The video game industry remains one of the most dynamic entertainment sectors globally. Gamers now number in the billions worldwide, and total market revenues are expected to climb steadily this year as platforms diversify and new technologies evolve. Video games shape household entertainment, influence digital culture, and power revenue streams across mobile, console, and PC mediums. In business environments, studios use these trends to guide investment strategies, while advertisers tap into expansive gamer engagement data to tailor campaigns. Keep reading for a deep dive into the latest statistics that define the video game landscape.

Editor’s Choice

- The global video game market is projected to reach $188.8 billion in 2025, up about 3.4% from 2024.

- There are approximately 3.6 billion active gamers worldwide in 2025.

- Mobile gaming revenue is projected to reach $103 billion by 2025.

- Console gaming growth leads all platforms with +5.5% year-over-year expansion.

- The US and China together account for ~50% of global gaming consumer spending.

- The average gamer’s annual spending is approximately $119.70 in 2025.

- Global gamer growth continues despite market saturation in key regions.

Recent Developments

- Global gaming M&A hit $56.9 billion in Q3 2025 alone, driven by the $55 billion Electronic Arts take-private deal.

- Xbox Game Pass generated nearly $5 billion in revenue during fiscal year 2025, marking a profitability milestone.

- Digital game sales now account for 95% of total sales, leaving physical retail with just 5% share.

- VR gaming market valued at $20.2 billion in 2025, projected to grow at 16% CAGR through 2035.

- India’s Promotion and Regulation of Online Gaming Act 2025 supports the domestic industry via 100% FDI allowance and STPI initiatives.

- Gaming startups raised $627 million in VC funding through mid-2025, amid selective investor focus.

- Cross-platform games show 45% higher 30-day retention and 31% higher daily return rates.

- Console market surged 31% YoY in Q3 2025, boosted by Nintendo Switch 2 and digital content sales.

Global Video Game Market Overview

- The global video games market is forecast to generate $188.8 billion in revenue in 2025.

- This reflects a 3.4% year-over-year increase compared with 2024.

- Market revenue is expected to surpass $206 billion by 2028.

- Approximately 3.6 billion players are active worldwide.

- North America and the Asia Pacific remain the largest regions by revenue share.

- Mobile gaming accounts for the largest platform share globally.

- Console gaming leads platform growth rates in 2025.

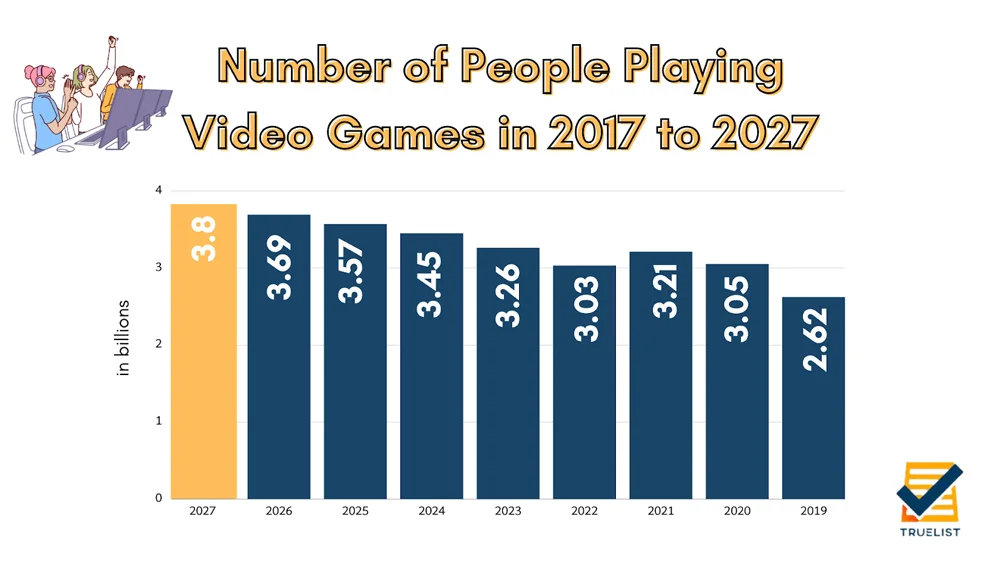

Growth of the Global Video Gaming Population (2019–2027)

- The number of people playing video games worldwide shows a strong overall upward trend from 2019 to 2027.

- In 2019, the global gaming population stood at 2.62 billion players, representing the lowest point in the period shown.

- A significant increase occurred in 2020, reaching 3.05 billion players, reflecting a major jump in global gaming engagement.

- The upward momentum continued in 2021, with the number rising to 3.21 billion players.

- A temporary dip is visible in 2022, when the gaming population slightly declined to 3.03 billion players.

- Growth resumed in 2023, climbing to 3.26 billion players, indicating renewed expansion of the gaming market.

- The market continued to expand steadily in 2024, reaching 3.45 billion players.

- By 2025, the number of gamers is expected to increase further to 3.57 billion, highlighting sustained global adoption.

- In 2026, the gaming population grew to 3.69 billion players, maintaining a consistent upward trajectory.

- The data projects a peak in 2027, with an estimated 3.8 billion people playing video games worldwide.

- Overall, the period from 2019 to 2027 reflects an increase of over 1.18 billion players, underscoring the rapid global expansion of the video gaming industry.

Video Game Industry Revenue Statistics

- Global gaming revenue reached about $187.7 billion in 2024.

- Revenue is forecast to increase to $188.8 billion in 2025.

- Mobile gaming revenue is projected to be near $103 billion.

- Console revenue is expected to grow by around 5.5% year over year.

- PC gaming revenue continues to rise steadily across regions.

- The US remains one of the largest contributors to global gaming revenue.

- Average spending per active gamer is approximately $119.7 annually.

- Emerging markets show strong double-digit growth potential.

Gaming Industry Growth Trends and Forecasts

- The gaming industry has stabilized after post-pandemic volatility.

- Market forecasts project growth beyond $206 billion by 2028.

- Console and subscription services remain primary growth drivers.

- Mobile gaming growth is stabilizing in mature markets.

- Digital entertainment revenue overall is projected to exceed $300 billion by 2029, with gaming as a key contributor.

- Cross-platform monetization models continue to expand.

- Regulatory clarity in developing markets supports long-term growth.

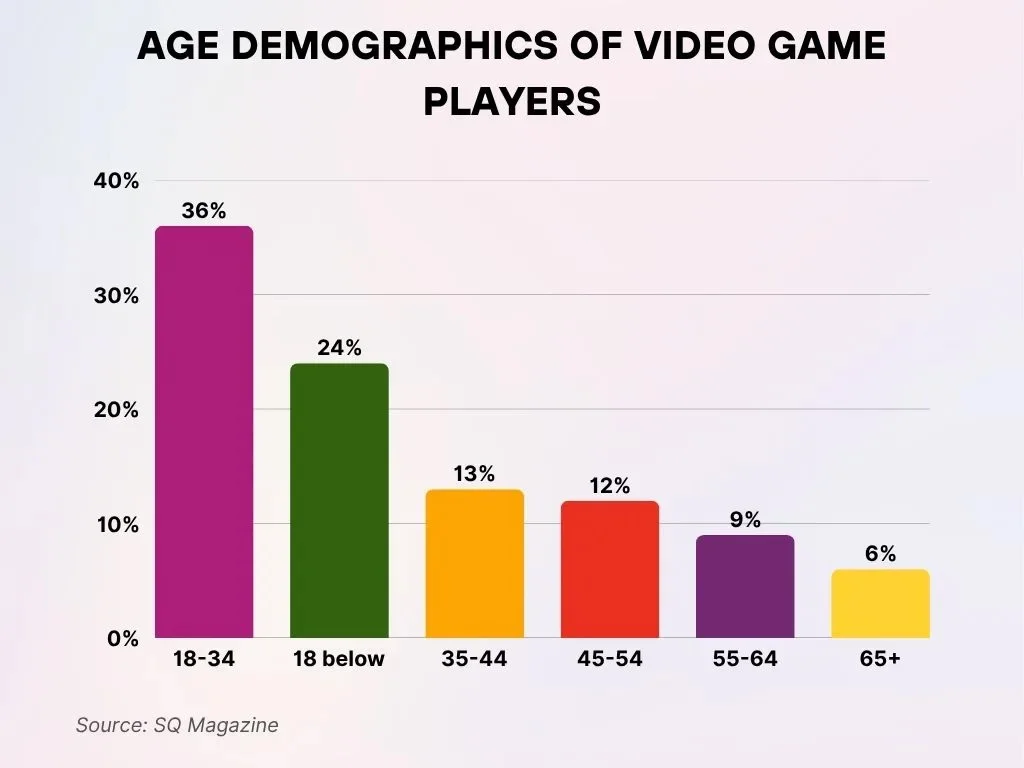

Age Distribution of Video Game Players

- The largest segment of gamers belongs to the 18 to 34-year age group, representing 36% of the total video game player population.

- A significant 24% of video game players are under 18 years old, emphasizing the strong involvement of younger audiences in the gaming ecosystem.

- Gamers aged 35 to 44 years constitute 13% of the overall gaming population, reflecting consistent engagement among adult players.

- Individuals in the 45 to 54-year age bracket account for 12%, demonstrating substantial participation from mid-life gamers.

- The 55 to 64-year-old demographic contributes 9% to the gaming community, indicating continued interest in gaming among older adults.

- Players aged 65 years and above make up 6% of the gaming audience, illustrating that video gaming spans all age groups.

Regional Breakdown of the Video Game Market

- Asia Pacific commands 46% of the $188.8 billion global video game market revenue in 2025.

- The US boasts over 205 million video game players, with steady demographic growth across all ages.

- Latin America hosts approximately 420 million gamers amid rapid market expansion.

- China‘s gaming revenue hits $50.7 billion in 2025, anchoring Asia Pacific dominance.

- The US and China drive substantial global revenue shares, with North America at ~$50.6 billion yearly.

- Europe derives 90% of gaming revenue from digital sales in 2024.

- Southeast Asia sees mobile gaming capture 71.52% of the regional market revenue.

- The Middle East gaming market surges at a 10.77% CAGR, reaching $42.6 billion by 2033.

- Latin America benefits from 19% growth in 5G connections, fueling gaming acceleration.

Mobile Gaming Industry Statistics

- Mobile gaming revenue reached about $92 billion in 2024.

- Mobile accounts for nearly half of global gaming revenue.

- An estimated 3.5 billion mobile gamers exist worldwide.

- Global mobile game downloads exceeded 49 billion annually.

- Average weekly mobile gaming time is about 8.5 hours.

- In-app purchase revenue continues to grow year over year.

- Top mobile titles generate hundreds of millions of downloads.

- Casual and hybrid-casual games drive engagement and monetization.

Console Gaming Statistics

- Console gaming revenue grows at5.5% in 2025, outpacing PC gaming’s 2.5% growth rate.

- Over 53% of US households own a gaming console.

- Exclusive PS5 titles like Horizon Zero Dawn sold 4.5 million units on PC alone.

- Console subscriptions account for 55% of subscription gaming revenue in 2025.

- North America holds 35% of the global console market share.

- Hybrid consoles command 92% of the global hybrid market.

- Nintendo Switch users average 6.4 hours of gameplay per week.

- 46% of console gamers have played for over 10 years.

PC and Cloud Gaming Statistics

- PC gaming market reaches $86.12 billion in 2025.

- Asia-Pacific holds 46.7% of the global PC gaming market share.

- Cloud gaming market valued at $4.32 billion in 2025, growing at 21% CAGR.

- The gaming peripherals market hits $20 billion in 2025.

- Steam peaks at 40.27 million concurrent PC gamers.

- Desktop PCs dominate with over 50% gaming PC market share.

- Cloud gaming users reach 455.4 million globally by 2025.

- The subscription gaming market at $11.99 billion in 2025.

- The esports market is expected to grow to $7.46 billion by 2030 at a 23.1% CAGR.

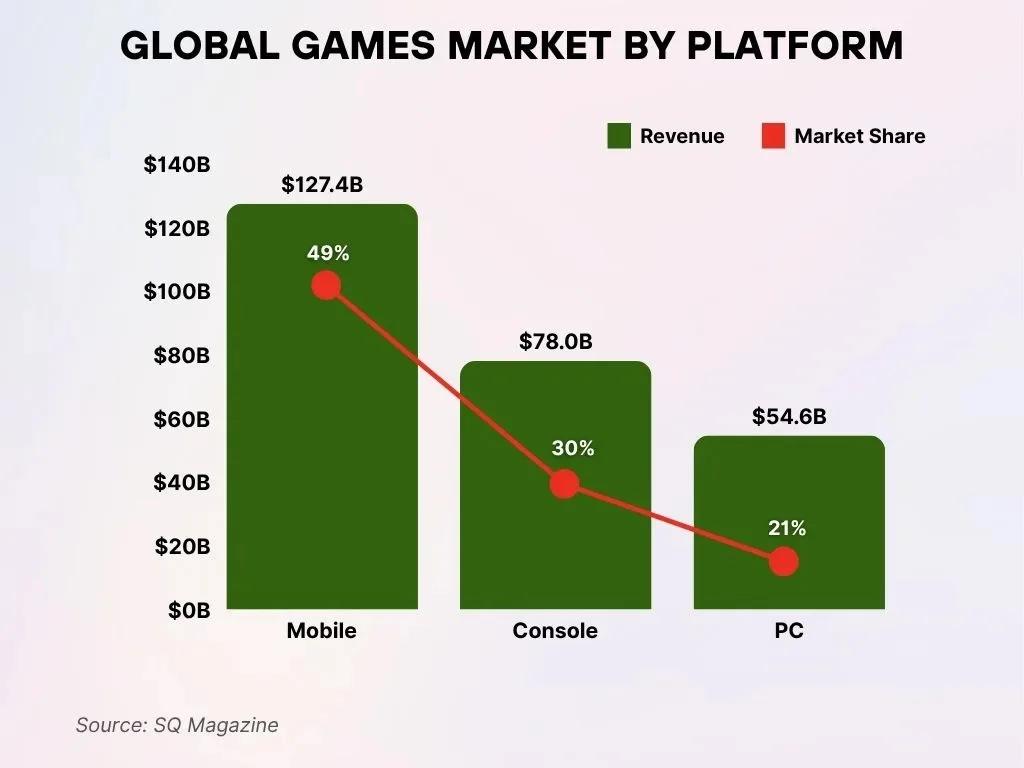

Platform-Wise Gaming Market Share Overview (Console, PC, Mobile)

- Mobile gaming commands the largest market share at 49%, translating into $127.4 billion in total value by 2025.

- Console gaming represents 30% of the overall market, producing approximately $78 billion in global revenue.

- PC gaming makes up 21% of the total market and generates $54.6 billion in annual revenues.

- Cloud gaming revenue operating within mobile platforms has grown to $9.6 billion.

- Handheld consoles, including devices such as the Nintendo Switch 2 and Steam Deck 2, collectively contribute $12.8 billion in combined revenue.

- AAA console titles generate $21.9 billion, while mobile-first titles like Honor of Kings and Genshin Impact each dominate the market with over $2 billion in earnings.

- Cross-platform multiplayer games account for 36% of total engagement hours across all gaming systems.

- Gaming through smart TVs and non-traditional consoles experienced a 14% increase in usage compared to last year.

- Tablet-based gaming contributes 9.1% of overall mobile gaming revenues.

- Wearable device-based gaming, including experiences on AR glasses, remains an emerging niche valued at $1.2 billion in 2025.

Esports Industry and Competitive Gaming Statistics

- Esports World Cup 2025 featured a record $71.5 million prize pool across championships and qualifiers.

- The global esports market reached $3.0 billion in 2025, growing at a 19% CAGR.

- Sponsorships and media rights account for 40% of total esports revenue streams.

- The Asia-Pacific region holds 57% of global esports viewership with 365.3 million viewers.

- Total global esports audience hit 640.8 million in 2025, including 318.1 million dedicated fans.

- Collegiate esports scholarships exceeded $20 million annually across U.S. programs.

- Team sponsorships captured a 35.4% share of the esports sponsorship market in 2025.

- Global Esports Federation unites 180 member federations for worldwide competitions.

- Esports World Cup 2025 drew 3 million live visitors over seven weeks in Riyadh.

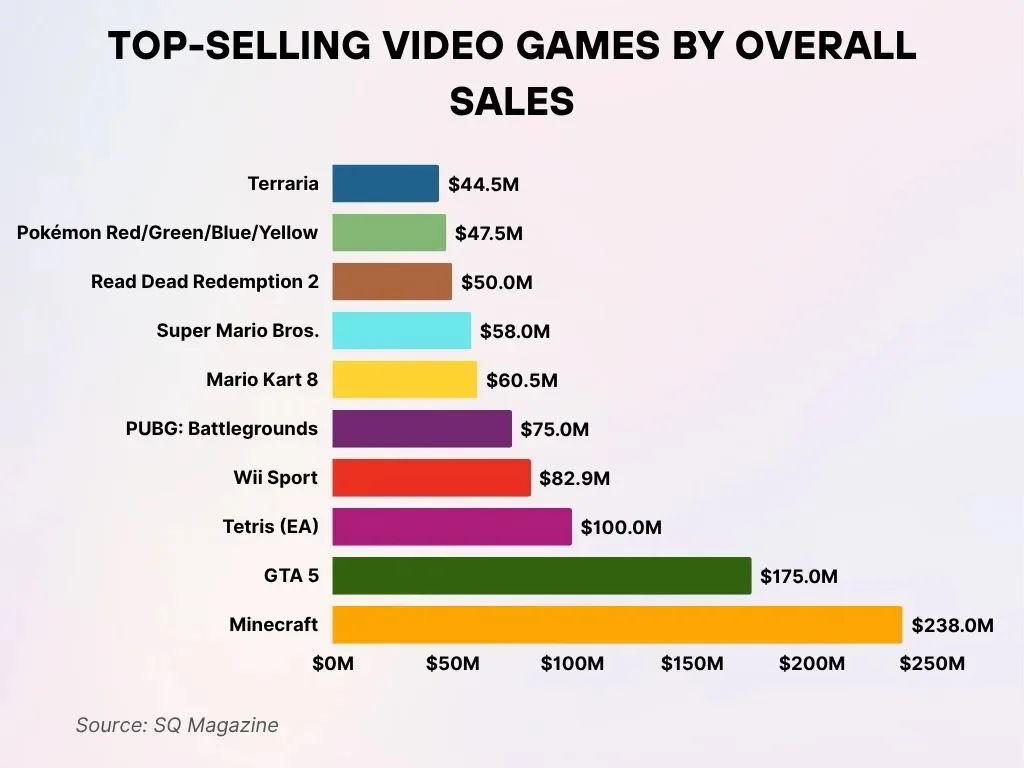

Best-Selling Video Games Ranked by Total Sales

- Minecraft dominates the rankings with an extraordinary 238 million copies sold, securing its position as the highest-selling video game of all time.

- Grand Theft Auto V (GTA 5) claims the second spot with 175 million units sold worldwide, reflecting its massive global appeal.

- Tetris (EA version) comes next with 100 million copies sold, highlighting the enduring popularity of this classic game.

- Wii Sports recorded remarkable success with 82.9 million copies sold, largely fueled by its inclusion in console bundles.

- PUBG: Battlegrounds achieved 75 million in sales, underscoring the widespread appeal of the battle royale genre.

- Mario Kart 8 crossed the 60-million milestone by selling 60.5 million units, reinforcing its status as a fan-favorite racing title.

- Super Mario Bros., an iconic and legendary game, has sold 58 million copies since its original release.

- Red Dead Redemption 2, Rockstar’s cinematic open-world western, reached sales of 50 million units globally.

- Pokémon Red/Green/Blue/Yellow together generated 47.5 million in sales, demonstrating the long-term strength of the Pokémon franchise.

- Terraria, a popular sandbox adventure game, amassed 44.5 million copies in global sales, earning recognition as a top indie success.

In-Game Monetization and Revenue Models (F2P, DLC, Subscriptions)

- Free-to-play models generated $62.32 billion in 2025, dominating with a 15.58% CAGR through 2032.

- Mobile F2P games account for 49% of global gaming revenue at $92 billion in 2025.

- Subscription services project $13.1 billion revenue with 16% growth in 2025.

- DLC content comprises 9% of first-year game revenue, rising to 23% in years 2–5.

- In-game ads in mobile games forecast $31.9 billion from 61% of mobile revenue in 2025.

- Battle passes boost revenue up to 95%, as in Lords Mobile’s $83 million monthly average.

- Cloud subscriptions reach $1.5 billion in 2025, growing to $18.3 billion by 2030.

- Esports sponsorships form 40% of market revenue through media rights and branding.

- Hybrid monetization elevates gaming ARPU to $2.00 annually in mobile by 2025.

Digital vs Physical Game Sales Statistics

- Digital sales comprised 95.4% of global game sales at $175.8 billion in 2024.

- PC gaming achieved 99% digital adoption, while consoles hit 84%.

- Physical game sales in the UK plunged 35% in FY25.

- PlayStation digital purchases made up 80% of PS4/PS5 sales in Q1 2025.

- Physical spending in the US dropped 85% from its 2008 peak by 2024.

- UK boxed sales represented just 10.4% of new game sales in 2024.

- The cloud gaming market grew to $4.32 billion in 2025, reaching $16.43 billion by 2032.

- Subscription gaming hit $10.92 billion in 2024, projected at $17.46 billion by 2029.

Time Spent Gaming and Usage Habits

- Global gamers average 8.45 hours weekly across platforms.

- Streaming viewers watch 8.5 hours weekly on Twitch and YouTube, exceeding gameplay.

- Young adults 18-29 see 21% spending 6-10 hours weekly on competitive games.

- Teens aged 13-17 average 10-15 hours weekly, with 2-4 hour sessions on console/PC.

- Social features boost retention by fostering community in multiplayer ecosystems.

- Gen Z dedicates 25% of its leisure time to gaming on social media.

- Mobile sessions last 4-6 minutes but occur 4-6 times daily.

- Gaming outpaces media as the top leisure activity for Gen Z and millennials.

- Console sessions average 2-4 hours, the longest among platforms.

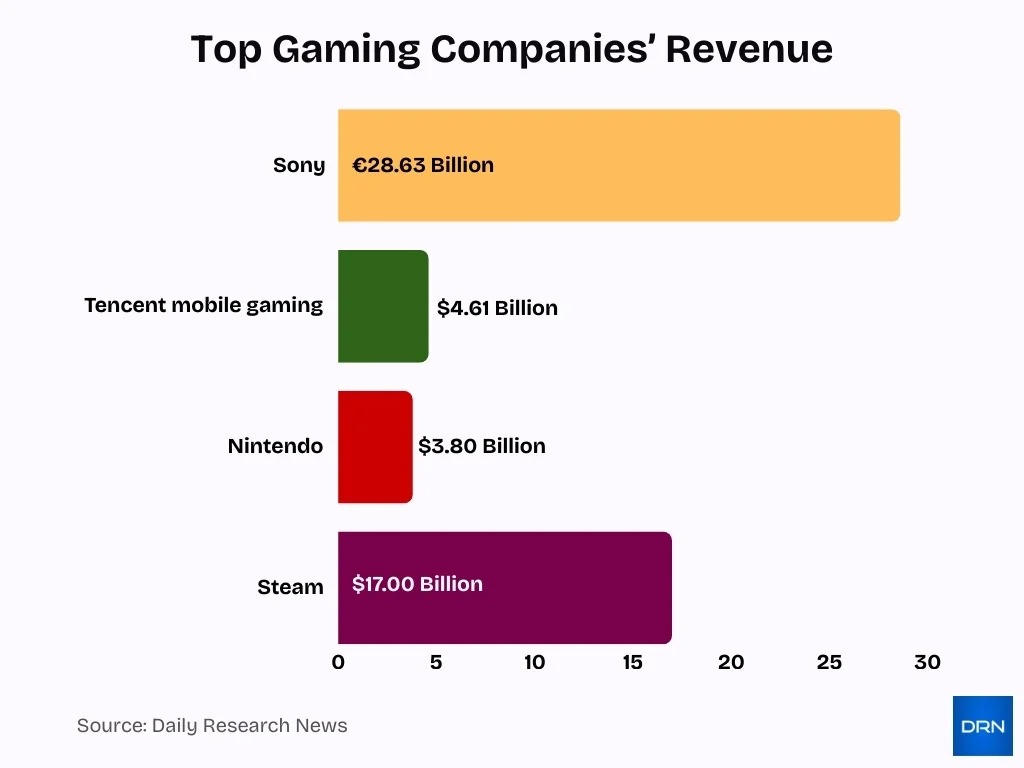

Top Gaming Companies by Revenue

- Sony Interactive Entertainment generated Yen 4.67 trillion (€28.63 billion) in FY2024 sales for its Game & Network Services division.

- Tencent reported $4.61 billion in mobile gaming revenue as of mid-2025.

- Microsoft’s gaming division saw 10% year-over-year revenue growth in Q4 FY2025, with Xbox content up 13%.

- Nintendo achieved ¥572.3 billion ($3.8 billion) revenue in Q1 FY2025, up 132% year-over-year.

- Steam generated $17 billion in total revenue in 2025.

- DLC accounts for 9% of a game’s total revenue in the first year, rising to 20–25% long-term.

- Live-service games represent 74% of EA’s net bookings as the largest revenue driver.

- The global gaming market hit $188.8 billion in 2025 revenues, with subscriptions boosting publishers.

Future Outlook for the Global Video Game Industry

- Global video game market to reach $600.7 billion by 2030, growing at a 12.2% CAGR from 2025.

- Cloud gaming market projected to hit $77.7 billion by 2033, with a 39.9% CAGR during 2025-2033.

- VR in gaming is expected to grow to $85.5 billion by 2030, at a 19.2% CAGR from 2025.

- AR gaming market forecasted to reach $68.5 billion by 2030, expanding at a 30% CAGR.

- Mobile gaming in emerging markets like India and Mexico shows double-digit revenue growth.

- The esports market is anticipated to grow at a 21.1% CAGR, reaching $6.8 billion by 2030.

- Subscription-based gaming to expand to $19.2 billion by 2030, with a 9.8% CAGR.

- AI in the video games market is set to surge to $11.4 billion by 2032, at a 26.8% CAGR.

Frequently Asked Questions (FAQs)

The global video game market is projected to generate $188.8 billion in revenue in 2025, growing about 3.4% year‑over‑year.

There are approximately 3.32 billion active gamers globally in 2025.

Mobile gaming is expected to earn around $103 billion in 2025, accounting for about 55% of total industry revenue.

Some forecasts estimate the video game market will grow with a CAGR of around 12.2% to 12.91% from 2025 to 2030.

Conclusion

The video game industry stands as a central pillar of global entertainment and digital culture. Game streaming and content creation have transformed how players engage with games, creating massive shared experiences. The transition toward digital distribution and subscription models reflects shifting consumer behavior and technological progress. Monetization strategies such as free-to-play, downloadable content, and subscriptions now underpin much of the industry revenue.

As time spent gaming continues to rise and companies innovate across platforms, the global video game industry remains positioned for sustained growth and long-term relevance.