Xbox Game Pass has become one of the most talked-about subscription services in gaming, blending console, PC, and cloud access into a unified platform. As of mid-2025, the service has an estimated 35–37 million subscribers, demonstrating steady growth since its launch in 2017 and highlighting its role in reshaping how players access games.

Every day, gamers value Game Pass for its expansive library and new titles on day one. Developers and studios use it to reach broader audiences and extend the lifespan of smaller and indie titles. These real-world applications span hobbyists discovering new games to esports teams training across genres.

Explore the full article to understand the key statistics behind Xbox Game Pass, including subscriber trends, plan breakdowns, and engagement metrics.

Editor’s Choice

- 35–37M subscribers recorded by mid-2025 across all Game Pass plans.

- Subscriber count grew from 34M in early 2024.

- 68% of subscribers are on the Ultimate tier as of 2025 estimates.

- ARPU, average revenue per user, is projected to rise by ~15% in 2025.

- Cloud gaming engagement up ~45% year-over-year.

- Xbox Cloud Gaming is now available in 29 countries.

- A new pricing structure was introduced in late 2025, with Ultimate at $29.99 per month.

Recent Developments

- Xbox Game Pass continues adding subscribers, reaching 35–37M by mid-2025.

- Growth has slowed compared to previous years, with only about 1M new subscribers added over more than 15 months.

- Ultimate tier remains the dominant subscription choice.

- Microsoft restructured tiers in October 2025, introducing Essential and Premium plans.

- Unlimited cloud gaming expanded across tiers, increasing perceived value.

- Price increase to $29.99 for Ultimate may influence future churn.

- Major first-party titles continue to launch directly into Game Pass.

- Annual Game Pass revenue reached nearly $5B.

Subscriber Statistics Overview for Xbox Game Pass

- Total subscribers reached ~37M as of mid-2025.

- Up from 34M in early 2024.

- Xbox Game Pass expanded from console-only to PC and cloud platforms.

- Subscriber growth pace moderated compared to earlier years.

- Day-one launches remain a key adoption driver.

- Service availability spans multiple global regions.

- Cloud gaming integration introduced flexible play options across devices.

- Pricing and tier changes continue to shape subscriber behavior.

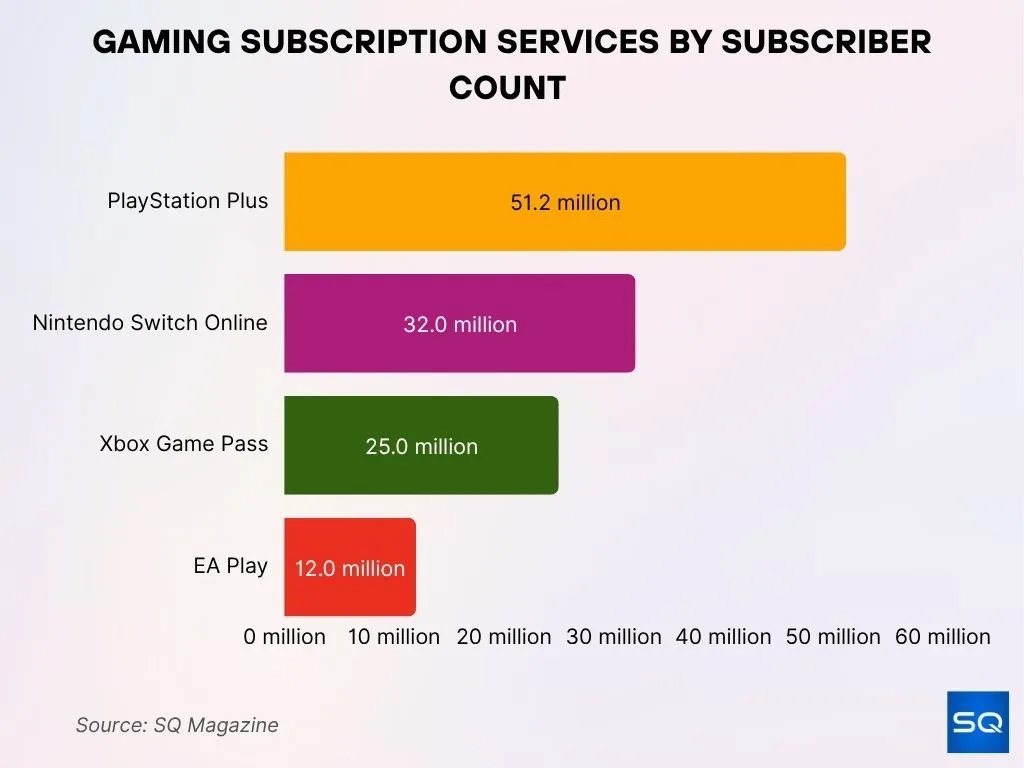

Subscriber Rankings Across Gaming Subscription Platforms

- PlayStation Plus dominates the market with 51.2 million subscribers, clearly highlighting its leadership in online console gaming services.

- Nintendo Switch Online secures second position with 32 million users, supported by family-friendly games and the global success of the Switch platform.

- Xbox Game Pass comes next with 25 million subscribers, providing broad access to an extensive game library across console, PC, and cloud gaming.

- EA Play completes the lineup with 12 million users, largely drawn by EA’s popular sports franchises and its bundled availability with other services.

Total Number of Game Pass Subscribers on Xbox

- Xbox Game Pass reached ~37 million subscribers across all plans by mid-2025.

- Grew from 34 million in early 2024 to the current 35–37 million levels.

- Growth slowed to ~1 million added over 15 months post-2024.

- 68% of subscribers choose the Ultimate tier.

- Ultimate tier accounts for 70–80% of the total Game Pass base.

- Generated nearly $5 billion in revenue for fiscal year 2025.

- ARPU projected to rise 15.3% in 2025 from tier shifts.

- Cloud gaming hours from subscribers up 45% year-over-year.

- Southeast Asia saw 31% year-over-year subscriber increase.

- PC Game Pass grew 45% year-over-year by mid-2025.

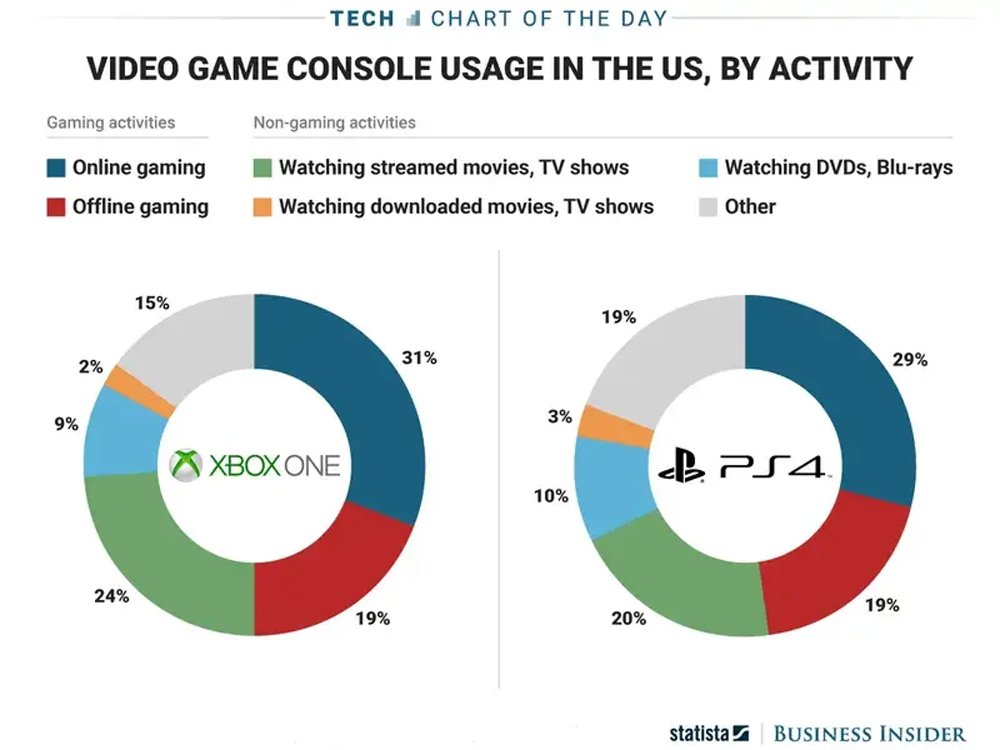

U.S. Video Game Console Activity Distribution by Usage Type

Xbox One Activity Breakdown

- 31% of total usage activity is dedicated to online gaming, making it the most frequently used function on the console.

- 24% of overall usage time is allocated to streaming movies and TV shows through entertainment apps.

- 19% of console activity is spent on offline gaming, reflecting strong single-player engagement.

- 15% of usage is grouped under other activities, covering miscellaneous console functions.

- 9% of total activity is used for watching DVDs and Blu-ray discs on the Xbox One.

- 2% of console usage time is spent watching downloaded content stored locally.

PlayStation 4 Activity Breakdown

- 29% of total console activity is focused on online gaming, representing the largest usage segment.

- 20% of usage time goes toward streaming digital content, including movies and TV shows.

- 19% of PlayStation 4 activity is spent on offline gaming experiences.

- 19% of total usage is categorized as other activities, covering non-gaming functions.

- 10% of console activity is dedicated to watching DVDs and Blu-ray discs.

- 3% of usage time is spent watching downloaded content on the PS4.

Ultimate Tier Statistics Within Xbox Game Pass

- Ultimate tier holds 68% of all Xbox Game Pass subscribers.

- Game Pass Ultimate drove 15.3% ARPU increase projected for 2025.

- Cloud gaming hours among Game Pass members surged 45% year-over-year.

- Ultimate subscribers retain at 70-80% rates post-2024 price hikes.

- 295 games added to Ultimate in 2025 with $8,000 retail value.

- Xbox Cloud Gaming streamed 1.2 billion hours in 2024, doubling from the prior year.

- Ultimate tier expected to generate $5.5 billion in Game Pass revenue for 2025.

- 75 day-one titles annually exclusive to Game Pass Ultimate.

- Ultimate pricing rose 77% since August 2024 while maintaining dominance.

Core and Console Plan Data for Xbox Game Pass

- Xbox Game Pass Essential offers a curated catalog of 50+ games accessible at $9.99/month.

- Premium tier provides 200+ games across console, PC, and cloud for $14.99/month.

- Ultimate subscribers comprise 68% of 37 million total Game Pass users in Q1 2025.

- Essential delivers online multiplayer and cloud gaming as key entry benefits.

- 2025 pricing raised Ultimate to $29.99/month, a 50% increase from $19.99.

- 37 million subscribers played an average of 18 titles yearly, with 34% higher engagement.

- 40% conversion rate applies from Essential time to Ultimate upgrades.

- Console plans drive 22% sales growth in Latin America’s price-sensitive markets.

- India’s cloud gaming surged 143% via Essential accessibility.

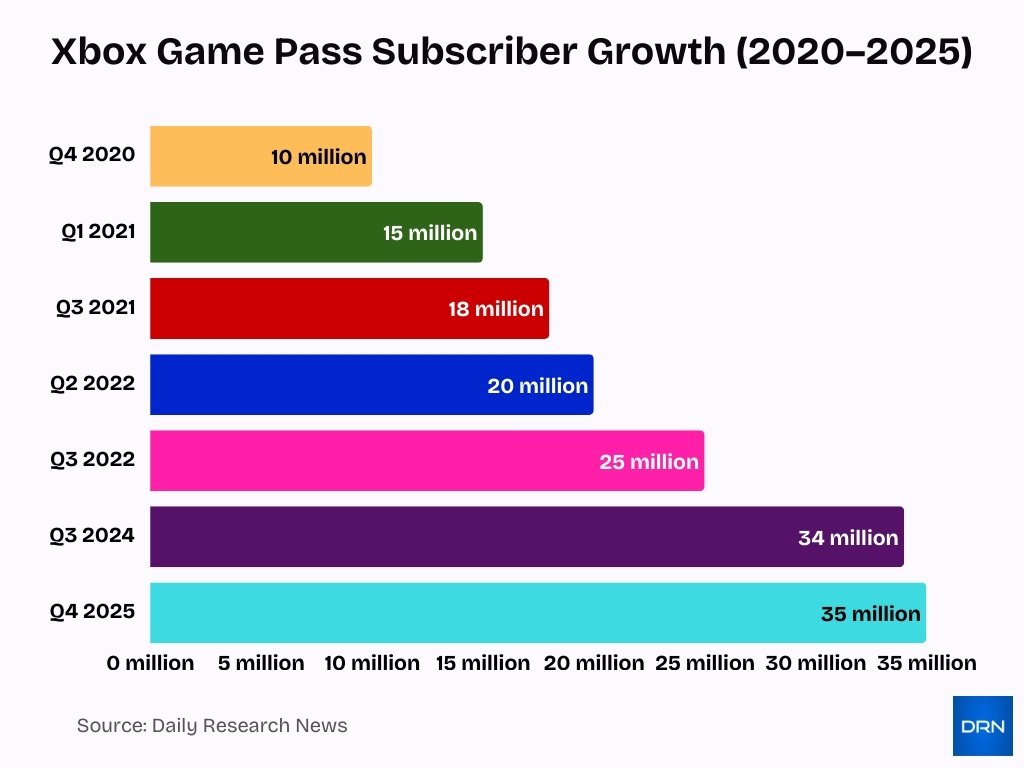

Xbox Game Pass Subscriber Growth Trends (2020–2025)

- Xbox Game Pass subscribers reached 10 million in Q4 2020, marking the early expansion phase of Microsoft’s gaming subscription strategy.

- The subscriber base increased to 15 million by Q1 2021, reflecting a rapid adoption rate within just one quarter.

- By Q3 2021, Xbox Game Pass had grown further to 18 million subscribers, showing continued momentum through 2021.

- In Q2 2022, the service crossed the 20 million subscriber milestone, highlighting sustained global demand.

- Subscriber numbers jumped to 25 million in Q3 2022, indicating a strong acceleration in user growth.

- By Q3 2024, Xbox Game Pass reached 34 million subscribers, representing one of the platform’s most significant growth phases.

- The service peaked at 35 million subscribers in Q4 2025, confirming Xbox Game Pass as a leading gaming subscription platform worldwide.

PC User Trends in Xbox Game Pass Subscriber Base

- PC Game Pass revenue surged 45% year-over-year in 2025, driving overall Xbox growth.

- Total Xbox Game Pass subscribers reached over 35 million by mid-2025, with strong PC contributions.

- Cloud gaming hours hit a record 150 million quarterly, boosting PC browser and app flexibility.

- 71% of cloud gamers prefer PC or laptops for Xbox Cloud Gaming sessions in 2025.

- Xbox games engaged 500 million monthly active users across platforms, led by PC cross-play.

- The handheld gaming market grew to $17.6 billion in 2025, enhancing PC Game Pass access.

- Game Pass generated nearly $5 billion in FY2025 revenue, with PC offsetting console slowdowns.

- ARPU projected to rise 15.3% in 2025 from bundled PC services and updates.

- 78 new titles added in 2024, including 23 day-one releases, sustaining PC library usage.

Cloud Gaming Engagement via Xbox Game Pass

- Cloud gaming hours from Game Pass subscribers increased 45% year-over-year.

- Console players spent 45% more time cloud-streaming games than in the prior year.

- Cloud usage on mobile/tablet devices rose 24% among Game Pass users.

- Xbox Cloud Gaming is now available in 29 countries worldwide.

- Emerging markets like India and Brazil show 1.2–1.5% penetration rates.

- Cloud access eliminates the need for high-end hardware, enabling 63-minute average sessions.

- Streaming boosted total playtime by 34% for Game Pass subscribers.

- Game Pass users average 18 titles yearly via cloud engagement.

- Cloud gaming drew new users, with 1.2 billion hours streamed in 2024.

Regional Subscriber Distribution in Xbox Game Pass

- North America holds the largest Xbox Game Pass subscriber base, accounting for the highest concentration of Ultimate-tier users among 37 million total.

- Southeast Asia reported a 31% YoY increase in Xbox users, fueled by Game Pass Core adoption.

- India saw 89% YoY growth in mobile cloud gaming via Game Pass, tapping 500 million gamers.

- Latin America’s console sales rose 22% in 2024, with double-digit growth in Brazil and Argentina.

- Europe features a mature market with grandfathered pricing protecting subscribers from hikes.

- Xbox cloud gaming hours surged 45% YoY, now in 29 countries, including emerging markets.

- 68% of subscribers choosethe Ultimate tier, dominant in North America and enabling cross-region access.

- India’s cloud users grew 143%, boosted by 5G and smartphone penetration for Game Pass.

- Regional pricing strategies drove 27% YoY revenue growth in Southeast Asia and Latin America.

Plan-Wise Breakdown of Xbox Game Pass Subscribers

- Ultimate tier holds 68% of total Xbox Game Pass subscribers among 35–37 million in mid-2025.

- Essential tier priced at $9.99/month targets entry-level users post-Core upgrade.

- Premium tier at $14.99/month offers 200+ games with yearly new releases.

- Ultimate tier serves over 400 games across console, PC, and cloud platforms.

- Unlimited cloud gaming drove 89% YoY growth in mobile usage for Ultimate.

- Ultimate subscribers fuel 15.3% ARPU rise projected for 2025.

- Tier changes aim at price-sensitive users with Essential at $9.99.

- Pricing gaps from $9.99 Essential to $29.99 Ultimate influence 70–80% retention on top tier.

- Ultimate dominance offsets lower-tier declines amid 37 million total subs.

- Day-one releases boosted to 75/year in Ultimate, up 50%.

Engagement Metrics Among Xbox Game Pass Subscribers

- Xbox Game Pass subscribers log 34% more total gameplay hours than non-subscribers.

- Cloud gaming hours among subscribers surged 45% year-over-year.

- Subscribers average 18 distinct titles per year, up from 15 in 2023.

- Game Pass users play 20% more time, 30% more games, and 40% more genres.

- Indie titles saw a 74% increase in playtime on the platform in 2024.

- Day-one launches boost large publishers’ DAU by 3.5x and indies’ MAU by 15x.

- Forza Horizon 5 reached 10 million players in its first week via Game Pass.

- 140 million hours streamed in a single quarter by cloud users.

- Console cloud streaming up 45%, other devices 24% more.

Game Library Usage by Xbox Game Pass Members

- Xbox Game Pass offers access to over 400 titles across console, PC, and cloud platforms.

- More than 75 day-one releases are added annually, a 50% increase from prior years.

- New releases boost library usage with 3.5x higher DAU for large publishers.

- Indie games see 74% playtime increase and 15x MAU growth on Game Pass.

- Cloud play drives 1.2 billion hours streamed in 2024, up 100% YoY.

- PC users average 18 titles yearly, with 34% more hours than non-subscribers.

- Older titles sustain engagement, with subscribers playing 18 distinct games per year.

- Departing games experience usage spikes, averaging 5.3 titles removed monthly in 2024.

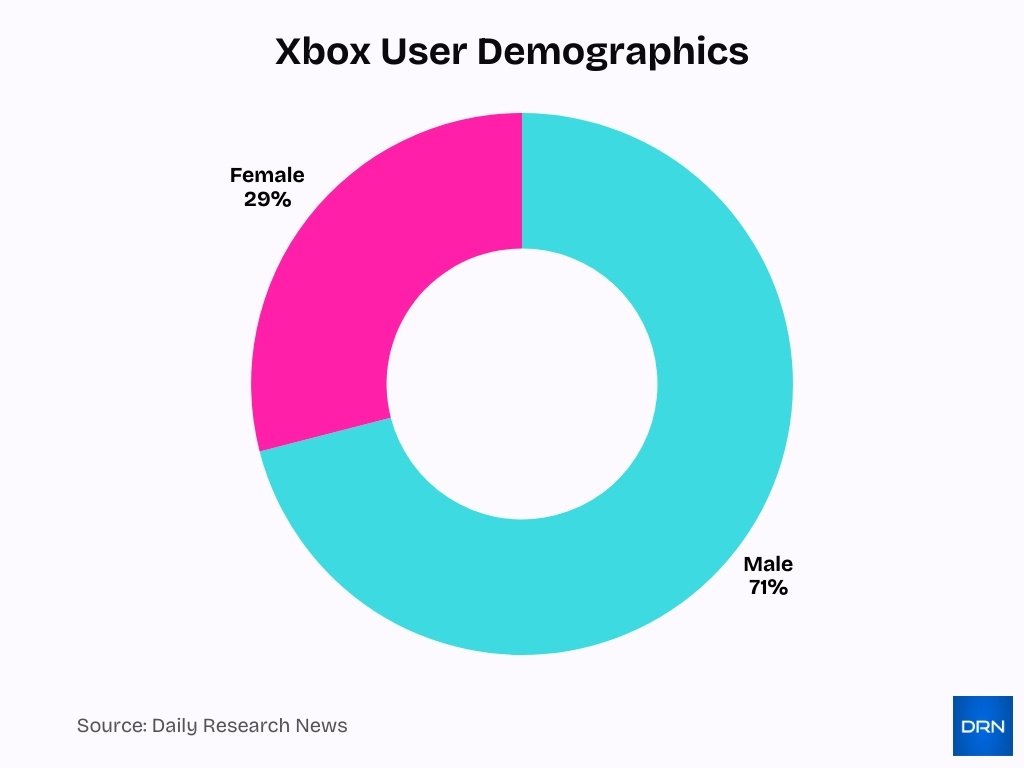

Demographic Insights Into Xbox Game Pass Users

- 71% of Xbox users are male compared to 29% female, mirroring Game Pass trends.

- 64% of Xbox players fall in the 18–34 age group, driving rapid Game Pass adoption among youth.

- Xbox Game Pass reached 37 million subscribers by Q1 2025, reflecting core younger demographic appeal.

- Cloud gaming via Game Pass saw 89% YoY growth in regions like India, South Korea, and Brazil.

- PC Game Pass boasts over 15 million users, attracting long-time PC gamers.

- Southeast Asia reported 31% YoY increase in Xbox users, fueled by Game Pass broadband access.

- The US holds 41% of Xbox sales, while emerging markets diversify Game Pass’s global base.

- Game Pass enables cross-generational play, with 70% user satisfaction in family plan trials.

Retention and Churn Rates in Xbox Game Pass

- Xbox Game Pass reached 35 million subscribers by mid-2025, up from 34 million in February 2024.

- New sign-ups softened since August 2024, declining ahead of the Ultimate price hikes.

- Churn rose after Game Pass Ultimate jumped 50% from $19.99 to $29.99 monthly.

- 70-80% of Ultimate subscribers retained the tier post-2024 price increase.

- Gaming subscriptions achieved 81% retention rate in 2025, up from 74% in 2024.

- Industry targets churn below 5% monthly for sustainable subscription growth.

- Game Pass users play 34% more hours than non-subscribers, boosting early engagement.

- 68% of subscribers choose the Ultimate tier, with ARPU up 15.3% in 2025.

- Tier downgrades to lower plans like Essential, and reduced full cancellations post-hikes.

Revenue Generated From Xbox Game Pass Subscribers

- Game Pass generated nearly $5B in annual revenue for FY2025, a record milestone.

- Subscription revenue from Game Pass drove 13% growth in Xbox content and services.

- Game Pass revenue growth offset 22% decline in Xbox hardware sales YoY.

- $4.7B Game Pass income in 2024 rivaled 65% of Xbox services revenue.

- 75 day-one titles in 2025 supported 50% increase in Game Pass Ultimate launches.

- Game Pass surpassed 35 million subscribers by mid-2025 amid regional expansions.

- Cloud streaming hit over 500 million hours yearly, boosting Game Pass monetization.

- Game Pass contributed 21% of Xbox’s $23.5B total gaming revenue in FY2025.

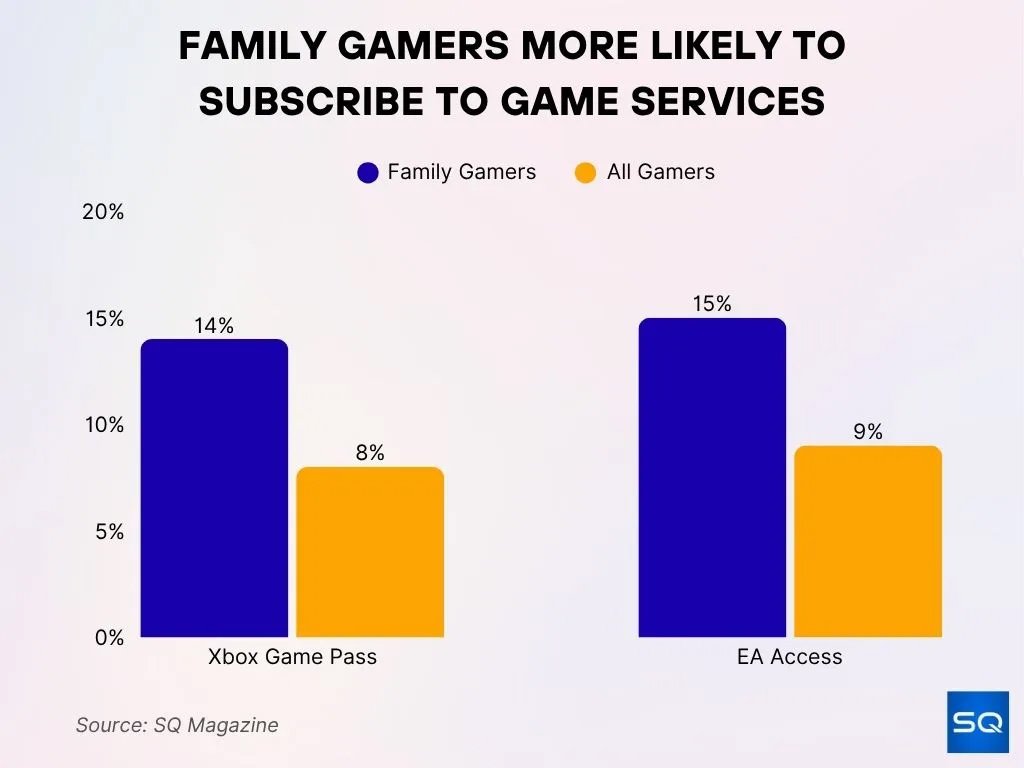

Family-Oriented Gamers Show Higher Subscription Adoption

- Family gamers are notably more inclined to subscribe to gaming services when compared with the broader gamer population.

- 14% of family gamers subscribe to Xbox Game Pass, whereas only 8% of all gamers hold the same subscription.

- 15% of family gamers use EA Access, in contrast to 9% of the overall gamer base.

- 29% of the total population lives in households where both children and adults play games together, underscoring the growing importance of family-focused gaming experiences.

ARPU Trends for Users of Xbox Game Pass

- Xbox Game Pass ARPU projected to rise 15% in 2025 to $151.07 annually.

- Ultimate tier accounts for 68% of subscribers, generating the highest ARPU.

- Price hikes raised Ultimate from $19.99 to $29.99/month, directly boosting ARPU.

- Lower tiers like Core and Standard provide steadier but smaller ARPU contributions.

- Bundled perks, including EA Play and cloud access, justify premium pricing for Ultimate users.

- Cloud gaming expansion drove 89% usage growth, supporting higher ARPU potential.

- Catalog growth with day-one releases sustains revenue, and users play 34% more hours.

- ARPU growth of 15.3% offsets slower subscriber expansion from 34M to 35M.

Subscriber Response to Price Changes in Xbox Game Pass

- Xbox Game Pass Ultimate price surged 50% to $29.99/month from $19.99.

- 34 million subscribers fueled nearly $5 billion in revenue last fiscal year.

- IGN poll of 10,000 readers showed 45% uninterested in Game Pass post-hike.

- Cancellation requests hit an all-time high per Google data after the price announcement.

- Microsoft’s cancellation page crashed due to a surge in user cancellations.

- >30% Ultimate drop-off needed for Microsoft to lose revenue on hike.

- 75+ day-one titles annually added to justify Ultimate tier value.

- New sign-ups declined pre-hike since August 2024 per Antenna data.

Effect of Day-One Releases on Xbox Game Pass Uptake

- Xbox Game Pass now offers over 75 day-one releases annually, a 50% increase from prior years.

- 23 day-one releases in 2024 contributed to 78 total new titles added to the service.

- Day-one launches boost large publishers’ daily active users by 3.5x and indies’ monthly active users by 15x.

- Game Pass subscribers play 34% more hours than non-subscribers, driven by new releases.

- Subscribers averaged 18 titles per year in 2024, up from 15 in 2023.

- Major day-one titles like Call of Duty: Black Ops 6 caused the biggest single-day subscriber spikes.

- 75+ day-one games yearly sustain engagement as indie playtime rose 74% in 2024.

- Day-one strategy supports retention with 68% of subscribers on the Ultimate tier.

- Over 35 million subscribers by mid-2025 link growth to day-one franchise launches.

Frequently Asked Questions (FAQs)

Xbox Game Pass has 37 million subscribers as of July 2025.

Cloud gaming hours from Game Pass subscribers have increased by 45% year‑over‑year.

Approximately 68% of Game Pass subscribers are on the Ultimate tier.

Xbox Game Pass generated nearly $5 billion in revenue during fiscal year 2025.

Conclusion

The Xbox Game Pass subscriber landscape reflects a mature but evolving subscription ecosystem. With roughly 35–37 million subscribers, Game Pass remains central to Microsoft’s gaming strategy while navigating slower growth and pricing pressures.

Expanded cloud engagement, higher ARPU, and record $5B in annual revenue highlight strong financial performance. At the same time, price increases and churn risks underscore the balance between value delivery and profitability.

Day-one releases and a deep game library continue to drive engagement and retention. As gaming subscriptions evolve, Xbox Game Pass will remain a benchmark shaping how players, publishers, and platforms approach the future of game access.