The PC gaming market stands at a fascinating crossroads. After years of steady growth, gamers around the world continue to engage deeply with PC titles, ranging from competitive esports to immersive story-driven experiences. This ecosystem now supports billions of players and drives sizeable economic activity through game sales, hardware upgrades, and digital services. In industry research and development, PC gaming fuels innovation in graphics, streaming, and online communities.

In enterprise tech adoption, gaming technology accelerates GPU performance trends that benefit AI and simulation sectors. Explore the latest figures and trends shaping this pivotal segment of interactive entertainment below.

Editor’s Choice

- ~1.9 billion PC gamers existed globally in early 2025, according to aggregated market reporting.

- The global PC gaming market size reached $86.12 billion in 2025, up from $76.7 billion in 2024.

- Steam reported 132 million monthly active users in 2025.

- 69 million daily Steam users play PC games each day.

- PC gaming accounts for about 26% of all players worldwide in 2025.

- Asia Pacific held ~46.7% share of the PC gaming market in 2024.

- The global gaming player base hit about 3.58 billion in 2025 across all platforms.

Recent Developments

- PC gaming continues to grow slowly but steadily at ~3% annually, year over year.

- Steam peaked at ~41.7 million concurrent users during a 2025 weekend, an all-time high.

- Monthly PC gaming activity on Steam surpassed 132 million active users in 2025.

- Daily PC gamers on Steam reached ~69 million in 2025.

- Steam’s catalog in the U.S. includes 239,558 titles available for players.

- New hardware surveys show Windows 11 adoption among gamers rising, impacting platform performance.

- PC gaming revenue showed signs of expansion, though not as fast as mobile or console segments.

- Emerging regions, Latin America, and Southeast Asia contribute more PC gamers due to increased broadband access.

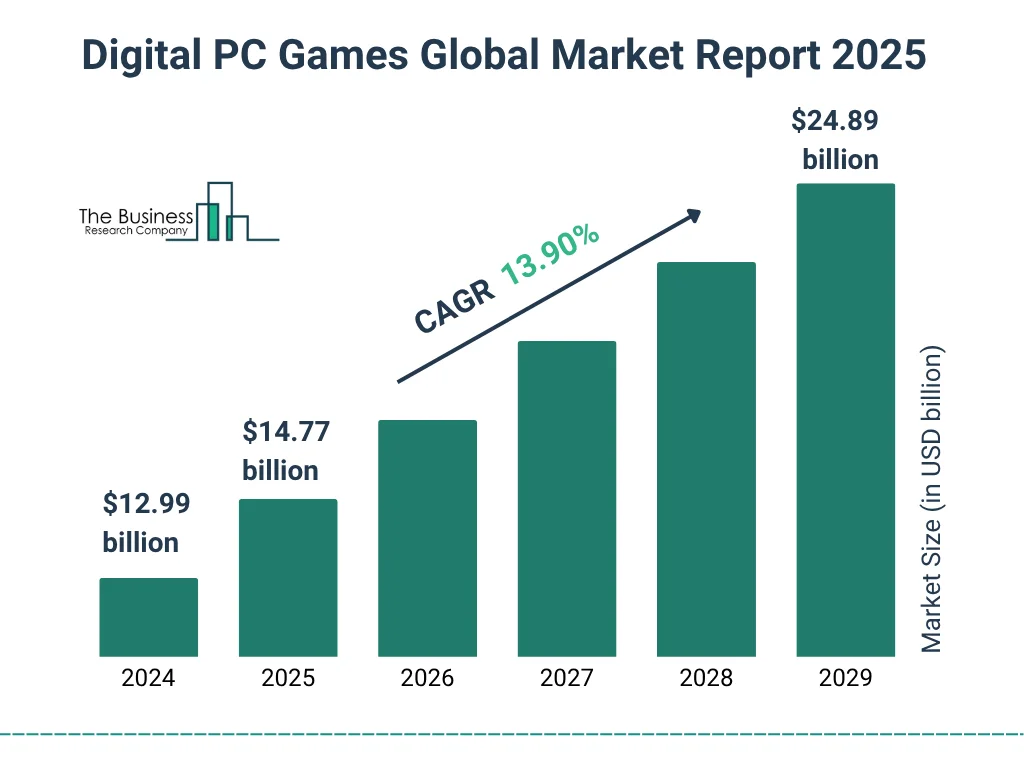

Digital PC Games Global Market Size (2025)

- The Digital PC Games market is experiencing strong and consistent growth, reflecting rising global demand for online and digital-only gaming experiences.

- Market size increases from $12.99 billion in 2024 to an expected $24.89 billion by 2029, showcasing a significant expansion over the five years.

- The industry is projected to grow at a CAGR of 13.90%, highlighting robust long-term momentum.

- Between 2024 and 2025, the market grows from $12.99 billion to $14.77 billion, indicating accelerating consumer spending on digital PC titles and platforms.

- Mid-term estimates show continued year-over-year increases, with approximate values of $17B in 2026, $19B in 2027, and $21B in 2028.

- This upward trajectory reflects expanding access to gaming hardware, rising popularity of esports, subscription gaming models, and increasing availability of high-quality digital titles.

- By 2029, the market will be nearly double relative to 2024, reinforcing the sector’s position as one of the fastest-growing segments in the digital entertainment industry.

Number of PC Gamers Worldwide

- Estimates place the PC player population between ~907 million and 1.9 billion globally in 2025, reflecting varying definitions of active play.

- One widely referenced figure suggests ~907.5 million PC gamers in 2024, up from 873.5 million in 2023.

- Another dataset estimates over 1.86 billion PC gamers by 2025.

- PC gamers represent roughly 26% of all global gamers in 2025.

- In contrast, mobile gaming accounts for the largest single share of gamers globally.

- Asia leads with the highest absolute number of gamers across platforms, influencing the PC gaming scale.

- PC gaming communities range from casual to competitive esports players worldwide.

- Data variation underscores how different sources define “PC gamer,” including hardware, engagement, or game library ownership.

PC Gamers Over Time

- From 2023 to 2024, PC gamers reportedly increased from ~873.5 million to 907.5 million.

- Year-over-year growth rates are generally modest, between 1.6% and 3% annually.

- Long-term trends show PC gaming expanding as global internet access improves.

- PC gaming played a foundational role in early gaming history and maintains relevance through evolution.

- Platforms like Steam consistently attract new users, fueling incremental growth.

- Peak concurrent user records indicate increased intensity of usage over time.

- Year-to-year figures vary based on reporting methodology and sample populations.

- Despite mobile gaming growth, PC remains a core long-term segment of the global gaming population.

Monthly Active Users

- Steam alone reported 132 million monthly active users in 2025.

- Of these, roughly 69 million daily users logged in to play games.

- Steam’s catalog growth boosts monthly engagement as new titles arrive.

- PC gaming subscription platforms also contribute to active user figures.

- Monthly activity metrics show engagement patterns that differ by region and game genre.

- The U.S. accounts for a significant share of active Steam users.

- Monthly engagement tends to spike during major game releases or promotions.

- PC gaming activity remains resilient, outpacing some console metrics in retention.

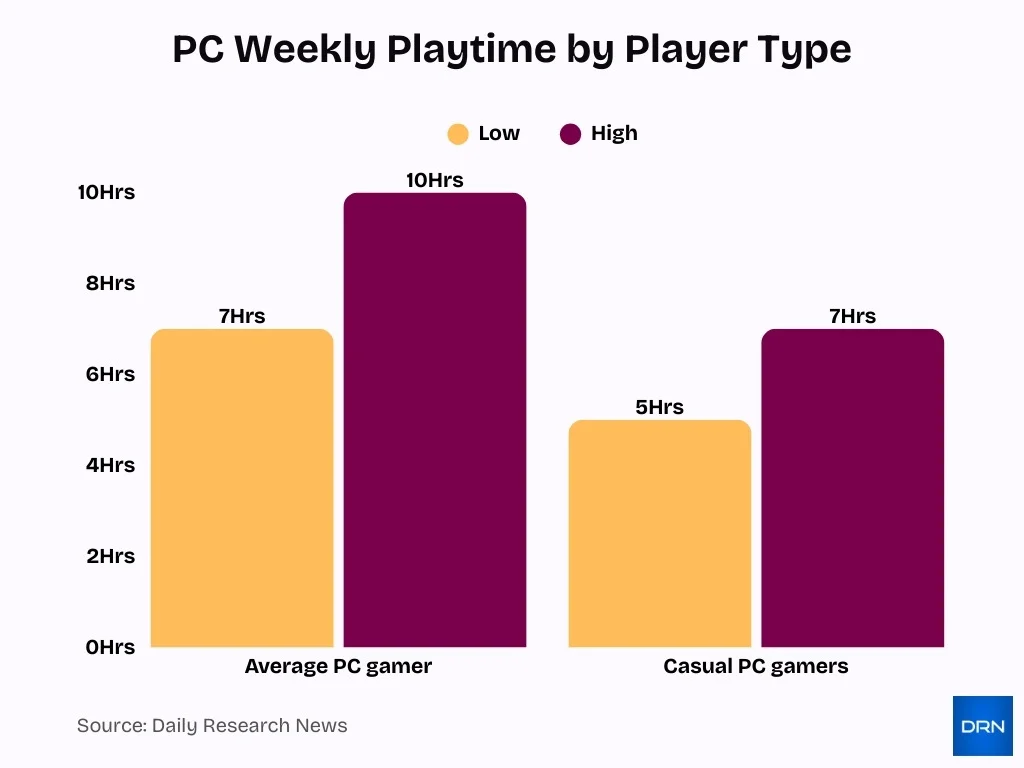

Average Playtime Statistics

- In 2025, PC gamers average approximately 7–10 hours of play per week, depending on region and type of game.

- Core PC gamers, those engaged with competitive or MMO titles, often exceed 12 hours weekly.

- Casual PC gamers typically play 5–7 hours per week, lower than console averages.

- Players of esports titles on PC often engage in sessions lasting 2–4 hours per day.

- Multiplayer online titles contribute most heavily to higher playtime statistics.

- Steam data suggests that concurrent user spikes often indicate heavy session lengths around major seasonal events.

- Monthly engagement increases significantly during major game launches or reductions in price promotions.

- Playtime trends in 2024 and 2025 continue to rise for competitive PC gaming versus casual single-player titles.

PC Gaming Usage Patterns

- Steam reports 69M daily and 132M monthly active users, meaning about 52% of monthly users log in every day.

- PC gamers average around 2–4 hours per session, compared with mobile sessions of about 15–25 minutes, highlighting much longer play durations on PC.

- Globally, gamers spend about 8.45 hours/week playing, which equates to roughly 1.2 hours per day and 33.8 hours per month of gaming time.

- Competitive multiplayer and PvP experiences account for roughly 29% of player preference, underscoring how multiplayer titles drive recurring engagement.

- The Steam catalog in the US includes about 239,558 games, with 18,626 new titles added in 2024, supporting highly diverse interests from indie to AAA.

- Steam saw 14,535 new games launch in 2023, nearly 3x the combined new releases on major consoles, expanding options that shape usage patterns.

- The average online gamer in the UK spends around 7.5 hours/week playing, or about 1 hour per day, reflecting consistent recurring usage across the week.

- Worldwide esports users are projected to reach about 896M by 2029, with user penetration of roughly 12.5% in 2025, showing a large core of frequent competitive players.

- In the U.S., about 212.6M people play video games at least 1 hour per week, and roughly 75% of them log 4+ hours weekly, indicating strong repeat play behavior.

Regional Market Share

- Asia Pacific commands 46.7%–52% of the global PC gaming market revenue in 2025.

- North America generated $11.9 billion in gaming PC revenue in 2024, holding over 25% share by 2035.

- Europe produced $12.8 billion in gaming PC market revenue in 2024, growing at a 12.1% CAGR through 2030.

- China leads with $14.4 billion in gaming PC revenue in 2024 and 30% of the national gaming market share.

- Latin America’s gaming PC market reached $2.1 billion in 2024, expanding at a 14.9% CAGR to 2030.

- The MENA gaming PC market is valued at $5.87 billion, with Saudi Arabia capturing 20% of regional gaming revenues.

- Japan PC gaming revenue surged 2.87x to ¥236.4 billion ($1.61 billion) from 2019–2023.

- Southeast Asia PC gaming grows steadily via cloud tech, within the total gaming revenue of $5.89 billion in 2024.

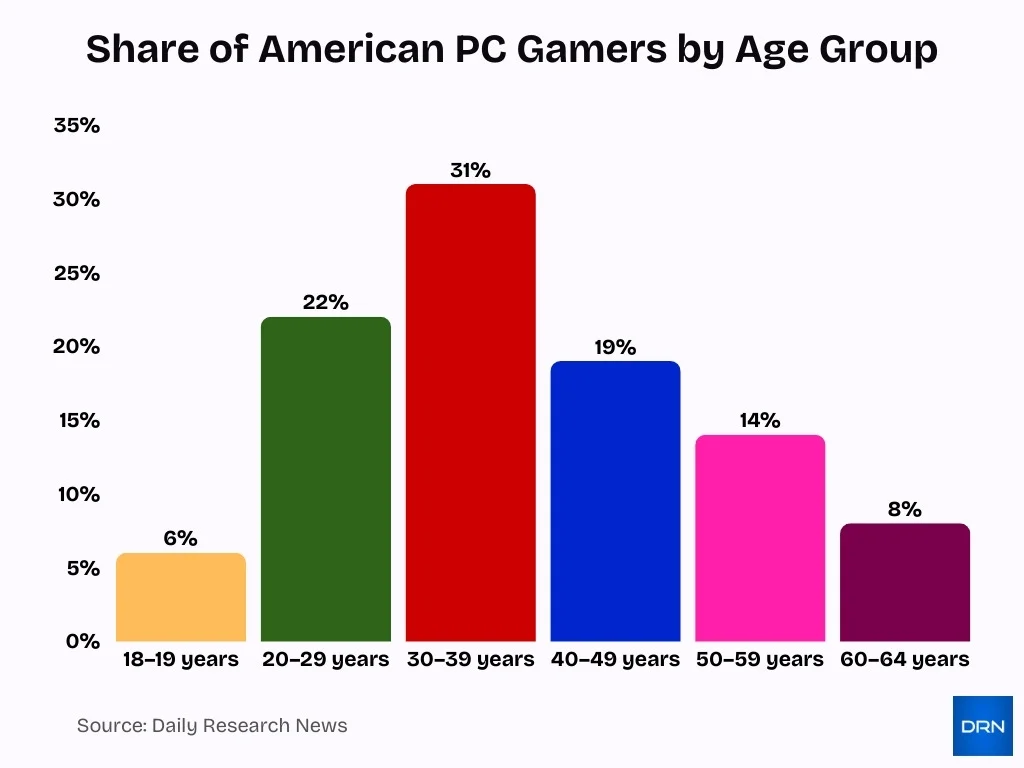

Share of American PC Gamers by Age

- The largest group of American PC gamers is aged 30–39, making up 31% of the total gamer population.

- Adults aged 20–29 years represent the second-largest share at 22%, showing strong engagement among younger adults.

- Teens aged 18–19 years account for only 6%, the smallest demographic, indicating that PC gaming is more popular among adults than older teens.

- The 40–49 year age group contributes 19%, demonstrating that PC gaming remains popular well into middle age.

- Gamers aged 50–59 years make up 14%, highlighting continued interest in gaming among older adults.

- The 60–64 year group still holds 8% of the PC gaming population, showing that gaming spans across a wide age range.

- Overall, the data suggests that PC gaming peaks in the 30s and remains consistently strong across adult age groups, with only modest drop-offs after age 50.

PC Gaming Revenue

- Global PC gaming revenue reaches $39.9 billion in 2025, up 2.5% year-over-year.

- Digital platforms like Steam capture 78% of PC game sales revenue.

- Steam generated $16.2 billion in total revenue through mid-November 2025.

- The PC gaming hardware market is valued at around $50 billion in 2025.

- Gaming peripherals exceeded $20 billion globally in 2025.

- PC subscription services are projected to reach $12.5 billion by 2025.

- Microtransactions account for 58% of PC gaming revenue, reaching $24.4 billion in 2024.

- Esports sponsorships contribute $1.1 billion to the $4.8 billion global market in 2025.

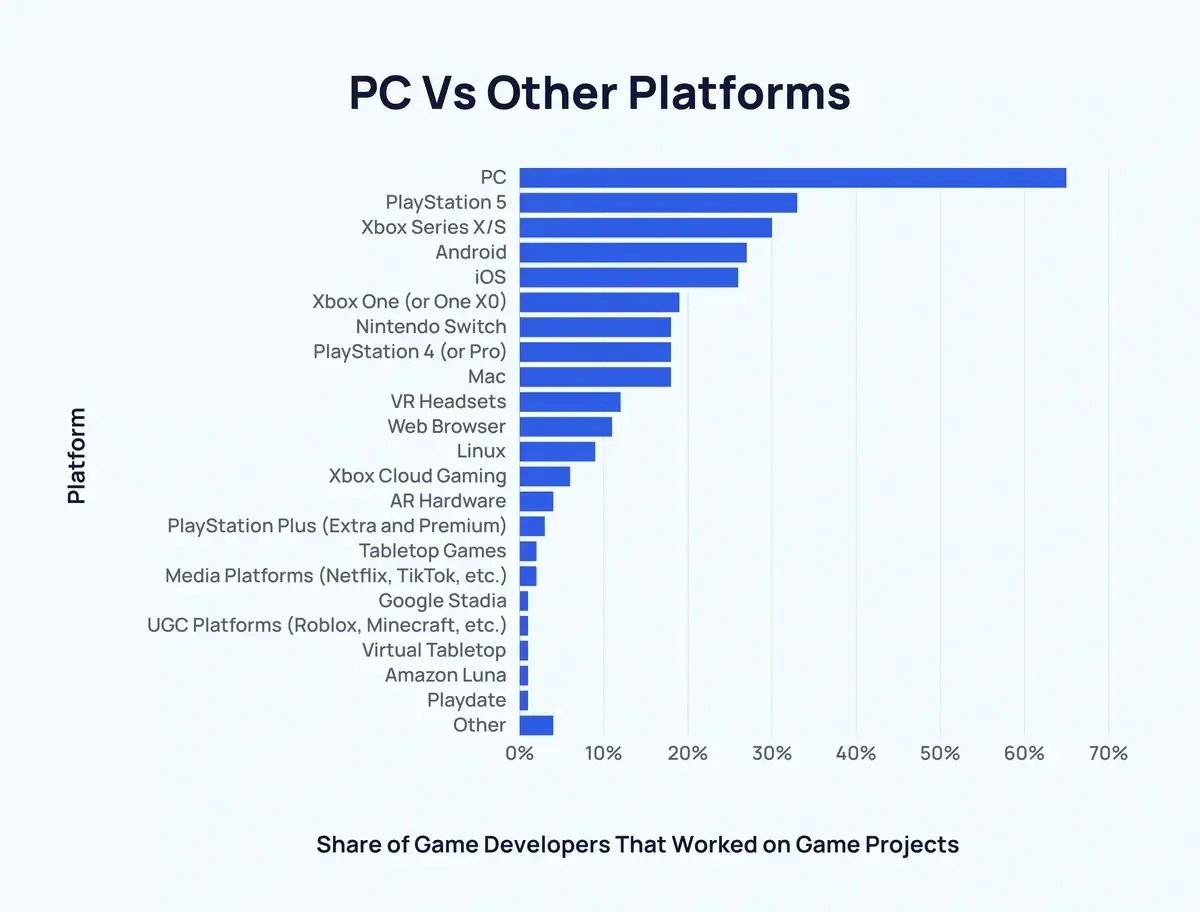

PC vs Other Platforms

- PC continues to dominate the ecosystem, with 65% of game developers having created projects on it.

- PlayStation 5 ranks next with 33%, closely tracked by Xbox Series X/S at 30%.

- Mobile platforms maintain strong traction, with Android at 27% and iOS at 26% participation.

- Older consoles such as Xbox One (19%), Nintendo Switch (18%), and PlayStation 4 (18%) still show ongoing relevance.

- Mac usage aligns with legacy console engagement at 18% among developers.

- VR headsets attracted 12% developer involvement, marking a niche yet noteworthy interest.

- Web browsers served as development platforms for 11% of contributors.

- Linux represented 9%, reflecting a smaller but active development base.

- Cloud and emerging platforms held modest shares, including Xbox Cloud Gaming (6%), AR Hardware (4%), and PlayStation Plus – Extra & Premium (3%).

- Minor platform engagement remained minimal at 2% for Tabletop Games and Media Platforms like Netflix and TikTok.

- Google Stadia, UGC Platforms (Roblox, Minecraft), Virtual Tabletop, Amazon Luna, and Playdate each recorded 1% developer usage.

- Other platforms were referenced by 4% of developers across the survey.

Market Share Comparison

- PC gaming holds roughly 23–26% of global gaming revenue in 2025, behind mobile and console segments.

- Mobile gaming leads with about 49% share of global game revenue, while console takes around 28%.

- Digital PC game revenue is projected to grow from $12.99 billion in 2024 to $14.77 billion in 2025.

- Hardware sales dominate PC gaming revenue, with desktops, laptops, and accessories making up the majority of value in 2025.

- Software and digital game titles contributed about $33.47 billion to the PC market in 2025.

- Subscription and live service revenue on PC is increasing, but remains smaller than hardware and base game sales.

- Console gaming revenue growth often outpaces PC gaming in key regions like North America.

- Mobile gaming’s sheer scale in player base and revenue limits PC’s share despite strong engagement on PC platforms.

Top PC Game Genres

- Shooter games captured 17% of PC gaming revenue in 2024, generating $7.4 billion with 9.6% growth.

- RPGs outpaced the market with ~6% annual growth, leveraging PC‘s graphics for immersive stories.

- MOBA titles like League of Legends hit 1.9M peak viewers in esports events throughout 2025.

- Strategy games drove $120M+ monthly revenue in key PC titles during early 2025.

- The simulation genre features top PC titles like Microsoft Flight Simulator, hailed as exceptionally ambitious.

- Esports FPS/battle royale like Counter-Strike 2 led with 1.86M concurrent players on Steam.

- Survival/co-op games boomed with 262M action downloads, including survival mechanics in 2025.

- Adventure games held 17.1% console revenue share, signaling strong PC crossover demand.

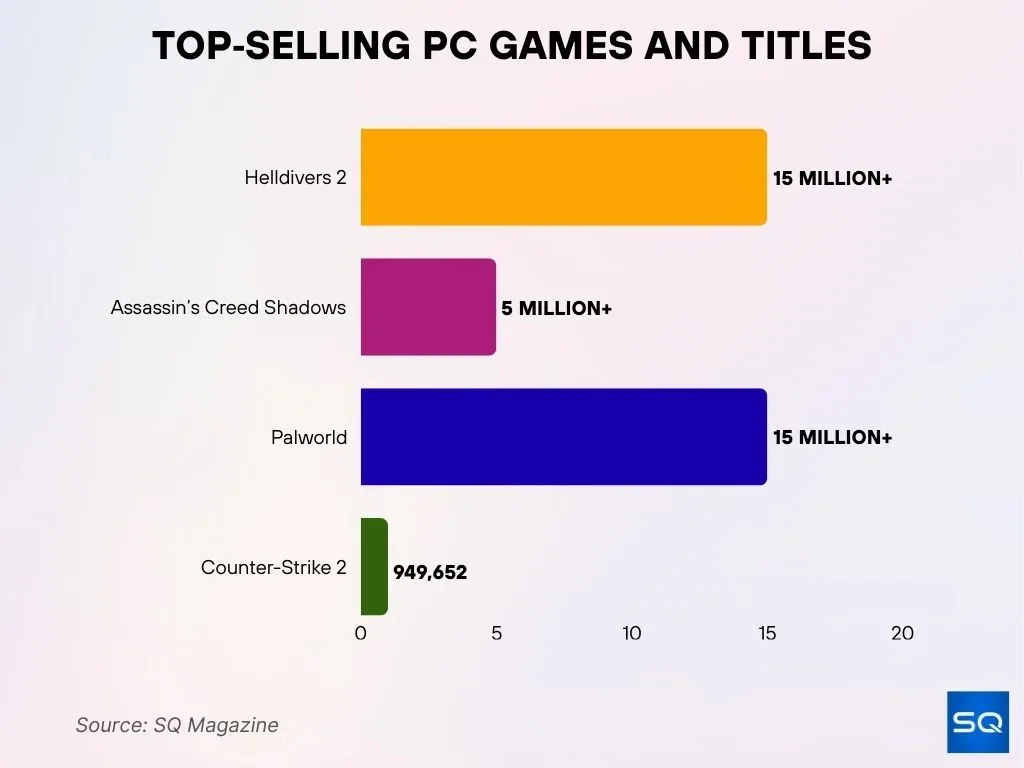

Top-Selling & Highest-Performing PC Games

- Helldivers 2 surpassed 15 million units sold by November 2024, firmly establishing itself as PlayStation’s fastest-selling PC title.

- Assassin’s Creed Shadows reached 1 million players on launch day, expanded to 3 million within a week, and exceeded 5 million unique players by July 2025.

- Counter-Strike 2 & GO maintained their position at the top in May 2025 based on monthly active users.

- Counter-Strike 2 recorded an average of about 949,652 concurrent players in January 2025, placing it firmly in the lead.

- Palworld, released in 2025, achieved sales of over 15 million copies on Steam within 45 days.

- Dota 2 closely trailed CS2 in terms of average concurrent players.

- R.E.P.O., Valorant, and Modern Warfare II/III ranked within the top-10 MAU titles.

Gaming Subscription Stats

- Global game subscription revenue is projected to hit $27 billion by 2028, up from $19 billion in 2024, equal to about 14% of global game spend.

- Total paid game subscriptions are forecast to reach 203 million users by 2028, up from 168 million in 2024.

- North America and Europe’s PC and cloud gaming subscription market was already worth about $3.7 billion in 2021, driven by library-style services.

- Microsoft and Sony together account for around 82 million game library subscriptions in 2024, led by Game Pass and PlayStation Plus.

- Xbox Game Pass Ultimate’s monthly price jumped 50% to $29.99 in 2025, after a prior 17.5% increase in 2024, signaling strong demand at higher price points.

- PC Game Pass pricing rose by more than 33% to $16.49 per month in 2025, following a 20% hike in 2024.

- Cloud gaming within subscriptions is expected to generate $3.7 billion in 2024, growing to about $5.8 billion by 2028 as hybrid subscription tiers expand.

- By 2028, cloud-only platforms like Amazon Luna+ are projected to capture just 3% of total game subscription revenue, with hybrids dominating.

- For PlayStation Plus Essential members, the annual retail value of free games exceeded $1,300 in 2022, enhancing perceived subscription value.

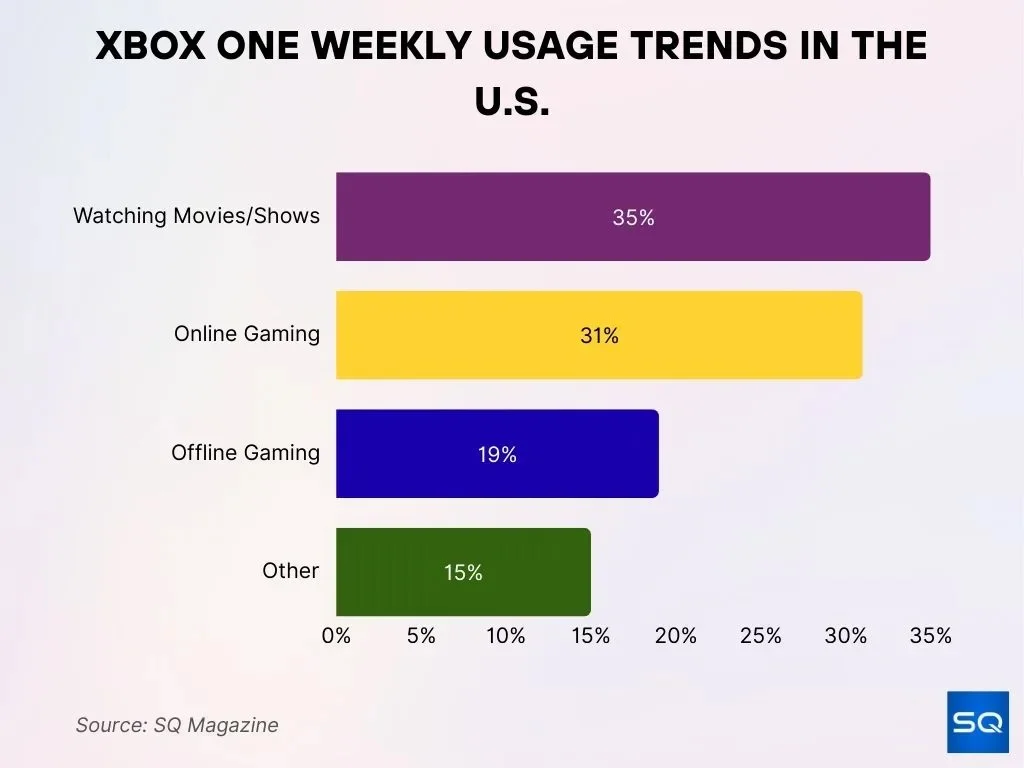

Xbox One Weekly Usage Patterns in the U.S.

- Watching movies and shows represents the largest share of weekly Xbox One usage at 35%, emphasizing its strong role as an entertainment hub beyond gaming.

- Online gaming comes next, accounting for 31% of weekly activity, reflecting high engagement with multiplayer and connected experiences.

- Offline gaming comprises 19%, indicating a persistent interest in single-player or non-networked play.

- 15% of overall usage falls into “Other” activities, which may include browsing, apps, or system customization.

Hardware Adoption Trends

- Advanced PC hardware spending remains a key economic foundation of the PC gaming market through 2025.

- The gaming computer market size is expected to grow significantly from 2025 to 2029 with a projected ~16.3% CAGR.

- Steam hardware surveys reflect shifts in component adoption, with notable increases in AMD CPU share surpassing 40% of surveyed gamers.

- NVIDIA GPUs continue to dominate discrete graphics adoption among PC gamers.

- Windows 11 usage on PC gaming rigs increases yearly, influencing software optimization trends.

- Memory and VRAM capacities trend upward, with 32GbillionRAM becoming more common among modern gaming PCs.

- Premium peripherals and high refresh displays remain growth categories within PC hardware spending.

- Cloud streaming hardware influence, low-end device compatibility, begins reshaping purchase decisions for some gamers.

Cloud Gaming Impact

- The global cloud gaming market is expanding rapidly, with projections to reach $89.07 billion by 2029.

- Cloud gaming revenues are still a small slice relative to traditional PC hardware sales, but growing quickly.

- Around 23.7 million gamers engaged in cloud gaming by 2025, according to some estimates.

- Internet penetration and faster broadband are key drivers enabling broader cloud gaming adoption.

- Cloud gaming blurs boundaries between hardware tiers, allowing gamers with modest PCs to play demanding titles.

- Enhanced platforms, RTX 5080 class streaming performance, improve quality, and entice new users.

- Subscription-linked cloud access is reshaping how consumers perceive PC gaming value.

- Innovations in cloud tech may democratize access to high-quality PC experiences globally.

Frequently Asked Questions (FAQs)

In 2025, the global PC gaming market is valued at $86.12 billion, up from $76.7 billion in 2024.

PC gaming accounts for approximately 23% of total global video gaming revenue in 2025.

The number of PC gamers worldwide in 2025 is estimated at 936 million players, representing about 26% of all gamers globally.

The PC gaming market is projected to grow to $152.16 billion by 2032, exhibiting a CAGR of 8.47% from 2025 to 2032.

Conclusion

The PC gaming market remains a dynamic and influential segment of the global gaming landscape. While it competes with mobile and console platforms for revenue share, PC gaming sustains its strength through diversified revenue streams, especially hardware sales, digital distribution, and live service titles. Emerging subscription models, evolving hardware adoption patterns, and the rise of cloud gaming all point to a platform in transformation rather than decline.

Core PC gamers continue to engage deeply across genres and titles, from shooters to RPGs, underpinned by a vast global community that fuels ongoing innovation. As technology, monetization, and player preferences evolve, the PC segment’s adaptability will define its future role in the broader interactive entertainment ecosystem.