Technology growth is reshaping industries, economies, and daily life at an accelerating pace. From investments in artificial intelligence (AI) to expanded cloud and cybersecurity spending, virtually every sector is seeing transformational shifts. For example, businesses are increasingly moving core functions to cloud platforms, and governments are investing heavily in digital infrastructure to boost services. Global tech spending is projected to remain robust, offering strategic value for enterprises and consumers alike. Continue reading to explore the latest data driving this digital evolution.

Editor’s Choice

- Worldwide IT spending is forecast to surpass $6.08 trillion in 2026, up nearly 10% from 2025 projections.

- Global digital transformation spending is expected to reach $3.4 trillion by 2026, led by cloud services and AI.

- The global IoT integration market is forecast to grow from $6.01 billion (2025) to $7.88 billion (2026).

- Connected IoT devices are projected to reach 21.1 billion in 2025.

- The U.S. IT services market is estimated at $490.86 billion in 2025, with steady growth ahead.

- The cybersecurity market is expected to rise from $218.98 billion (2025) to $248.28 billion (2026).

- More than half of IT departments plan to increase tech spending in 2026.

Recent Developments

- AI adoption across enterprises continues to grow significantly year over year.

- Productivity rises in certain sectors, partly driven by automation and AI.

- Investors cite AI-driven inflation risks for 2026 due to heightened infrastructure and tech expenditures.

- Global data center markets are poised to expand by ~14% annually through 2030.

- Leaders emphasize shifting AI strategies from efficiency to growth-oriented goals.

- Expansion of global tech trends is focusing on actionable outcomes over hype.

- Cloud giant investments are affecting stock markets and corporate capital plans.

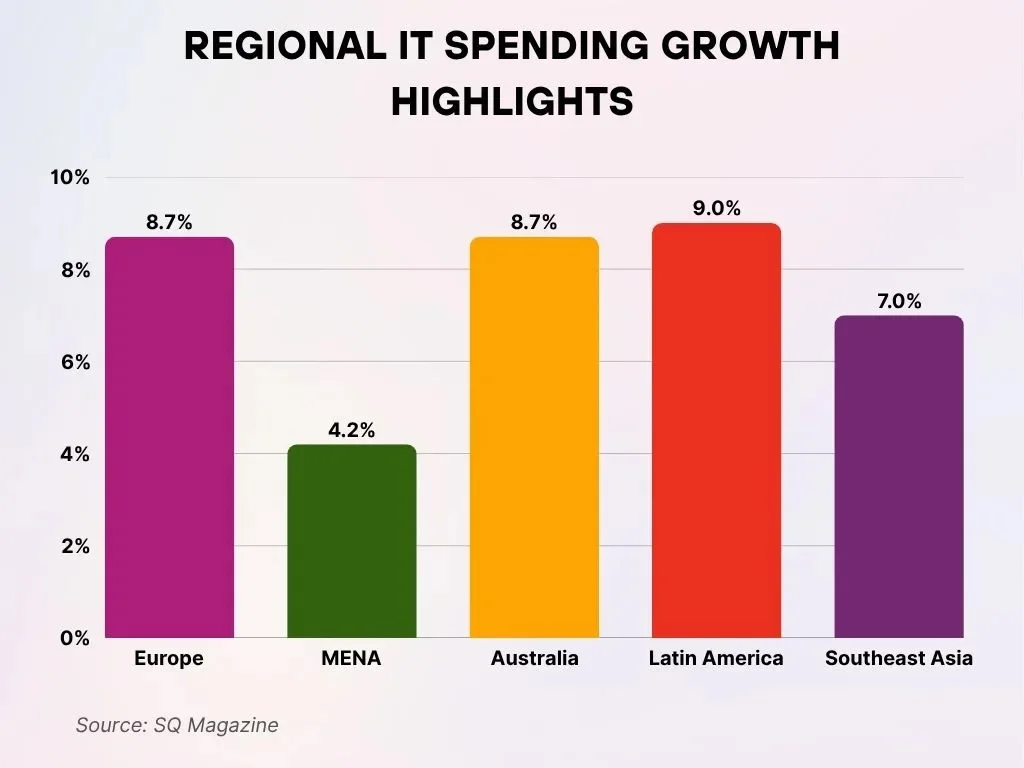

Regional IT Spending Growth Overview

- Latin America emerges as the fastest-growing region, recording the highest IT spending growth rate of 9.0%.

- Europe and Australia remain strong performers, each posting a robust IT spending growth rate of 8.7%.

- Southeast Asia demonstrates steady momentum, achieving a solid growth rate of 7.0% in IT spending.

- MENA (Middle East and North Africa) trails other regions, registering the lowest IT spending growth rate of 4.2%.

IT Services Market Growth

- The U.S. IT services market is valued at $490.86 billion (2025).

- Forecasts anticipate growth to $691.57 billion by 2030 at ~7.1% CAGR.

- Managed services account for ~28.2% of the U.S. IT services market share.

- Cloud & platform services are expected to grow at a ~9.2% CAGR through 2030.

- Project-based contracts held a ~45.7% share in 2024.

- The global IT services market size was about $1.9 trillion (2025).

- Projected to reach $2.08 trillion in 2026.

Software Industry Expansion

- Global software market reaches $824 billion in 2025, growing at 11.8% CAGR to $2,248 billion by 2034.

- Enterprise software spend surges 15.2% in 2026, hitting $1.43 trillion as the largest IT segment.

- Software captures over one-third of Europe’s €1.4 trillion tech spend in 2025.

- Cloud-native technologies are adopted by 15.6 million developers globally, with 77% backend usage.

- The embedded AI market expands from $9.4 billion in 2023 to $18 billion by 2028 at 14% CAGR.

- Public cloud services spending hits $723.4 billion in 2025, up 21.5% year-over-year.

- Europe’s software development revenue grows at 6.9% CAGR, reaching €490 billion by 2025.

- 88% of enterprises report regular AI use, fueling software integration demands.

- SaaS revenues lead the cloud at $390.5 billion in 2025, dominating enterprise adoption.

Data Center Investments

- Spending on data centers linked to AI demand can boost U.S. GDP growth.

- Data center markets are expected to grow around 14% annually through 2030.

- Hyperscale facilities support expanding AI and cloud workloads.

- Energy infrastructure investments are increasing alongside data center builds.

- US firms are expanding capacities to meet analytics and storage demand.

- Data center investment trends reflect broader enterprise digital transformation.

- Emerging markets gain interest in distributed computing facilities.

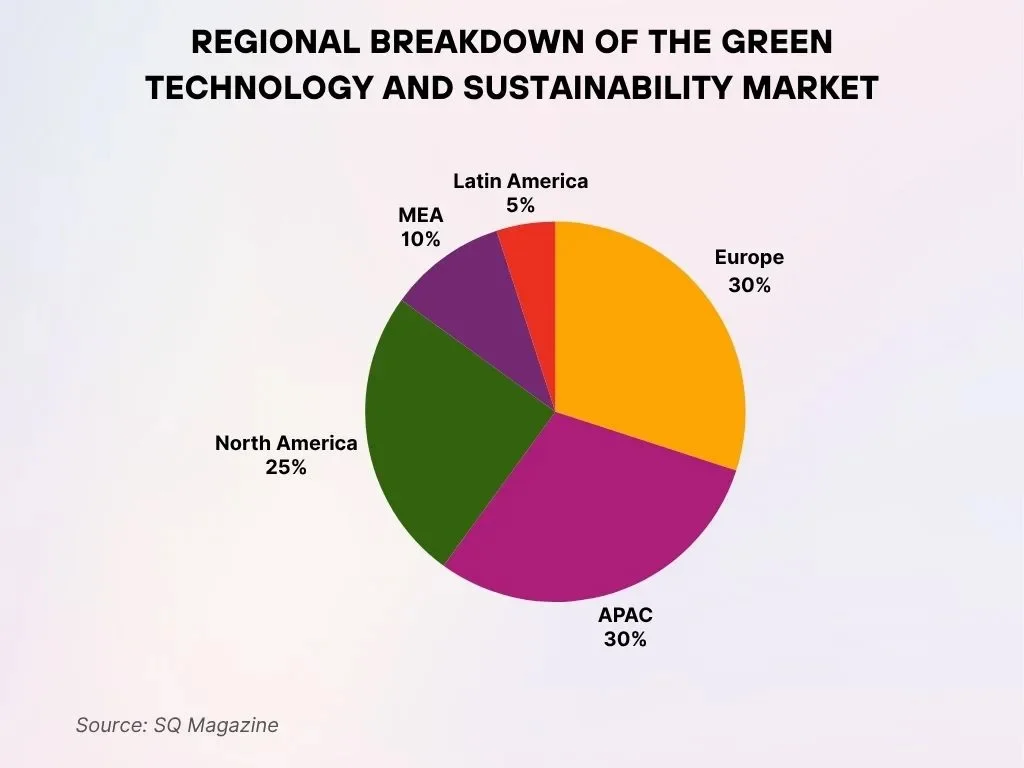

Regional Distribution of the Green Technology and Sustainability Market

- Europe and APAC are jointly positioned as market leaders, with each region accounting for 30% of the global market share.

- North America ranks next, representing a substantial market presence with a 25% share of the overall market.

- MEA (Middle East and Africa) adds a moderate contribution, comprising 10% of the total market share.

- Latin America records the lowest participation at 5%, clearly highlighting significant growth potential within the region.

Cloud Computing Adoption

- The global cloud computing market is projected to be roughly $905 billion in 2026, up sharply from about $781 billion in 2025.

- Market forecasts show continued long‑term expansion toward multi‑trillion dollar valuations by 2034, with a CAGR of ~15.7% from 2026 onward.

- Cloud infrastructure spending reached $102.6 billion in Q3 2025, marking over 25% year‑over‑year growth as enterprises shift AI and core workloads to cloud platforms.

- AWS, Microsoft Azure, and Google Cloud together held ~66% of global cloud infrastructure spending in late 2025.

- Around 60% of business data is stored in the cloud, reflecting deep adoption across sectors.

- Nearly 96% of companies utilize public cloud services, with 84% also using private cloud models.

- Hybrid and multi‑cloud strategies now dominate enterprise IT plans, balancing cost and operational flexibility.

- Cloud adoption is especially strong in North America (52% share) and Europe (~$205 billion market) in 2026.

- Asia Pacific cloud spending is rising fast, with markets like China and India contributing significantly as AI and 5G use expands.

AI Market Projections

- The global AI market is projected to grow from about $375.9 billion in 2026 to more than $2.4 trillion by 2034 at a ~26.6% CAGR.

- AI spending worldwide has become central to enterprise budgets, with hyperscaler capex alone estimated at $490 billion by 2026.

- Samsung plans to integrate AI features into 800 million devices in 2026, doubling its AI‑enabled shipments from the prior year.

- Global AI compute demand and infrastructure investment are forecast to require 55 gigawatts of new data center power capacity by 2030.

- AI integration into enterprise workflows is rising, with more than 79% of organizations reporting some level of AI adoption by 2025.

- Market research indicates AI software enterprise adoption has increased more than 270% over recent years.

- Growth in generative AI, intelligent automation, and machine learning platforms boosts total market size and solution diversity.

- By 2026, AI PCs are expected to represent a growing share of device shipments, pushing embedded intelligence across enterprise and consumer systems.

- AI remains a strategic priority for U.S. and global tech investment, although some analysts caution about potential overheating.

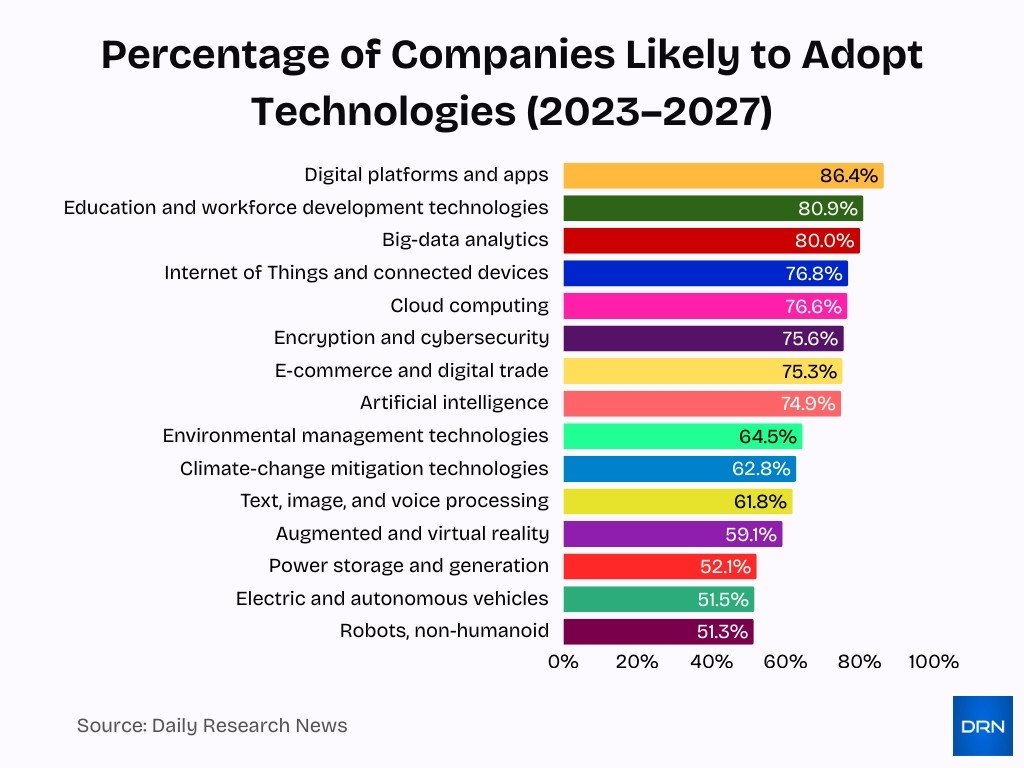

Technology Adoption Trends Among Companies

- Digital platforms and apps dominate corporate technology priorities, with 86.4% of companies expected to adopt these solutions between 2023 and 2027.

- Education and workforce development technologies show strong momentum, as 80.9% of organizations plan to implement them to support upskilling and talent development.

- Big-data analytics remains a strategic focus, with 80.0% of companies likely to adopt data-driven decision-making tools.

- Internet of Things (IoT) and connected devices continue expanding across industries, with 76.8% of firms projected to adopt these technologies.

- Cloud computing adoption remains robust, with 76.6% of companies expected to migrate or expand cloud-based infrastructure.

- Encryption and cybersecurity technologies are a top priority for digital risk management, with 75.6% of companies planning adoption.

- E-commerce and digital trade solutions are set for widespread uptake, with 75.3% of organizations expected to integrate them.

- Artificial intelligence (AI) is moving toward mainstream enterprise use, with 74.9% of companies likely to adopt AI-driven systems.

- Environmental management technologies are gaining relevance, with 64.5% of firms planning adoption to improve sustainability performance.

- Climate-change mitigation technologies show rising corporate interest, with 62.8% adoption expected over the forecast period.

- Text, image, and voice processing technologies are projected to be adopted by 61.8% of companies as automation and AI use grow.

- Augmented and virtual reality (AR/VR) solutions are expected to reach 59.1% adoption, particularly in training and simulation use cases.

- Power storage and generation technologies are likely to be adopted by 52.1% of organizations, reflecting energy transition efforts.

- Electric and autonomous vehicles show moderate enterprise uptake, with 51.5% of companies expected to adopt related technologies.

- Non-humanoid robots are projected to see 51.3% adoption, highlighting continued automation in industrial and logistics operations.

IoT Device Proliferation

- Globally connected IoT devices hit ~27.1 billion in 2025, reflecting 13% year-over-year growth.

- IoT devices are projected to reach 40 billion by 2030 worldwide.

- The Industrial IoT market reached $289 billion in 2024, growing at 12.7% CAGR through 2033.

- Cellular IoT connections comprise 21% of global IoT links, with 5.9 billion forecast by 2035.

- Consumer electronics account for ~60% of all IoT devices deployed.

- The IoT wearable devices market is valued at $23.37 billion in 2025.

- Enterprise IoT expected to surpass $2,021 billion by 2033 at 13% CAGR.

- The IoT security market is expected to grow from $35.9 billion in 2024 at 22.1% CAGR.

- The edge computing market for IoT reached $16.6 billion by 2025.

- The connected vehicles market is valued at $84.68 billion in 2025.

Cybersecurity Spending Rise

- The global cybersecurity market was valued at approximately $271.9 billion in 2025.

- Spending is estimated to grow further in 2026, with forecasts expecting continued double‑digit annual growth.

- Cybercrime losses are projected to exceed $10.5 trillion annually by 2025, fueling demand for defensive solutions.

- The U.S. and Western Europe jointly account for more than 70% of global security expenditures.

- Identity and Access Management (IAM) and hardware security segments held significant market shares in 2025.

- North America dominated cybersecurity spending with about 38% revenue share in 2025.

- IoT and cloud expansion are major drivers of elevated security requirements across enterprises.

- Regulatory compliance pushes firms to increase budgets for threat detection, response, and analytics.

- AI‑enabled security tools are increasingly deployed for real‑time threat analysis and automated response.

Internet Users Worldwide

- In 2025, an estimated ~6 billion people were online globally, about 75% of the world’s population.

- This figure reflects more than 240 million new users added compared with 2024.

- Despite growth, about 2.2 billion people remain offline as of late 2025.

- Expanded 5G coverage is now part of roughly 55% of the global population through mobile broadband.

- Internet access quality varies significantly by income levels and region, with high‑income nations exceeding 80% penetration.

- Mobile data affordability continues to improve, but cost barriers still limit adoption in low‑income countries.

- The rise in internet users directly supports growth in e‑commerce, social media, and digital services adoption.

- Advances in broadband infrastructure correlate with increased digital skills and economic activity.

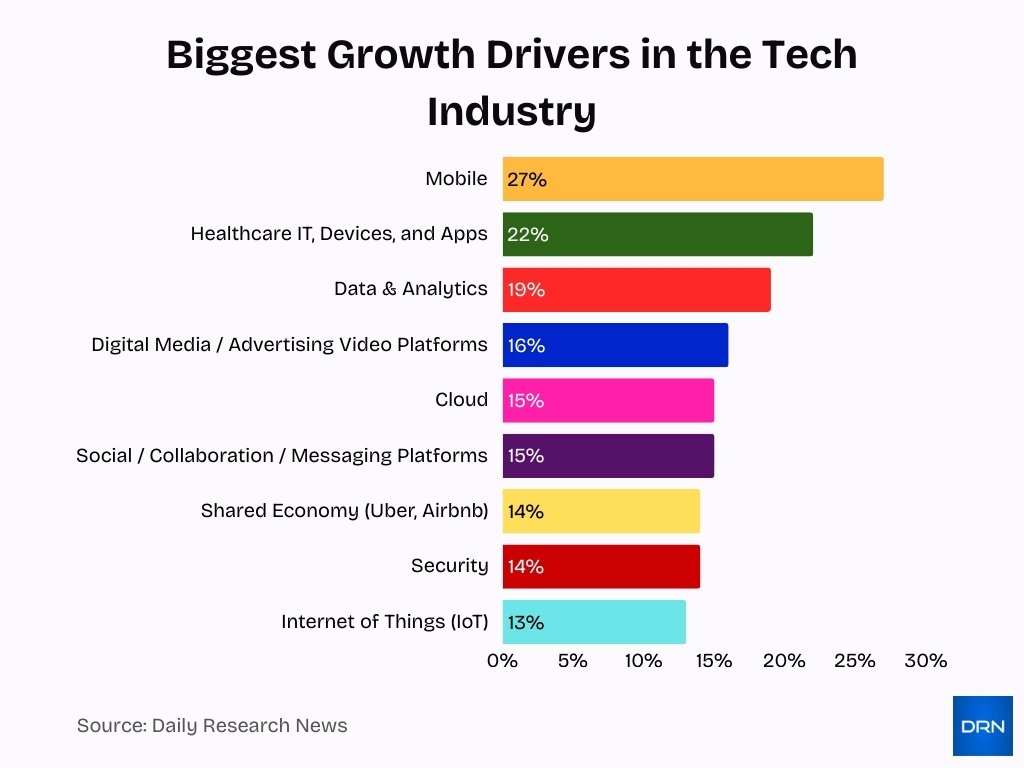

Biggest Growth Drivers Shaping the Tech Industry

- Mobile technology dominates growth expectations, with 27% of tech executives identifying it as the largest revenue growth driver over the next 24 months.

- Healthcare IT, devices, and applications emerge as a major expansion area, as 22% of respondents expect digital healthcare solutions to drive strong revenue gains.

- Data & analytics platforms continue to gain traction, with 19% of industry leaders citing advanced analytics and data-driven insights as key contributors to growth.

- Digital media and advertising video platforms are forecast to expand rapidly, supported by 16% of executives amid rising video consumption and ad monetization.

- Cloud computing services remain a core growth pillar, with 15% expecting cloud adoption and migration to boost revenues.

- Social, collaboration, and messaging platforms also capture 15%, reflecting ongoing demand for remote work tools and digital communication solutions.

- Shared economy platforms, including Uber and Airbnb, are projected to grow, with 14% highlighting the continued expansion of platform-based business models.

- Cybersecurity solutions match this trend at 14%, underscoring increasing investment in data protection and threat mitigation.

- Internet of Things (IoT) technologies round out the list, as 13% of respondents anticipate growth driven by connected devices and smart systems.

5G Subscriptions Growth

- Global 5G adoption has become a mainstream mobile broadband option in many markets.

- In high‑income countries, 5G coverage now exceeds 80% of the population.

- Emerging markets continue rapid 5G rollout, offering new connectivity for IoT and industrial applications.

- India’s 5G rollout alone saw ~250 million subscribers by early 2025, with expanding infrastructure.

- Telecom reports anticipate 5G users in India could top 770 million by 2028.

- Globally, 5G subscriptions now comprise roughly one‑third of all mobile broadband plans.

- 5G growth supports edge computing and ultra‑low latency use cases for industrial automation.

- As 5G networks expand, associated services like augmented reality and immersive video streaming scale too.

E-commerce Sales Surge

- Global e-commerce retail sales reached $6.01 trillion in 2024, up 7.65% YoY.

- India’s e-commerce market is projected to hit $211.6 billion in 2025, growing 12.5%.

- UPI transactions in India surged to 59.33 billion in Q3 FY25, up 33.5% YoY.

- Mobile commerce will account for 59% of total e-commerce sales, worth $4.01 trillion in 2025.

- AI recommendations drive 35% of Amazon’s total sales.

- The cross-border e-commerce market is expected to reach $551.23 billion in 2025.

- India is expected to have over 900 million active internet users by 2025, boosting online shoppers.

- Global e-commerce will represent 20.5% of all retail sales in 2025.

- Asia Pacific holds 45.6% share of the e-commerce market by 2035.

Digital Transformation Stats

- The digital transformation market was valued at around $1.49 trillion in 2025.

- It’s projected to reach $1.87 trillion in 2026, marking robust growth in enterprise modernization.

- Forecasts suggest a climb to ~$12.53 trillion by 2035 at a ~23.7% CAGR over the next decade.

- North America accounted for over 44% of the digital transformation market share in 2025.

- Analytics, cloud, IoT, and automation drive much of this transformation spending.

- SMEs are rapidly integrating digital tools to remain competitive and scalable.

- Hybrid cloud and AI‑enabled systems are central to ongoing digital plans.

- Retail and BFSI segments show particularly strong adoption rates.

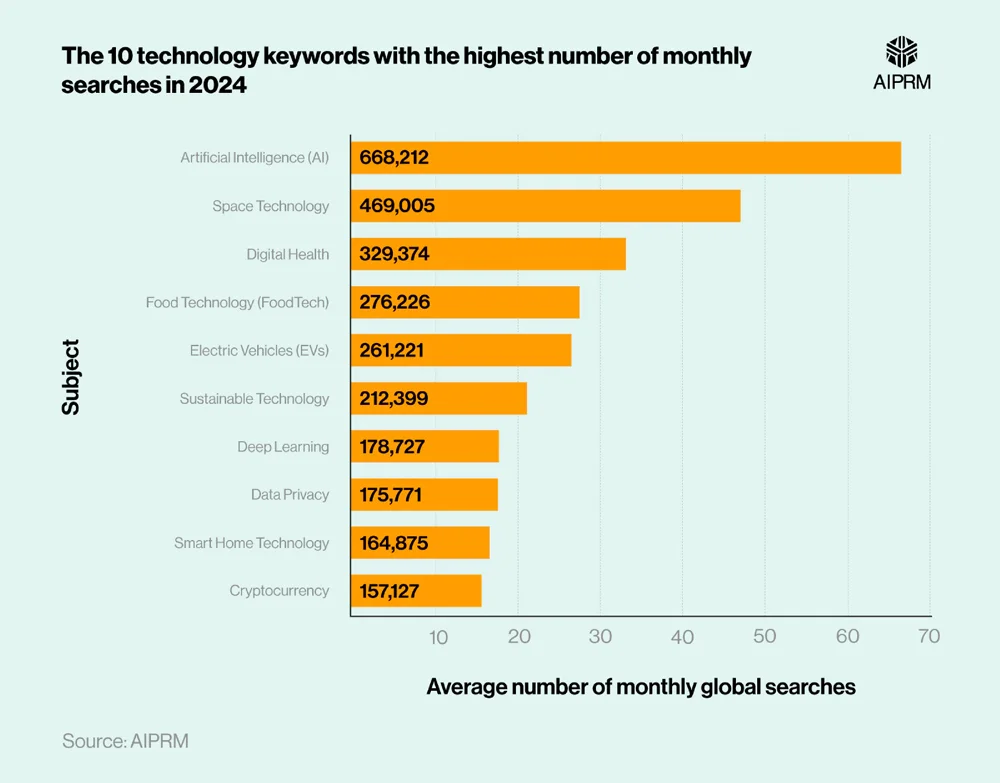

Most Searched Technology Keywords Worldwide in 2024

- Artificial Intelligence (AI) dominates global interest with an average of 668,212 monthly searches, making it the most searched technology topic in 2024.

- Space Technology secures the second position, attracting 469,005 average monthly searches, driven by increased focus on space missions and commercialization.

- Digital Health ranks third with 329,374 monthly searches, reflecting the rapid expansion of healthcare digitization and telehealth solutions.

- Food Technology (FoodTech) records 276,226 average monthly searches, highlighting growing consumer interest in alternative proteins and food innovation.

- Electric Vehicles (EVs) generate 261,221 monthly searches, underscoring strong global momentum toward clean and sustainable transportation.

- Sustainable Technology attracts 212,399 average monthly searches, indicating rising awareness around climate-focused and eco-friendly technologies.

- Deep Learning accounts for 178,727 monthly searches, showcasing its critical role in advancing artificial intelligence applications.

- Data Privacy draws 175,771 average monthly searches, emphasizing increasing public concern over data security and digital protection.

- Smart Home Technology sees 164,875 monthly searches, fueled by the adoption of connected devices and home automation systems.

- Cryptocurrency maintains relevance with 157,127 average monthly searches, reflecting ongoing interest in digital assets and blockchain technology.

Tech Employment Figures

- Computer and IT occupations are projected to grow much faster than average through 2034, with about 317,700 annual job openings from growth and replacement needs.

- Roles such as data scientists and data analysts are expected to see ~414% growth, reflecting rapid demand for analytics skills.

- Cybersecurity analysts and engineers are forecast to grow by ~367%, highlighting defensive tech hiring trends.

- Software developers are likely to grow by about ~297%, driven by ongoing digitization across sectors.

- Software QA and testers could increase by ~220% as quality becomes more central in agile and AI workflows.

- Tech unemployment remains below broader averages in key U.S. markets, with core tech roles at sub‑3% unemployment mid‑2025.

- The median annual tech salary in the U.S. hovers around $112,667, well above national averages.

- India’s tech workforce is rapidly expanding, with estimates suggesting ~9.5 million tech professionals by FY2026.

- Despite growth, U.S. macro jobs data show modest new jobs overall, with mixed seasonal hiring patterns late 2025.

R&D Investment Levels

- Engineering and R&D budgets often exceed $1.5 trillion globally, with significant allocations to digital modernization and AI tools.

- Around 63% of senior tech executives say innovation and value creation via digital technologies are strategic priorities for R&D functions.

- Firms plan to increase engineering and R&D spending on AI by an average of ~11% over the next few years.

- China and Japan lead in R&D investment share for AI, at ~9–10% of total R&D budgets, above the global average.

- Emerging technologies like digital twins, next‑gen materials, and immersive tech are prioritized for future R&D.

- Executives expect AI and advanced computing to accelerate time‑to‑market by 20 – 50% in R&D outcomes.

- Outsourcing and partnerships with external tech vendors form a key part of modern R&D strategies for faster innovation.

- A minority of organizations (~48%) anticipate significantly reducing costs through digital R&D transformation in the near term.

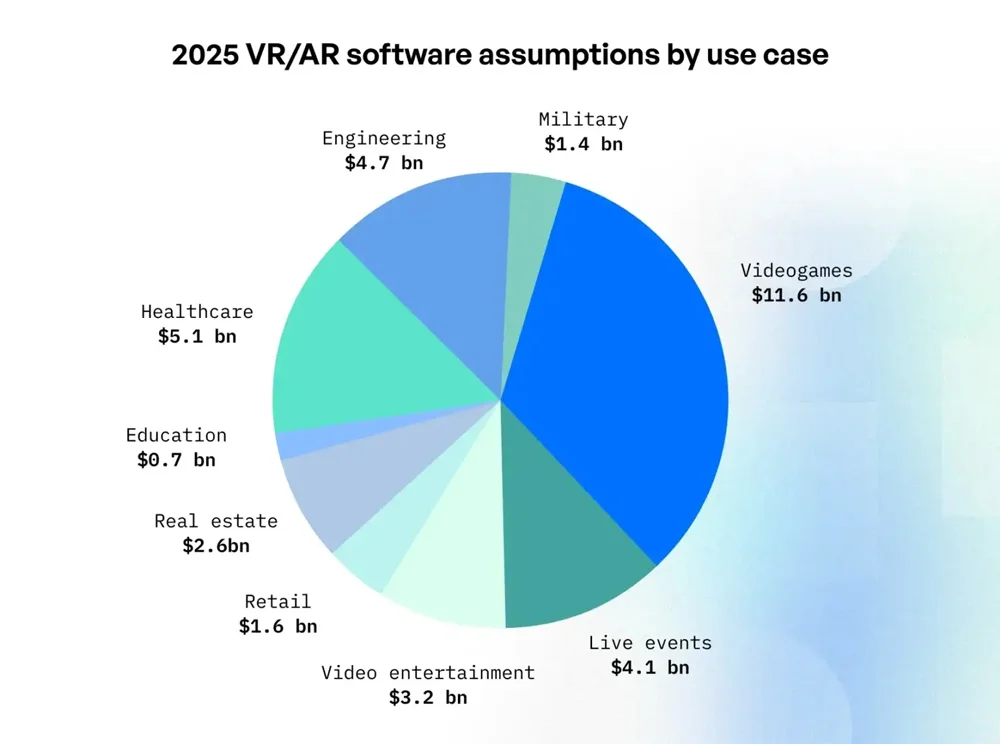

VR/AR Software Adoption Across Key Industries

- Video games dominate overall adoption, leading the market with $11.6 billion in total VR/AR software spending.

- Healthcare usage is forecast to climb to $5.1 billion, underscoring strong momentum in medical innovation and digital treatment solutions.

- Engineering adoption stands at $4.7 billion, primarily fueled by advanced simulation technologies and rapid prototyping workflows.

- Live events rank next with $4.1 billion in spending, reflecting rising demand for immersive and interactive audience experiences.

- Video entertainment is projected to account for $3.2 billion, driven by growing consumption of immersive media content.

- Real estate adoption is expected to reach $2.6 billion, enabling enhanced virtual property tours and visualization tools.

- Retail use cases are estimated at $1.6 billion, supporting virtual shopping experiences and product engagement.

- Military applications are anticipated to generate $1.4 billion in spending, focused on training, simulations, and operational readiness.

- Education is set to contribute $0.7 billion, signaling steady growth in immersive learning environments and digital classrooms.

Regional Tech Growth

- U.S. private AI investment reached $109.1 billion in 2024, dwarfing China’s $9.3 billion.

- India’s IT spend is projected to hit $176.3 billion in 2026, growing 10.6% from 2025.

- Bengaluru tech workforce exceeds 1 million professionals, ranking among the global top hubs.

- Tamil Nadu launches ₹100 crore deep-tech policy to support 100 startups over five years.

- Visakhapatnam Google AI hub with $15 billion investment to create over 100,000 jobs.

- Spain tech investment grew 18% in 2025 to $2 billion, boosting unicorn count.

- Bengal Silicon Valley Tech Hub set to generate 100,000 direct jobs upon completion.

- India’s IT sector contributes 7.3% to the national GDP, employing 5.8 million professionals.

Emerging Tech Forecasts

- Gartner forecasts that by 2028, over 40% of leading enterprises will adopt AI supercomputing hybrid paradigms, up from 8% today.

- Hybrid human-AI workforces will dominate, with 50% of companies launching agentic AI by 2027 for complex tasks.

- Generative design and digital twins cut development time by up to 50%, reducing costs in key industries.

- Global edge computing market hits $28.5 billion in 2026, growing at 28% CAGR to 2035.

- Real-time analytics market reaches $27.7 billion by 2026, driven by edge AI demands.

- Industrial robot installations surge to 718,000 units worldwide in 2026.

- Enterprise AR/VR grows at 58.4% CAGR through 2026, fueled by training adoption.

- The physical AI market expands from $3.1 billion in 2025 to $83.6 billion by 2035.

- AI data center capex projected at $400-450 billion globally in 2026.

- By 2030, preemptive cybersecurity will claim 50% of all cybersecurity spending.

Tech Company Valuations

- AI is cited as a key factor driving sharper company valuation increases at events like CES 2026.

- Venture and private equity deals, such as KKR’s $1.5 billion investment in data centers, illustrate rising valuations in infrastructure‑adjacent tech.

- Tech unicorn counts continue expanding globally, with European hubs adding significant new players.

- Data center and cloud companies see mid‑single‑digit billion valuations as infrastructure demand grows.

- Software and AI platform firms dominate public and private market valuation gains in 2025.

- Emerging sectors like cybersecurity and enterprise AI show higher multiples than traditional IT services.

- M&A activity remains robust, signaling strong strategic valuations across technologies.

- Valuations are increasingly tied to AI, analytics, and cloud capabilities as core business drivers.

Frequently Asked Questions (FAQs)

Connected IoT devices grew about 14% to 21.1 billion in 2025, and are projected to reach 39 billion by 2030 with a ~13.2% CAGR.

Worldwide IT spending is expected to total $6.08 trillion in 2026, up 9.8% from 2025.

India’s IT spending is expected to rise 11.1% to $161.5 billion in 2025, up from $145.4 billion in 2024.

The global IT market is projected to grow from $8.92 trillion in 2024 to $13.17 trillion by 2029 at an 8.2% CAGR.

Conclusion

Technology growth reflects dynamic shifts in employment, R&D investment, regional expansion, and emerging innovation. Job markets in tech roles continue outpacing broader sectors, while R&D budgets increasingly prioritize AI and digital transformation. Regional hubs, from the U.S. and Europe to India, are fueling talent and investment, and strategic trends like hybrid AI workforces and advanced computing platforms signal where innovation is headed.

Meanwhile, tech company valuations remain tied to AI adoption and infrastructure build‑outs. Together, these data points paint a detailed picture of how technology is shaping the economic landscape and beyond, driven by continued innovation, investment, and workforce evolution.

Hover or focus to see the definition of the term.