The company Samsung Electronics stands today at a critical inflection point. It balances renewed momentum in semiconductors, steady smartphone demand, and a more diversified business mix, signaling a rebound in revenue and profitability after a challenging recent past. In real-world terms, that translates both into stronger investor confidence and continuing supply of Galaxy smartphones, memory chips, and home electronics worldwide. In the sections below, you will find data-backed insights that show how Samsung is performing, and why that performance matters.

Editor’s Choice

- In Q3 2025, Samsung posted KRW 86.1 trillion in consolidated revenue, up 15.4% quarter-on-quarter.

- The same quarter delivered an operating profit of KRW 12.2 trillion.

- Fiscal year 2024 revenue stands at KRW 285.4 trillion ($211.2 billion), marking a 2.6% year-on-year increase.

- The Device Solutions division, semiconductors and memory, accounted for about 46% of the total 2024 revenue.

- For 2025 (TTM), Samsung’s revenue is listed at approximately ₹19.706 trillion in INR-based reporting.

- In Q2 2025, the Mobile eXperience (MX) business saw year-on-year growth in both revenue and operating profit thanks to Galaxy S25 and A-series sales.

- Samsung’s renewed profitability coincides with a global rebound in memory demand and a strong showing in high-value memory products for AI and servers.

Recent Developments

- Samsung posted KRW 86.1 trillion revenue and KRW 12.2 trillion operating profit in Q3 2025, up 15.4% QoQ.

- DS Division achieved KRW 33.1 trillion revenue and KRW 7.0 trillion profit in Q3 2025, with 19% sales growth QoQ.

- Memory Business hit a record-high quarterly revenue in Q3 2025 via HBM3E expansion and server SSD demand.

- DS Division generated KRW 27.9 trillion in revenue in Q2 2025, focusing on high-density DDR5 and HBM3E.

- MX Business sold over 20.22 million Galaxy S25 series units by June 2025, crushing S24 sales.

- Foundry ramps 2nm GAA mass production in H2 2025 for mobile SoCs, targeting advanced nodes.

- SDC posted KRW 8.1 trillion in revenue in Q3 2025, driven by flagship smartphone displays.

- Samsung allocated KRW 53.6 trillion in capex in 2024, with KRW 46.3 trillion to DS semiconductors.

- Galaxy S25 Ultra led with 9.64 million units sold by June 2025, boosting MX growth.

Samsung Overview

- Samsung Electronics reported $53.7 billion in consolidated revenue in Q1 2025.

- The company achieved a net income of $25.17 billion in 2024, recovering strongly from $11.29 billion in 2023.

- Samsung holds the largest global market share in memory semiconductors with over 40% in DRAM and about 35% in NAND flash.

- Samsung sold approximately 173.5 million smartphones in the first three quarters of 2023, targeting 270 million units for the full year.

- Samsung Display leads the AMOLED market with around 43% market share in small and medium panels in 2023.

- Samsung India Electronics reported an 11% revenue increase to Rs 1.11 trillion in FY 2025.

- Samsung’s memory segment revenue grew by 71.8% in 2024, contributing to 25.2% of the total semiconductor market share.

- Samsung invested a record 35 trillion Korean won in R&D, and 53.6 trillion Korean won in facility investment in 2024.

- Samsung Display is projected to hold a 41% revenue share of the OLED market in 2025.

- Samsung’s flexible business mix enables quick pivoting among semiconductors, mobile devices, and displays, supporting sustained growth across global markets.

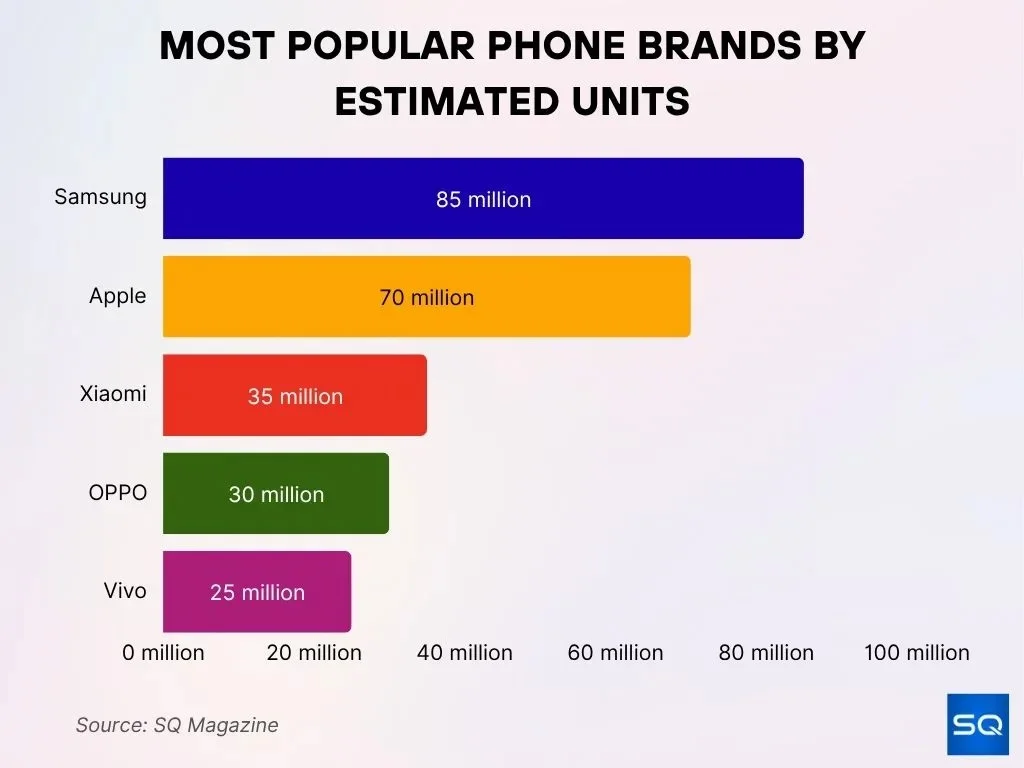

Most Popular Smartphone Brands by Estimated Unit Sales

- Samsung leads the ranking with an estimated 85 million units, highlighting its strong dominance across global markets and varied price categories.

- Apple comes next with roughly 70 million units, maintaining its firm stronghold in the premium smartphone segment.

- Xiaomi secures the third position with 35 million units, demonstrating steady demand for its budget-friendly smartphone lineup.

- OPPO achieves an estimated 30 million units, backed by its innovations in camera systems and fast-charging technology.

- Vivo completes the top five with around 25 million units, propelled by its consistent performance in Asian and emerging markets.

Samsung Revenue and Financial Performance

- In fiscal 2024, Samsung generated KRW 285.4 trillion in consolidated revenue.

- That marked a 2.6% increase year-on-year, a recovery after a slump in 2023.

- Q3 2025 alone delivered KRW 86.1 trillion in revenue, a 15.4% increase from the previous quarter.

- For 2025 (trailing 12 months), revenue in INR-based reporting is ₹19.706 trillion.

- In Q1 2025, Samsung posted consolidated revenue of ₩79.14 trillion (US$55.4 billion).

- In 2024, the company engaged in substantial capital expenditures to support Device Solutions, Display, and Device Experience segments, securing capacity for future growth.

- Diversified revenue streams across semiconductors, mobile devices, and displays helped mitigate cyclical volatility inherent in individual segments.

- The revenue recovery in 2024–2025 reflects both macro-level recovery in global chip demand and strategic execution across segments.

Samsung Profit, Net Income, and Margins

- Samsung posted Q3 2025 consolidated revenue of KRW 86.1 trillion, up 15.4% QoQ.

- Operating profit hit KRW 12.2 trillion in Q3 2025, surging 159.6% QoQ and 32.6% YoY.

- Q3 2025 net profit margin stood at 14.2%, boosted by semiconductor strength.

- Q1 2025 operating profit reached KRW 6.7 trillion ($4.71 billion), up 1.2% YoY.

- Net income in Q1 2025 climbed to KRW 8.22 trillion ($5.7 billion), rising 21.7% YoY.

- Q2 2025 operating profit fell to KRW 4.7 trillion, down 54.8% YoY amid chip weakness.

- 2025 full-year net income projected at KRW 37.35 trillion, up 11.1% from 2024.

- Device Solutions Division delivered Q3 2025 operating profit of KRW 7 trillion, up 1650% QoQ.

Samsung Market Capitalization and Valuation

- As of November 2025, Samsung Electronics has a market capitalization of ₹40.889 trillion.

- On a dollar basis, Samsung’s market cap stood around US$463.82 billion in late November 2025.

- That valuation reflects a roughly 61–62% increase year-on-year.

- Enterprise-value metrics list Samsung at 578.89T (KRW base) as of late 2025.

- On a trailing-12-month revenue basis, Samsung reports US$220.84 billion.

- Its price-to-earnings ratio is around 21.4.

- Analysts consider Samsung a large-cap global tech firm, ranked among the world’s top companies by valuation.

- The robust valuation reflects renewed investor confidence, driven by a rebound in semiconductor demand and stabilized smartphone sales.

Samsung Global Market Position

- Samsung reclaimed the No. 1 spot in global semiconductors with $66.5 billion in revenue in 2024.

- The global semiconductor market grew 18.1% to $626 billion in 2024, led by Samsung.

- Samsung held 34.8% DRAM market share with $13.9 billion in revenue in Q3 2025.

- Samsung led global smartphones with 19% market share, shipping 61.4 million units in Q3 2025.

- Samsung Display commanded 41% OLED revenue share globally in 2025.

- Samsung captured a 21% share of the US home appliances market by sales in 2023.

- Samsung topped global gaming monitors with 21.0% revenue share in 2024.

- Samsung Foundry secured a 7.3% market share with $3.16 billion in revenue in Q2 2025.

- Samsung generated $96.9 billion from semiconductors, nearly half its total revenue in 2024.

Samsung Business Segments Breakdown

- Device Solutions generated KRW 131 trillion ($96.9 billion), 46% of Samsung’s total 2024 revenue.

- IT & Mobile Communications delivered KRW 100.8 trillion ($74.5 billion) from smartphones and tablets in 2024.

- Consumer Electronics contributed KRW 53.6 trillion ($39.7 billion), driven by TVs and appliances in 2024.

- Samsung allocated KRW 46.3 trillion of 2024 capex to the DS division semiconductors out of a total of KRW 53.6 trillion.

- MX business posted KRW 25.8 trillion revenue and KRW 2.1 trillion profit in Q4 2024.

- Display business (SDC) achieved KRW 8.1 trillion in revenue in Q4 2024 amid smartphone demand shifts.

- Visual Display & Appliances generated KRW 14.4 trillion in revenue in Q4 2024 with peak-season sales.

- Samsung’s DS division held over 57% of the 2024 operating profit from memory chips.

- Total 2024 revenue reached KRW 285.4 trillion ($211.2 billion) across diversified segments.

Samsung Semiconductor and Memory Business Statistics

- Samsung’s semiconductor revenue hit US$66.5 billion in 2024, reclaiming the top global vendor position.

- DS Division generated 111.1 trillion KRW ($76.4 billion) in 2024 sales, a record high.

- Memory business achieved record Q4 2024 revenue of 30.1 trillion KRW, driven by HBM and DDR5.

- Foundry revenue reached $3.26 billion in 4Q24, securing 8.1% market share.

- The global semiconductor market grew 18.1% to $626 billion in 2024, boosting Samsung’s operations.

- Samsung held 36.9% NAND market share in Q2 2024, leading the industry.

- DRAM revenue worldwide surged 75.4% in 2024, with HBM at 13.6% of total DRAM sales.

- DS Division contributed 34% to Samsung’s total 2024 sales of 300.9 trillion KRW.

Samsung Mobile and Smartphone Business Statistics

Samsung captured 20% global smartphone market share in Q2 2025, leading all vendors.

Global smartphone shipments hit 295.2 million units in Q2 2025, up 1-2% year-over-year.

Samsung shipped approximately 57.5 million smartphones in Q2 2025, growing 7-8% YoY.

Samsung Mobile eXperience (MX) posted KRW 34.1 trillion revenue in Q3 2025, up 11.8% YoY.

Samsung MX achieved KRW 3.6 trillion operating profit in Q3 2025, rising 28.6% YoY.

Samsung MX revenue reached KRW 29.2 trillion in Q2 2025 with KRW 3.1 trillion profit.

Samsung India Electronics’ revenue surged 11% to ₹1.11 lakh crore in FY25, driven by mobiles.

Samsung saw Q3 2025 consolidated revenue of KRW 86.1 trillion, up 15.4% QoQ.

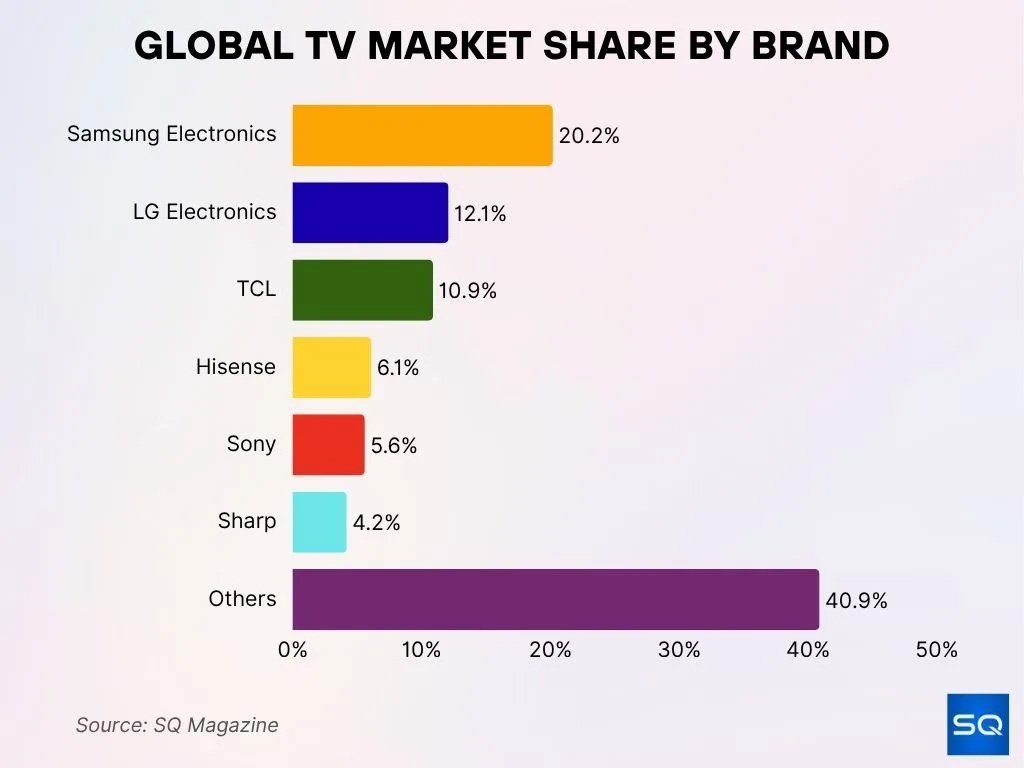

Global Television Market Share by Leading Brands

- Samsung Electronics retains a leading position with a 20.2% market share, continuing its dominance in the global TV industry.

- LG Electronics holds 12.1%, backed by its premium OLED technology and innovative television offerings.

- TCL secures 10.9%, driven by competitive pricing and strong performance in mid-range markets.

- Hisense captures 6.1%, steadily expanding its presence in the affordable smart TV segment.

- Sony commands 5.6%, leveraging its strong reputation for high-quality display technology.

- Sharp accounts for 4.2%, maintaining a smaller yet consistent market share.

- Others collectively represent 40.9%, highlighting the highly fragmented market with numerous regional and niche brands.

Samsung Smartphone Market Share Worldwide

- In Q1 2025, Samsung shipped 60.5 million smartphones globally, claiming a 20% share of the global market.

- In Q2 2025, global smartphone shipments reached 295.2 million units, and Samsung’s share remained close to 20%.

- In Q3 2025, Samsung shipped 61.4 million units, corresponding to a 19% market share, keeping the top vendor rank.

- The broader global smartphone market grew in Q3 2025 by 3% year-over-year, amounting to 320.1 million units shipped worldwide.

- Between Oct 2024 and Oct 2025, Samsung held around 20.3% share of the global mobile vendor market.

- Some 2025 estimates place Samsung’s contribution to Android smartphone shipments at 19–20%.

- Across 2024–2025, Samsung’s shipment share fluctuated but stayed near 19–20%, indicating stability amid competition.

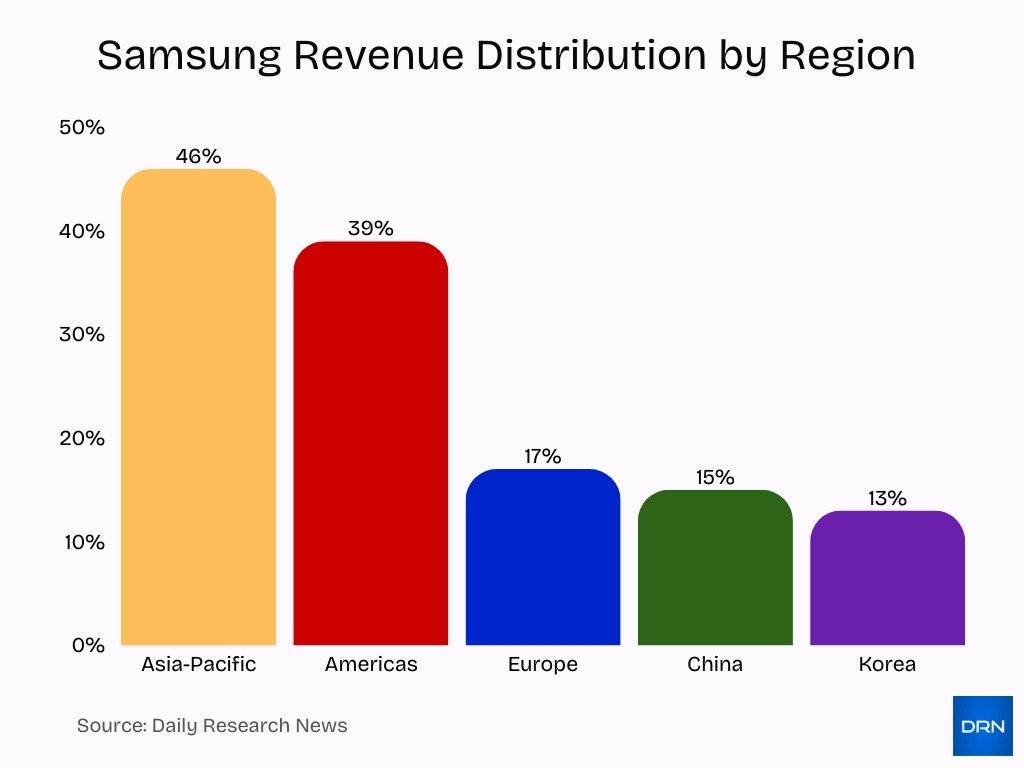

Samsung Regional Sales and Revenue Distribution

- India’s exports of smartphones, TVs, and appliances from Samsung surged 25% to ₹45,930 crore in FY 2024-25.

- India exports accounted for 42% of Samsung India’s total revenue in FY 2024-25.

- Samsung India’s revenue from operations rose 11% to ₹1.11 lakh crore in FY 2024-25.

- Asia-Pacific contributed 46% of Samsung’s global sales revenue in 2024.

- The Americas generated 39% of Samsung’s total revenue worldwide in 2024.

- Europe represented 17% of Samsung’s sales revenue globally in 2024.

- China accounted for 15% of Samsung’s global revenue in 2024.

- Samsung’s home market, Korea, held 13% of the total revenue share in 2024.

- Samsung India’s revenue grew 14% YoY, the second-largest smartphone market after the US.

Samsung Smartphone Shipments and Unit Sales

- Q2 2025 global smartphone shipments amounted to 295.2 million units globally, a 1.0% year-over-year increase.

- In Q2 2025, Samsung shipped 58.0 million units, up about 7.9% YoY, capturing nearly 20% global market share.

- Q3 2025 saw Samsung ship 61.4 million smartphones, reflecting a 6.3% increase compared to Q3 2024.

- Global smartphone shipments in Q3 2025 rose 3% YoY to 320.1 million units.

- Samsung’s shipments in Q3 2025 gave it a 19% market share, enough to remain the top smartphone vendor worldwide.

- YoY shipment growth suggests Samsung continues to see stable demand globally despite macroeconomic pressures.

- Samsung’s unit sales remain robust globally, driven by both high-end models and mid- to budget-tier devices appealing in diverse markets.

- The trend confirms that Samsung remains one of the few manufacturers capable of shipping 50–60 million units per quarter.

Samsung Top Selling Galaxy Models Statistics

- Galaxy S25 Ultra ranked 7th globally in Q1 2025 best-selling smartphone.

- Galaxy A16 5G was Samsung’s top-selling model worldwide in Q1 2025.

- Samsung shipped 57.5 million smartphones in Q2 2025, up 7% YoY, driven by Galaxy S25.

- Samsung held 19% global market share with 6% YoY shipment growth in Q3 2025.

- Galaxy A-series drove Samsung’s Q3 2025 growth, including A17 and A07 models.

- Samsung shipped 60.6 million units in Q3 2025, led by foldables and A-series.

- Galaxy Z Fold7 US sales outpaced the prior model by 50% post-launch.

- Galaxy Z Fold7/Z Flip7 preorders rose 25% over the previous generation.

- Galaxy S25 series contributed 25% of Samsung’s smartphone sales in the launch month.

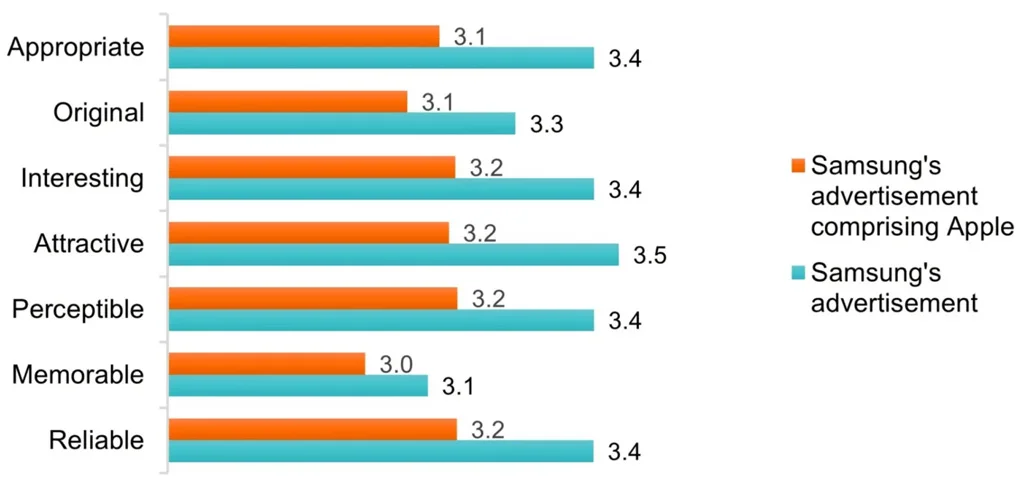

Comparative Evaluation of Samsung Advertisements With and Without Apple Mentions

- Appropriate: Samsung ads with Apple reference scored 3.1, while standard Samsung ads registered a higher score of 3.4.

- Original: Ads referencing Apple received a score of 3.1, in comparison to the 3.3 scored by regular Samsung ads.

- Interesting: Ads mentioning Apple obtained 3.2, which was slightly lower than the 3.4 achieved by Samsung-only ads.

- Attractive: The Apple-inclusive ads scored 3.2, while the Samsung-only ads performed slightly better with a score of 3.5.

- Perceptible: The Apple-inclusive ads achieved a score of 3.2, whereas the Samsung-only ads reached 3.4.

- Memorable: Showing the smallest difference, the Apple-referencing ads scored 3.0, compared with 3.1 for the Samsung-only ads.

- Reliable: Reflecting a similar trend as other metrics, the Apple-inclusive ads scored 3.2, while the Samsung-only ads scored 3.4.

Samsung Research and Development Statistics

- Samsung invested ₩35 trillion in R&D in 2024, its highest-ever annual amount.

- In Q1 2025, Samsung boosted R&D spending by 16% YoY to ₩9 trillion.

- Samsung spent $29 billion on R&D in 2024, tripling from $7 billion in 2009.

- Semiconductor R&D rose 71.3% to $9.5 billion in 2024 among top firms.

- Samsung ranked #1 in global research innovation in 2024 by Clarivate.

- Samsung secured 6,377 US patents in 2024, up 3% YoY and top spot.

- Over 30% of Samsung‘s 267,000 employees focus on R&D roles.

- Samsung operates 42 global R&D centers across key regions.

- Samsung hired 14,800 new R&D staff in 2024 for AI and semis.

Samsung Brand Value and Ranking Statistics

- Samsung tops YouGov’s Best Global Brands 2025 rankings as the world’s best brand among global consumers.

- Samsung ranks 5th in Interbrand’s Best Global Brands 2025 with a $90.5 billion brand value for the sixth consecutive year.

- Samsung maintains its status as the only Asian company in Interbrand’s global top 5 brands since 2020.

- Samsung achieved a brand value surpassing $100 billion in prior Interbrand rankings, driven by AI technologies.

- Samsung holds the No.1 mobile brand globally in 2025 with a 19.7% market share.

- Samsung was recognized in Interbrand’s Global Top 5 for the fifth consecutive year in 2024, before 2025 retention.

- Connected TV campaigns on Samsung Smart TVs deliver up to 8.5% uplift in Gen Z purchase intent.

- Samsung consistently finished in the top 4 of YouGov rankings from 2017-2022 before topping in 2025.

Frequently Asked Questions (FAQs)

Samsung held about 19% of global smartphone shipments in Q3 2025.

Samsung shipped approximately 60.6 million smartphones globally in Q3 2025.

Samsung’s trailing-12-month (TTM) revenue in 2025 was about ₹19.706 trillion.

Samsung’s U.S. smartphone market share rose to 31% in Q2 2025 (up from 23% in Q2 2024).

Conclusion

Samsung demonstrates a rare blend of scale, diversification, and innovation. From robust smartphone shipments and global market share to heavy R&D investment and a varied Galaxy lineup, this company has built multiple levers to stay competitive. Its global manufacturing footprints, combined with flagship and mass-market devices, reinforce both regional relevance and global leadership.

As technology evolves, with memory chips, AI, foldables, and more, Samsung appears well-positioned to adapt and grow. The data-driven snapshot above offers a clear view into how Samsung navigates complexity and sustains momentum throughout shifting global trends.