Spotify remains the dominant force in global music and audio streaming, shaping how millions of people listen to music and podcasts daily. With its freemium model and wide content library, Spotify affects not just individual listening habits but also trends in advertising, artist revenue, and audio content production worldwide. In the U.S., creators use Spotify data to inform marketing and touring decisions, while brands tap into listener behavior for targeted audio ads. This article breaks down the latest user statistics to show how Spotify’s reach and engagement continue to evolve. Let’s dive into the numbers.

Editor’s Choice

- Spotify has 713 million monthly active users as of Q3 2025.

- 281 million of those users are Premium subscribers, representing its paid base.

- As of 2024, Spotify generated €15.67 billion in revenue.

- Spotify’s global market share in music streaming is about 31.7%.

- Europe accounts for roughly 28% of active users.

- Nearly 7 million podcasts are available on Spotify.

- Spotify’s Premium user growth is trending upward year over year.

Recent Developments

- Spotify expanded music video access for Premium users in the U.S. and Canada in late 2025.

- Engagement from Spotify Wrapped 2025 reached more than 200 million users in 24 hours, up 19% from 2024.

- Spotify plans U.S. subscription price increases following global adjustments.

- Spotify’s third-quarter earnings report shows revenue up 12% year over year in 2025.

- Gross margin improved to around 31.6%, showing operational gains.

- Spotify projects continued user growth, anticipating 745 million MAUs by year-end.

- Premium subscribers are also expected to rise to about 289 million by year-end.

- Spotify introduced expanded video podcasts and audiobooks to diversify content.

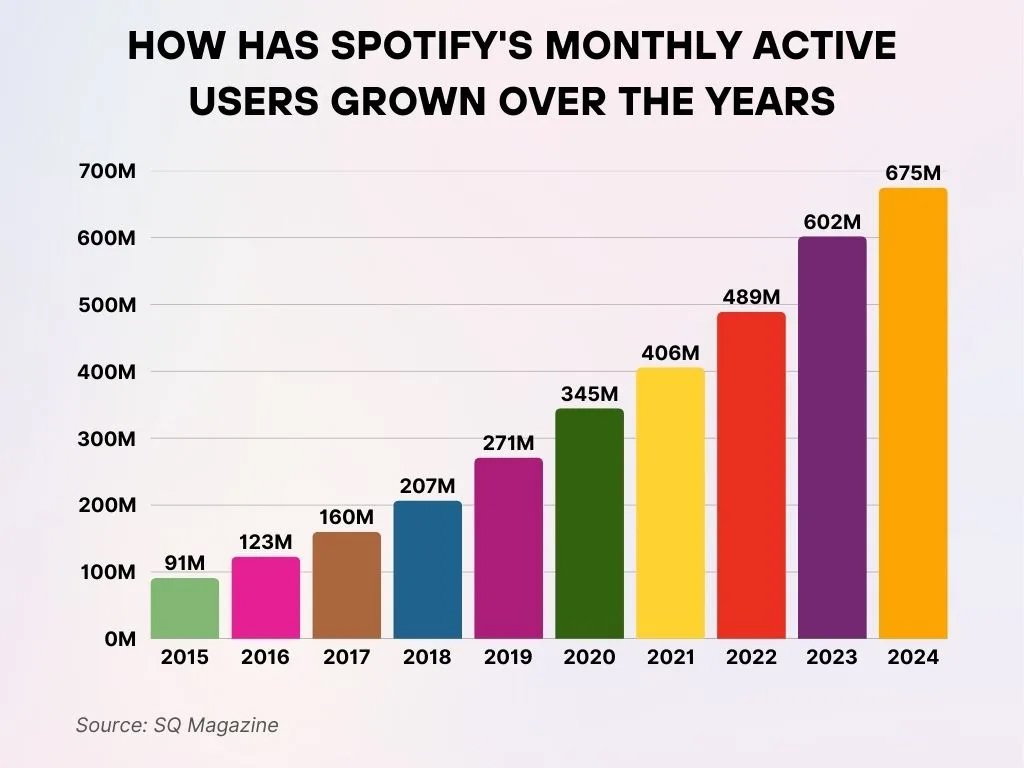

Spotify’s Growth in Monthly Active Users Over Time

- In 2015, Spotify recorded 91 million monthly active users, signaling its early leadership in the music streaming industry, with growth continuing steadily in the years that followed.

- By 2016, the user base rose to 123 million, representing a 35% growth compared to the previous year and reflecting increasing global adoption.

- In 2017, Spotify expanded to 160 million users, clearly demonstrating the platform’s ongoing global expansion and rising brand recognition.

- During 2018, usage climbed sharply to 207 million, fueled by mobile app adoption and multiple regional market launches worldwide.

- In 2019, the monthly active user base reached 271 million, marking a 31% increase that emphasized Spotify’s aggressive market expansion strategy.

- By 2020, Spotify surged to 345 million monthly active users, driven largely by the pandemic-related acceleration of digital entertainment services.

- In 2021, the platform grew further to 406 million users, strengthening Spotify’s status as the leading global music streaming platform.

- Throughout 2022, Spotify expanded to 489 million users, adding 83 million new users within a single year and reflecting strong consumer demand.

- In 2023, Spotify surpassed the 600 million milestone, reaching 602 million users globally, highlighting strong platform loyalty and increasing content value.

- As of 2024, Spotify achieved 675 million monthly active users, underscoring its explosive growth, sustained market resilience, and long-term industry dominance.

Spotify Premium Subscriber Growth

- Spotify’s Premium subscribers reached 281 million globally as of Q3 2025.

- This reflects about 12% year-over-year growth in paid subscribers.

- Europe and North America account for the largest share of Premium subscribers.

- Premium subscribers grew from 276 million in Q2 to 281 million in Q3 2025.

- Premium growth has outpaced many competitors in mature markets.

- Family and Duo plans represent a large portion of paid accounts.

- Subscriber growth continues even amid subscription price increases.

- Industry forecasts suggest continued growth through 2026.

Spotify Free vs Premium Users

- Spotify boasts 281 million Premium subscribers out of 713 million total MAUs in Q3 2025.

- Premium accounts represent approximately 39% of Spotify’s overall user base.

- Free users constitute the remaining 61% of the total user base.

- Premium subscribers generated €13.82 billion in revenue in 2024, comprising 88% of total company revenue.

- Free-to-Premium conversion rate reached 5.4% per quarter in 2025.

- Free users skip over 45% of tracks before the 30-second mark.

- Premium users are 2.3x more likely to complete full albums than Free users.

- Free tier experiences ads every 3–4 songs, driving advertising revenue growth.

- Monthly churn rate for Free users stands at 7.6%.

- Premium users exhibit 34% higher retention when creating personal playlists.

Demographic Breakdown of Spotify Users

- Millennials and Gen Z account for roughly 55% of Spotify’s user population.

- Spotify’s audience skews slightly male, at about 56% male overall.

- Most users are under 35 years old, though older groups continue to grow.

- Around 19% of users are age 55 or older, reflecting broader adoption.

- Average listening time per user exceeds that of many competing audio platforms.

- Many users engage with both music and podcasts regularly.

- Spotify’s demographic spread supports precise advertising segmentation.

- Growth among older listeners signals mainstream adoption beyond youth audiences.

Country-Wise Breakdown of Spotify Users

- The United States represents the largest share of Spotify users, with about 24.9% of global traffic.

- Brazil follows with roughly 14.0%, highlighting strong Latin American engagement.

- The United Kingdom contributes around 4.3% of global Spotify traffic.

- India accounts for approximately 3.5% of total usage, reflecting rapid growth.

- Mexico closely follows with about 3.4% of global traffic.

- Germany ranks among Europe’s largest Spotify markets with around 28 million users.

- South Korea entered the top markets with roughly 18 million users, driven by K-pop demand.

- In the U.S., listeners stream over 1.9 billion hours of audio monthly.

- Mobile access dominates across countries regardless of region.

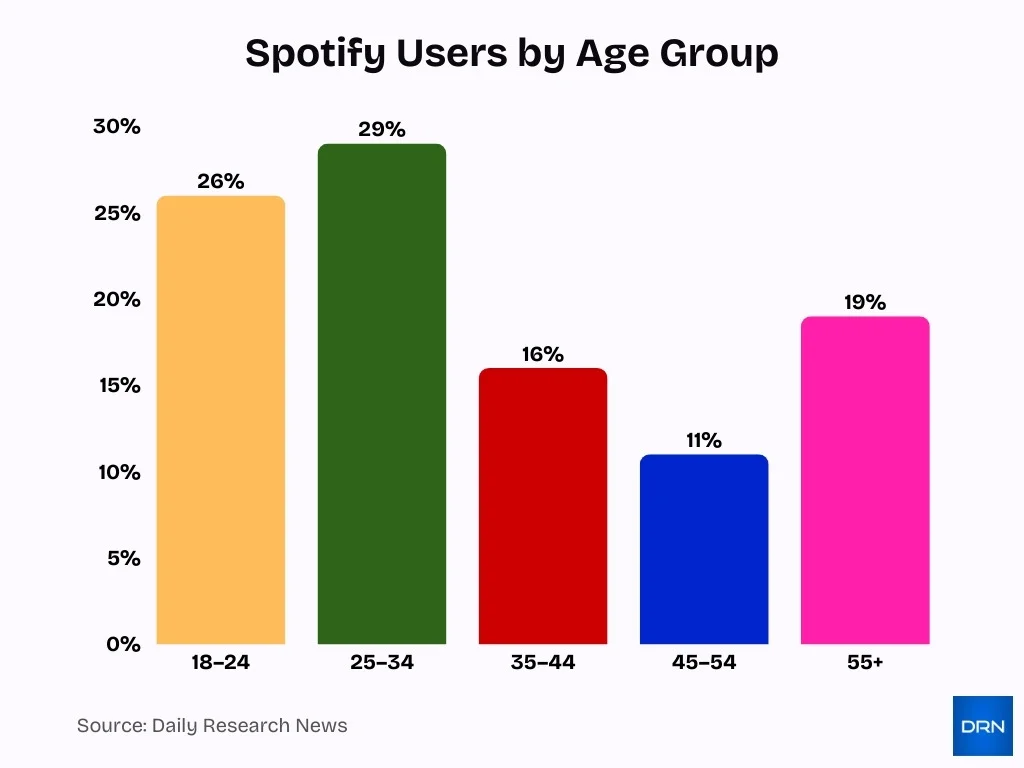

Spotify Users by Age Group

- Users aged 25–34 make up about 29% of Spotify’s global audience.

- The 18–24 age group represents roughly 26% of listeners.

- Users aged 35–44 account for about 16% of the user base.

- The 45–54 age group comprises around 11% of users.

- Listeners 55 and older represent approximately 19% of Spotify users.

- Gen Z and Millennials together account for more than half of total usage.

- Older age groups continue to show rising adoption rates.

- Spotify usage reflects a broad and diverse age distribution globally.

Retention and Churn Metrics for Spotify Users

- Premium users experience lower churn rates than Free users.

- Free users churn more frequently due to ads and feature limitations.

- Family, Duo, and Student plans demonstrate higher retention levels.

- Premium churn has declined to roughly 1.3% in recent periods.

- Algorithm-driven playlists and personalization improve long-term retention.

- Spotify Wrapped helps temporarily boost engagement and retention at year-end.

- Podcast engagement correlates with stronger long-term user retention.

- Cross-device syncing reduces churn by improving listening continuity.

Tracks Streamed per User

- On Spotify, users listen to an average of 40 unique artists per week, up from just under 30 since 2014.

- Spotify users spend around 140 minutes per day on the platform, equal to roughly 16–20 full tracks daily per user.

- Global music streaming services grew streams by about 10.4% in 2023, reflecting rising per-user listening volumes each year.

- Teenagers aged 16–19 get about 62% of their total listening time from streaming, with Spotify alone taking 51% of that time.

- Among U.S. listeners 18–34, podcasts capture roughly 32% of daily audio time, significantly lifting total streams per user.

- For Americans 13+, podcasts now represent about 10% of total daily audio time, adding meaningfully to overall streaming minutes per user.

- Super-listener “power fans” can be just 2% of an artist’s monthly listeners yet generate over 18% of monthly streams, often hundreds of plays each.

- Music streaming services collectively added about 34.1 million new tracks in 2022, a 12% rise year over year, supporting higher per-user stream counts.

- By Q1 2023, around 120,000 new tracks per day were hitting streaming platforms, up from 93,400 per day in 2022, deepening catalogs and boosting user streaming.

Mobile vs Desktop Usage

- About 72% of Spotify sessions begin on mobile devices.

- Desktop accounts for roughly 19% of total sessions.

- Smart speakers and wearables contribute about 9% of session starts.

- Tablet usage represents less than 4% of overall sessions.

- Desktop listening peaks during typical workday hours.

- Mobile listening peaks during morning and evening commute times.

- Android users represent a large share of mobile listening globally.

- In-car integrations contribute a growing share of mobile listening time.

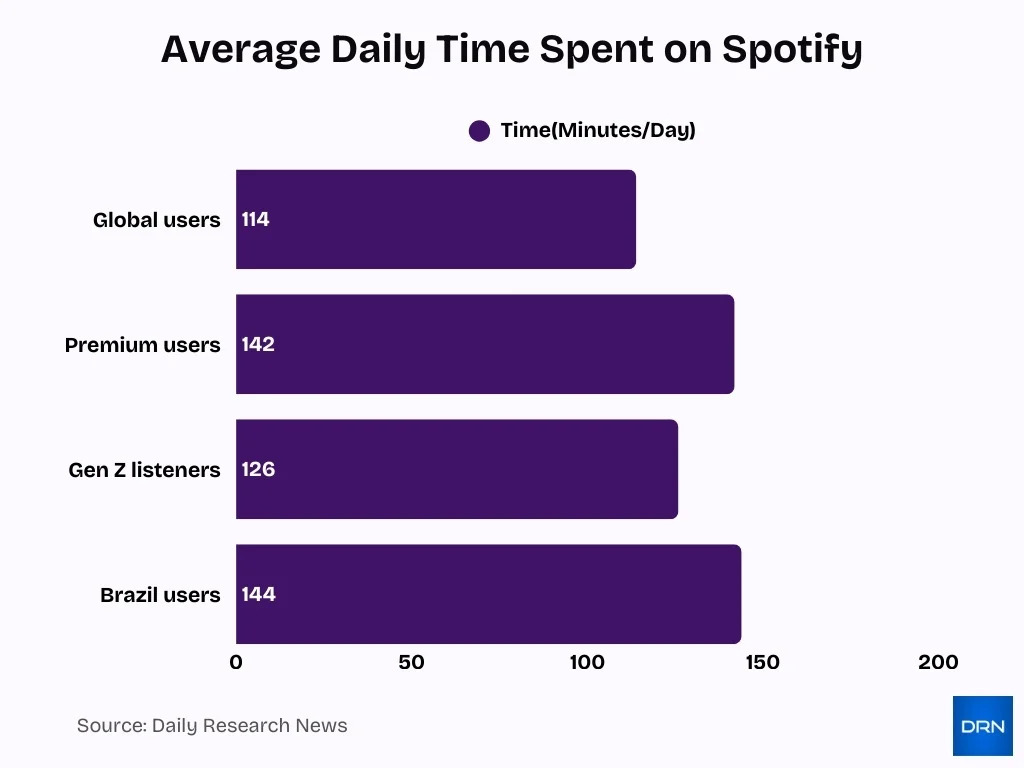

Average Time Spent on Spotify

- Global users spend an average of 114 minutes per day on Spotify.

- Premium users listen longer, averaging about 142 minutes daily.

- Gen Z listeners average approximately 126 minutes per day.

- In Brazil, average daily listening exceeds 2.4 hours per user.

- Listening time varies by region and by music versus podcast consumption.

- North American users tend to spend more time listening daily than Europeans.

- Older users often favor longer listening sessions outside work hours.

- Personalized playlists contribute significantly to extended listening time.

Cross-Device Usage Patterns

- 72% of Spotify sessions occur on mobile devices worldwide.

- Desktop accounts for 19% of Spotify listening sessions.

- Smart speakers represent 9% of Spotify access among global users.

- Wearables contribute 3.5% to total mobile Spotify usage.

- Smart speaker ownership reaches 35% among U.S. adults aged 12+.

- 22% of Americans listened to audio on smart speakers last month.

- Car audio streaming time on Spotify surged over 40% since April reopenings.

- Spotify users average 148 minutes daily across cross-platform devices.

- Cross-device switching boosts session lengths as mobile sessions shorten faster than desktop sessions.

Spotify Global Market Share in Music Streaming

- Spotify controls approximately 31.7% of the global music streaming market.

- Some market estimates place Spotify’s share closer to 35% globally.

- Tencent Music holds about 14.4% of the global market, far behind Spotify.

- Apple Music’s global share sits around 12.6–14%.

- Amazon Music accounts for roughly 11.1% of the global market share.

- YouTube Music holds close to 9.7% of the market.

- Smaller regional platforms make up the remaining share.

- Spotify’s lead reflects its Free-plus-Premium hybrid model.

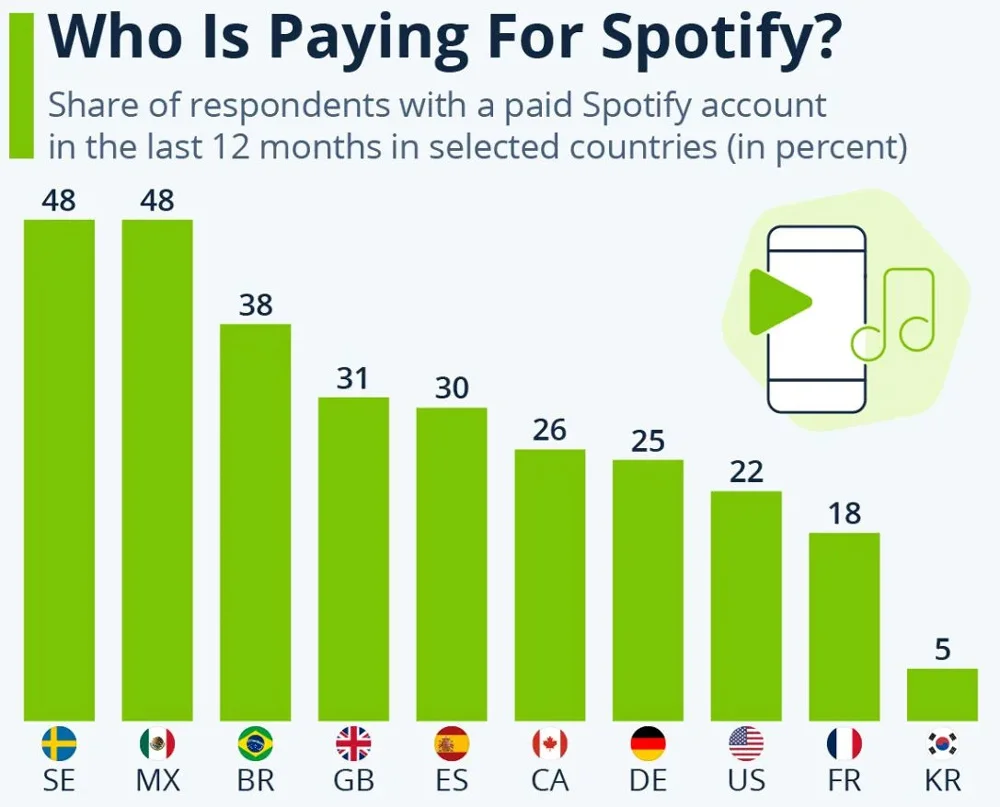

Spotify Premium Subscription Trends Across Countries

- Sweden and Mexico emerge as leaders in Spotify Premium adoption, with 48% of respondents in both countries reporting that they held paid accounts during the past year.

- Brazil comes next with 38%, highlighting strong demand for Spotify’s paid services throughout Latin America.

- The United Kingdom reports 31%, while Spain follows closely with 30% of users maintaining paid Spotify subscriptions.

- Canada records 26% of respondents paying for Spotify, slightly higher than Germany, which stands at 25%.

- In the United States, only 22% of users indicated that they paid for a Spotify subscription within the past 12 months.

- France shows a comparatively smaller premium user base at 18%, reflecting a slower adoption rate of paid music streaming.

- South Korea ranks the lowest among the listed countries, with just 5% of users subscribing to Spotify Premium.

Spotify vs Apple Music Users

- Spotify has about 281 million Premium subscribers, compared with Apple Music’s roughly 108 million.

- Spotify’s combined Free and Premium user base far exceeds Apple Music’s paid-only audience.

- In the U.S., Spotify holds around 36% of paid streaming listeners.

- Apple Music follows closely in the U.S. with about 30.7% share.

- Amazon Music accounts for roughly 21.6% of U.S. paid subscribers.

- Spotify’s freemium model attracts more casual listeners globally.

- Apple Music benefits from deep integration within Apple’s device ecosystem.

- Both platforms continue competing through personalization and exclusive content.

Spotify Subscription Revenue

- Spotify generated €15.67 billion in revenue in 2024.

- Q3 2025 revenue reached approximately €4.3 billion, up 12% year over year.

- Premium subscriptions remain Spotify’s largest revenue driver.

- Advertising from Free users contributes a growing share of revenue.

- Podcasts and audiobooks help diversify revenue streams beyond music.

- Subscription price increases aim to strengthen long-term revenue growth.

- Tiered plans support flexible monetization strategies.

- Engagement features like playlists and video content support revenue expansion.

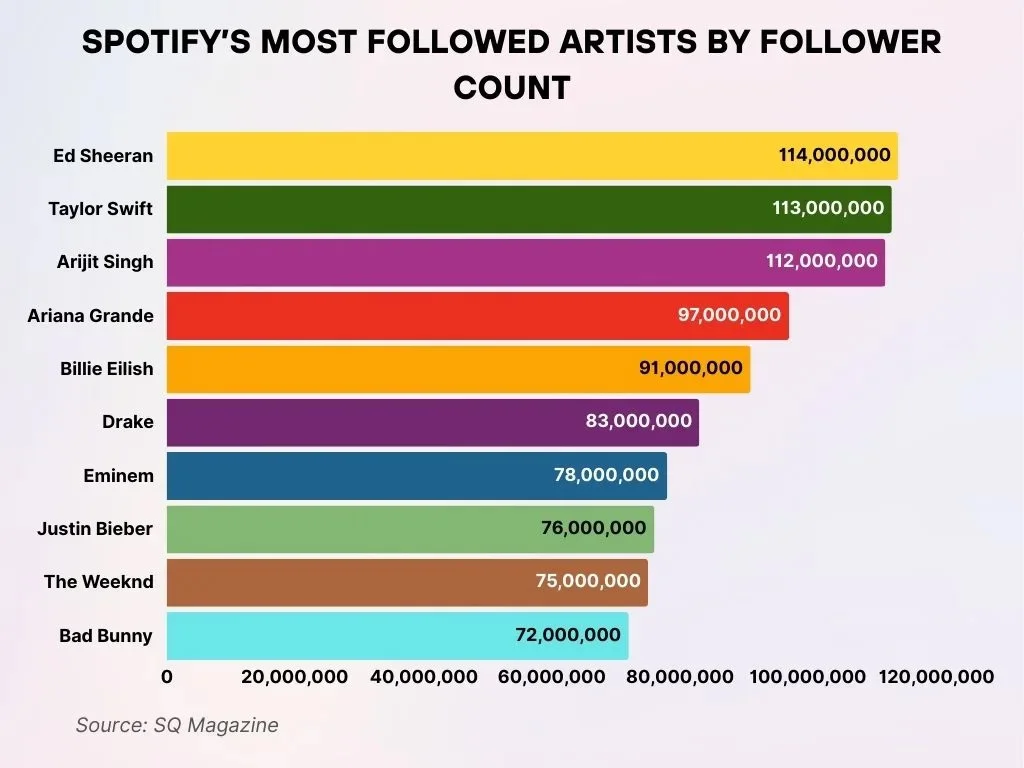

Top Spotify Artists Ranked by Total Followers

- Ed Sheeran leads the rankings with approximately 114 million followers, solidifying his position as the most followed artist on Spotify.

- Taylor Swift comes in a close second with around 113 million followers, fueled by her global fanbase and recent successful album releases.

- Arijit Singh secures the third spot with 112 million followers, highlighting the worldwide popularity of Indian music.

- Ariana Grande has accumulated about 97 million followers, continuing her strong influence across pop and R&B audiences.

- Billie Eilish draws nearly 91 million followers, demonstrating her strong appeal among younger listeners and alternative pop fans.

- Drake commands an impressive 83 million followers, driven by his consistent dominance on global music charts.

- Eminem has established a dedicated base of 78 million followers, sustained by decades of iconic hip-hop releases.

- Justin Bieber remains one of the most followed artists with 76 million followers, despite intense competition from newer musicians.

- The Weeknd attracts 75 million followers, supported by his genre-blending sound and international hit records.

- Bad Bunny completes the top ten with 72 million followers, underscoring the global rise and influence of Latin music.

Average Revenue per User (ARPU)

- Spotify’s Premium ARPU reached €4.53 in Q3 2025, flat YoY at constant currency.

- Global ARPU for Spotify Premium rose 5% YoY to €4.85 in Q4 2024.

- Apple Music maintains a higher ARPU at $7-8 per user due to a paid-only model.

- Premium ARPU climbed to €4.57 monthly in 2025, up 3% from 2024.

- Europe accounts for 40% of Spotify’s paying subscribers, boosting regional ARPU.

- Ad-supported users comprise 12% of revenue, diluting blended ARPU.

- North America represents 29% of paying subscribers with higher pricing potential.

- Latin America holds 20% of subscribers, but has a lower regional ARPU due to pricing.

- Premium subscribers grew to 281 million in Q3 2025, supporting ARPU resilience.

Spotify Podcast Listeners

- Spotify hosts nearly 7 million podcasts globally.

- Podcast listeners on Spotify total 42.4 million monthly active users in the US.

- Over 390 million users have streamed a video podcast on Spotify.

- Nearly 1 in 3 US podcast monthly active users engage with video podcasts.

- Spotify paid over $100 million to podcast creators in Q1 2025 alone.

- Video podcast consumption grew by 40% year-over-year globally.

- Time spent on video podcasts has doubled in the past year.

- Listeners engaging with shows via comments/polls consume 42% more content.

- Podcast adopters increase total streaming time by 20% weekly on Spotify.

Spotify User Growth Over Time

- Spotify hit 713 million MAUs in Q3 2025, up 11% year-over-year.

- Premium subscribers reached 281 million in Q3 2025, growing 12% YoY.

- Spotify added 17 million net MAUs in Q3 2025 alone, from 696 million in the prior quarter.

- MAUs surged from 626 million in Q2 2024 to 696 million in Q2 2025.

- Spotify Wrapped 2025 engaged over 200 million users in the first 24 hours, up 19% YoY.

- Wrapped shares hit around 500 million in 2025, a 41% YoY increase.

- Spotify forecasts 745 million MAUs by the end of Q4 2025, adding 32 million quarterly.

- Premium net additions grew over 30% in the first half of 2025 vs. 2024.

- Europe drives 28% of Spotify’s MAU growth as its largest market.

Frequently Asked Questions (FAQs)

713 million monthly active users as of Q3 2025.

281 million Premium subscribers, making up roughly 39% of total users.

Premium subscribers grew 12% year-over-year as of the third quarter of 2025.

Spotify reported €4.3 billion in total revenue for Q3 2025.

Conclusion

Spotify stands as the leading global music streaming platform, both in audience size and market presence. Its freemium model fuels sustained user growth, while Premium subscriptions and diversified audio offerings support revenue and engagement. Spotify’s market share exceeds that of Apple Music, Amazon Music, and other competitors, though competition remains intense in key regions like the U.S.

Continued investment in podcasts, personalization, and global expansion positions Spotify for ongoing growth. These statistics provide a clear view of Spotify’s current standing and the direction it is heading next.