Social media marketing continues to shape how brands connect with consumers and influence purchasing decisions. In the retail industry, companies use social feeds to launch new products and track purchase behaviour in real time. B2B services, LinkedIn content drives lead generation campaigns with measurable pipeline volume. In both cases, the scale and speed of social media marketing are larger than ever. Explore how key statistics reflect that growth and the strategic implications for marketers.

Editor’s Choice

- The global number of social media user identities reached 5.66 billion by October 2025.

- Worldwide social media advertising spend is projected at $276.7 billion in 2025.

- Mobile platform ad spend will account for roughly 88% of social media ad budgets by 2030.

- The average person uses about 6.83 different social networks per month in 2025.

- More than 63.9% of the global population uses social media.

- Digital advertising spend in 2025 is forecasted to grow by 7.9%, with social media driving much of that increase.

- In the U.S., mobile social media ad spend alone is expected to be around $82.69 billion in 2025.

Recent Developments

- In 2025, the top trend for social media teams is content experimentation; more than 60% of social content aims to entertain, educate or inform.

- Around 41% of organizations have tested outbound engagement, brands actively commenting on creator posts to reach new audiences.

- 62% of social marketers are now using social listening tools, a rise that enhances ROI confidence.

- 83% of marketers say generative AI helps them create significantly more content than without it.

- Social video platforms are posing a strong challenge to traditional entertainment channels, according to 2025 media trends.

- The global social ad market is expected to grow by about 12% in 2025.

- Nearly half of consumers say they interact with brands more on social media now than six months ago.

- Short-form video formats now dominate experimentation; 35% of social media marketers say short-form video offers the highest ROI.

Global User Penetration & Platform Growth

- As of early 2025, 63.9% of the world’s population uses social media.

- At the start of October 2025, there were approximately 5.66 billion social media user identities globally.

- In 2025, the average internet user engages with 6.83 social networks each month.

- Worldwide, 259 million new users were added in the last 12 months.

- User growth rates are slower in saturated markets, but incremental growth continues globally.

- Social media adoption spans emerging and mature markets with significant penetration.

- Platforms with strong mobile penetration are seeing the fastest growth.

- Because user identity counts may include multiple accounts per person, real user estimates must be interpreted carefully.

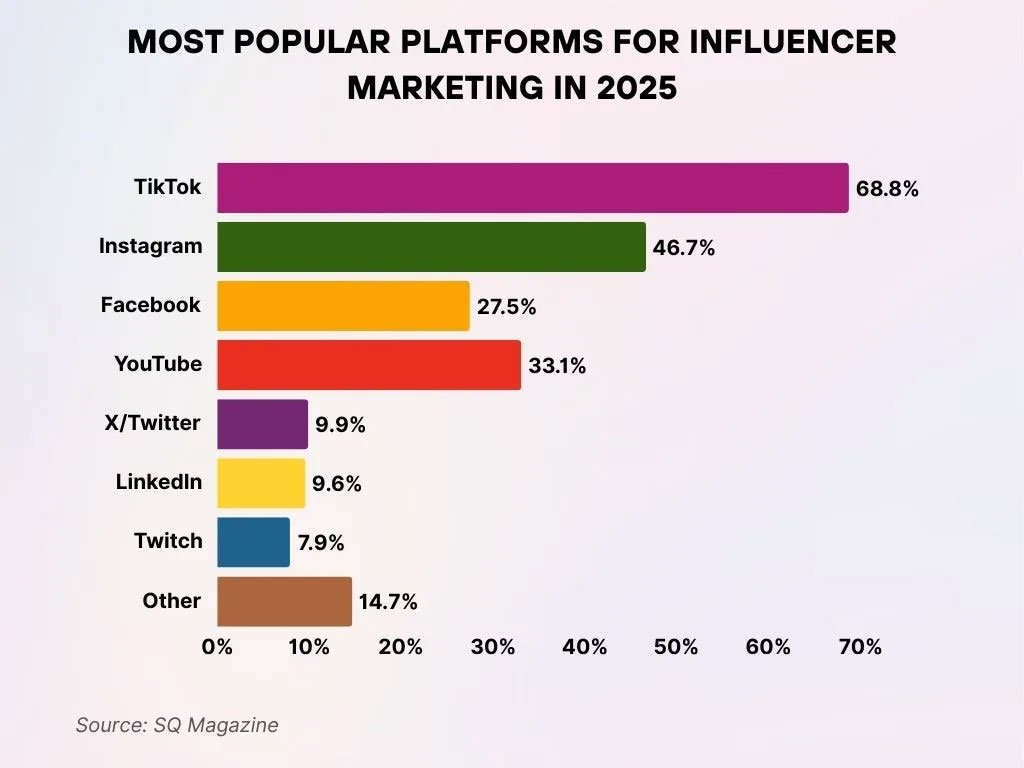

Most Popular Platforms for Influencer Marketing

- TikTok stands as the leading platform, chosen by 68.8% of influencer marketing brands, with its short-form video style continuing to drive strong engagement.

- Instagram follows in second place at 46.7%, maintaining its role as a preferred hub for visual storytelling and product-focused promotions.

- YouTube holds the third spot with 33.1%, valued for its long-form content format and in-depth product review potential.

- Facebook is leveraged by 27.5% of brands, remaining relevant thanks to its massive user base and targeted advertising capabilities.

- Other platforms make up 14.7%, reflecting how brands are expanding into emerging and niche marketing channels.

- X/Twitter is used by 9.9%, offering advantages for rapid updates and fostering a dynamic brand voice.

- LinkedIn engages 9.6%, proving especially effective within B2B influencer efforts and professional-focused sectors.

- Twitch captures 7.9%, emphasizing its strong resonance with gaming communities and live-stream-driven campaigns.

Daily Usage Patterns & Engagement Metrics

- The average social media user spends 2 hours 21 minutes per day.

- Another estimate places daily usage at around 2 hours and 24 minutes per day.

- Nearly 48% of consumers report they interact with brands on social media more often than six months ago.

- Social media competes with traditional media for daily time allocation in the U.S., where entertainment time is roughly six hours.

- Users multitask across platforms, with 6.8 networks per month contributing to rising cross-engagement.

- Mobile dominates usage patterns, driving both engagement and ad consumption.

- Brands that prioritize conversations and listening outperform one-way broadcasters.

- Static posts are losing traction as video, live, and interactive formats drive higher engagement.

Advertising Spend & Budget Allocation

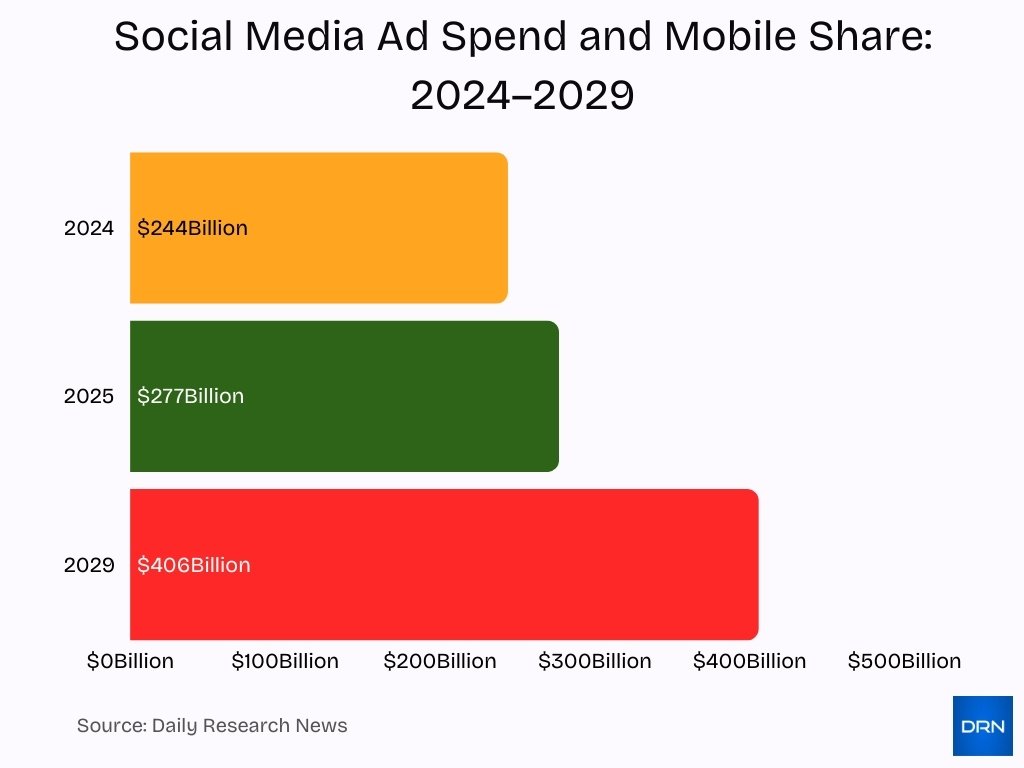

- Global social media ad spend for 2025 is $277 billion, up 13.6% year-on-year.

- This reflects a year-over-year growth of about 10.9%.

- In the U.S., mobile social ad spend is estimated at $82.69 billion for 2025, with desktop at $13.01 billion.

- The U.S. social media ad spend total was about $84.62 billion in 2024 and is forecasted to rise in 2025.

- By 2030, mobile is expected to capture 88% of all social media ad spend.

- Global digital ad spend overall is projected to grow by 7.9% in 2025.

- Social media accounts for about 30% of all digital ad spending.

- Brands are shifting budgets from traditional formats to platform native social content.

- U.S. advertisers continue to expand investment in creator and influencer ad inventory.

Mobile & Platform Specific Trends

- Global mobile advertising spending is projected to reach $402 billion in 2025, up 11% from the prior year.

- Mobile devices are expected to account for over 75% of digital ad spending globally in 2025.

- SMS marketing in the U.S. is projected to be worth $12.6 billion by 2025.

- Businesses increasingly optimize video content for mobile-first viewing.

- 56% of businesses report that their video content is under two minutes in 2025.

- The average U.S. household now contains more than 21 connected devices.

- Mobile vs desktop spend continues to diverge, with mobile dominating.

- Mobile-first creative formats, including vertical video, are increasingly favoured.

- Emerging markets show strong mobile-first social engagement patterns.

- Mobile optimization remains essential as mobile becomes the primary social channel.

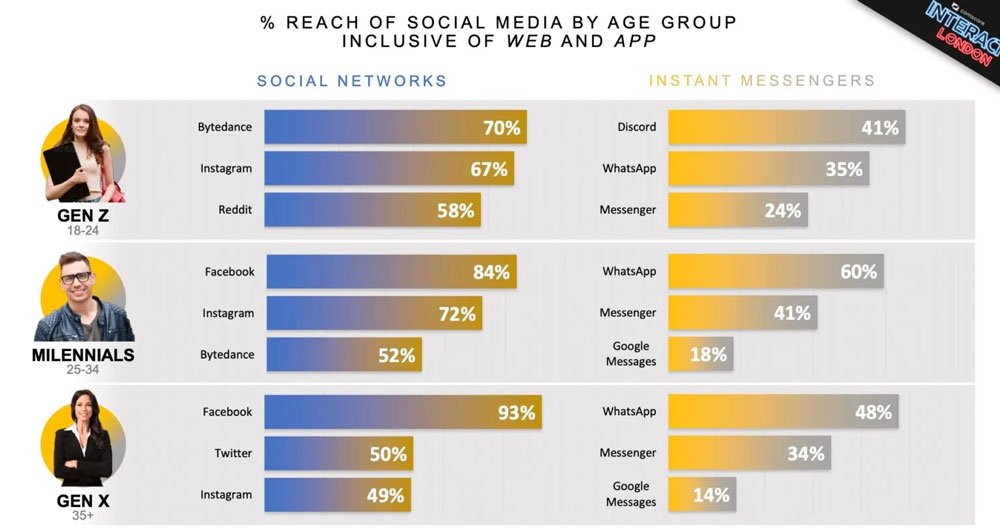

Social Media and Messaging Platform Reach by Age Group

- Gen Z (18–24) shows a strong preference for ByteDance (70%), Instagram (67%), and Reddit (58%) for social networking, while Discord (41%) stands out as their primary messaging platform.

- Millennials (25–34) engage most actively with Facebook (84%) and Instagram (72%), with ByteDance also notable at 52%, and WhatsApp (60%) taking the lead in their messaging habits.

- Gen X (35+) demonstrates dominant usage of Facebook (93%), followed by Twitter (50%) and Instagram (49%), with WhatsApp (48%) continuing to be their primary messaging choice.

- Across all age groups, WhatsApp serves as the top messenger, whereas Messenger maintains moderate popularity, particularly among Millennials (41%) and Gen Z (24%).

- Google Messages ranks the lowest among messaging platforms, with especially low usage among Gen X (14%) and Millennials (18%).

Influencer & Creator Economy Statistics

- The influencer marketing industry is projected to grow by 35.6% from 2024 to 2025.

- The influencer marketing sector is expected to reach $32.55 billion in 2025.

- There are more than 207 million active content creators worldwide.

- The creator economy may reach $528 billion by 2030.

- 86% of U.S. marketers plan influencer collaborations in 2025.

- Only 4% of creators earn more than $100k annually.

- Micro creators often generate higher engagement rates than larger creators.

- 65% of influencers want early involvement in campaign development.

- 58% of B2B marketers always use influencer strategies.

- Instagram leads as the top platform for influencer campaigns.

Content Type Effectiveness, video, short form, live

- In 2025, 89% of businesses use video as a marketing tool.

- Short-form video delivers the highest ROI among all social content formats.

- 21% of marketers say short-form video has the absolute highest ROI.

- Videos under 90 seconds achieve roughly 50% viewer retention.

- Video content may account for 82% of global online traffic by late 2025.

- Live video remains strong, with 37% of users rating it the most engaging format.

- On Facebook, video posts can deliver 135% higher reach than photo posts.

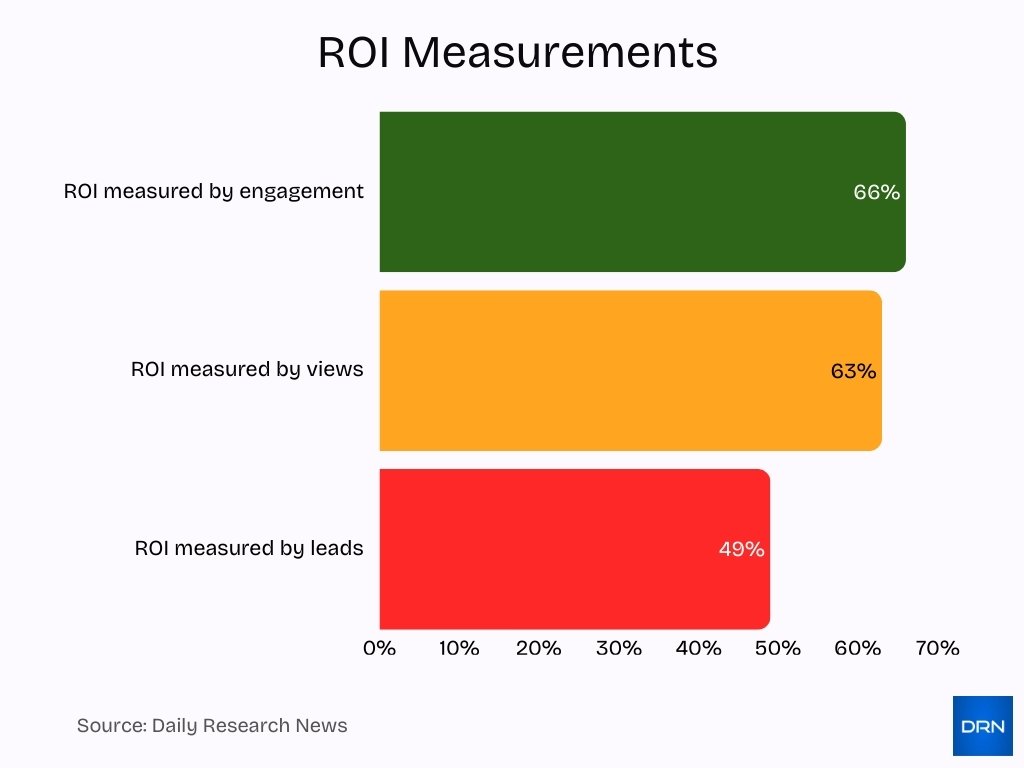

- 66% measure video ROI through engagement, 63% through views, 49% through leads.

- Live and long-form video remain part of the mix, though ROI trails short form.

- Short, mobile-optimized, visually compelling content remains king.

Social Commerce & Conversion Metrics

- U.S. retail social commerce sales are expected to pass $100 billion in 2025.

- Global social commerce penetration is projected to be near 24% by the end of 2025.

- Millennials are projected to represent 33% of global social commerce spend, Gen Z about 29%.

- Shoppable tags and Stories can increase conversion rates by up to 20%.

- 81% of consumers have made an impulse purchase after seeing a product on social media.

- In-app checkout and live shopping drive rapid conversion cycles.

- Fashion, beauty and lifestyle dominate social commerce performance.

- Platforms with integrated shopping features outperform those that redirect off-platform.

- Content and commerce continue to merge as purchase shortens.

- Budgets increasingly favour conversion-driven formats over awareness-only formats.

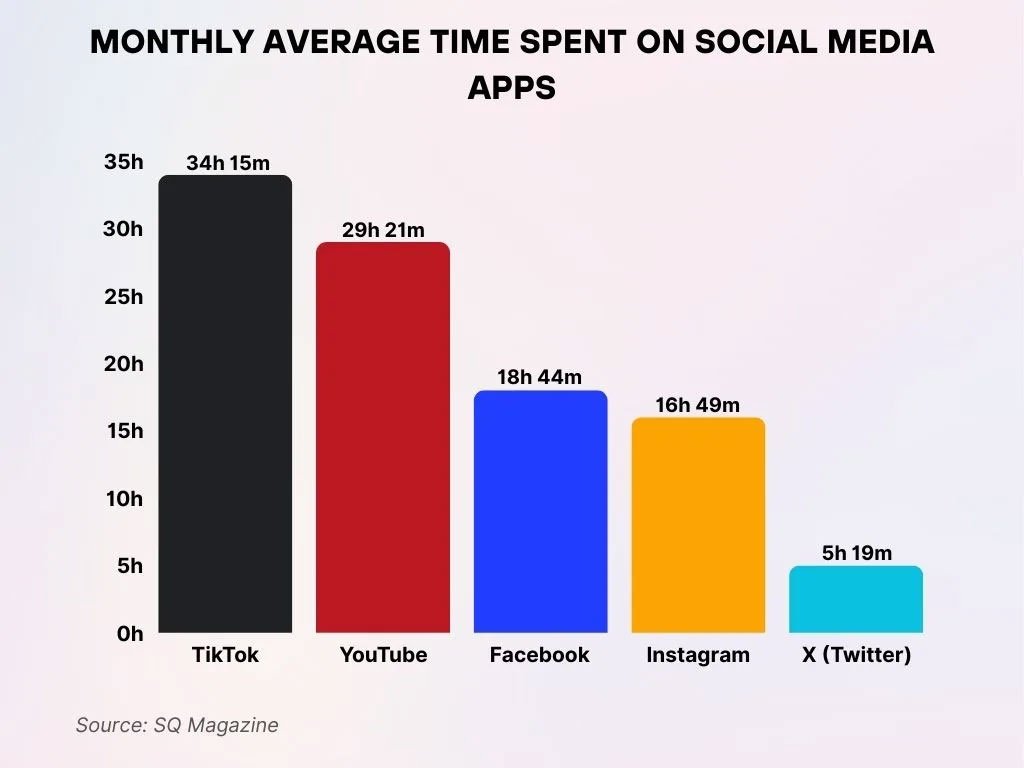

Monthly Average Time Spent on Social Media Apps

- TikTok leads user engagement, with an average of 34 hours and 15 minutes per month, marking the highest usage among all platforms.

- YouTube users spend about 29 hours and 21 minutes monthly, making it the second most time-consuming app.

- Facebook clocks in at 18 hours and 44 minutes per month, maintaining strong engagement from its user base.

- Instagram users average 16 hours and 49 minutes per month, reflecting its continued popularity for visuals and stories.

- X (formerly Twitter) sees the least time spent, with only 5 hours and 19 minutes per month on average.

Regional Variations & Emerging Markets

- Emerging markets in the Asia Pacific and Africa contribute to over 7% annual user base growth globally.

- India’s creator economy is valued at around $12.28 billion in 2025, growing at a 22.2% CAGR from 2025 to 2032.

- Data costs in low and middle-income regions can be up to 26.3% of GNI per capita, limiting access.

- Some markets in Latin America and Africa show daily social media use exceeding 3 hours 38 minutes, well above the 2 hours 16 minutes U.S. average.

- India’s social commerce market is expected to reach $8.42 billion in 2025, with a CAGR of 17.2%.

- Localized social media content achieves up to 12 times higher engagement than generic global campaigns.

- Privacy and trust concerns vary regionally, influencing social media behaviour in over 50% of surveyed users in emerging markets.

- Latin America and Africa exhibit rapid social platform growth rates of around 10-15% year-over-year user increases.

- Infrastructure constraints cause mobile data usage in some emerging regions to linger at an average of 0.2 GB per month compared to 7 GB in high-income countries.

- Global brands aligning messaging for both emerging and mature markets see up to 84% higher revenue growth with tailored approaches.

Audience Trust & Behaviour Insights

- 60% of consumers trust creators who feel relatable and authentic.

- 67% say honest, unbiased reviews are the most effective influencer content.

- Smaller TikTok creators may generate engagement up to 7.5%, higher than larger accounts.

- 34% of marketers are uncertain about social ROI measurement.

- 58% of consumers discover new businesses through social media.

- 83% of marketers report that AI helps them produce significantly more content.

- Users distrust overly promotional messaging, preferring community-oriented content.

- Engagement and trust outperform pure reach in audience retention.

- Minor UX friction can undermine trust and harm conversion.

- Consumers expect transparency in data usage, influencer partnerships and ad targeting.

ROI & Performance Measurement in Social Marketing

- Influencer marketing generates an average ROI of $5.78 per $1 spent.

- Social networks generate 17.11% of total global online sales in 2025.

- Social commerce is growing at a 13.7% CAGR, expected to exceed $1 trillion.

- 48% of marketers share similar content across platforms instead of fully customizing.

- 22% of marketers list ROI measurement as a core challenge.

- About 47.6% say they can measure AI’s impact effectively.

- Engagement metrics are used by 66% of video marketers for ROI measurement.

- Short-form videos deliver the highest ROI for 35% of marketers.

- Only 34% feel confident in measuring ROI precisely.

- Mobile social ad spend reached $82.69 billion, emphasizing mobile performance.

Regulatory, Privacy & Ethical Considerations

- As of early 2025, 42% of U.S. states had passed data privacy laws.

- Data protection laws now cover 79% of the global population.

- Major platforms vary widely in privacy scores, with some ranking high and others low.

- India’s Digital Personal Data Protection Act became fully operational in 2025.

- U.S. legislation increasingly targets deepfakes and non-consensual imagery.

- The EU’s Digital Services Act adds stricter transparency and content obligations.

- 60% of consumers trust creators who feel relatable and authentic, raising ethical stakes.

- Brands must emphasize consent, age verification and minimal data practices.

- Nearly 33% of social users have experienced at least one cyberattack attempt.

- Ethical, transparent data use becomes crucial for trust and compliance.

Predictions & Forecasts for the Coming Years

- Social media ad spend may rise from $276.7 billion in 2025 to $406.45 billion by 2029.

- By 2029, 88% of social ad spending may be mobile-based.

- The creator economy could surpass $528 billion by 2030.

- Short-form video will dominate brand content, with over 56% under two minutes by 2027.

- Social commerce may exceed 30% of global e-commerce by 2028.

- AI-driven content and analytics will become standard as adoption accelerates.

- Emerging markets will dominate new user growth beyond 2025.

- Regulations will tighten around youth privacy and data targeting.

- Platforms combining commerce, content and community will outperform others.

- Real-time measurement and agile creative testing will define performance leaders.

Global Social Media User Growth

- The global number of social media identities reached 5.66 billion in 2025.

- Annual net additions are roughly 259 million.

- Global penetration is 63.9% of the world population.

- Mature markets show slower growth compared to emerging regions.

- Average of 6.83 platforms used monthly per user.

- Mobile-first adoption drives user expansion in South Asia and Africa.

- Many new users enter social networks via mobile apps only.

- Global brands must engage both saturated and high-growth regions.

- Cultural, linguistic and technical differences shape platform usage.

- By 2030, global users could approach 6.5 billion.

Frequently Asked Questions (FAQs)

About 5.66 billion social-media user identities exist worldwide as of October 2025.

Roughly 63.9% of the world’s population uses social media as of the latest global overview.

Global spending on social-media advertising is expected to reach approximately $276.7 billion in 2025.

Social-media ad spend increased by about 10.9% year-over-year in 2025.

Conclusion

Social media marketing continues to scale in both reach and complexity. From strong ROI signals to the evolving creator economy, brands have more opportunities than ever, but also more variables to manage. Performance measurement, mobile optimization, and platform adaptation dominate the modern playbook.

At the same time, regulatory forces and privacy expectations reshape how social media works for brands and users. Looking ahead, marketers who stay agile, data-driven and ethically grounded are best positioned to harness the full potential of social media in both mature and emerging markets. Continue to the full article to explore deeper insights and regional breakdowns.