The competition between OpenAI and Anthropic has become one of the defining narratives of the AI industry. As both firms race to scale revenue, refine models, and secure massive funding, their performance sheds light on broader trends shaping enterprise adoption and AI economics. In sectors from enterprise software to developer tools, their successes and struggles already influence how organizations plan AI investments. Below, readers will find a data-driven comparison, from funding to growth, that charts how these two leading firms compare today.

Editor’s Choice

- OpenAI’s annualized revenue reached ≈ $13 billion by August 2025.

- Anthropic’s run rate revenue rose from about $1 billion at the start of 2025 to over $5 billion by August 2025.

- In September 2025, Anthropic closed a $13 billion Series F funding round, reaching a $183 billion post-money valuation.

- Recent private market trades value OpenAI at $500 billion, creating a roughly $300 billion gap with Anthropic.

- OpenAI expects to burn roughly $8–$9 billion in 2025 despite large revenue.

- Anthropic aims to reach $9 billion ARR by the end of 2025, with a target of $20–$26 billion ARR in 2026.

- Multiple sources indicate Anthropic’s 2025 growth rate, from $1B to $5B+, represents one of the fastest revenue ramp-ups in tech history.

Recent Developments

- In August 2025, OpenAI’s annualized revenue hit $13 billion, reflecting continued growth in ChatGPT subscriptions and enterprise adoption.

- By June 2025, OpenAI’s revenue run rate had reached $10 billion, nearly doubling from $5.5 billion in December 2024.

- For Anthropic, run rate revenue jumped from roughly $1 billion at the start of 2025 to over $5 billion by August.

- In September 2025, Anthropic completed a $13 billion Series F funding round, raising its valuation to $183 billion.

- Following that, some private market trades placed OpenAI’s value near $500 billion, underscoring its lead over Anthropic in valuations.

- Analysts report that both companies are going through aggressive growth, but with very different burn rates and investment strategies.

- Anthropic reportedly plans to expand cloud compute capacity significantly by 2026, leveraging recent funding to support enterprise demand and safety research.

- The competition between the two firms has accelerated scrutiny on AI valuations, resource consumption, and long-term sustainability, key discussion points across the industry.

Company Overview

Founding History

- OpenAI was founded on December 11, 2015, as a nonprofit with $1 billion pledged initially.

- Anthropic was launched in 2021 by 7 former OpenAI employees, including siblings Dario and Daniela Amodei.

- Anthropic secured $124 million in its Series A funding just months after its 2021 founding.

- By early 2025, Anthropic’s run-rate revenue hit approximately $1 billion, surging to $5 billion by August.

- Anthropic completed $13 billion Series F in September 2025 at $183 billion post-money valuation.

- Total funding for Anthropic reached $27.3 billion across 14 rounds by late 2025.

- Anthropic’s workforce exploded from 192 employees in 2022 to 1,097 by 2025, a 471% increase.

- OpenAI started with $130 million, actually collected from initial pledges by 2019.

- By October 2025, Anthropic’s annual run-rate revenue approached $7 billion.

Mission and Goals

- OpenAI’s mission focuses on ensuring AGI benefits all humanity through safe development.

- Anthropic mission builds AI for humanity’s long-term well-being with emphasis on safety and alignment.

- Anthropic raised $13 billion in 2025 Series F funding at $183 billion post-money valuation.

- Anthropic revenue surged from $1 billion early in 2025 to over $5 billion by August.

- Anthropic projects $9 billion annualized revenue by the end of 2025, driven by enterprise demand.

- Anthropic invests $50 billion in US AI infrastructure, creating 800 permanent and 2,400 construction jobs.

- OpenAI spent $7 billion on cloud computing in 2024, mostly for R&D and training.

- OpenAI plans $1.15 trillion hardware spend from 2025-2035 for scaling infrastructure.

- OpenAI faces $792 billion in infrastructure costs through 2030, projecting ongoing losses.

Revenue Growth

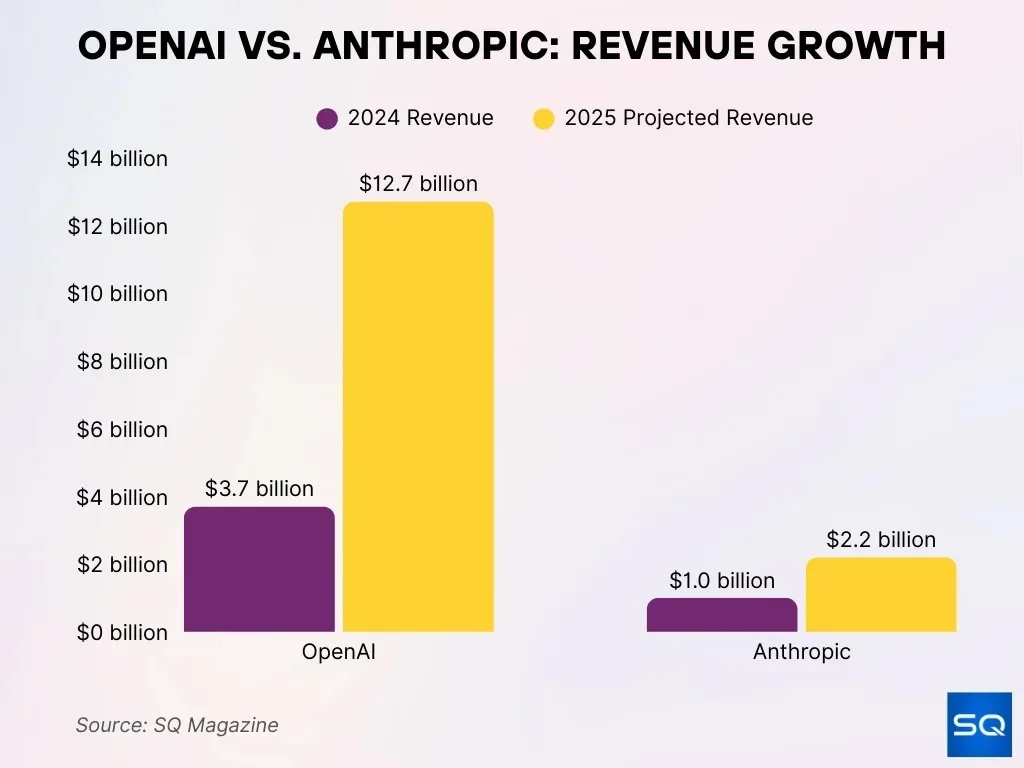

- OpenAI’s revenue, reported at $3.7 billion (2024) and projected to reach $12.7 billion (2025), is described as experiencing a dramatic 243% year-over-year jump.

- Anthropic’s revenue, listed as $1 billion (2024) and expected to rise to $2.2 billion (2025), is noted for achieving a strong 120% increase.

- Its annualized revenue is reported to have expanded to $4–5 billion by mid-2025.

- OpenAI’s valuation, estimated at roughly $300 billion following funding rounds, is highlighted as a significant benchmark.

- Anthropic’s valuation, indicated at $61.5 billion (Mar 2025) and now edging toward $170 billion in new funding rounds, reflects rapid upward momentum.

- Certain investor discussions are reported to propose a valuation exceeding $100 billion, signaling heightened growth expectations.

- Projections for 2030 suggest that OpenAI and Anthropic could produce revenues exceeding $225 billion and $75 billion, respectively, aligning with their ambitious valuation trajectories.

Leadership Team

- Anthropic was founded by 11 OpenAI employees, including siblings Dario and Daniela Amodei.

- Engineers are 8x more likely to leave OpenAI for Anthropic than vice versa.

- From DeepMind, the ratio is nearly 11,1 in favor of moves to Anthropic.

- Anthropic hires engineers 2.68x faster than losing them, vs OpenAI‘s 2.18.

- 80% of Anthropic hires from the last 2 years are still employed, topping OpenAI‘s 67%.

- Anthropic workforce grew 471% from 192 in 2022 to 1,097 in 2025.

- OpenAI expanded from 770 employees in 2023 to 3,531 by September 2024.

- Jan Leike, former OpenAI safety lead, joined Anthropic to head a new team in 2024.

ARR Breakdown

- As of mid-2025, OpenAI reports $12–$13 billion ARR.

- ARR grew from $3.5 million in 2020 to billions in under five years.

- Roughly 70% of 2025 revenue comes from consumer subscriptions.

- Enterprise subscriptions, API usage, and licensing form the remainder.

- Some projections place OpenAI at $20 billion ARR by late 2025.

- Year-over-year ARR growth may exceed 240–260%.

- Analysts argue OpenAI is among the fastest-growing large-scale software companies in history.

Profitability Metrics

- OpenAI’s first half 2025 spending totaled $6.7 billion.

- The company held around $17.5 billion in cash and securities as of mid-2025.

- OpenAI expects to burn $8.5 billion in 2025.

- Long-term computing and infrastructure spending may exceed $1.4 trillion across five years.

- Some projections suggest OpenAI may need $207 billion in funding by 2030.

- Gross margins may improve from 48% in 2025 to 70% by 2029 if scaling efficiencies hold.

- Profitability remains distant as long as infrastructure investments remain heavy.

Market Share

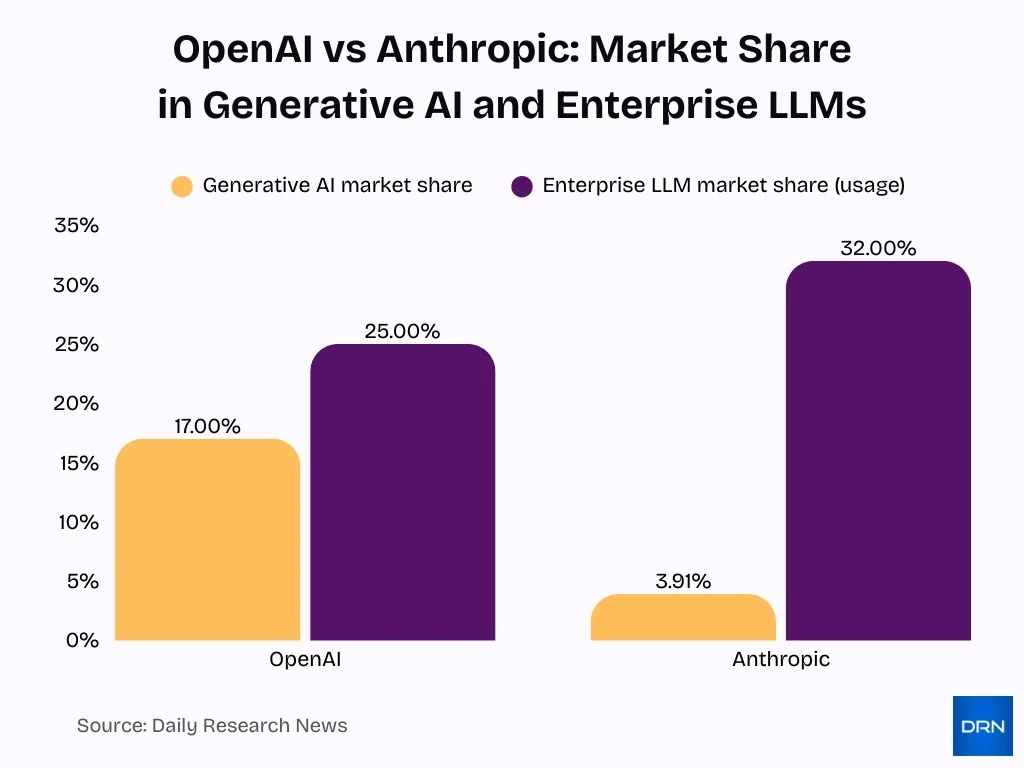

- OpenAI commands 17% of the generative AI market, dwarfing competitors.

- Anthropic secures 3.91% market share in the generative AI software and services sector.

- Global generative AI market hit $25.6 billion in 2024, surging from $191 million in 2022.

- Anthropic boasts 32% enterprise LLM market share by usage, surpassing OpenAI‘s 25%.

- OpenAI‘s annualized revenue reached $12 billion by mid-2025, leading the pack.

- Anthropic‘s valuation hit $61.5 billion post-Series E, eyeing $170 billion next.

- OpenAI’s valuation nears $300 billion after $40 billion funding round in 2025.

- Enterprise AI adoption stands at 78% of organizations using it in at least one function.

- The generative AI market is projected to grow at a 36.2% CAGR, reaching $603.7 billion by 2032.

User Statistics

- OpenAI reports 800 million regular monthly users across its major products.

- Roughly 5% of users pay for subscriptions.

- Anthropic data shows directive automation tasks rising from 27% to 39% across 2025.

- Use of Claude for design tasks grew from 14.3% to 36.9%.

- Anthropic’s enterprise customer base expanded alongside its API offerings.

- Growth in structured task usage points to deeper enterprise reliance.

Enterprise Adoption

- OpenAI reports over 1 million business customers globally in 2025.

- Over 92% of Fortune 500 companies use at least one OpenAI product.

- Anthropic holds 32% of the enterprise LLM market share, compared to OpenAI’s 25%, as of August 2025.

- Adoption of Claude models spans over 150 countries, with 80% usage outside the US.

- 87% of large enterprises implement AI solutions, averaging $6.5M annual investment.

- Industry-wide AI adoption reached 78% of enterprises in 2025.

- 89% of enterprises have adopted AI tools, but only 23% measure ROI effectively.

- 71% of organizations regularly use generative AI in business operations.

- 37% of enterprises spend over $250,000 annually on LLMs.

API Usage Data

- OpenAI’s international API customer base grew more than 70% in six months.

- Enterprises consumed 320× more reasoning tokens year over year.

- Anthropic saw directive task usage rise from 27% to 39% in 2025.

- Claude usage for design tasks rose from 14.3% to 36.9%.

- Teams increasingly replace simple Q&A prompts with full workflow automation.

- API adoption indicates AI is becoming essential infrastructure.

Key Products

- ChatGPT hit 800 million weekly active users by late 2025.

- OpenAI enterprise API customers consume 320x more reasoning tokens year-over-year.

- OpenAI serves over 1 million business customers with enterprise AI tools.

- ChatGPT Enterprise seats grew 9x in the past year.

- Weekly enterprise messages on ChatGPT surged 8x since November 2024.

- Anthropic grew enterprise customers from under 1,000 to over 300,000 in two years.

- Claude processes 25 billion API calls monthly, 45% from enterprises.

- Nearly 80% of Claude usage originates outside the United States.

- Over 60% of Anthropic’s business customers use multiple Claude products.

- Claude 3.5 reached 30 million monthly active users in Q2 2025.

Top-Funded LLM Builders

- OpenAI leads the funding race with a massive $19.1 billion in total equity funding.

- Anthropic follows with $16.0 billion, positioning itself as OpenAI’s closest financial rival.

- xAI, founded by Elon Musk, has secured $12.2 billion in funding, solidifying its place in the top three.

- Inflection and Moonshot AI are tied at $1.5 billion each in total raised capital.

- Mistral AI and Baichuan AI both hold funding at the $1.0 billion mark.

- Cohere has raised $971.3 million, staying just ahead of Zhipu AI with $962.9 million.

- MiniMax rounds out the top ten with $850 million in total funding.

Model Capabilities

- Claude models span heavy reasoning to lightweight, low-latency variants.

- OpenAI models support broad natural language, analysis, and enterprise integrations at scale.

- Claude holds 42% of the developer tooling market, compared with OpenAI’s 21%.

- Claude has a 41% share in academic AI applications.

- Model diversity allows organizations to tailor selection to workload.

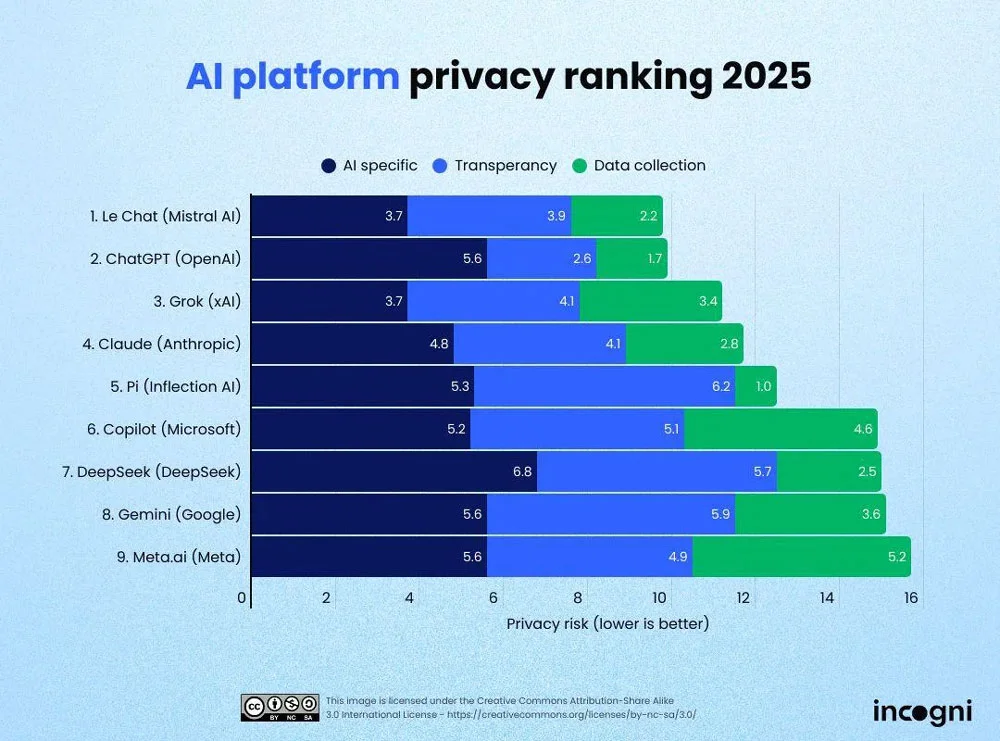

Privacy Risk Ratings for AI Platforms

- Le Chat (Mistral AI) secures #1 in privacy with the lowest overall risk score of 9.8, comprising 3.7 for AI-specific risk, 3.9 for transparency, and 2.2 for data collection.

- ChatGPT (OpenAI) attains 2nd place with a total risk score of 9.9, showing strong performance in data collection (1.7) while receiving 5.6 in AI-specific privacy.

- Grok (xAI) holds 3rd position with a privacy risk level of 11.2, marked by an effective AI-specific score of 3.7, though accompanied by a slightly elevated data collection score of 3.4.

- Claude (Anthropic) stands 4th with an overall score of 11.7, balancing 4.8 in AI-specific privacy, 4.1 in transparency, and 2.8 in data collection.

- Pi (Inflection AI) takes 5th place, reaching a total score of 12.5, performing strongest in data collection (1.0) but weakest in transparency (6.2).

- Copilot (Microsoft) ranks 6th with a risk score of 14.9, driven by a notably high data collection risk of 4.6 and an AI-specific risk of 5.2.

- DeepSeek (DeepSeek) places 7th, scoring 15.0, featuring the highest AI-specific score of 6.8, countered by relatively better data collection (2.5) results.

- Gemini (Google) reaches 8th with a total risk value of 15.1, influenced by a 5.9 transparency score and 3.6 in data collection.

- Meta.ai (Meta) concludes the list in 9th place, presenting the highest privacy risk score of 15.7, consisting of 5.6 in AI-specific risk and 5.2 in data collection, the worst result in that category.

Model Performance

- Enterprises using AI tools report an average 66% increase in work throughput on realistic tasks.

- Support agents with AI handle 13.8% more customer inquiries per hour.

- Business professionals using AI write 59% more documents per hour.

- Programmers with AI code 126% more projects per week.

- Claude 3.5 Sonnet achieves 87.6% on the MMLU benchmark, outperforming GPT-4’s 85.2%.

- Claude scores an 83.4% pass rate on HumanEval coding tasks.

- OpenAI enterprise API customers consume 320x more reasoning tokens year-over-year.

- Enterprise workers save 40-60 minutes daily using OpenAI tools.

- 47% of enterprises have multiple AI use cases live in production.

- 88% of enterprises use AI, with 82% of executives applying it weekly.

Safety Measures

- 78% of enterprises list AI safety and compliance as their top deployment priority.

- 64% of organizations adopt hybrid AI models to balance performance and controllability.

- 42% of AI incidents in 2025 were linked to insufficient safety checks before deployment.

- Firms with formal AI ethics policies report 30% fewer operational risks.

- 81% of enterprises perform annual safety audits on deployed AI systems.

- The use of low-latency models like Haiku 4.5 reduced incident rates by 18%.

- 67% of AI practitioners emphasize governance frameworks to prevent biased outputs.

- Businesses allocating over 10% of AI budgets to safety see 25% fewer compliance breaches.

- 54% of large organizations conduct pre-launch red teaming for AI safety validation.

- 39% of model misuse cases** stem from unclear safety thresholds or poor oversight.

Frequently Asked Questions (FAQs)

As of late 2025, OpenAI is valued at about $500 billion, while Anthropic stands at approximately $183 billion, creating a valuation gap of roughly $317 billion.

Anthropic targets an annualized revenue run-rate of $9 billion by the end of 2025 and potentially $26 billion in 2026.

OpenAI generated about $3.7 billion in 2024, and its 2025 revenue is projected to reach $12.7 billion–$15 billion+ run-rate.

Enterprise customers drive around 80% of Anthropic’s revenue in 2025.

Conclusion

The competitive landscape between OpenAI and Anthropic has matured from speculation to concrete outcomes. OpenAI retains dominance in consumer reach, sheer user volume, and broad enterprise adoption, while Anthropic proves increasingly formidable in enterprise LLM deployment, developer tooling, and niche workflows. Their divergent strategies, scale, and ubiquity vs. targeted performance and flexibility, show that the generative AI market is large enough for multiple winners.

As organizations worldwide continue integrating AI into core processes, success will favor those that balance performance, safety, and adaptability most effectively. Read on for a full breakdown and data-rich comparison of each dimension across both companies.