Trello remains one of the most widely used project management and collaboration tools, offering teams and individuals a simple way to organize tasks and workflows. With tens of millions of users worldwide, it powers planning and execution across industries from tech startups to marketing agencies and education teams. In the U.S., professionals lean on Trello to manage hybrid work schedules and cross-functional projects, while globally, teams rely on it to unify remote workflows and boost productivity. Below, we unpack the latest Trello statistics to help you understand its growth, users, and evolving role in modern work.

Editor’s Choice

- 76.75 million monthly visits to Trello’s platform in January 2025.

- Trello captures ~4.8% market share in the ERP and productivity category.

- Trello supports users in 21 languages worldwide.

- 20.02% of Trello’s web traffic came from Brazil in early 2025.

- ~75+ million users globally as of 2024.

- The platform is part of Atlassian’s $4.4B revenue ecosystem in 2024.

- Trello logged a 3.20% increase in U.S. traffic share in early 2025.

Recent Developments

- Atlassian launched the new Trello experience in May 2025, introducing AI-assisted task capture.

- New Trello Inbox functionality lets users collect tasks from Slack and email directly.

- AI capabilities now extract due dates and priorities from text inputs.

- Trello Planner connects with Google and Microsoft calendars to block focus time.

- Mirror cards enhancements allow synchronized views across multiple boards.

- Updated UI with reorganized navigation improves cross-feature access.

- Rollout covers Free, Standard, and Premium plans with Enterprise updates coming later.

- Jira and Confluence users benefit from tighter integration with updated Trello workflows.

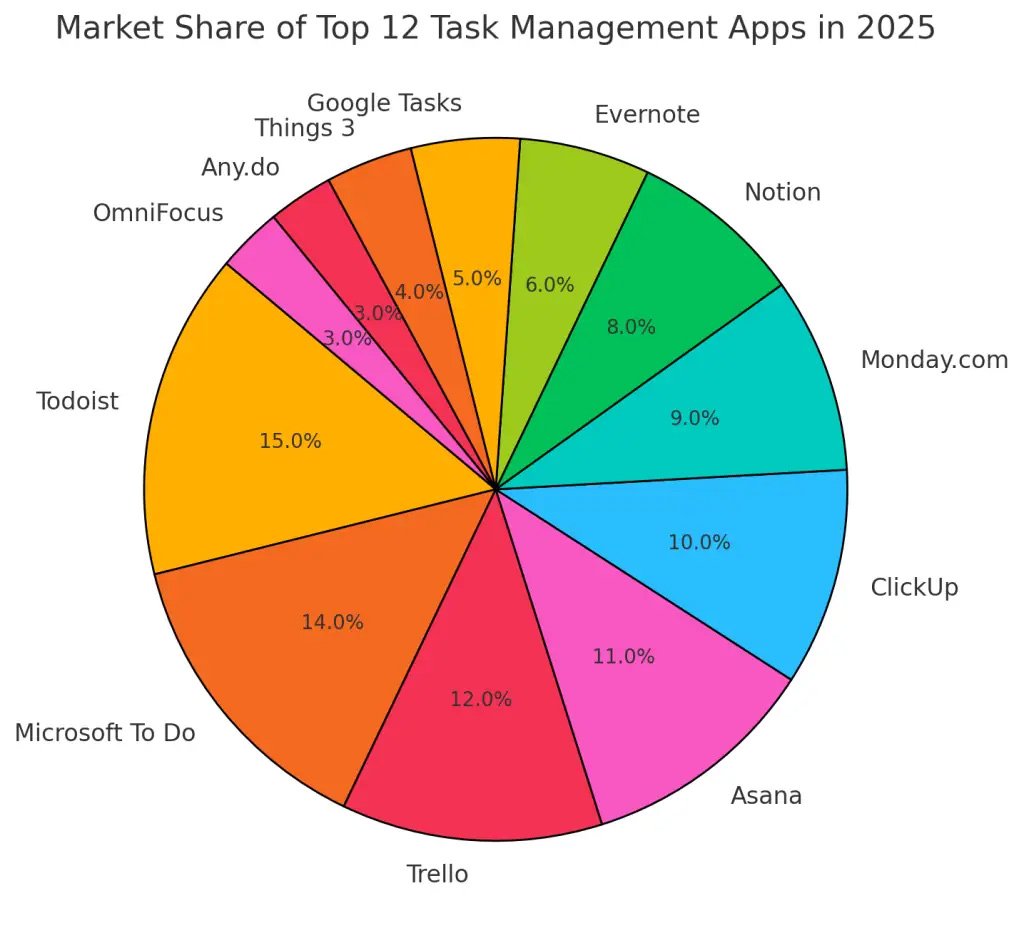

Task Management Application Market Distribution Overview

- Todoist dominates the market with a 15.0% share, establishing itself as the most widely adopted task management application among users.

- Microsoft To Do secures the second position with a robust 14.0% market share, reflecting its strong user adoption and ecosystem integration.

- Trello accounts for 12.0% of the market, continuing to maintain a solid presence among individuals and teams.

- Asana follows closely with 11.0%, being highly preferred by teams for efficient project coordination.

- ClickUp represents 10.0% of the market share, highlighting its rapid rise in popularity within productivity tools.

- Monday.com records a 9.0% share and is well known for its visual planning features and collaborative capabilities.

- Notion holds 8.0% of the market, attracting users who seek integrated note-taking combined with task tracking.

- Evernote commands a 6.0% share, primarily utilized for its note-centric task management functions.

- Google Tasks maintains a 5.0% market share, benefiting from its seamless integration with Google Workspace tools.

- Things 3 controls 4.0% of the market, and is especially popular among Apple-focused users.

- Any.do and OmniFocus each capture 3.0%, collectively rounding out the top twelve task management applications in the market.

Key Facts and History of Trello

- Trello was founded in 2011 by Fog Creek Software.

- Originally named “Trellis,” it launched publicly at TechCrunch.

- Atlassian acquired Trello for $425 million in 2017.

- Trello raised $10.3M in funding in 2014.

- The platform supports 21 languages globally.

- The Power-Up ecosystem expanded through acquisitions like Butler in 2018.

- Trello’s design is rooted in the Kanban methodology, appealing to visual task flow.

- In early 2024, Trello faced a data exposure incident impacting millions of profiles.

User Base and Growth Trends for Trello

- Trello’s monthly web traffic peaked at 76.75M visits in January 2025.

- Traffic remained solid at 74.49M visits by February 2025.

- The U.S. represented ~16.95% of global web traffic early in 2025.

- Brazil led traffic share at 20.02% despite a recent decline.

- ~75+ million users worldwide reported in 2024.

- Average QoQ adoption growth estimated at ~12%.

- ~2 million teams use Trello actively across business settings.

- Market share in its category stands near 4.8%.

Active Users and Team Participation on Trello

- 1.1 million daily active users recorded in 2016

- Over 2 million teams collaborate on the platform globally.

- Large enterprises increasingly adopt Premium and Enterprise plans.

- Free tier retains popularity due to easy onboarding and core features.

- Active participation is driven by drag-and-drop workflows.

- Teams with structured Kanban workflows report higher engagement.

- Casual users leverage Trello for personal projects and daily planning.

- Collaboration increases during Q1 project launches, aligning with traffic spikes.

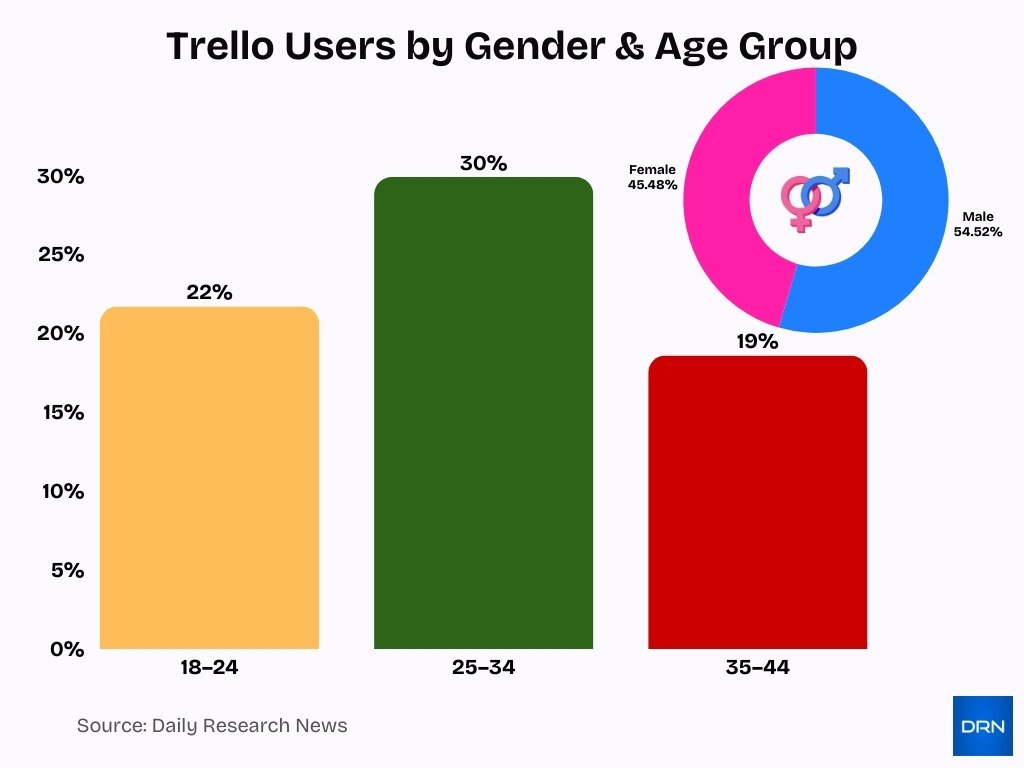

Demographics and User Profile of Trello Users

- 54.52% male users compared with 45.48% female early 2025.

- The largest age group is 25–34 years (~29.9%).

- Ages 18–24 represent ~21.7% of users.

- Users aged 35–44 account for ~18.6%.

- Geographic traffic data shows Brazil and the U.S. dominate adoption.

- Younger professionals gravitate toward Trello for simple planning.

- Demographic profiles mirror broader productivity tool use in hybrid work.

- Adoption among students and freelancers shows growth in 2025.

Usage Patterns by Company Size on Trello

- 39.4% of Trello’s customer base are small businesses (10–49 employees), with 29.2% coming from very small businesses (<10 employees), showing small teams form the majority user segment.

- 31.3% of Trello customers are mid-size and enterprise organizations (50–999+ employees), reflecting strong adoption for cross-department workflows beyond microbusiness use.

- Larger organizations and enterprises together account for 31.3% of users while still using Trello within broader project tool stacks, including ERP-related setups where Trello holds a 4.8% share of the segment.

- Trello’s customer base is nearly evenly split, with 39.4% SMB, 31.3% mid/enterprise, and 29.2% very small businesses, supporting usage where large companies pair it with other platforms to manage complexity.

- Small and medium businesses represent around 68.6% of Trello users when combining SMB (39.4%) and very small businesses (29.2%), highlighting how SMBs favor economical tiers such as the free and lower paid plans.

- Trello serves over 50 million users globally, many in teams of 10–50 members that rely on add-ons like Butler and reporting Power-Ups to extend workflow automation.

- Trello captures 4.8% of the task/project management share within ERP-related tools, indicating that enterprise usage often emphasizes compliance, reporting, and integration rather than standalone deployment.

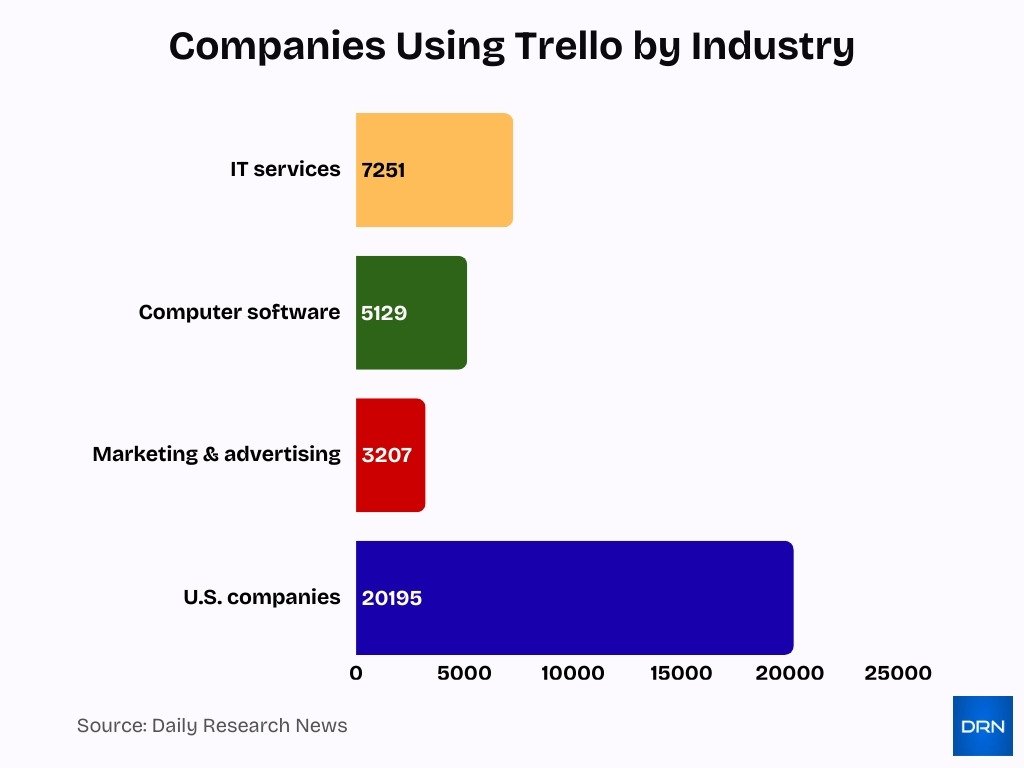

- The U.S. alone counts 20,195 companies using Trello, with strong representation from IT, software, and marketing, where smaller agile teams report faster setup and launch cycles than traditional tools.

Industry and Sector-Based Trello Adoption

- Information Technology Services account for 7,251 Trello-using companies, making IT the leading sector for adoption.

- The Computer Software sector follows closely, with 5,129 companies relying on Trello for software development workflows.

- Marketing and Advertising firms represent 3,207 Trello customers, using boards heavily for campaign planning and tracking.

- Across industries, Information Technology and Services make up 15%, Computer Software 11%, and Marketing & Advertising 7% of Trello’s customer base.

- Professional services, including consulting-related categories, form a significant slice of Trello users within the over 47,000 companies tracked globally.

- Small and mid-size organizations dominate, with roughly 39.4% of Trello’s customer base coming from small businesses and 31.3% from mid-size to enterprise firms.

- Remote and distributed organizations are a core focus, as Trello promotes use for remote teams spanning multiple locations and time zones worldwide.

- Trello’s B2B target market spans diverse sectors, led by IT services, software, and marketing & advertising, underscoring cross-industry adoption.

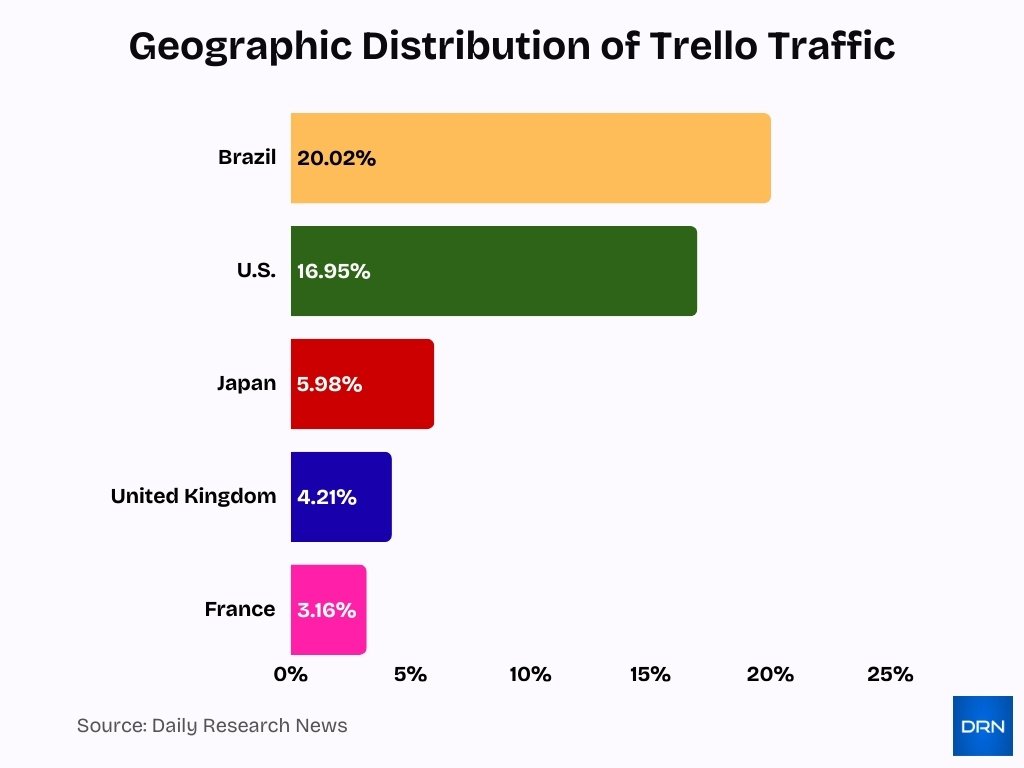

Geographic Distribution of Trello Users

- Brazil leads with 20.02% of global Trello traffic share.

- The U.S. holds 16.95% of total traffic, up 3.20% recently.

- Japan contributes 5.98% of Trello website visits.

- The United Kingdom accounts for 4.21% of traffic, down 3.26%.

- France represents 3.16% of global Trello traffic.

- Recent data shows Brazil at 21.14%, and the U.S. at 16.2% of visits.

- Japan holds 6.41% in the latest desktop traffic rankings.

- Germany provides 2.81% of Trello’s web traffic.

- North America has 20,195 companies using Trello.

Website Traffic Statistics Related to Trello

- Trello recorded 72.56 million visits in December 2024.

- Traffic peaked at 76.75 million in January 2025.

- February 2025 traffic reached 74.49 million visits.

- Seasonal planning drives early-year traffic growth.

- Organic search delivers ~10.78% of traffic.

- Paid marketing accounts for ~1.40% of visits.

- High traffic reinforces Trello’s brand strength.

- Traffic trends indicate sustained user demand.

Mobile App Usage Statistics for Trello

- 48% of Trello premium users actively use the mobile app.

- The Trello Android app has exceeded 10 million downloads worldwide.

- Trello achieves 600,000 monthly downloads via the App Store.

- 97% of free plan users access Trello via the web, highlighting mobile premium reliance.

- 40% of users rely on Trello for both professional and personal mobile workflows.

- 25% of premium members host weekly meetings using Trello mobile.

- 75% of organizations see value from Trello mobile within 30 days.

- 81% of users prefer Trello for its ease of use on mobile devices.

Why Trello Excels in a Competitive Market

- Customizable Cards and Boards enable teams to design and adapt workflows precisely according to their unique operational requirements and project needs.

- Flexible Automation with Butler helps streamline repetitive tasks by leveraging built-in, rule-based automation that reduces manual effort and saves time.

- Integration with Other Tools significantly boosts productivity by seamlessly connecting Trello with a wide range of popular apps and services used across teams.

- Intuitive Kanban Boards offer a clear and highly visual approach to organizing tasks and managing project flow efficiently.

- Ease of Use ensures that Trello remains accessible and user-friendly for teams of all sizes, regardless of their technical expertise or experience level.

Use Cases and Workflow Trends in Trello

- Around 78% of Trello users rely on it for core project workflows like onboarding, IT intake queues, and planning boards to move tasks from “to-do” to “done.”

- Nearly 40% of Trello users apply boards for both personal and professional task tracking, blending CRM-style lead follow-up with other work in a single workflow.

- About 25% of premium users host weekly meetings directly in Trello, turning action-item cards into the central source of truth after each call.

- Roughly 1 in 4 standard-plan customers use Trello specifically for product roadmapping, visually mapping features, backlogs, and sprints.

- Support, engineering, and product departments lead Trello adoption at 42%, 37%, and 36% usage, respectively, showing strong traction in technical workflows.

- Trello’s site attracts up to 76.75 million monthly visits, reflecting heavy recurring use for finance approvals, HR onboarding, and other routine processes.

- Only 7% of organizations report Trello usage in legal teams, indicating visual boards are still underused for contract or compliance workflows.

- Around 97% of free-plan users access Trello via the web app, aligning with distributed teams that update content calendars and task boards from browsers.

- Approximately 48% of premium members use Trello’s mobile app, enabling on-the-go check-ins for sales pipelines and field teams.

- Daily to-do lists are the second most common Trello use case at 69%, complementing structured workflows like budgeting, approvals, and hiring pipelines.

Adoption of Trello for Remote Work and Collaboration

- Over 80% of Fortune 500 companies use Trello for remote team management.

- 74% of Trello users report improved communication between remote co-workers.

- 87% of Trello users see increased team productivity in distributed setups.

- 81% of users select Trello for its ease of use in remote onboarding.

- 75% of organizations find that Trello proves value within the first month of hybrid adoption.

- 63% of remote workers rely on Trello for daily task collaboration.

- 25% increase in team collaboration reported by Trello remote users.

- 3 out of 4 customers say Trello boosts project visibility across time zones.

Business and Enterprise Adoption of Trello

- 32% of Trello customers are from mid-market and enterprise organizations, while 68% are SMBs.

- 47,718 companies worldwide use Trello for project management.

- 7,251 companies in IT services represent the largest share of Trello adopters.

- 5,129 computer software companies rank high in Trello adoption.

- 3,207 firms in marketing and advertising show strong Trello usage.

- Trello’s Enterprise plan provides enhanced admin controls and integrations for large organizations.

- 43% of Trello users are small companies with under 50 employees, 41% medium-sized, and 17% large enterprises.

- 15% of Trello customers are in Information Technology and Services, 11% in Computer Software.

- 20,195 companies in the United States lead Trello enterprise adoption globally.

- Many enterprises integrate Trello with Atlassian tools like Jira for comprehensive workflows.

Impact on Productivity and Efficiency Through Trello

- 81% of Trello users report improved team communication.

- 74% say collaboration with coworkers improved.

- 65-80% productivity boost reported by Sprout Social teams using Trello.

- 75% of organizations see value from Trello within 30 days.

- 76% of users find checklists the most beneficial feature.

- 61% report better task clarity and ownership with Trello.

- 70% value due dates for enhanced efficiency.

- 25% increase in campaign efficiency for Unilever marketing teams.

- 81% stick with Trello due to its ease of use.

Integrations and Power-Ups Usage in Trello

- Trello hosts 311 Power-Ups for enhanced functionality.

- Card Relationships Power-Up reached over 100,000 board installs.

- Google Calendar Sync ranks among the fastest-growing Power-Ups.

- New Power-Ups in 2023 achieved over 5,000 installs each.

- Butler offers up to 250,000 monthly automations on Enterprise plans.

- 48% of premium users access Trello via the mobile app for integrations.

- 40% of users apply Trello professionally and personally with Power-Ups.

- 13% growth in the Power-Ups directory from 297 to 334 in a year.

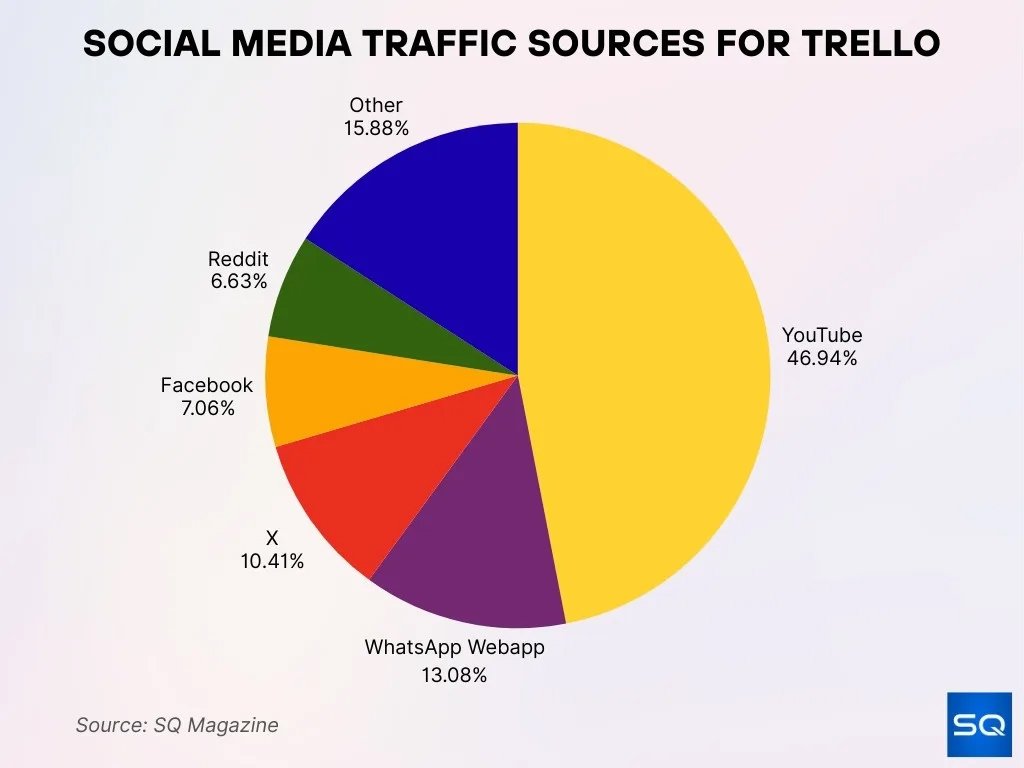

Social Media Sources Driving Traffic to Trello

- YouTube stands out as the leading traffic source, responsible for 46.94% of Trello’s social media visits, highlighting its strong video-driven discovery.

- WhatsApp Webapp contributes 13.08%, indicating significant traffic generated through direct sharing and private messaging.

- X (formerly Twitter) accounts for 10.41%, reflecting active engagement from professional, tech-savvy, and productivity-focused users.

- Facebook delivers 7.06% of the traffic, supporting collaboration-oriented communities and team-based interactions.

- Reddit drives 6.63%, likely originating from in-depth discussions within productivity, project management, and software forums.

- Other platforms together make up 15.88%, demonstrating that Trello benefits from a diverse and well-distributed range of social media channels.

Revenue and Financial Performance of Trello

- $5.215B projected revenue in 2025.

- ~19.66% year-over-year growth reported.

- Trello serves 300,000+ paying customers.

- 45,000+ customers exceed $10K in annual revenue.

- Trello contributes to Atlassian’s overall growth.

- Pricing ranges from free to Enterprise tiers.

- Premium plan adoption supports revenue growth.

- The freemium SaaS model drives scale and upsell.

Market Share and Key Competitors of Trello

- Trello commands a 12% share in the task management app market, trailing Todoist at 15% and Microsoft To Do at 14%.

- Trello generated $15–25 million in revenue through September 2025 via its top domain.

- In project management software, Trello secures 0.47% market share per 6sense reports.

- Asana reported $652.5 million in revenue in 2024, up 19% year-over-year.

- ClickUp hit $300 million ARR in 2025 with over 10 million users.

- Monday.com achieved $972 million in revenue in 2024, leading Asana by 49%.

- Jira dominates with 42% project management market share in key sectors.

- The productivity software market reached $74.94 billion in 2025 at 15.5% CAGR.

- Trello boasts 90 million registered users as part of Atlassian’s ecosystem.

- Miro, a collaboration rival, serves 60+ million users with $560 million ARR in 2023.

Customer Satisfaction and User Reviews of Trello

- Trello averages 4.5 out of 5 stars in user ratings.

- Ease of use scores exceed 4.7 out of 5.

- Value for money rates near 4.6 out of 5.

- ~93.3% likelihood to recommend Trello.

- Users praise flexibility for work and personal use.

- Some users note limits in advanced reporting.

- Free plan users report strong satisfaction.

- Community feedback drives ongoing improvements.

Frequently Asked Questions (FAQs)

76.75 million monthly visits were recorded in January 2025.

20.02% of global Trello web traffic came from Brazil in early 2025.

Trello holds approximately 4.8% market share in the ERP software category.

7,251 companies in the IT services sector use Trello.

Conclusion

Trello remains a leading choice for visual project management and collaboration, blending ease of use with flexible workflows and strong integrations. Millions of users across industries rely on it to manage remote, hybrid, and in-office work. Strong adoption, steady revenue growth, and high customer satisfaction confirm Trello’s lasting relevance. For teams seeking clarity, transparency, and efficiency, Trello continues to deliver measurable value at scale.