Scams are no longer fringe crimes; they are a pervasive part of everyday life. From online phishing campaigns to investment fraud, individuals and businesses alike are dealing with increasingly sophisticated schemes that strip billions in value annually. In the U.S. alone, scammers stole more than $16.6 billion in 2024, marking a sharp rise in both frequency and financial impact. Across industries, fraud affects everything from banking and e-commerce to social platforms, while everyday consumers grapple with identity theft and romance scams. For instance, businesses worldwide are losing an average of 7.7% of annual revenue due to fraud, underscoring the threat’s reach.

Editor’s Choice

- $16.6 billion lost to scams in the U.S. in 2024, up sharply from prior years.

- 2.6 million fraud reports logged with the FTC in 2024.

- 57% of adults globally reported scam encounters in the past year.

- 23% of adults worldwide reported financial loss from scams.

- 1,003,924 phishing attacks recorded in Q1 2025.

- 7.7% of business revenue is lost to fraud globally.

- 3.4 billion phishing emails were sent daily in 2025.

Recent Developments

- FBI warned of AI-generated virtual kidnapping scams using deepfakes, with a deepfake incident reported every 5 minutes worldwide in 2024.

- The UK FCA launched Firm Checker after 800,000 people reported losing money to investment scams in the 12 months to May 2024.

- QR code phishing attacks surged by 25% year-over-year into 2025, with 26% of phishing using QR codes for malware.

- International crackdowns rescued over 7,000 workers from cyber scam centers in Myanmar, awaiting repatriation in 2An 025.

- The Interpol operation led to 260 arrests in African romance scam rings, targeting 1,400 victims who lost $2.8 million.

- Deepfake incidents hit 179 in Q1 2025, a 19% rise over all of 2024, with AI scams up 456% year-over-year.

- Synthetic identity fraud accounts for 80% of new account fraud, projected to cause $23 billion in losses by 2030.

- First-party fraud now represents 36% of global fraud in 2024, up from 15% the prior year.

- GenAI-enabled scams rose by 456% from May 2024 to April 2025 amid expanding deepfake threats.

Global Scam Overview

- 57% of adults worldwide encountered a scam in the last year.

- 23% of global scam victims lost money financially.

- Shopping scams impacted 54% of global scam victims.

- Investment scams hit 48% of those surveyed worldwide.

- Scam resolution usually occurs within one day for 64% of cases.

- Globally, phishing remains among the top scam vectors.

- Fraud patterns show rising complexity with AI and deepfake integration.

- Underreporting continues to obscure the full scale of scams globally.

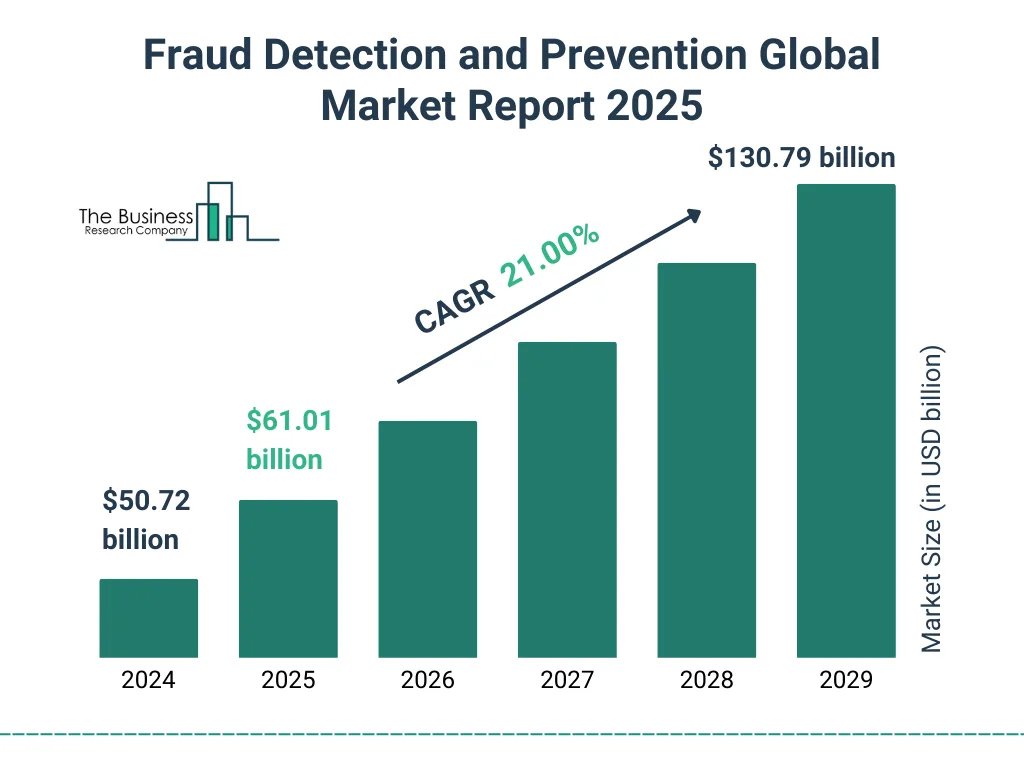

Global Fraud Detection and Prevention Market Growth

- The fraud detection and prevention market is anticipated to expand from $50.72 billion in 2024 to $130.79 billion by 2029, demonstrating substantial global growth.

- In 2025, the market is projected to reach $61.01 billion, indicating strong early momentum in its upward trajectory.

- The industry is forecasted to grow at a CAGR of 21.00% over the next 5 years, highlighting a robust pace of expansion.

- The market size continues to show consistent yearly growth, nearly tripling by 2029, underscoring sustained industry acceleration.

Global Economic Impact of Scams

- Global scam losses were estimated at over $1 trillion in 2024.

- Businesses worldwide lose roughly 7.7% in revenue to fraud annually.

- U.S. cybercrime losses reached $16.6 billion in 2024.

- BEC scams caused $2.7 billion in losses.

- Identity fraud and scams drain consumer confidence and economic participation.

- Scams add hidden costs, including legal, recovery, and prevention investments.

- E-commerce fraud is causing significant retail merchant losses.

- Global investments in fraud detection tech have surged to counter losses.

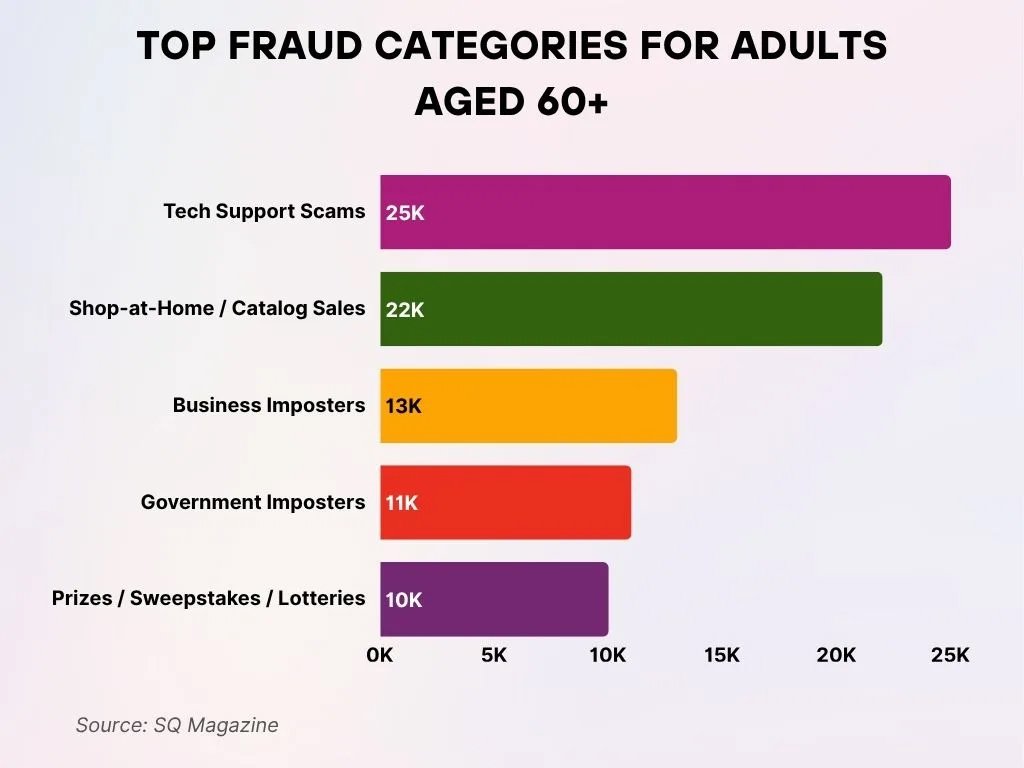

Leading Fraud Categories Affecting Adults Aged 60+

- Prize, sweepstakes, and lottery scams emerged as the fifth most common fraud, accounting for 10,000 loss-related reports.

- Tech support scams remained the top-ranked threat, generating 25,000 reports of financial loss, reflecting the most prevalent fraud impacting older adults.

- Shop-at-home and catalog sales scams ranked next in frequency, producing 22,000 reports involving monetary losses.

- Business impostors represented a major concern for old people, with 13,000 documented cases of financial harm.

- Government impostors contributed to widespread issues, resulting in 11,000 reports from individuals aged 60 and older.

Average Loss per Scam Victim

- Estimated global scam losses reached approximately $442 billion in 2024.

- 1 in 7 consumers worldwide reported being scammed in the past year.

- The average loss per scam victim globally is roughly $545.

- Phishing attacks alone caused an estimated $17.4 billion in losses in 2024.

- In the U.S., scam losses hit $16.6 billion in 2024, up 33% from 2023.

- Older adults, 60+, reported losses totaling nearly $4.8 billion in the U.S. in 2024.

- Investment and cryptocurrency fraud complaints exceeded $6.5 billion in losses.

- Among phishing victims, the typical breach costs organizations $4.8 million.

- Many scam victims report losing between $100 – $249 on average in online and phone scams.

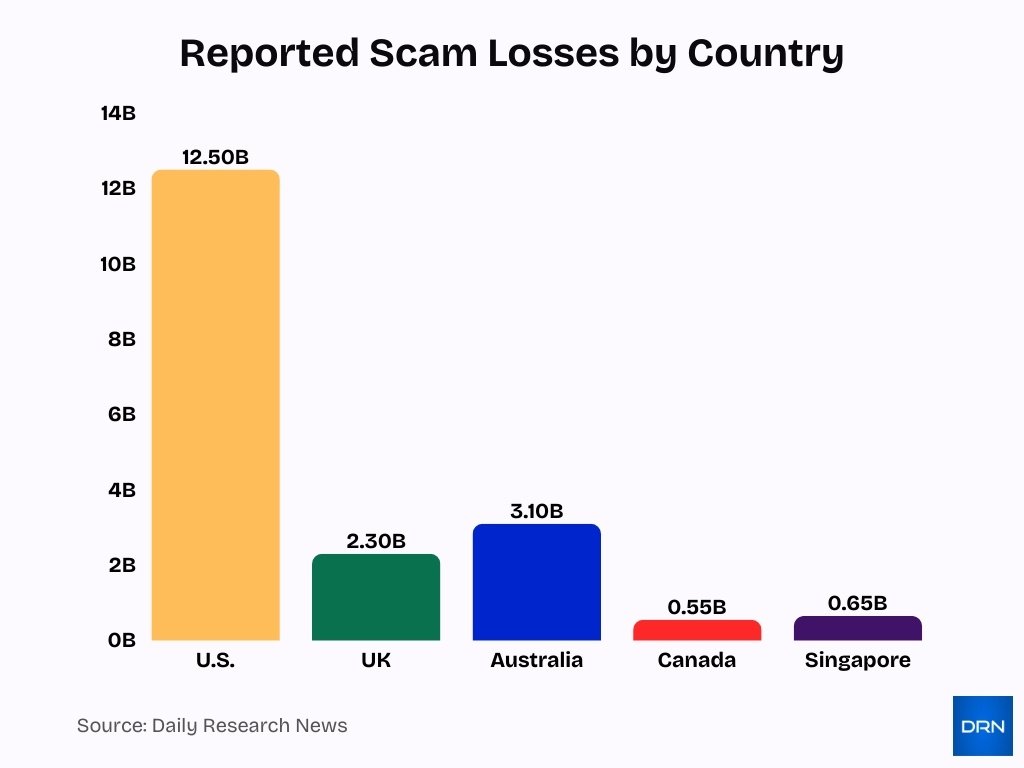

Scam Statistics by Country and Region

- The U.S. recorded scam losses exceeding $12.5 billion in 2024, up 18% from 2023.

- The UK saw over 4.7 million fraud reports in 2024, with losses surpassing £2.3 billion.

- In India, digital payment scams rose by 45% year-over-year, impacting over 120 million users.

- Australia reported more than $3.1 billion AUD in scam losses in 2023, triple the 2020 figure.

- Brazil saw a 22% increase in online fraud, with nearly 1 in 5 internet users targeted.

- Nigeria reported that 38% of adults encountered digital scams, mostly via social media.

- In Japan, phishing-related scams climbed 67% in 2024, hitting a record 76,000 cases.

- Canada lost over $550 million CAD to fraud in 2024, a rise of 40% from the prior year.

- Singapore’s scam victims lost about SGD 650 million in 2023, mainly through investment fraud.

- In Europe, cross-border scams accounted for nearly 30% of reported financial fraud incidents.

Online and Digital Scam Statistics

- Approximately 1 in 7 consumers reported being scammed online in the past year.

- Phishing emails account for about 1.2% of total global email traffic and 3.4 billion phishing emails daily.

- AI-enabled phishing attacks surged over 1,000% with new automation tools.

- Phishing-related breaches cost firms an average of $4.8 million per incident.

- Online scam vectors include social media, email, chat apps, and fake websites.

- Malicious actors increasingly use QR code-based phishing to bypass protections.

- Deepfake-assisted scams are emerging in digital spaces, complicating detection.

- Mobile apps and fake digital storefronts contribute to e-commerce fraud.

- Online dating sites are exploited for investment and romance scams with a global reach.

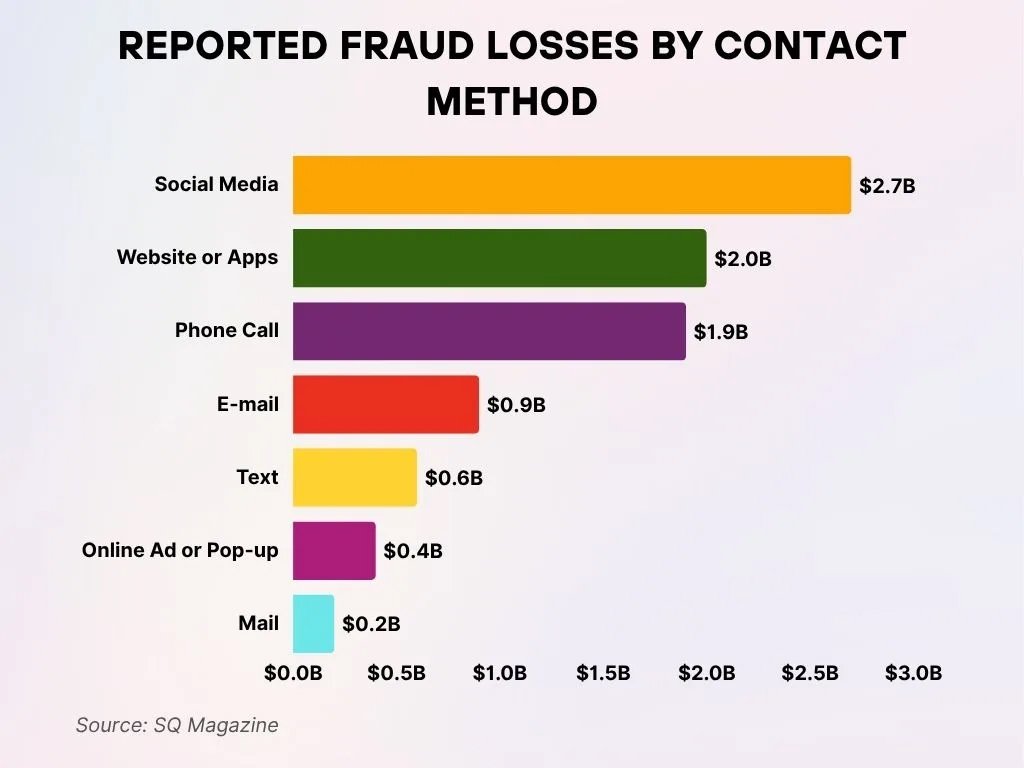

Reported Fraud Losses by Type of Contact Method

- Social media stands out as the primary source of fraud losses, generating a substantial $2.7 billion in reported damages.

- Websites or apps rank next, with consumers reporting fraud losses amounting to $2.0 billion.

- Phone calls follow closely, being responsible for an estimated $1.9 billion in financial losses.

- Email-based scams contributed significantly, leading to reported losses totaling $0.9 billion.

- Text message fraud resulted in consumer losses reaching $0.6 billion.

- Online ads or pop-ups accounted for notable fraud-related damages of $0.4 billion.

- Mail scams, though less frequent, still produced meaningful losses of $0.2 billion.

Phone and SMS Scam Statistics

- Voice phishing surged 442% in 2025, fueled by AI voice cloning.

- Smishing attacks comprised 39% of mobile threats in 2024, up over 300% since 2023.

- 68% of Americans receive scam phone calls at least weekly.

- Phone scam reports to the FTC rose 9% in the first half of 2025 vs 2024.

- Phone impersonation scams formed 32% of imposter fraud reports in 2023.

- Scam calls to Americans hit 2.56 billion monthly in 2025.

- IVR fraud accounts for 27% of telephony fraudulent activity.

- US consumers lost $86 million to smishing in 2019.

- Florida reported 3,199 phone/mobile scams in H1 2025.

Email and Phishing Scam Statistics

- Phishing attacks represent the initial vector in 36% of all data breaches worldwide.

- 3.4 billion phishing emails flood global inboxes every single day.

- Google blocks over 100 million phishing emails daily, yet threats persist.

- 57% of organizations face phishing attempts daily or weekly.

- The average cost of a phishing breach reaches $4.88 million per organization.

- AI-generated phishing emails achieve a 54% click-through rate, far exceeding human-written ones.

- 82.6% of phishing emails now incorporate AI-generated content for personalization.

- MFA phishing attempts succeed in about 5% of cases, leading to breaches.

- 99.5% catch rate by advanced spam filters still allows sophisticated phishing through.

Investment and Crypto Scam Statistics

- Investment fraud was the costliest scam category in 2024, with losses of about $6.57 billion in the U.S.

- Cryptocurrency investment scams generated 41,557 complaints in 2024, a 29% increase from 2023.

- Losses from crypto investment scams reached roughly $5.7 billion, up 47% year over year.

- The FBI’s Operation Level Up notified 5,831 victims of cryptocurrency fraud by early 2025.

- Approximately 77% of those notified were unaware they’d been scammed before being contacted.

- Nearly $2.5 billion was lost to crypto scams and hacks in the first half of 2025.

- About $1.71 billion of these losses stemmed from compromised wallets.

- Pig butchering scams have grown rapidly, blending emotional manipulation with fraudulent crypto investments.

- Crypto continues to be one of the most common mediums facilitating fraud across scam types.

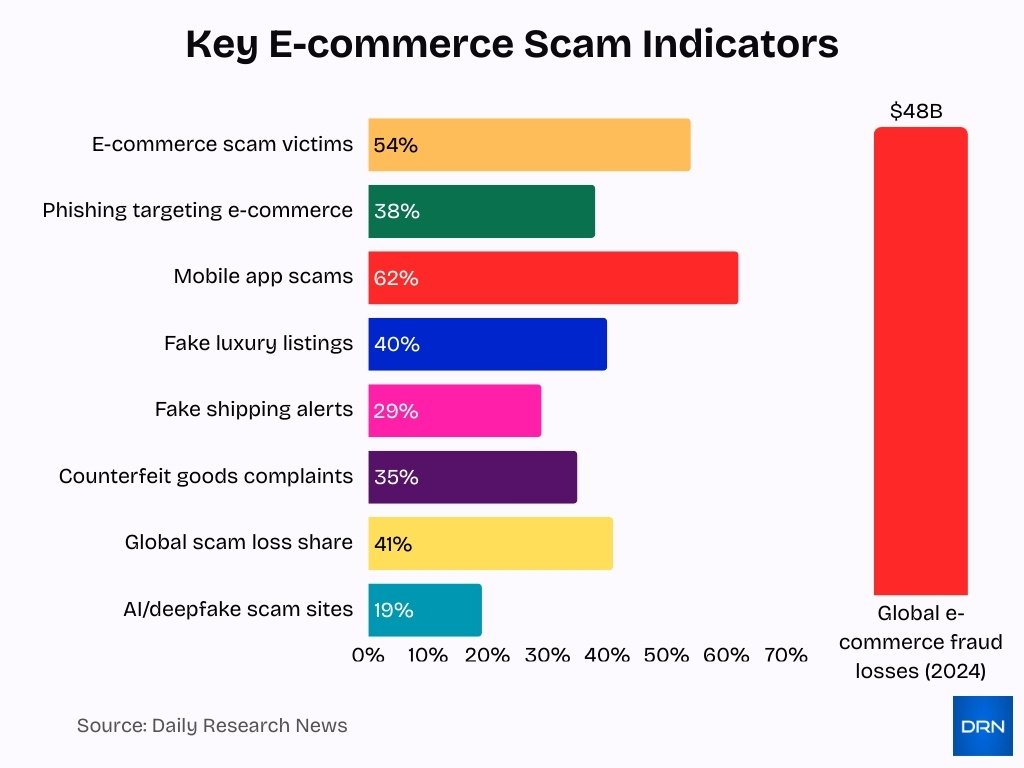

E-commerce and Online Shopping Scam Statistics

- 54% of global scam victims reported encountering shopping or e-commerce scams in 2025.

- Around $48 billion in global losses were linked to e-commerce fraud in 2024.

- Nearly 1 in 4 online shoppers experienced a non-delivery scam at least once last year.

- 38% of all phishing attacks in 2025 targeted e-commerce platforms and payment gateways.

- 62% of e-commerce scams occurred via mobile apps rather than desktop sites.

- Over 40% of fraudulent listings on major marketplaces promoted nonexistent luxury products.

- Fake shipping notifications accounted for 29% of reported e-commerce phishing attempts.

- Counterfeit goods made up 35% of all e-commerce-related consumer complaints in 2025.

- About 19% of detected e-commerce scam sites used AI-generated or deepfake endorsements.

- E-commerce fraud contributed roughly 41% of total global online scam losses in 2025.

Banking and Payment Fraud Statistics

- 79% of organizations faced payment fraud attacks in 2024.

- 63% of organizations reported check fraud incidents in 2024.

- Fraudulent payment volume rose 40.7% to 815K in 2024.

- BEC scams totaled $2.77 billion in losses across 21,442 incidents in 2024.

- Wire transfers topped BEC vulnerability, with 60% vendor impersonation.

- Authorized push payment fraud losses hit $8.3 billion in 2024.

- Bank fraud value tripled to ₹36,014 crore in FY25.

- Consumers lost $12.5 billion to fraud, up 25% in 2024.

- Banking scams surged 65% globally in the last year.

Romance and Dating Scam Statistics

- Reported U.S. romance scam losses reached $1.14 billion in 2024, up 9% from 2023.

- Over 64,000 Americans filed romance scam complaints in 2024.

- Victims aged 60+ lost a total of $389 million, nearly 34% of total losses.

- The average individual loss from romance scams in the U.S. was about $18,000.

- Around 42% of scams began on social media or dating apps.

- Crypto-related romance scams accounted for nearly 46% of reported losses in 2024.

- In the U.K., scams linked to romance fraud caused over £92 million in losses across 8,700 victims.

- Global law enforcement operations in 2025 recovered over $216 million from romance fraud rings.

- More than 70% of romance scam accounts used stolen photos or AI-generated images.

- Romance scams tied to investment fraud surged over 50% from the previous year.

Impersonation and Identity Theft Scam Statistics

- Impersonation scams rose by a 148-percentage-point year-over-year, becoming the top-reported scam type.

- 6.5 million total fraud and identity theft reports filed in 2024, up 20% from the prior year.

- Over 1.1 million identity theft reports were received by the FTC in 2024.

- Identity theft caused $12.5 billion in reported losses during 2024, a 25% increase.

- Deepfake attacks on ID verification surged 704% in 2023.

- 16.4% of older adults are vulnerable to government impersonation scams, sharing personal info.

- Digital arrest scams in India jumped to 123,672 incidents in 2024 from 39,925 in 2022.

- 52% of identity crime reports involved personal info misuse.

- Employment identity theft cases hit 37,556 in 2024, up 20% year-over-year.

Reporting Rates and Underreporting of Scams

- The FBI received over 859,000 complaints of suspected internet crime in 2024.

- Reported losses reached $16.6 billion in 2024, a 33% increase from 2023.

- The percentage of victims reporting financial loss rose from 27% to 38% between 2023 and 2024.

- Many victims still do not report scams due to embarrassment or doubt that reporting will help.

- Global operations in 2025 recovered more than $400 million and shut down thousands of scam accounts.

- Awareness campaigns aim to improve reporting, but underreporting remains widespread.

- Regions with strong reporting systems often show higher scam counts due to better data capture.

- User-friendly reporting tools help victims come forward more quickly.

Frequently Asked Questions (FAQs)

Consumers worldwide lost approximately $442 billion to scams in the past year.

About 57% of adults worldwide reported encountering a scam in the past year.

U.S. consumers reported losing more than $12.5 billion to fraud in 2024.

Losses reported by adults aged 60+ who lost over $100,000 increased eightfold, from $55 million to $445 million.

Conclusion

Scams continue to grow in scope, complexity, and financial impact, with investment and crypto fraud driving massive losses alongside traditional vectors like phishing, romance, and impersonation schemes. Financial institutions and law enforcement are responding with coordinated efforts, but underreporting still clouds the full picture. From $16.6 billion in U.S. reported losses to millions of individual complaints worldwide, the data underscores that vigilance, awareness, and rapid reporting remain crucial defenses against evolving scam tactics.

Understanding these trends can help individuals and organizations stay ahead of fraudsters and protect hard-earned assets in an increasingly digital age.