Outsourcing software development has evolved from a cost-cutting tactic into a strategic lever for companies worldwide. By tapping into global talent pools, firms streamline development cycles, accelerate product launches, and respond faster to shifting market demands. In industries such as fintech and health tech, outsourcing enables rapid scaling and access to specialized expertise that might not be available in-house. Explore below for detailed data and trends shaping outsourcing today.

Editor’s Choice

- In 2025, the global software development outsourcing market is estimated at $564.22 billion.

- The global IT services outsourcing market was valued at $611.8 billion in 2024.

- About 64% of IT leaders globally opt to outsource their software development needs.

- Offshore outsourcing accounted for 52.3% of the market share in 2024.

- Large enterprises represented 71.6% of outsourcing spend in 2024, with SMEs showing the fastest growth.

- Businesses leveraging outsourcing report up to 40% cost savings.

- Quality of service has become a key factor; 86% of business leaders rank service quality as critical when selecting an outsourcing partner.

Recent Developments

- Global IT outsourcing revenue projected to grow at 10.99% CAGR, reaching $777.70bn by 2028.

- Startup software outsourcing is expected to surge by 70% from 2022 to 2023.

- 80% of executives plan to maintain or increase third-party outsourcing investments amid talent and agility needs.

- 83% of firms expect vendors to provide AI capabilities in outsourcing services.

- Nearshore outsourcing market to expand at 8.7% CAGR through 2030, hitting $93.5bn.

- 77% of IT leaders view outsourcing providers as long-term strategic partners.

- 87% of executives integrate external IT vendors into their core workforce.

- 40% of organizations plan to boost outsourcing spend, versus 20% planning cuts.

- North America drove 29% of the global IT outsourcing market value in 2023.

Overview of Software Development Outsourcing Market

- The global software development outsourcing market is forecast to reach $897.44 billion by 2030.

- In 2024, application development led the service-type segment, with 38.2% market share.

- Small and medium enterprises (SMEs) are growing fastest in outsourcing adoption, with a projected CAGR of 11.6% through 2030.

- The Banking, Financial Services & Insurance (BFSI) sector held the largest end-user share at 26.4% in 2024.

- Healthcare and life sciences outsourcing is gaining traction, projected to grow at a 13.2% CAGR through 2030.

- Outsourcing appeals to firms needing to scale development quickly without the overhead of a full in-house team.

- For many companies, outsourcing is now a strategic tool for time-to-market acceleration.

- Service providers offer flexibility, and firms can scale team size up or down depending on the project phase.

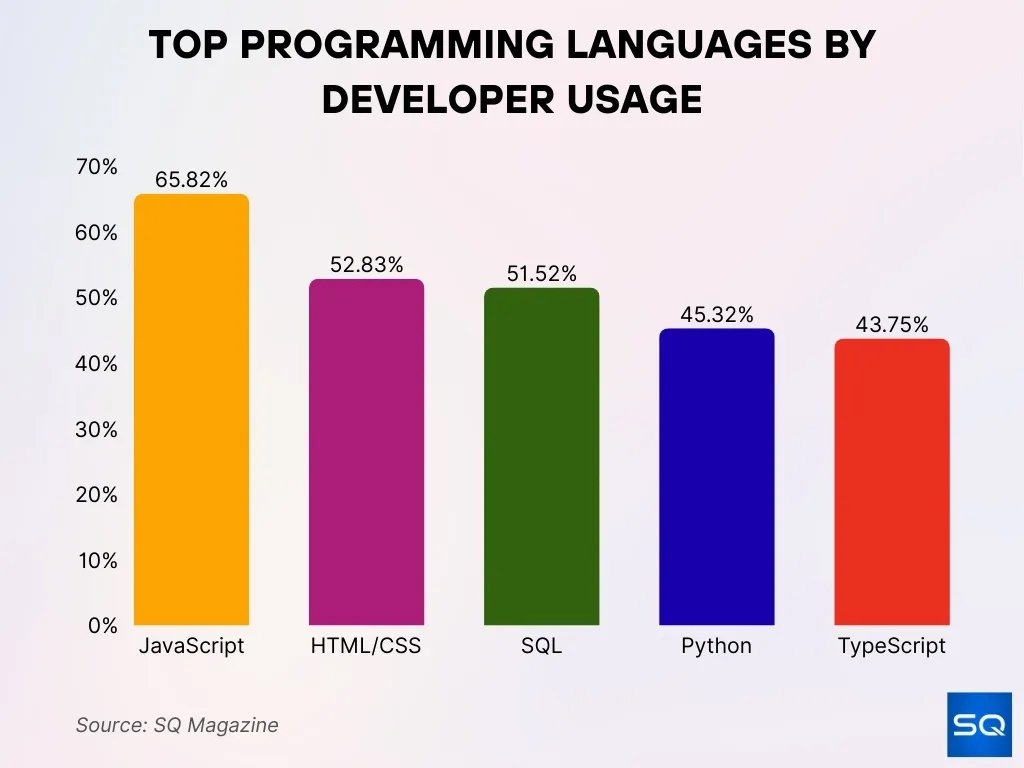

Top Programming Languages by Developer Adoption

- JavaScript dominates with 65.82% developer usage, establishing it as the most widely embraced programming language.

- HTML/CSS ranks next at 52.83%, remaining crucial for web development and front-end design.

- SQL is utilized by 51.52% of developers, highlighting its significance in database management.

- Python maintains 45.32% usage, being highly favored for AI, machine learning, and backend systems.

- TypeScript is adopted by 43.75%, increasingly valued for building scalable and maintainable codebases.

Global Software Development Outsourcing Statistics

- In 2025, the outsourcing market stands at $564.22 billion worldwide.

- Across all IT services outsourcing, the global market was estimated at $611.8 billion in 2024 and is projected to grow in 2025.

- Research indicates a global outsourcing market growth rate (CAGR) between 8% and 9% over the coming decade.

- Around 64% of IT leaders globally now outsource development projects.

- Offshore outsourcing remains dominant globally, with 52.3% market share in 2024.

- Demand growth originates especially from sectors like BFSI, healthcare, and tech-driven services.

- Smaller enterprises (SMEs) are becoming a significant outsourcing segment, with higher growth rates than large corporations.

- Quality and flexibility now trump pure cost savings in global outsourcing decisions.

- Global outsourcing services revenue (including software) is projected to top $1.3 trillion by 2034.

U.S. Software Development Outsourcing Statistics

- The U.S. IT outsourcing segment (software, infrastructure, managed services) is expected to exceed $213 billion in 2025.

- Each year, approximately 300,000 U.S. jobs in software development are outsourced.

- According to a 2025 projection, the U.S. remains the largest funds allocator globally. In 2024, U.S. software investment reached around $368.5 billion, more than half of global spending.

- Roughly 66% of U.S. businesses outsource at least one department.

- The demand for software developers, testers, and QA experts in the U.S. is projected to grow by 22% by 2030, making it among the fastest-growing job categories.

- Outsourcing continues to appeal in the U.S. because of access to specialized skills and the ability to scale temporarily without long-term commitment.

- Many U.S.-based firms outsource to manage peak workload demands rather than build permanent teams.

Popular Outsourcing Destinations by Region

- Eastern European countries hold nearly 40% of the global outsourcing market share in 2025.

- Offshore outsourcing took a 52.3% share globally in 2024.

- Nearshore outsourcing demand rose notably among European and North American clients in 2025.

- India and China attract over 50% of Asia’s outsourcing demand for IT and business processes.

- Emerging markets show annual growth rates of about 6.8% to 9% in outsourcing revenue.

- Eastern Europe’s IT outsourcing revenue is projected at $5.34 billion in 2025.

- Remote work boosted the global outsourcing market size to over $410 billion in 2025.

- Latin America, especially Colombia, is growing as a nearshoring hub with a 9.03% CAGR expected till 2029.

- Poland, Ukraine, Romania, and Bulgaria combined account for over 38% of the outsourcing market globally.

- Asia-Pacific is expected to be the fastest-growing outsourcing region, with India alone covering more than 50% of global BPO demand.

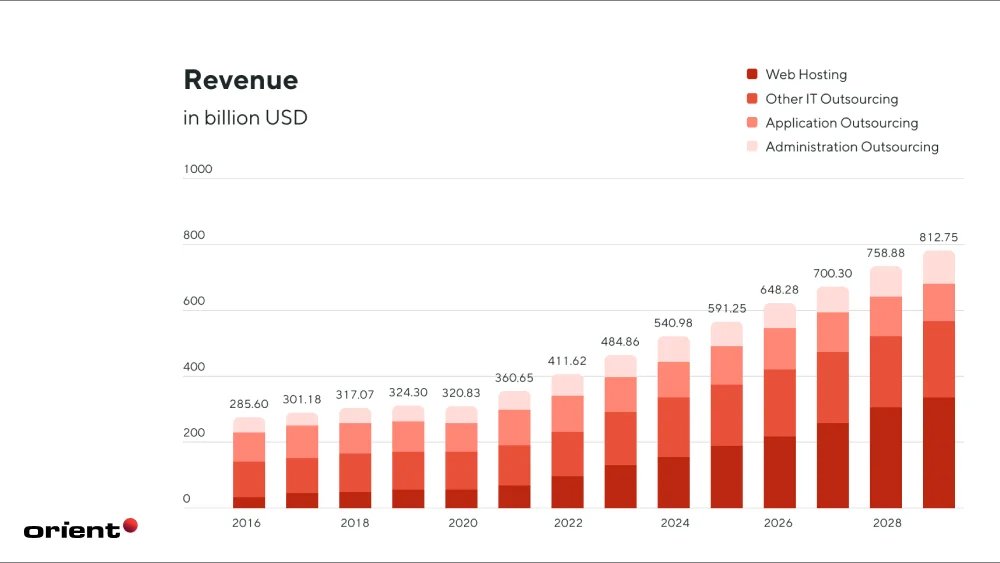

Global IT Outsourcing Revenue Trends and Segment-Wise Growth Overview

- Total global IT outsourcing–related revenue shows a steady rise from $285.60B in 2016 to a projected $812.75B in 2029, reflecting sustained expansion across the sector.

- The chart highlights four major segments: Web Hosting, Other IT Outsourcing, Application Outsourcing, and Administration Outsourcing, each contributing uniquely to overall growth.

- Growth accelerates sharply after 2021, with revenue increasing from $360.65B (2021) to $411.62B (2022) and continuing to climb annually.

- The industry crosses significant milestones, hitting $400B around 2022, $500B around 2024 (reaching $540.98B), $600B in 2026 (at $648.28B), $700B in 2027 (at $700.30B), and ultimately $800B by 2029 (at $812.75B).

- Web Hosting and Other IT Outsourcing stand out as the largest contributors, displaying consistently larger stacked portions throughout the observed period.

- Application Outsourcing and Administration Outsourcing likewise grow steadily, adding to the market’s expanding size.

- Year-over-year growth becomes increasingly prominent after 2023, indicating accelerating global demand for IT outsourcing services.

Cost Savings and Financial Benefits

- Companies achieve an average of 15% cost savings through business process outsourcing programs.

- 82% of businesses saved money via IT outsourcing in 2023.

- Firms report up to 70% labor cost reductions by hiring offshore developers.

- 59% of businesses cite cost savings as the primary reason for software outsourcing.

- Outsourcing cuts development costs by 40–60% versus in-house teams.

- Deloitte notes that 70% operational cost savings are possible for certain IT functions.

- Businesses save 20–30% or more on costs through strategic outsourcing.

- 93% of outsourcing companies report positive financial outcomes.

Growth Trends and Forecasts in Outsourcing

- The global outsourcing market is valued at over $400 billion in 2025 and projected to surpass $525 billion by 2030.

- The IT outsourcing market alone is expected to reach $662 billion in 2025 and grow to $1.345 trillion by 2034, with a CAGR of 8.2%.

- Outsourced product development generated $484.86 billion in 2023 and is forecasted to grow to $812.75 billion by 2029.

- 40% of outsourcing growth is attributed to SMEs, making outsourcing accessible beyond large enterprises.

- 92% of the top 2,000 global companies use IT outsourcing, showing strong adoption among large firms.

- About 77% of CIOs plan to increase outsourcing for critical skills, including cloud, AI, and cybersecurity.

- The broader IT outsourcing market is growing steadily, with an expected CAGR of 10.99% between 2024 and 2028.

- Regional outsourcing is diversifying, with Latin America and Eastern Europe projected to see double-digit growth over the next five years.

- IT outsourcing spend per employee averages around $164.56 in 2025, reflecting growing investment in outsourced capabilities.

- Full outsourcing is projected to account for 9% of the IT market by 2025, emphasizing strategic reliance beyond cost-cutting.

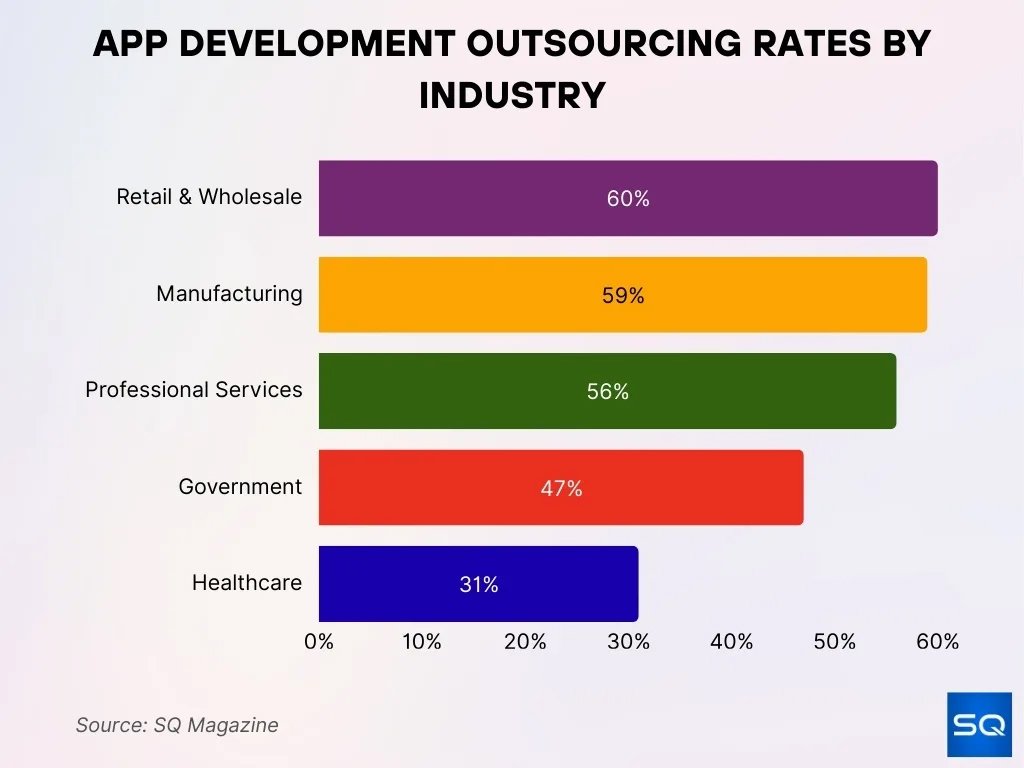

Most Common Outsourced Software Development Services

- Retail and wholesale businesses outsource app development at 60%, manufacturing at 59%, professional services at 56%, government at 47%, and healthcare at 31%, reflecting broad reliance on external development partners.

- Global businesses direct 64% of their outsourcing requests specifically toward software development services, indicating a strong emphasis on digital solutions.

- Financial companies outsource 72% of app development, showing the sector’s heavy dependence on external technical expertise.

- Companies prioritize cloud computing services in outsourcing, with 90% considering such capabilities crucial for operational efficiency.

- U.S. businesses consistently rank technology and innovation functions as their top categories for outsourcing due to strategic value.

- UK B2B companies most commonly outsource IT support, along with several additional important service functions.

- Corporate executives outsource analytics and data development at a notably high rate of 96%, underscoring data-driven decision-making needs.

- Enterprises direct 84.7% of their outsourced projects toward enterprise applications, highlighting large-scale operational priorities.

Outsourcing for Agile and DevOps Practices

- 75% of organizations require outsourcing partners to adopt Agile practices for iterative development.

- The DevOps outsourcing market is valued at $23.9 billion in 2023, projected to reach $71.9 billion by 2030.

- Agile projects achieve a 64% success rate, 1.5X higher than Waterfall’s 49%.

- Companies outsourcing DevOps gain 24X faster failure recovery and 3X fewer change failures.

- Agile outsourcing teams show 15% higher productivity and 65% better quality.

- High-performance DevOps teams enable 417X more deployments and 30X faster recovery.

- Stable outsourced Agile teams maintain less than 15% velocity variation between sprints.

- DevOps practices in outsourcing reduce deployment times by up to 50%.

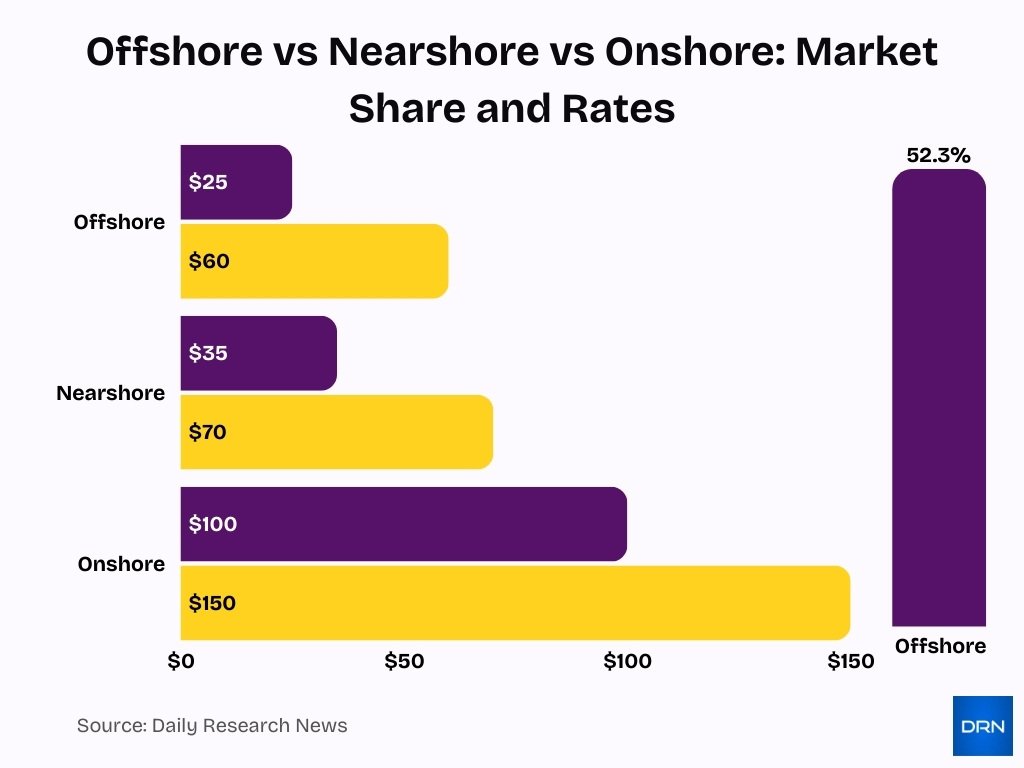

Offshore vs Nearshore vs Onshore Outsourcing Trends

- Offshore outsourcing constitutes approximately 52.3% of the global software development outsourcing market in 2025.

- Typical hourly rates for offshore outsourcing range from $25 to 60 per hour.

- Nearshore outsourcing hourly rates generally range between $35–70 per hour.

- Onshore outsourcing remains the most expensive, with rates averaging $100–150 per hour.

- Nearshore projects achieve an 80% success rate, compared to 60% for offshore projects.

- Nearshore outsourcing reduces communication issues by 65% and speeds project completion by 40% versus offshore.

- About 70% of U.S. businesses are changing outsourcing operations, with 33% specifically adopting nearshore solutions.

- Hybrid outsourcing models combining offshore, nearshore, and onshore teams are increasingly used for balancing cost, quality, and collaboration.

- North American companies show rising preference for nearshore outsourcing, with 80% exploring or using nearshore software development partnerships.

- Offshore developers can offer specialty skills like cloud and AI at 40–70% lower rates than onshore equivalents.

Impact of Hybrid Outsourcing Models

- Hybrid outsourcing models reduce operational costs by an average of 35%, according to a 2023 Deloitte survey.

- Businesses using hybrid in-house/offshore teams deliver MVPs up to 7 weeks faster than fully in-house setups.

- Outsourcing boosts delivery speed by up to 37% through hybrid team structures, optimizing time zones.

- Global outsourcing via hybrid models achieves 15-70% cost savings by converting fixed salaries to variable spend.

- Hybrid outsourcing cuts software release cycles to 12 weeks versus 19 weeks for in-house teams.

- Firms report 20-30% faster delivery velocity with hybrid teams leveraging near-24-hour progress.

- 59% of companies adopt hybrid outsourcing primarily to control or reduce operating costs.

- 84% of firms mix onshore, offshore, and nearshore teams in hybrid models for flexibility.

- Hybrid models save 30-40% on development costs while retaining in-house project control.

Key Technologies Influencing Outsourcing (AI, Cloud, Low-code)

- 70% of new enterprise applications will use low-code/no-code platforms by 2025.

- The global cloud computing market reached $912.77 billion in 2025.

- The cloud-based BPO market is expected to grow from $141.41 billion in 2025 at a 12.7% CAGR.

- 84% of businesses adopt low-code/no-code to address developer shortages.

- Companies using AI in outsourcing report 7% higher satisfaction rates.

- 77% of firms outsource IT infrastructure services, including cloud.

- 75% outsource emerging tech like AI, GenAI, and cloud.

- India’s custom software development grows at a 23.9% CAGR through 2035.

- 50% of new apps will be built with low-code/no-code by 2025 via hyperautomation.

Outsourcing for Quality Assurance and Testing

- The outsourced software testing market is valued at $61.13 billion in 2025, projected to reach $107.72 billion by 2029 at a 15.2% CAGR.

- Over 45% of organizations globally outsource at least one part of their software testing lifecycle in 2024.

- 72% of companies identify faster time-to-market as their top driver for QA outsourcing.

- Outsourcing QA can save 20-30% of project budgets by eliminating in-house overhead costs.

- 68% of outsourced testing projects involve automation to accelerate release cycles in 2024.

- The outsourced QA market is growing at a robust 11% CAGR due to rising software complexity.

- Companies save up to 70% on operational costs through IT outsourcing, including QA.

- Functional testing dominates outsourced QA services, verifying core software operations.

- 32% global increase in outsourced QA services volume in 2023, especially in IT and e-commerce.

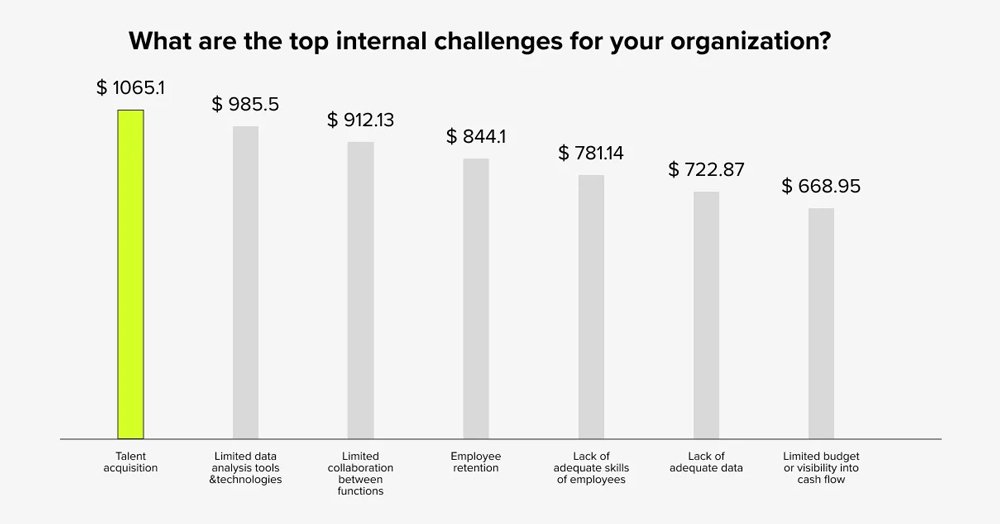

Major Internal Challenges in Software Development Outsourcing

- Talent acquisition remains the biggest challenge at $1,065.1, emphasizing the global shortage of skilled developers.

- Limited data analysis tools and technologies account for $985.5, indicating the strong need for advanced digital infrastructure.

- Limited collaboration between functions costs $912.13, reflecting persistent barriers in cross-team communication.

- Employee retention challenges total $844.1, underscoring the rising turnover in critical tech roles.

- Lack of adequate skills among employees stands at $781.14, pointing toward widening skill gaps in essential areas.

- Lack of adequate data is a hurdle worth $722.87, emphasizing the crucial importance of data accessibility.

- Limited budget or visibility into cash flow represents $668.95, highlighting financial constraints that hinder project scaling.

Talent Availability and Developer Salaries

- In 2025, there are 47.2 million developers worldwide, confirming persistent global talent shortages.

- 85% of companies have developer positions open for over 90 days, up from 42% in 2020.

- 74% of global employers struggle to fill developer roles, driving outsourcing adoption.

- Over 51% of tech leaders report lacking AI-skilled developers, with shortages at a 3.2:1 demand ratio.

- 76% of global executives outsource IT functions to access broader talent pools.

- US software developers earn a median of $210,000 annually, while the global median is $107,090.

- Outsourcing IT cuts operational costs by up to 70%, enabling access to lower-cost regions.

- Hiring senior developers now takes 4.5 months on average, nearly double from 2.3 months in 2020.

- 32% year-over-year AI developer salary increases highlight escalating talent competition.

Outsourcing and Business Performance Impact

- Companies outsourcing modern development (cloud, AI, low-code) achieve up to 25% faster time-to-market.

- Outsourcing hybrid teams deliver MVPs up to 7 weeks faster than in-house alone.

- Firms report 30-60% operating cost savings by converting fixed staff costs to variable outsourcing expenses.

- AI-assisted low-code outsourcing cuts enterprise project time-to-market by 50%.

- Outsourced software projects yield 2.8x ROI within 12-18 months through efficiency gains.

- Outsourcing reduces testing cycles by 40%, minimizing bugs and production downtime.

- 67% of financial services firms outsource testing, enhancing compliance and stability in regulated sectors.

- Businesses achieve up to 45% time-to-market reduction and rapid scalability during growth phases via outsourcing.

Security and Data Privacy in Outsourcing

- 83% of IT leaders plan to outsource to enhance data security measures.

- 81% of executives report outsourcing their cybersecurity needs amid rising threats.

- 73% of firms say cybersecurity risks heavily influence outsourcing vendor choices.

- 63% of data breaches stem from poor outsourcing decisions by third parties.

- 61% of DevOps teams adopt DevSecOps for secure outsourcing practices.

- 60% of organizations prioritize cybersecurity risks in third-party vendor deals by 2025.

- 47% of small businesses lacked dedicated compliance roles before outsourcing.

- 38% of organizations now outsource some or all compliance functions.

Frequently Asked Questions (FAQs)

The market is estimated to be $564.22 billion globally in 2025.

It is projected to reach $897.44 billion by 2030, with a compound annual growth rate (CAGR) of 9.73% from 2025 to 2030.

Approximately 64% of IT leaders globally report that they outsource software development.

Companies may realize between 15% and 70% cost savings when outsourcing software development rather than hiring and maintaining equivalent in-house teams.

Conclusion

Software development outsourcing reflects a mature, strategic industry, no longer just about cutting costs, but about accessing global talent, accelerating delivery, and navigating complex technical and regulatory demands. From low-code and AI-driven development to outsourced QA and secure DevSecOps practices, companies leverage outsourcing not as a stopgap but as a core element of their technology strategy.

At the same time, the model demands vigilance, quality control, data security, and vendor management remain critical. As demand for skilled developers stays high and technologies evolve rapidly, outsourcing stands poised to remain a cornerstone of enterprise growth and innovation.