The software-as-a-service (SaaS) industry continues to transform how companies of all sizes operate and innovate. With the rise of AI-driven capabilities, evolving pricing models, and increasing demands for security and integration, the SaaS landscape reflects a sector both maturing and expanding at once. From enterprise resource planning to customer experience automation, SaaS plays a critical role in everything from startups to Fortune 500s. Industries like healthcare and fintech, for example, are increasingly dependent on scalable, cloud-based tools that deliver functionality with minimal infrastructure overhead.

Editor’s Choice Stats

- The global SaaS market is projected to reach $317 billion in revenue by the end of 2025.

- Over 76% of private SaaS companies report using AI in their core products.

- The average organization uses 106 SaaS applications in 2025, down from 112 in 2023.

- SMBs experience churn rates over 20% compared to 8.5% in larger SaaS companies.

- Usage-based pricing models are now used by 78% of SaaS companies.

- Multi-year SaaS contracts account for 40% of deals, up significantly from 2022.

- Data breaches in SaaS cost an average of $4.88 million per incident.

Recent Developments

- SaaS adoption continues to expand, especially in APAC and LATAM, with regional growth rates exceeding 22% CAGR.

- AI integration in SaaS has accelerated, with over 60% of enterprise tools embedding machine learning features.

- SaaS cost optimization is a priority, with firms reducing SaaS tools per employee and renegotiating contracts.

- Shadow IT remains a challenge, with 73% of SaaS licenses underutilized or unused.

- Investor interest is strong in vertical SaaS and AI-native startups, fueling early-stage funding rounds.

- Vendor consolidation trends are accelerating, with enterprise buyers preferring integrated platforms over standalone tools.

- Security breaches tied to third-party SaaS vendors have surged 180% year-over-year.

What Is SaaS? (Quick Overview)

- The global SaaS market is projected to reach $317.55 billion by 2025, up from $273.55 billion in 2023.

- Around 85% of business applications will run on SaaS by 2025.

- 78% of small and medium enterprises have adopted SaaS solutions.

- SaaS revenues are expected to grow at a CAGR of 19.38% between 2025 and 2029.

- The average company uses about 106 SaaS applications.

- SaaS spending per U.S. employee averages $1,100 annually in the technology sector.

- Organizations save an average of 5.36% on SaaS spending through negotiation strategies.

- The SaaS market is expected to reach $1.25 trillion globally by 2034.

- 22.8% of U.S. employees worked partially or fully remotely in 2024, boosting SaaS adoption for remote work.

- By 2025, 50% of SaaS companies plan to use AI for advanced capabilities like automation and

- personalization.

Leading Global SaaS & Software Providers

- Key Sales Figures: Microsoft ($237B), Alphabet ($318B), Salesforce ($34.9B), SAP ($34.5B), and Adobe ($19.9B) reported top software revenues in 2025.

- Adobe Growth: Adobe Creative Cloud generated $21.51 with ~11% year-over-year growth.

- Stripe Revenue: Stripe posted $14B in revenue as a major private SaaS fintech company.

- Microsoft Segment Revenue: Microsoft earned $77.73 from productivity/business processes and $105.36 from its intelligent cloud division.

Global SaaS Market Size & Growth Statistics

- Global SaaS revenue is expected to reach $317 billion by the end of 2025.

- The market is growing at a CAGR of 19.38% from 2025 to 2029.

- The Asia-Pacific region is the fastest-growing SaaS market with a 22% CAGR.

- SaaS represents over 70% of all cloud services revenue worldwide.

- U.S. companies account for nearly half of the global SaaS market share.

- European SaaS adoption continues to increase, driven by privacy-first applications.

- The AI-powered SaaS market is projected to surpass $5.6 billion by 2030.

- Hybrid SaaS (combining subscription and usage-based models) is growing 21% YoY.

- Vertical SaaS (industry-specific platforms) shows faster growth than horizontal SaaS.

- SaaS valuations remain strong, with EV/revenue multiples around 6.1× for public firms.

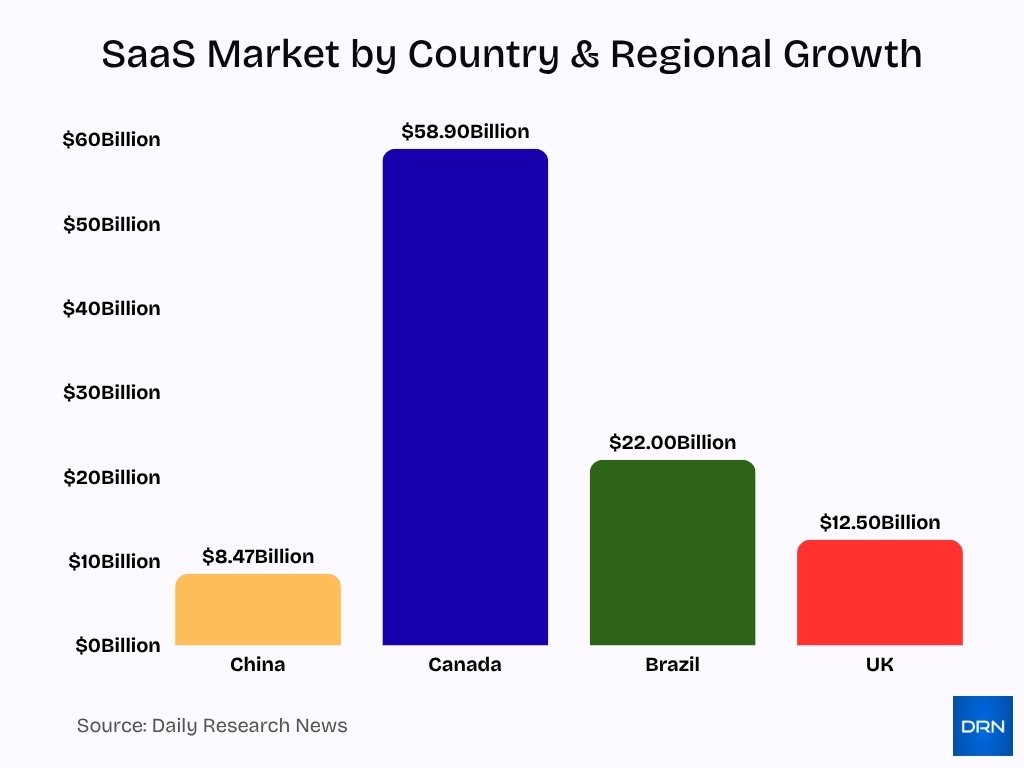

Regional SaaS Market Statistics by Country & Region

- The U.S. accounts for 45% of global SaaS revenue, leading worldwide adoption.

- India’s private equity investment in SaaS surged by 66% in 2025.

- China’s SaaS market hit $8.47 billion in 2025, with a 14.14% CAGR projected.

- Canada’s SaaS revenue is expected to reach $58.9 billion by 2030 with a 12.6% CAGR.

- Brazil’s SaaS market is projected to double by 2027, reaching $22 billion.

- The UK leads SaaS adoption in the legal and insurance sectors with a market valuation of $12.5 billion in 2025.

- Germany’s SaaS growth is driven by manufacturing and compliance tools, aligned with upcoming NIS2 regulations in 2025.

- Southeast Asia’s SaaS spending per employee increased by over 2.5 times from 2020 to 2025.

- Africa’s SaaS market growth is powered by mobile-first business software adoption trends.

- Australia sees strong SaaS demand in health, education, and government sectors, driving annual market growth rates above 15%.

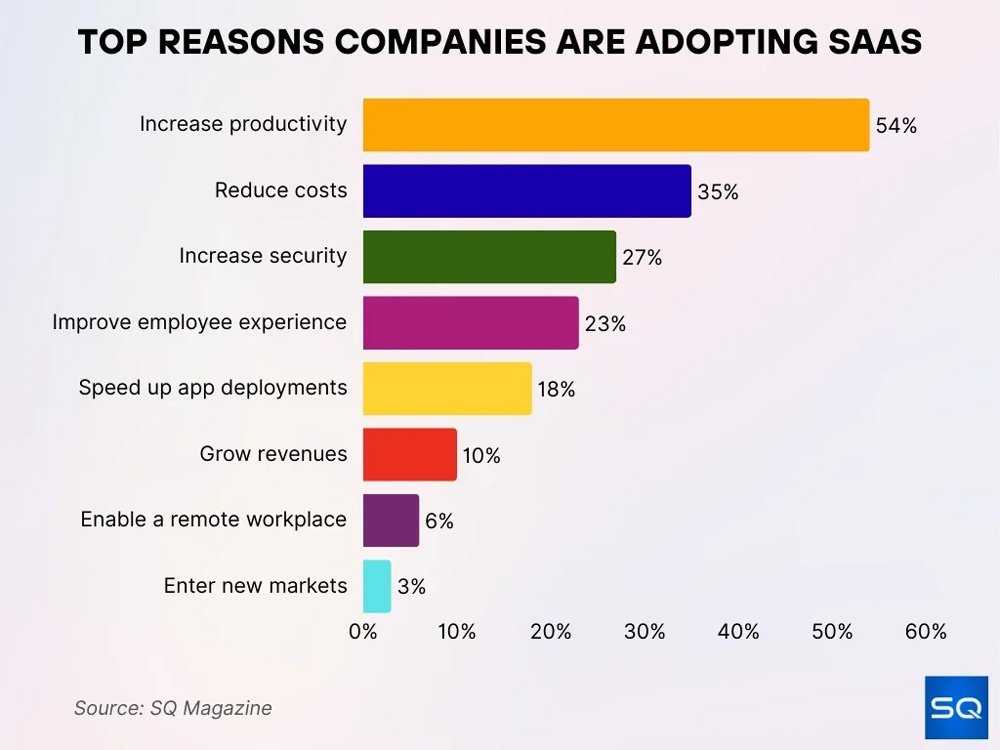

Top Drivers for SaaS Adoption

- 54% – Boost productivity through cloud-based workflows

- 35% – Cut operational costs and enhance efficiency

- 27% – Strengthen security with cloud tools and protocols

- 23% – Improve employee experience with easier, more intuitive platforms

- 18% – Accelerate app deployment for quicker innovation

- 10% – Increase revenue by scaling services efficiently

- 6% – Support remote and hybrid work environments

- 3% – Expand into new markets with flexible, global-ready SaaS solutions

SaaS Usage Statistics by Company Size

- In 2024, the average company used 106 SaaS applications, down from 112 in 2023.

- Mid-sized firms with 1,500–4,999 employees are expected to cut SaaS apps by 29% in 2025.

- Large enterprises with over 1,000 employees generated 60%+ of global SaaS revenue in 2022.

- Some organizations spend up to US$3,500 per employee yearly on SaaS tools.

- By the end of 2025, about 75% of business applications will be SaaS-based.

- Among SaaS users, 81% have automated at least one process via SaaS apps.

- Approximately 73% of employees don’t use their assigned SaaS licenses, indicating shadow IT.

- Smaller companies often face churn rates exceeding 20% annually.

- SaaS firms with revenues above US$10 million have an average churn rate of 10%.

- The average number of SaaS apps used by businesses peaked at 112 in 2023 before declining.

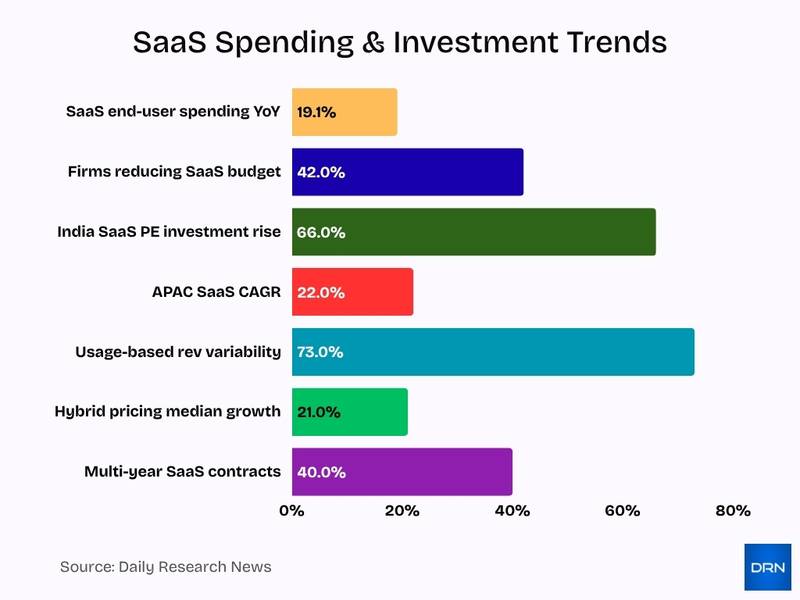

SaaS Spending & Investment Statistics

- Global end-user spending on SaaS is projected to grow by 19.1% year-over-year.

- Worldwide SaaS revenue is forecast to reach ~US$793.1 billion by 2029.

- 42% of organisations have reduced their SaaS budgets amid economic pressure.

- Private equity investment in India’s SaaS sector surged 66% in early 2025.The

- The APAC SaaS market is growing at a 22% CAGR over the next decade.

- 73% of companies using usage-based models forecast variable revenue.

- Hybrid pricing models (subscription + usage) drive a 21% median growth rate.

- 40% of SaaS agreements are now multi-year contracts.

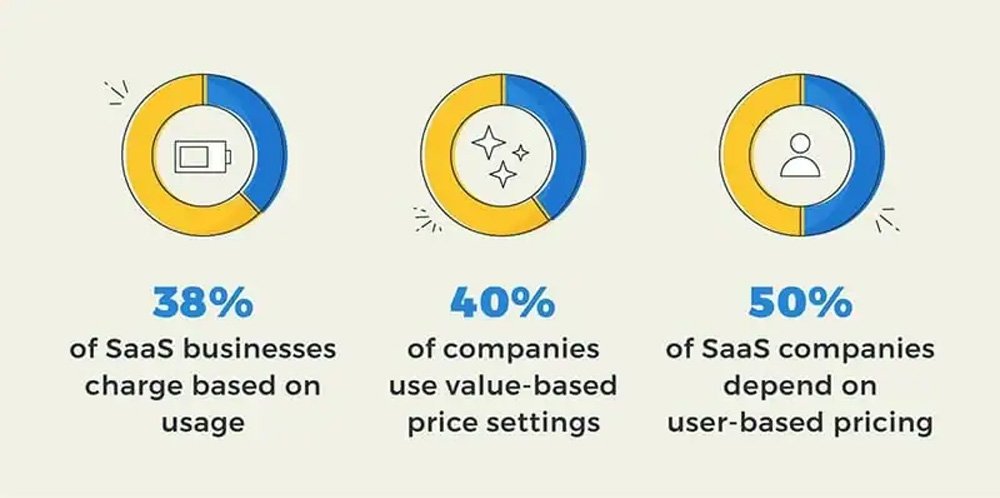

Leading Pricing Models in SaaS

- Usage-based: 38% of SaaS companies charge according to actual consumption.

- Value-based: 40% set pricing based on the value delivered to customers.

- User-based: 50% bill per user or seat across teams and organizations.

SaaS Revenue, ARR & Profitability Statistics

- Median EV/Revenue multiples for public SaaS companies in 2025 are approximately 6.1×.

- Funded SaaS companies often achieve ARR growth rates exceeding 60%, with AI-native firms reaching 100% median ARR growth.

- Companies with over US$50 million ARR had 40% median growth in AI-native SaaS vs 15% in traditional B2B SaaS.

- Gross margins of AI-native SaaS firms run about 5 points lower than non-AI peers.

- ARR per employee for top SaaS firms has reached over US$580,000, with some firms hitting up to US$1.3 million per employee.

- A 1 percentage point reduction in churn can increase company valuation by up to 15%.

- Enterprises with 1,000+ employees generate over 60% of global SaaS revenue.

- Global SaaS spending is projected to reach around $317 billion in 2025, growing annually at about 19.38% through 2029.

- SaaS firms with $20-50M ARR achieve median ARR per employee efficiency of about $175,000.

- AI-native SaaS companies maintain 50% higher ARR per employee at scale compared to traditional SaaS firms.

SaaS Churn, Retention & Customer Lifetime Value Statistics

- The average annual churn rate for B2B SaaS in 2025 is 3.5%, with voluntary churn at 2.6% and involuntary churn at 0.8%.

- A monthly churn rate below 1% (approximately annual < 5%) is considered strong for B2B SaaS.

- Net Revenue Retention (NRR) median is 106% in 2025; exceeding 120% is top-tier performance.

- Enterprise Net Dollar Retention (NDR) declined from 120% in 2021 to 108% by Q3 2024.

- Avoidable churn, like expired credit card accounts for 20%–40% of total SaaS churn.

- Approximately 30%–40% of SaaS licenses go unused in enterprises, raising churn risk.

- A 5% reduction in churn can boost SaaS company profits by up to 95% over five years.

- Fixing involuntary churn can lift revenue by 8.6% in the first year.

- Companies focused on retention automation recover up to 70% of involuntary churn.

- Customer churn inversely correlates with Customer Lifetime Value (CLTV), where lower churn extends CLTV significantly.

SaaS Customer Acquisition & Marketing Statistics

- SaaS companies allocate up to 40% of ARR toward sales and marketing efforts.

- Average CAC (Customer Acquisition Cost) for B2B SaaS rose 15% year-over-year.

- Word of mouth and SEO are the most effective channels for SaaS lead generation.

- Companies with strong onboarding processes improve retention by up to 50%.

- SaaS marketers using intent data report higher lead-to-opportunity conversion rates.

- Freemium models convert at rates between 2–5%, with premium features driving upgrades.

- Personalized email campaigns see 6x higher transaction rates compared to non-personalized ones.

- B2B SaaS firms that blog consistently generate 67% more leads per month.

- SaaS companies using product-led growth strategies see greater than 30% CAC savings.

- Retargeting ads improve SaaS conversion by up to 150% when applied across key buyer journey stages.

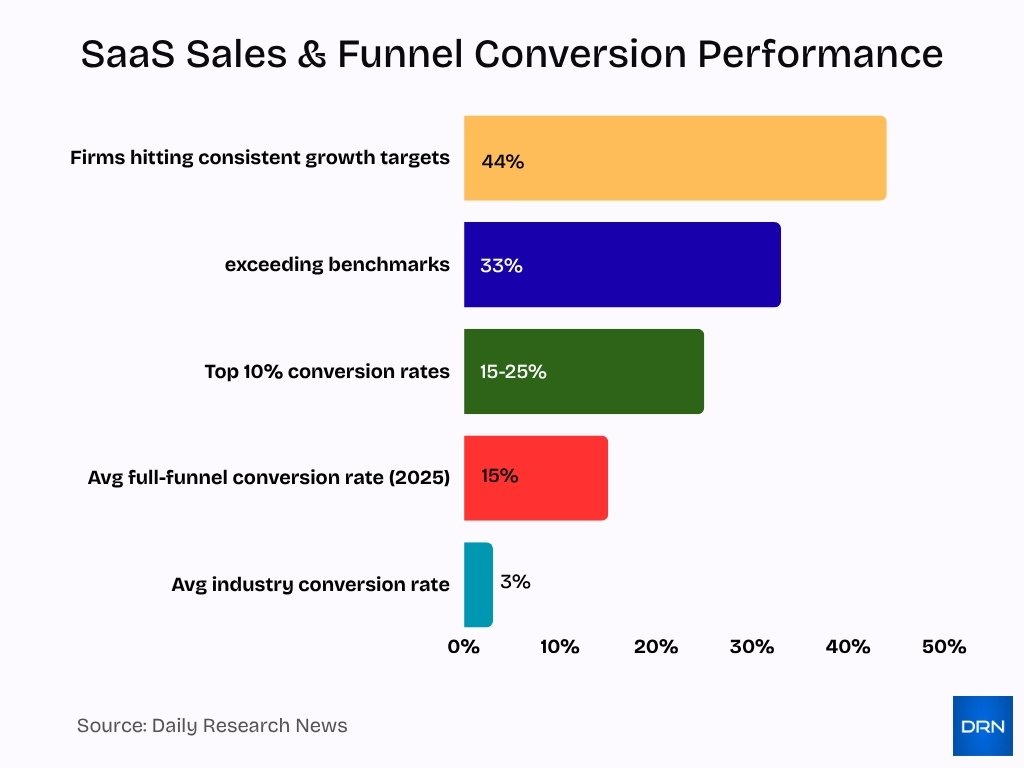

SaaS Sales Performance & Conversion Statistics

- The average full-funnel conversion rate for SaaS companies is 15.1% in 2025.

- Only about 33% of SaaS firms meet or exceed benchmark conversion rates.

- Top 10% of SaaS websites report conversion rates in the 15%–25% range.

- Mobile conversion rates lag desktop by 40–60% across SaaS categories.

- Trial-to-paid conversion rates are significantly higher in B2B than in B2C SaaS.

- The industry average conversion rate is 2.9% from website visit to action.

- Companies that track Time-to-First-Value (TTFV) report higher customer activation.

- Just 44% of B2B SaaS companies consistently hit growth targets.

SaaS Security, Compliance & Data Breach Statistics

- 28% of organisations experienced a SaaS-related data breach in the past year.

- 82% of data breaches in 2025 involved cloud-stored or SaaS-based data.

- The average cost per SaaS-related breach is approximately US$4.88 million.

- 79 supply-chain attacks affected 690 organisations and 78.3 million individuals in H1 2025.

- 68% of incidents involve human error, including phishing or stolen credentials.

- 83% of organisations experienced at least one cloud security breach in the past 18 months.

- 55% of companies have had a SaaS security incident, but only 26% cancel unused software formally.

- 36% of breached organisations experienced more than one breach in a single year.

SaaS Usage in SMBs vs Enterprises

- Enterprises account for over 60% of the global SaaS market revenue in 2025.

- SMB SaaS churn rates can exceed 20% annually, while enterprises maintain under 10% churn.

- Average SaaS apps per company declined from 112 in 2023 to 106 in 2024.

- Enterprises prefer multi-year contracts with 30-45% higher customer lifetime value than SMBs.

- SMBs favor monthly billing or freemium options due to higher price sensitivity.

- Enterprises manage between 125 and 200 SaaS apps on average, with significant governance structures.

- SMBs typically have a monthly churn rate between 3% and 7%, translating to very high annual churn.

- Enterprises prioritize SaaS features like analytics and integrations, while SMBs focus on onboarding and affordability.

- SaaS solutions are expected to make up 85% of all business software by 2025.

- Average SaaS spend per employee in enterprises reached $5,607, highlighting intensive usage and investment.

SaaS Statistics by Application Category (CRM, Marketing, Finance, etc.)

- 40% of enterprise SaaS apps embed AI in customer support functions.

- 45% of IT service management SaaS tools report AI usage.

- Marketing SaaS sees rapid AI adoption, including predictive analytics and chatbots.

- Finance SaaS uses AI for forecasting, anomaly detection, and fraud prevention.

- CRM SaaS integrates virtual agents and automation, boosting sales pipeline velocity.

- Multichannel marketing tools improve conversion rates by leveraging AI-enhanced journey analytics.

- HR SaaS embeds AI for recruiting, onboarding, and employee engagement.

- Vertical SaaS in healthcare, law, and manufacturing grows faster than general-use platforms.

- By 2025, 95% of organizations will adopt AI-powered SaaS applications across categories.

- The SaaS CRM market is projected to grow to $54.98 billion in 2025 with a CAGR of 20.5% to 2030.

SaaS Integrations & Ecosystem Statistics

- Organisations use an average of 7.3 SaaS apps with AI functionality in 2025.

- The global SaaS integration market is projected to surpass $15 billion in annual revenue by 2025.

- 79 supply-chain attacks in early 2025 impacted 690 companies and 78.3 million people related to SaaS integrations.

- Around 50% of SaaS companies are expected to integrate AI into their platforms by 2025.

- The Single Sign-On (SSO) market is projected to reach $1.81 billion in 2025 with a CAGR of 12.4%.

- SMBs prefer integrated SaaS solutions that reduce costs and require minimal IT intervention.

- SaaS app consolidation reduced the average number of apps per company from 112 in 2023 to 106 in 2024.

- Multi-year SaaS contracts now account for 40% of total agreements in 2025, up from 14% in 2022.

- Over 60% of enterprise SaaS products embed AI features as of 2025.

- Consolidation rates dropped from 14% to 5% year-over-year in SaaS app usage among companies in 2024.

Most Popular SaaS Products & Vendors (By Users or Revenue)

- Microsoft Azure is projected to reach $76 billion in annual SaaS revenue by 2025.

- OpenAI leads with over $12.7 billion in revenue and 1.5 billion monthly visitors in 2025.

- 60%+ of enterprise SaaS products now have embedded AI features, driving new adoption.

- 40% of SaaS contracts are multi-year, reflecting high vendor trust and reduced churn.

- AI-native SaaS firms report ARR per employee exceeding US$580,000 in top performers (2025).

- Leading public SaaS companies hold EV/revenue multiples of 6.1× in 2025 benchmarks.

- Private equity deals and acquisitions remain strongest in AI and vertical SaaS, with record global activity.

- Top-performing SaaS vendors achieve Net Revenue Retention (NRR) over 120%, setting industry standards.

- Global vendors like Salesforce and HubSpot maintain market dominance by active user count and revenue.

- Cloud Service Provider (CSP) bundles, notably Azure, AWS, and Google Cloud, influence enterprise vendor choice in 2025.

Key Future Trends in the SaaS Industry (2025 and Beyond)

- 56% of SaaS companies now use usage-based pricing, a 31% increase since 2023.

- Pure subscription models fell from 65% to 43% as usage and hybrid pricing grow.

- Hybrid (subscription + usage) pricing delivers the highest median growth rate of 21% for SaaS firms.

- AI-driven automation will replace 30% of traditional SaaS workflows by 2027.

- SaaS app portfolios declined as firms now average 342 apps, down from 374 last year; the trend continues.

- 29% reduction of SaaS apps in mid-sized firms, evidence of consolidation and platform integration.

- 44% of SaaS platforms monetize AI-powered features, unlocking new revenue streams.

- By 2025, 95% of organizations will adopt AI-powered SaaS apps, with over half using generative AI.

- Security breaches in SaaS are up, with 66% of companies reporting increased revenue after deploying AI security tools.

- The APAC region, Africa, and Latin America are forecast to lead global SaaS expansion through localization.

Frequently Asked Questions (FAQs)

The global SaaS market is projected to reach approximately USD $408.21 billion in 2025.

The AI SaaS market is expected to grow at a 38.28% CAGR from USD $71.54 billion in 2023 to USD $775.44 billion by 2031.

Approximately 85% of business applications are expected to be SaaS‑based by 2025.

About 86% of companies say SaaS security is a top priority in 2025.

Conclusion

The SaaS industry is defined by strategic transformation. Companies are navigating an environment where AI, integration, security, and flexible pricing all converge. While enterprises dominate revenue and shape platform trends, SMBs are reshaping accessibility and agility. Vendors embedding AI capabilities, optimizing conversions, and building scalable ecosystems will lead the market. At the same time, customers expect more from SaaS providers: better onboarding, security transparency, measurable ROI, and seamless functionality.

As the landscape continues to evolve, SaaS companies must be more than service providers. They must become strategic partners, offering not just tools, but outcomes. With change accelerating, the companies that thrive will be those that anticipate needs, prioritize user experience, and drive continuous value.