Slack remains one of the most influential team collaboration platforms in business communication. Over the past decade, the tool has transformed the way teams communicate, replacing traditional email threads with real-time messaging, channels, and integrations. Today, millions of businesses across sectors rely on Slack to power workflow coordination, improve response times, and connect hybrid and remote teams.

In technology firms and creative industries, Slack has become integral for project tracking, while customer service and HR teams use it to accelerate internal communication. Below, explore the latest Slack statistics shaping its role in modern work.

Editor’s Choice

- Slack is projected to reach 79 million monthly active users by 2025, indicating strong long-term growth.

- An estimated 47 million daily active users are using Slack globally in 2025.

- Slack’s Connect usage rose 35% in 2025, expanding inter-company communication.

- Slack contributed approximately $2.3 billion in revenue under Salesforce in the latest fiscal cycle.

- Slack holds roughly 18.6% market share in collaboration tools compared with major competitors.

- Over 215,000 organizations use Slack in 2025.

- Slack is active in 150+ countries, with usage spanning global teams.

Recent Developments

- Slack AI adoption among workers rose 50% in 2025, with 60% now using AI daily.

- Business+ plan pricing increased to $15 per user per month from $12.50 to cover advanced AI features.

- Slack Workflow Builder usage grew 34% in 2025, with 40% of paid teams using it weekly.

- Teams using Slack report a 32% decrease in internal email volume, enhancing response speeds.

- Slack’s ecosystem features AI integrations from thousands of partners like Anthropic, Google, and Perplexity.

- Daily AI usage among Slack workers surged 233% in six months, boosting productivity by 64%.

- Slack enables a 23% increase in cross-functional collaboration within six months of implementation.

- Slack Huddles reduced ad hoc Zoom meetings by 18%, especially in remote teams.

- Enterprise Grid supports unlimited workspaces with compliance like HIPAA, GDPR, and 24/7 premium support.

- Slack CEO Denise Dresser departed in December 2025 to join OpenAI as Chief Revenue Officer.

Slack Statistics Overview

- Daily active users are estimated at 47 million globally in 2025.

- Monthly active users are projected to reach 79 million by the end of 2025.

- Slack Connect messages surpassed 100 million per week, up 35% year over year.

- Slack serves an estimated 215,000+ organizations globally.

- Daily engagement time on Slack exceeds 90 minutes per user on average.

- Slack’s daily active user base grew by roughly 12% year over year from early 2024 to 2025.

- The platform operates in 150+ countries with diverse global adoption.

- Slack’s revenue under Salesforce was about $2.3 billion with consistent year-over-year growth.

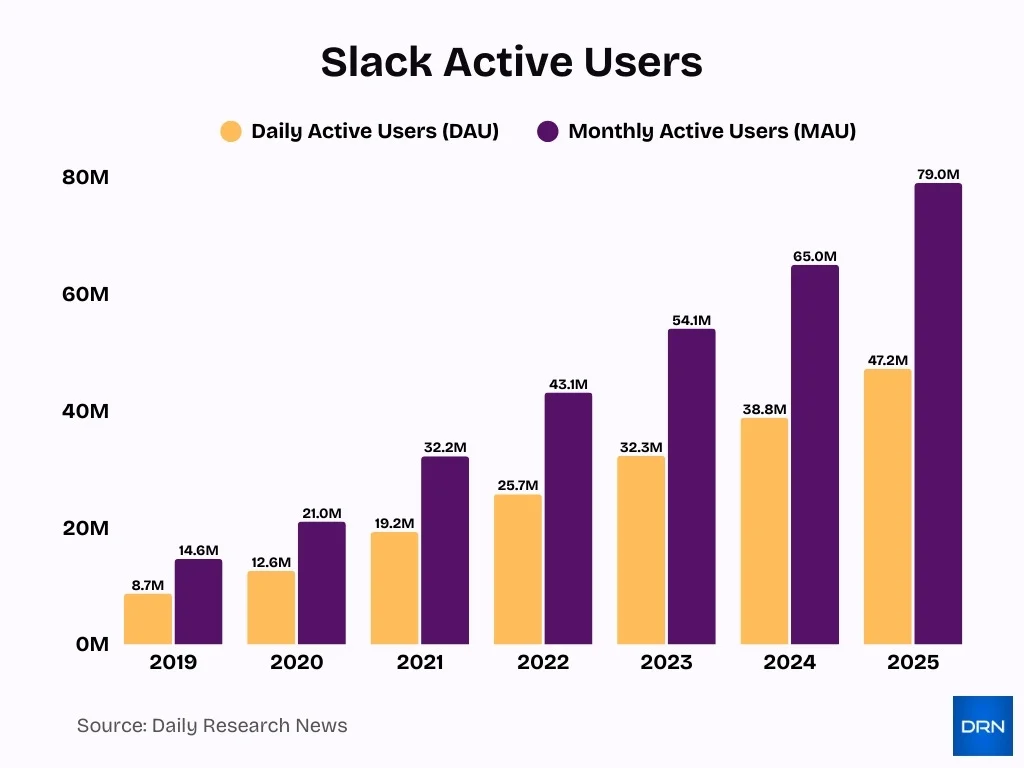

Growth of Slack’s Global Active Users (2019–2025)

- Slack’s Daily Active Users (DAU) and Monthly Active Users (MAU) show strong and consistent growth from 2019 to 2025, reflecting increasing global adoption.

- In 2019, Slack recorded approximately 8.7 million DAU and 14.6 million MAU, establishing its early global user base.

- By 2020, usage rose sharply to 12.6 million DAU and 21.0 million MAU, driven largely by the shift to remote and hybrid work.

- Growth accelerated in 2021, with users reaching 19.2 million DAU and 32.2 million MAU, highlighting Slack’s role as a core workplace communication tool.

- In 2022, Daily Active Users increased to 25.7 million, while Monthly Active Users climbed to 43.1 million, indicating strong user retention and engagement.

- Slack’s momentum continued in 2023, reaching 32.3 million DAU and 54.1 million MAU, as enterprises expanded long-term digital collaboration strategies.

- Projections for 2024 estimate 38.8 million DAU and 65.0 million MAU, showing sustained adoption across industries and regions.

- By 2025, Slack is expected to reach approximately 47.2 million Daily Active Users and 79.0 million Monthly Active Users, marking nearly a 5× increase in DAU and over a 4× increase in MAU compared to 2019.

- Throughout the period, MAU consistently exceeds DAU, demonstrating that a large portion of users engage with Slack at least monthly, even if not daily.

Key Slack Facts at a Glance

- Slack was acquired by Salesforce for $27.7 billion, a major milestone in SaaS history.

- The platform supports channels, direct messaging, and AI-driven workflows.

- Slack Connect enables secure external collaboration with partners and clients.

- 77 of the Fortune 100 companies use Slack as part of their communication stack.

- Slack’s integration marketplace features thousands of third-party apps.

- The daily to monthly active user ratio reflects Slack’s role in regular business engagement.

- Threaded conversations help teams keep context within fast-moving discussions.

- Slack AI helps summarize discussions and improve knowledge sharing.

Slack Market Share and Position

- Slack commands an 18.6% market share in the global team collaboration software segment as of 2025.

- Microsoft Teams dominates with 44% market share, while Zoom Team Chat holds 10% in collaboration tools.

- Over 215,000 organizations use Slack, including 80% of Fortune 100 companies.

- Slack leads with a 52% market share among tech startups under 500 employees.

- Among multi-tool organizations, 65% include Slack in their collaboration stacks.

- Slack generated $2.3 billion in revenue last fiscal year, up 14% year-over-year.

- Enterprise retention rate for Slack exceeds 98% among clients.

- Slack Connect usage grew 35% in 2025, with 100 million inter-company messages weekly.

- North America accounts for 45% of Slack‘s market presence, followed by Europe at 28%.

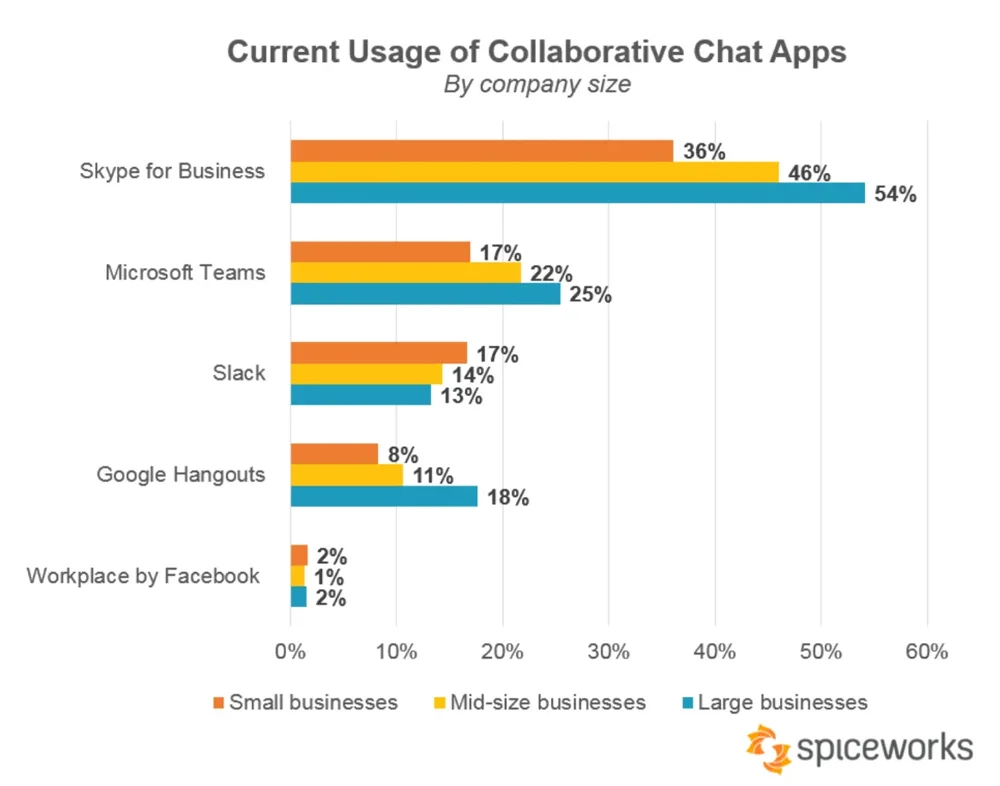

Adoption of Collaborative Chat Applications Across Different Company Sizes

- Skype for Business remains the most widely adopted platform, with 54% of large, 46% of mid-size, and 36% of small businesses using it, making it a leading choice across all organization sizes.

- Microsoft Teams continues to show consistent growth, being used by 25% of large, 22% of mid-size, and 17% of small businesses, with its strong Microsoft ecosystem integration acting as a major attraction.

- Slack demonstrates relatively even adoption, with 17% of small, 14% of mid-size, and 13% of large businesses using it, and it remains particularly favored by startups.

- Google Hangouts sees higher adoption in larger organizations, with usage at 18% among large, 11% among mid-size, and 8% among small businesses, showing a declining trend as company size decreases.

- Workplace by Facebook records the lowest overall usage, with only 2% adoption in small and large businesses and 1% in mid-size companies, indicating it has not achieved significant market traction.

Revenue and Valuation Statistics

- Slack’s annual revenue is forecast to reach roughly $4.2 billion in 2025.

- Revenue estimates placed Slack at approximately $1.7 billion in 2023.

- Growth reflects steady expansion since the Salesforce acquisition.

- Slack’s acquisition valuation stood at $27 billion, underscoring long-term expectations.

- Market projections suggest Slack could capture up to 25% of the enterprise productivity segment.

- Revenue growth aligns with broader adoption across industries.

- Slack delivers economic value by reducing communication friction and time loss.

- Salesforce integration supports continued revenue expansion.

Slack Financial Performance Under Salesforce

- Salesforce achieved $37.9 billion in FY2025 revenue, up 9% year-over-year.

- Slack generated $2.3 billion in revenue under Salesforce in 2025, marking 14% growth.

- Subscription revenue reached $9.5 billion in Q4 FY2025, with Slack driving key contributions.

- Over 750,000 custom apps and integrations operate in Slack workspaces globally.

- Slack boasts a 98% retention rate among enterprise clients.

- Average Slack users send 92 messages daily, boosting workflow efficiency.

- Slack’s operating margin hit 24%, aiding Salesforce’s growth margins.

- 693.9 million Slack messages sent internally by Salesforce employees in 2025.

- Recurring revenue comprises over 94% of Slack‘s total earnings.

Slack Customer and Organization Statistics

- Slack was used by over 215,000 organizations worldwide in 2025.

- 77 of the Fortune 100 companies rely on Slack for internal collaboration.

- Slack customers operate across 150+ countries.

- Many organizations deploy Slack across multiple teams and departments.

- Adoption spans technology, education, finance, and healthcare sectors.

- Smaller businesses often use Slack to replace internal email.

- Large enterprises standardize Slack for centralized communication.

- Slack serves both paid subscribers and freemium users.

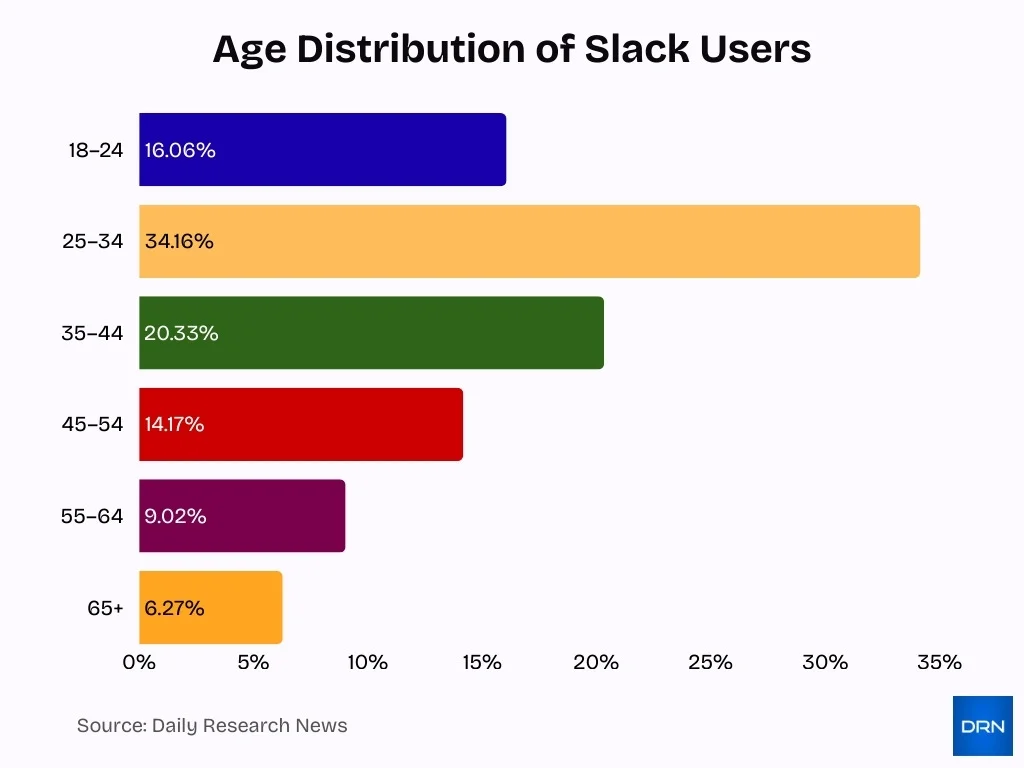

Age Distribution of Slack Users

- Young professionals dominate Slack usage, with the 25–34 age group accounting for the largest share at 34.16%.

- The 35–44 age group follows as the second-largest segment, representing 20.33%, highlighting strong adoption among mid-career professionals.

- Users aged 18–24 make up 16.06%, showing that Slack is already well established among students and early-career entrants.

- Combined, the 25–44 age range represents over 54% of total users, reinforcing Slack’s position as a core tool for the modern workforce.

- Engagement begins to decline after age 45, with the 45–54 group comprising 14.17% of users.

- Older demographics show lower adoption, with 55–64 at 9.02% and 65+ at just 6.27%.

Enterprise and Large Customer Adoption

- Slack serves over 750,000 organizations globally, with some enterprise deployments like IBM’s 350,000 employees using Slack company-wide.

- More than 200,000 organizations use Slack, and over 100,000 of them are paying customers, indicating strong enterprise penetration.

- Slack reports that 77% of the Fortune 100 use its platform, underscoring widespread adoption among the largest enterprises.

- Nearly 80% of Fortune 100 companies rely on Slack Connect to collaborate with partners, vendors, and customers.

- Slack users send over 1.5 billion messages per day, reflecting intense engagement and frequent cross‑department communication.

- Slack supports compliance with major regulations such as GDPR, HIPAA, FINRA, and FedRAMP, making it suitable for highly regulated industries.

- Slack holds numerous security certifications, including ISO 27001, SOC 2, and SOC 3, aligning with strict enterprise governance requirements.

- Slack has users in more than 150 countries, enabling large multinational enterprises to standardize collaboration globally.

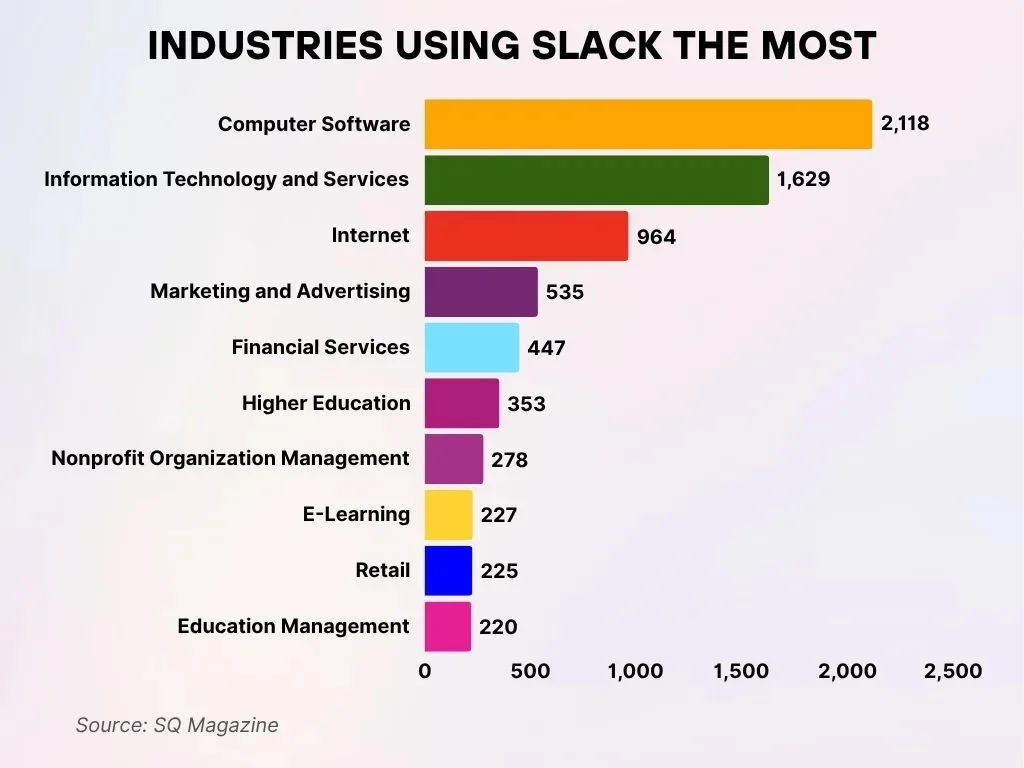

Industries with the Highest Slack Adoption

- The Computer Software industry dominates Slack usage with 2,118 companies actively using the platform, making it the most prominent sector overall.

- Information Technology and Services follows closely with 1,629 companies, highlighting strong adoption across technology-driven fields.

- The Internet industry ranks third with 964 companies, reflecting Slack’s widespread popularity among digital-first businesses.

- Marketing and Advertising firms account for 535 users, indicating a growing trend among creative, collaborative, and client-focused teams.

- The Financial Services sector includes 447 companies, showing an increasing reliance on modern workplace communication tools.

- Higher Education represents 353 institutions, demonstrating Slack’s expanding role in academic collaboration and coordination.

- Nonprofit Organization Management records usage from 278 organizations, proving its value and effectiveness in mission-driven environments.

- E-Learning platforms report 227 users, emphasizing Slack’s importance in remote education and digital training programs.

- The Retail industry shows a modest yet meaningful presence with 225 companies adopting Slack for team communication.

- Education Management completes the list with 220 companies, reinforcing the platform’s appeal in administrative and operational settings.

Slack Features and Product Usage

- Slack serves over 42 million daily active users worldwide, with users spending ~90 minutes per day engaged in channels, DMs, huddles, and apps.

- Typical Slack users stay signed in ~9 hours but are actively engaged for about 1.5 hours daily, underscoring deep reliance for ongoing work communication.

- Slack users perform roughly 5 billion actions per week, contributing to more than 1 billion usage minutes every weekday, showcasing persistent message activity and history creation.

- Teams adopting Slack workflow automation report up to a 47% boost in productivity, with broader workflow automation shown to improve business processes by around 60% by reducing manual, repetitive tasks.

- Around 80% of people who build Slack workflows are non‑technical users, reflecting how accessible automation is for everyday business processes.

- Nearly 44% of paying enterprise customers use Huddles weekly, generating about 243 million minutes of audio/video collaboration per week for quick syncs.

- Slack crosses 1+ billion usage minutes every weekday, driven by heavy use of file sharing, app alerts, and integrations that connect work across tools.

- Notifications rank among the most-clicked elements in Slack, with the average user engaging with about 8 alerts per session, highlighting how alerts and admin‑configured settings shape daily workflows.

Statistics on Slack Connect Usage

- Slack Connect usage surged 35% in 2025.

- Over 100 million inter-company messages are exchanged weekly via Slack Connect.

- 77% of Fortune 100 companies rely on Slack Connect for collaboration.

- Slack Connect is used by more than 100,000 organizations globally.

- Teams report a 50-80% reduction in daily email inbox size using Slack Connect.

- Slack Connect reduces support ticket backlog by 64%.

- 33% of enterprise clients use Slack Connect integrations for partner automation.

- Sales teams achieve 4x faster deal cycles with Slack Connect.

- 85% of organizations with over 1,000 employees adopt Slack Enterprise features, including Connect.

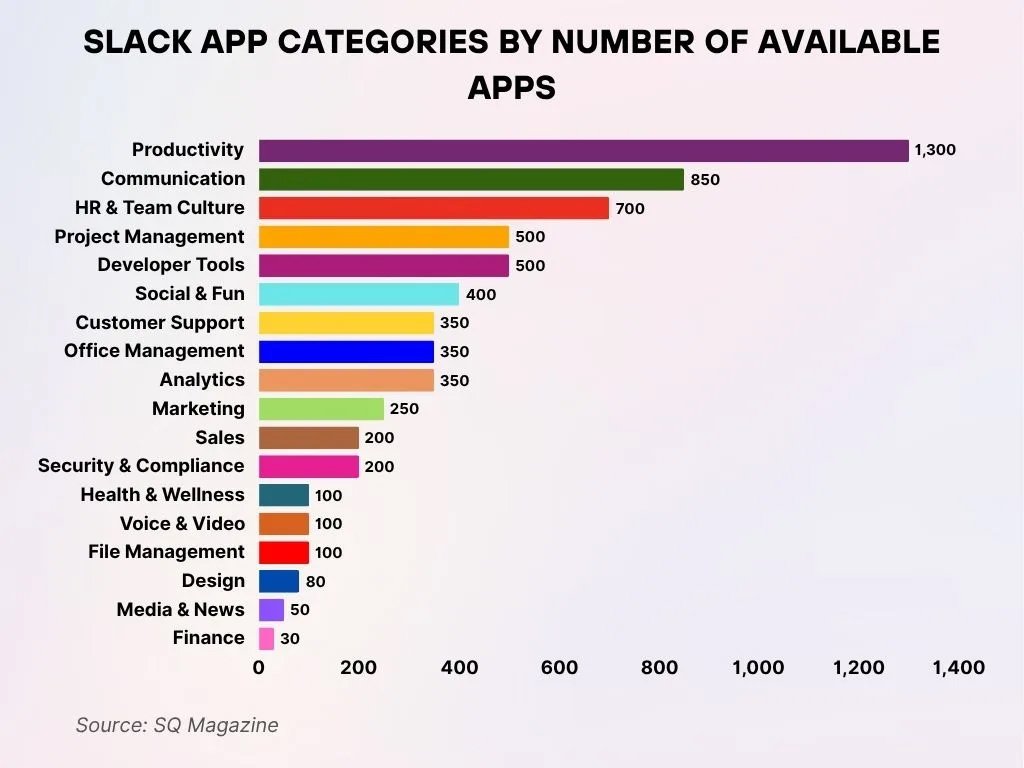

Breakdown of Slack App Categories by App Volume

- The Productivity category dominates with approximately 1,300 apps, positioning it as the most widely supported use case available on Slack.

- Communication tools follow closely with around 850 apps, strongly emphasizing Slack’s core functionality as a collaboration platform.

- HR & Team Culture applications represent about 700 apps, indicating a significant emphasis on employee engagement and workplace culture.

- The Project Management and Developer Tools categories each provide roughly 500 apps, effectively supporting team workflows and technical development needs.

- The Social & Fun category contains about 400 apps, promoting informal interaction and team bonding within organizations.

- Categories such as Customer Support, Office Management, and Analytics each include approximately 350 apps, reflecting strong operational and performance support.

- Marketing tools account for around 250 apps, while Sales tools include about 200 apps, collectively enabling business growth and revenue activities.

- Smaller categories like Security & Compliance, Health & Wellness, Voice & Video, and File Management range between 100 and 200 apps, addressing specialized functional needs.

- The least represented categories are Design with 80 apps, Media & News with 50 apps, and Finance with only 30 apps, indicating lower overall availability.

Usage in Remote and Hybrid Work

- In 2025, 72% of Slack users work in remote or hybrid models, reflecting how essential collaboration tools have become in distributed workplaces.

- Slack users report 87% improved communication quality, showing how the platform bridges coordination gaps in geographically dispersed teams.

- Teams adopting Slack experience about a 32% reduction in internal emails, replacing long email chains with channel-based messaging.

- In environments where both Slack and Teams are available, Slack handles 2.3x more daily messages per user, underscoring its central role in hybrid workplace visibility.

- Asynchronous communication via Slack has increased by 19% among remote-first companies, supporting both synchronous and async work styles.

- Remote teams using Slack huddles now conduct 16% of their remote conversations through this feature, enabling rich collaboration across time zones.

- Persistent channels and workflows in Slack help remote teams achieve 23% faster resolution times on internal tickets and support requests.

- Slack offers 2,600+ app integrations, helping remote teams maintain workflow continuity by connecting tools like Zoom, Google Meet, and project platforms.

Frequently Asked Questions (FAQs)

Slack is estimated to have 47.2 million daily active users in 2025.

Slack is forecast to generate approximately $4.22 billion in global revenue in 2025.

Slack’s market share in the team collaboration software segment is about 18.6 % in 2025.

More than 750,000 organizations use Slack as their business communication platform.

Conclusion

Slack’s position confirms its role as a core collaboration platform across organizations of all sizes. From adoption by Fortune 100 companies to daily use in remote and hybrid teams, Slack supports modern work with flexibility and efficiency. The growth of Slack Connect, rich feature usage, and extensive integrations highlight how the platform continues to evolve with workplace needs. Enterprise adoption, strong daily engagement, and cross-industry relevance reinforce Slack’s value as a central communication hub.

As work continues to blend real-time and distributed collaboration, Slack’s usage trends suggest it will remain a key driver of productive teamwork in the years ahead.