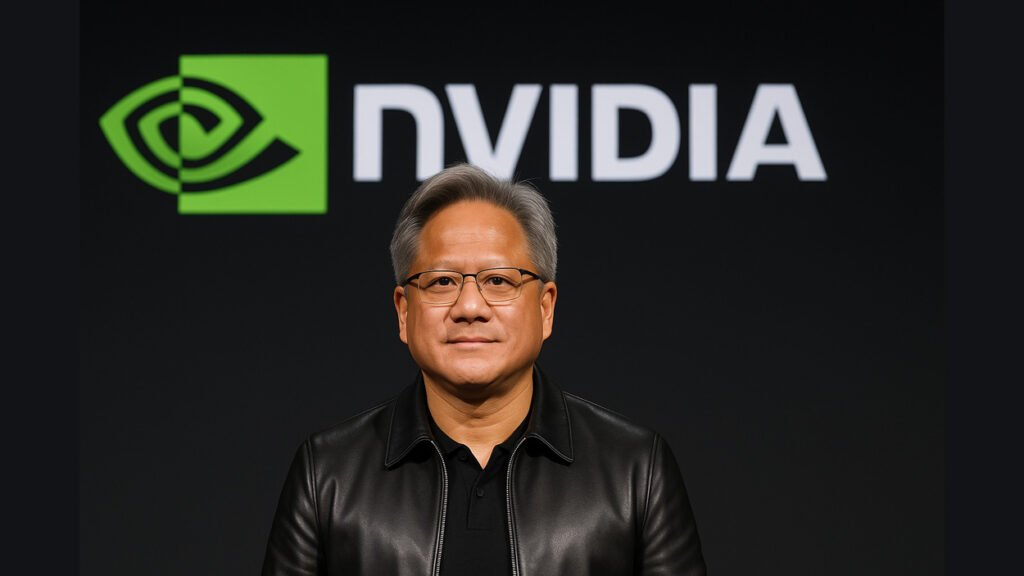

Nvidia CEO Jensen Huang has confirmed that the company is facing its strongest-ever demand for its new Blackwell AI chips, crediting TSMC’s production support and collaboration with Samsung, SK Hynix, and Micron for meeting the growing global appetite.

Quick Summary (TLDR)

- Nvidia CEO Jensen Huang says demand for Blackwell AI chips is “very strong.”

- TSMC is providing wafer support crucial for Nvidia’s chip production.

- Samsung, SK hynix, and Micron have sent advanced memory samples to Nvidia.

- SK Hynix sold out its 2026 memory production as the AI chip supercycle accelerates.

What Happened?

During an event hosted by Taiwan Semiconductor Manufacturing Company (TSMC) in Hsinchu, Taiwan, Jensen Huang announced that Nvidia’s demand for its next-generation Blackwell processors has surged sharply amid the ongoing AI boom. He praised TSMC’s efforts in supporting wafer production and highlighted the role of key memory suppliers in meeting the company’s manufacturing needs.

Nvidia’s Blackwell Chips Fuel AI Growth

Huang said the demand for Nvidia’s Blackwell architecture chips has been “very strong” across markets, reflecting the company’s central role in powering AI models and data centers worldwide. “Nvidia builds the GPU, but we also build the CPU, the networking, the switches, and so there are a lot of chips associated with Blackwell,” Huang explained. The surge in demand has driven a parallel increase in wafer requirements from TSMC, Nvidia’s long-time foundry partner. TSMC CEO C.C. Wei confirmed that Huang had requested a large wafer supply but noted that the exact volume remains confidential.

“TSMC is doing a very good job supporting us on wafers,” Huang said, adding that Nvidia’s success would not have been possible without the chipmaker’s assistance. Huang’s visit marked his fourth official trip to Taiwan this year, a sign of how closely Nvidia is working with its supply partners amid record demand and production challenges.

Nvidia CEO Jensen Huang said he had asked TSMC for more chip supplies as artificial intelligence demand remains strong https://t.co/mhYeoYconk

— Bloomberg (@business) November 8, 2025

Collaboration with Samsung, SK hynix, and Micron

Huang also confirmed that Nvidia has received cutting-edge memory samples from all three major suppliers, Samsung Electronics, SK hynix, and Micron Technology. These advanced memory modules, including High Bandwidth Memory (HBM4), are vital for powering AI training workloads that require high processing throughput.

SK hynix recently revealed that it has already sold out its entire chip production for next year, as it expects a semiconductor supercycle driven by the rapid expansion of AI computing. The company also plans to boost capital investment to meet rising demand. Meanwhile, Samsung Electronics confirmed it is in close discussions with Nvidia regarding next-generation HBM4 supply. Huang also acknowledged that potential memory shortages could arise as demand continues to outpace supply, noting that “shortages could appear in various sectors.” When asked about the possibility of price increases, he responded, “It’s for them to decide how to run their business.”

No Plans for Blackwell Sales in China

Despite the global surge in demand, Huang made it clear that Nvidia is not in active discussions about selling Blackwell AI chips to China. The restriction aligns with U.S. trade policies that limit the export of advanced semiconductors, citing national security concerns. As a result, China’s government has issued guidance requiring new state-funded data centers to use domestic AI chips, a move seen as an effort to reduce reliance on U.S. semiconductor technology.

Nvidia’s $5 Trillion Milestone

At the same TSMC event, C.C. Wei referred to Huang as “the five-trillion-dollar man,” celebrating Nvidia’s milestone of becoming the first company in history to surpass a $5 trillion market capitalization. Huang expressed gratitude to TSMC, calling it a vital partner in Nvidia’s journey to becoming the most valuable chipmaker in the world.

Daily Research News Takeaway

I find this story a fascinating snapshot of how AI’s explosive demand is reshaping the semiconductor landscape. Nvidia is no longer just a GPU maker; it’s the heartbeat of the AI revolution. What stands out to me is Huang’s tone of gratitude toward partners like TSMC and SK Hynix, which shows how even the biggest players depend on a resilient global supply chain. The collaboration among chip giants is more important than ever as the world races to build the next wave of AI infrastructure.