PlayStation remains a dominant force in the gaming industry, shaping digital entertainment for millions worldwide. From immersive single-player adventures to dynamic multiplayer ecosystems, its influence spans hardware innovation and content strategy. Industries ranging from esports to streaming entertainment continue to benefit from PlayStation’s evolving platform model. As we move through this article compiles the latest PlayStation statistics, offering a detailed look into its market impact, user behavior, and global reach.

Editor’s Choice

- PlayStation Network (PSN) recorded 119 million monthly active users as of September 2025.

- 51.6 million users are subscribed to PlayStation Plus across all tiers, with 23.7 million on Premium.

- PlayStation 5 has shipped over 84 million units globally as of Q3 2025.

- Sony’s PlayStation division saw a 127% year-over-year profit increase in Q1 FY2025.

- The combined PlayStation game software sales exceeded 1.468 billion titles globally by Q3 2025.

- PlayStation Plus Essential tier remains the largest with 24.2 million subscribers.

- The PlayStation brand contributed to a projected $34.1 billion market size in 2025.

Recent Developments

- Sony reported that the PS5 has now outsold the PS4 in the same timeframe since launch, signaling strong generational momentum.

- Q1 FY2025 saw a 127% increase in operating profit for PlayStation, marking a major earnings milestone.

- PS Plus Premium subscriptions rose by 9% year-over-year, showing strong demand for higher-tier content access.

- PlayStation Studios revealed development of over 10 new live-service titles, indicating a strategic pivot.

- Backward compatibility features for PS5 have driven continued software revenue from older titles.

- Sony announced expansion plans for PSN infrastructure in Latin America and Southeast Asia to support global growth.

- The PlayStation Showcase 2025 presented over 20 new exclusive titles, bolstering first-party strength.

- Mobile integration through Remote Play continues to gain traction with a growing number of active users.

- The recent cloud-streaming rollout for PS5 games expanded access to AAA titles without hardware upgrades.

Global PlayStation Overview

- PlayStation operates in over 100 countries, with major markets in North America, Europe, and Asia.

- The PS brand has sold over 579 million consoles across all generations.

- As of 2025, PlayStation’s cumulative software sales across all platforms exceed 1.4 billion units.

- Over 119 million monthly active users access PlayStation Network globally.

- Digital sales, subscriptions, and add-on content represent over 70% of Sony’s gaming revenue.

- PS Plus has subscribers in nearly 80 countries, showcasing global demand for tiered services.

- Sony continues to invest in regional content localization to support user engagement worldwide.

- The platform supports multiple languages, with PSN accessible in more than 35 localizations.

- PlayStation remains the top-selling console brand in European markets for the fourth consecutive year.

- Strategic partnerships with studios in Asia and Eastern Europe aim to expand exclusive content pipelines.

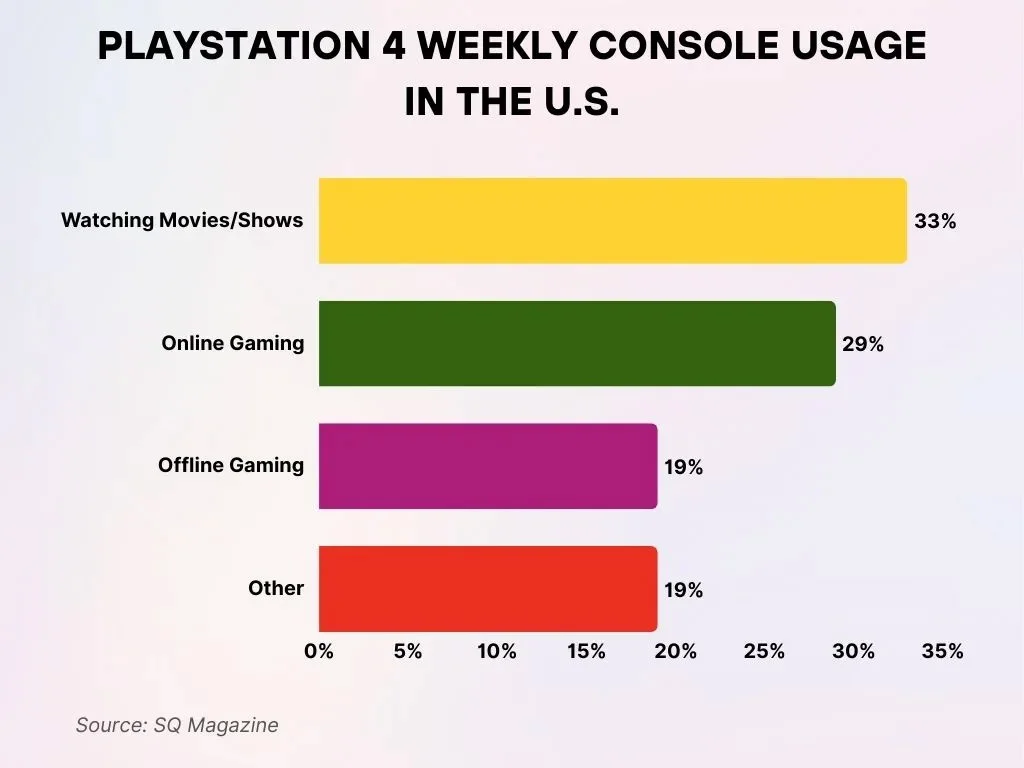

PlayStation 4 Weekly Console Engagement in the U.S.

- Watching movies and shows remains the most favored activity, comprising 33% of the weekly console engagement.

- Online gaming comes next in prominence, representing 29% of users’ weekly time spent on the PlayStation 4.

- Offline gaming accounts for 19% of engagement, sharing this proportion with various miscellaneous activities.

- Additional functions, including diverse apps and non-gaming features, likewise contribute 19% to weekly engagement.

Console Sales Statistics

- PlayStation 5 has sold over 84 million units globally as of Q3 2025.

- PS4 lifetime sales stand at 117.2 million units, maintaining its position as Sony’s second-best-selling console.

- Combined PS4 and PS5 hardware shipments have surpassed 173 million units.

- Legacy console sales (PS1 through PS3) account for over 344 million units sold.

- The PS5 reached its first 10 million units faster than any previous PlayStation console.

- Demand for PS5 Digital Edition remains high, accounting for 35% of all PS5 units sold.

- In 2025, PlayStation consoles maintain a 46% share of global console hardware sales.

- Hardware bundle sales (console + game packages) rose by 12% YoY due to holiday promotions.

- PlayStation 5 had its best-ever quarterly sales in Q4 2024 with over 7.8 million units sold.

- Despite chip shortages in earlier years, Sony achieved normalization of PS5 inventory globally by mid-2024.

PlayStation 5 Statistics

- PS5 units sold reached 84 million as of Q3 2025.

- Average monthly playtime per PS5 user stands at 52 hours in 2025.

- The top-selling PS5 game, Spider-Man 2, sold over 10 million copies within its first year.

- 63% of PS5 users subscribe to at least one tier of PlayStation Plus.

- Digital game downloads on PS5 outpace physical purchases by a 4:1 ratio.

- PS5 users spend $62 on average per quarter on downloadable content.

- Backward compatibility features account for 25% of total playtime on PS5.

- PS5-exclusive titles contributed to 40% of all PlayStation digital software revenue in 2025.

- Game install sizes on PS5 average 68 GB, reinforcing user reliance on cloud and expanded storage.

- PS5’s DualSense controller maintains a 96% satisfaction rating among surveyed users.

Legacy PlayStation Console Statistics

- PS2 shipped over 160 million units worldwide, the best-selling console ever.

- PS1 reached 102.49 million units shipped combined with early models.

- PS3 sold 87.4 million units lifetime as of 2017.

- Total PlayStation hardware from PS1-PS5 exceeded 579 million shipments by 2022.

- PlayStation software hit 5.82 billion units sold across all legacy generations.

- PS2 software shipped over 800 million units by the mid-2000s.

- PS1 generated 962 million software units sold with 4,000+ titles.

- PS3 Store remains active in 2025, supporting legacy digital sales.

- Legacy PS titles sustain revenue via digital storefronts and backward compatibility.

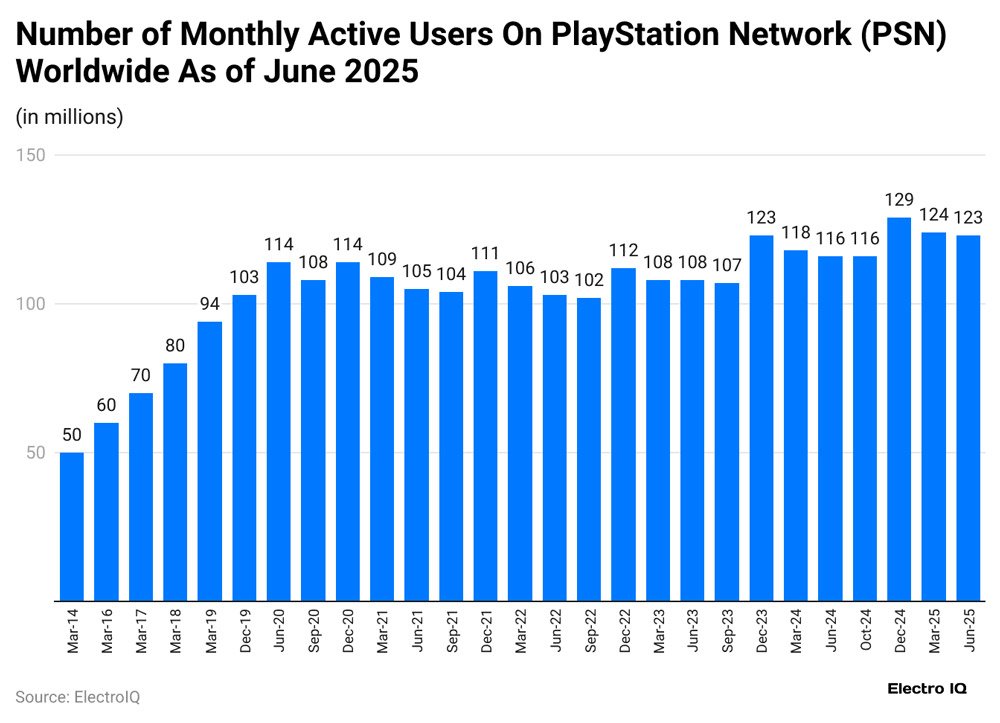

PlayStation Network (PSN) Monthly Active User Statistics

- PSN’s worldwide user base has shown steady long-term expansion, increasing from 50 million (Mar 2014) to 123 million (Jun 2025) while maintaining all key growth figures.

- The service passed several major usage milestones, including 60M in 2016, 80M in 2018, 100M+ in late 2019, and 120M+ in late 2023, each reflecting notable progress.

- Peak engagement climbed to 129 million in Mar 2025, representing the highest figure achieved across the entire dataset.

- Following this peak, user counts eased slightly to 124M in Mar 2025 and later to 123M in Jun 2025, showing a minor post-surge adjustment.

- Distinct year-end spikes appeared in Dec 2019 (103M), Dec 2020 (114M), Dec 2021 (111M), Dec 2022 (112M), and Dec 2023 (123M), patterns likely influenced by holiday engagement and major releases.

- A phase of mild variation occurred between 2021–2023, with values shifting between 102M and 112M, reflecting a steady and resilient user base during that span.

- Marked renewed growth emerged in 2024–2025, increasing from 118M in Mar 2024 to 129M in Mar 2025, signaling one of the strongest expansion periods since the PlayStation ecosystem matured.

- In total, PSN gained about 73 million users across 11 years, underscoring the platform’s broadening global influence and high engagement within the PlayStation network.

PlayStation Plus Subscription Statistics

- As of Q1 2025, PlayStation Plus counted 51.6 million subscribers worldwide.

- The Premium tier alone reached 23.7 million subscribers in 2025.

- The Essential tier remains the largest, with 24.2 million subscribers as of Q1 2025.

- Premium subscriptions saw a 9% increase year over year, reflecting higher tier adoption.

- PS Plus revenue rose due to users upgrading to higher cost tiers, boosting ARPU.

- Revenue from PS Plus contributed to a record operating profit for PlayStation in Q1 FY2025.

- Despite periodic game removals, subscription numbers remain strong.

- About 19% of PS Plus subscribers still play on PS4, showing cross-generation support.

- Cross-platform continuity helps Sony maintain a broad and loyal subscriber base.

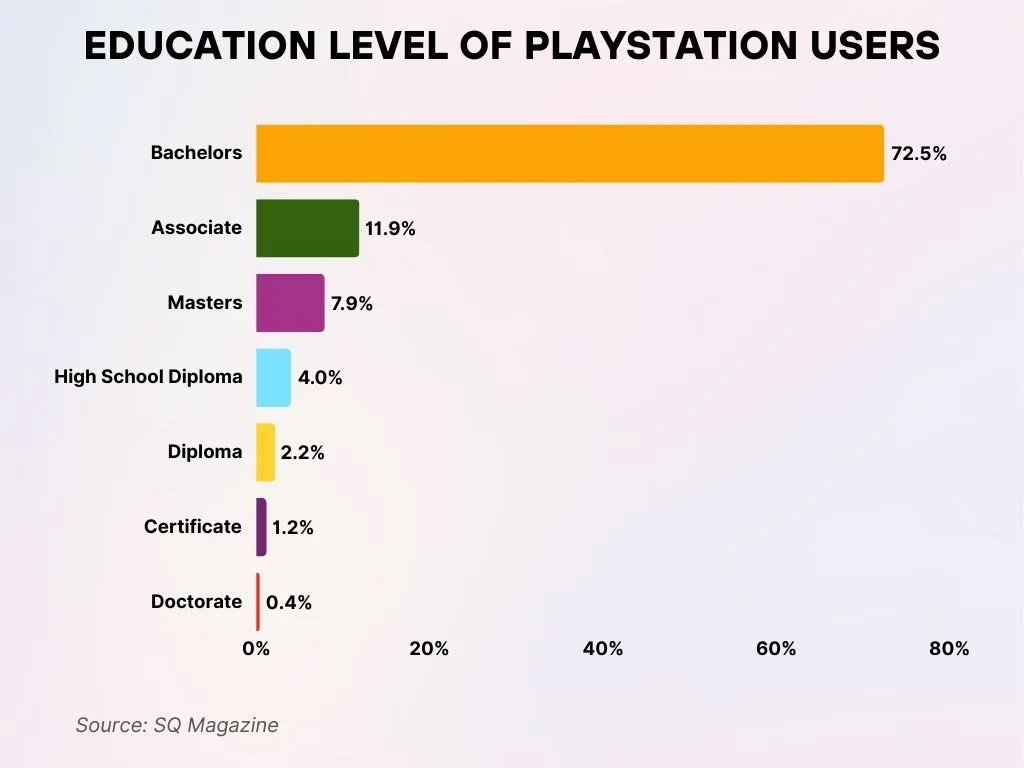

Educational Background of PlayStation Users

- A dominant 72.5% of PlayStation users hold a Bachelor’s degree, emphasizing the platform’s highly educated user base.

- 11.9% of users have completed an Associate degree, marking them as the second-largest group.

- 7.9% of users possess a Master’s degree, indicating strong appeal among postgraduate players.

- 4.0% of PlayStation users report having only a High School Diploma.

- 2.2% identified a Diploma as their highest educational attainment.

- 1.2% of users have completed a Certificate program.

- Only 0.4% of users hold a Doctorate.

- These findings show that over 90% of PlayStation users have post-secondary education, reinforcing the brand’s link with a well-educated gaming community.

Digital and Online Revenue Statistics

- Digital software and add-ons comprised 49% of PlayStation’s total revenue in 2024.

- Add-on content alone generated 29% of overall PlayStation income in 2024.

- PlayStation’s Q1 FY2025 operating profit surged 127% year-over-year to $1.024 billion.

- PlayStation Plus’ annual revenue exceeded $3.8 billion, forming 33% of PSN service income.

- Digital purchases accounted for 83% of all software sales in Q1 FY2025.

- Live service games generated over 40% of first-party revenue in Q1 FY2025.

- PS Plus subscribers reached 51.6 million across all tiers in Q1 2025.

- Physical software sales represented just 3% of PlayStation revenue in 2024.

- Network services contributed 14% to PlayStation’s total gaming revenue in 2024.

PlayStation Overall Revenue and Profit Statistics

- For Q1 FY2025, the PlayStation segment reported a 127% year-over-year increase in operating profit, reaching $1 billion.

- The profit margin hit 16%, the highest in recent years, driven by digital services.

- The PS5 generation is the most profitable console era for Sony to date.

- Digital and network services reduce dependency on hardware cycles.

- Sony forecasts higher full-year revenue for PlayStation due to diversified income streams.

- The PlayStation-related market is valued at around $34.1 billion in 2025.

- Market projections show this could reach $54.1 billion by 2035, with a CAGR of 4.7%.

- Subscriptions, digital services, and live service titles are key long-term revenue drivers.

PlayStation Market Share Statistics

- PlayStation holds 45% global console market share in 2024.

- PS5 has sold 80.3 million units worldwide as of mid-2025.

- PlayStation commands 46% of global console gaming revenue.

- In North America, PlayStation leads with 49% US console market share.

- Europe sees PlayStation dominating at 52% console market share.

- PlayStation Plus boasts ~51.6 million subscribers globally.

- PSN market valued at $24.8 billion in 2024, projected to reach $50 billion by 2035.

- The PlayStation market is expected to reach $54.12 billion by 2035 with a 4.72% CAGR.

- G&NS revenues hit $10.6 billion in Q4 2024, up 16% year-over-year.

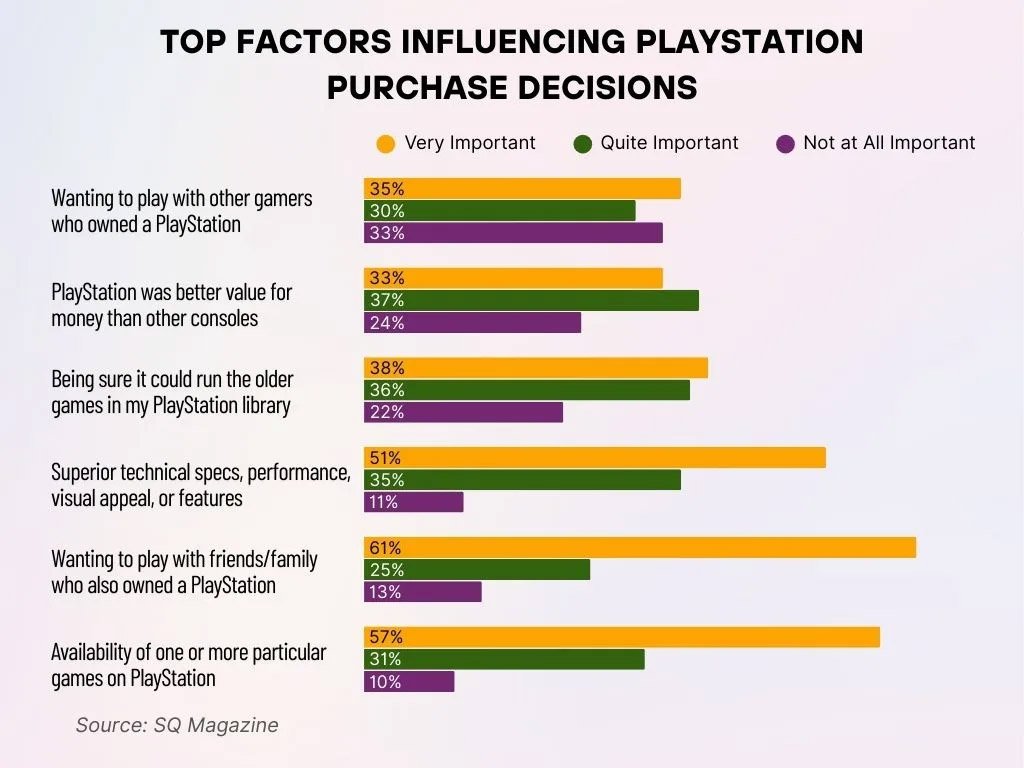

Key Drivers Behind PlayStation Buying Decisions

- Bold buyers reported that 61% felt that being able to play with friends/family who already owned a PlayStation was a very important motivator for their purchase.

- A notable 57% indicated that the availability of specific PlayStation games held a very important influence over their final decision.

- Roughly 51% selected PlayStation due to its superior specs, performance, design, or features when compared to competing consoles.

- Approximately 38% placed strong importance on backward compatibility, valuing the ability to access older titles from their existing PlayStation library.

- About 35% were motivated by the goal of playing alongside other gamers who owned a PlayStation.

- Nearly 33% emphasized that PlayStation’s value for money played a very important role in their choice.

- Intriguingly, only 10–13% of respondents across all categories said these factors were not at all important, highlighting the broad appeal of PlayStation’s key features.

PlayStation User Demographics Statistics

- 51% of PlayStation gamers worldwide are under age 35.

- 38% of U.S. PlayStation gamers belong to racial and ethnic minority groups.

- Parents account for 24% of regular PlayStation users.

- 71.4% of PlayStation users are male.

- North America contributes 37% of total PlayStation revenue.

- Europe accounts for 34% of PlayStation’s market contribution.

- 72.5% of PlayStation users hold a Bachelor’s degree.

- Gen Z and Millennials comprise 68% of PlayStation Plus subscribers.

- 80% of global gamers (including PlayStation) are 18 or older.

Player Behavior and Engagement Statistics

- PSN maintains 119 million monthly active users globally as of early 2025.

- 55% of US-based PlayStation users play both single-player and multiplayer titles regularly.

- 36% of players access PlayStation through cloud or Remote Play weekly.

- 60% of PSN users log in weekly, showing strong platform stickiness.

- Average weekly playtime reaches 9.6 hours per user, up from 9.2 hours in 2024.

- PS Plus totals 51.6 million subscribers across all tiers in Q1 2025.

- 68% of PS Plus Premium users utilize game streaming benefits.

- Over 1.2 billion hours of gameplay were logged across PSN in January 2025.

- PS5 and PS4 each claim around 49 million monthly users, enabling high cross-gen activity.

PlayStation Game Library and Title Statistics

- PS4 and PS5 combined software sales exceed 1.468 billion units as of September 2025.

- PS5 library includes 1,056 native titles, plus backwards compatibility.

- Over 4,000 PS4 titles are playable on PS5 via backwards compatibility.

- Digital software accounts for 79% of total PlayStation game purchases.

- Add-on content and DLC generate 29% of PlayStation’s overall revenue.

- PlayStation Plus serves 51.6 million subscribers across all tiers in Q1 2025.

- PSN monthly active users reached 119 million as of September 2025.

- Adventure games claim 17.1% of console revenues, leading PlayStation genres.

- PS5 hardware sales hit 84.1 million units shipped worldwide.

Exclusive and First-Party PlayStation Game Statistics

- Sony sold 6.9 million first-party games for PS4 and PS5 in Q1 FY2025.

- 11.6 million first-party titles sold in Q3 FY2024, up from 7.7 million prior quarter.

- PlayStation Studios live service games generated over 40% of first-party revenue in Q1 2025.

- DLC and microtransactions contributed 34% of Sony’s profit last year.

- Digital sales accounted for 76% of first-party game revenue on PC platforms.

- Nine PS5 Pro upgraded PlayStation Studios games saw an average of 30.2% player count boost at launch.

- 83% of PlayStation sales were digital downloads in Q1 2025.

- PS5 exclusives like Spider-Man 2 drive upgrades, with 50% of gamers yet to transition from PS4.

- First-party titles like God of War and Spider-Man rank among the top 20 all-time best-sellers on PlayStation.

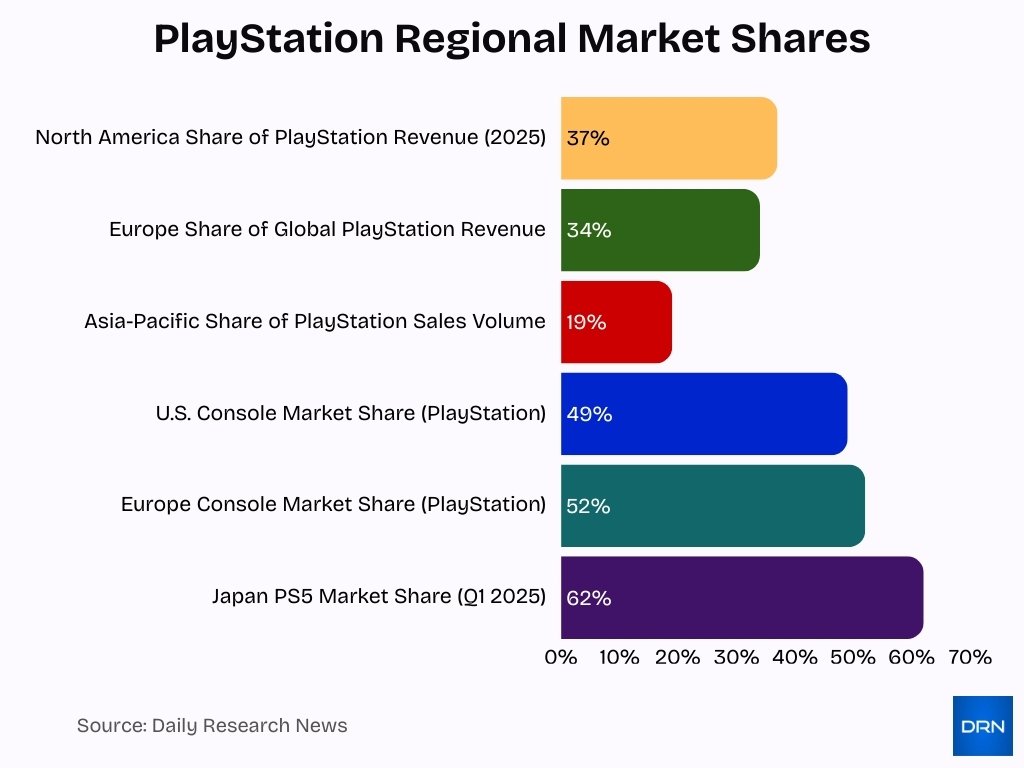

Regional PlayStation Statistics

- North America contributes 37% of PlayStation’s total 2025 revenue.

- Europe accounts for 34% of the global PlayStation revenue share.

- Asia-Pacific represents 19% of PlayStation sales volume.

- The US console market sees PlayStation holding a 49% share.

- Europe commands 52% console market share for PlayStation.

- Japan PS5 achieved 62% market share in Q1 2025.

- Latin America recorded 18% YoY growth in PlayStation sales.

- Japan sold 10.6 million PS5 units lifetime.

- US PS5 sales reached 25.81 million units through April 2025.

PlayStation VR and Accessories Statistics

- PSVR2 sold nearly 600,000 units in the first six weeks after its February 2023 launch.

- Over 2 million PSVR2 units were produced by March 2024 before Sony paused manufacturing.

- PSVR2 shipments totaled 1.7 million units across 2023 quarters per IDC data.

- PSVR original reached 4.2 million units sold by early 2019, among 94.2 million PS4 owners.

- PSVR2 sales are projected at 2.5–3 million units by late 2025 with modest growth.

- $350 US promotion drove a 2,350% PSVR2 sales spike in one day during 2025.

- Holiday 2024 discounts boosted PSVR2 sales 5x year-over-year on Amazon.

- PSVR lifetime revenue estimated at $2.5 billion, including hardware and software.

- Beat Saber topped PSVR2 download charts in the US, Canada, and Europe for 2024.

Future Outlook and Forecast Statistics

- The PlayStation-related market is projected to grow from $34.12 billion in 2025 to $54.12 billion by 2035, at a 4.7% CAGR.

- Digital distribution, subscriptions, and live service games will drive most revenue growth.

- Emerging markets will shape future expansion as digital access increases.

- Cross-generation continuity supports smooth console transitions.

- Exclusive titles, remasters, and digital releases will strengthen engagement.

- Subscription and online services will grow as central components of the PlayStation model.

- Diverse revenue streams will help PlayStation remain competitive against PC, mobile, and cloud platforms.

- Current trends position PlayStation for continued global relevance through the next decade.

Frequently Asked Questions (FAQs)

84.2 million units have been sold worldwide as of Q2 FY2025.

PSN reached approximately 123 million monthly active users as of June 30, 2025.

Digital software and add‑on content accounted for 49% of PlayStation’s total revenue in 2024.

The PlayStation market is projected to reach $54.12 billion by 2035, up from about $34.12 billion in 2025.

Conclusion

PlayStation stands as a leader in gaming through its expansive hardware ecosystem, massive digital footprint, and diverse, global user base. With strong engagement across PSN, a growing subscription economy, and a library of over 1.468 billion accumulated software units, the platform continues to thrive. PlayStation’s future is defined by digital growth, cross-generation support, global expansion, and a commitment to first-party excellence.

As the industry moves toward a projected $54 billion PlayStation market by 2035, the brand remains well-positioned to shape the next decade of interactive entertainment.