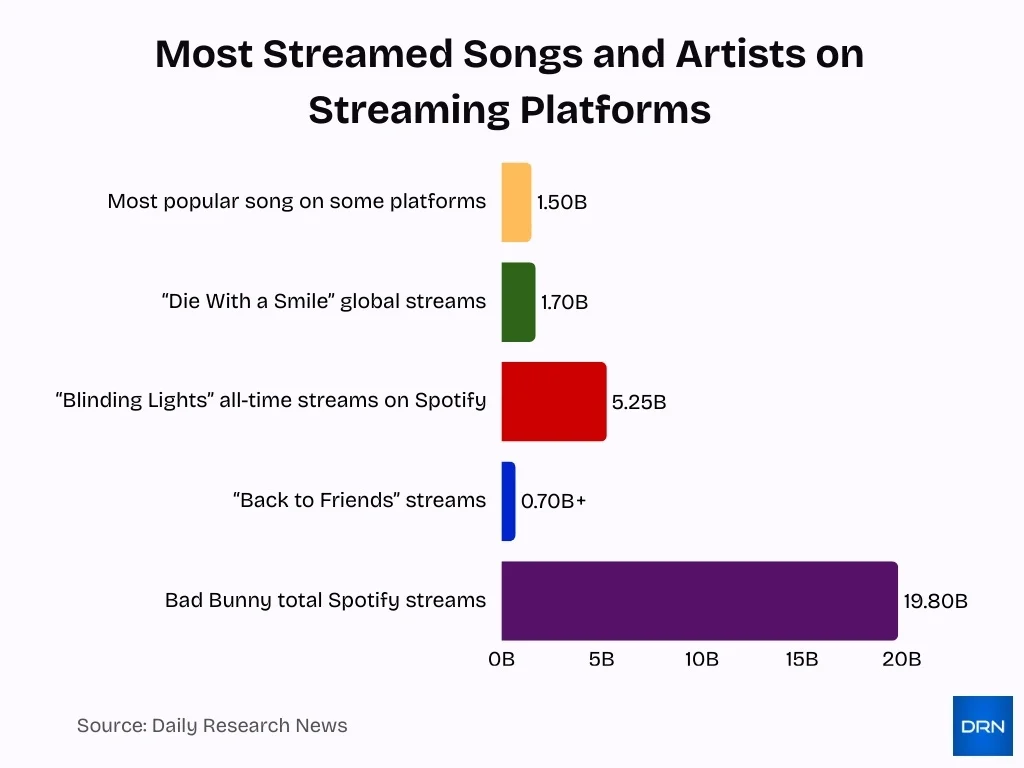

- In 2025, the most popular song on some platforms garnered ~1.5 billion streams globally.

- Spotify’s all‑time most-streamed track is “Blinding Lights” with over 5.25 billion plays.

- “Die With a Smile” by Lady Gaga & Bruno Mars became 2025’s top global song with ~1.7 billion streams.

- Apple Music’s year‑end charts named “APT.” by Rosé & Bruno Mars as the top song in 2025.

- Artists leading monthly listeners in early 2026 include Ariana Grande, Justin Bieber, and The Weeknd, with over 120 million each.

- Bad Bunny was Spotify’s most globally streamed artist of 2025, with nearly 19.8 billion streams.

- Songs like “Back to Friends” crossed 700 million+ streams during 2025.

- Billboard Streaming Songs charts in 2026 featured tracks from artists like Mariah Carey and Taylor Swift at the No.1 weekly positions.

Device and Platform Usage for Music Streaming

- Apps drive 75% of music streaming on mobile devices, with smartphones at 60% and tablets at 15%.

- Mobile platforms account for 59.2% of global digital music listening hours in 2025.

- Desktop and web comprise 15% of total streaming activity worldwide.

- Smart speakers represent 10% of music streams, with Amazon Echo and Google Nest exceeding 30% U.S. household penetration.

- Smart speaker audio listening time surged 400% in recent years.

- 85% of commuters use audio entertainment like music streaming during drives.

- Nearly 60% of listeners use multiple streaming services, boosting cross-platform sync adoption.

- YouTube Music sees 90% of visits via mobile devices, blending video-audio experiences.

- VR music streaming platforms reached $93.47 billion market value, signaling emerging growth.

Consumption Habits in Music Streaming

- In the first half of 2025, global on‑demand audio streams reached a record 2.5 trillion, while U.S. streams hit 696.6 billion, showing huge user engagement.

- Streaming now makes up 92% of all music listening in the U.S., highlighting how dominant the format has become.

- Listener growth slowed in 2025 compared with prior years, but overall volume continues to climb.

- Usage continues across diverse contexts, workouts, commutes, and background listening while working.

- Personalized mixes and auto‑generated playlists drive repeated daily streaming habits.

- Web radio and on‑demand streaming together exceed 50% of daily audio listening time among U.S. adults aged 13+.

- Smart speakers and connected car audio systems increase daily listening outside handheld devices.

- Peak listening hours concentrate in late afternoons and weekends, aligning with leisure time.

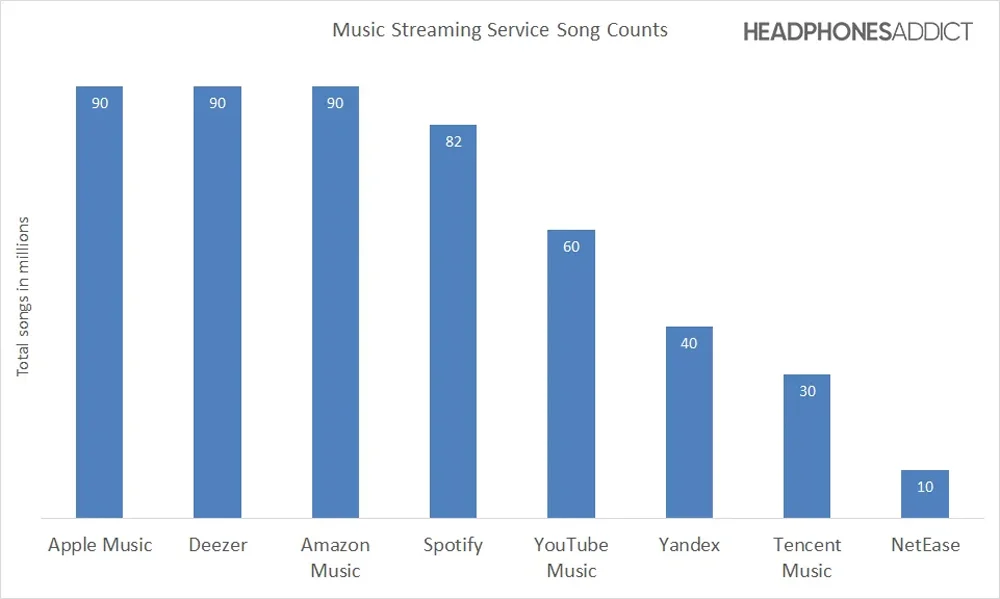

Music Streaming Platforms by Total Song Library Size

- Apple Music, Deezer, and Amazon Music deliver the largest music libraries, with each platform offering approximately 90 million songs to listeners worldwide.

- Spotify ranks just behind the leaders, maintaining an extensive catalog that includes around 82 million tracks available for streaming.

- YouTube Music enables users to access a substantial selection of content, providing roughly 60 million songs across its platform.

- Yandex Music supports a moderately sized offering, hosting close to 40 million tracks in its overall music library.

- Tencent Music curates a sizable but more limited collection, featuring about 30 million songs in total.

- NetEase maintains the smallest music catalog among major platforms, offering only 10 million songs to its user base.

Genre Preferences in Music Streaming

- R&B/hip-hop garnered 349.9 billion on-demand audio streams in the U.S. in 2025, leading all genres.

- Rock followed with 260.5 billion streams in the U.S., growing its market share by 0.3 percentage points.

- Rock streams increased by 6.4% year-over-year in the U.S.

- Latin music grew 5.2% in streams and accounted for 120.9 billion in the U.S.

- Christian/gospel expanded by 18.5% in on-demand audio volume, with 30 billion streams.

- Its audience is 60% female and 30% millennial among younger listeners.

- The recession that popped from the late 2000s saw streams rise 6.4% in the U.S.

- Pop recorded 167.2 billion streams in the U.S., consistently topping playlists.

- The electronic music market hit USD 12.9 billion globally, up 6% YoY, and strong among youth.

- Korean music, including K-pop, ranked fourth most-streamed globally in 2025.

Playlist and Curation in Music Streaming

- On Spotify, personalized playlists like Discover Weekly now drive over 30% of total listening time, underscoring their central role in user engagement.

- Users have streamed more than 2.3 billion hours of the personalized Discover Weekly playlist alone, with its listeners streaming over 2x longer than non‑users.

- After the launch of Discover Weekly, Spotify recorded around a 30% uplift in overall user engagement, highlighting the impact of algorithmic curation on daily listening time.

- Contextual explanations around recommendations can make users up to 4× more likely to click on AI‑powered suggested tracks and niche playlists.

- Globally, more than 80% of consumers say they want and expect personalized experiences, supporting the growth of tailored daily mixes and mood‑based playlists in music apps.

- Spotify’s user base and revenue grew by about 1,000% over the past decade to more than 600 million users and 14 billion USD in revenue, largely attributed to personalization and curated playlists.

- Interactive recap formats like Spotify Wrapped hit 200 million engaged users within about 62 hours in 2024, with shares growing 41% year over year to roughly 500 million, showing the social pull of playlist‑driven identity and discovery.

- In experiments with narrative recommendations, tracks accompanied by richer AI‑generated explanations saw significantly higher engagement, with some segments reporting up to 4× increases in recommendation clicks.

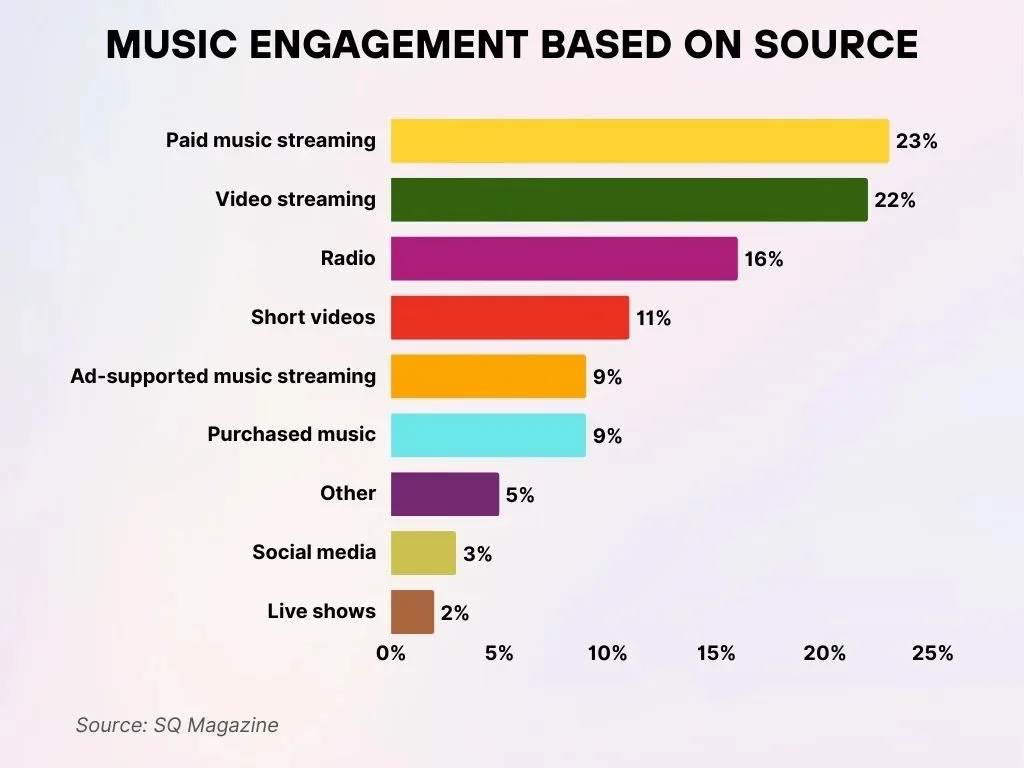

Music Engagement by Consumption Source

- Paid music streaming stands as the leading source of engagement, accounting for 23% of total music interactions across platforms.

- Video streaming comes in a close second with 22%, reflecting a strong user preference for platforms such as YouTube.

- Radio continues to play an important role, contributing 16% to overall music engagement despite digital growth.

- Short-form video platforms such as TikTok drive 11% of total music consumption, underscoring their rising influence.

- Ad-supported music streaming and purchased music each account for 9% of engagement, showing balanced usage between free and owned content.

- Other sources, including borrowing and non-traditional platforms, collectively represent 5% of total engagement.

- Social media platforms contribute a relatively smaller share at 3% of overall music engagement.

- Live music shows account for just 2%, highlighting the clear dominance of digital platforms in music consumption.

Social Media Integration with Music Streaming

- Annual campaigns like Spotify Wrapped see tens of millions of shares on social platforms, boosting engagement and brand visibility.

- Wrapped data features often go viral on Instagram, TikTok, and Twitter, turning listening behavior into shareable content.

- Music content trending on TikTok frequently translates into streaming spikes across platforms.

- TikTok’s influence on discovery channels can elevate songs that might otherwise go unnoticed.

- Artists increasingly use social platforms to drive pre‑release hype, leading to higher first‑week streaming numbers.

- Social media challenges tied to songs often boost cross‑platform streaming performance.

- Influencer playlists and artist collabs shared on social feeds expand reach rapidly.

- Real‑time social metrics (likes, shares) now influence some playlist placements and suggestions.

Future Trends in Music Streaming

- The global music streaming market is projected to reach $51.5 billion in 2026 and grow to $127.3 billion by 2033 at a 13.8% CAGR.

- Other forecasts indicate the market will grow from about $36.9 billion in 2025 to roughly $42.8 billion in 2026, underscoring sustained double‑digit expansion.

- Around 75% of music streaming services now use AI algorithms for personalization, boosting listener retention by about 40% versus traditional playlists.

- AI‑driven recommendation and personalization engines are expected to underpin most major platforms’ engagement strategies, with personalized streams already accounting for a majority of listening time on leading apps.

- Platforms supporting spatial/immersive audio report roughly a 30% increase in consumption of spatial audio content and around a 40% rise in user engagement versus standard stereo.

- Surveys show that about 85% of music producers say spatial audio expands their creative possibilities, helping drive broader catalog conversion into immersive formats.

- Sales of spatial‑audio‑enabled headphones are growing at roughly 25% year‑over‑year, supporting future uptake of lossless and immersive streaming tiers.

- Home and consumer audio gear with spatial sound is forecast to grow from about $33.2 billion in 2025 to nearly $89.5 billion by 2033, amplifying demand for compatible streaming content.

- The broader AI in music segment, including generative and analytical tools used by streaming platforms, is expanding at an estimated CAGR of about 27–28% this decade.

Frequently Asked Questions (FAQs)

There were 752 million paid music streaming subscribers globally by the end of 2024, according to industry statistics.

The global music streaming market was estimated at USD 49.09 billion in 2026 as part of the forecast data.

The music streaming market is projected to grow at a 19.4% CAGR from 2026 through 2033.

Music streaming apps generated $53.7 billion in revenue in 2024, a 12.5% increase from the prior year.

Conclusion

Music streaming remains the central way listeners access music, reshaping habits and industry economics. With trillions of annual streams, broad genre diversification, and deeper social integration, platforms compete for attention with smarter, more personalized experiences. AI‑infused curation and emerging audio formats are set to define the next phase, pushing creative boundaries and business models alike.

What listeners choose, share, and stream today will continue driving the evolution of music discovery, consumption, and community engagement.