Smartwatches have grown from niche tech gadgets to everyday essentials that combine communication, convenience, and health tracking. In workplaces, they help professionals stay reachable and organized, while in healthcare, they offer real-time monitoring of vital signs, supporting preventive care and fitness regimes. As more people adopt them, smartwatches increasingly influence how we manage time, health, and connectivity. Below, we dive deep into key statistics shaping the smartwatch landscape.

Editor’s Choice

Here are seven of the most noteworthy statistics for smartwatches in 2025:

- The global smartwatch market was valued at $39.1 billion in 2024.

- The market is forecast to grow to $92 billion by 2034, at a compound annual growth rate (CAGR) of 9%.

- Worldwide smartwatch users reached approximately 454.7 million in 2025, a 41% increase over 2023.

- Among smartwatch users, around 92% use their device for health and fitness tracking.

- In Q1 2025, global smartwatch shipments fell 2% year over year, suggesting a temporary cooling in demand.

- The wearables market shipped 136.5 million units in Q2 2025, with smartwatches accounting for 38.3 million units.

- The trend toward independent connectivity grew; many new smartwatches now support LTE, reducing reliance on paired smartphones.

Recent Developments

- Research firm Counterpoint Research reported a 2% global drop in smartwatch shipments in Q1 2025, signaling a short-term slowdown.

- Despite the dip, the global market is expected to rebound in 2025 with projected growth of around 3 to 7%.

- The overall wearables category saw a strong Q2 2025, with 136.5 million units shipped, smartwatches representing a significant share.

- The rise in standalone smartwatches, with LTE or cellular connectivity, reflects increasing demand for devices that work independently of smartphones.

- Growing interest in health and fitness features, from heart rate tracking to sleep monitoring, is driving renewed product launches and innovation.

- Price segmentation is shifting, while premium devices remain popular, mid-range and budget models are gaining traction in emerging markets.

- Manufacturers are broadening their smartwatch lineups, offering varied designs and feature sets to attract a wider user base, from fitness enthusiasts to casual users.

Global Smartwatch Market Forecast

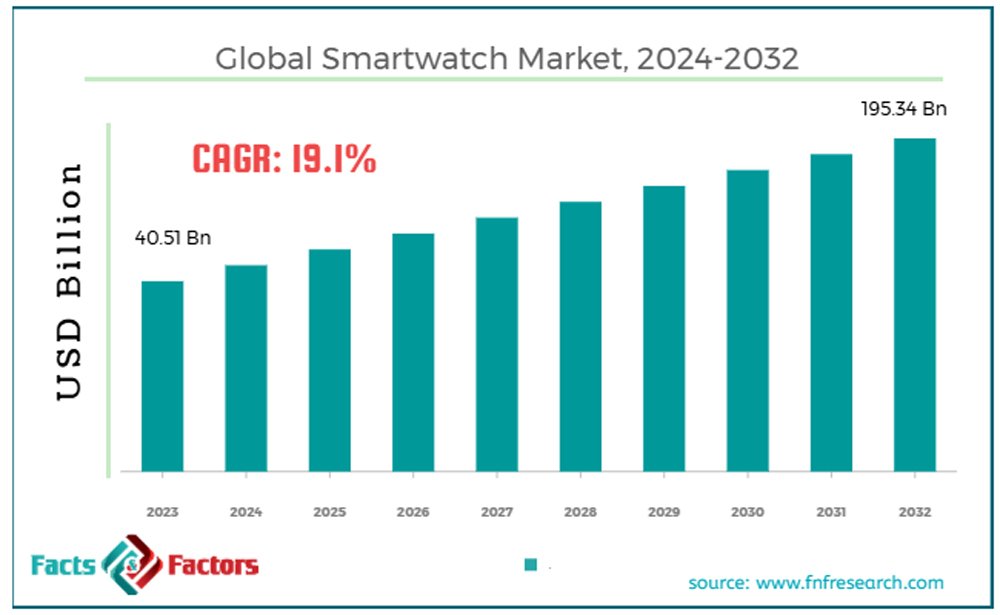

- The global smartwatch market is projected to experience strong growth from 2024 to 2032.

- Market value in 2023 was approximately $40.51 billion.

- By 2032, the market is expected to reach around $195.34 billion.

- This expansion reflects a robust CAGR of 19.1%, indicating sustained industry momentum.

- The chart shows consistent year-on-year growth, with no projected declines across the forecast period.

- Demand is driven by increasing adoption of health-tracking features, fitness monitoring, and wearable connectivity.

- The market outlook suggests rising consumer interest in premium smartwatches, advanced sensors, and integration with mobile ecosystems.

Smartwatch Shipments and Sales Statistics

- In Q2 2025, total wearables shipments reached 136.5 million units, and smartwatches made up 38.3 million units.

- Global smartwatch shipments fell 2% year over year in Q1 2025, a sign of short-term cooling.

- The market is expected to rebound over the rest of 2025 with modest growth.

- Demand for LTE-enabled and standalone smartwatches is rising, which may shift consumption patterns away from basic wearables.

- Entry-level and budget watches continue to perform strongly in cost-sensitive markets, supporting overall sales volumes.

- Mid-range and premium models, with advanced health features or app ecosystems, attract tech-savvy and health-conscious users.

- Wider global distribution supports stronger sales, particularly in regions where smartphone adoption is high.

Smartwatch Adoption Rate Worldwide

- As of 2025, global smartwatch adoption reached 5.2% of the total population.

- In the United States, smartwatch penetration hit 28.3% of the population in 2025.

- Around 43% of smartwatch owners report wearing their device daily in 2025.

- Among first-time buyers in 2025, 61% cited health monitoring as their main reason for purchase.

- The rate of upgrades rose to 32% in 2025, driven by interest in new features.

- Smartwatch gifting increased by 19% during the 2024 to 2025 holiday season.

- Workplace wellness programs offering smartwatches rose by 28% in 2025, reflecting growing corporate adoption for health tracking.

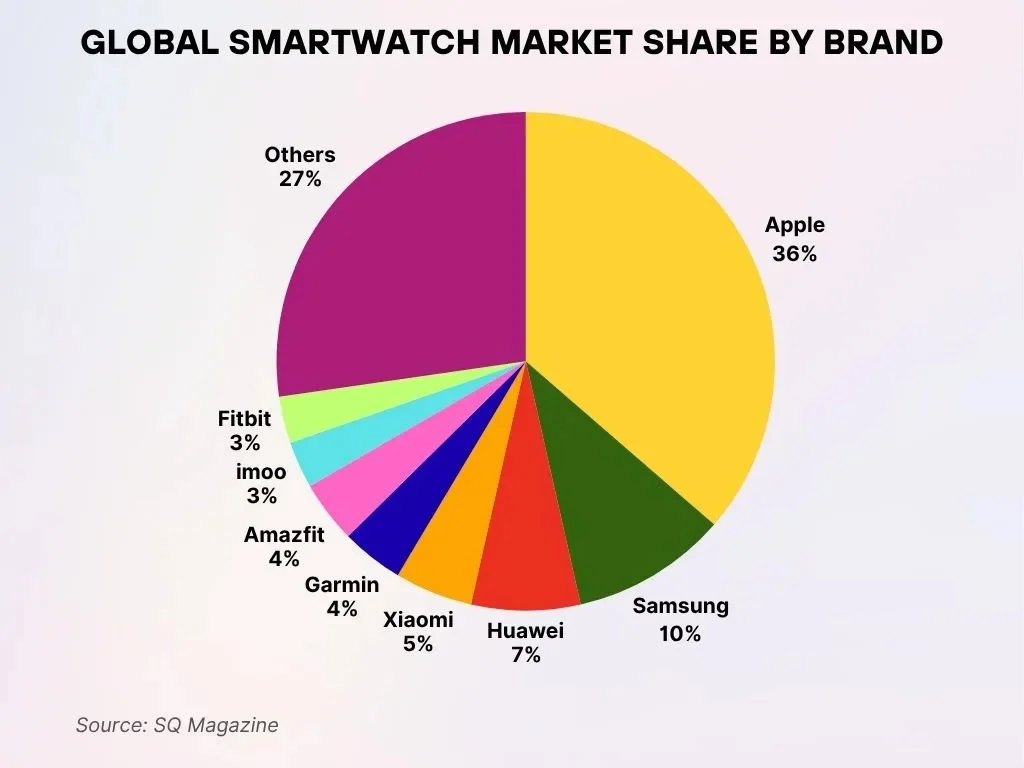

Global Smartwatch Market Share by Brand

- Apple dominates the global smartwatch market with a 36% share, maintaining its lead in the industry.

- Samsung secures the second position with a solid 10% market share, reinforcing its strong presence.

- Huawei captures 7%, demonstrating steady performance across both domestic and international markets.

- Xiaomi holds 5%, reflecting its continued influence in the budget-friendly segment.

- Garmin and Amazfit each command a 4% share, remaining popular for their fitness and health-focused smartwatch offerings.

- imoo and Fitbit follow with 3% each, appealing to niche user bases and health-conscious consumers.

- Others collectively represent 27%, highlighting a fragmented market filled with numerous smaller players.

Demographics: Age, Gender, and Geography

- In 2025, the male-female split among smartwatch users globally stood at 52% male, 48% female.

- The core age group for smartwatch owners remains 25 to 44 years old, with especially strong adoption among those aged 25 to 34.

- Users aged 45 to 64 accounted for ~27% of U.S. smartwatch owners in 2025.

- Smartwatch penetration among older people reached 14% in 2025.

- The average global smartwatch user age is 35.8 years.

- In the U.S., ownership among Asian Americans reached 29%, while Hispanic users represented 18% of owners.

- Data suggests growing acceptance across gender, age, and ethnic profiles globally.

Apple, Samsung, Huawei & Major Brands Comparison

- In Q2 2025, Huawei overtook Apple to become the top global smartwatch shipper.

- Apple’s share fell from ~28% in late 2024 to roughly 13% in 2025.

- Samsung maintained a stable share of ~11%.

- The “Others” category collectively holds ~55% of the market.

- Smaller players focusing on affordability or niche features contribute heavily to volume.

- Consumers increasingly evaluate watches based on value and functionality rather than brand prestige.

- Premium devices still see strong uptake, but budget models dominate volume.

Smartwatch Users and Health Engagement

- 80% of users reported a positive impact on mental health as a result of sustained smartwatch engagement.

- 80% of users consistently track daily steps, emphasizing the core role of smartwatches in continuous activity monitoring.

- 75% of users depend on heart rate monitoring, highlighting the device’s health-focused usage.

- 70% of users feel motivated to pursue a healthier lifestyle with ongoing smartwatch support.

- 70% of users rely on activity reminders and notifications to maintain steady fitness consistency.

- 65% of users adopted positive changes in both diet and exercise due to their regular smartwatch use.

- 60% of users experienced an increase in health-related app downloads after beginning to use smartwatches.

- 60% of users actively monitor physical activity and overall health, reinforcing their commitment to a wellness focus.

- 55% of users boosted their fitness app usage, linking wearable devices closely with digital health tools.

- 50% of users make active use of sleep tracking, demonstrating heightened sleep health awareness.

Medical and Health Applications

- 76 to 90% of adults wearing smartwatches said they would share wearable health data with their physician.

- Smartwatches are used widely in chronic condition management and early detection of anomalies.

- Growth in advanced sensors drives broader adoption.

- Integration with telemedicine is rising, enabling remote health monitoring.

- Smartwatches support preventive care in underserved regions.

- Users rely on reminders for heart rate checks, inactivity, and sleep hygiene.

- Devices are becoming portable health monitors, blurring lines with medical tools.

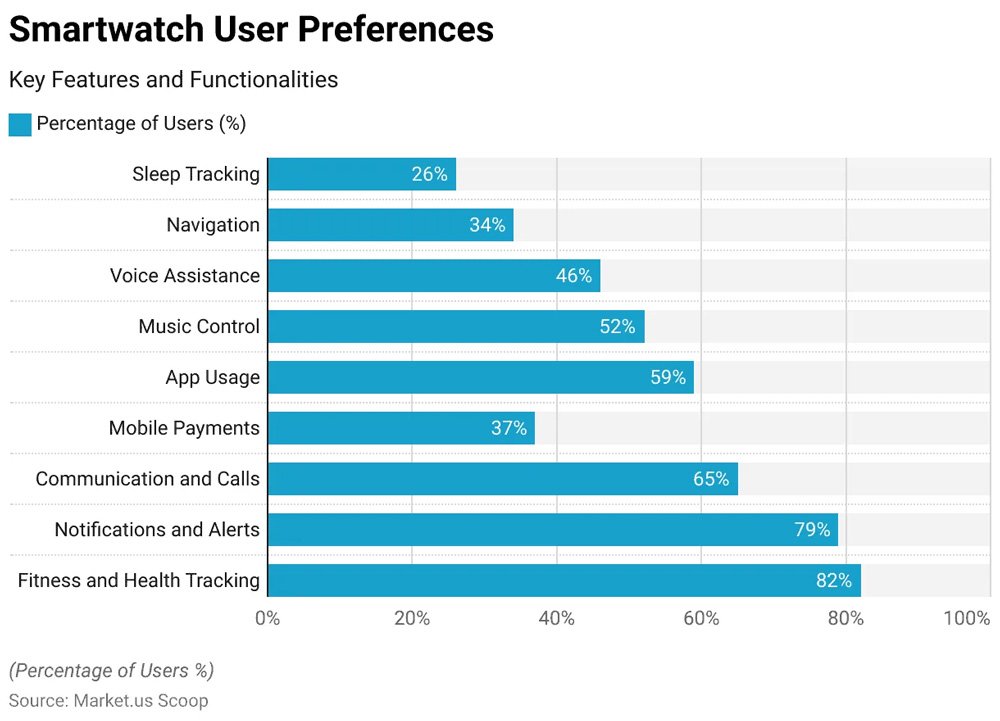

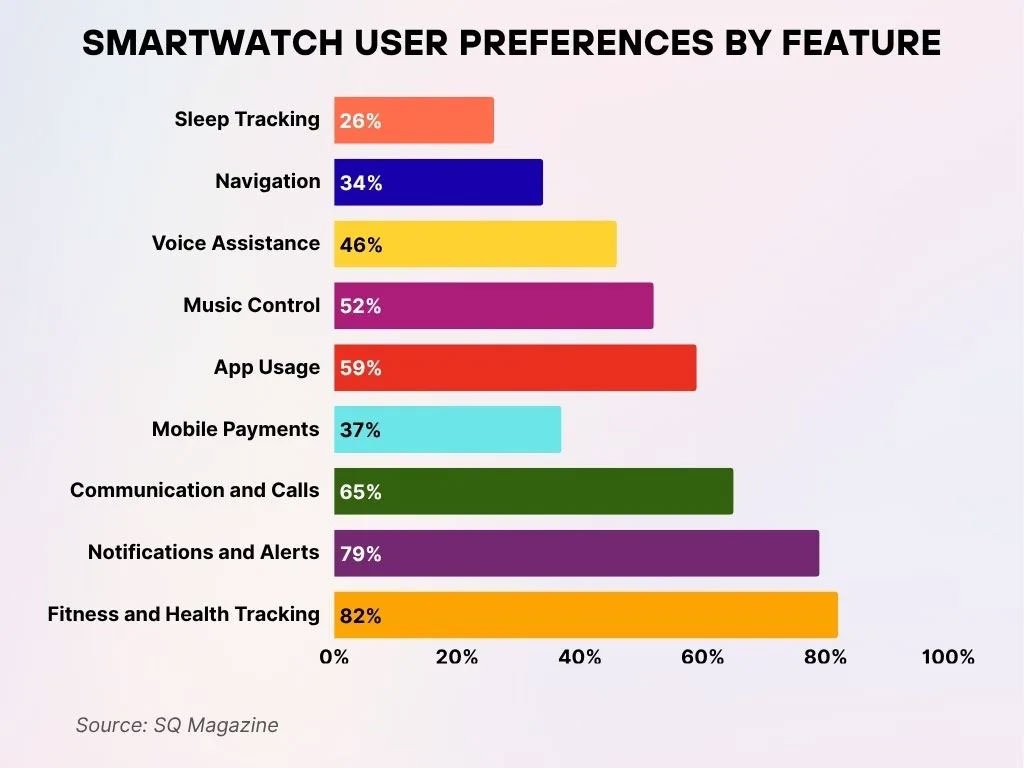

Smartwatch User Preferences by Feature

- 82% of users place strong emphasis on Fitness and Health Tracking, making this the most preferred smartwatch feature among consumers.

- 79% of users highly value Notifications and Alerts, underscoring the significance of receiving real-time updates directly on the wrist.

- 65% of users rely on smartwatches for Communication and Calls, highlighting their usefulness beyond fitness-related functions.

- 59% of users participate in App Usage, indicating a rising desire for multifunctional smartwatch applications.

- 52% of users make use of Music Control, reflecting the smartwatch’s role in convenient media management.

- 46% of users depend on Voice Assistance, suggesting increasing user comfort with AI-driven interaction.

- 37% of users engage in Mobile Payments, showing a moderate but growing acceptance of smartwatches as a payment solution.

- 34% of users utilize Navigation features, emphasizing the expanding importance of location and directional support.

- 26% of users track Sleep, making it the least-used feature, yet still significant within health-focused use.

User Preferences and Buying Behavior

- 61% of first-time buyers prioritize health monitoring over aesthetics or connectivity.

- Fitness tracking remains the top influence on purchase decisions.

- Value for money drives strong interest in mid-range and budget models.

- Brand loyalty is declining as more consumers adopt smaller manufacturers.

- Many buyers prefer devices offering core features at affordable prices.

- Health features outweigh traditional “smart” features for many consumers.

- Upgrade cycles are slowing as users wait for significant improvements.

- Regional and economic factors heavily influence buying behavior.

Consumer Motivations and Purchase Drivers

- A 2025 survey found that performance expectancy, effort expectancy, price value, hedonic motivation, and facilitating conditions drive purchases.

- Social influence showed no significant effect in some markets.

- 83% of users globally see health tracking as their top motivation.

- Over 60% consider battery life a critical purchase factor.

- Value for money is a growing priority in emerging markets.

- Brand image, features, and price remain key decision drivers.

- Stylish design and lifestyle integration influence buying behavior.

- Many users view smartwatches as all-day devices, increasing demand for comfort and endurance.

Popular Smartwatch Apps and Categories

- Health and fitness apps dominate usage across global markets.

- Personal assistance features account for 40% of smartwatch use cases.

- Messaging and notifications remain high-priority use categories.

- Sleep and stress monitoring apps are gaining traction.

- Mobile payments are a growing secondary use case.

- Productivity apps appeal strongly to professionals.

- Third-party health and lifestyle apps broaden user engagement.

- Smartwatches are increasingly used throughout the day, not just for workouts.

Regional Market Insights (US, India, China, etc.)

- The global wearable electronics market will rise from $52.4 billion in 2025 to $172.8 billion by 2032.

- North America held 34% of the wearable tech market in 2024.

- Asia Pacific is one of the fastest-growing smartwatch regions.

- APAC leads in volume demand despite stronger premium demand in the U.S. and Europe.

- Emerging markets emphasize affordability and essential features.

- Regional differences shape smartwatch usage styles and needs.

- Rural regions lag due to ecosystem and connectivity constraints.

- Overall, global growth is driven by health awareness, disposable income, and ecommerce expansion.

IoT Integration and Smart Home Usage

- Future growth will be driven by IoT integration, AI features, and smart home connectivity.

- The smartwatch chip market will grow from $1.78 billion in 2024 to $3.91 billion by 2032.

- Smartwatches increasingly act as smart home control hubs.

- Contactless payments and digital wallet integration continue to rise.

- Voice assistants and AI-powered personal tools expand smartwatch utility.

- Watches will become more central for notifications, alerts, and automation.

- Smartwatches are evolving into health and home management consoles.

- New use cases from remote monitoring to lifestyle automation are emerging.

Privacy and Security Concerns

- Privacy concerns, including health and location data, slow adoption in some markets.

- Data protection expectations are rising as smartwatches collect sensitive metrics.

- On-device processing reduces privacy risks by minimizing data uploads.

- Transparency, consent, and clear policies are required for trust.

- Regulatory ambiguity in some regions creates adoption barriers.

- Security risks, such as hacking, still deter some buyers.

- As the IoT role expands, robust security becomes essential.

- Balancing convenience and privacy will shape adoption trajectories.

Future Trends and Market Outlook

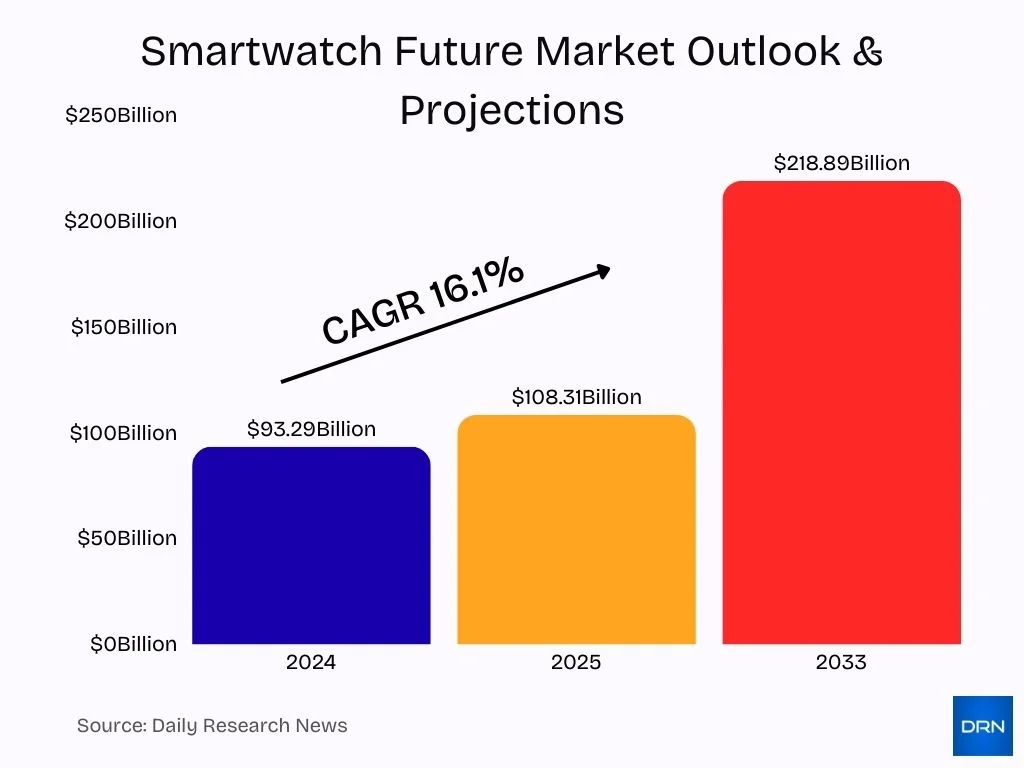

- The global smartwatch market may grow from $93.29 billion in 2024 to $108.31 billion in 2025, a CAGR of 16.1%.

- Other forecasts place the market at $218.89 billion by 2033.

- Smartwatch chipset innovation will accelerate feature expansion and IoT integration.

- Demand will increasingly favor mid-range and budget devices.

- Smartwatches will move further into preventive health, telehealth, and remote monitoring.

- AI assistants, health analytics, and ecosystem integration will define the next era.

- Privacy and regulatory clarity will be essential for mass adoption.

- Smartwatches appear poised for the next wave of growth driven by versatility and daily relevance.

Frequently Asked Questions (FAQs)

There are approximately 454.69 million smartwatch users worldwide in 2025.

The global smartwatch market was valued at $39.1 billion in 2024 and is forecast to reach $92 billion by 2034 with a CAGR of around 9%.

The leading brand, Huawei, holds around 21% of the global smartwatch shipment market share in 2025.

Over 92% of smartwatch users rely on their devices to track and improve health and fitness.

Conclusion

Smartwatches stand at a pivotal moment. On one hand, global market value and user adoption continue to climb steadily, but on the other, short-term shipment dips highlight shifting dynamics as consumers pause, wait for newer models, or reconsider upgrades.

With broad interest in health tracking, increased demand for standalone connectivity, and rising acceptance among mainstream users, the smartwatch market seems poised for renewed momentum. In the next parts of this article, we will explore who is wearing these devices, which brands lead, and how features and consumer behavior are evolving.