WeChat stands as one of the world’s most influential digital platforms, evolving far beyond a simple messaging app into a full‑scale super app that blends communication, payments, commerce, and social networking. The platform continues to shape daily life for over a billion users, particularly in China, while steadily expanding its global footprint. Its impact is clear in industries such as mobile payments, where WeChat Pay competes with established digital wallets, and digital marketing, where brands leverage WeChat ecosystems to reach engaged audiences. Explore this article to understand the latest WeChat statistics and how they compare with recent trends.

Editor’s Choice

- 1.4+ billion total users worldwide in 2025.

- 1.4+ billion monthly active users as of 2025.

- Growth continues, albeit slower, with ~3–4% year‑over‑year increases.

- Over 810 million users in China alone.

- 935 million WeChat Pay users reported mid‑2025.

- Mini Programs attract 900 million+ monthly users.

- WeChat users exchange tens of billions of messages daily.

Recent Developments

- WeChat saw its user growth slow as penetration in China matured.

- Tencent continues focusing on engagement and retention over raw user gains.

- Expansion of Mini Programs and in‑app services to boost ecosystem involvement.

- Increased emphasis on WeChat Pay features to compete with rival wallets.

- Broader international adaptation in select markets such as Southeast Asia.

- WeChat Channels (video feature) is gaining traction as a content hub.

- More brands use WeChat for direct sales and customer engagement.

WeChat Statistics Overview

- WeChat averages ~1.4 billion monthly active users in 2025.

- Growth is steady but slower (~3.7% YOY).

- Over 810 million users reside in China, the core market.

- International user counts are smaller but growing.

- Users exchange 45+ billion messages daily.

- Engagement spans messaging, payments, mini‑apps, and commerce.

- WeChat consistently ranks among the top global social platforms by user count.

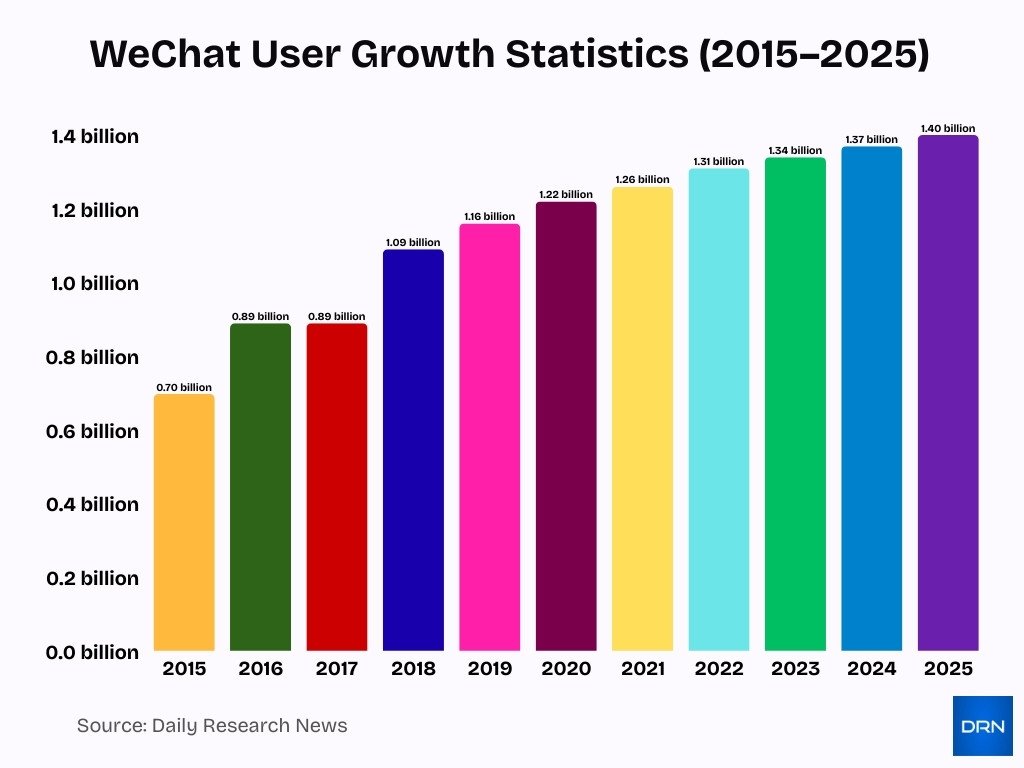

WeChat User Growth Trends

- WeChat users increased from 697 million in 2015 to 1.40 billion in 2025, highlighting a decade of sustained platform expansion.

- The platform recorded a sharp jump to 889 million users in 2016, signaling rapid early adoption and mass-market penetration.

- User growth crossed the 1 billion mark in 2018, reaching approximately 1.09 billion users worldwide.

- Between 2019 and 2020, WeChat added over 60 million users, growing from 1.16 billion to 1.22 billion.

- Global users rose steadily from 1.26 billion in 2021 to 1.31 billion in 2022, reflecting strong engagement and retention.

- The platform surpassed 1.34 billion users in 2023, reinforcing its position as one of the world’s largest social platforms.

- Growth continued at a stable pace, reaching 1.37 billion users in 2024.

- By 2025, WeChat achieved a new peak of 1.40 billion users, underlining its long-term dominance in the messaging and super-app ecosystem.

WeChat Monthly Active Users

- ~1.4+ billion MAUs recorded in 2025.

- About 43+ million users added year over year.

- MAU growth shows deceleration versus previous years.

- WeChat reached ~1.385 billion in late 2024.

- Quarterly tracking shows steady engagement across regions.

- MAU reflects both domestic and international activity.

- Comparisons place WeChat near the top of global platforms.

WeChat Daily Active Users

- Over 1.2 billion users log in daily as of the latest estimates, reflecting exceptionally high engagement.

- The platform commands a daily login rate of roughly 87% of its installed user base.

- Users exchange 45+ billion messages daily, underscoring heavy real‑time interaction.

- 410+ million voice and video calls are made daily, highlighting communication use beyond text.

- Mini Programs contribute to DAU, with estimates of ~764 million daily active Mini Program users by 2025.

- A significant share of users, 60%+, open the app more than 10 times daily, showing habitual usage patterns.

- Daily engagement trends place WeChat among the most frequently accessed messaging platforms globally.

- Metrics indicate small yet persistent increases in DAU despite the platform’s saturation in core markets.

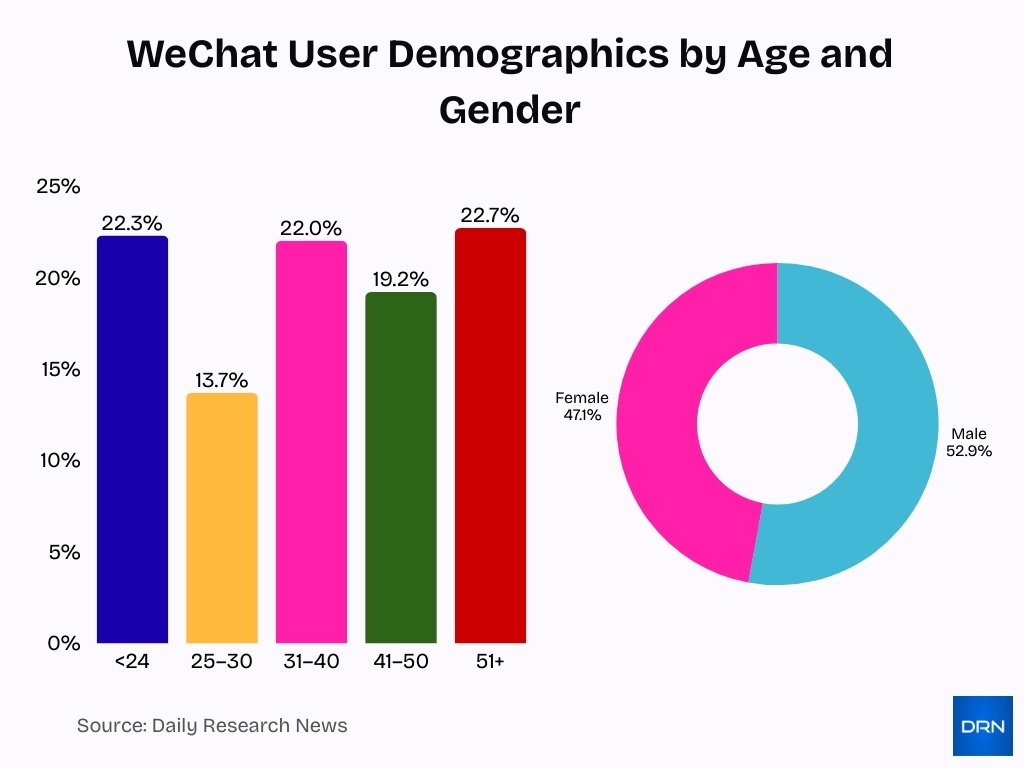

Age-Based Demographics of WeChat Users

- ~22.3% of WeChat users are under age 24, the prominent young cohort.

- ~13.7% of users fall in the 25-30 age group, the smallest segment.

- 22% of users are aged 31-40, showing strong mid-adult engagement.

- 19.2% comprise the 41-50 age bracket, reflecting mature adoption.

- Users over 51 account for 22.7%, highlighting older demographic growth.

- Males represent 52.9% of users, with females at 47.1% for near parity.

- 98.5% of 50-80 year-old Chinese smartphone users actively use WeChat.

- 61% of 60+ users dedicate over half their mobile data to WeChat.

- 49.5% of Official Account users are under 30, balanced by older groups.

WeChat Users by Country and Region

- China hosts over 1 billion WeChat monthly active users, comprising the vast majority of the global total.

- Approximately 78% of Chinese aged 16-64 actively use WeChat.

- The United States has around 4 million WeChat users, mainly from the diaspora.

- Malaysia reports 12 million WeChat users, significant in Southeast Asia.

- Singapore and Hong Kong each have about 1.5 million dedicated WeChat users.

- Indonesia shows 3 million WeChat users with 1.64 million Q1 2025 downloads.

- Thailand and the Philippines each claim 2.5 million and 2 million WeChat users, respectively.

- Users aged 24-30 represent the largest group at 26% of WeChat’s total.

- Over 20% of WeChat users are aged over 40, ensuring broad demographic appeal.

Time Spent on WeChat per Day

- Chinese users spend an average of 79 minutes 42 seconds daily on WeChat.

- Users average 80 minutes per day, with some reports citing up to 82 minutes.

- Daily usage exceeds 66 minutes per user, reflecting high engagement levels.

- 60% of users open WeChat 9-11 times daily, totaling significant screen time.

- 21% of users access WeChat over 50 times per day.

- WeChat accounts for over 30% of Chinese users’ total daily online time.

- The average time on WeChat is one hour and 20 minutes per day across users.

- Users spend more daily time on WeChat than on many Western social apps.

- Hospital wait times reduced by 43.6 minutes via WeChat services.

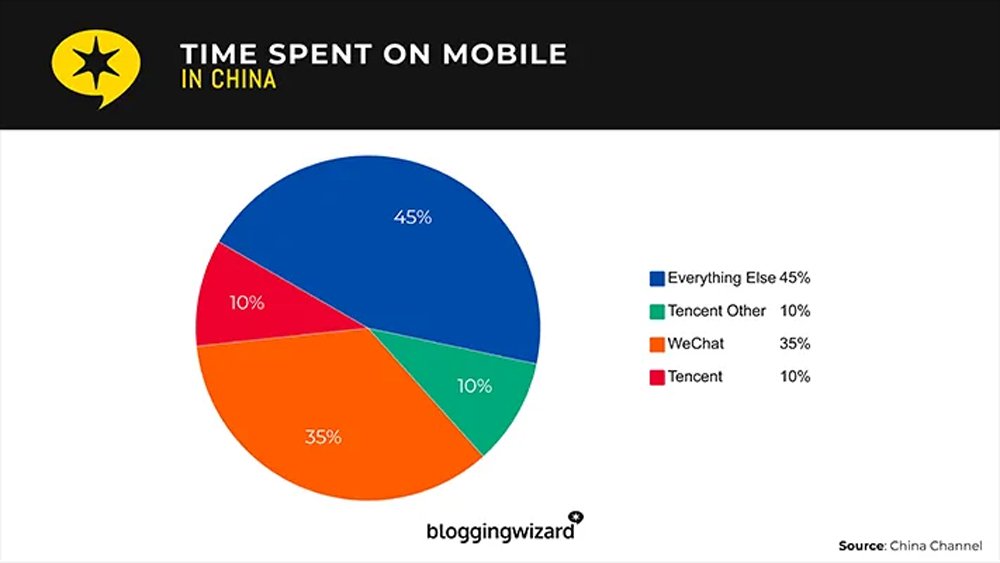

Mobile Usage Time Distribution in China

- WeChat accounts for 35% of all mobile usage time in China, reinforcing its position as the most widely used individual app in the country.

- Tencent’s other applications together represent 10% of total mobile usage time, highlighting the breadth and depth of Tencent’s app ecosystem beyond WeChat.

- When combined, Tencent controls 45% of all mobile usage time, a share that matches the total usage of all non-Tencent apps combined.

- Everything Else (non-Tencent apps) also captures 45% of total mobile time, illustrating a clearly split market between Tencent and all other app developers in China.

Daily Messages and Calls on WeChat

- WeChat users send 45+ billion messages every day.

- Daily voice and video calls exceed 410 million, expanding beyond texts.

- Messaging volume dwarfs many global competitors in sheer scale.

- Calls and messaging feature usage shows the platform’s role as a primary communication hub.

- High messaging volumes reflect both social and business use cases.

- The prevalence of multimedia messaging contributes to overall traffic volumes.

- Messaging and calls together highlight communication intensity within the app.

- Daily activity trends reflect sustained engagement across regions.

Mini Programs Users and Growth

- WeChat Mini Programs reach 954 million monthly active users, covering over 90% of WeChat’s entire user base in China.

- This represents a 2.38% increase from Q4 2023 to Q1 2024.

- Monthly Mini Program users have steadily climbed from 832 million in 2020 to nearly 945 million by early 2024.

- Mini Programs’ daily engagement includes sectors like transportation, utilities, finance, and food delivery.

- Estimates suggest Mini Programs contribute to nearly 1 billion daily interaction touchpoints across the ecosystem.

- Users open an average of ~9.8 Mini Programs per day, reflecting deep integration into daily workflows.

- There are millions of distinct Mini Programs, many developed by brands and service providers to support commerce, games, and services.

- Mini Program adoption persists as a key driver of user engagement and ecosystem expansion.

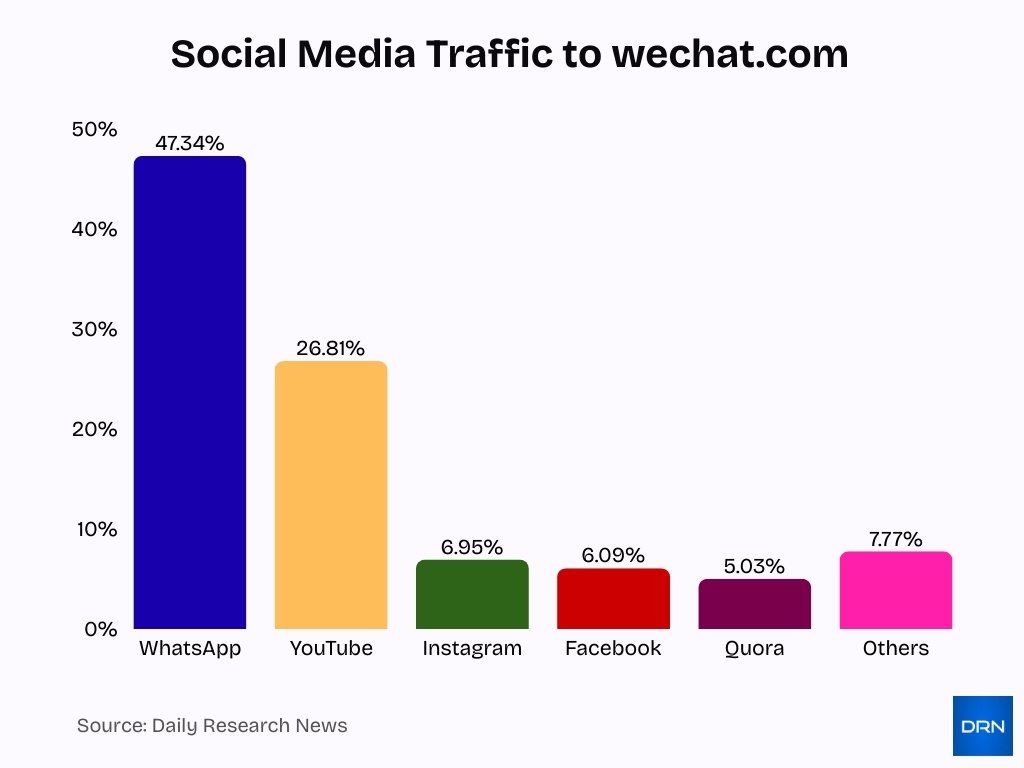

Social Media Traffic Sources Driving Visits to WeChat

- WhatsApp dominates WeChat’s social referral traffic, contributing 47.34% of total visits, highlighting the strong role of messaging-based sharing in user discovery.

- YouTube ranks as the second-largest traffic source, accounting for 26.81%, indicating high user interest driven by video content, tutorials, and explainers.

- Instagram contributes 6.95% of traffic, showing moderate influence through visual content and social sharing.

- Facebook drives 6.09% of referrals, reflecting a steady but comparatively lower impact from traditional social networking.

- Quora accounts for 5.03%, suggesting that Q&A-driven discovery and informational intent play a meaningful role in attracting users.

- Other social platforms collectively contribute 7.77%, underscoring the long-tail impact of smaller networks and niche communities.

Most Popular Mini Program Categories

- Mobile shopping Mini Programs attracted 867 million MAU in China as of December 2024.

- Daily services, Mini Programs like Tencent Phone Top Up reached 757 million MAU in 2024.

- WeChat Mini Programs overall had 954 million MAU in September 2024, over 90% of users.

- E-commerce Mini Programs saw transactions 27 times higher in 2019 vs the prior year.

- Food delivery Mini Programs are deemed more useful than apps by 47% of users.

- Bus services in transportation Mini Programs exceeded 200 million DAU in 2018.

- Daily active users for all Mini Programs hit 450 million.

- Entertainment categories like video and games dominate over 50% of the top 50 traffic share.

- Financial tools contribute to 1 billion daily transactions on Mini Programs.

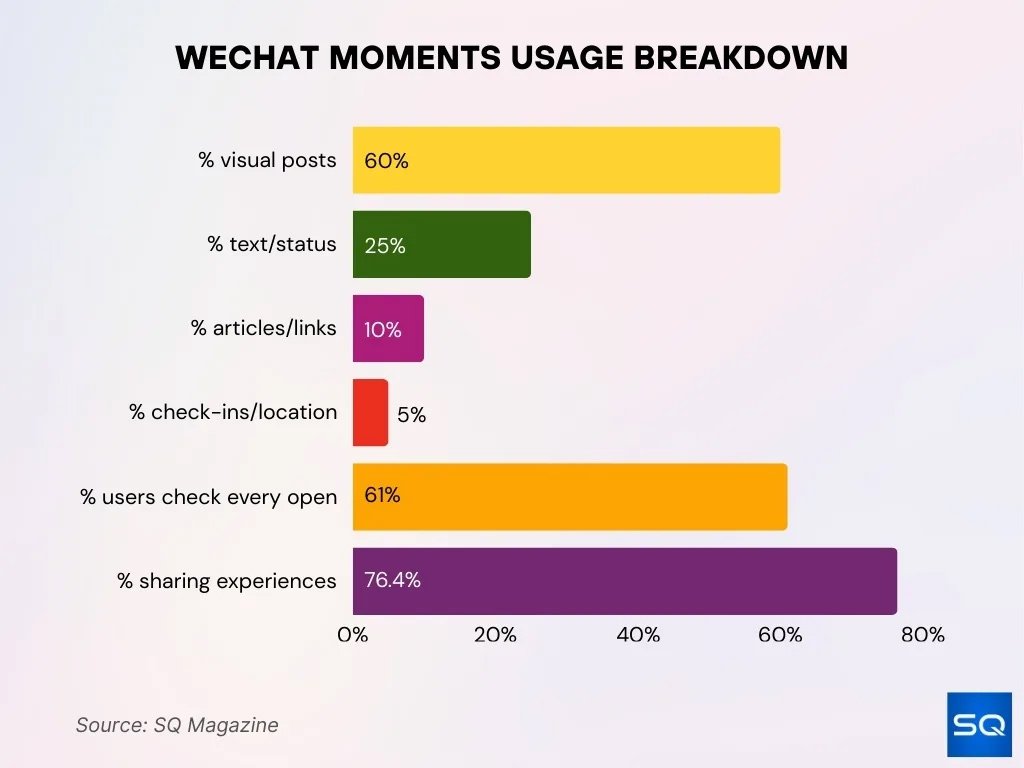

WeChat Moments Usage and Engagement

- In 2025, WeChat Moments recorded approximately 780 million daily active users, underscoring its massive and sustained engagement base.

- Among these users, around 120 million frequently publish updates such as photos, videos, and statuses, highlighting active participation rather than purely passive consumption.

- Visual content strongly dominates Moments, with nearly 60% of all posts consisting of photos or videos, reflecting user preference for rich media sharing.

- Text and status updates represent about 25% of total content, while shared links and articles contribute roughly 10% of overall posts on the platform.

- Check-ins and location tags remain relatively niche, accounting for only around 5% of total posts shared on WeChat Moments.

- More than 61% of users check Moments every time they open WeChat, indicating habitual and high-frequency engagement behavior.

- Approximately 76.4% of users rely on Moments to share personal experiences and stay updated with friends’ stories, reinforcing its role as a core social feature.

Growth of WeChat Pay Users

- WeChat Pay maintains ~935 million users, a core part of WeChat’s daily utility.

- The user count grew modestly from 920 million in 2022 to 935 million in 2025.

- WeChat Pay is the leading mobile payment option in China, surpassing many global wallets like Apple Pay in active users.

- In major Chinese cities, 90%+ of consumers use WeChat Pay for offline purchases.

- More than 200 million bank cards are linked to WeChat Pay, reflecting deep payment integration.

- A significant share of merchants in China, 40 million+ stores, accept WeChat Pay.

- WeChat Pay’s feature set spans QR code scans, transfers, bill payments, and online shopping.

- The payment service remains essential to everyday life, underlying the near‑cashless trend in China.

WeChat Pay Transaction Volume

- WeChat Pay processes billions of transactions annually, though exact up‑to‑date totals are proprietary.

- Its transaction volume regularly exceeds that of many Western digital wallets in China’s market.

- E‑commerce inside WeChat, driven by Mini Programs and Pay, is expected to contribute $100 billion + to overall revenue.

- WeChat Pay’s deep integration supports peer‑to‑peer, retail, and service payments seamlessly within the app.

- Contactless QR code transactions are now ubiquitous at local merchants.

- Digital transactions through WeChat Pay have largely replaced cash in many Chinese urban markets.

- Growth in transaction volume underscores the platform’s strong stickiness and reliability.

- Cross‑border WeChat Pay features expand usage beyond mainland China.

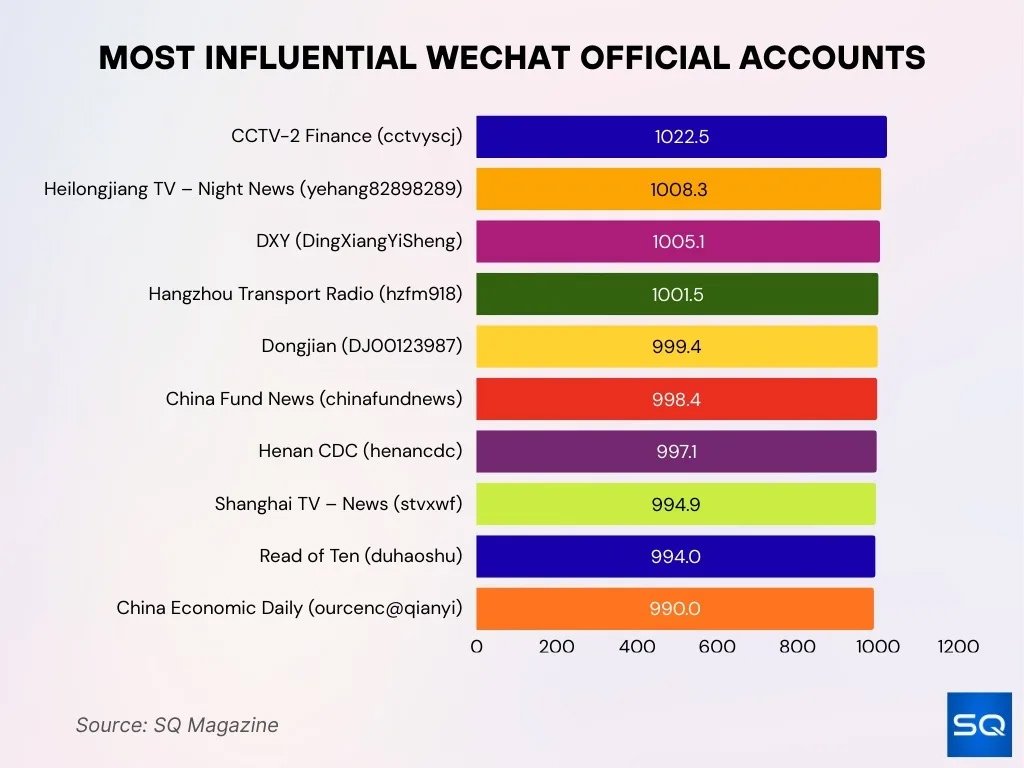

Top-Ranking WeChat Official Accounts by Influence

- CCTV-2 Finance ranks #1 with an influence index of 1022.5, establishing it as the most authoritative financial media account on WeChat.

- Heilongjiang TV – Night News holds the #2 position with 1008.3 points, underscoring its strong reach in regional news coverage.

- DXY (DingXiangYiSheng) secures #3 with 1005.1 points, highlighting its prominence in health and medical content.

- Hangzhou Transport Radio records 1001.5 points, driven by daily updates on local traffic and commuting news.

- Dongjian (DJ00123987) earns 999.4 points, signaling significant influence in opinion and commentary content.

- China Fund News posts 998.4 points, emphasizing its authority in investment and mutual fund reporting.

- Henan CDC achieves 997.1 points, reflecting high public trust in health and epidemic updates.

- Shanghai TV – News secures 994.9 points, representing a major metropolitan broadcast news presence on the platform.

- Read of Ten (duhaoshu) reaches 994 points, indicating strong engagement in reading, book reviews, and thought leadership.

- China Economic Daily completes the ranking with 990 points, reinforcing its role as a leading economic and policy publication.

WeChat Advertising Revenue and Spend

- WeChat reported $16.38 billion in total revenue, with advertising comprising a major share.

- Tencent’s marketing services, largely from WeChat, hit RMB35.8 billion in Q2 2025, up 20% YoY.

- WeChat Moments ads minimum spend starts at ¥50,000, with ¥50-180 CPM.

- Mini Programs banner ads cost USD 2.1-3.4 CPM, depending on city tier.

- WeChat Moments ads achieve 1-2% CTR and 3-8% engagement rate.

- 75% of WeChat users engage with Moments daily, boosting ad effectiveness.

- 85% of high-income users (above ¥30,000/month) actively use Moments.

- Video Accounts and Mini Programs marketing on WeChat grew ~50% YoY.

- WeChat has over 1.3 billion monthly active users, ideal for targeted ads.

Future Trends and Forecasts for WeChat

- WeChat is expected to grow its monthly active user base to ~1.48 billion by 2025, according to estimates.

- Growth will likely focus on service depth rather than raw user additions.

- Mini Program and Pay ecosystems are poised to drive e‑commerce and payments adoption further.

- Advertising spend inside the platform is set to rise as brands optimize performance.

- AI and personalization features may shape in‑app user experiences in the coming years.

- Cross‑border features will encourage international merchant use of WeChat Pay.

- Future development emphasizes content, commerce, and enterprise utility, blending social and business functions.

- WeChat’s role as a digital infrastructure platform is likely to deepen in Asian markets.

Frequently Asked Questions (FAQs)

WeChat has approximately 1.4 billion monthly active users worldwide as of 2025.

WeChat Pay reached about 935 million active users, up from 920 million in 2022.

In 2023, WeChat generated about $16.38 billion in total annual revenue.

Users send more than 45 billion messages per day on WeChat.

Conclusion

WeChat’s landscape reflects a mature but deeply embedded digital ecosystem, where messaging, payments, commerce, and content coexist. The platform’s Mini Programs and WeChat Pay continue to define user engagement patterns, contributing to extensive daily touchpoints and transaction volumes. Advertising revenue and Moments usage underscore WeChat’s value to brands connecting with highly active audiences.

Looking forward, sustained integration of services and strategic expansion into new markets will shape WeChat’s future, reinforcing its standing as more than just a messaging app; it remains a central hub for digital life.