OpenAI continues to reshape how organisations and individuals use artificial intelligence. From the explosive uptake of its models in business to new financial milestones, the company’s trajectory offers a clear lens into the broader AI economy. For example, enterprises are now embedding OpenAI’s tools into customer‑service workflows, while software developers are leveraging its API to power next‑generation applications. Understanding its statistical footprint helps chart the direction of the industry and the role OpenAI plays in it. Read on for a detailed view of the numbers behind the story.

Editor’s Choice OpenAI Statistics

- As of March 2025, OpenAI’s valuation reached US$300 billion following a $40 billion funding round led by SoftBank, up from $157 billion in October 2024.

- For the first half of 2025, OpenAI reported revenue of approximately $4.3 billion, while burning $2.5 billion in cash.

- The company is projected to generate $12.7 billion in full‑year revenue for 2025.

- OpenAI’s market share in the generative AI software/services segment is estimated at 17% in 2025.

- More than 1 million business customers worldwide are reported to use OpenAI’s paid models or enterprise offerings.

- OpenAI has raised a cumulative funding amount of approximately $57.9 billion across funding rounds as of March 2025.

- A $6.6 billion secondary share sale completed in October 2025 valued the company at US$500 billion, making it the world’s most valuable private company, surpassing SpaceX.

Recent Developments

- OpenAI raised US$40 billion in early 2025, pushing its valuation near US$300 billion.

- Over 500 million monthly active users accessed OpenAI products in Q2 2025.

- Compute infrastructure accounted for 46% of OpenAI’s operational expenses, as disclosed in mid-2025 filings.

- OpenAI invested over US$2.1 billion in R&D and model training from January to June 2025.

- Usage of API endpoints rose by 68% YoY in H1 2025.

- Over 160 new enterprise contracts were signed in the first half of 2025.

- Security audits and compliance costs increased by 38% compared to 2024.

- The global workforce grew to 2,600+ employees as of June 2025.

- Strategic partnerships with 5 major cloud providers were formalized in 2025 to expand capacity.

- Regulatory disclosures doubled in the first six months of 2025, highlighting rising scrutiny.

OpenAI Company Overview

- OpenAI was founded in December 2015 in San Francisco, California.

- The company shifted from a non-profit research lab to a capped-profit public benefit corporation in 2019.

- Headquarters are located in San Francisco, California, U.S.

- Key leadership in 2025 includes CEO Sam Altman and CFO Sarah Friar.

- OpenAI’s mission statement is: “to ensure that artificial general intelligence benefits all of humanity.“

- By 2025, OpenAI’s workforce included over 4,400–6,400 employees and external collaborators in 20+ countries.

- The product suite covers GPT models, DALL·E, and multimodal AI systems for text, images, and audio.

- As of 2025, over 1 million companies globally used OpenAI tools.

- OpenAI’s research output exceeded 87 peer-reviewed papers published in the first half of 2025.

- The OpenAI Charter guides principles around safety, broad benefit, and long-term stewardship.

OpenAI Employee and Team Growth

- In 2025, OpenAI had an estimated 4,400–6,400 employees, reflecting rapid headcount growth.

- Over 973 new hires joined in the first half of 2025, marking a 45% YoY increase in staff.

- 32% of the workforce was focused on research or technical development roles as of 2025.

- Employee compensation for top engineers exceeded $710,000 total package annually in 2025.

- OpenAI published 87 peer-reviewed papers in the first half of 2025, with 220+ research collaborations globally.

- More than 1,200 full-time employees were in the U.S., while offices in New York and London each hosted 300+ team members.

- Diversity emphasis grew: 44% of staff identified as women or non-binary, and ethics roles were increasingly prioritized.

- OpenAI awarded million-dollar retention bonuses to nearly 1,000 employees to counter poaching ahead of major product launches.

- Infrastructure, hardware, security, and cloud operations roles saw proportional increases with platform scaling.

- In 2025, OpenAI’s job portal received over 400,000 applications in just six months, indicating strong global interest.

OpenAI Revenue and Valuation Figures

- In 2024, OpenAI’s annual revenue was around US$3.7 billion.

- For the first half of 2025, the reported revenue is US$4.3 billion, illustrating rapid growth.

- The projected full‑year revenue for 2025 is approximately US$12.7 billion.

- OpenAI achieved an annualised revenue run‑rate of around US$10 billion by June 2025.

- Burn rate/cash loss: Approximately $2.5 billion in the first half of 2025.

- Post‑money valuation, US$300 billion after the major funding round in March/April 2025.

- Secondary share sale in October 2025 valued the company at US$500 billion.

- Revenue growth from 2023 to 2025, from approx US$1.6 billion in 2023 to projected US$12.7 billion in 2025.

- The large valuation compared with relatively modest revenues indicates investor confidence in future growth rather than current earnings, a dynamic worth watching.

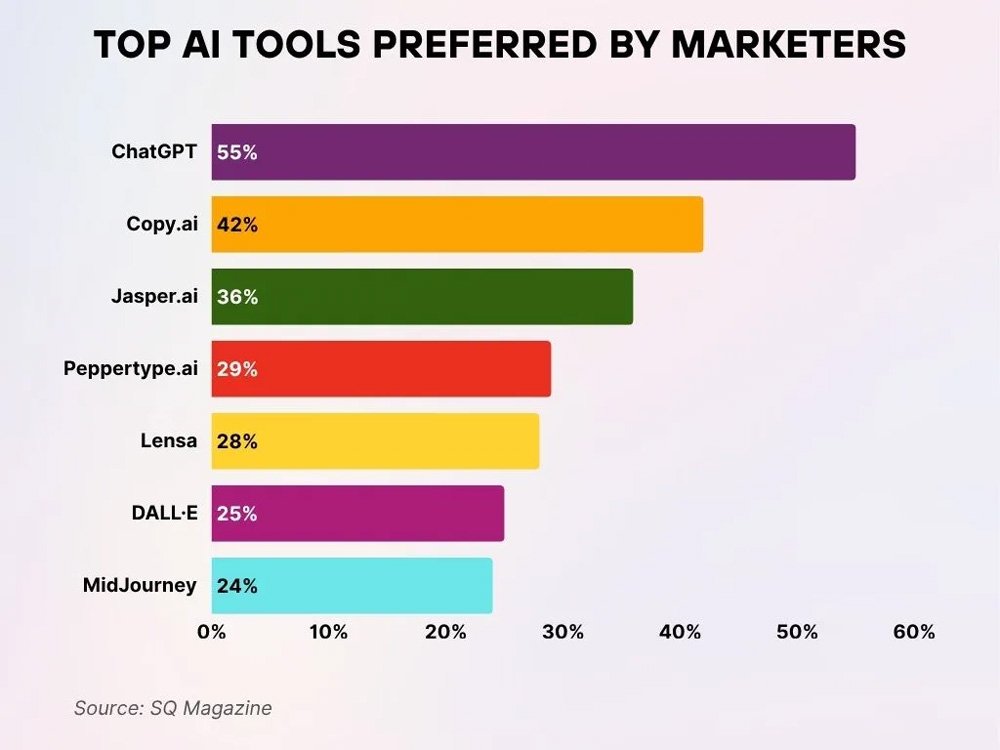

Most Popular AI Tools Among Marketers

- ChatGPT tops the list with 55% of marketers using it regularly.

- Copy.ai is used by 42% for content creation and productivity tasks.

- Jasper.ai is chosen by 36%, valued for its marketing-focused templates.

- Peppertype.ai is preferred by 29% for ad copy and short-form content.

- Lensa is used by 28% for image editing and avatar design.

- DALL·E is adopted by 25% to create AI-generated images.

- MidJourney is used by 24% for artistic and generative visual content.

OpenAI Funding and Valuation

- By March 2025, OpenAI had raised a total of US$57.9 billion across funding rounds.

- The landmark funding round in early 2025, roughly $40 billion, was led by SoftBank and other major investors, valuing the firm around $300 billion.

- In the October 2025 secondary share transaction, employees sold about $6.6 billion of shares, leading to a valuation of $500 billion.

- Funding structure, SoftBank reportedly contributed 75 % of the $40 billion round, the remaining 25 % from investors including Microsoft, Coatue, Altimeter, and Thrive.

- The funding round was conditional on OpenAI completing its transition from non‑profit to for‑profit (or capped‑profit) status.

- Valuation growth, from early 2023 $29 billion, to $300 billion in early 2025, to $500 billion in late 2025.

- The high valuation relative to revenue and profit indicates that investors are pricing in future potential rather than current earnings.

- Valuation comparisons, if listed today, the $300‑500 billion range would place OpenAI among the largest companies globally by market cap.

- Funding and valuation support OpenAI’s ability to invest heavily in compute infrastructure, model training, global expansion, and partnerships.

OpenAI Adoption and Usage Metrics

- As of early 2025, OpenAI reports more than 1 million business customers worldwide actively using its products.

- In mid‑2025, more than 92 % of Fortune 500 companies had adopted OpenAI products or APIs in some form.

- The average number of daily queries to OpenAI’s API exceeded 2.2 billion in 2025.

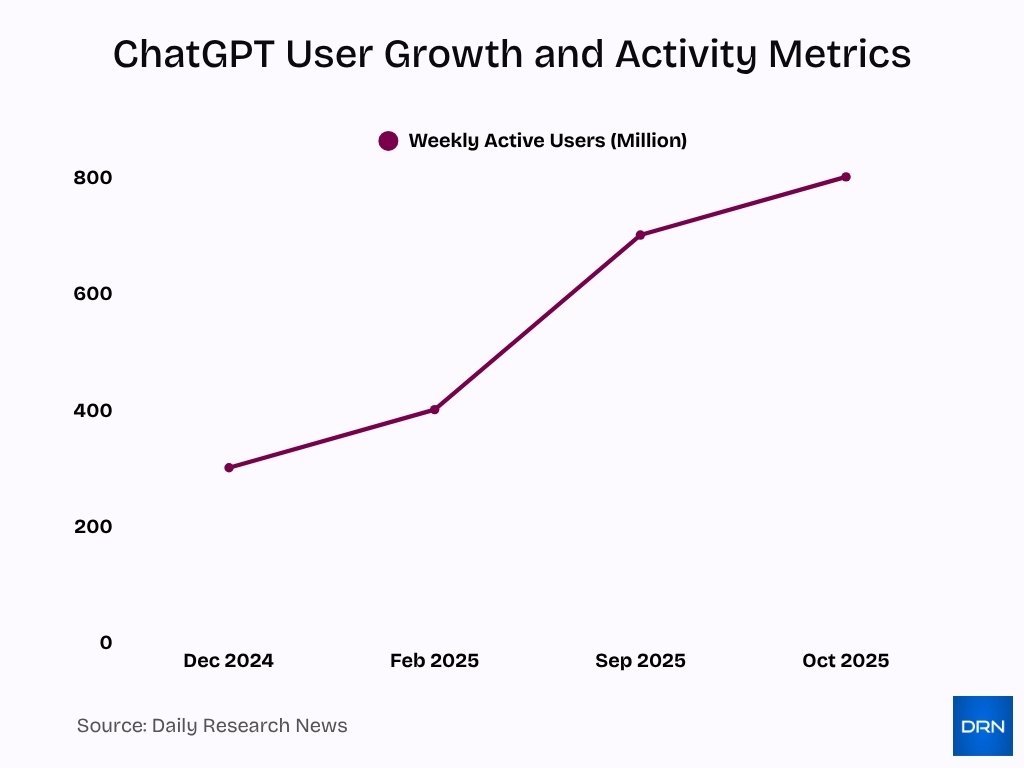

- In February 2025, weekly active users of ChatGPT passed 400 million, up from about 300 million in December 2024.

- In September 2025, OpenAI reported 700 million weekly active users, which grew to 800 million by October 2025, according to CEO Sam Altman.

- According to OpenAI’s internal research, as of 2025, around 78 % of ChatGPT conversations were focused on practical guidance, information seeking, and writing rather than coding or self‑expression.

- The adoption growth rate of ChatGPT in the lowest-income countries was more than 4× that of the highest‑income countries by May 2025.

- Over 600,000 paying business users for ChatGPT Enterprise by mid‑2025, reflecting a 275 % jump year‑on‑year.

ChatGPT Adoption and Usage Metrics

- ChatGPT’s monthly active visits in 2025 reached over 5.8 billion visits per month.

- Daily visit estimate for ChatGPT exceeded 193 million visits per day, equivalent to 114 million daily active users using one conversion method.

- According to one source, by July 2025, ChatGPT handled 2.5 billion user prompts per day worldwide.

- The free‑tier remains dominant; in user composition, the majority of ChatGPT users do not subscribe to premium plans.

- Among employees using ChatGPT in the workplace, over 25 % of U.S. workers and 45 % of those with postgraduate degrees reported using it for work tasks.

- In mid‑2025, the number of app downloads for ChatGPT alone exceeded 410 million globally in 2025 year‑to‑date.

- The growth path: 300 million weekly users in December 2024 → 400 million in February 2025 → 800 million by September 2025.

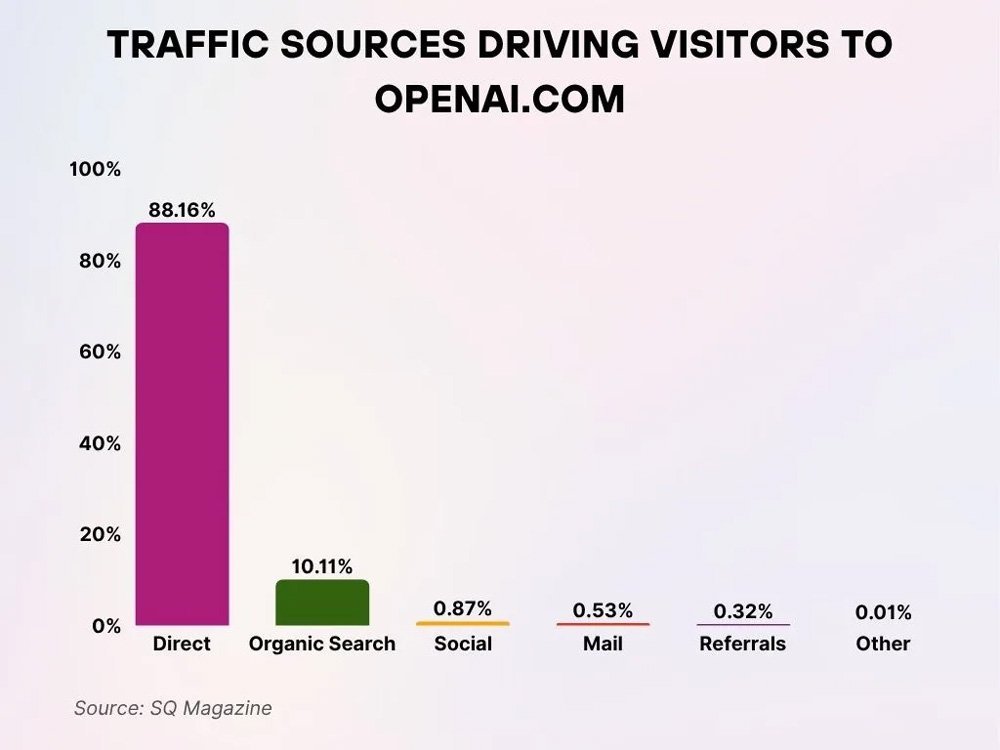

Top Traffic Sources Bringing Visitors to OpenAI.com

- Direct traffic leads with 88.16%, showing that most users visit the site directly.

- Organic search drives 10.11% of traffic, reflecting strong visibility on search engines.

- Social media contributes just 0.87%, indicating low dependence on social platforms.

- Email (Mail) sources bring in 0.53% of total site visits.

- Referral links account for 0.32%, showing limited traffic from external sites.

- Other sources contribute a minimal 0.01% of total traffic.

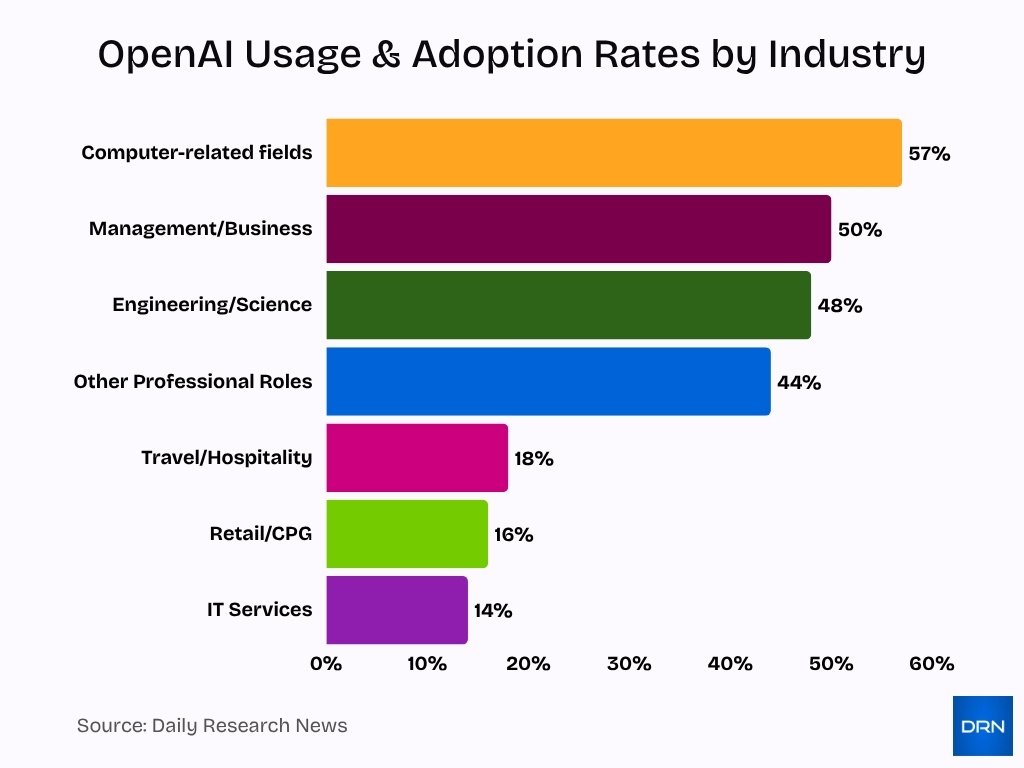

OpenAI Usage by Industry

- 49% of companies are currently employing ChatGPT, with 93% of existing users planning to expand their usage.

- Adoption rates reached 57% in computer-related fields, 50% in management/business, 48% in engineering/science, and 44% in other professional roles.

- Over 92% of Fortune 500 enterprises use OpenAI tools (including ChatGPT, API, and Azure integrations) as of mid-2025.

- Over 1,171 IT services companies and 1,070 computer software companies worldwide implemented OpenAI tools in 2025.

- Industries like travel/hospitality (18%), retail/CPG (16%), and IT services (14%) show the highest rates of ChatGPT-driven purchasing decisions.

- Weekly enterprise user messages exceeded 1 million in the finance, consulting, and software sectors.

- Companies in healthcare, legal, and marketing increasingly adopted Codex and DALL·E for specialized workflows.

- Educational institutions expanded ChatGPT use for teaching, research support, and review tasks.

- 28% of the U.S. workforce was actively using ChatGPT for job tasks by late 2025.

- Usage spanned corporate, academic, creative, and technical environments with significant productivity gains reported.

OpenAI Usage by Company Size and Revenue

- In 2025, over 900 companies with 10,000+ employees were using OpenAI services globally.

- Small firms (10–50 employees) represented a large share, with 1,643 companies in the $1–10 million revenue range using OpenAI.

- More than 1,300 companies with $10–50 million in revenue adopted OpenAI products.

- Only 376 firms in the 5,000–10,000 employee group used OpenAI, fewer than in smaller company groups.

- Small and mid‑size firms frequently started with OpenAI APIs for automation, adopting early.

- Larger enterprises preferred full enterprise licensing and internal integration of OpenAI solutions.

- Companies with revenue below $50 million showed accelerated adoption due to low entry costs.

- By mid‑2025, there were over 600,000 paying ChatGPT Enterprise business users worldwide.

- Usage trends showed strong penetration among both start‑ups and major corporations.

- Around 66% of new OpenAI business users in 2025 came from companies with fewer than 100 employees.

API Usage and Developer Engagement

- As of 2025, OpenAI’s API was handling over 2.2 billion requests per day, marking a significant increase from 2024.

- The number of registered developers using OpenAI’s API surpassed 3 million globally by mid‑2025.

- Over 65% of new AI startups in North America integrated OpenAI’s API into their products in 2025.

- OpenAI’s API supports over 50 programming languages, including Python, JavaScript, and C#, and is used in diverse sectors from finance to education.

- The average monthly growth rate of new API users in Q2 2025 was approximately 9.7%, reflecting strong developer adoption.

- More than 1.5 million applications have been built using OpenAI APIs as of August 2025, ranging from chatbots to data‑analysis tools.

- API usage among enterprises rose by over 120% year‑on‑year, driven by automation, search, and customer service applications.

- OpenAI’s Playground and fine‑tuning interfaces logged over 200 million interactions in the first half of 2025.

- Developers cited ease of integration and robust documentation as top reasons for continued preference over competing platforms.

- New API endpoints introduced in 2025, including image generation and audio interpretation, led to broader multimodal development use cases.

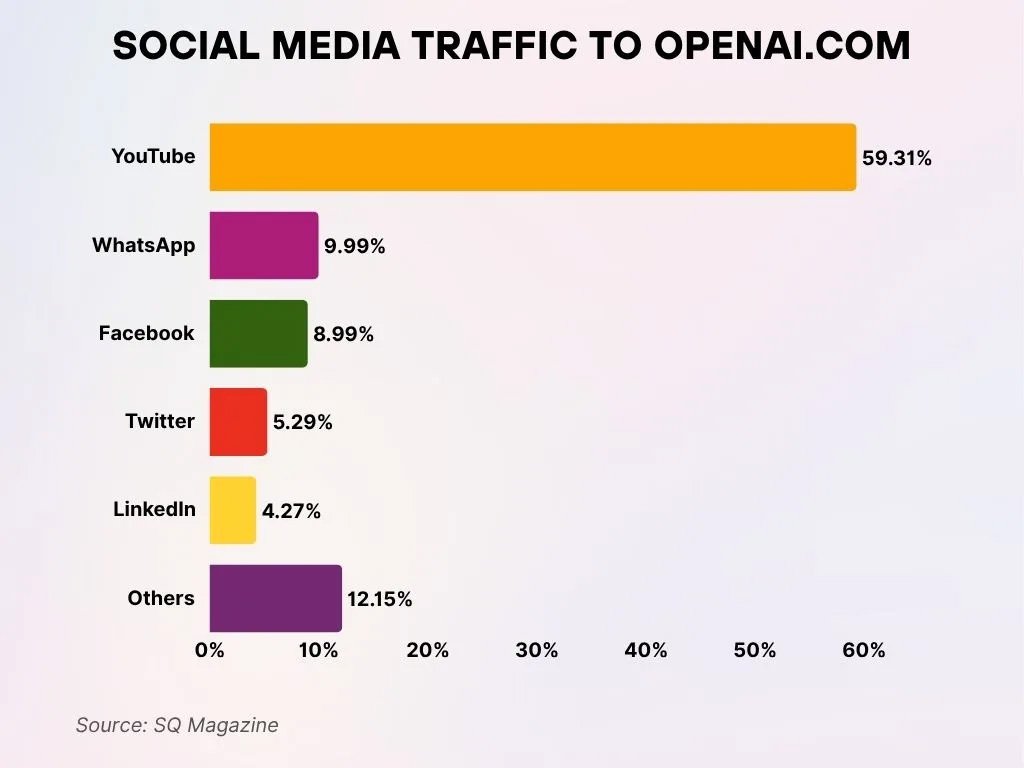

Top Social Media Platforms Driving Traffic to OpenAI.com

- YouTube leads with 59.31% of social media traffic to openai.com.

- WhatsApp drives 9.99%, showing strong engagement via direct sharing.

- Facebook contributes 8.99%, maintaining its role in traffic generation.

- Twitter accounts for 5.29%, reflecting a moderate referral impact.

- LinkedIn brings in 4.27%, tied to professional audience interest.

- Other platforms make up 12.15%, indicating influence from smaller or niche channels.

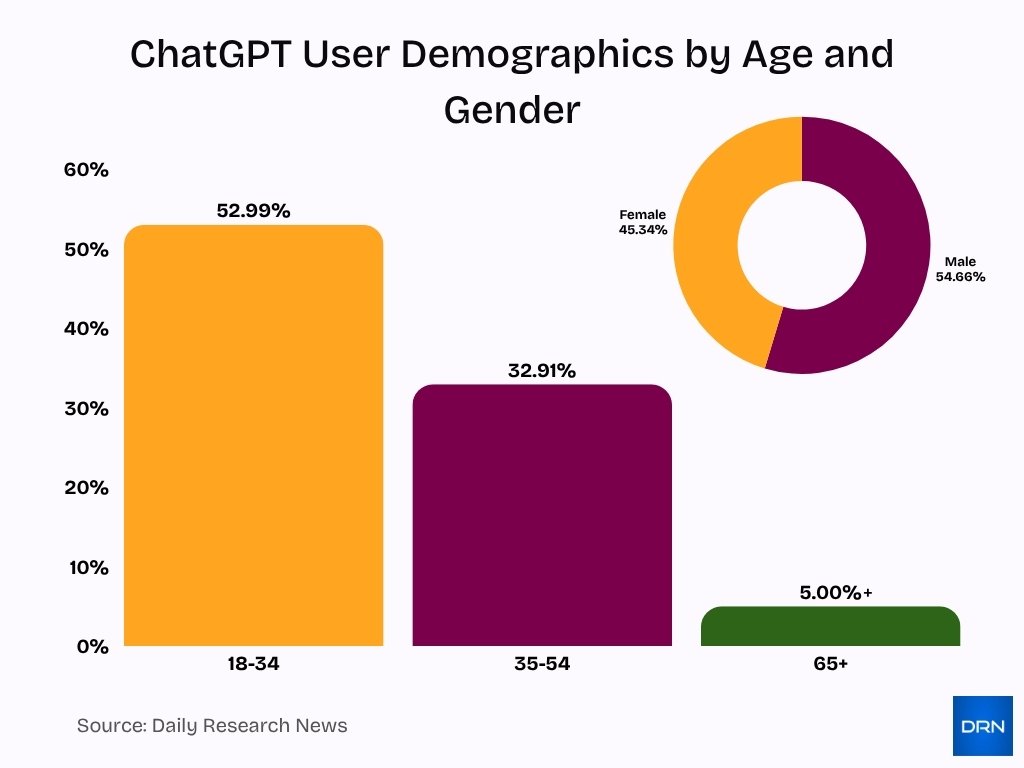

User Demographics (Age & Gender)

- ChatGPT’s user base consisted of 54.66% male and 45.34% female users.

- The age group 18‑34 represented 52.99% of total users, while those 35‑54 made up 32.91%.

- In a surveyed sample, 46% of ChatGPT respondents were aged 18‑25.

- Among openai.com website users, 25‑34 accounted for 28.84% and 18‑24 accounted for 24.81%.

- Users aged 65+ represented slightly more than 5% of the platform’s traffic.

- The United States generated approximately 15-16% of ChatGPT traffic, with India contributing around 8.71-9% based on Semrush and traffic analytics.

- Adoption in low‑income countries grew more than 4× faster than in high‑income countries.

- Global popularity ranked ChatGPT among the most visited websites worldwide.

OpenAI Product and Feature Stats (GPT, DALL·E, Sora, Codex, etc.)

- GDPval measured model performance on 1,320 tasks across 44 occupations using real deliverables.

- As of June 2025, ChatGPT recorded around 5.24 billion monthly visits.

- Token pricing in August 2025 averaged about $1.25 per million input tokens, with cached prompts costing $0.125 per million.

- In early 2025, OpenAI launched multimodal GPT‑4o, enabling unified text, image, and audio interactions.

- ChatGPT deployed built-in image generation via GPT‑4o for Free, Plus, Team, and Enterprise tiers.

- Adoption among small businesses surged, with over 1,415 firms (10‑50 employees) using OpenAI in 2025.

- DALL·E processed millions of image‑generation requests daily worldwide in 2025.

- By mid‑2025, ChatGPT API handled 2.5 billion prompts per day.

- The number of active weekly ChatGPT users exceeded 800 million in October 2025, up from 400 million in February and 700 million in September.

- More than 40% of ChatGPT’s web traffic in 2025 originated from mobile devices.

Model Performance Benchmarks (GPT‑4, GPT‑4o, etc.)

- GPT-4.1 reached 90.2% on the MMLU benchmark, up 1.5 points over GPT-4o’s 88.7%.

- On SWE‑Bench Verified, GPT-4.1 scored 54.6%, improving 21.4 points compared to GPT‑4o (33.2% in late 2024).

- GPT-4o achieved 69% accuracy in verbal reasoning, outperforming GPT-4 Turbo’s 50%.

- Benchmark studies show GPT-4.1 outperforms GPT-4o in coding, instruction following, and long-context tasks.

- GPT-OSS-20B achieved 80–85% of larger model accuracy on standard benchmarks while processing 45–55 tokens/s on consumer hardware.

- With only 17.3% of parameters active, GPT-OSS‑20B delivered 31.8% higher throughput and 25.8% lower energy per 1,000 tokens than Qwen3‑32B in 2025.

- Significant benchmark gains: MMLU +18.8, GPQA +48.9, and SWE‑bench +67.3 percentage points vs. prior models.

- In 2025, a new GDPval evaluation measured AI’s usefulness in real economic job tasks.

- GPT-4 demonstrated human‑level performance in professional exams, including academic and legal assessments.

- Efficiency upgrades reduced inference costs compared to 2024 models, while scaling multimodal capabilities across text, image, and audio.

Market Share Among AI Providers

- OpenAI held around 61% of the U.S. generative‑AI market in 2025.

- Approximately 72% of enterprises using AI tools globally reported using OpenAI products.

- Over 50% of the API‑based AI infrastructure market was captured by OpenAI, surpassing major competitors.

- In customer‑support automation, OpenAI held roughly 48% market share.

- Around 42% of new SaaS products launched in 2025 used OpenAI models with AI components used OpenAI models.

- OpenAI integrated into 9 of the top 10 cloud‑provider developer ecosystems in 2025.

- The company’s market strength was supported by consistent performance improvements and cross‑industry relevance.

- Despite increasing competition, OpenAI maintained a strong lead through ecosystem depth and enterprise adoption.

- More than 92% of Fortune 500 companies adopted OpenAI products or APIs in 2025.

- OpenAI API handled over 2.2 billion daily queries worldwide in mid‑2025.

Partnership and Licensing Metrics

- In October 2025, OpenAI announced partnerships with Spotify, Zillow, and Mattel to integrate ChatGPT into core platforms.

- By late 2025, over 1 million companies globally were using OpenAI-powered solutions across sectors.

- The Databricks and OpenAI collaboration targeted $100 million+ in projected revenue from joint AI agents over multiple years.

- In 2025, OpenAI gained status as an “Emerging Leader in Generative AI” among leading industry analysts.

- New infrastructure partnerships in 2025 committed over $3 billion to hardware and cloud resources for AI workloads.

- In 2025, data‑licensing deals grew to cover 250+ major publishers, expanding access to diverse training sets.

- Over 70% of OpenAI’s enterprise clients in 2025 utilized custom licensed models tailored to their operations.

- OpenAI’s platform supported AI integrations in 40+ countries across North America, Europe, and Asia-Pacific by October 2025.

- More than 85% of OpenAI’s revenue growth in 2025 was attributed to partnership-driven product deployments.

- Partner ecosystem size has more than tripled since 2023, showing rapid expansion in both consumer and enterprise markets.

Frequently Asked Questions (FAQs)

Over 800 million weekly active users.

About US$4.3 billion in the first six months.

Around US$500 billion.

Over 92% of Fortune 500 companies.

Conclusion

In 2025, OpenAI has solidified its position as a leading force in generative AI, and the data reflects its wide‑ranging impact. With soaring website traffic, expansive demographic reach, ongoing product innovation, and consistently strong performance benchmarks, the company continues to influence how individuals and businesses use artificial intelligence.

Its large market share and growing portfolio of partnerships show that OpenAI is evolving from a model provider into a foundational layer of modern software infrastructure. The statistics throughout this report highlight not only OpenAI’s current footprint but also its shaping role in the broader technological and economic landscape.