The smart home revolution is no longer futuristic; it’s here and gaining traction. Today’s connected devices automate lighting, temperature, security, and entertainment, making homes more efficient and responsive. In real estate, smart features can boost property value and appeal to younger buyers, while in energy management, smart thermostats and sensors help households cut utility costs and reduce carbon footprints. With rapid adoption underway, explore the full Smart Home Statistics to see how connected living is reshaping modern lifestyles and industries.

Editor’s Choice

- Over 60–65% of American homes now contain some form of smart home technology in 2025, showing widespread adoption across income and age groups.

- The global smart home devices market is projected to grow from $126.22 billion in 2024 to about $145.44 billion in 2025, reflecting strong year-over-year momentum.

- Nearly 48% of U.S. households now own at least one smart home device, highlighting mainstream acceptance.

- The U.S. smart home market is expected to grow at a 23.4% CAGR from 2025 to 2030, outpacing many other consumer tech categories.

- The global smart home platforms market is valued at $23.4B in 2025 and forecast to more than double by 2030.

- Around 35% of Americans own a smart speaker, making voice assistants a central control layer in many homes.

- The number of connected IoT devices worldwide is projected to reach over 21 billion by 2025, supporting rapid smart home expansion.

Recent Developments

- Home Telecom drove 5X subscriber upgrades in six months after launching lifestyle-based smart home Wi-Fi bundles.

- Smart home starter kits now average $500–$3,000, with basic bundles at $399–$699 for security and automation.

- Matter-compatible devices unify ecosystems, driving the smart home market to $135 billion by 2025 with seamless interoperability.

- Low-cost air quality sensors hit 150 million units in 2024, growing to 300 million by 2028 in residential ecosystems.

- Smart home security market reaches $24 billion in 2025, with cellular backup standard in 16.65% CAGR growth systems.

- Professional monitoring bundles boost consumer security to $65.4 billion in 2024, expanding 12.8% annually.

- AI personalization in platforms grows to $525 billion in 2025, predicting user behavior with a 5.4% CAGR.

- Software updates prioritize stability, supporting $174 billion smart home revenue in 2025 at 9.55% penetration.

Global Smart Home Overview

- The global smart home market was valued at over $180B in 2024 and continues to expand rapidly.

- Smart home device revenues are growing across security, lighting, HVAC, and entertainment categories.

- Long-term forecasts suggest the market could exceed $1 trillion by the mid-2030s under optimistic scenarios.

- Security and access control remain among the largest global segments by revenue.

- Smart lighting and climate control are key growth drivers due to energy efficiency demands.

- North America leads adoption due to strong infrastructure and high disposable income.

- Asia-Pacific is one of the fastest-growing regions due to urbanization and technology investment.

- Wireless protocols continue to improve device reliability and cross-brand compatibility.

Smart Home Market Size and Growth

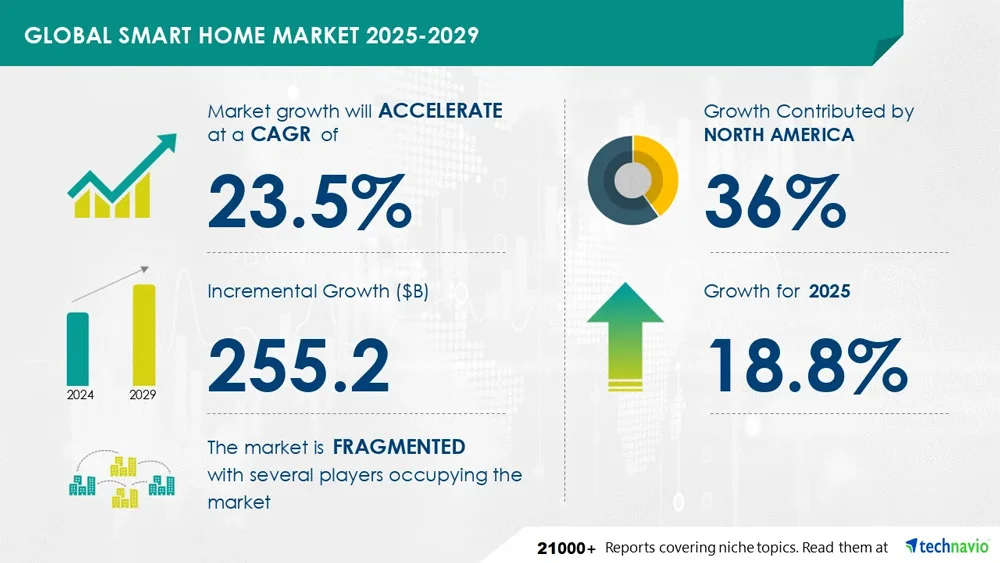

- The global smart home market is anticipated to expand at a CAGR of 23.5% during the forecast period from 2025 to 2029.

- The incremental market expansion throughout the forecast timeline is projected to amount to $255.2 billion in total value.

- North America is expected to account for nearly 36% of the overall market growth during the forecast period.

- In the year 2025 alone, the smart home market is forecasted to register growth of 18.8%.

- The industry landscape continues to be highly fragmented, with several major players actively competing to increase their market share.

Smart Home Household Penetration Rates

- Over 60–65% of U.S. homes now include some form of smart technology.

- Nearly 48% of households have at least one dedicated smart device.

- Smart TVs are present in roughly 71% of connected homes.

- About 35% of Americans use smart speakers.

- Around 18% of households own six or more smart devices.

- Penetration is significantly higher among millennials.

- Security cameras and smart doorbells are increasingly common.

- Urban households show higher penetration than rural ones.

Voice Assistant and Smart Speaker Statistics

- 100 million Americans, or 35% of those aged 12+, own a smart speaker.

- 72 million US households own at least one smart speaker in 2025.

- 153.5 million individual voice assistant users in the United States in 2025.

- Amazon Echo commands 65% of US smart speaker ownership.

- Google Nest holds a significant household penetration alongside Amazon Echo.

- An average smart speaker household features 2.6 devices.

- 68% of smart home interactions are initiated via voice commands.

- Voice assistants like Google Assistant lead with 92.4 million US users.

- The US smart speaker market grows at a 23.2% CAGR through 2029.

Market Dominance of Leading Smart Home Management Applications

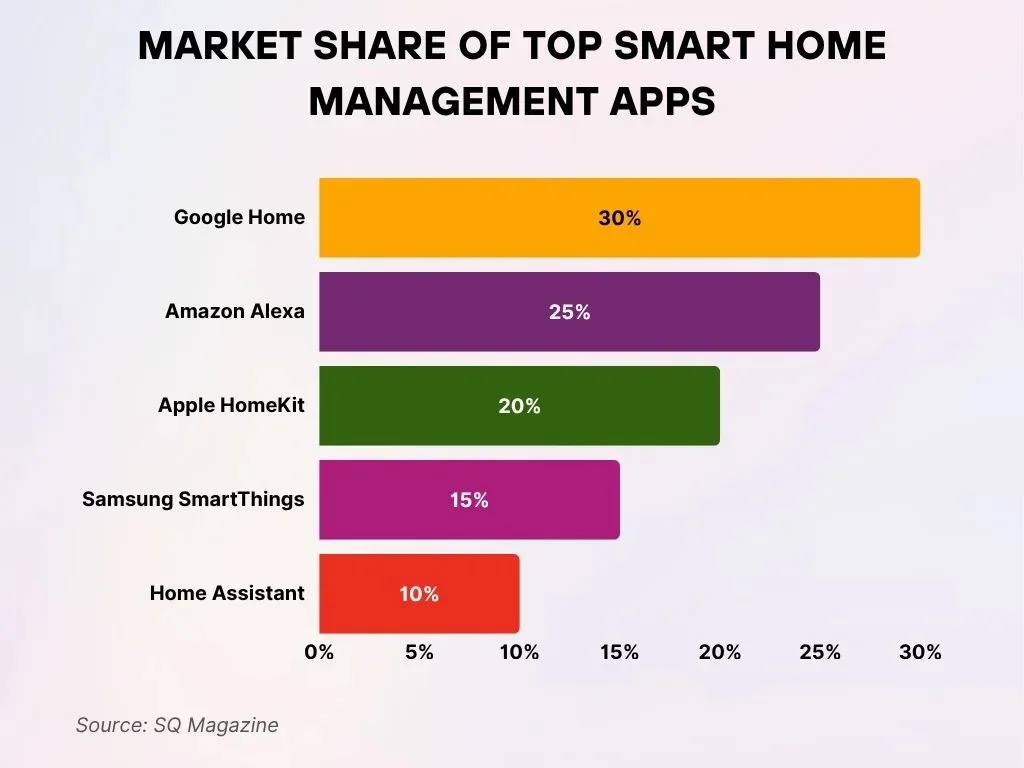

- Google Home dominates the smart home management market with a 30% share, establishing itself as the most widely used application in 2025.

- Amazon Alexa secures a strong second position by holding a 25% market share, reflecting its continued popularity and adoption.

- Apple HomeKit represents 20% of the total market, showing consistent growth, particularly among iOS users.

- Samsung SmartThings accounts for 15% of the market, sustaining a stable and reliable presence within the smart home ecosystem.

- Home Assistant completes the top five apps with a 10% market share, attracting tech-savvy and privacy-focused users.

Smart Lighting and Climate Control Statistics

- Smart lighting market reaches USD 34.4 billion globally in 2025, growing to USD 127.5 billion by 2032.

- Smart thermostats penetrate 16-17% of U.S. internet households in 2025.

- U.S. smart home adoption rises to 59% in 2025, with smart lights at 31%.

- The global smart HVAC market is valued at USD 96.6 billion in 2024, hitting USD 178.3 billion by 2033.

- Smart thermostats save 8% on HVAC costs, or $50 annually per household.

- Voice AI in smart homes grows at 44.8% CAGR, powering thermostats and lighting.

- Smart lighting cuts energy use by 7-27% in households.

- North America claims 30.5% of the global smart lighting share in 2025.

- Energy efficiency motivates top adoption alongside convenience in smart homes.

Most Desired Smart Home Devices

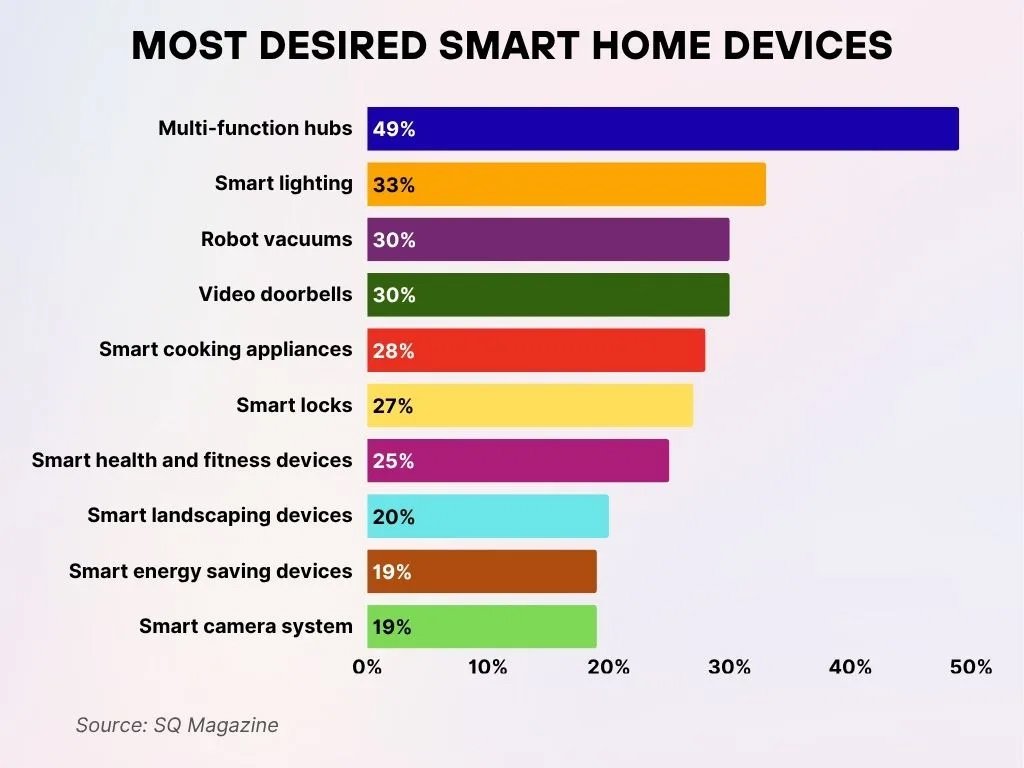

- 49% of consumers express interest in multi-function hubs, positioning them as the most highly demanded smart home device in the market.

- 33% show strong interest in smart lighting, emphasizing its popularity for ambiance creation and improved energy efficiency.

- 30% of users desire robot vacuums and video doorbells, valuing them equally for enhanced convenience and home security.

- 28% prefer smart cooking appliances, indicating a growing enthusiasm for connected and intelligent kitchens.

- 27% are actively seeking smart locks as a way to strengthen overall home security systems.

- 25% desire smart health and fitness devices, clearly linking personal wellness with advanced home technology.

- 20% are interested in smart landscaping devices, supporting the trend toward automated outdoor management.

- 19% want smart energy-saving devices, reflecting an increased focus on energy efficiency and sustainability.

- Another 19% of users prioritize smart camera systems, underscoring the importance of surveillance and household safety.

User Demographics and Smart Home Adoption

- Millennials lead smart home adoption with 44–45% ownership rates.

- Gen X follows closely at 33% smart device ownership.

- Individuals aged 55+ show lower adoption, with only 24% owning smart home devices.

- 65% of US smart home users are under 45, highlighting younger adults‘ dominance.

- Households with children own smart devices at 63%, far exceeding 37% without kids.

- Millennials average 4.6 smart devices per household, outpacing Gen X‘s 3.1.

- 52% of male consumers express interest in smart homes versus 47% of females.

- Urban residents drive adoption due to higher tech affinity and digital lifestyles.

Consumer Attitudes Toward Smart Home Technology

- Around 90% of smart device owners report satisfaction.

- About 50% believe smart devices improve home security.

- 55% of users say smart homes save time.

- Roughly 75% use devices for remote monitoring.

- Nearly 45% prefer voice assistants as their main control method.

- Convenience remains the top adoption driver.

- Cost concerns remain a barrier for potential buyers.

- Energy efficiency influences many purchase decisions.

Smart Home Usage Patterns and Behaviors

- 63% of US households owned at least one smart home device in 2025.

- 84% of smart home users control devices via mobile apps regularly.

- 68% of smart home interactions use voice assistants in 2025.

- 37% of users automate lighting routines for energy efficiency.

- Smart speakers equip 72 million US households.

- 28% of US homes install smart thermostats for energy savings.

- 29% of connected households use indoor security cameras.

- 19% of households adopt multi-room audio systems.

- 65% of Americans own at least one smart home device.

Smart Home Market Share by Region (2024)

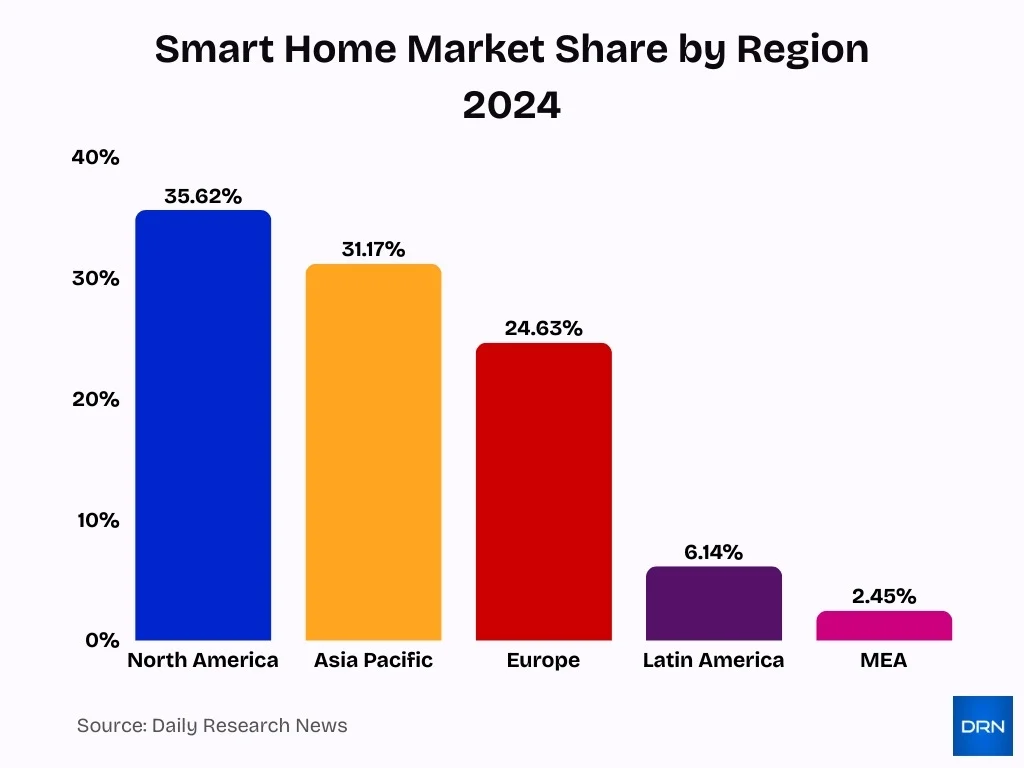

- North America leads the global smart home market, accounting for 35.62% of the total market share, driven by high consumer adoption, advanced infrastructure, and the strong presence of technology leaders.

- Asia Pacific holds the second-largest share at 31.17%, reflecting rapid urbanization, growing middle-class income, and increasing demand for smart and connected devices.

- Europe represents 24.63% of the market, supported by energy-efficiency regulations, rising adoption of smart security systems, and strong awareness of home automation technologies.

- Latin America captures 6.14%, showing steady growth potential as smart home adoption increases alongside improving internet connectivity and digital transformation initiatives.

- Middle East & Africa (MEA) holds the smallest share at 2.45%, primarily due to lower penetration rates, though smart city projects and government-led initiatives are expected to drive future growth.

- Overall, the market remains highly concentrated in developed regions, while emerging economies present significant long-term growth opportunities for smart home technologies.

Energy Efficiency and Cost Savings Statistics

- Smart thermostats save 10-12% on heating and 15% on cooling costs annually.

- Nest thermostats reduce heating gas by 13.3% and cooling electricity by 13.9%.

- Energy Star smart thermostats cut 8% from heating/cooling bills, averaging $50 yearly savings.

- Households with smart automation achieve 8-18% gas savings via learning algorithms.

- AI-powered smart homes enable up to 36% energy savings through optimized management.

- IoT energy monitoring reduces commercial building consumption by 10-30%.

- Smart occupancy sensors lower annual energy use by 16.2-21.2%.

- Peak demand programs with smart thermostats cut 0.6-1.2 kW per event.

Smart Home Technology in Real Estate

- 78% of homebuyers are willing to pay more for smart homes.

- Smart homes sell 22% faster with pre-installed systems.

- 41% of North American households own smart products in 2023.

- Millennials/Gen Z to comprise 60% of new homebuyers by 2030.

- Smart features boost property value by 3-5%.

- Smart thermostats/security add 3-5% to home valuation.

- Energy savings from smart tech reach 19% on utilities.

- Global smart home market to hit $633 billion by 2032.

- India’s smart homes are projected at $33 billion by 2030.

Barriers to Smart Home Adoption

- Cost ranks as the primary barrier, with 44% of consumers citing high upfront expenses as the top obstacle to smart home adoption.

- 36% of consumers face difficulty setting up smart home devices themselves, highlighting installation complexity issues.

- Privacy concerns deter 20% of potential adopters from purchasing smart home technologies.

- Data privacy tops barriers for many, even as convenience drives interest in smart home devices.

- Interoperability challenges persist, as no single gateway supports all smart devices on the market.

- 22% of smart home owners report low ownership rates due to cost and perceived value doubts.

- Older adults show higher resistance, with age negatively impacting adoption willingness.

- 70% of North American households own at least one device, yet cost and compatibility limit broader uptake.

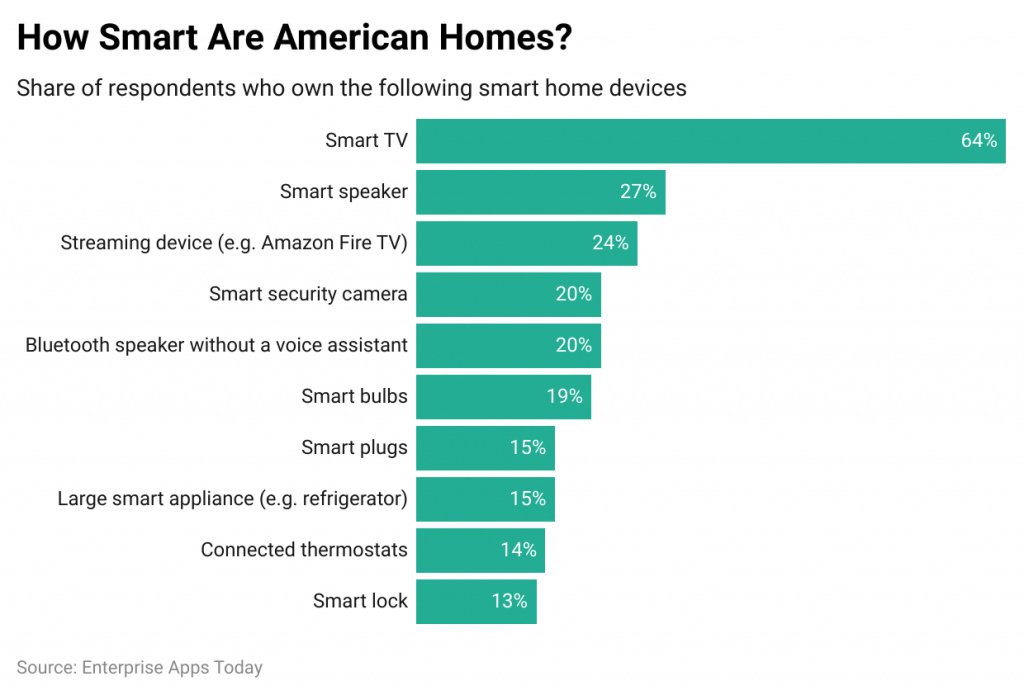

How Smart Are American Homes?

- Smart TVs dominate American homes, with 64% of respondents owning one, making them the most widely adopted smart home device.

- Voice-enabled technology is gaining traction, as 27% of households report owning a smart speaker.

- Streaming devices such as Amazon Fire TV are also popular, with 24% ownership, highlighting the strong demand for connected entertainment.

- Home security technology is becoming mainstream, with 20% of respondents using smart security cameras.

- Non-voice Bluetooth speakers remain relevant, matching security cameras at 20%, showing continued demand for simpler smart audio devices.

- Smart lighting adoption is growing, with 19% of households installing smart bulbs for convenience and energy efficiency.

- Entry-level smart home devices like smart plugs are owned by 15% of respondents, often serving as a first step into home automation.

- Large smart appliances, including connected refrigerators, are present in 15% of homes, indicating slower adoption due to higher costs.

- Connected thermostats are used by 14% of households, despite their potential for long-term energy savings.

- Smart locks remain a niche technology, with only 13% adoption, suggesting ongoing concerns around cost, installation, or security.

Privacy and Security Concerns in Smart Homes

- 72% of smart home owners express concern over personal data security collected by devices.

- 57% of Americans worry about data privacy in how smart home information is collected and used.

- 46% fear hacking of smart home systems, highlighting top security vulnerabilities.

- An average smart home with 22 IoT devices faces 29 cybersecurity attacks daily.

- 27% of homeowners report increased privacy concerns with smart home adoption in 2024.

- Streaming devices account for over 25% of smart home security flaws.

- Smart home security services market to reach USD 76.78 billion by growing at a 15.38% CAGR.

- 70% of IoT devices in smart homes have serious security vulnerabilities.

Impact of AI and Automation in Smart Homes

- The AI smart home market is expected to grow by $255.2 billion from 2025 to 2029 at a 23.5% CAGR.

- Voice AI in smart homes is projected to reach $514.62 billion by 2034 with a 44.8% CAGR.

- 70% of smartphone owners use voice assistants, with 41% daily in smart home automation.

- Machine learning achieves 99.99% accuracy in predicting smart home energy consumption patterns.

- Smart home healthcare market valued at $27.22 billion in 2025, growing at 24.4% CAGR.

- AI-powered security systems lead the market with real-time threat detection via facial recognition.

- Smart home assistants captured 30.7% market share in 2024 for personalized automation.

- AI predictive maintenance reduces smart home system downtime by 35%.

- Ambient computing in smart homes holds a 30% market share for contextual responses.

- Global smart home revenue reaches US$174 billion in 2025 with 77.6% household penetration.

Future Outlook and Forecasts for Smart Homes

- The global smart home market could grow from $147.52 billion in 2025 to over $600 billion by 2032.

- Long-term projections place market value between $489 billion and $633 billion by the mid-2030s.

- Smart home platforms may reach nearly $100B by 2034.

- AI and IoT integration will drive personalization.

- Energy management features will expand rapidly.

- Voice and gesture controls will gain dominance.

- Asia-Pacific will contribute significant growth.

- Renewable energy integration will shape future designs.

Frequently Asked Questions (FAQs)

The global smart home devices market is projected to reach $145.44 billion in 2025, growing from $126.22 billion in 2024 at a 15.2% CAGR.

The number of connected IoT devices is expected to grow 14% year‑over‑year to roughly 21.1 billion by the end of 2025.

The global smart home technologies market is expected to expand from $121.59 billion in 2025 to about $633.29 billion by 2032, at a 26.6% CAGR.

In the Asia‑Pacific smart home market, security solutions accounted for 29.7% of the market share in 2024, leading all product segments.

Conclusion

Smart home ecosystems are reshaping how people live, work, and manage resources. Usage patterns emphasize automation, remote control, and integrated systems that enhance comfort, security, and efficiency. While cost and privacy concerns remain, advances in AI, analytics, and interoperability continue to lower barriers.

With forecasts pointing to substantial market expansion, smart homes are set to become a core part of everyday living, making connected technology an essential consideration for households and industries alike.