The landscape of web browsers reflects more than simple shifts in preferred software; it signals how people across the globe access and experience the internet. From businesses optimizing for the most used browsers to developers tailoring sites by device and operating system, these numbers shape strategy. For example, a digital marketing team prioritizes testing on the leading browser to maximise reach, and a software vendor adjusts its UI for mobile-browser trends because mobile usage is overtaking desktop. In the sections that follow. We explore key metrics and trends in web browser usage worldwide, so let’s dive in.

Editor’s Choice Stats

- 5.56 billion people use the internet at the start of 2025, representing 67.9% of the global population.

- The browser Google Chrome holds about 73.2% of the global market share as of October 2025.

- Apple Safari accounts for around 13.3% worldwide share in the same period.

- Mobile devices account for approximately 49.6% of all internet traffic as of early 2025.

- The global online population grew by 136 million users (+2.5%) during 2024.

- On desktops, Chrome retains roughly 65%+ market share in mid-2025.

- Browsers other than the top three (Chrome, Safari, Edge) are each operating in single-digit percentages globally.

Recent Developments

- The global internet user base rose by 136 million in 2024, slowing to around a +2.5% growth rate.

- The browser market saw continued dominance by Chrome, while smaller browsers remained flat or declined.

- Increased mobile internet traffic means browser design and optimisation receive heightened attention.

- Browser vendors continue integrating new features, such as AI tools in browsing, impacting user choice and loyalty.

- Privacy and ad-blocking pressures influence browser updates and user trust, shaping usage trends.

- Growth in emerging markets, mobile-first populations influences global browser usage more than in mature markets.

- Device convergence, phones, tablets, and desktops, means browsers must perform across hardware, making cross-browser compatibility more critical.

Overview of Global Web Browser Usage in 2025

- As of October 2025, Chrome commands 73.2% of the global browser market share.

- Safari holds around 13.3% globally in the same timeframe.

- Microsoft Edge has approximately 4.6% global share worldwide.

- Firefox falls to 2.2% globally.

- Opera has a 1.75% share, Samsung Internet 1.74%.

- Smaller browsers, Brave, Vivaldi, etc., each account for less than 1% globally.

- The global browser market remains highly consolidated, top browser capturing nearly three-quarters of usage.

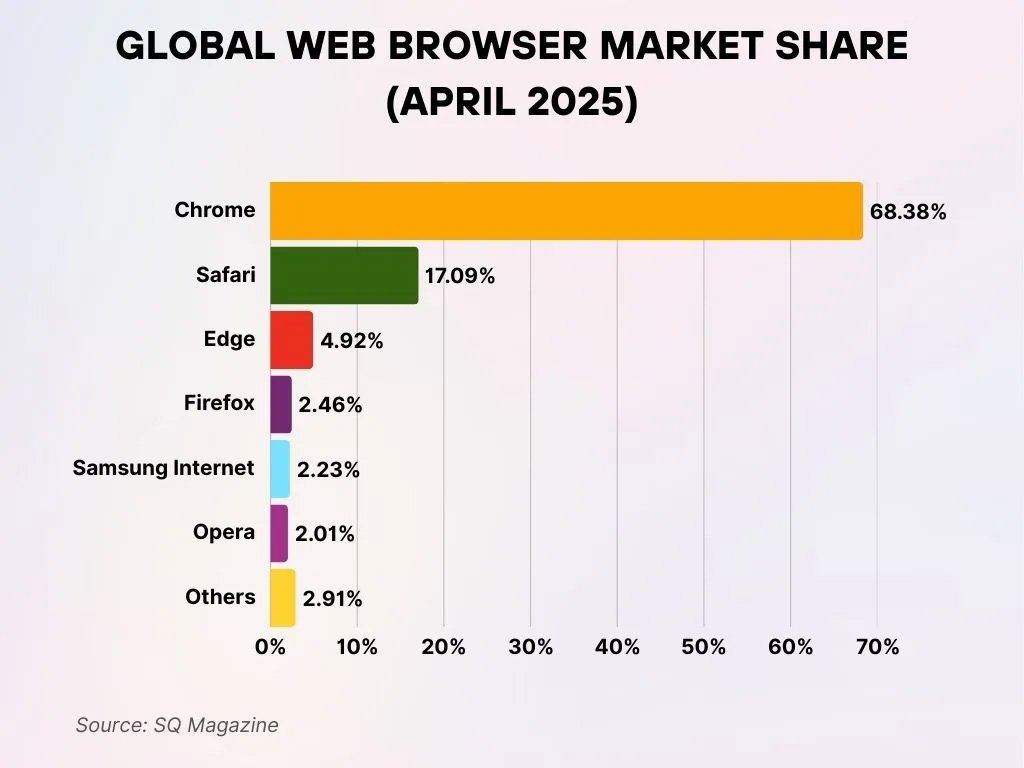

Global Web Browser Market Share (April 2025)

- Google Chrome leads the global web browser market with a 68.38% share, continuing to uphold its position as the world’s most widely used browser.

- Safari retains the second position with 17.09% of worldwide usage, largely fueled by its strong presence among Apple device users.

- Microsoft Edge holds a moderate 4.92% market share, indicating gradual yet consistent growth in adoption.

- Firefox sustains its niche appeal with a 2.46% share, appreciated by individuals who place a high value on privacy.

- Samsung Internet accounts for 2.23%, primarily supported by its extensive use on Samsung mobile devices.

- Opera attains 2.01%, bolstered by its integrated VPN and data-saving capabilities.

- Other browsers together represent 2.91%, highlighting the continued diversity within the browser landscape.

Number of Web Users and Browser Adoption Worldwide

- Around 5.56 billion people are using the internet at the start of 2025 (67.9% global penetration).

- In 2024, the online population increased by 136 million users.

- Roughly 2.63 billion people were still offline at the start of 2025.

- The average daily time online per user in 2025 is reported to be around 6 h 38 min.

- Mobile internet access drives much of the growth in new users, especially in developing economies.

- Internet adoption in many high-income countries already exceeds 90%, while many lower-income regions remain under-connected.

- Browsers are the gateway for this global user base, meaning browser market share strongly correlates with reach and platform strategy.

Browser Market Share by Device Type (Desktop, Mobile, Tablet)

- Mobile devices represent 49.6% of internet traffic, desktops 36%, tablets 2% as of early 2025.

- Among mobile browsers, Safari (on iOS) holds a larger share than desktops due to Apple device prevalence.

- On desktops, Chrome holds 65%+, with Edge and Safari competing in the second tier.

- The shift toward mobile-first browsing means browser adaptation for mobile is critical for publishers and developers.

- Tablet usage, though smaller in traffic share, still requires browser compatibility given device diversification.

- Device-type differentiation influences which browser version or engine gets priority, for example, WebKit on mobile vs Chromium on desktop.

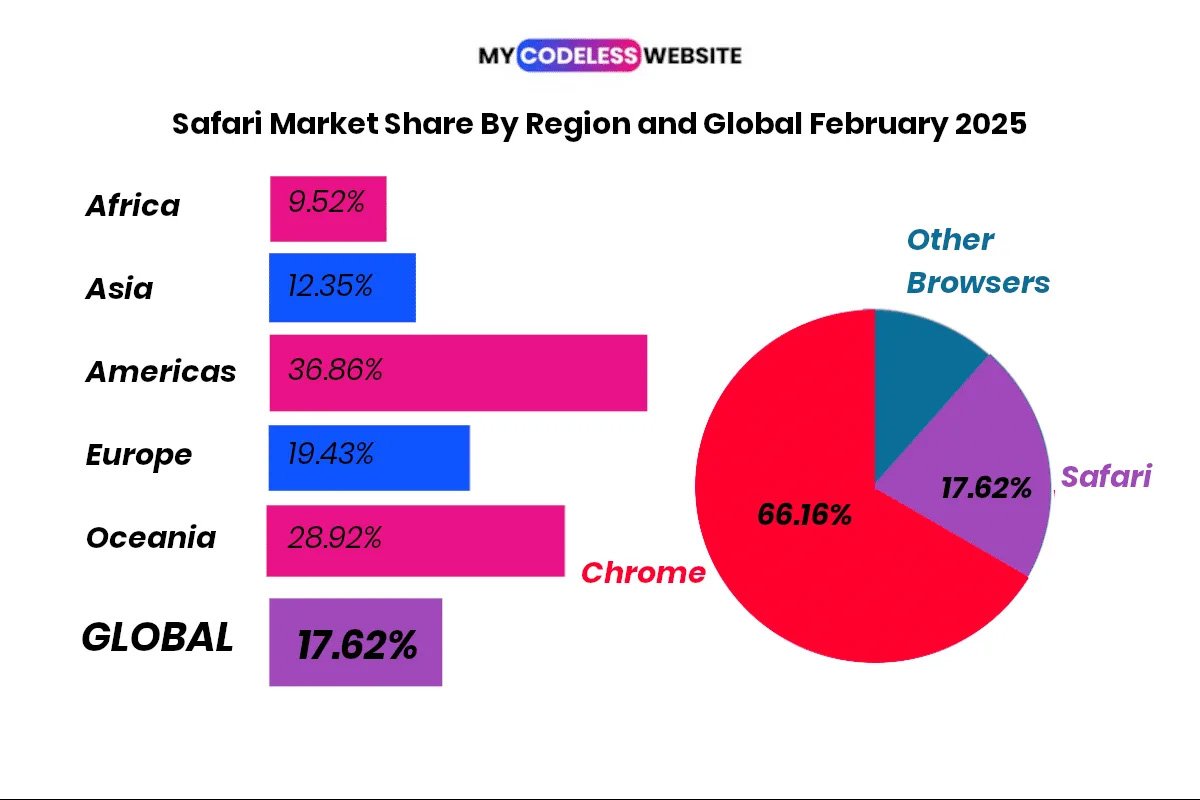

Safari Market Share by Region

- Safari’s global market share is 13.3%, placing it as the second most-used browser worldwide while retaining the same comparative ranking.

- The Americas lead Safari adoption with 36.86% market share, which is more than twice the global average figure.

- Oceania holds the second-highest regional usage level with 28.92% Safari market share.

- Europe records 19.43% Safari usage, placing it slightly above the global average rate.

- Asia demonstrates moderate Safari adoption at 12.35%, whereas Africa follows behind with only 9.52% usage.

- In the worldwide browser landscape, Chrome commands 66.16%, maintaining a large lead over Safari.

- The combined market presence of all other browsers totals 16.22%, which is just below Safari’s overall share.

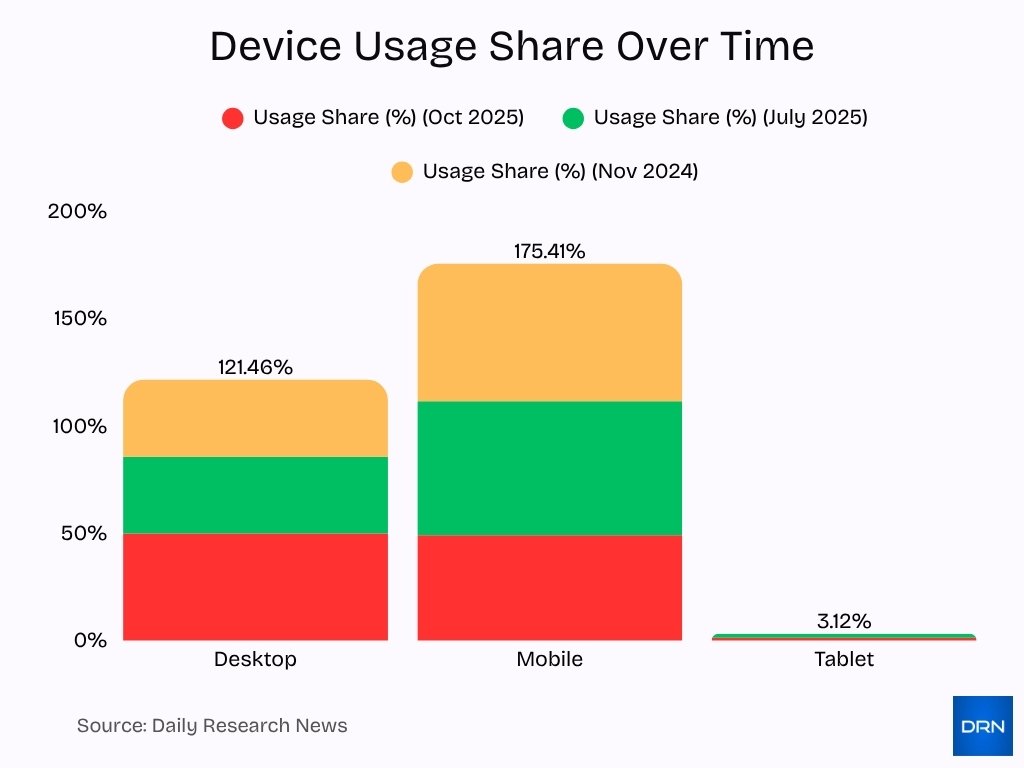

Desktop vs Mobile vs Tablet Browser Usage Share

- Globally in October 2025, the usage share by device types is: Desktop 49.79%, Mobile 48.92%, Tablet 1.28%.

- Another source reports mobile traffic at about 62.45%, desktop at 35.71%, and tablet at 1.84% as of July 2025.

- For November 2024 data, mobile devices accounted for around 64.04% of all internet traffic, and desktops 35.96%.

- In the U.S., in late 2024, mobile traffic was 56.75%, desktop 43.25%.

- The tablet segment remains small (<2% globally) but is still significant for specific user segments, such as education or enterprise.

- Mobile’s near-parity with desktop in usage share means that browser optimisation for mobile, speed, UX, and memory is no longer optional.

- Developers focusing only on desktop browsers may neglect nearly half of potential users globally.

- The nearly 50,50 split suggests that, even in 2025, desktop remains relevant, especially in enterprise, creative, and productivity use-cases.

Browser Usage by User Demographics and Segments

- A 2025 survey found that 67% of Gen Z users would abandon a browser if they discovered it sold anonymized data.

- Approximately 82% of U.S. users say they consider privacy and data-tracking policies before installing a new browser.

- Among users who switch browsers, 52% say they regularly use two or more browsers, depending on the task (work vs personal).

- Privacy-first browsers saw a 42% increase in daily downloads in early 2025, reflecting growth in user segments seeking alternatives.

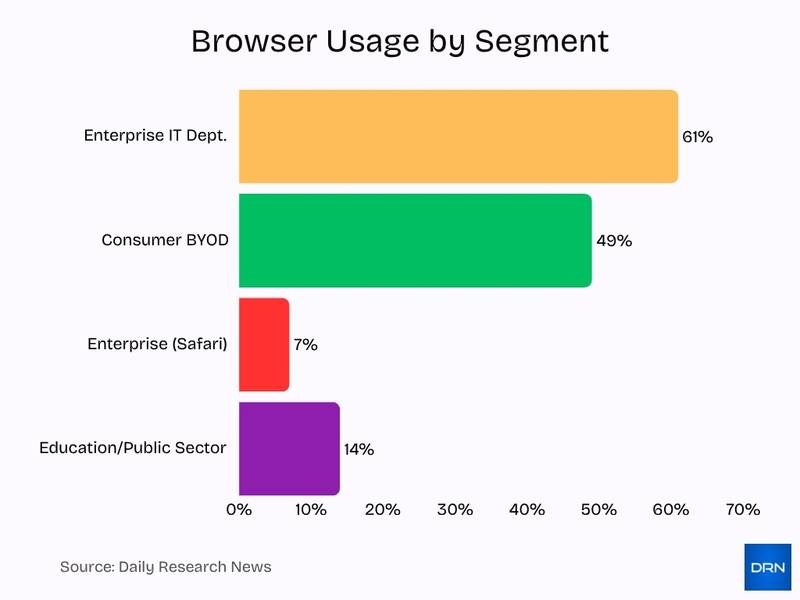

- In enterprise segments, about 61% of corporate IT departments report using Microsoft Edge as their primary browser.

- Among BYOD environments in SMBs, Google Chrome remains preferred with a 49% share.

- Retention rates: Chrome leads with 71% of users keeping it as their primary browser for over 12 months, and Safari has 65% in Apple ecosystem users.

- Browsers with built-in news feeds or gamified features show 16% higher engagement among younger audiences.

Historical Trends in Browser Usage and Market Share

- From 2018 to 2025, the global browser-user base grew from 4.19 billion to a projected 5.84 billion users.

- Over the past decade, the top browser’s share, Chrome, rose from 61.5% in 2018 to over 73% in 2025.

- During the “second browser war” (2004-2017), Firefox peaked at 24% market share in 2010 before declining.

- The shift from desktop to mobile browsing accelerated, mobile traffic surpassed desktop around 2016-18, and by 2024, mobile traffic approached 60%+ of total.

- Niche browsers that once held >10% share have each declined to low single digits by 2025.

- The majority of browser market consolidation happened by 2018-2020, with the top 5 browsers now controlling 98% of the market.

- Default browser settings have become more entrenched over time. In 2025, 84% of smartphone users still use the pre-installed default browser.

- The transition in enterprise via BYOD and cloud apps also influenced historical adoption patterns.

Year-over-Year Growth and Decline of Major Browsers

- Google Chrome’s global share rose from 66.68% in 2024 to 68.35% in 2025.

- Apple Safari fell from 18.07% in 2024 to 16.25% in 2025.

- Microsoft Edge increased from 4.12% in 2022 to 4.96% in 2025.

- Mozilla Firefox declined from 3.04% in 2022 to 2.37% in 2025.

- Browsers such as Samsung Internet held around 2.04% in 2025, showing very slow growth.

- Samsung Internet’s all-platform share was 1.93% in September 2025.

- The top browsers’ combined share remains >90%, leaving <10% to all other niche browsers.

Comparison of Major Browsers (Chrome, Safari, Edge, Firefox, Opera, etc.)

- Chrome: 73.22% share worldwide in Oct 2025.

- Safari: 13.27% worldwide in Oct 2025.

- Edge: 4.61% global share in Oct 2025.

- Firefox: 2.2% global share in Oct 2025.

- Opera: 1.75% global share in Oct 2025.

- On desktop: Chrome holds 65%, Edge 13%, Safari 10%.

- On mobile: Chrome >61%, Safari 20-22%, Samsung Internet 3%.

- Opera and other niche browsers typically hold <2% each.

- For enterprise, Edge is often chosen for integration with Microsoft 365, while Chrome remains the default for consumers.

Market Share of Privacy-Focused and Niche Browsers

- Brave Browser reported 100 million monthly active users as of October 2025.

- Brave also reported 42 million daily active users.

- Samsung Internet had 109 million users worldwide for its 1.93% share in September 2025.

- Privacy-first browsers saw usage rise due to increased concern over tracking and data collection.

- Many niche browsers emphasise privacy, yet still hold <1% each globally.

- 41% of data breaches were linked to outdated or insecure browser versions.

- Despite growth, niche browsers still account for under 5% of total usage collectively.

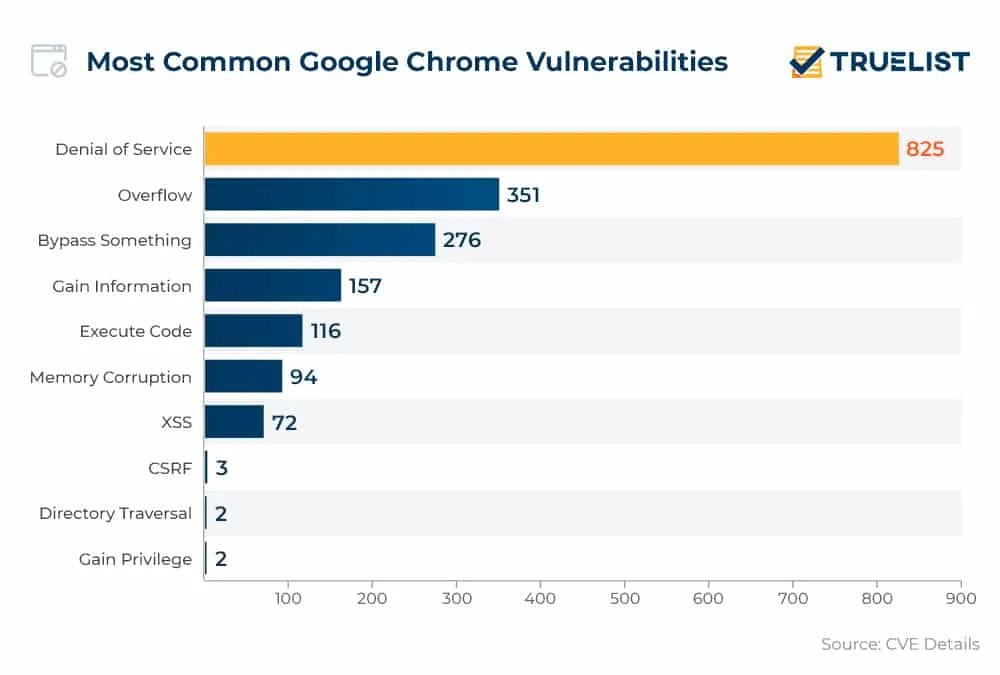

Most Common Google Chrome Vulnerabilities

- Denial of Service (DoS) leads the category with 825 documented vulnerabilities, establishing it as Chrome’s most prevalent security concern.

- Overflow vulnerabilities follow with 351 recorded cases, representing substantial threats tied to memory-related exploits.

- Bypass-focused exploits have appeared 276 times, highlighting recurring instances where protective security layers are circumvented.

- Information Gain vulnerabilities have been observed 157 times, indicating repeated risks of exposing sensitive user information.

- Code Execution flaws amount to 116 vulnerabilities, providing opportunities for attackers to execute harmful code.

- Memory Corruption problems come next with 94 occurrences, frequently resulting in crashes or unpredictable system reactions.

- Cross-Site Scripting (XSS) has been identified 72 times, enabling attackers to insert and execute malicious scripts.

- Less frequent yet significant issues include CSRF (3), Directory Traversal (2), and Gain Privilege (2), each still representing critical security weaknesses despite their lower counts.

Browser Usage in Enterprise vs Consumer Environments

- In enterprise IT departments, Edge is used by 61% of those surveyed.

- In consumer BYOD segments for SMBs, Chrome leads with 49% usage.

- Safari holds under 7% enterprise adoption due to manageability limits.

- Education and public-sector institutions still use Firefox ESR in 14% of cases.

- Browser containerization usage rose 22% year over year in hybrid work environments.

- Remote workforce practices led to a 38% increase in VPN-based browser traffic.

- Consumer browsing prioritises convenience and ecosystem compatibility, while enterprise environments emphasise security and compliance.

Performance and Speed Statistics

- Edge now renders the first content in under 300 milliseconds.

- Edge experienced a 40% speed boost across core actions, including downloads and private-tab creation.

- Browsers blocking trackers showed 12% lower latency on average.

- On desktops, Chrome at 65% share indicates broad performance leadership.

- Mobile browser performance remains critical for retention.

- Desktop users typically have 9.8 tabs open on average, Chrome users 11.4.

- Privacy-first browsers such as Brave average 11.3 minutes per session.

Security and Privacy Usage Statistics

- Chrome recorded 75 zero-day exploits in 2024.

- 41% of data breaches were linked to outdated or insecure browsers.

- Firefox’s anti-fingerprinting protections reduce tracking by 70%.

- 60% of U.S. mobile users install third-party ad blockers within a month of device purchase.

- In 2025, Safari’s private browsing relay is used by 48% of iCloud+ subscribers in North America.

- Over 56% of websites use iframes capable of bypassing popular blockers.

- Chromium’s Manifest V3 has raised concerns over reduced ad-blocking effectiveness.

Browser Extension and Plugin Usage Statistics

- The Chrome Web Store hosts over 200,000 extensions.

- uBlock Origin has over 9 million active users on Chrome.

- 54.86% of users with at least one detectable extension were identifiable through fingerprinting.

- Browsers offering robust extension management see 16% higher engagement.

- Privacy-oriented browsers bundle ad-blocking by default.

- 60% of mobile browser users install ad-block extensions or apps within the first month.

- Plugin ecosystems remain a key differentiator for niche and power-user browsers.

Time Spent in Browsers and Engagement Metrics

- Average daily internet usage globally is about 6 h 38 min in 2025.

- Chrome retention is strong, with 71% of users sticking to it for more than a year.

- Brave’s average session duration of 11.3 minutes ranks highest among privacy-focused browsers.

- Desktop browsers show lower bounce rates (47%) compared to mobile (64%).

- Desktop users typically have 9.8 tabs open, Chrome users 11.4.

- Browsers with integrated features see 16% higher engagement than minimalist browsers.

- Global mobile browser traffic share is 49.6% of internet activity.

Future Outlook and Predictions for Web Browser Usage

- By 2032, the global internet browsing market could reach US$998 billion.

- Market consolidation will likely continue with the top three browsers holding 90%+ share.

- Privacy and AI integration will define next-generation browser features such as built-in assistants and tracker-blocking.

- Emerging markets will shape future browsing trends, especially in mobile-first regions.

- Enterprise usage may diversify as zero-trust and isolated browsing models evolve.

- Web development will face increasing complexity despite concentrated market share due to device fragmentation.

- Browsers that neglect security, speed, and cross-platform continuity may stagnate.

- Future browser competition may center around agent-based browsing, privacy economics, and ecosystem features.

Frequently Asked Questions (FAQs)

Chrome held approximately 73.22% of the global browser market share.

The we about 5.52 billion people on the internet worldwide in 2025.

Chrome held over 61% of the mobile browser market in 2025.

The market is projected to reach about $998.1 billion by 2032.

Conclusion

The browser landscape remains firmly dominated by a handful of major players, yet beneath the surface, we are seeing meaningful shifts in user segments, privacy behaviour, device usage, and developer priorities. For marketers, developers, and enterprise professionals, staying ahead means not only focusing on share-leaders like Chrome, Safari, and Edge, but also understanding how device, OS, region, security, and engagement metrics all interplay.

With mobile usage nearing parity with desktop and privacy-first alternatives gaining steam, the web browser remains a dynamic space. Explore the full article to dive deeper into each of these trends and make informed strategic decisions.